Airbnb (ABNB)

Airbnb is a great business. Its efficient marketing engine and robust unit economics tee it up for immense long-term profits.― StockStory Analyst Team

1. News

2. Summary

Why We Like Airbnb

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

- Successful business model is illustrated by its impressive EBITDA margin, and its profits increased over the last few years as it scaled

- Robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

- Platform is difficult to replicate at scale and leads to a stellar gross margin of 83.1%

We expect great things from Airbnb. The price seems reasonable relative to its quality, so this could be a prudent time to invest in some shares.

Why Is Now The Time To Buy Airbnb?

Why Is Now The Time To Buy Airbnb?

Airbnb’s stock price of $132.50 implies a valuation ratio of 16.2x forward EV/EBITDA. This valuation is fair - even cheap depending on how much you like the story - for the quality you get.

By definition, where you buy a stock impacts returns. Compared to entry price, business quality matters much more for long-term market outperformance. Buying in at a great price helps, nevertheless.

3. Airbnb (ABNB) Research Report: Q3 CY2025 Update

Online accommodations platform Airbnb (NASDAQ:ABNB) met Wall Streets revenue expectations in Q3 CY2025, with sales up 9.7% year on year to $4.10 billion. The company expects next quarter’s revenue to be around $2.69 billion, coming in 0.7% above analysts’ estimates. Its GAAP profit of $2.21 per share was 4.8% below analysts’ consensus estimates.

Airbnb (ABNB) Q3 CY2025 Highlights:

- Revenue: $4.10 billion vs analyst estimates of $4.08 billion (9.7% year-on-year growth, in line)

- EPS (GAAP): $2.21 vs analyst expectations of $2.32 (4.8% miss)

- Adjusted EBITDA: $2.05 billion vs analyst estimates of $2.04 billion (50.1% margin, 0.7% beat)

- Revenue Guidance for Q4 CY2025 is $2.69 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 39.7%, down from 40.9% in the same quarter last year

- Free Cash Flow Margin: 32.9%, up from 31.1% in the previous quarter

- Nights and Experiences Booked: 134 million, up 11.2 million year on year

- Market Capitalization: $75 billion

Company Overview

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb was founded on the premise that the travel industry had become commoditized into offering standardized accommodations in crowded hotel districts around landmarks and attractions. The founders' view was that a one-size-fits-all approach limited how much of the world a person could access, leaving guests feeling like outsiders in the places they visit. Airbnb solved this by enabling home sharing globally, creating a new category of travel.

Airbnb’s platform also opened up a whole new revenue stream to thousands of people around the world; earning money on spare rooms. For hosts, Airbnb provided them with an aggregation platform that brought global demand to their doorsteps while providing pricing, scheduling, liability protection, and merchandising functionality to remove the friction from bringing their inventory online. As the company has grown, it has expanded beyond its core of home-sharing into private vacation rentals, longer-term rentals (30+ days), and experiences, where hosts can earn money by organizing activities such as a city tour or wine tasting.

Airbnb generates revenue by taking a cut of each transaction, or booking, on its platform. This marketplace model is quite lucrative because it is asset-lite, meaning few capital expenditures are necessary to maintain the quality of its offerings.

4. Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

Airbnb (NASDAQ:ABNB) competes with a range of online travel companies such as Booking Holdings (NASDAQ:BKNG), Expedia (NASDAQ:EXPE), TripAdvisor (NASDAQ:TRIP), Trivago (NASDAQ:TRIV) and Alphabet (NASDAQ:GOOG.L).

