Abercrombie and Fitch (ANF)

Abercrombie and Fitch is a great business. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why We Like Abercrombie and Fitch

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

- Collection of products is difficult to replicate at scale and leads to a best-in-class gross margin of 63.3%

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

- Healthy operating margin shows it’s a well-run company with efficient processes

Abercrombie and Fitch is a market leader. The valuation seems fair in light of its quality, so this might be a prudent time to buy some shares.

Why Is Now The Time To Buy Abercrombie and Fitch?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Abercrombie and Fitch?

At $96.15 per share, Abercrombie and Fitch trades at 9.5x forward P/E. The stock’s multiple sure seems like a bargain relative to its business quality and fundamentals.

Our eyes light up when companies with elite fundamentals trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. Abercrombie and Fitch (ANF) Research Report: Q3 CY2025 Update

Young adult apparel retailer Abercrombie & Fitch (NYSE:ANF) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 6.8% year on year to $1.29 billion. The company expects next quarter’s revenue to be around $1.66 billion, close to analysts’ estimates. Its GAAP profit of $2.36 per share was 9.4% above analysts’ consensus estimates.

Abercrombie and Fitch (ANF) Q3 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.28 billion (6.8% year-on-year growth, 0.9% beat)

- EPS (GAAP): $2.36 vs analyst estimates of $2.16 (9.4% beat)

- Adjusted EBITDA: $193.6 million vs analyst estimates of $191.2 million (15% margin, 1.2% beat)

- Revenue Guidance for Q4 CY2025 is $1.66 billion at the midpoint, roughly in line with what analysts were expecting

- EPS (GAAP) guidance for the full year is $10.35 at the midpoint, beating analyst estimates by 2.9%

- Operating Margin: 12%, down from 14.8% in the same quarter last year

- Free Cash Flow Margin: 10.2%, up from 7.6% in the same quarter last year

- Same-Store Sales rose 3% year on year (16% in the same quarter last year)

- Market Capitalization: $3.09 billion

Company Overview

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE:ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

The core customer is the high school or college student (male and female) who cares about fashion and appearances but prefers casual, somewhat nondescript clothing. In recent years, Abercrombie & Fitch has added a level of sophistication to its designs to appeal to slightly older customers as well. Prices for its jeans, t-shirts, sweatshirts, and casual dresses are considered mid-tier, neither approaching the stratospheric prices of luxury brands but also not as affordable as fast fashion peers.

Historically, Abercrombie & Fitch was known for hiring attractive young store associates, although the company has recently put more emphasis on diversity rather than looks. Stores tend to be roughly 8,000 square feet and located in malls or shopping centers along with other retailers. The ambiance tends to be characterized by dim lighting, loud music, and the smell of its branded fragrance.

In addition to brick and mortar stores, Abercrombie & Fitch has an ecommerce presence that was launched in 1999. This omnichannel approach gives customers options such as pure online shopping or buying online and picking up in store.

4. Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Retailers offering youth-focused apparel and accessories include American Eagle Outfitters (NYSE:AEO), Urban Outfitters (NASDAQ:URBN), and The Gap (NYSE:GPS).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

