CONMED (CNMD)

We’re wary of CONMED. Its low returns on capital raise concerns about its ability to deliver profits, a must for quality companies.― StockStory Analyst Team

1. News

2. Summary

Why We Think CONMED Will Underperform

With over five decades of experience in surgical innovation since its founding in 1970, CONMED (NYSE:CNMD) develops and manufactures medical devices and equipment for surgical procedures, specializing in orthopedic and general surgery products.

- Subscale operations are evident in its revenue base of $1.37 billion, meaning it has fewer distribution channels than its larger rivals

- Projected sales decline of 1.3% for the next 12 months points to a tough demand environment ahead

- A silver lining is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 16.4% over the last five years outstripped its revenue performance

CONMED’s quality doesn’t meet our expectations. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than CONMED

High Quality

Investable

Underperform

Why There Are Better Opportunities Than CONMED

At $41.44 per share, CONMED trades at 9.9x forward P/E. CONMED’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. CONMED (CNMD) Research Report: Q4 CY2025 Update

Medical tech company CONMED (NYSE:CNMD) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 7.9% year on year to $373.2 million. On the other hand, the company’s full-year revenue guidance of $1.36 billion at the midpoint came in 0.7% below analysts’ estimates. Its non-GAAP profit of $1.43 per share was 8% above analysts’ consensus estimates.

CONMED (CNMD) Q4 CY2025 Highlights:

- Revenue: $373.2 million vs analyst estimates of $367 million (7.9% year-on-year growth, 1.7% beat)

- Adjusted EPS: $1.43 vs analyst estimates of $1.32 (8% beat)

- Adjusted EBITDA: $80.36 million vs analyst estimates of $79.27 million (21.5% margin, 1.4% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $4.38 at the midpoint, missing analyst estimates by 1%

- Operating Margin: 9.8%, down from 15.2% in the same quarter last year

- Constant Currency Revenue rose 7.1% year on year (6% in the same quarter last year)

- Market Capitalization: $1.23 billion

Company Overview

With over five decades of experience in surgical innovation since its founding in 1970, CONMED (NYSE:CNMD) develops and manufactures medical devices and equipment for surgical procedures, specializing in orthopedic and general surgery products.

CONMED's product portfolio spans two main categories: orthopedic surgery and general surgery. In orthopedics, the company offers implants like the BioBrace and Y-Knot All-Suture Anchors for soft tissue repair, powered resection instruments, and systems for foot and ankle surgery such as the Quantum Total Ankle System. The company also provides battery-powered bone tool systems under the Hall surgical brand for various bone-related procedures.

The general surgery division features advanced surgical and endoscopic technologies. A flagship product is the AirSeal insufflation system with valveless access ports that enhance minimally invasive and robotic surgeries. Through its Buffalo Filter acquisition, CONMED offers comprehensive smoke evacuation products for surgical procedures. The division also includes electrosurgical generators, endomechanical instruments for minimally invasive surgery, and specialized devices for gastroenterology procedures.

A surgeon might use CONMED's AirSeal system during a laparoscopic gallbladder removal to maintain stable pneumoperitoneum (abdominal inflation), while simultaneously using the company's smoke evacuation technology to clear the surgical field of smoke generated during tissue cauterization.

CONMED generates revenue by selling its products directly to hospitals and surgery centers, through medical specialty distributors, and via contracts with group purchasing organizations (GPOs) and integrated delivery networks (IDNs). The company maintains a global presence, distributing products in over 100 countries through both direct sales subsidiaries and independent distributors.

Research and development is a significant focus, with the company investing substantially to develop new products and enhance existing ones. CONMED's manufacturing and distribution processes must comply with strict FDA regulations and international standards for medical devices.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

CONMED's competitors in the orthopedic space include Smith & Nephew, Arthrex, Stryker Corporation, Johnson & Johnson's DePuy Mitek, and Zimmer Biomet. In general surgery products, the company competes with Medtronic, Johnson & Johnson's Ethicon Endo-Surgery, Stryker Endoscopy, Olympus, and Boston Scientific.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.37 billion in revenue over the past 12 months, CONMED is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, CONMED’s 9.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. CONMED’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5.2% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that CONMED has properly hedged its foreign currency exposure.

