JLL (JLL)

We wouldn’t buy JLL. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think JLL Will Underperform

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 8.1% over the last five years was below our standards for the consumer discretionary sector

- Earnings growth underperformed the sector average over the last five years as its EPS grew by just 9.1% annually

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

JLL doesn’t meet our quality criteria. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than JLL

High Quality

Investable

Underperform

Why There Are Better Opportunities Than JLL

JLL is trading at $354.14 per share, or 18.1x forward P/E. JLL’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. JLL (JLL) Research Report: Q3 CY2025 Update

Real estate firm JLL (NYSE:JLL) met Wall Streets revenue expectations in Q3 CY2025, with sales up 10.9% year on year to $6.51 billion. Its non-GAAP profit of $4.50 per share was 5.5% above analysts’ consensus estimates.

JLL (JLL) Q3 CY2025 Highlights:

- Revenue: $6.51 billion vs analyst estimates of $6.54 billion (10.9% year-on-year growth, in line)

- Adjusted EPS: $4.50 vs analyst estimates of $4.27 (5.5% beat)

- Adjusted EBITDA: $347.3 million vs analyst estimates of $346.8 million (5.3% margin, in line)

- Operating Margin: 4.2%, in line with the same quarter last year

- Free Cash Flow Margin: 8.7%, up from 3.7% in the same quarter last year

- Market Capitalization: $14.17 billion

Company Overview

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

JLL’s extensive service portfolio encompasses agency leasing, capital markets, property management, facility management, project and development services, tenant representation, real estate investment management, valuation, and advisory services. This comprehensive range of offerings allows JLL to cater to a diverse array of client needs, from individual property owners and corporate occupiers to large institutional investors.

The company operates across various real estate sectors, including office, retail, industrial, multi-family residential, hotels, and healthcare facilities. JLL's approach combines deep industry knowledge with technology-driven solutions, enabling it to provide insightful, data-driven advice and services to its clients.

JLL's investment management arm, LaSalle Investment Management, is a significant component of its business, managing assets for a wide range of investors, including public and private pension funds, insurance companies, governments, endowments, and private individuals. LaSalle Investment Management is known for its global investment approach, allowing it to identify and capitalize on investment opportunities in different regions and real estate subsectors.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

JLL’s primary competitors include CBRE (NYSE:CBRE), Cushman & Wakefield (NYSE:CWK), Colliers International (NASDAQ:CIGI), and Savills (LSE:SVS).