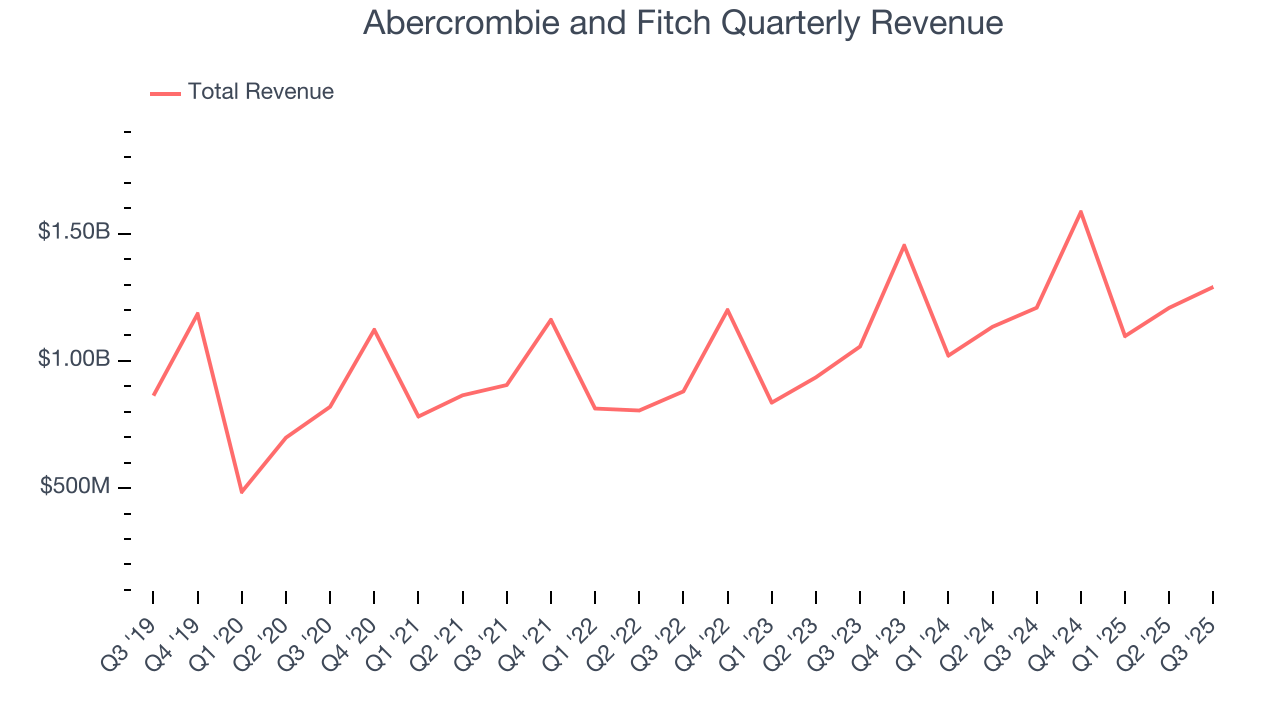

With $5.18 billion in revenue over the past 12 months, Abercrombie and Fitch is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Abercrombie and Fitch grew its sales at a decent 12.3% compounded annual growth rate over the last three years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, Abercrombie and Fitch reported year-on-year revenue growth of 6.8%, and its $1.29 billion of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.1% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above average for the sector and indicates the market is baking in some success for its newer products.

