UL Solutions (ULS)

UL Solutions catches our eye. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why UL Solutions Is Interesting

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE:ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- On the other hand, its earnings growth over the last three years fell short of the peer group average as its EPS only increased by 2.4% annually

UL Solutions has the potential to be a high-quality business. Consider adding this company to your watchlist.

Why Should You Watch UL Solutions

Why Should You Watch UL Solutions

UL Solutions’s stock price of $81.06 implies a valuation ratio of 37.1x forward P/E. This valuation represents a premium to business services peers.

If UL Solutions strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. UL Solutions (ULS) Research Report: Q4 CY2025 Update

Safety certification company UL Solutions (NYSE:ULS) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 6.8% year on year to $789 million. Its GAAP profit of $0.32 per share was 13.3% below analysts’ consensus estimates.

UL Solutions (ULS) Q4 CY2025 Highlights:

- Revenue: $789 million vs analyst estimates of $781.6 million (6.8% year-on-year growth, 0.9% beat)

- EPS (GAAP): $0.32 vs analyst expectations of $0.37 (13.3% miss)

- Adjusted EBITDA: $217 million vs analyst estimates of $187.9 million (27.5% margin, 15.5% beat)

- Operating Margin: 15%, in line with the same quarter last year

- Free Cash Flow Margin: 10.9%, up from 9.7% in the same quarter last year

- Market Capitalization: $15.21 billion

Company Overview

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE:ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

UL Solutions operates through two main business segments: Testing, Inspection, and Certification (TIC) and Software and Advisory (S&A). The TIC segment is further divided into Industrial and Consumer divisions, with the Industrial division focusing on manufacturing, construction, and energy sectors, while the Consumer division serves manufacturers and retailers of consumer goods.

When a company develops a new product—whether it's a smartphone, a household appliance, or industrial equipment—they often turn to UL Solutions to verify that it meets relevant safety standards. For example, a manufacturer of electric vehicle charging stations might engage UL Solutions to test their product against electrical safety standards, ensuring it won't pose fire or shock hazards when installed in homes.

The company's Software and Advisory segment provides digital tools and consulting services that help businesses navigate complex regulatory requirements. These solutions enable clients to track compliance across global supply chains, implement sustainability initiatives, and manage operational risks.

UL Solutions generates revenue by charging fees for its testing and certification services, as well as through subscriptions to its software platforms and payment for advisory services. The company's iconic UL Mark is widely recognized as a symbol of safety, and manufacturers often pay to display this certification on their products to build consumer trust and meet regulatory requirements.

With operations spanning multiple countries including the United States, China, Germany, India, Japan, and the United Kingdom, UL Solutions serves thousands of clients across diverse industries. The company leverages advanced technologies like artificial intelligence and machine learning to enhance its service offerings and operational efficiency.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

UL Solutions competes with other global testing and certification providers such as Intertek Group (LSE:ITRK), SGS (SWX:SGSN), Bureau Veritas (EPA:BVI), and TÜV SÜD. In the software and advisory space, it faces competition from specialized compliance software providers and consulting firms.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $3.05 billion in revenue over the past 12 months, UL Solutions is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, UL Solutions grew its sales at a decent 5.1% compounded annual growth rate over the last four years. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. UL Solutions’s annualized revenue growth of 6.8% over the last two years is above its four-year trend, suggesting some bright spots.

This quarter, UL Solutions reported year-on-year revenue growth of 6.8%, and its $789 million of revenue exceeded Wall Street’s estimates by 0.9%.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, similar to its two-year rate. Still, this projection is above average for the sector and indicates the market is baking in some success for its newer products and services.

6. Operating Margin

UL Solutions has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 15.5%.

Analyzing the trend in its profitability, UL Solutions’s operating margin rose by 3.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, UL Solutions generated an operating margin profit margin of 15%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

