Dutch Bros (BROS)

Dutch Bros is a great business. Its marvelous same-store sales and new restaurant openings show there’s healthy demand for its meals.― StockStory Analyst Team

1. News

2. Summary

Why We Like Dutch Bros

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

- Fast expansion of new restaurants to reach markets with few or no locations is justified by its same-store sales growth

- Remarkable 37.9% revenue growth over the last six years demonstrates its ability to capture significant market share

- Market share will likely rise over the next 12 months as its expected revenue growth of 25% is robust

We have an affinity for Dutch Bros. This is a fantastic business you don’t see often.

Is Now The Time To Buy Dutch Bros?

High Quality

Investable

Underperform

Is Now The Time To Buy Dutch Bros?

Dutch Bros is trading at $53.78 per share, or 56.9x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Are you a fan of the business model? If so, we suggest a small position as the long-term outlook seems promising. Keep in mind that Dutch Bros’s lofty valuation could result in short-term volatility based on both macro and company-specific factors.

3. Dutch Bros (BROS) Research Report: Q4 CY2025 Update

Coffee chain Dutch Bros (NYSE:BROS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 29.4% year on year to $443.6 million. On the other hand, the company’s full-year revenue guidance of $2.02 billion at the midpoint came in 1% below analysts’ estimates. Its non-GAAP profit of $0.17 per share was 73.9% above analysts’ consensus estimates.

Dutch Bros (BROS) Q4 CY2025 Highlights:

- Revenue: $443.6 million vs analyst estimates of $424.7 million (29.4% year-on-year growth, 4.5% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.10 (73.9% beat)

- Adjusted EBITDA: $72.64 million vs analyst estimates of $60.11 million (16.4% margin, 20.9% beat)

- EBITDA guidance for the upcoming financial year 2026 is $360 million at the midpoint, below analyst estimates of $365.2 million

- Operating Margin: 7.7%, up from 4.6% in the same quarter last year

- Locations: 1,136 at quarter end, up from 982 in the same quarter last year

- Same-Store Sales rose 7.7% year on year, in line with the same quarter last year

- Market Capitalization: $6.80 billion

Company Overview

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Since day one, the Dane brothers, founders of the Oregon-based company, set out to create not just any coffee shop but a community-driven brand that’d be known for its vibrant energy. This is seen in its distinctive blue stands, which are staffed by enthusiastic baristas known as "broistas”.

Combined with the upbeat atmosphere stirred up by the broistas, the company leverages a unique model to serve its customers. For Dutch Bros, the drive-thru is the main mode of coffee delivery as the average stand is around 950 square feet, roughly the size of a studio apartment, and only has outdoor seating. This approach reduces wait times and enables the company to serve a high volume of customers.

Dutch Bros has over 700 locations across the United States and offers a wide range of beverages at its stands, from traditional lattes and mochas to innovative creations like the Dutch Freeze.

Given its focus on the customer experience, Dutch Bros has also built a digital presence. Vintage photos featuring Chicago landmarks, celebrities, or pop culture line the walls to remind everyone of the restaurant’s roots. Customers can sign up for the company’s mobile app to order ahead and earn rewards. Dutch Bros is also active on social media platforms like TikTok, further bolstering their reputation as the “fun” brand.

4. Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Some competitors that sell caffeinated beverages include private company Dunkin’ as well as public companies McDonald’s (NYSE:MCD), Starbucks (NASDAQ:SBUX), and Tim Hortons (owned by Restaurant Brands, NYSE:QSR).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.64 billion in revenue over the past 12 months, Dutch Bros is a mid-sized restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Dutch Bros’s 37.9% annualized revenue growth over the last six years was incredible as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Dutch Bros reported robust year-on-year revenue growth of 29.4%, and its $443.6 million of revenue topped Wall Street estimates by 4.5%.

Looking ahead, sell-side analysts expect revenue to grow 24.4% over the next 12 months, a deceleration versus the last six years. Despite the slowdown, this projection is healthy and indicates the market is baking in success for its menu offerings.

6. Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Dutch Bros sported 1,136 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 17.6% annual growth, among the fastest in the restaurant sector. This gives it a chance to become a large, scaled business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

Dutch Bros has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 6%. This performance along with its meaningful buildout of new restaurants suggest it’s playing some aggressive offense.

In the latest quarter, Dutch Bros’s same-store sales rose 7.7% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

7. Gross Margin & Pricing Power

Dutch Bros’s unit economics are higher than the typical restaurant company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 26.2% gross margin over the last two years. That means for every $100 in revenue, roughly $26.17 was left to spend on selling, marketing, and general administrative overhead.

In Q4, Dutch Bros produced a 24.1% gross profit margin, marking a 1.5 percentage point decrease from 25.7% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

Dutch Bros has done a decent job managing its cost base over the last two years. The company has produced an average operating margin of 9.2%, higher than the broader restaurant sector.

