GoDaddy (GDDY)

GoDaddy is in for a bumpy ride. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think GoDaddy Will Underperform

Known for its memorable Super Bowl commercials that put it on the map, GoDaddy (NYSE:GDDY) is a domain registrar and web services provider that helps entrepreneurs establish an online presence through domain registration, website building, hosting, and e-commerce tools.

- Projected sales growth of 6.5% for the next 12 months suggests sluggish demand

- 7.8% annual revenue growth over the last two years was slower than its software peers

- Average bookings growth of 7.8% over the last year was mediocre and suggests fewer customers signed long-term contracts

GoDaddy’s quality isn’t up to par. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than GoDaddy

High Quality

Investable

Underperform

Why There Are Better Opportunities Than GoDaddy

At $103.40 per share, GoDaddy trades at 2.8x forward price-to-sales. GoDaddy’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. GoDaddy (GDDY) Research Report: Q3 CY2025 Update

Domain registrar and web services company GoDaddy (NYSE:GDDY) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 10.3% year on year to $1.27 billion. On the other hand, next quarter’s revenue guidance of $1.27 billion was less impressive, coming in 0.5% below analysts’ estimates. Its GAAP profit of $1.51 per share was 3.1% above analysts’ consensus estimates.

GoDaddy (GDDY) Q3 CY2025 Highlights:

- Revenue: $1.27 billion vs analyst estimates of $1.23 billion (10.3% year-on-year growth, 2.7% beat)

- EPS (GAAP): $1.51 vs analyst estimates of $1.46 (3.1% beat)

- Adjusted EBITDA: $408.6 million vs analyst estimates of $394.2 million (32.3% margin, 3.7% beat)

- Revenue Guidance for Q4 CY2025 is $1.27 billion at the midpoint, below analyst estimates of $1.27 billion

