Teradata (TDC)

Teradata faces an uphill battle. Its low gross margin indicates weak unit economics and its declining sales suggest its offerings are unpopular.― StockStory Analyst Team

1. News

2. Summary

Why We Think Teradata Will Underperform

Pioneering data warehousing technology in the 1980s before "big data" was a common term, Teradata (NYSE:TDC) provides cloud-based data analytics and AI platforms that help large enterprises integrate, analyze, and leverage their data across multiple environments.

- Sales tumbled by 2% annually over the last five years, showing industry trends like AI are working against its favor

- ARR was flat over the last year, suggesting the company faced challenges in acquiring and retaining long-term customers

- Projected sales for the next 12 months are flat and suggest demand will be subdued

Teradata falls short of our expectations. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Teradata

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Teradata

Teradata’s stock price of $31.32 implies a valuation ratio of 1.9x forward price-to-sales. Teradata’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Teradata (TDC) Research Report: Q4 CY2025 Update

Cloud analytics platform Teradata (NYSE:TDC) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 2.9% year on year to $421 million. On top of that, next quarter’s revenue guidance ($426.4 million at the midpoint) was surprisingly good and 3.8% above what analysts were expecting. Its non-GAAP profit of $0.74 per share was 33.1% above analysts’ consensus estimates.

Teradata (TDC) Q4 CY2025 Highlights:

- Revenue: $421 million vs analyst estimates of $399.6 million (2.9% year-on-year growth, 5.4% beat)

- Adjusted EPS: $0.74 vs analyst estimates of $0.56 (33.1% beat)

- Adjusted Operating Income: $95.99 million vs analyst estimates of $82.54 million (22.8% margin, 16.3% beat)

- Revenue Guidance for Q1 CY2026 is $426.4 million at the midpoint, above analyst estimates of $410.7 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.60 at the midpoint, beating analyst estimates by 2%

- Operating Margin: 12.8%, up from 9.5% in the same quarter last year

- Free Cash Flow Margin: 35.9%, up from 21.2% in the previous quarter

- Annual Recurring Revenue: $1.52 billion (3.3% year-on-year growth, beat)

- Market Capitalization: $2.64 billion

Company Overview

Pioneering data warehousing technology in the 1980s before "big data" was a common term, Teradata (NYSE:TDC) provides cloud-based data analytics and AI platforms that help large enterprises integrate, analyze, and leverage their data across multiple environments.

Teradata's flagship offering is its Vantage platform, which comes in multiple deployment options: VantageCloud for cloud environments and VantageCore for on-premises implementations. This flexibility allows organizations to maintain hybrid environments where data can reside in public clouds, private clouds, or on traditional servers while still being accessible through a unified system.

The platform includes ClearScape Analytics, which provides advanced analytics capabilities including AI and machine learning functionalities that enable users to build, deploy, and manage predictive models. Query Grid, Teradata's "data fabric" technology, serves as connective tissue that allows organizations to access and analyze data regardless of where it's stored, reducing silos and enabling consistent data governance.

Teradata primarily serves large enterprises in data-intensive industries such as financial services, retail, telecommunications, manufacturing, healthcare, and government. These organizations typically have complex data environments with massive volumes of information spread across multiple systems. For example, a global bank might use Teradata to analyze customer transaction patterns across different regions to detect fraud while simultaneously using the same platform for regulatory compliance reporting.

The company has evolved its business model from traditional perpetual software licenses to subscription-based pricing, offering both capacity-based and consumption-based options to provide customers with financial flexibility.

4. Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

Teradata competes with cloud hyperscalers like Amazon Web Services (NASDAQ:AMZN), Microsoft Azure (NASDAQ:MSFT), and Google Cloud (NASDAQ:GOOGL), as well as traditional database and analytics vendors such as Oracle (NYSE:ORCL), IBM (NYSE:IBM), and SAP (NYSE:SAP).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Teradata struggled to consistently generate demand over the last five years as its sales dropped at a 2% annual rate. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Teradata’s recent performance shows its demand remained suppressed as its revenue has declined by 4.8% annually over the last two years.

