Tilray (TLRY)

We wouldn’t recommend Tilray. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Tilray Will Underperform

Founded in 2013, Tilray Brands (NASDAQ:TLRY) engages in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

- Operating losses have increased over the last year, highlighting expense inefficiencies and competitive challenges

- Cash burn has widened over the last year, making us question whether it can reliably generate shareholder value

- Negative returns on capital show that some of its growth strategies have backfired, and its falling returns suggest its earlier profit pools are drying up

Tilray’s quality is not up to our standards. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Tilray

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Tilray

At $13.15 per share, Tilray trades at 135.6x forward EV-to-EBITDA. This multiple is quite expensive for the quality you get.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Tilray (TLRY) Research Report: Q3 CY2025 Update

Cannabis company Tilray Brands (NASDAQ:TLRY) announced better-than-expected revenue in Q3 CY2025, with sales up 4.7% year on year to $209.5 million. Its non-GAAP loss of $0 per share increased from -$0.04 in the same quarter last year.

Tilray (TLRY) Q3 CY2025 Highlights:

- Revenue: $209.5 million vs analyst estimates of $204 million (4.7% year-on-year growth, 2.7% beat)

- Adjusted EBITDA: $10.18 million vs analyst estimates of $10.29 million (4.9% margin, 1% miss)

- Operating Margin: 1%, up from -18.3% in the same quarter last year

- Free Cash Flow was -$10.86 million compared to -$42.02 million in the same quarter last year

- Market Capitalization: $1.90 billion

Company Overview

Founded in 2013, Tilray Brands (NASDAQ:TLRY) engages in cannabis research, cultivation, and distribution, offering a range of medical and recreational cannabis products, hemp-based foods, and alcoholic beverages.

The company operates across North America and Europe, serving medical patients, recreational consumers, and retail partners. Tilray generates revenue through product sales, brand partnerships, and licensing agreements.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the cannabis industry include Aurora Cannabis (TSX:ACB) and Cronos Group (TSX:CRON). Tobacco companies like Altria (NYSE:MO) and British American Tobacco have made investments in the cannabis space, making them competitors as well.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $830.8 million in revenue over the past 12 months, Tilray is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