5. Revenue Growth

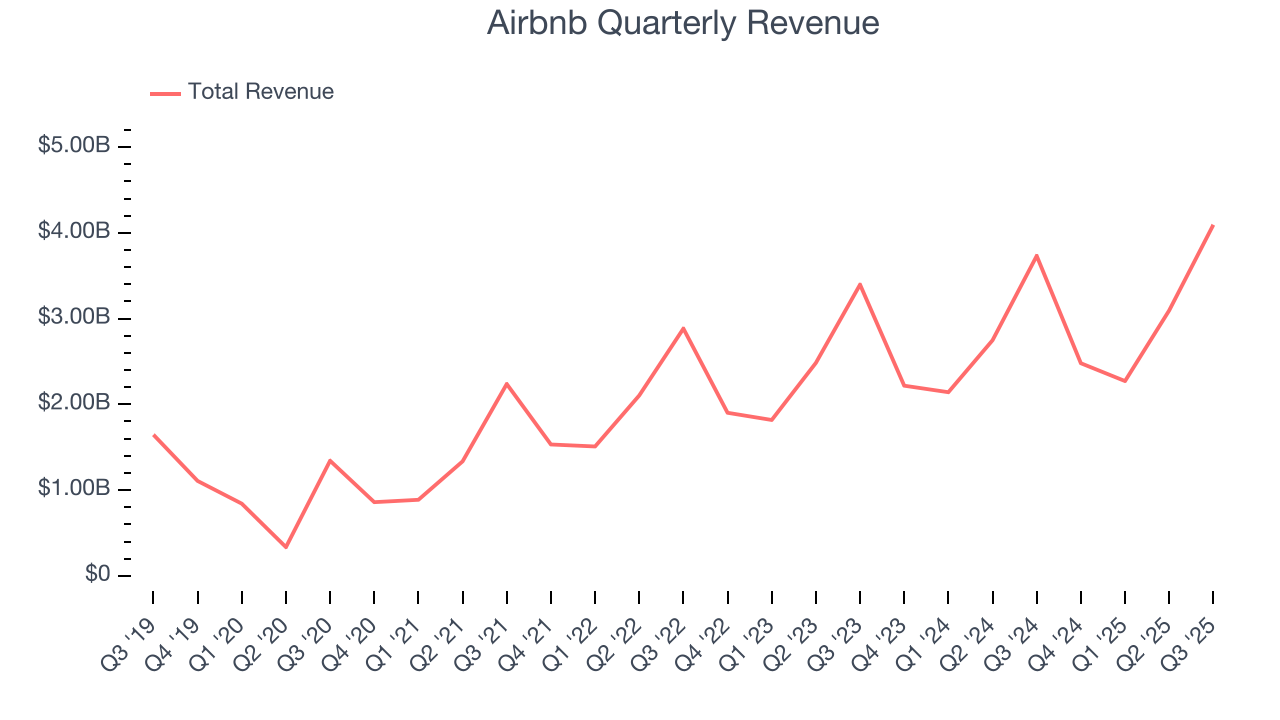

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Airbnb’s sales grew at a solid 14.2% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Airbnb grew its revenue by 9.7% year on year, and its $4.10 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 8.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.5% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Nights And Experiences Booked

Booking Growth

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 9.4% annually to 134 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q3, Airbnb added 11.2 million nights and experiences booked, leading to 9.1% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