This quarter, Teradata reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 5.4%. Company management is currently guiding for a 2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.8% over the next 12 months. While this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Teradata failed to grow its ARR, which came in at $1.52 billion in the latest quarter. However, this alternate topline metric outperformed its total sales, which likely means that the recurring portions of the business are growing faster than less predictable, choppier ones such as implementation fees. That could be a good sign for future revenue growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Teradata to acquire new customers as its CAC payback period checked in at 54.6 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

8. Gross Margin & Pricing Power

For software companies like Teradata, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Teradata’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 59.7% gross margin over the last year. That means Teradata paid its providers a lot of money ($40.35 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Teradata has seen gross margins decline by 1.2 percentage points over the last 2 year, which is poor compared to software peers.

Teradata’s gross profit margin came in at 60.8% this quarter, in line with the same quarter last year. On a wider time horizon, Teradata’s full-year margin has been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

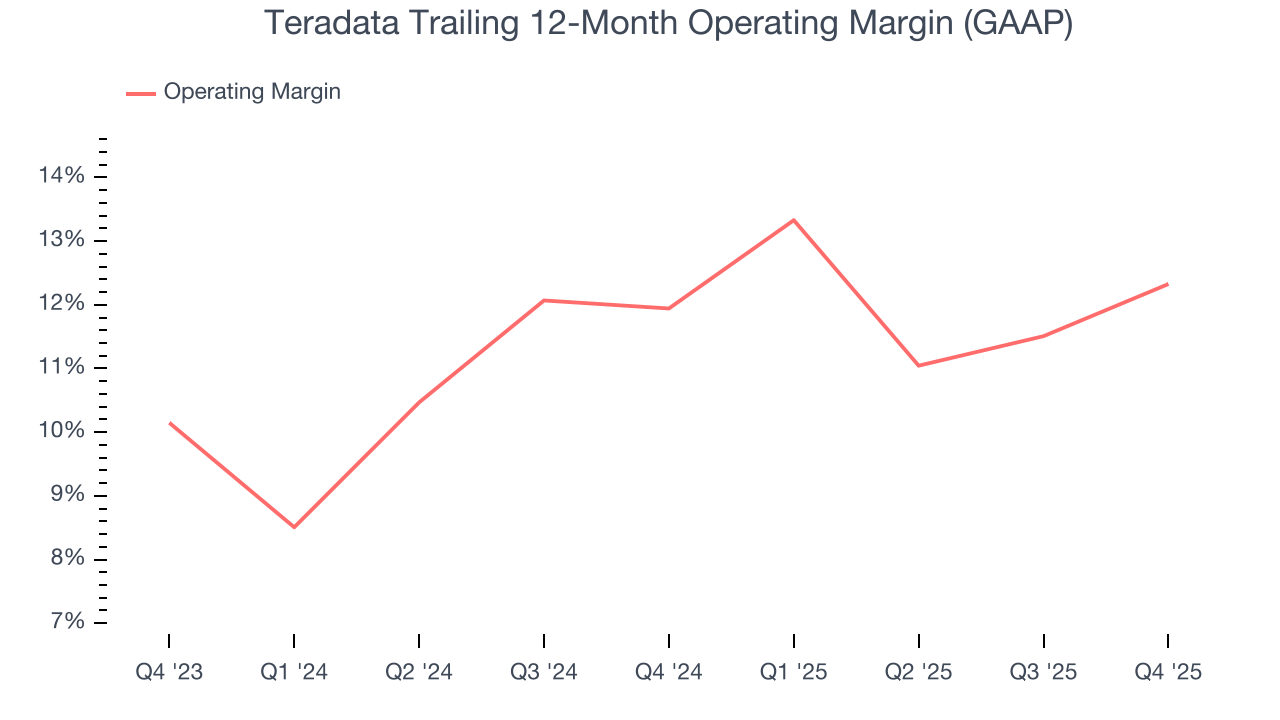

9. Operating Margin

Teradata has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 12.3%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Teradata’s operating margin might fluctuated slightly but has generally stayed the same over the last two years, highlighting the consistency of its expense base.

