Shutterstock (SSTK)

Shutterstock is up against the odds. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Shutterstock Will Underperform

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

- Estimated sales decline of 10% for the next 12 months implies a challenging demand environment

- Customer spending has dipped by 73.7% on average as it focused on growing its requests

- Flat earnings per share over the last three years lagged its peers

Shutterstock’s quality is inadequate. Better stocks can be found in the market.

Why There Are Better Opportunities Than Shutterstock

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Shutterstock

Shutterstock’s stock price of $16.46 implies a valuation ratio of 2.9x forward EV/EBITDA. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Shutterstock (SSTK) Research Report: Q4 CY2025 Update

Stock photography and footage provider Shutterstock (NYSE:SSTK) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 12% year on year to $220.2 million. Its non-GAAP profit of $0.67 per share was 40.4% below analysts’ consensus estimates.

Shutterstock (SSTK) Q4 CY2025 Highlights:

- Revenue: $220.2 million vs analyst estimates of $252.3 million (12% year-on-year decline, 12.7% miss)

- Adjusted EPS: $0.67 vs analyst expectations of $1.13 (40.4% miss)

- Adjusted EBITDA: $46.79 million vs analyst estimates of $65.57 million (21.2% margin, 28.6% miss)

- Operating Margin: -1.1%, down from 5.3% in the same quarter last year

- Free Cash Flow Margin: 11.8%, down from 26.1% in the previous quarter

- Market Capitalization: $613.4 million

Company Overview

Originally featuring a library that included many of founder Jon Oringer’s photos, Shutterstock (NYSE:SSTK) is now a digital platform where customers can license and use hundreds of millions of pieces of content.

This vast collection of digital content includes photos, videos, and music that customers can use in their projects ranging from advertising campaigns to editorial to personal art projects. Contributors to Shutterstock's library include professionals and hobbyists alike. Contributors are compensated based on the type of license purchased by the customer, with royalties ranging from teens percentages to nearly half of the sale price. The more popular an asset, the higher the royalty percentage.

Shutterstock solves the need for high-quality visual content without legal worries. “A picture is worth a thousand words” is a good way to understand how important visuals are. However, using any good image or video on the internet can be dangerous since a user may not have legal rights. Shutterstock’s content comes with licensing rights so users can sleep easy and know that they are legally protected from copyright or trademark infringement.

Shutterstock generates revenue by selling digital content and the associated licenses to it. Customers can choose from a variety of licensing options depending on their needs, such as standard or extended licenses for images or footage, or subscription plans that provide access to a certain number of downloads per month.

4. Online Marketplace

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

Competitors offering visual content include Adobe (NYSE:ADBE), Getty Images (NYSE:GETY), and Alphabet (NASDAQ:GOOGL).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Shutterstock’s sales grew at a tepid 6.1% compounded annual growth rate over the last three years. This was below our standard for the consumer internet sector and is a tough starting point for our analysis.

This quarter, Shutterstock missed Wall Street’s estimates and reported a rather uninspiring 12% year-on-year revenue decline, generating $220.2 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges.

6. Gross Margin & Pricing Power

For online marketplaces like Shutterstock, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include payment processing, hosting, and bandwidth fees in addition to the costs necessary to onboard buyers and sellers, such as identity verification.

Shutterstock’s unit economics are higher than the typical consumer internet business and signal that it has competitive products and services. As you can see below, it averaged a decent 58.3% gross margin over the last two years. That means for every $100 in revenue, roughly $58.28 was left to spend on selling, marketing, and R&D.

In Q4, Shutterstock produced a 55.8% gross profit margin, in line with the same quarter last year. On a wider time horizon, Shutterstock’s full-year margin has been trending up over the past 12 months, increasing by 1.3 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs.

7. User Acquisition Efficiency

Consumer internet businesses like Shutterstock grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Shutterstock is efficient at acquiring new users, spending 38.1% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates relatively solid competitive positioning, giving Shutterstock the freedom to invest its resources into new growth initiatives.

8. EBITDA

Investors regularly analyze operating income to understand a company’s profitability. Similarly, EBITDA is a common profitability metric for consumer internet companies because it excludes various one-time or non-cash expenses, offering a better perspective of the business’s profit potential.

Shutterstock has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 27%.

