Veeva Systems (VEEV)

Veeva Systems is interesting. Despite its slow growth, its highly profitable model gives it a margin of safety during times of stress.― StockStory Analyst Team

1. News

2. Summary

Why Veeva Systems Is Interesting

Originally named "Verticals onDemand" before rebranding in 2009, Veeva Systems (NYSE:VEEV) provides cloud software, data solutions, and consulting services that help life sciences companies develop and bring products to market more efficiently.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its profits increased over the last year as it scaled

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently

- A drawback is its operating profits and efficiency rose over the last year as it benefited from some fixed cost leverage

Veeva Systems is close to becoming a high-quality business. If you’ve been itching to buy the stock, the price seems reasonable.

Why Is Now The Time To Buy Veeva Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Veeva Systems?

Veeva Systems’s stock price of $225.38 implies a valuation ratio of 10.7x forward price-to-sales. This valuation multiple is higher than many software peers, but we think it’s warranted given Veeva Systems’s business fundamentals.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Veeva Systems (VEEV) Research Report: Q3 CY2025 Update

Life sciences cloud software provider Veeva Systems (NYSE:VEEV) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 16% year on year to $811.2 million. Guidance for next quarter’s revenue was better than expected at $808.5 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $2.04 per share was 4.5% above analysts’ consensus estimates.

Veeva Systems (VEEV) Q3 CY2025 Highlights:

- Revenue: $811.2 million vs analyst estimates of $792.9 million (16% year-on-year growth, 2.3% beat)

- Adjusted EPS: $2.04 vs analyst estimates of $1.95 (4.5% beat)

- Adjusted Operating Income: $364.9 million vs analyst estimates of $350.3 million (45% margin, 4.2% beat)

- Revenue Guidance for Q4 CY2025 is $808.5 million at the midpoint, above analyst estimates of $800.5 million

- Management raised its full-year Adjusted EPS guidance to $7.93 at the midpoint, a 1.9% increase

- Operating Margin: 29.7%, up from 25.9% in the same quarter last year

- Free Cash Flow Margin: 23.8%, down from 29.4% in the previous quarter

- Market Capitalization: $44.75 billion

Company Overview

Originally named "Verticals onDemand" before rebranding in 2009, Veeva Systems (NYSE:VEEV) provides cloud software, data solutions, and consulting services that help life sciences companies develop and bring products to market more efficiently.

Veeva's solutions are organized into three main categories. Veeva Development Cloud supports the entire R&D process with applications for clinical trials, regulatory submissions, quality management, and safety monitoring. Veeva Commercial Cloud helps pharmaceutical sales and marketing teams engage with healthcare professionals through customer relationship management tools, content management, and analytics. Veeva Data Cloud provides reference data and insights on healthcare providers, organizations, and patients.

The company's technology addresses the unique regulatory and compliance requirements of the pharmaceutical, biotechnology, and medical device industries. For instance, a pharmaceutical company might use Veeva's clinical trial management system to track study progress across multiple research sites while maintaining regulatory compliance, then leverage Veeva CRM to efficiently coordinate communication between its sales representatives and physicians after product approval.

Veeva generates revenue through software subscriptions and professional services. Its professional services teams offer implementation support, training, and strategic consulting to help customers transform their business processes. While primarily focused on life sciences, Veeva has expanded some of its quality and regulatory solutions to serve consumer products companies as well. The company maintains data centers globally to support customers across North America, Europe, Asia, and other regions.

4. Healthcare And Life Sciences Software

The coronavirus pandemic has underscored the importance of high-quality health infrastructure in times of crisis. Coupled with intense competition between drugmakers and the growing volume of data in the health care sector, demand for data management solutions in the healthcare space is expected to remain strong in the years ahead.

Veeva's primary competitor is IQVIA Holdings Inc., which offers competing CRM applications, data products, and analytics services. Other competitors include Dassault Systèmes, OpenText Corporation, Oracle Corporation, and Honeywell International Inc. in various segments of the life sciences software market.