In Q4, Teradata generated an operating margin profit margin of 12.8%, up 3.3 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

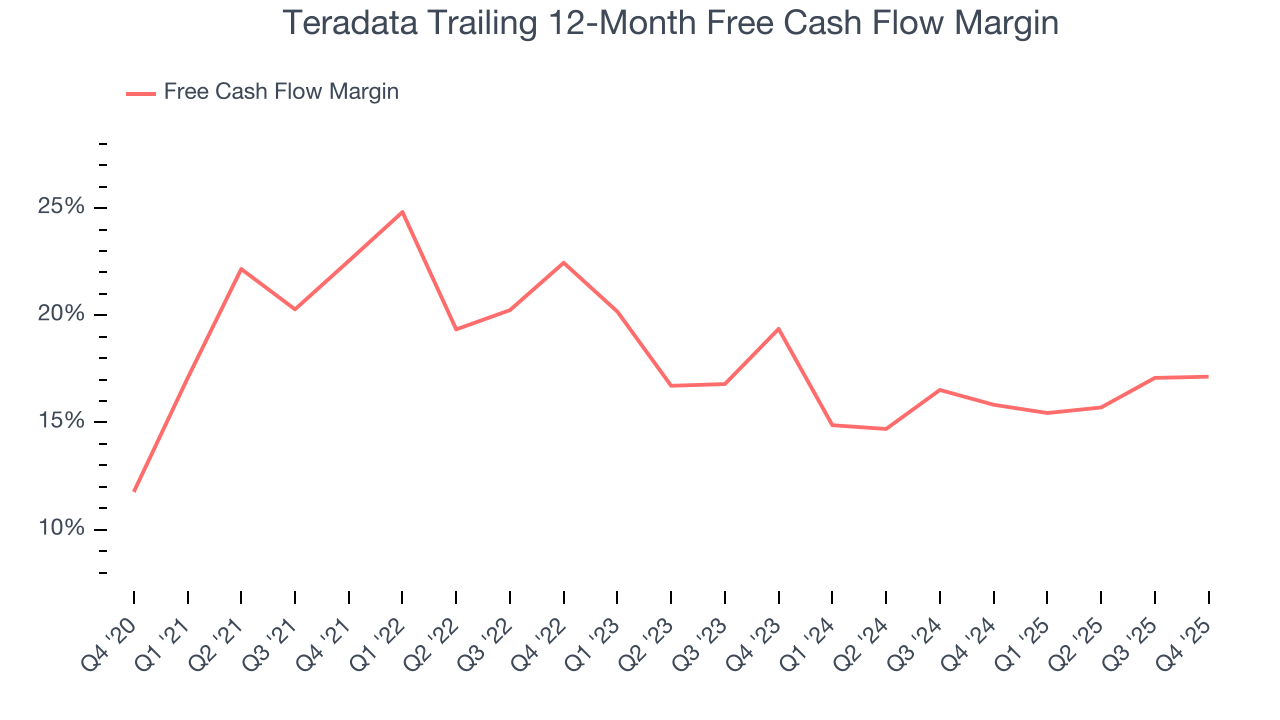

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Teradata has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 17.1% over the last year, slightly better than the broader software sector.

Teradata’s free cash flow clocked in at $151 million in Q4, equivalent to a 35.9% margin. This cash profitability was in line with the comparable period last year and above its one-year average.

Over the next year, analysts’ consensus estimates show they’re expecting Teradata’s free cash flow margin of 17.1% for the last 12 months to remain the same.