- Operating Margin: 23.4%, up from 22.1% in the same quarter last year

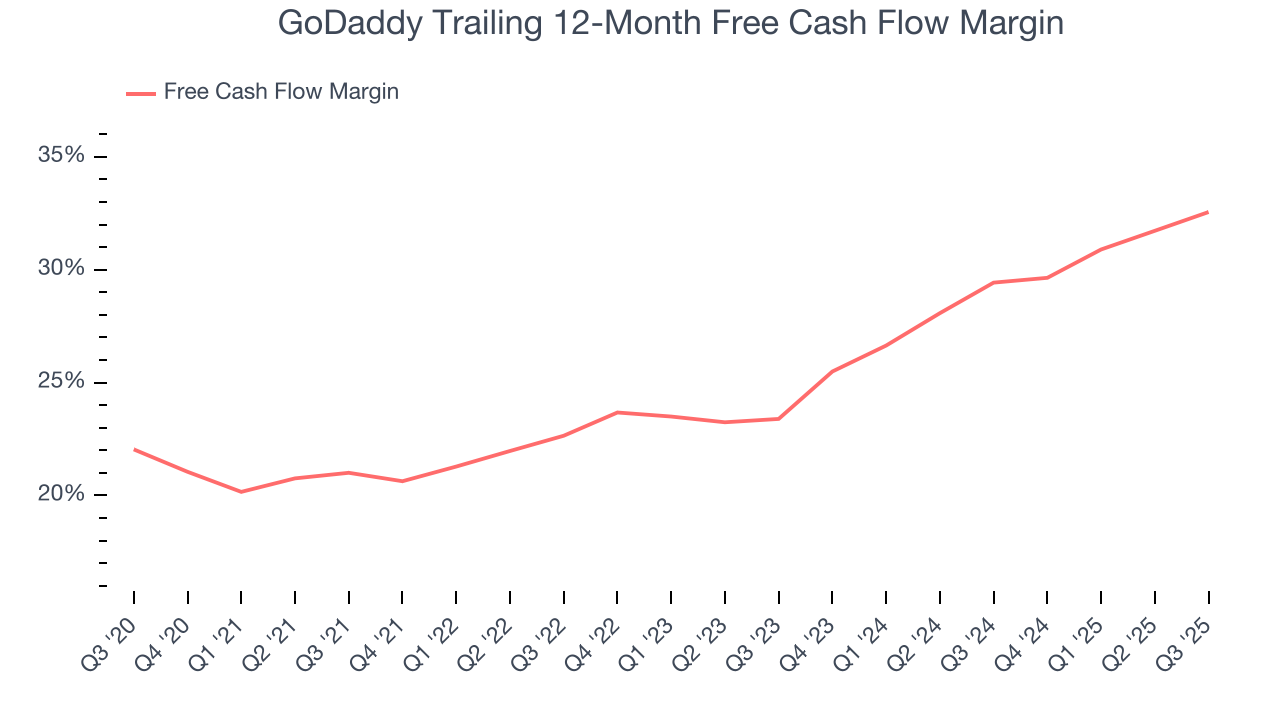

- Free Cash Flow Margin: 34.8%, up from 32.2% in the previous quarter

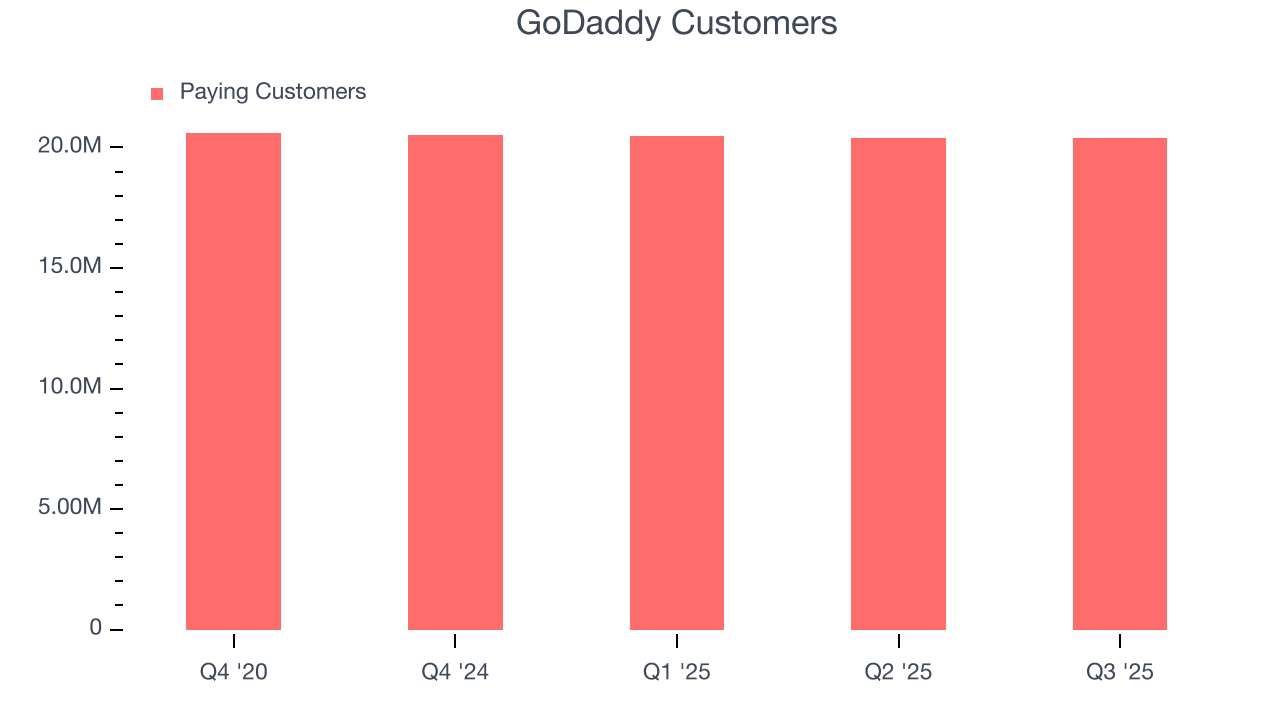

- Customers: 20.41 million, up from 20.41 million in the previous quarter

- Annual Recurring Revenue: $4.29 billion vs analyst estimates of $4.21 billion (8% year-on-year growth, 1.9% beat)

- Billings: $1.29 billion at quarter end, up 9.1% year on year

- Market Capitalization: $17.52 billion

Company Overview

Known for its memorable Super Bowl commercials that put it on the map, GoDaddy (NYSE:GDDY) is a domain registrar and web services provider that helps entrepreneurs establish an online presence through domain registration, website building, hosting, and e-commerce tools.

The company operates in a "one-stop shop" model, providing solutions across the entire digital journey of small businesses and individuals. Beyond its core domain registration service with approximately 85 million domains under management (representing about 24% of all registered domains worldwide), GoDaddy offers a comprehensive ecosystem of products tailored to different customer segments.