5. Revenue Growth

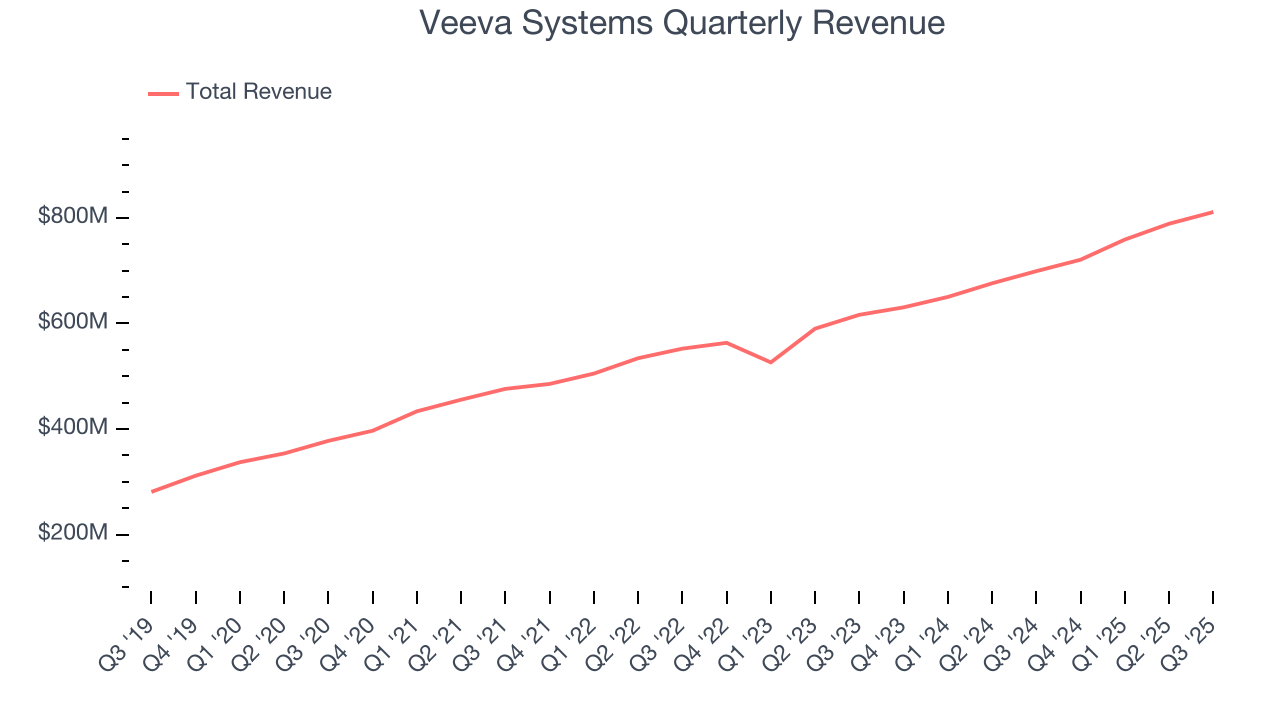

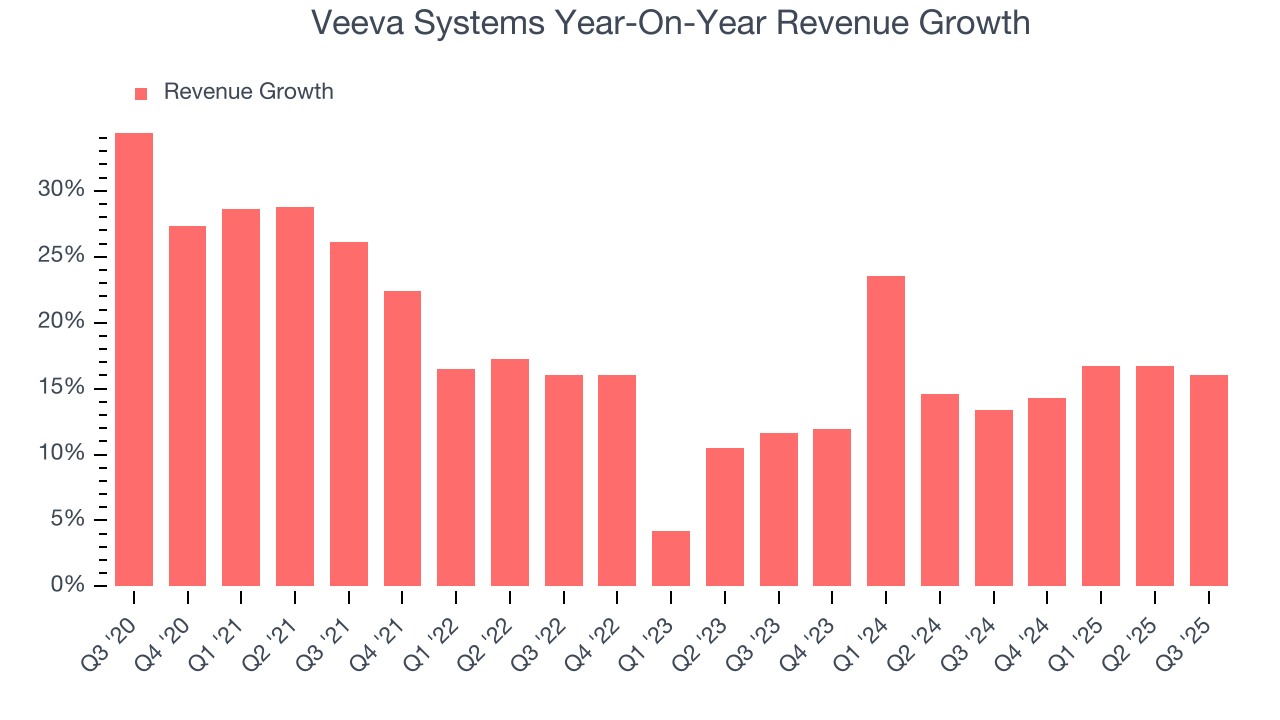

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Veeva Systems grew its sales at a 17.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Veeva Systems.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Veeva Systems’s annualized revenue growth of 15.8% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Veeva Systems reported year-on-year revenue growth of 16%, and its $811.2 million of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 12.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.8% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

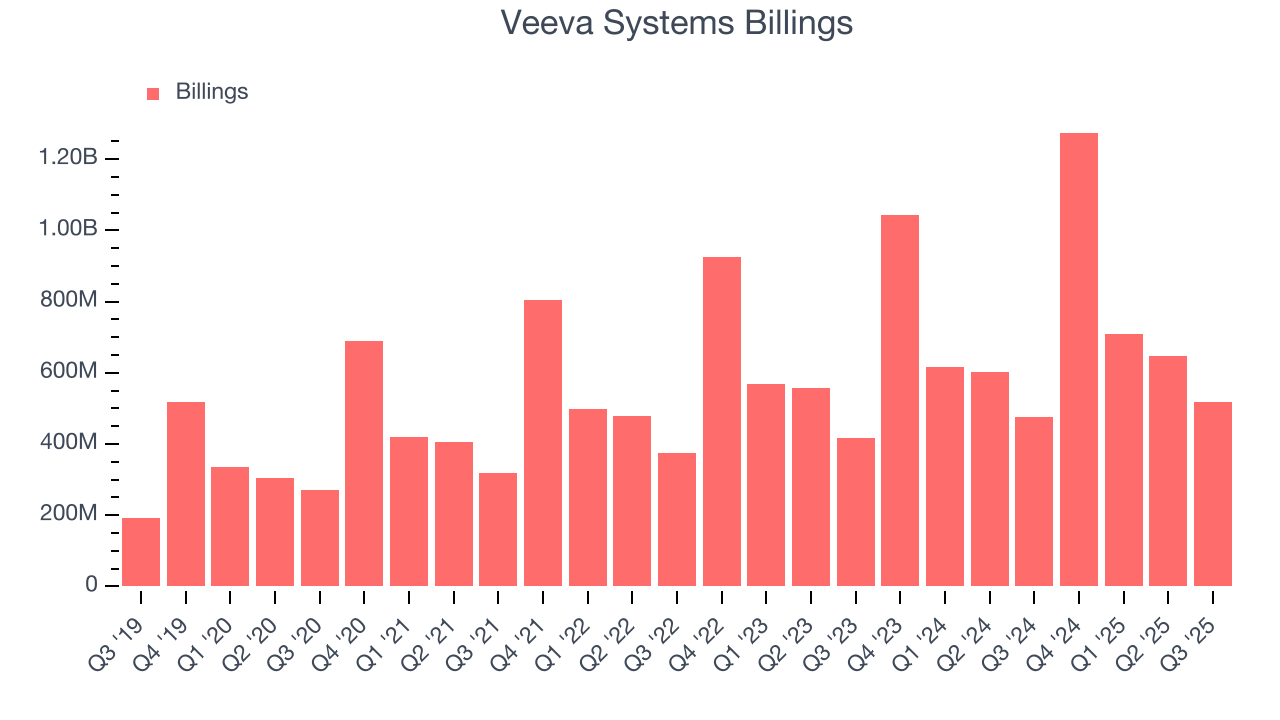

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Veeva Systems’s billings came in at $518.8 million in Q3, and over the last four quarters, its growth slightly lagged the sector as it averaged 13.4% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