Revenue Per Booking

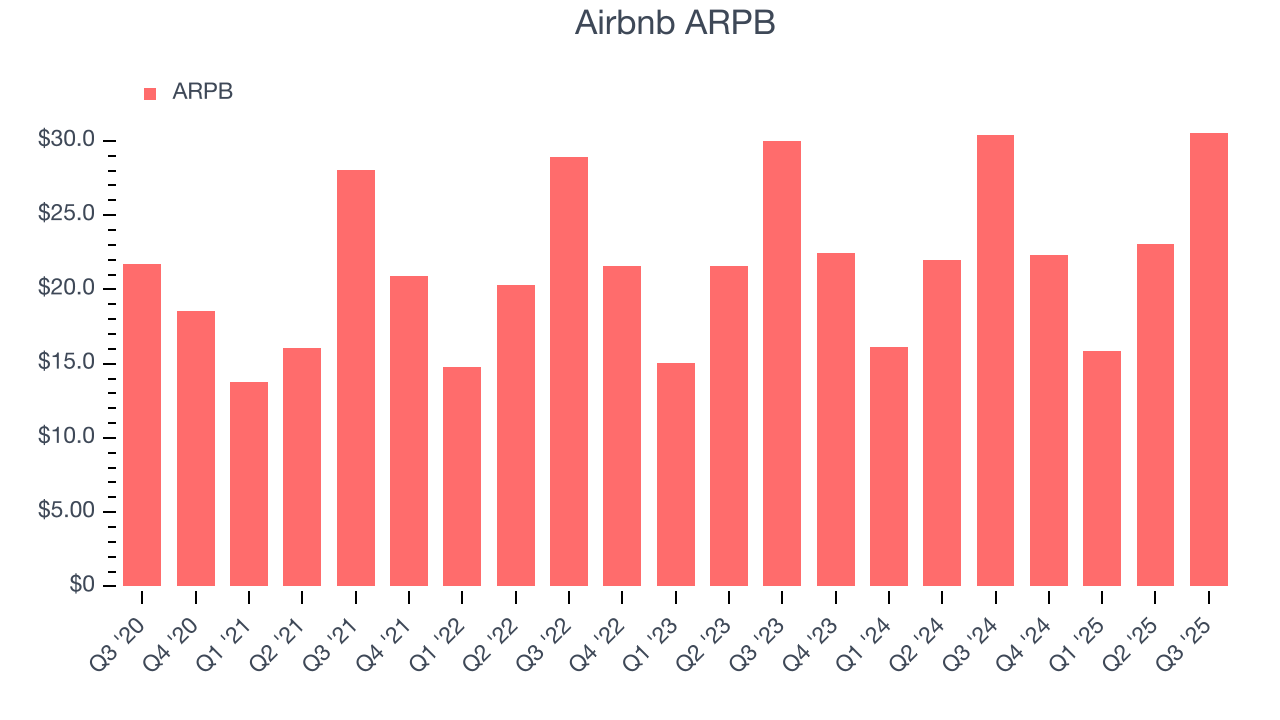

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Airbnb can charge.

Airbnb’s ARPB growth has been subpar over the last two years, averaging 2.2%. This isn’t great, but the increase in nights and experiences booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Airbnb tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Airbnb’s ARPB clocked in at $30.56. It was flat year on year, worse than the change in its nights and experiences booked.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For online travel businesses like Airbnb, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer support, payment processing, fulfillment fees (paid to the airlines, hotels, or car rental companies), and data center expenses to keep the app or website online.