6. Store Performance

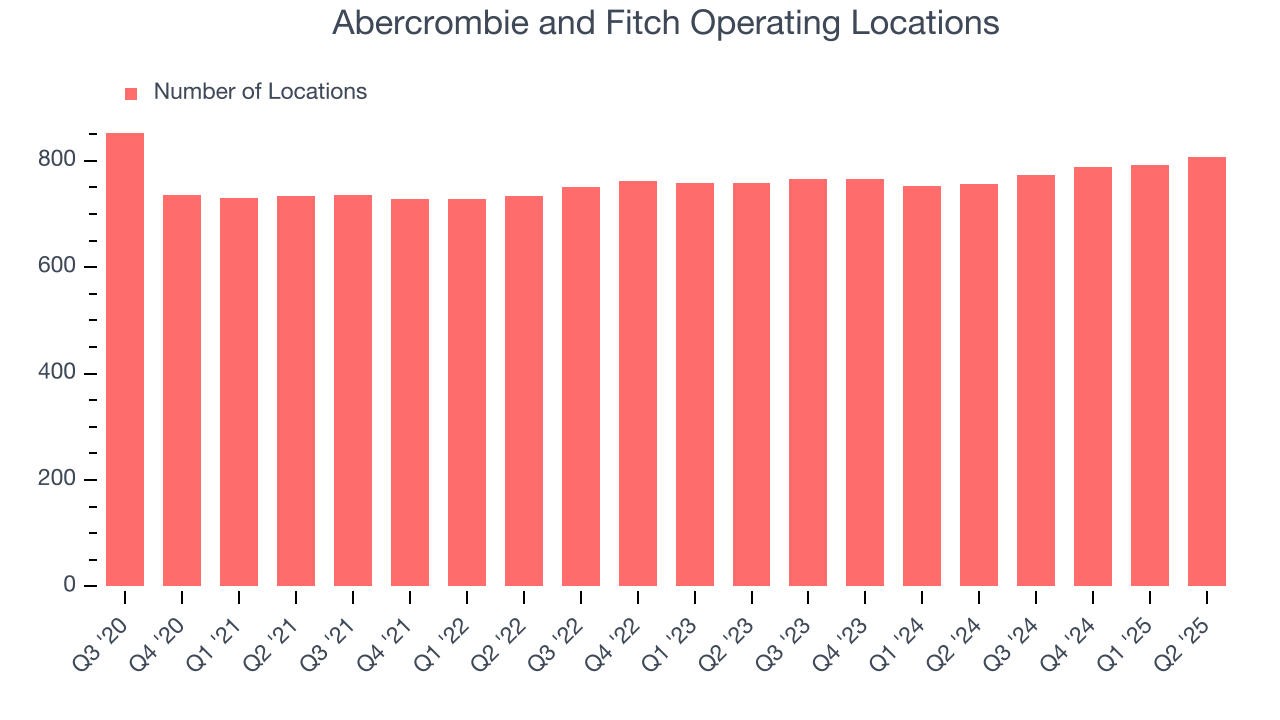

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Abercrombie and Fitch opened new stores quickly over the last two years, averaging 2.2% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Note that Abercrombie and Fitch reports its store count intermittently, so some data points are missing in the chart below.