Looking at the trend in its profitability, Dutch Bros’s operating margin rose by 1.6 percentage points over the last year, as its sales growth gave it operating leverage.

In Q4, Dutch Bros generated an operating margin profit margin of 7.7%, up 3.1 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

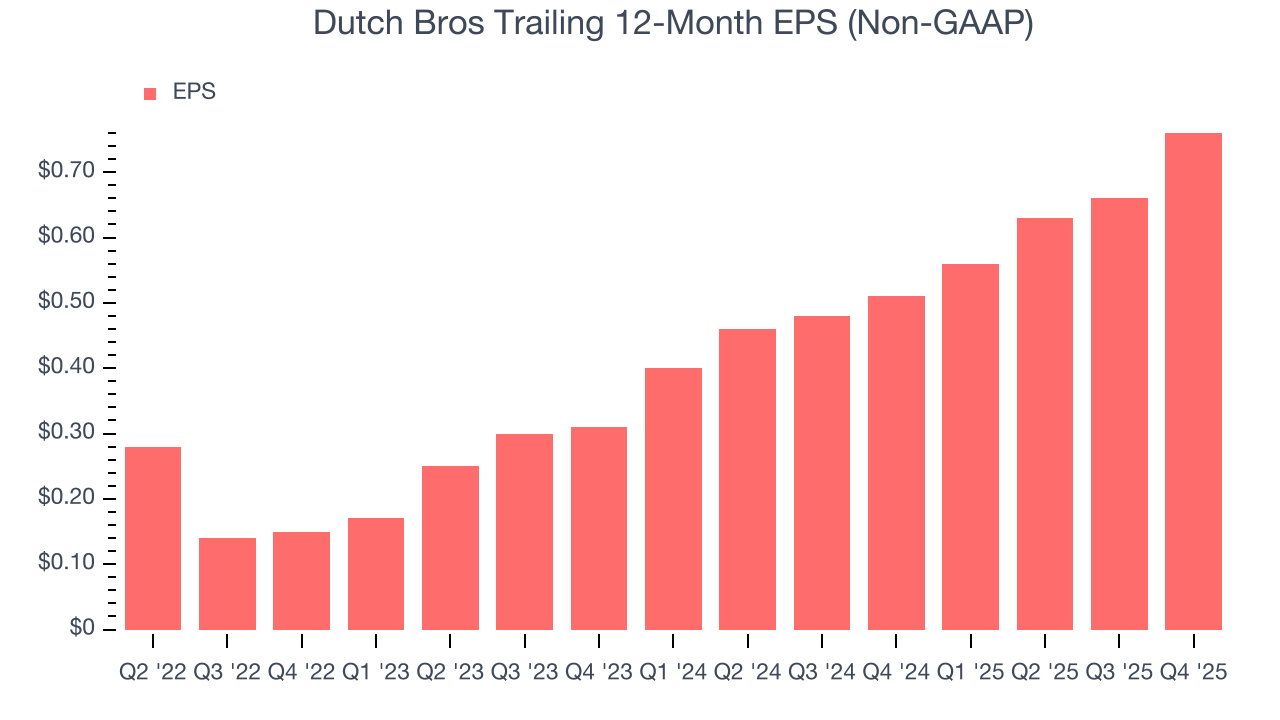

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Dutch Bros’s full-year EPS grew at an unimpressive 9.5% compounded annual growth rate over the last four years, in line with the broader restaurant sector.

In Q4, Dutch Bros reported adjusted EPS of $0.17, up from $0.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Dutch Bros’s full-year EPS of $0.76 to grow 18.2%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Dutch Bros has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.9%, subpar for a restaurant business.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Dutch Bros’s four-year average ROIC was 12%, higher than most restaurant businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

12. Balance Sheet Assessment

Dutch Bros reported $269.4 million of cash and $1.09 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $302.6 million of EBITDA over the last 12 months, we view Dutch Bros’s 2.7× net-debt-to-EBITDA ratio as safe. We also see its $28.31 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Dutch Bros’s Q4 Results

It was good to see Dutch Bros beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance slightly missed and its full-year EBITDA guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 15.2% to $58.52 immediately following the results.

14. Is Now The Time To Buy Dutch Bros?

Updated: February 26, 2026 at 9:52 PM EST

Are you wondering whether to buy Dutch Bros or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Dutch Bros is a rock-solid business worth owning. First of all, the company’s revenue growth was exceptional over the last six years. On top of that, its marvelous same-store sales growth is on another level, and its new restaurant openings have increased its brand equity.

Dutch Bros’s P/E ratio based on the next 12 months is 56.9x. A lot of good news is certainly baked in given its premium multiple, but we’ll happily own Dutch Bros as its fundamentals really stand out. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $77.10 on the company (compared to the current share price of $53.78).