For those building websites, GoDaddy provides both simplified solutions like Websites + Marketing for non-technical users and more flexible options like Managed WordPress for developers. Its commerce offerings enable customers to sell products online through integrated storefronts, in physical locations via point-of-sale systems, and across marketplaces like Amazon and social platforms like Instagram.

The company has expanded its toolkit with GoDaddy Airo, an AI-powered solution that creates personalized website content, logos, and marketing materials. It also offers productivity tools like professional email services through Microsoft 365 integration, security products including SSL certificates, and web hosting services ranging from basic shared hosting to virtual private servers.

GoDaddy generates revenue through subscription-based services and transaction fees from its payment processing system, GoDaddy Payments. The company serves various customer segments including "Independents" (primarily microbusinesses), "WebPros" (website designers and developers building sites for clients), domain investors, and corporate domain portfolio owners. With approximately 48% of its customers located outside the U.S., GoDaddy has invested significantly in localizing its offerings for international markets.

4. E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

GoDaddy's competitors include domain registrars like Namecheap and Network Solutions, website building platforms such as Wix (NASDAQ: WIX), Squarespace (NYSE: SQSP), and Shopify (NYSE: SHOP), as well as hosting providers like Cloudflare (NYSE: NET), DigitalOcean (NYSE: DOCN), and Bluehost.