5. Revenue Growth

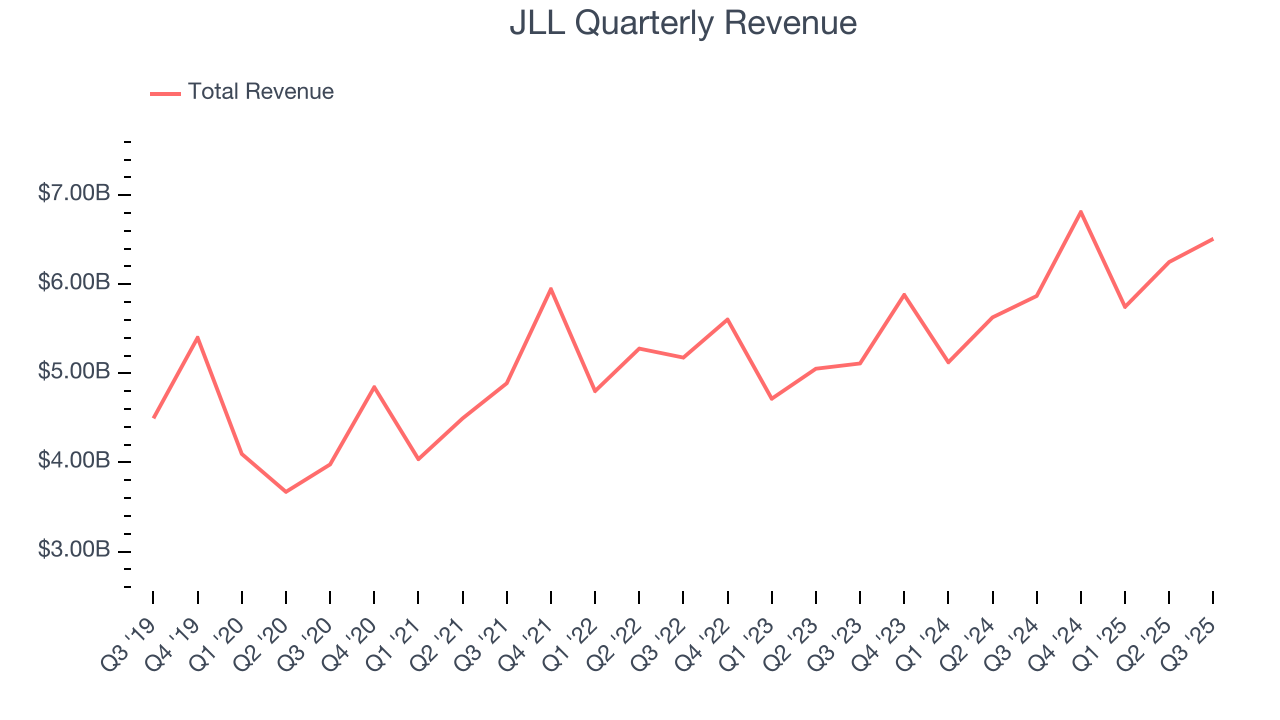

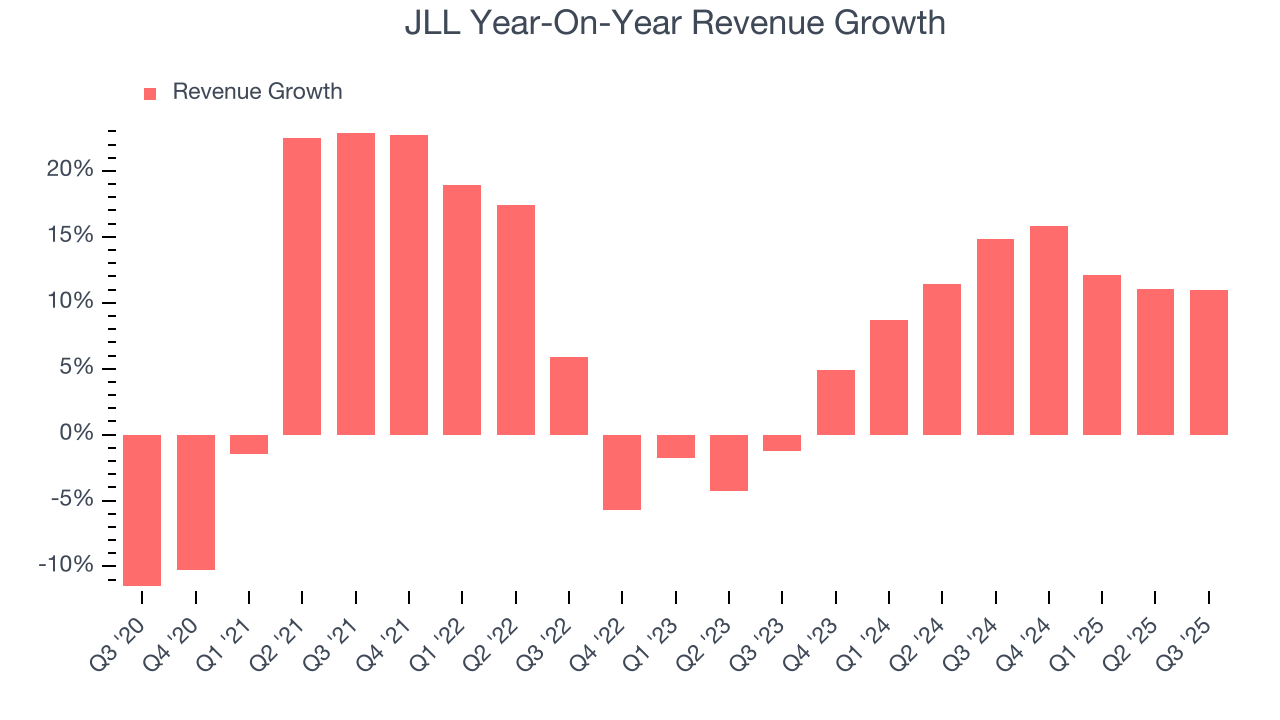

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, JLL’s 8.1% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. JLL’s annualized revenue growth of 11.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, JLL’s year-on-year revenue growth was 10.9%, and its $6.51 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