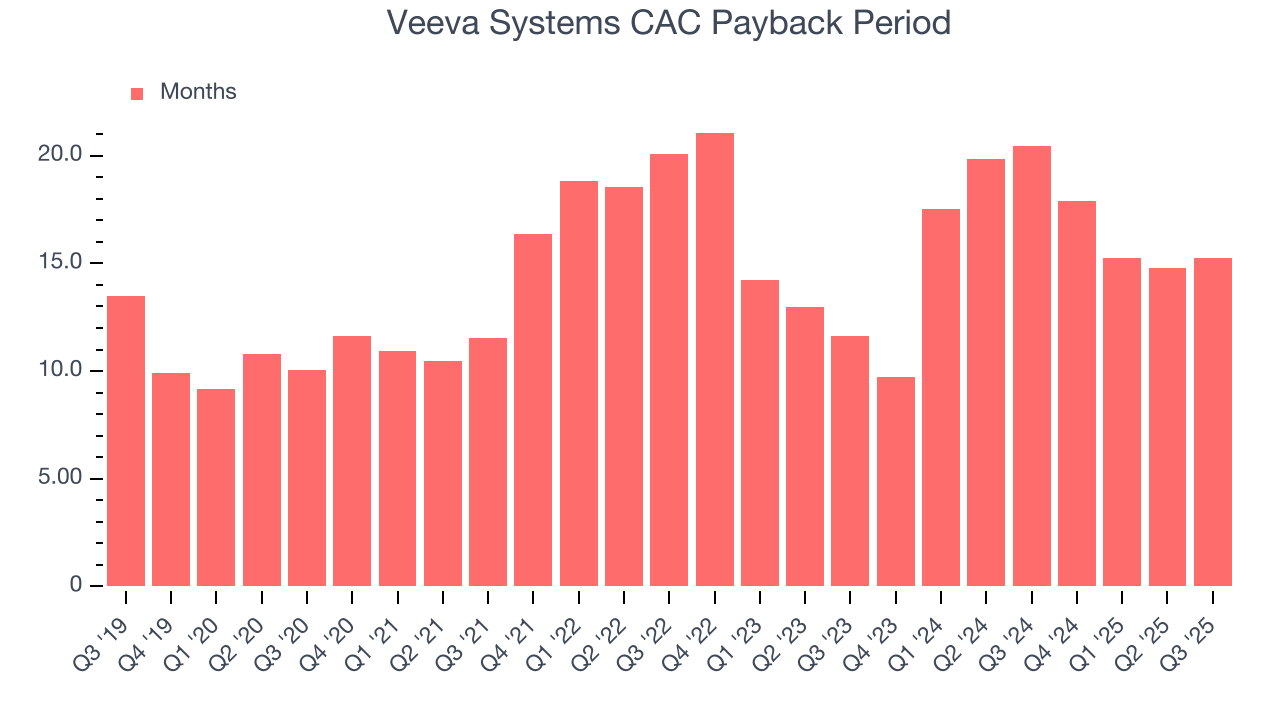

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Veeva Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.3 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Veeva Systems more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