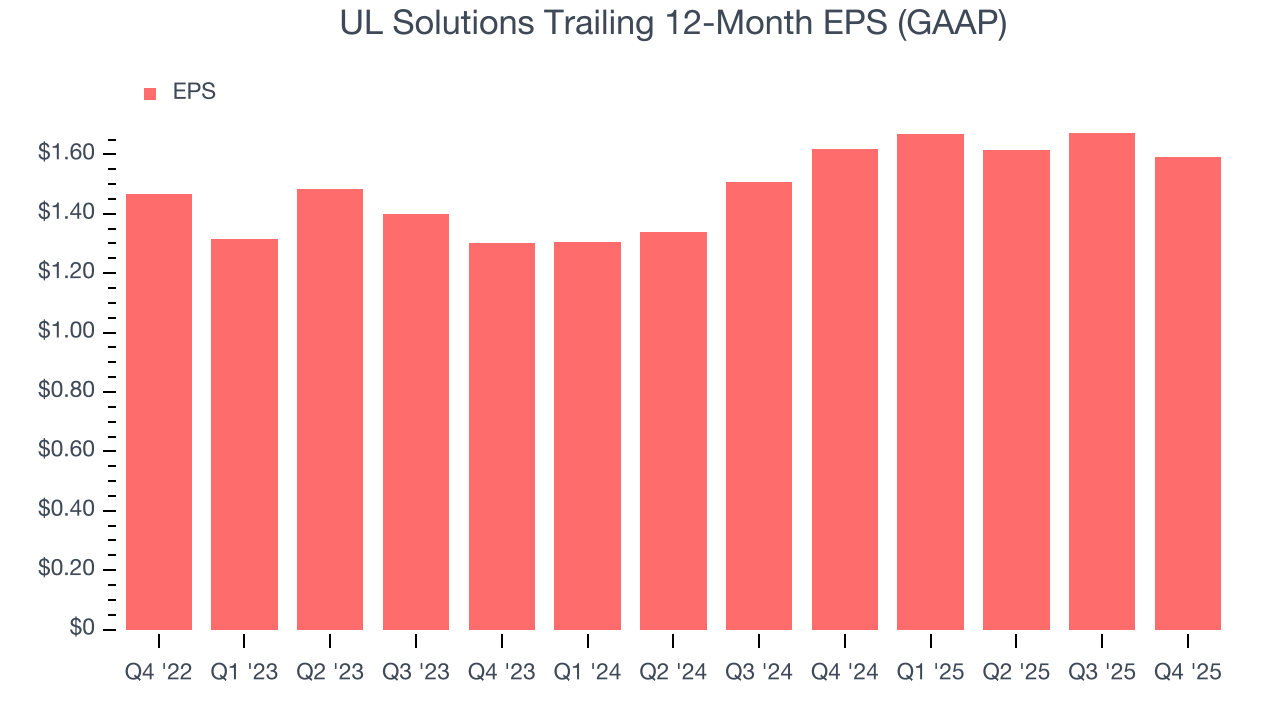

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

UL Solutions’s full-year EPS grew at a weak 2.4% compounded annual growth rate over the last three years, worse than the broader business services sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For UL Solutions, its two-year annual EPS growth of 10.6% was higher than its three-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, UL Solutions reported EPS of $0.32, down from $0.40 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects UL Solutions’s full-year EPS of $1.59 to grow 18.6%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

UL Solutions has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 9.8% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that UL Solutions’s margin expanded by 7.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

UL Solutions’s free cash flow clocked in at $86 million in Q4, equivalent to a 10.9% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although UL Solutions hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it found a few growth initiatives in the past that worked out wonderfully. Its four-year average ROIC was 28.9%, splendid for a business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, UL Solutions’s ROIC averaged 2 percentage point decreases each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

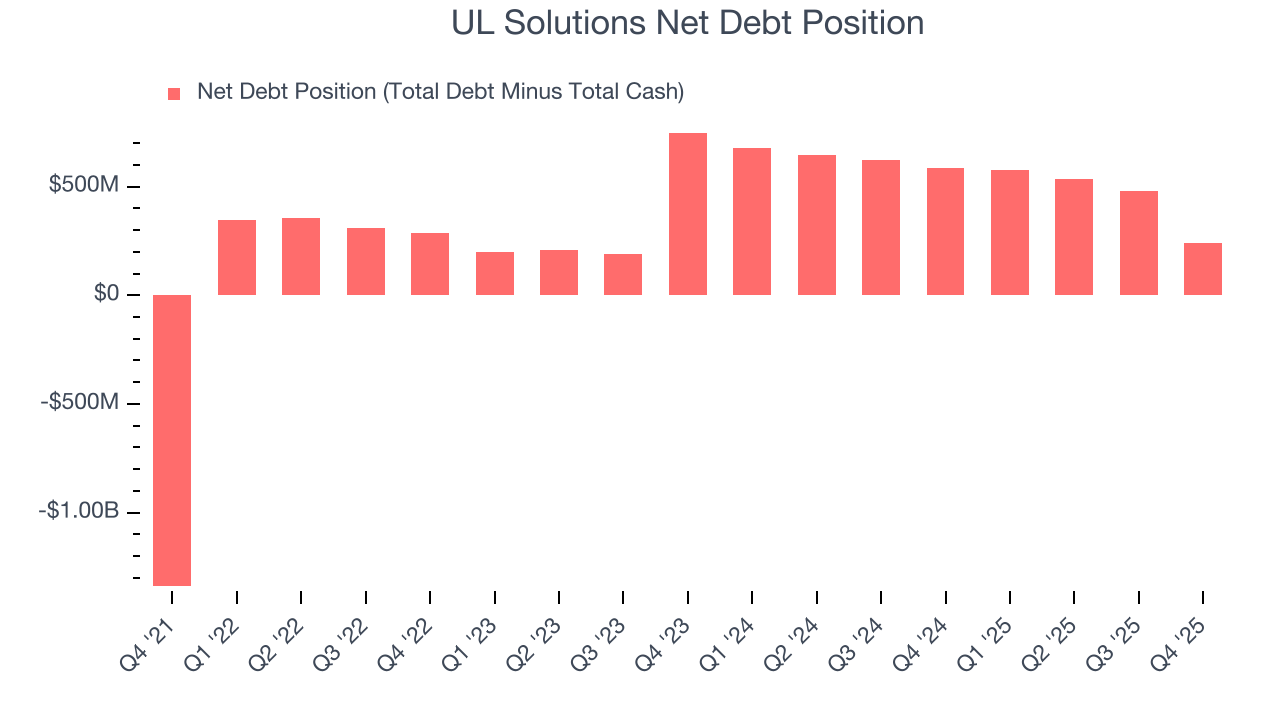

10. Balance Sheet Assessment

UL Solutions reported $295 million of cash and $534 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $792 million of EBITDA over the last 12 months, we view UL Solutions’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $20 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from UL Solutions’s Q4 Results

It was good to see UL Solutions narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a softer quarter. The stock traded up 1.1% to $72 immediately after reporting.

12. Is Now The Time To Buy UL Solutions?

Updated: March 7, 2026 at 12:04 AM EST

Before investing in or passing on UL Solutions, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We think UL Solutions is a solid business. To begin with, the its revenue growth was decent over the last four years, and analysts believe it can continue growing at these levels. And while its weak EPS growth over the last three years shows it’s failed to produce meaningful profits for shareholders, its rising cash profitability gives it more optionality. On top of that, its projected EPS for the next year implies the company’s fundamentals will improve.

UL Solutions’s P/E ratio based on the next 12 months is 37.1x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. UL Solutions is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $93.25 on the company (compared to the current share price of $81.06).