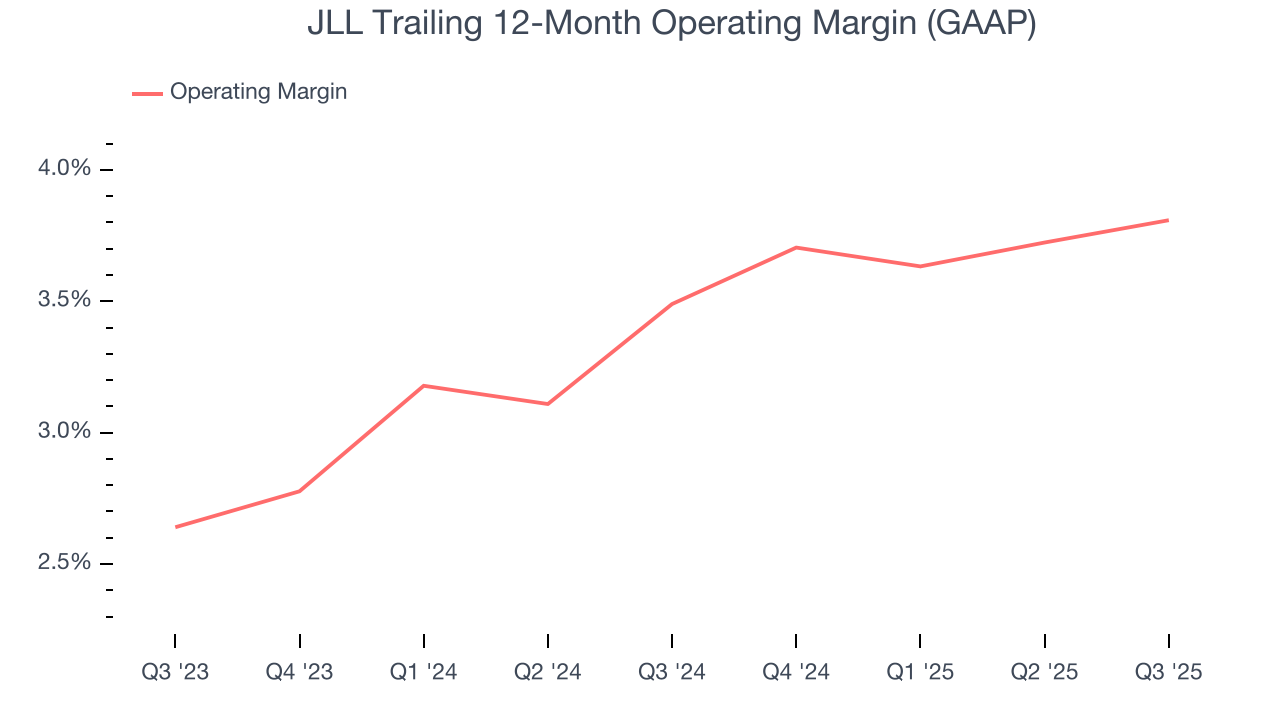

6. Operating Margin

JLL’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 3.7% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q3, JLL generated an operating margin profit margin of 4.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