This quarter, CONMED reported year-on-year revenue growth of 7.9%, and its $373.2 million of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

7. Operating Margin

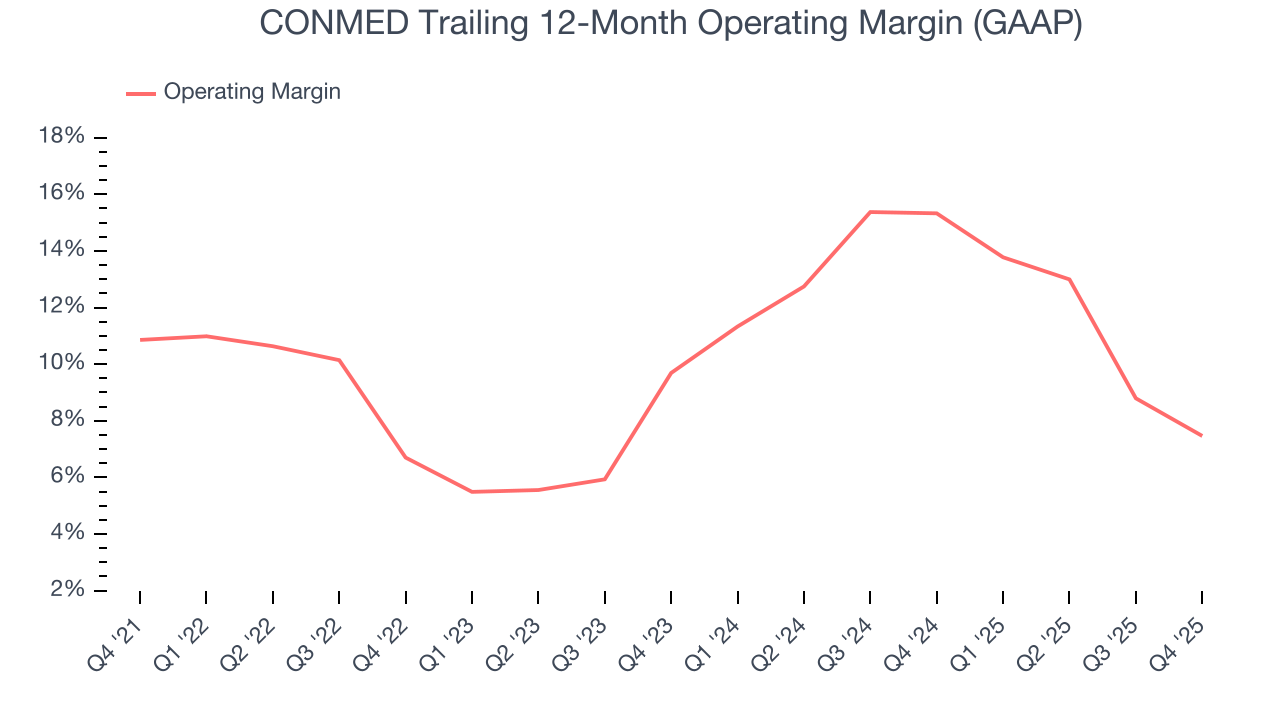

CONMED has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 10.1%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, CONMED’s operating margin decreased by 3.4 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 2.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, CONMED generated an operating margin profit margin of 9.8%, down 5.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