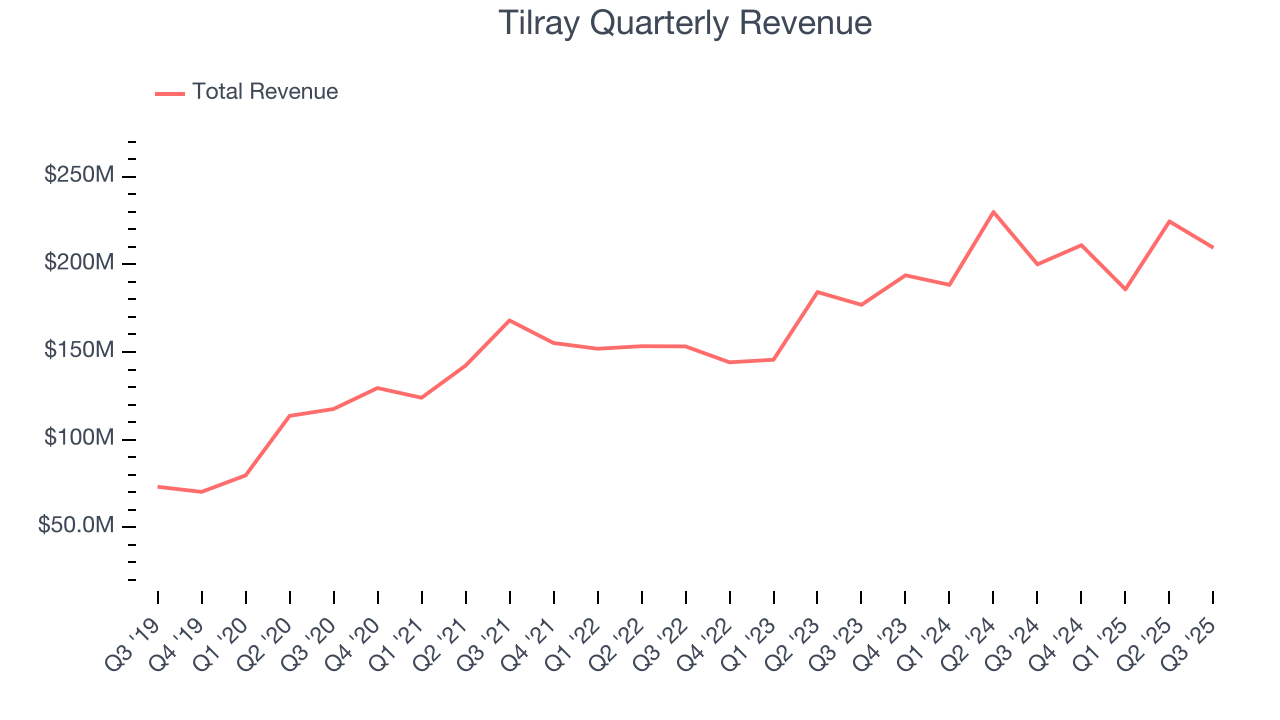

As you can see below, Tilray’s 10.6% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a useful starting point for our analysis.

This quarter, Tilray reported modest year-on-year revenue growth of 4.7% but beat Wall Street’s estimates by 2.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.9% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will see some demand headwinds.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

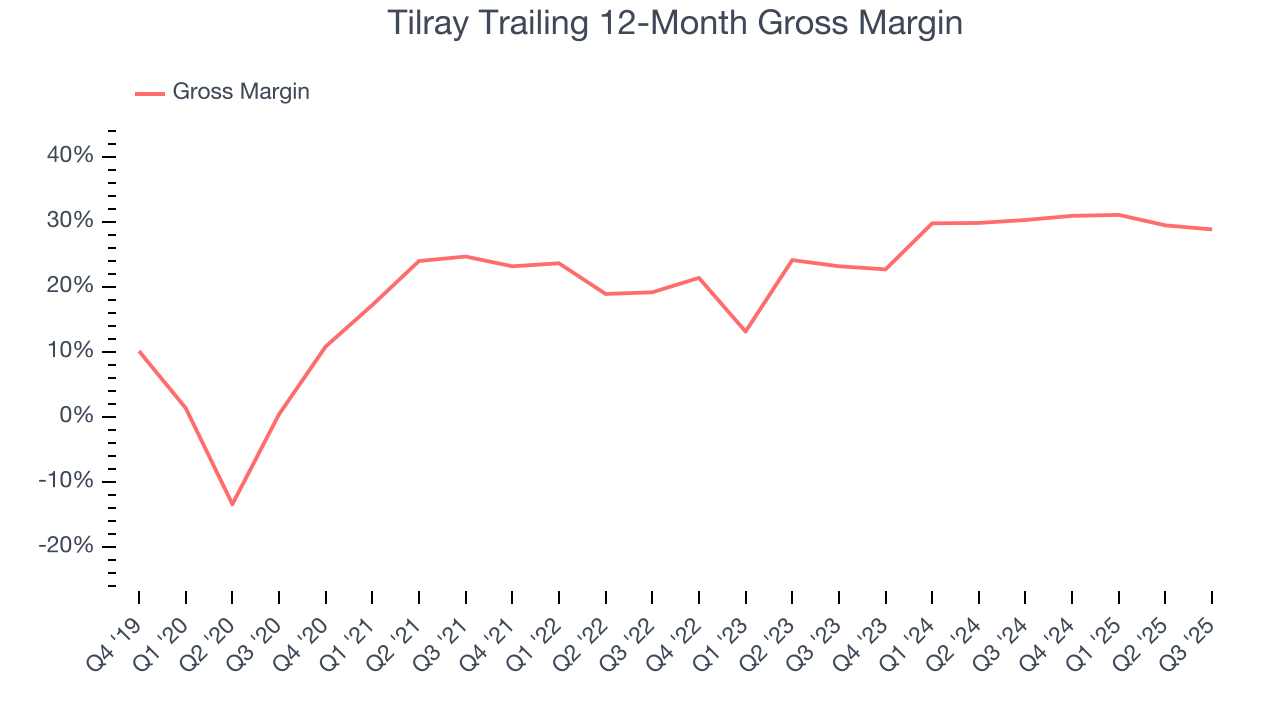

Tilray’s gross margin is slightly below the average consumer staples company, giving it less room to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged a 29.6% gross margin over the last two years. That means Tilray paid its suppliers a lot of money ($70.42 for every $100 in revenue) to run its business.