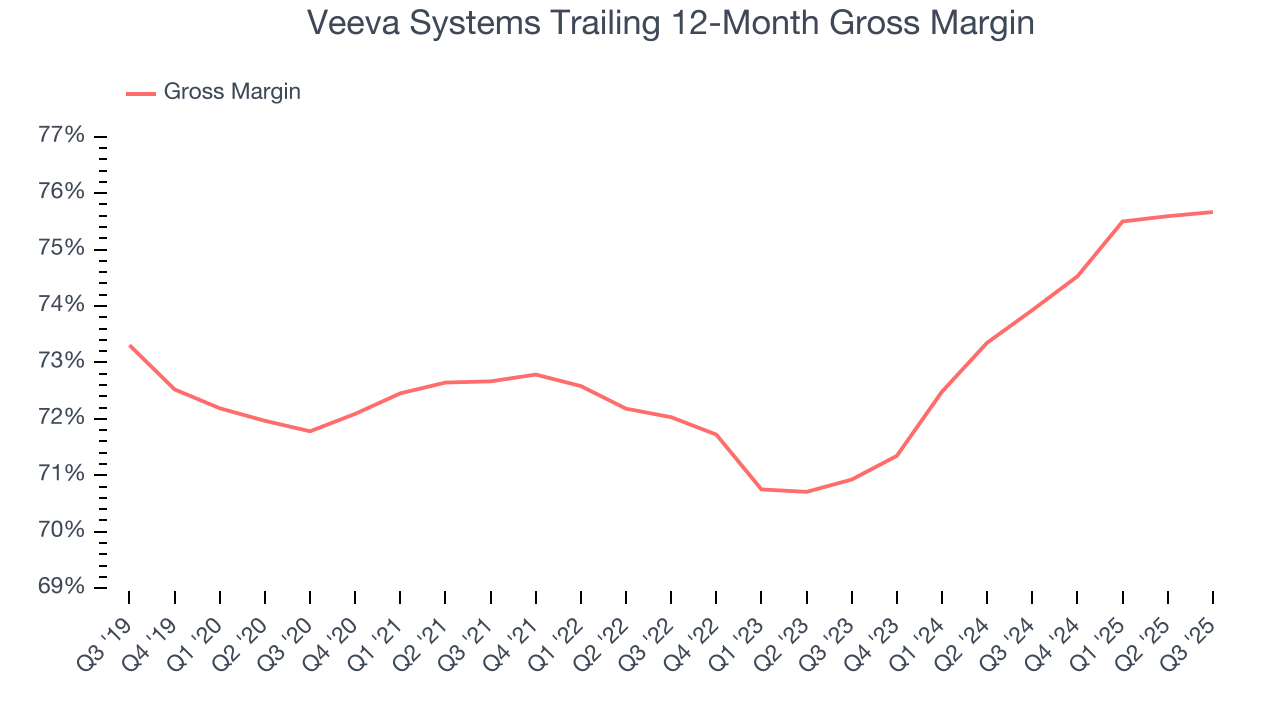

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Veeva Systems’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 75.7% gross margin over the last year. Said differently, Veeva Systems paid its providers $24.33 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Veeva Systems has seen gross margins improve by 4.7 percentage points over the last 2 year, which is very good in the software space.

In Q3, Veeva Systems produced a 75.4% gross profit margin, in line with the same quarter last year. Zooming out, Veeva Systems’s full-year margin has been trending up over the past 12 months, increasing by 1.7 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