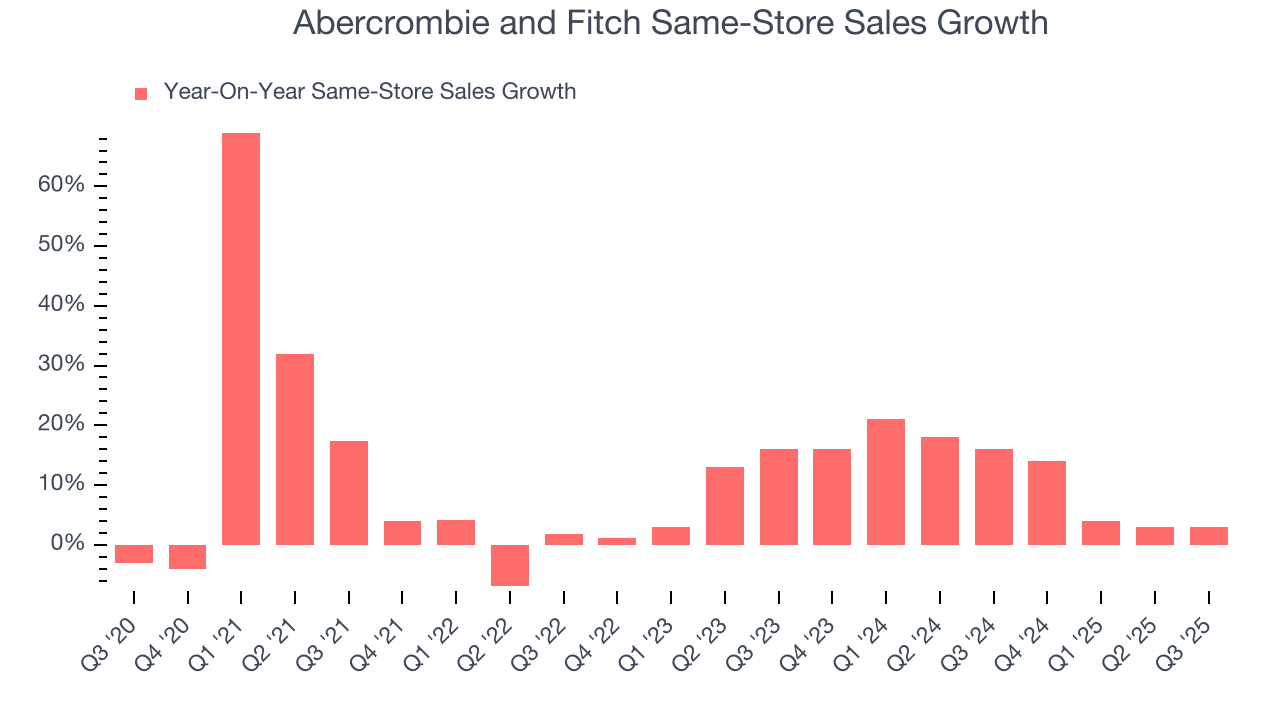

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Abercrombie and Fitch has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 11.9%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Abercrombie and Fitch multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Abercrombie and Fitch’s same-store sales rose 3% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Abercrombie and Fitch can reaccelerate growth.

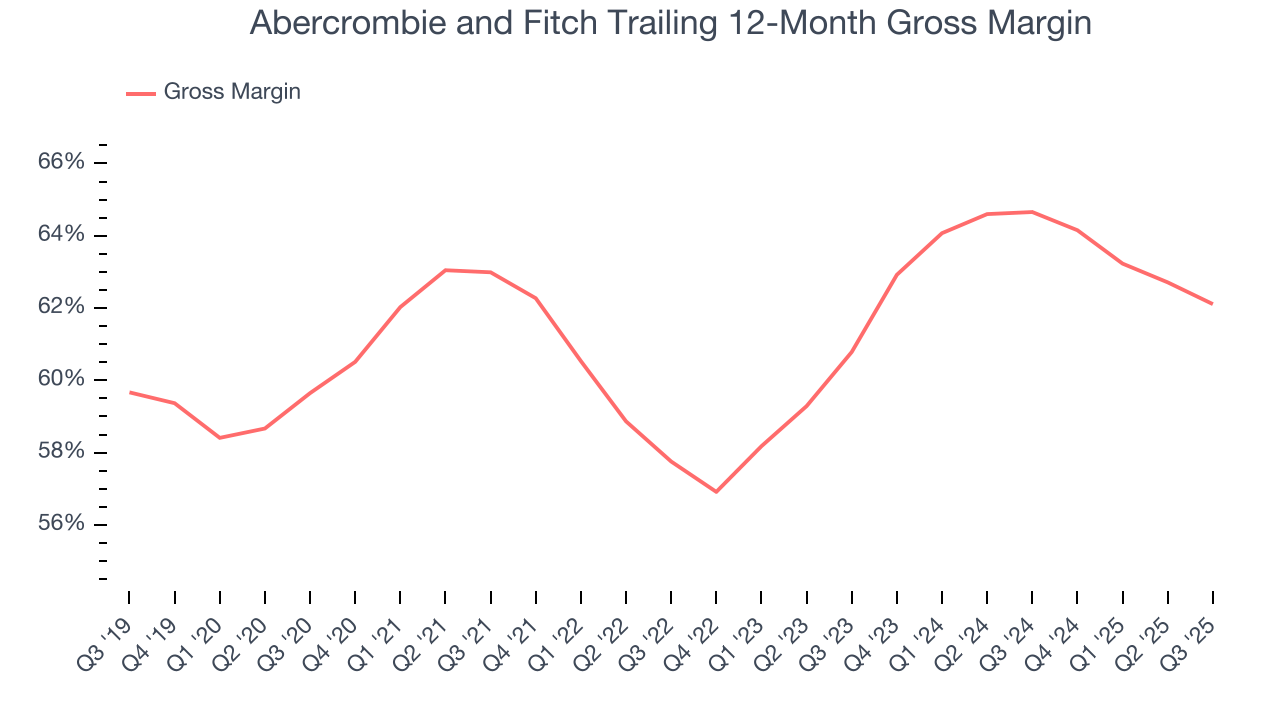

7. Gross Margin & Pricing Power

Gross profit margins are an important measure of a retailer’s pricing power, product differentiation, and negotiating leverage.