Tilray’s gross profit margin came in at 27.4% this quarter, marking a 2.5 percentage point decrease from 29.9% in the same quarter last year. Tilray’s full-year margin has also been trending down over the past 12 months, decreasing by 1.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

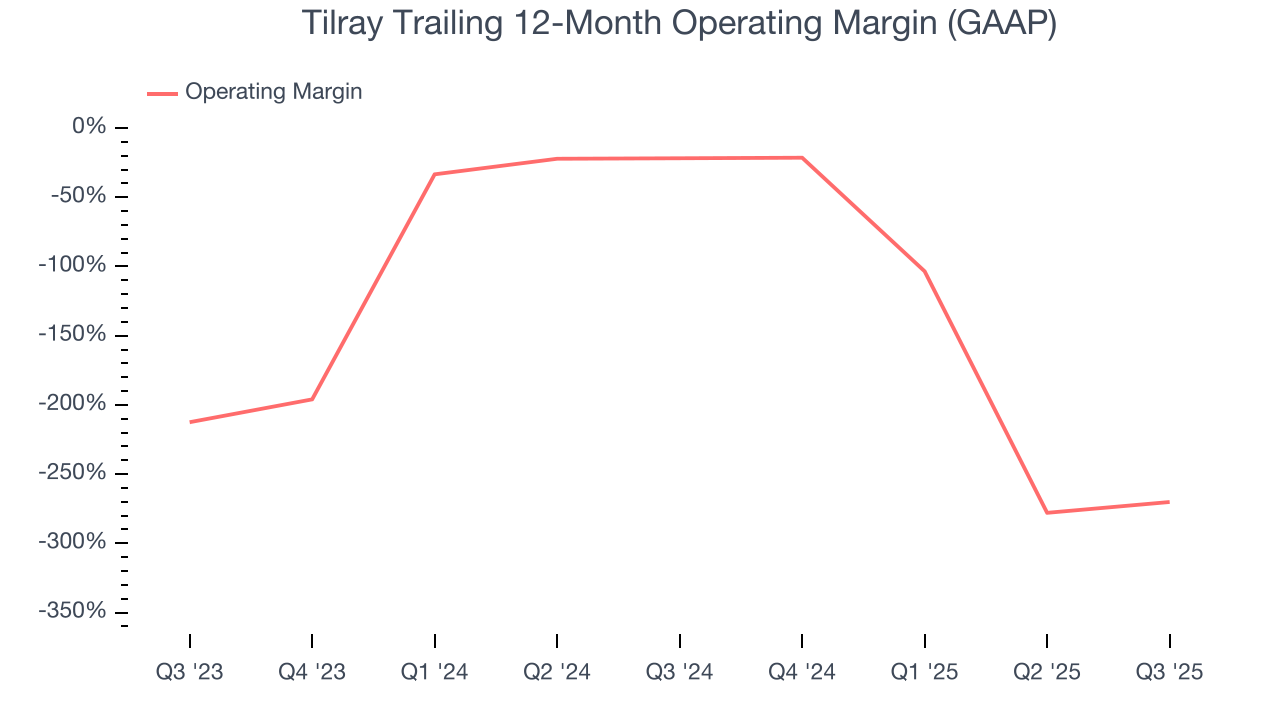

Although Tilray broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 147% over the last two years. Unprofitable public companies are rare in the defensive consumer staples industry, so this performance certainly caught our eye.

Analyzing the trend in its profitability, Tilray’s operating margin decreased significantly over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Tilray’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Tilray’s breakeven margin was up 19.3 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