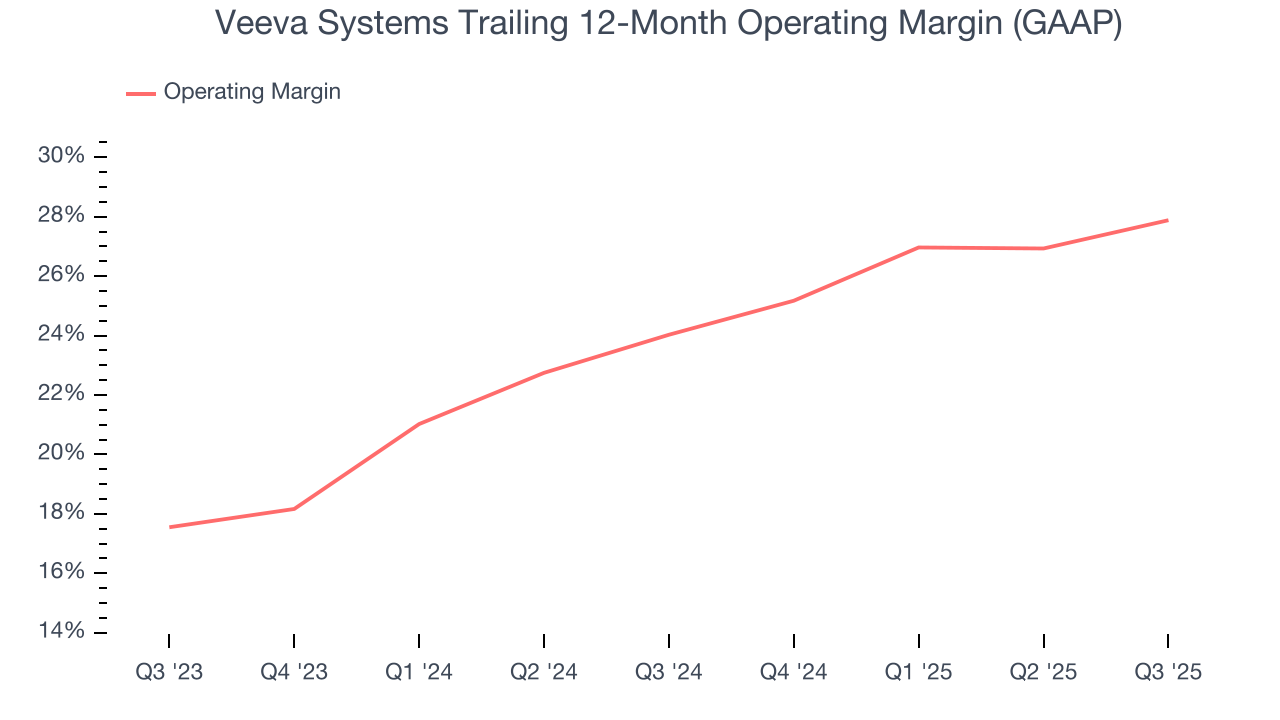

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Veeva Systems has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 27.9%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Veeva Systems’s operating margin rose by 3.9 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, Veeva Systems generated an operating margin profit margin of 29.7%, up 3.8 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

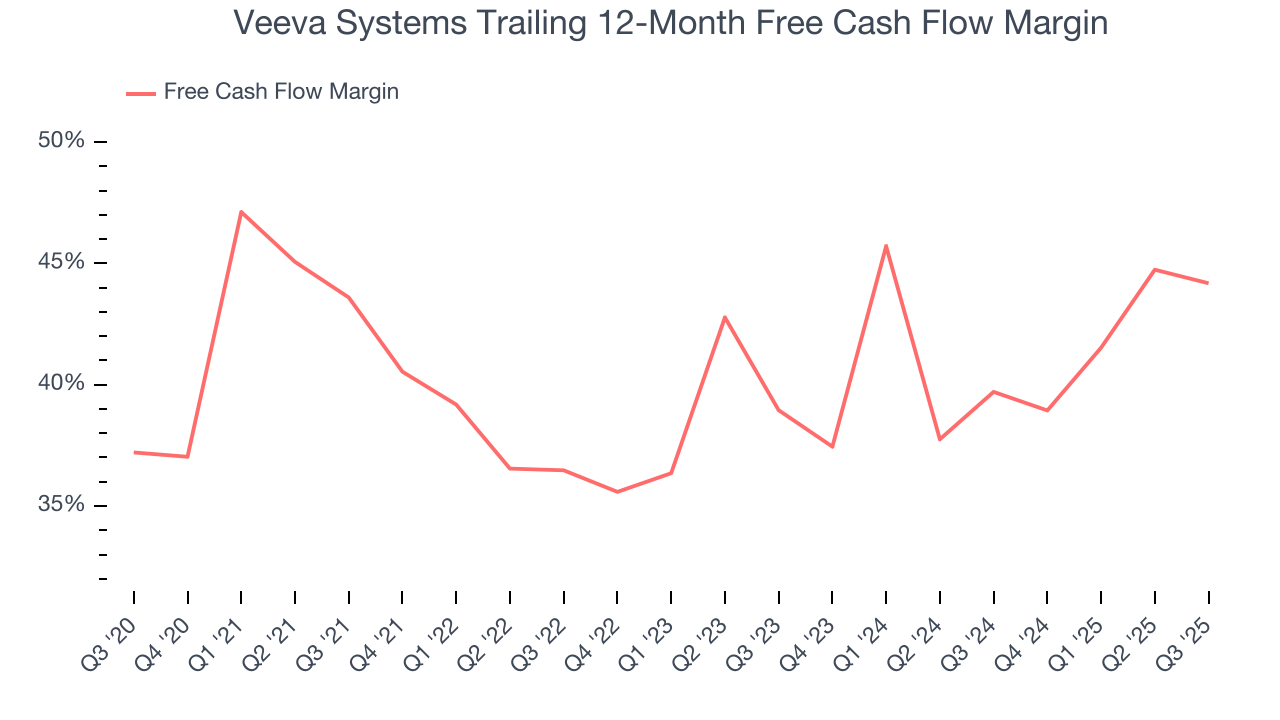

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Veeva Systems has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 44.2% over the last year.