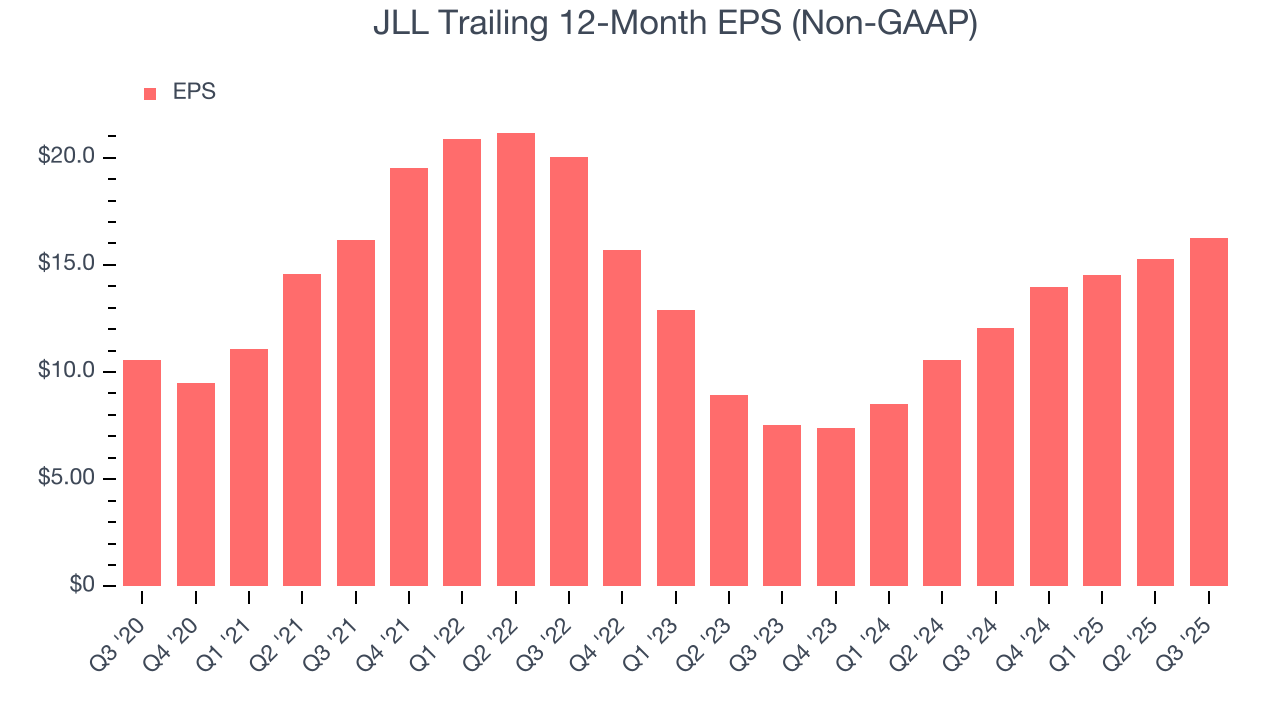

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

JLL’s unimpressive 9.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q3, JLL reported adjusted EPS of $4.50, up from $3.50 in the same quarter last year. This print beat analysts’ estimates by 5.5%. Over the next 12 months, Wall Street expects JLL’s full-year EPS of $16.26 to grow 15.7%.