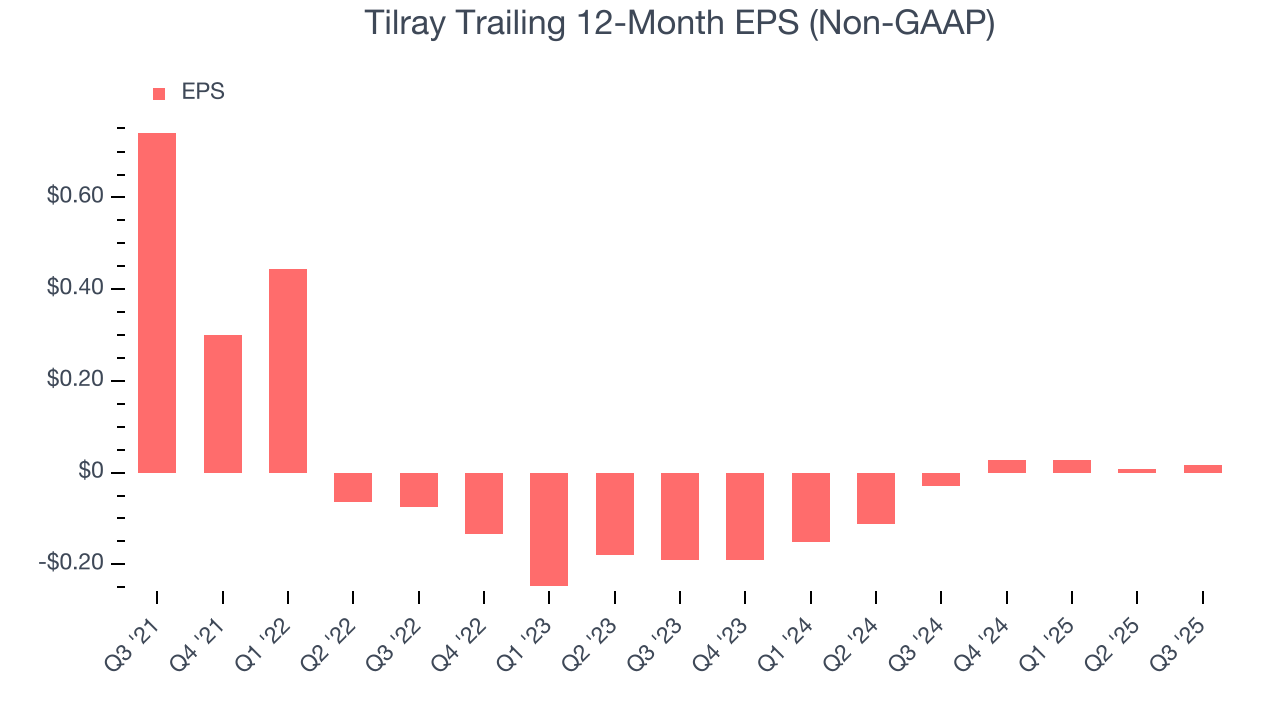

In Q3, Tilray reported adjusted EPS of $0, up from negative $0.01 in the same quarter last year. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