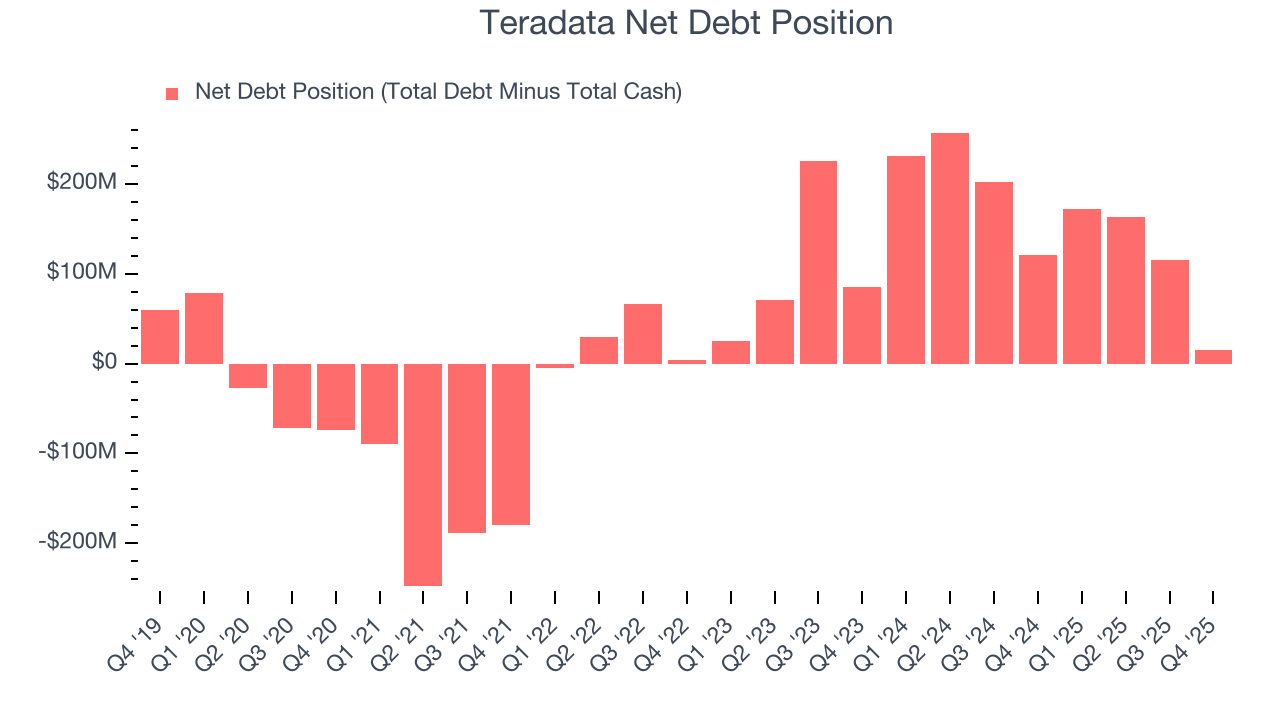

11. Balance Sheet Assessment

Teradata reported $493 million of cash and $508 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $442 million of EBITDA over the last 12 months, we view Teradata’s 0.0× net-debt-to-EBITDA ratio as safe. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Teradata’s Q4 Results

We were impressed by Teradata’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. As for the quarter, that was quite solid as well, with revenue and adjusted operating income beating expectations. Zooming out, we think this was a very good print with some key areas of upside. The stock traded up 14.2% to $33.40 immediately following the results.

13. Is Now The Time To Buy Teradata?

Updated: February 22, 2026 at 9:49 PM EST

Before making an investment decision, investors should account for Teradata’s business fundamentals and valuation in addition to what happened in the latest quarter.

Teradata falls short of our quality standards. First off, its revenue has declined over the last five years. While its strong operating margins show it’s a well-run business, the downside is its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. On top of that, its gross margins show its business model is much less lucrative than other companies.

Teradata’s price-to-sales ratio based on the next 12 months is 1.9x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $35.73 on the company (compared to the current share price of $31.32).