5. Revenue Growth

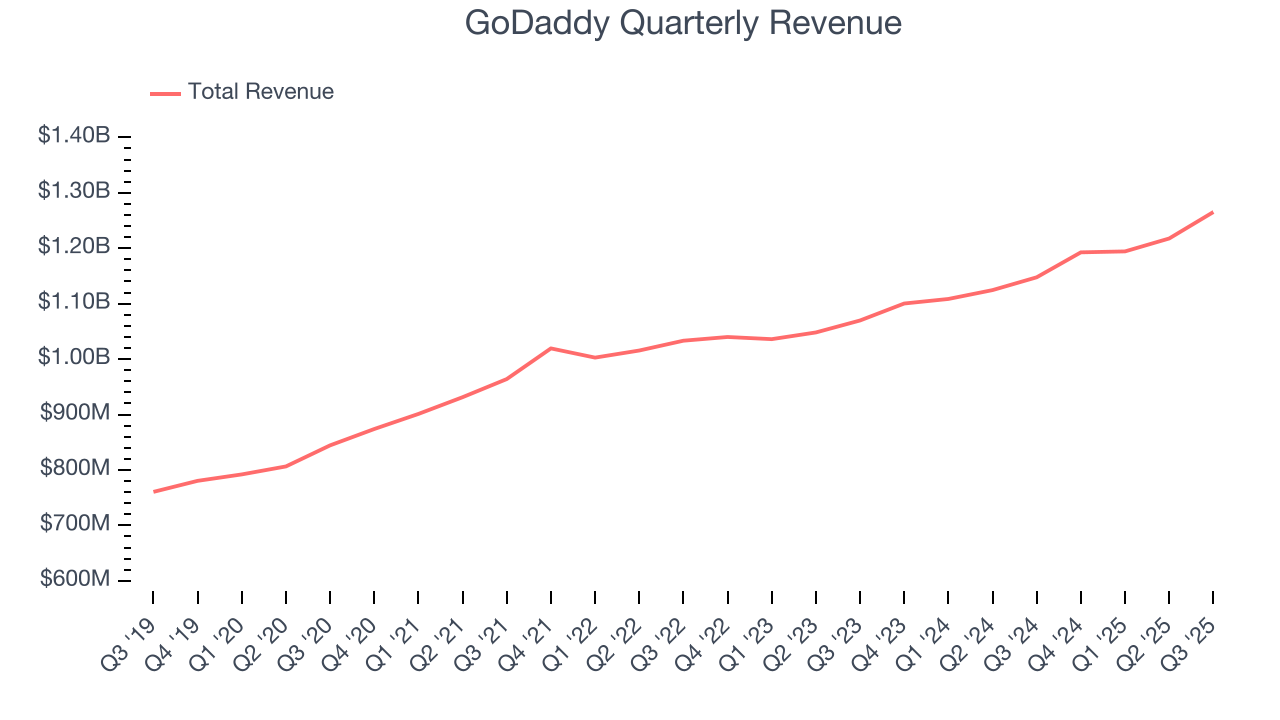

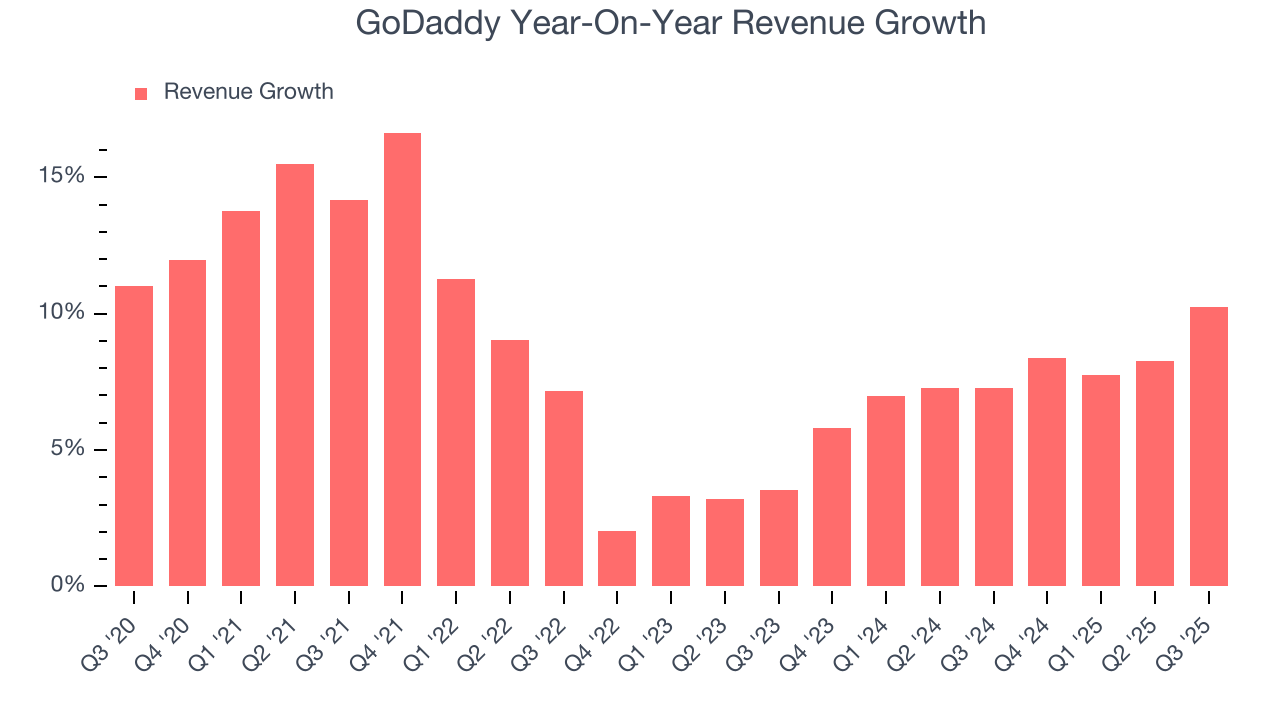

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, GoDaddy’s 8.6% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the software sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. GoDaddy’s annualized revenue growth of 7.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, GoDaddy reported year-on-year revenue growth of 10.3%, and its $1.27 billion of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 6.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