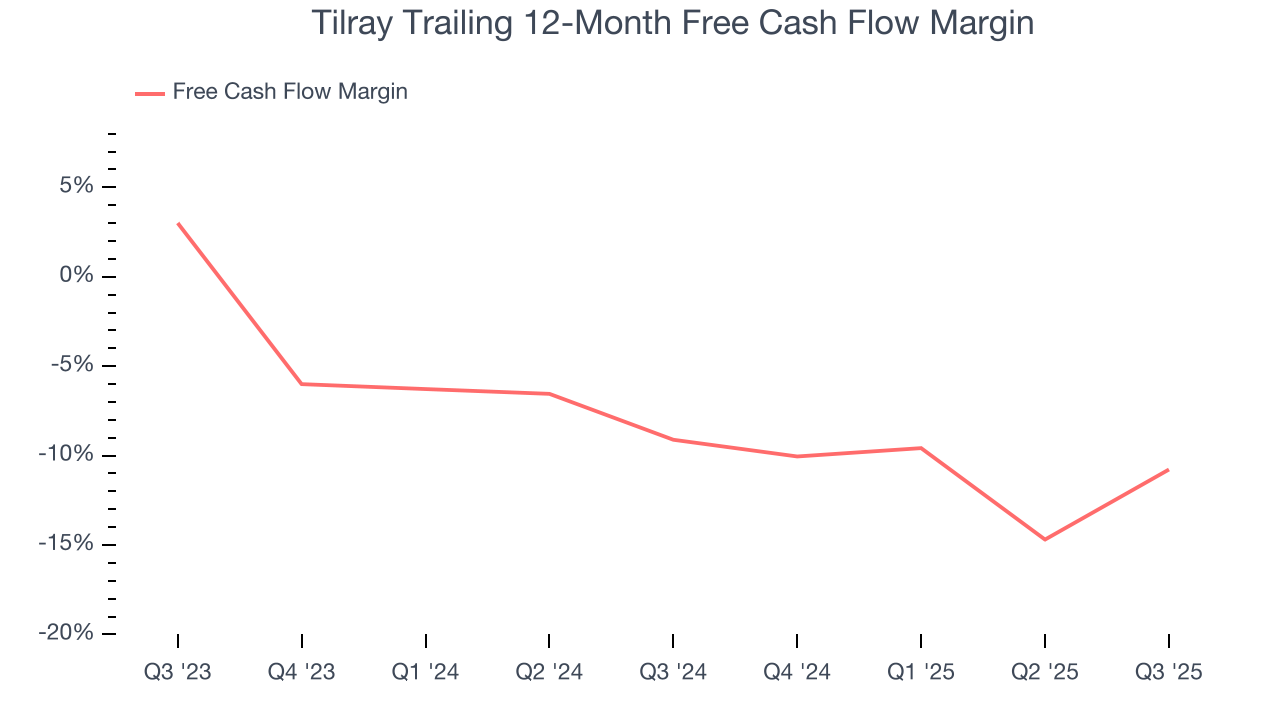

Tilray’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 10%, meaning it lit $9.96 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Tilray’s margin dropped by 1.7 percentage points over the last year. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s in the middle of an investment cycle.

Tilray burned through $10.86 million of cash in Q3, equivalent to a negative 5.2% margin. The company’s cash burn slowed from $42.02 million of lost cash in the same quarter last year.

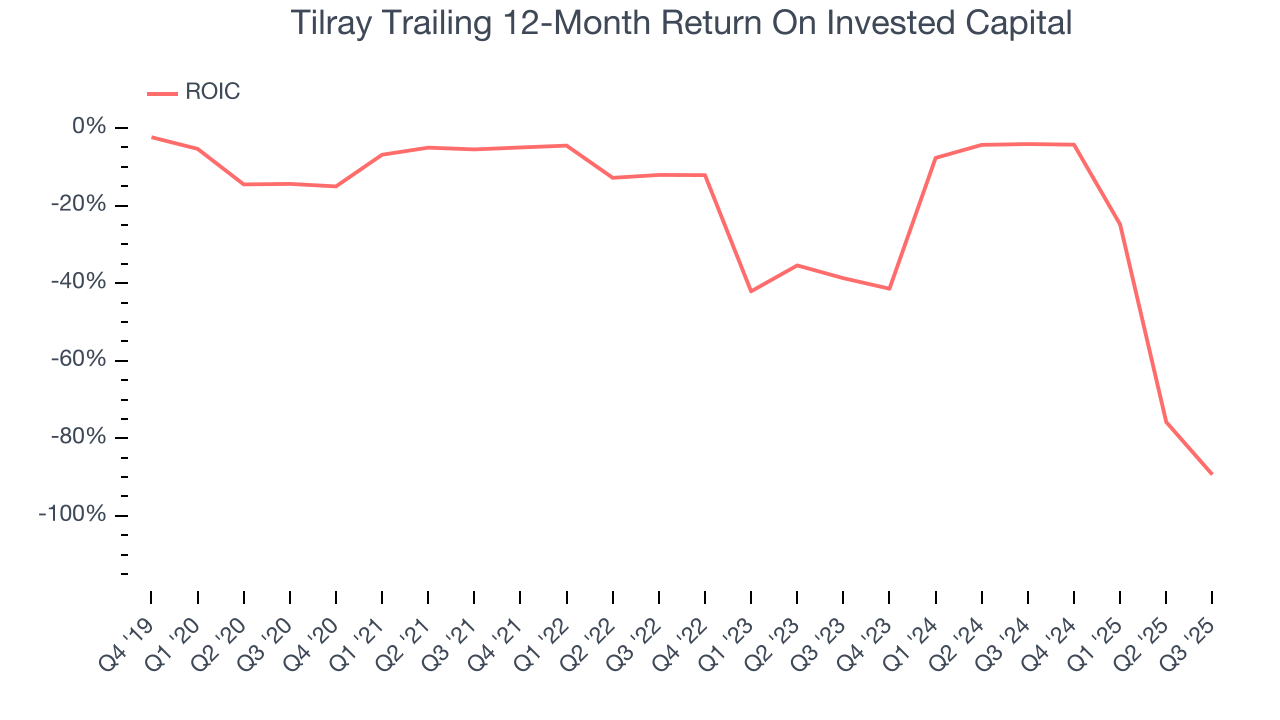

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Tilray’s five-year average ROIC was negative 29.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