Abercrombie and Fitch has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent. As you can see below, it averaged an elite 63.3% gross margin over the last two years. That means for every $100 in revenue, only $36.66 went towards paying for inventory, transportation, and distribution.

In Q3, Abercrombie and Fitch produced a 62.5% gross profit margin, down 2.6 percentage points year on year. Abercrombie and Fitch’s full-year margin has also been trending down over the past 12 months, decreasing by 2.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to discount products and higher input costs (such as labor and freight expenses to transport goods).

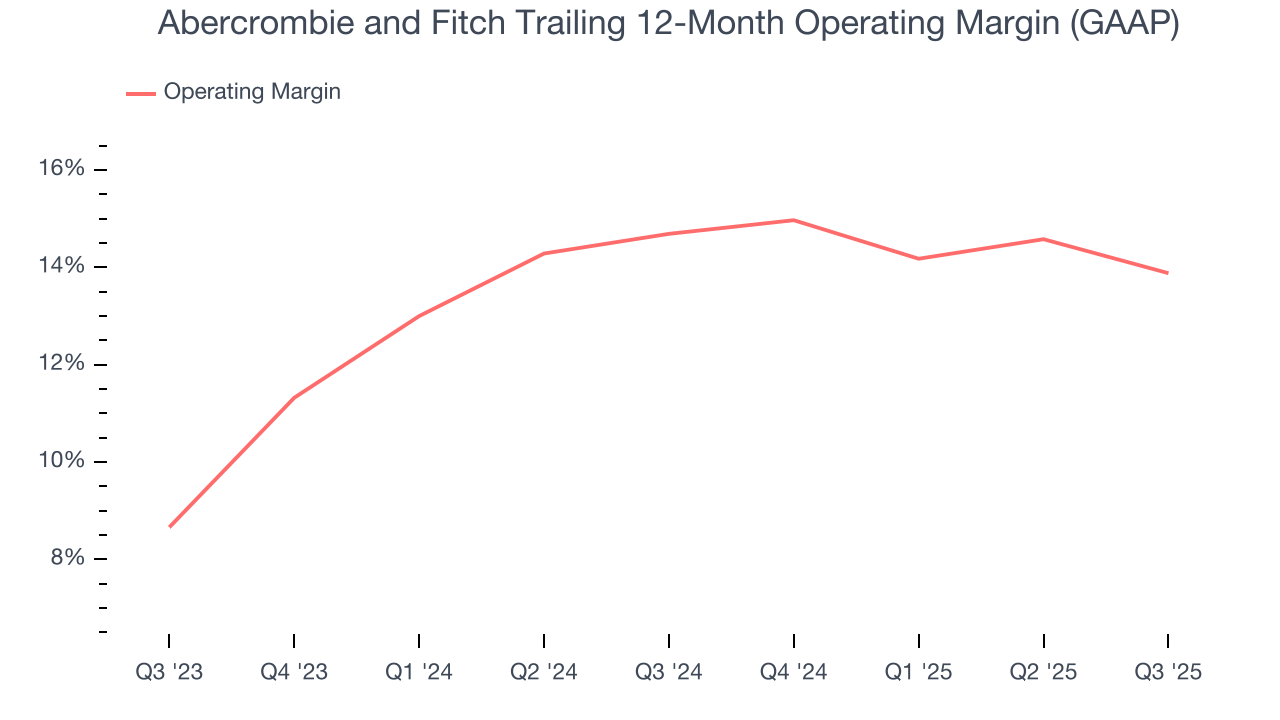

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Abercrombie and Fitch’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 14.3% over the last two years. This profitability was top-notch for a consumer retail business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Abercrombie and Fitch’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Abercrombie and Fitch generated an operating margin profit margin of 12%, down 2.8 percentage points year on year. Since Abercrombie and Fitch’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