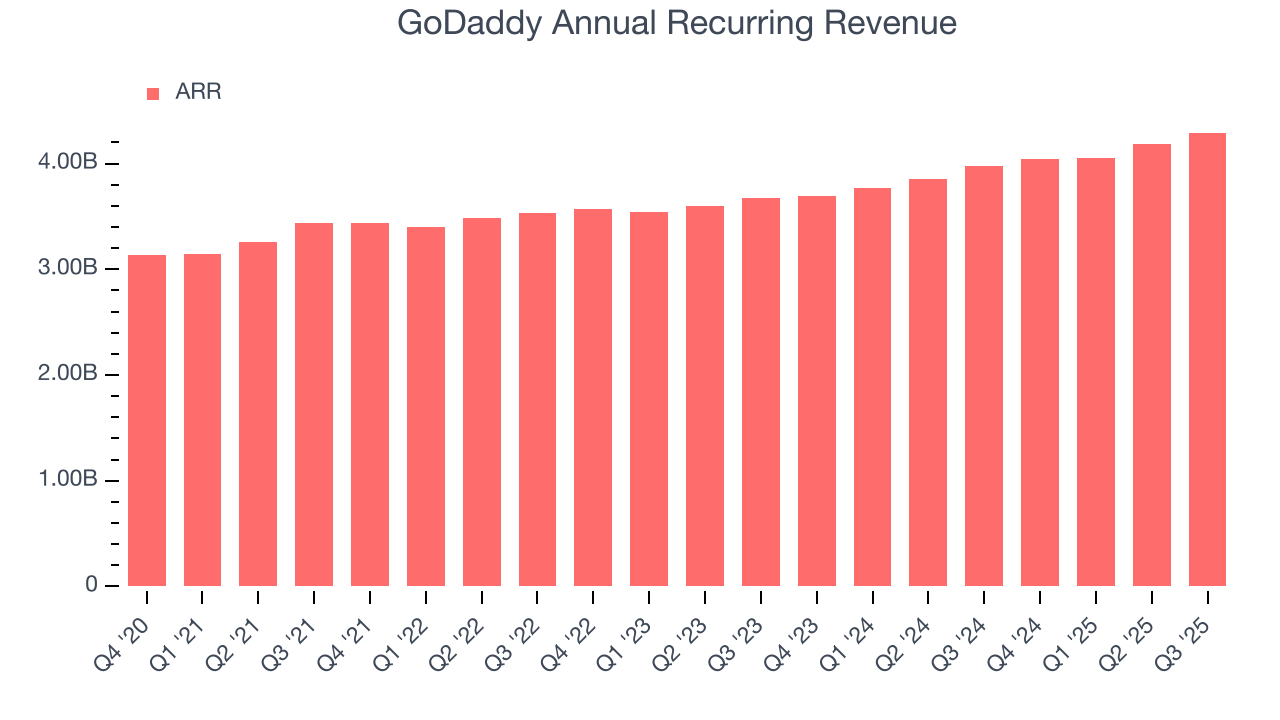

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GoDaddy’s ARR came in at $4.29 billion in Q3, and over the last four quarters, its growth was underwhelming as it averaged 8.4% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

7. Customer Base

GoDaddy reported 20.41 million customers at the end of the quarter, a sequential increase of 4,000. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that GoDaddy has made some recent improvements to its go-to-market strategy and that they are working well for the time being.

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for GoDaddy to acquire new customers as its CAC payback period checked in at 129.1 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

