JLL (JLL)

JLL is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think JLL Will Underperform

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 9.5% for the last five years

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 14.7% annually

- Poor expense management has led to an operating margin that is below the industry average

JLL doesn’t check our boxes. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than JLL

High Quality

Investable

Underperform

Why There Are Better Opportunities Than JLL

At $321.63 per share, JLL trades at 14.5x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. JLL (JLL) Research Report: Q4 CY2025 Update

Real estate firm JLL (NYSE:JLL) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 11.7% year on year to $7.61 billion. Its non-GAAP profit of $8.71 per share was 18.3% above analysts’ consensus estimates.

JLL (JLL) Q4 CY2025 Highlights:

- Revenue: $7.61 billion vs analyst estimates of $7.51 billion (11.7% year-on-year growth, 1.3% beat)

- Adjusted EPS: $8.71 vs analyst estimates of $7.36 (18.3% beat)

- Adjusted EBITDA: $589.1 million vs analyst estimates of $528.8 million (7.7% margin, 11.4% beat)

- Operating Margin: 6.7%, up from 5.5% in the same quarter last year

- Free Cash Flow Margin: 12.3%, similar to the same quarter last year

- Market Capitalization: $13.54 billion

Company Overview

Founded in 1999 through the merger of Jones Lang Wootton and LaSalle Partners, JLL (NYSE:JLL) is a company specializing in real estate advisory and investment management services.

JLL’s extensive service portfolio encompasses agency leasing, capital markets, property management, facility management, project and development services, tenant representation, real estate investment management, valuation, and advisory services. This comprehensive range of offerings allows JLL to cater to a diverse array of client needs, from individual property owners and corporate occupiers to large institutional investors.

The company operates across various real estate sectors, including office, retail, industrial, multi-family residential, hotels, and healthcare facilities. JLL's approach combines deep industry knowledge with technology-driven solutions, enabling it to provide insightful, data-driven advice and services to its clients.

JLL's investment management arm, LaSalle Investment Management, is a significant component of its business, managing assets for a wide range of investors, including public and private pension funds, insurance companies, governments, endowments, and private individuals. LaSalle Investment Management is known for its global investment approach, allowing it to identify and capitalize on investment opportunities in different regions and real estate subsectors.

4. Consumer Discretionary - Real Estate Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Real estate services companies provide brokerage, property management, appraisal, and advisory services, earning transaction-based commissions and recurring management fees. Tailwinds include long-term housing demand driven by demographic growth, technology platforms that expand market access, and commercial real estate complexity that sustains advisory needs. Headwinds are pronounced: rising interest rates directly suppress transaction volumes by reducing housing affordability and commercial deal activity. Commission-rate compression, driven by discount brokerages and regulatory changes, erodes per-transaction revenue. The industry is highly cyclical, with revenue swings amplified by leverage. PropTech (property technology) disruptors threaten traditional intermediary models.

JLL’s primary competitors include CBRE (NYSE:CBRE), Cushman & Wakefield (NYSE:CWK), Colliers International (NASDAQ:CIGI), and Savills (LSE:SVS).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, JLL’s 9.5% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. JLL’s annualized revenue growth of 12.2% over the last two years is above its five-year trend, which is encouraging.

This quarter, JLL reported year-on-year revenue growth of 11.7%, and its $7.61 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Operating Margin

JLL’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, JLL generated an operating margin profit margin of 6.7%, up 1.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