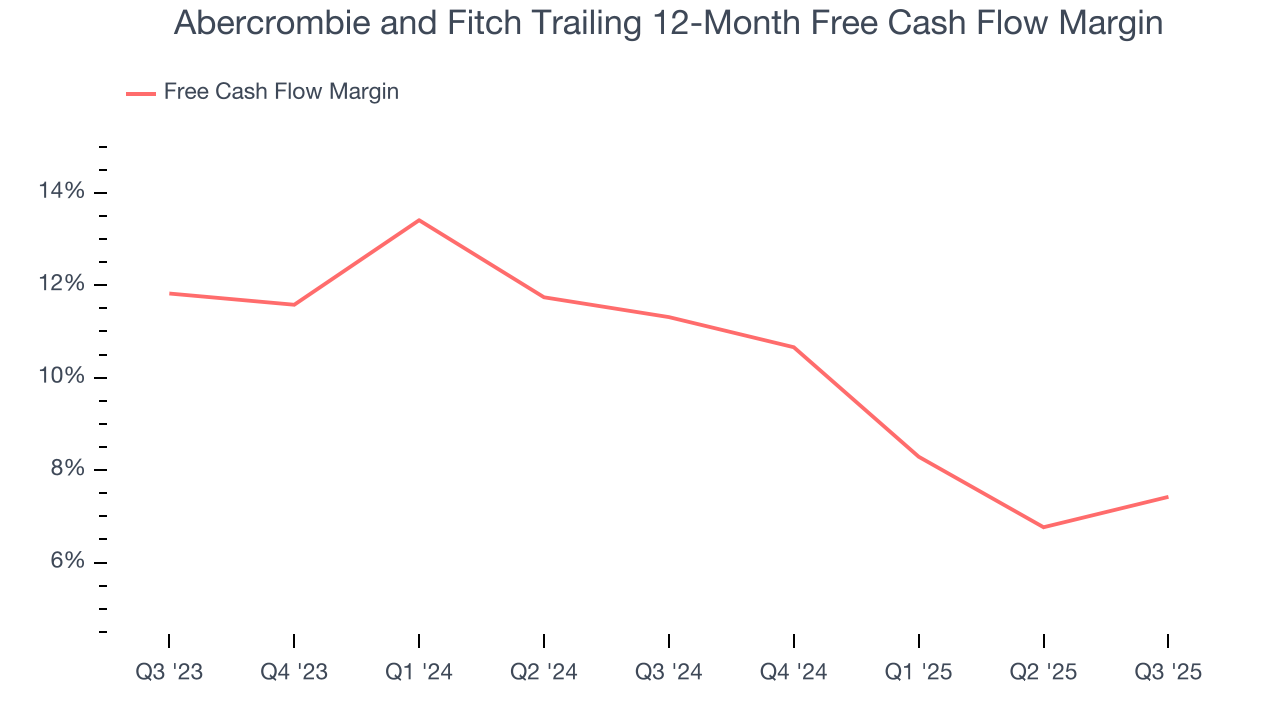

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Abercrombie and Fitch has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.3% over the last two years, quite impressive for a consumer retail business.

Taking a step back, we can see that Abercrombie and Fitch’s margin dropped by 3.9 percentage points over the last year. This decrease came from the higher costs associated with opening more stores.

Abercrombie and Fitch’s free cash flow clocked in at $131.8 million in Q3, equivalent to a 10.2% margin. This result was good as its margin was 2.6 percentage points higher than in the same quarter last year. We hope the company can build on this trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Abercrombie and Fitch’s five-year average ROIC was 23.1%, beating other consumer retail companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