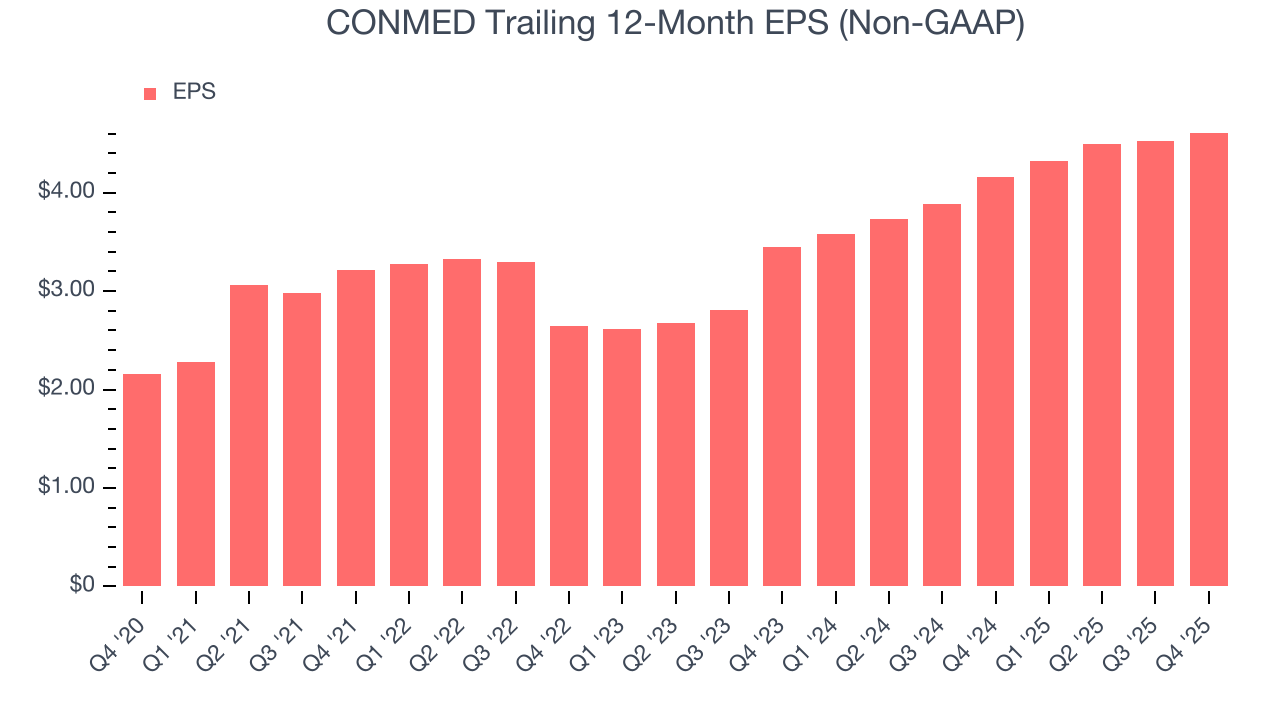

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CONMED’s EPS grew at an astounding 16.4% compounded annual growth rate over the last five years, higher than its 9.8% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, CONMED reported adjusted EPS of $1.43, up from $1.34 in the same quarter last year. This print beat analysts’ estimates by 8%. Over the next 12 months, Wall Street expects CONMED’s full-year EPS of $4.61 to shrink by 7.3%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

CONMED has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.5% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that CONMED’s margin expanded by 1.9 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CONMED historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.7%, somewhat low compared to the best healthcare companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, CONMED’s ROIC averaged 2.4 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

11. Balance Sheet Assessment

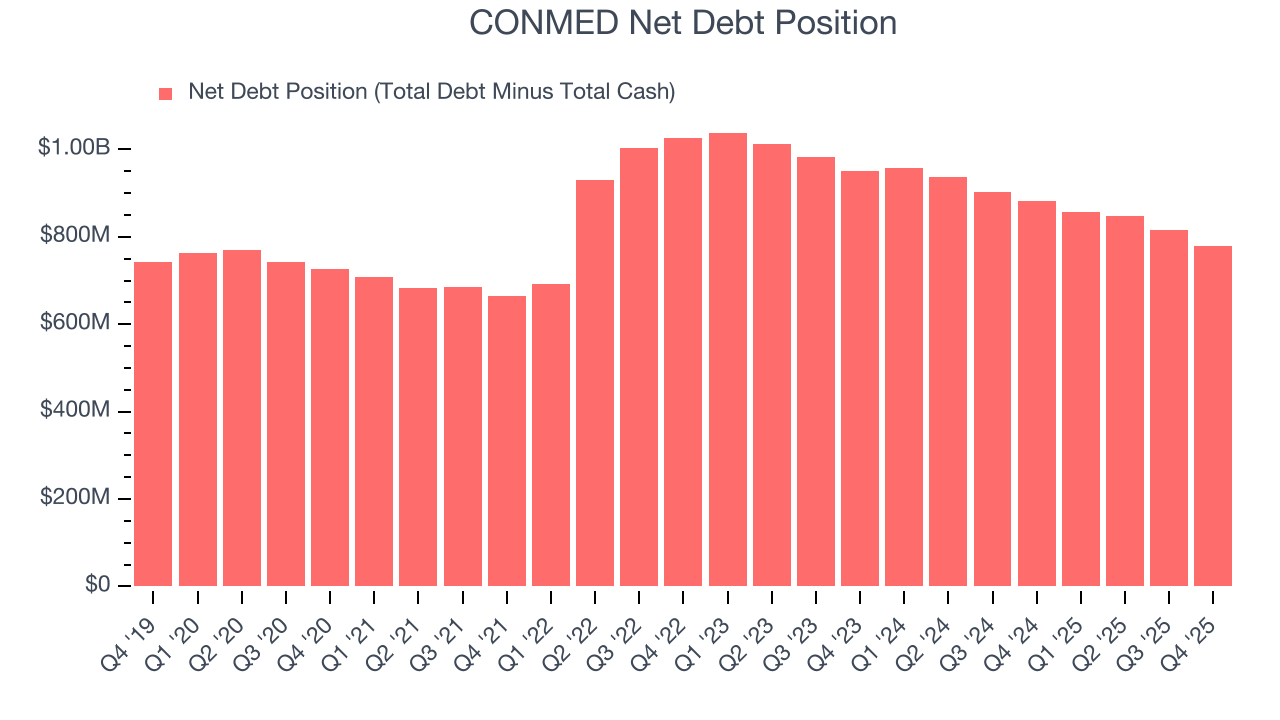

CONMED reported $70.19 million of cash and $848.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $275.9 million of EBITDA over the last 12 months, we view CONMED’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $31.09 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from CONMED’s Q4 Results

We enjoyed seeing CONMED beat analysts’ constant currency revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock traded up 5.4% to $40.74 immediately after reporting.

13. Is Now The Time To Buy CONMED?

Updated: March 5, 2026 at 11:25 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

CONMED’s business quality ultimately falls short of our standards. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its subscale operations give it fewer distribution channels than its larger rivals. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its mediocre ROIC lags the market and is a headwind for its stock price.

CONMED’s P/E ratio based on the next 12 months is 9.9x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $47.40 on the company (compared to the current share price of $41.44).