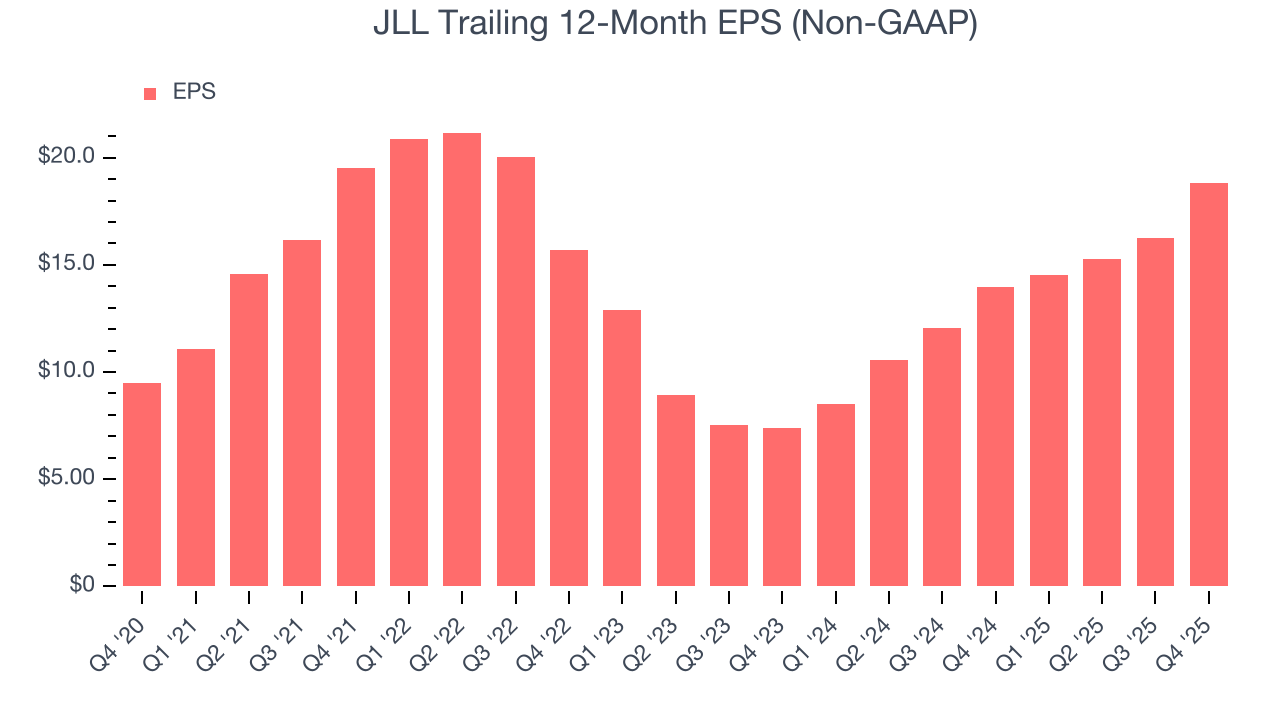

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

JLL’s EPS grew at a weak 14.7% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, JLL reported adjusted EPS of $8.71, up from $6.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects JLL’s full-year EPS of $18.82 to grow 8.5%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

JLL has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, lousy for a consumer discretionary business.

JLL’s free cash flow clocked in at $934.6 million in Q4, equivalent to a 12.3% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

JLL historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.2%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, JLL’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

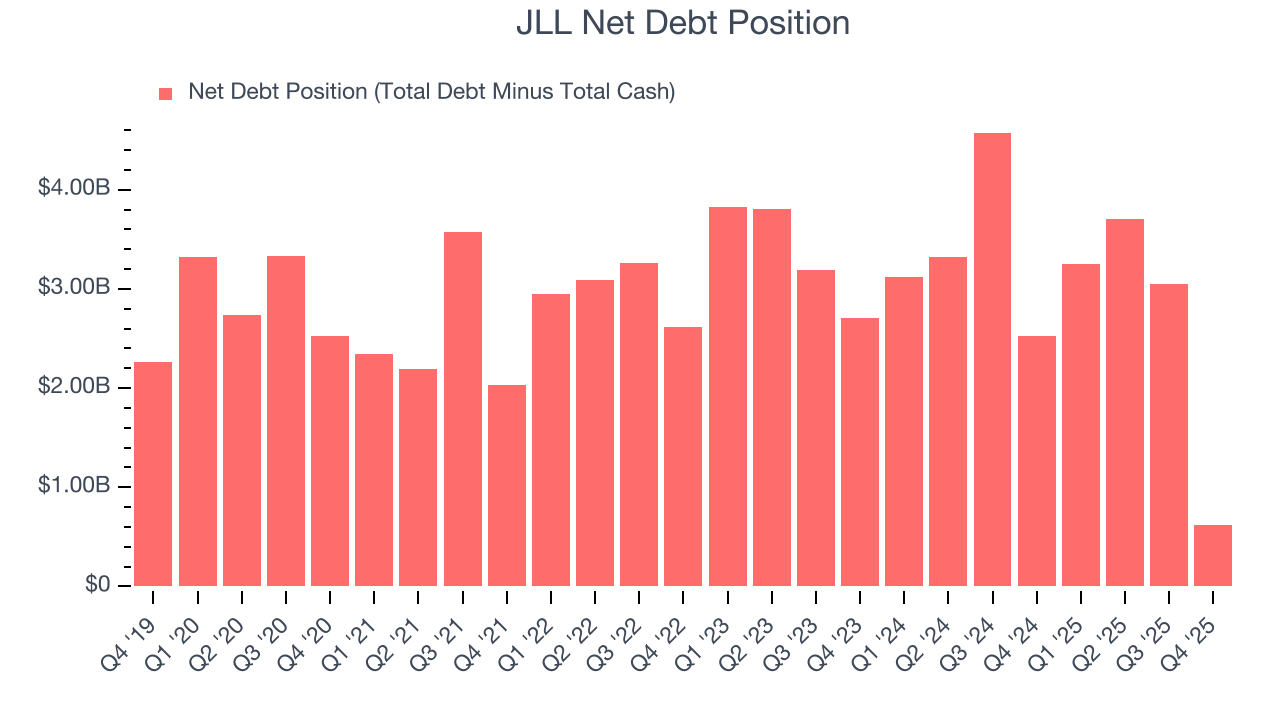

10. Balance Sheet Assessment

JLL reported $1.23 billion of cash and $1.85 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.45 billion of EBITDA over the last 12 months, we view JLL’s 0.4× net-debt-to-EBITDA ratio as safe. We also see its $70.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from JLL’s Q4 Results

It was good to see JLL beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.5% to $297.00 immediately following the results.

12. Is Now The Time To Buy JLL?

Updated: February 27, 2026 at 9:59 PM EST

Before investing in or passing on JLL, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We see the value of companies helping consumers, but in the case of JLL, we’re out. On top of that, JLL’s Forecasted free cash flow margin for next year suggests the company will fail to improve its cash conversion, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

JLL’s P/E ratio based on the next 12 months is 14.8x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $381 on the company (compared to the current share price of $314.97).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.