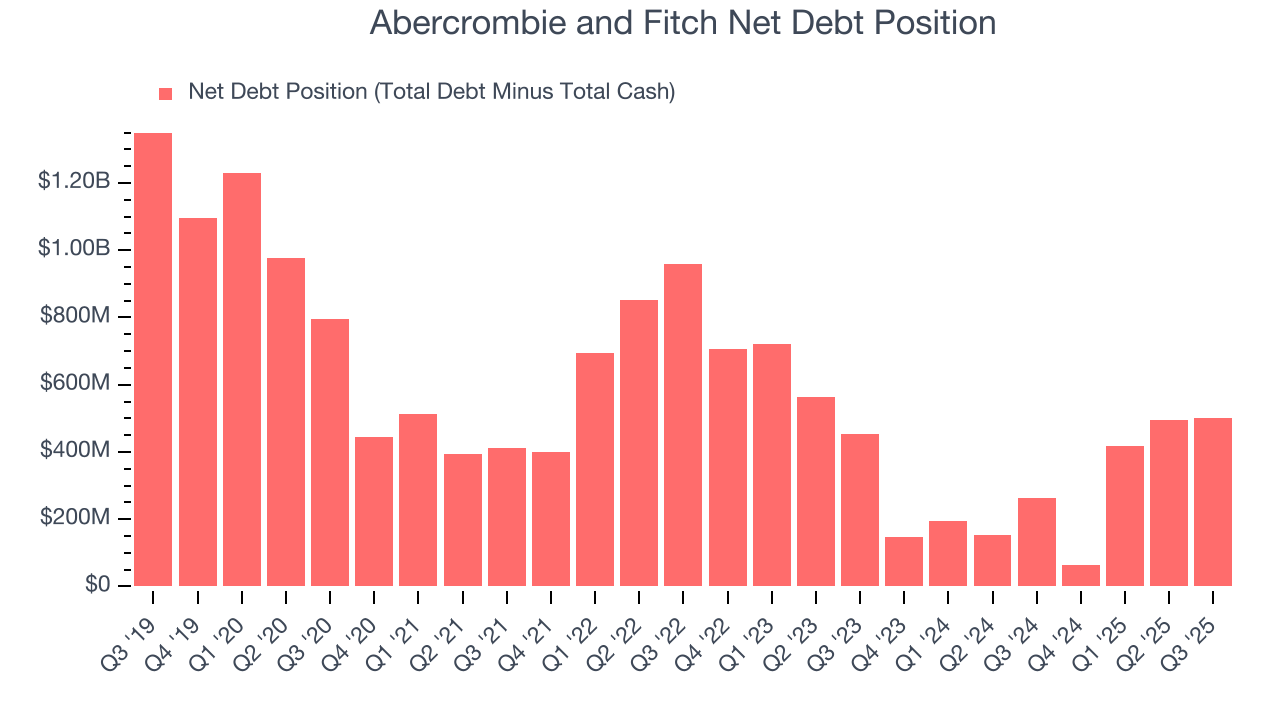

11. Balance Sheet Assessment

Abercrombie and Fitch reported $631 million of cash and $1.13 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $822.8 million of EBITDA over the last 12 months, we view Abercrombie and Fitch’s 0.6× net-debt-to-EBITDA ratio as safe. We also see its $12.21 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Abercrombie and Fitch’s Q3 Results

It was great to see Abercrombie and Fitch’s full-year EPS guidance top analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter slightly missed and its gross margin was in line with Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $89.80 immediately after reporting.

13. Is Now The Time To Buy Abercrombie and Fitch?

Updated: January 24, 2026 at 9:33 PM EST

Before deciding whether to buy Abercrombie and Fitch or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are multiple reasons why we think Abercrombie and Fitch is an amazing business. First of all, the company’s revenue growth was solid over the last three years. On top of that, its marvelous same-store sales growth is on another level, and its admirable gross margins are a wonderful starting point for the overall profitability of the business.

Abercrombie and Fitch’s P/E ratio based on the next 12 months is 9.5x. Analyzing the consumer retail landscape today, Abercrombie and Fitch’s positive attributes shine bright. We like the stock at this bargain price.

Wall Street analysts have a consensus one-year price target of $127.56 on the company (compared to the current share price of $96.15), implying they see 32.7% upside in buying Abercrombie and Fitch in the short term.