Veeva Systems’s free cash flow clocked in at $192.8 million in Q3, equivalent to a 23.8% margin. This cash profitability was in line with the comparable period last year but below its one-year average. We wouldn’t read too much into it because investment needs can be seasonal, causing short-term swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Veeva Systems’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 44.2% for the last 12 months will decrease to 41.6%.

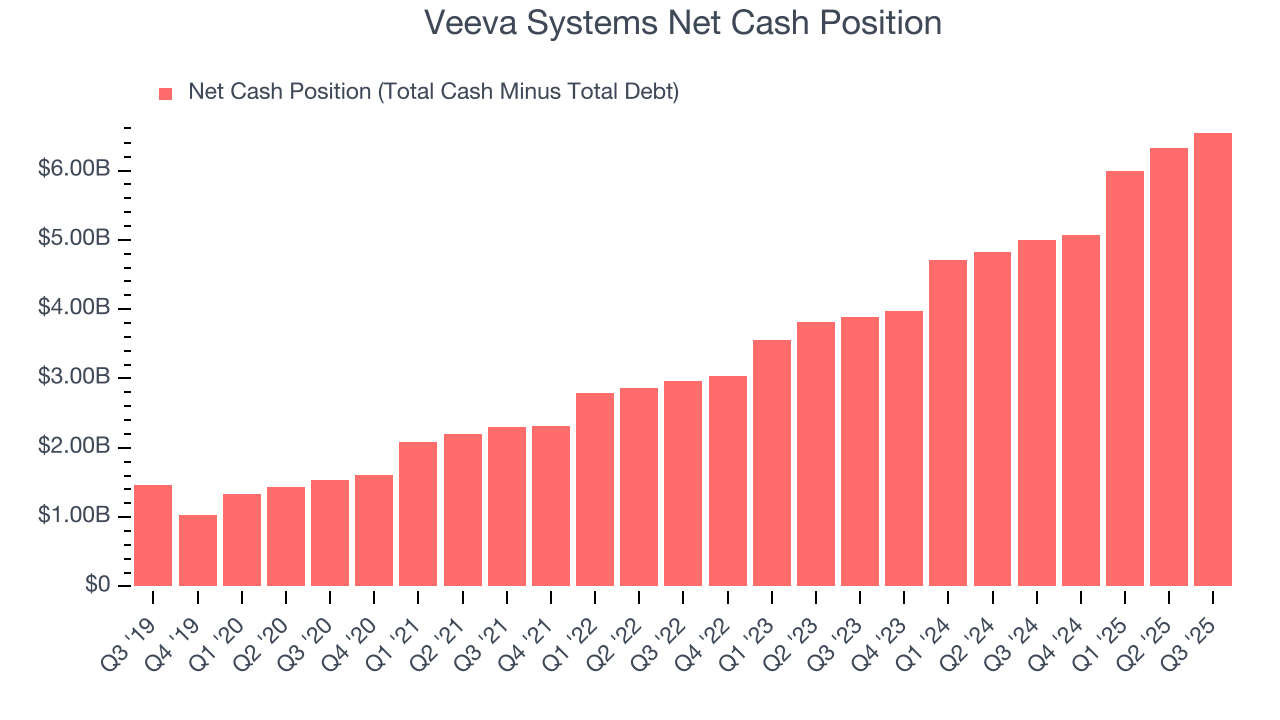

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Veeva Systems is a profitable, well-capitalized company with $6.64 billion of cash and $89.8 million of debt on its balance sheet. This $6.55 billion net cash position is 16.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Veeva Systems’s Q3 Results

It was great to see Veeva Systems’s full-year EPS guidance top analysts’ expectations. We were also glad its EPS guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 2.7% to $263.38 immediately following the results.

13. Is Now The Time To Buy Veeva Systems?

Updated: January 22, 2026 at 9:11 PM EST

Are you wondering whether to buy Veeva Systems or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Veeva Systems possesses a number of positive attributes. Although its revenue growth was mediocre over the last five years and analysts expect growth to slow over the next 12 months, its bountiful generation of free cash flow empowers it to invest in growth initiatives. And while its expanding operating margin shows it’s becoming more efficient at building and selling its software, its impressive operating margins show it has a highly efficient business model.

Veeva Systems’s price-to-sales ratio based on the next 12 months is 10.7x. Looking at the software landscape right now, Veeva Systems trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $309.61 on the company (compared to the current share price of $225.38), implying they see 37.4% upside in buying Veeva Systems in the short term.