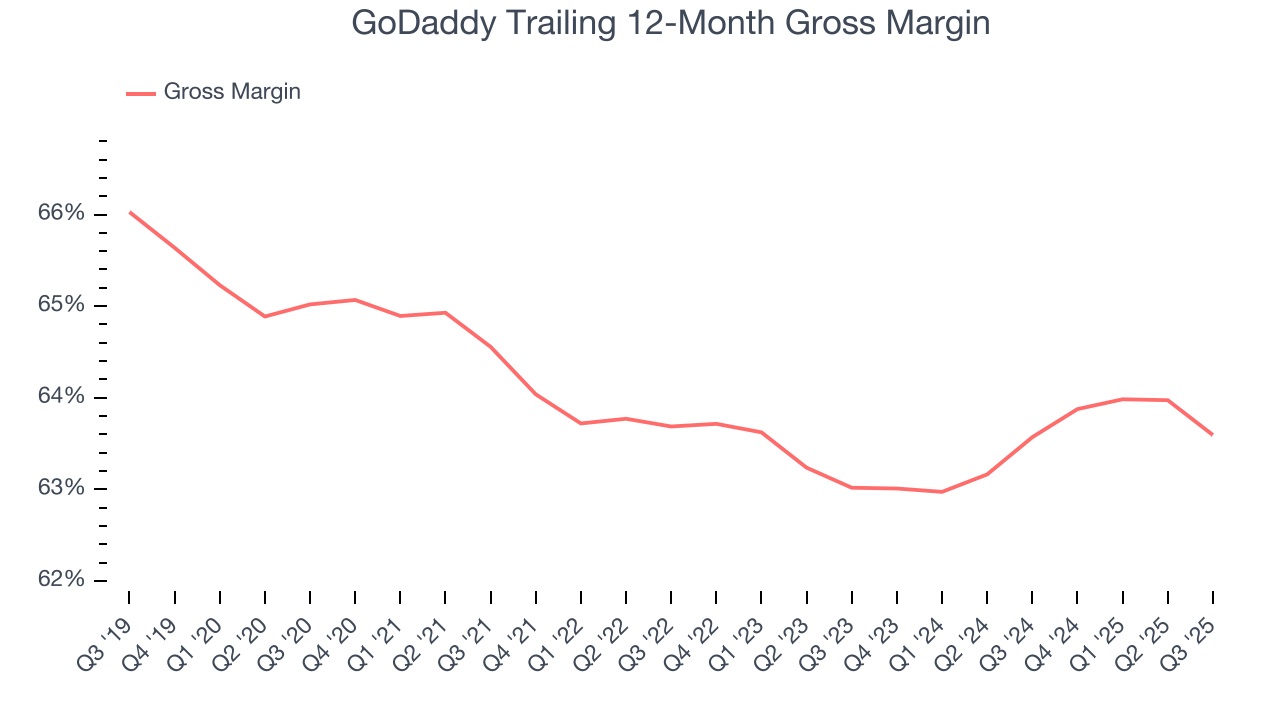

9. Gross Margin & Pricing Power

For software companies like GoDaddy, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

GoDaddy’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 63.6% gross margin over the last year. That means GoDaddy paid its providers a lot of money ($36.41 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. GoDaddy has seen gross margins improve by 0.6 percentage points over the last 2 year, which is slightly better than average for software.

GoDaddy produced a 63% gross profit margin in Q3, down 1.5 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

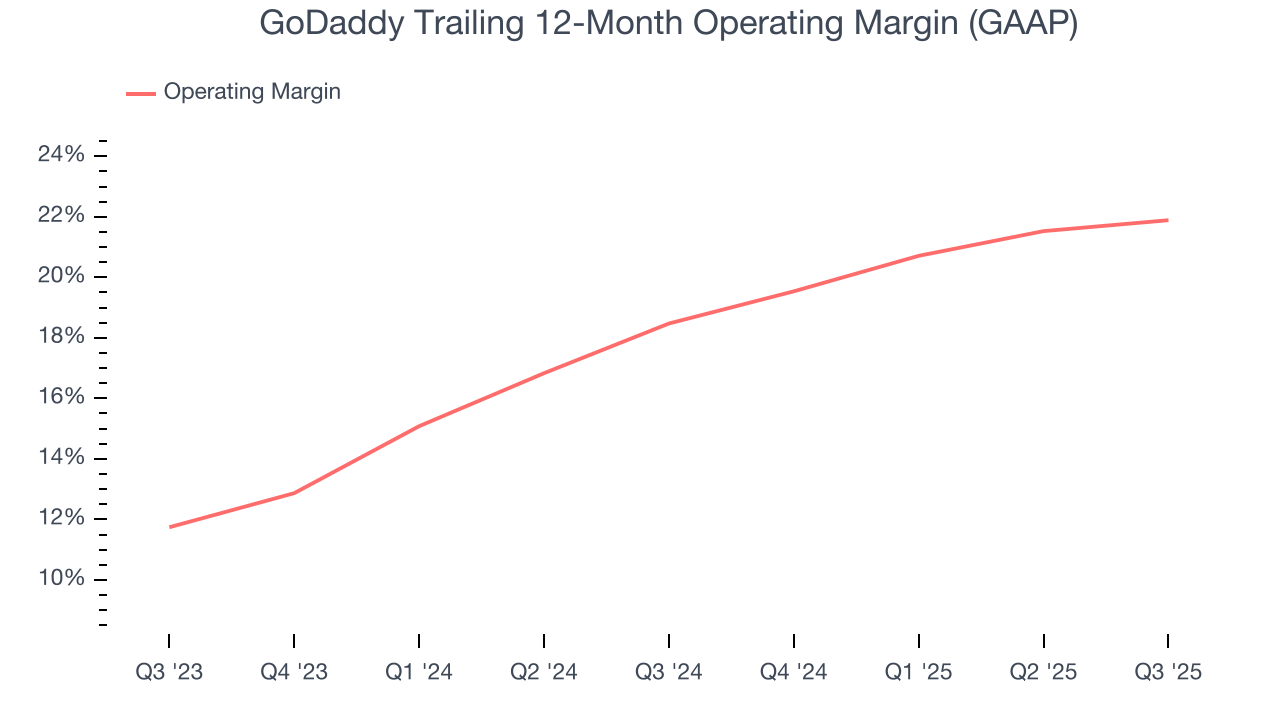

10. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

GoDaddy has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 21.9%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, GoDaddy’s operating margin rose by 3.4 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, GoDaddy generated an operating margin profit margin of 23.4%, up 1.3 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

GoDaddy has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 32.6% over the last year.