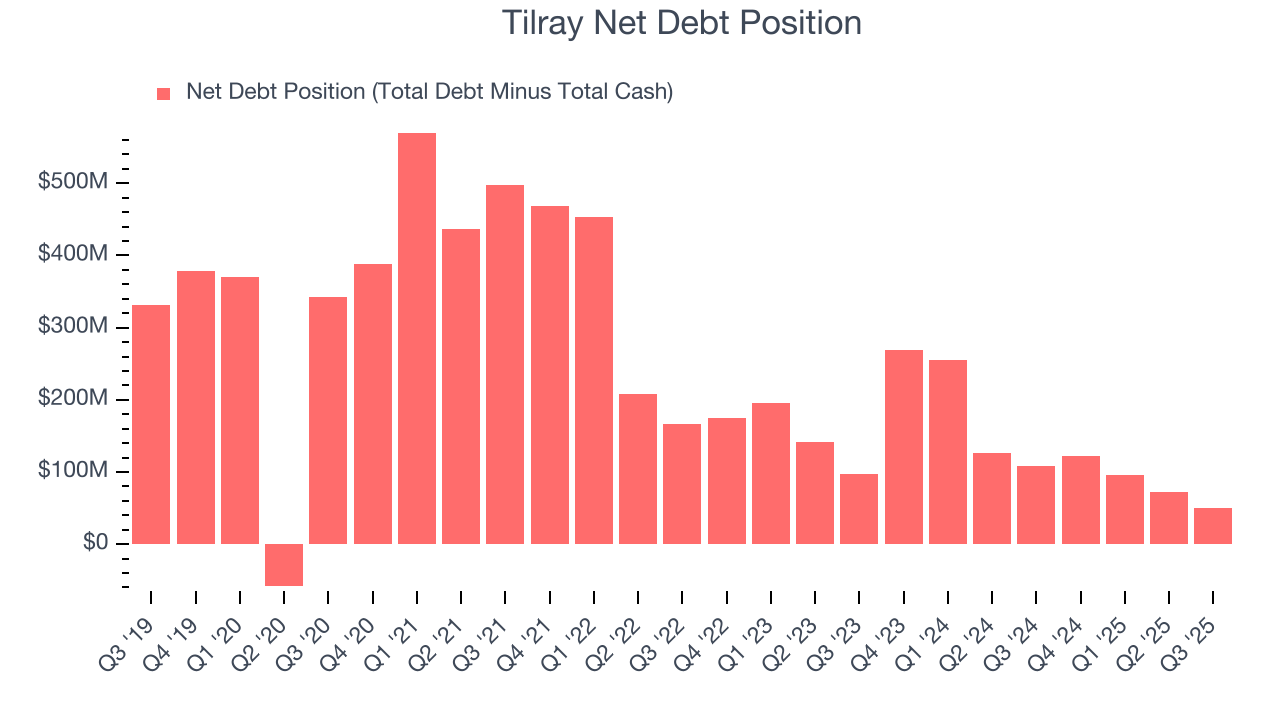

11. Balance Sheet Assessment

Tilray reported $264.8 million of cash and $315.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $55.88 million of EBITDA over the last 12 months, we view Tilray’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $26.81 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Tilray’s Q3 Results

It was encouraging to see Tilray beat analysts’ revenue expectations this quarter. Profit margin also increased meaningfully from the same period last year. Zooming out, we think this was an encouraging quarter showing progress and profitable growth. The stock traded up 17.1% to $2.02 immediately after reporting.

13. Is Now The Time To Buy Tilray?

Updated: December 12, 2025 at 11:15 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Tilray.

Tilray falls short of our quality standards. Although its revenue growth was solid over the last three years, it’s expected to deteriorate over the next 12 months and its declining operating margin shows the business has become less efficient. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Tilray’s EV-to-EBITDA ratio based on the next 12 months is 135.6x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $16.17 on the company (compared to the current share price of $13.15).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.