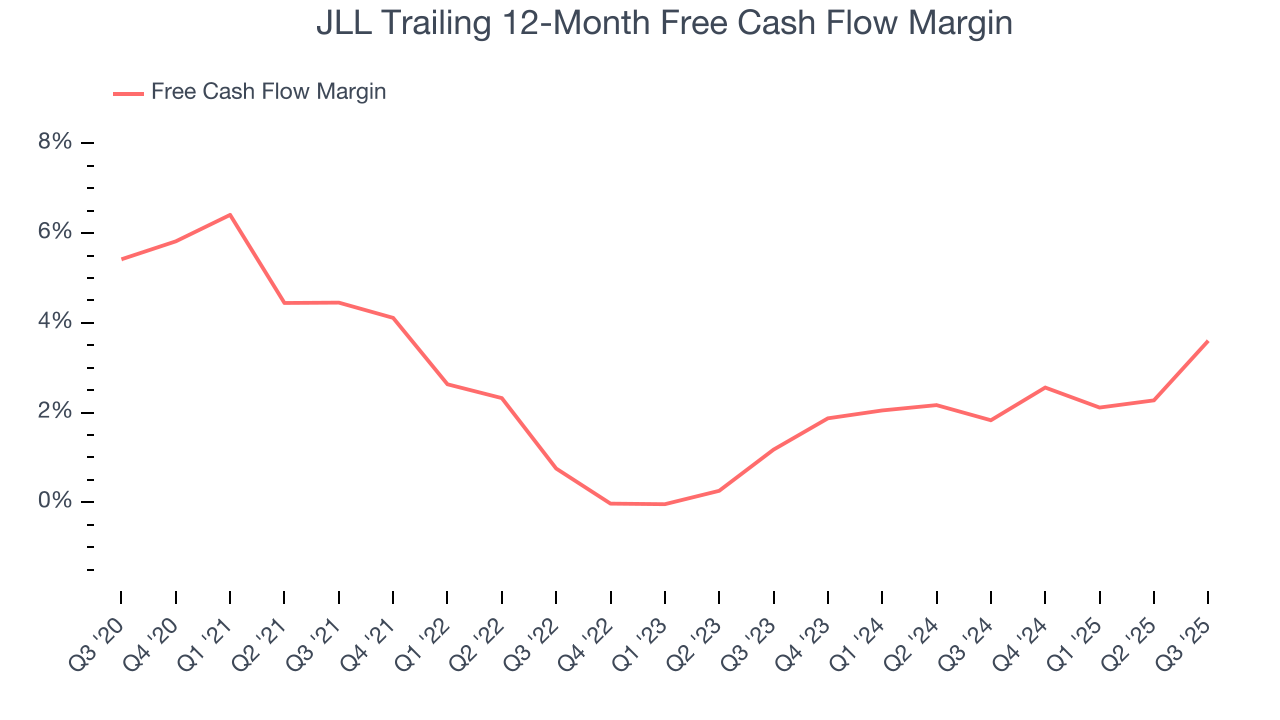

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

JLL has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.8%, lousy for a consumer discretionary business.

JLL’s free cash flow clocked in at $567.6 million in Q3, equivalent to a 8.7% margin. This result was good as its margin was 5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

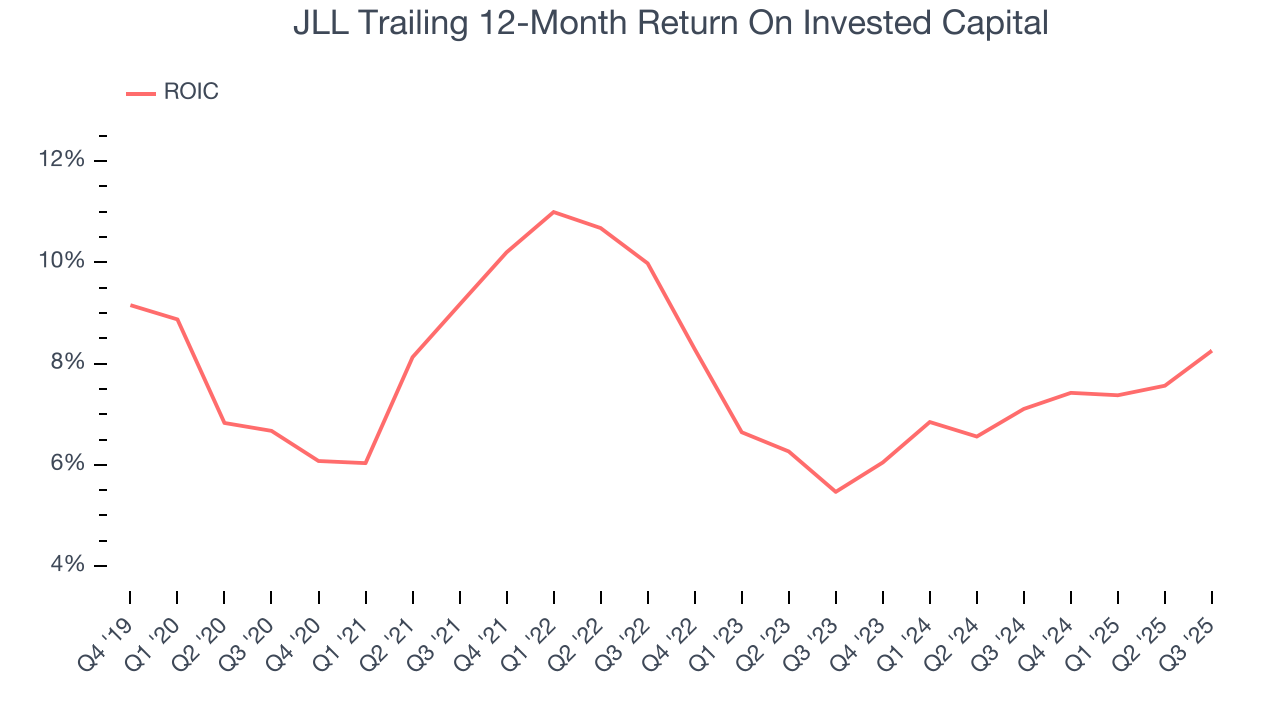

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

JLL historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, JLL’s ROIC decreased by 1.9 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