GoDaddy’s free cash flow clocked in at $440.5 million in Q3, equivalent to a 34.8% margin. This result was good as its margin was 3.2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict GoDaddy’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 32.6% for the last 12 months will increase to 34%, giving it more flexibility for investments, share buybacks, and dividends.

12. Balance Sheet Assessment

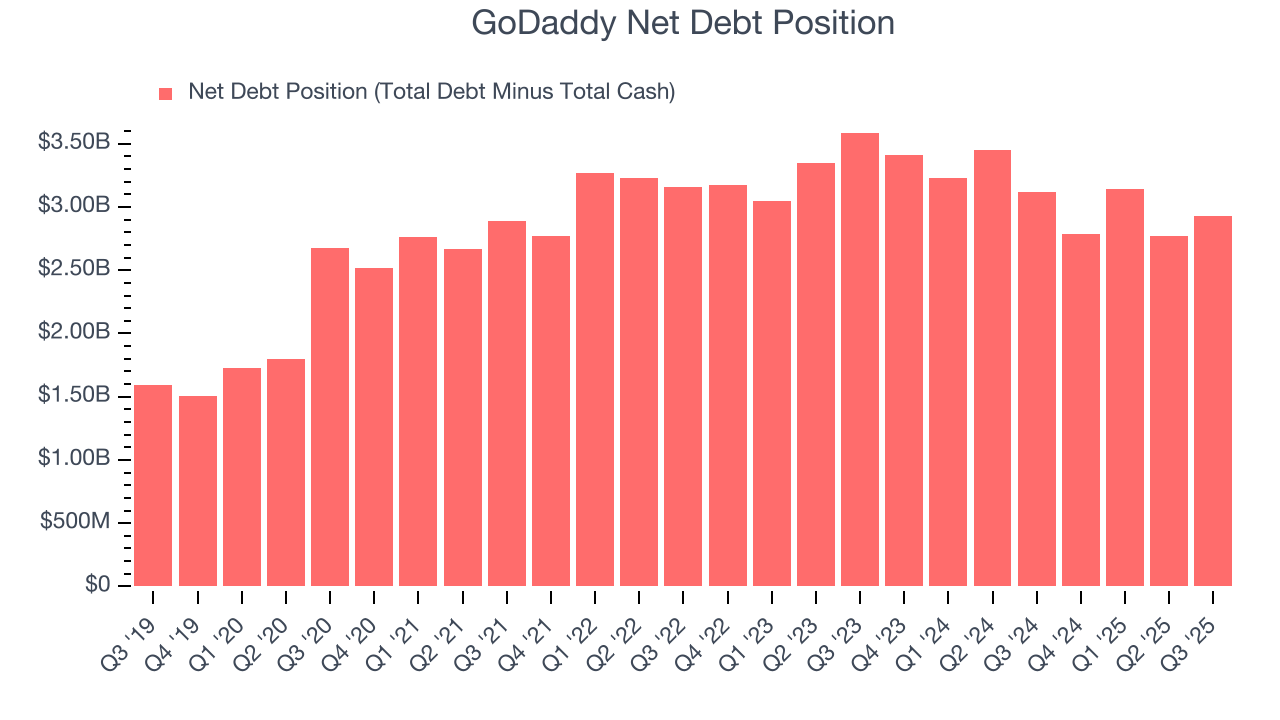

GoDaddy reported $923.7 million of cash and $3.85 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.54 billion of EBITDA over the last 12 months, we view GoDaddy’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $151.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from GoDaddy’s Q3 Results

We were impressed by how significantly GoDaddy blew past analysts’ bookings expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 1.3% to $125 immediately after reporting.

14. Is Now The Time To Buy GoDaddy?

Updated: January 24, 2026 at 9:20 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

GoDaddy doesn’t pass our quality test. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its bookings have disappointed as fewer customers are signing sales agreements. On top of that, its gross margins show its business model is much less lucrative than other companies.

GoDaddy’s price-to-sales ratio based on the next 12 months is 2.8x. This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $175 on the company (compared to the current share price of $103.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.