Analyzing the trend in its profitability, Shutterstock’s EBITDA margin rose by 1.1 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, Shutterstock generated an EBITDA margin profit margin of 21.2%, down 2.4 percentage points year on year. Since Shutterstock’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Earnings Per Share

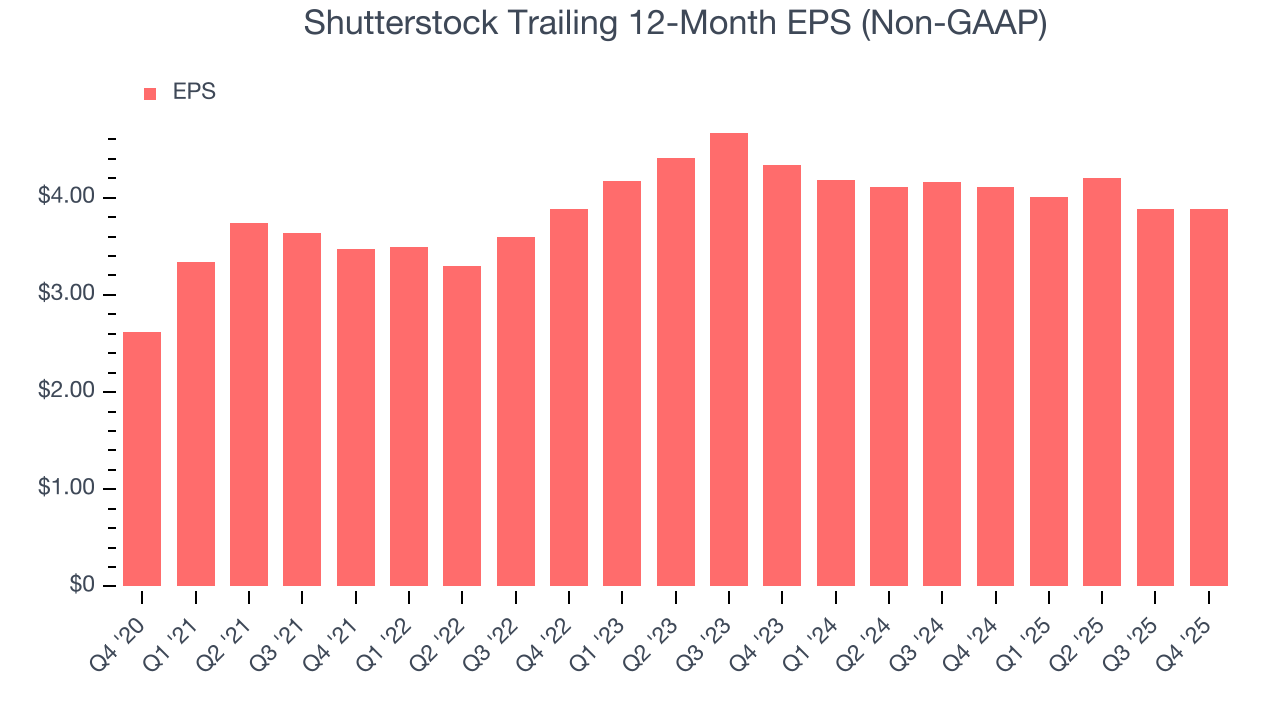

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Shutterstock’s flat EPS over the last three years was below its 6.1% annualized revenue growth. However, its EBITDA margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

We can take a deeper look into Shutterstock’s earnings to better understand the drivers of its performance. A three-year view shows Shutterstock has diluted its shareholders, growing its share count by 2.7%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Shutterstock reported adjusted EPS of $0.67, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Shutterstock’s full-year EPS of $3.88 to shrink by 1%.

10. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Shutterstock has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Shutterstock’s margin dropped by 1.4 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Shutterstock’s free cash flow clocked in at $25.9 million in Q4, equivalent to a 11.8% margin. This result was good as its margin was 12.1 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Shutterstock is a profitable, well-capitalized company with $178.2 million of cash and $133.9 million of debt on its balance sheet. This $44.36 million net cash position is 7.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Shutterstock’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 11.4% to $15.27 immediately after reporting.

13. Is Now The Time To Buy Shutterstock?

Updated: March 3, 2026 at 9:29 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Shutterstock, you should also grasp the company’s longer-term business quality and valuation.

We see the value of companies helping consumers, but in the case of Shutterstock, we’re out. To kick things off, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its impressive EBITDA margins show it has a highly efficient business model, the downside is its ARPU has declined over the last two years. On top of that, its projected EPS for the next year is lacking.

Shutterstock’s EV/EBITDA ratio based on the next 12 months is 2.8x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $28.85 on the company (compared to the current share price of $16.47).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.