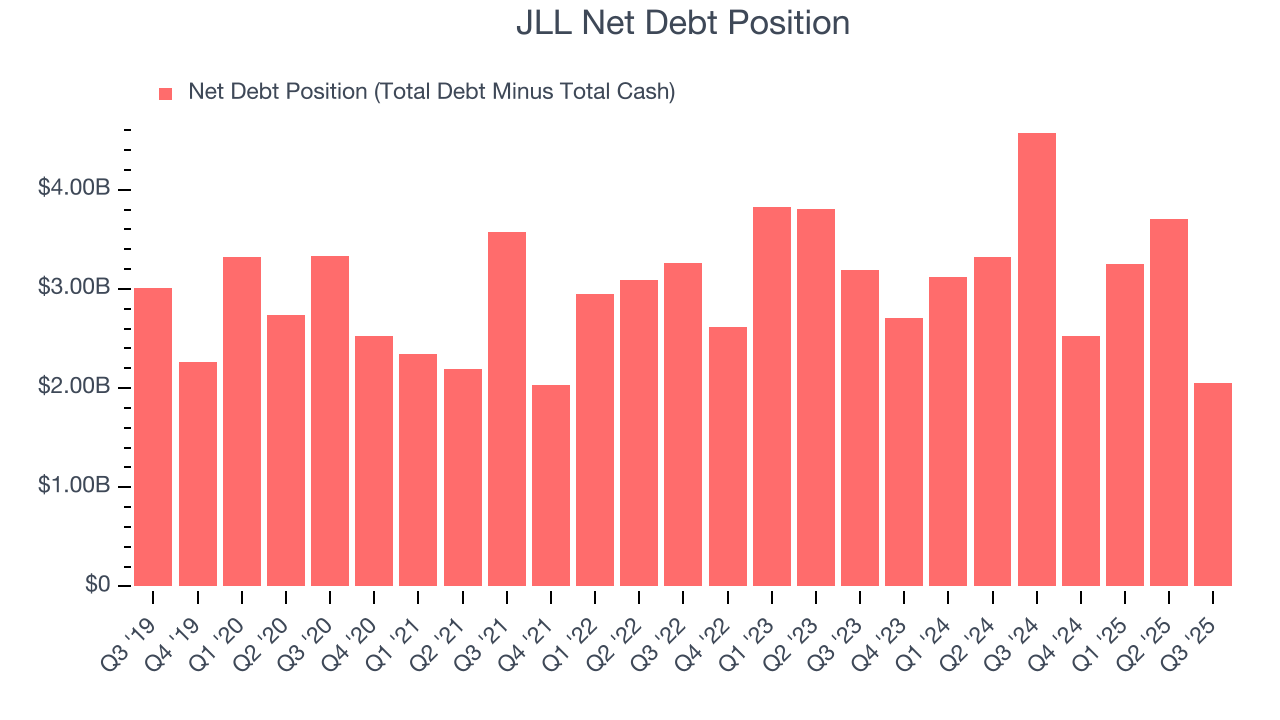

JLL reported $428.9 million of cash and $2.48 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.32 billion of EBITDA over the last 12 months, we view JLL’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $57.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from JLL’s Q3 Results

It was good to see JLL beat analysts’ EPS expectations this quarter.Zooming out, we think this was a decent quarter. The stock remained flat at $297 immediately following the results.

12. Is Now The Time To Buy JLL?

Updated: January 24, 2026 at 9:58 PM EST

Before deciding whether to buy JLL or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies serving everyday consumers, but in the case of JLL, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. On top of that, JLL’s weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders, and its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

JLL’s P/E ratio based on the next 12 months is 18.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $376 on the company (compared to the current share price of $354.14).