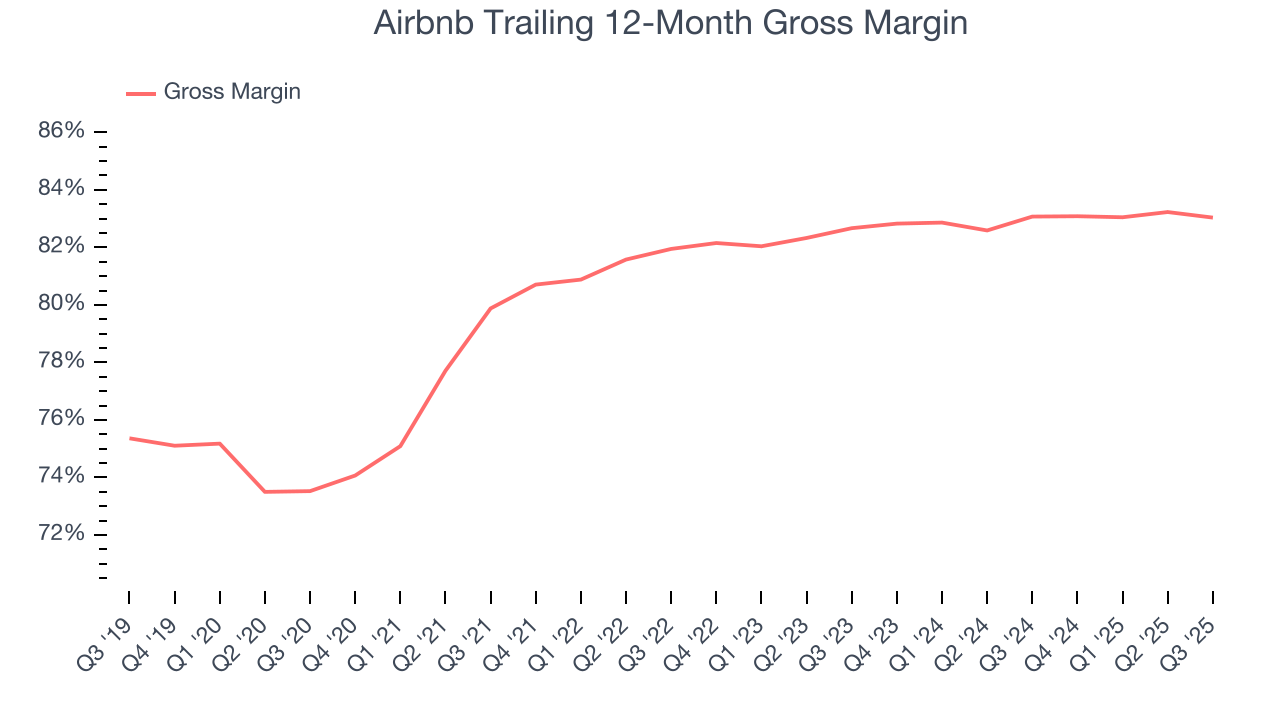

Airbnb’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 83.1% gross margin over the last two years. Said differently, roughly $83.05 was left to spend on selling, marketing, and R&D for every $100 in revenue.

In Q3, Airbnb produced a 86.6% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Consumer internet businesses like Airbnb grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

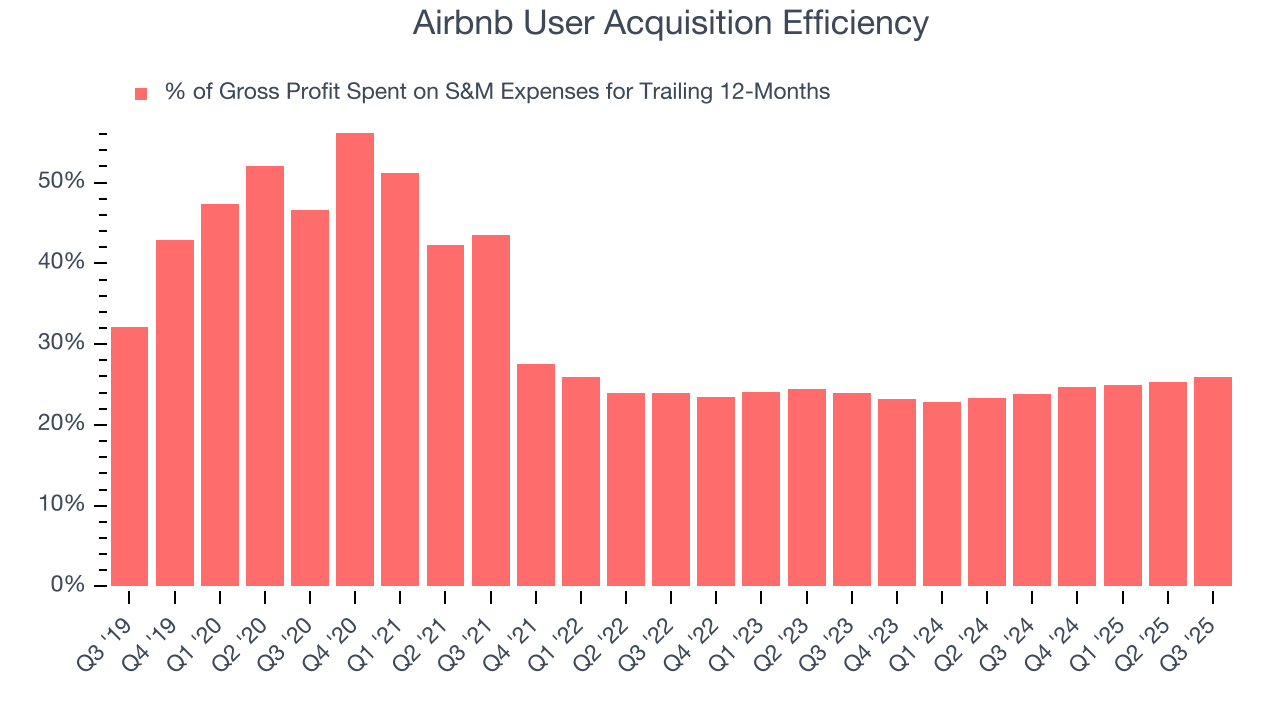

Airbnb is very efficient at acquiring new users, spending only 25.9% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation from scale, giving Airbnb the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

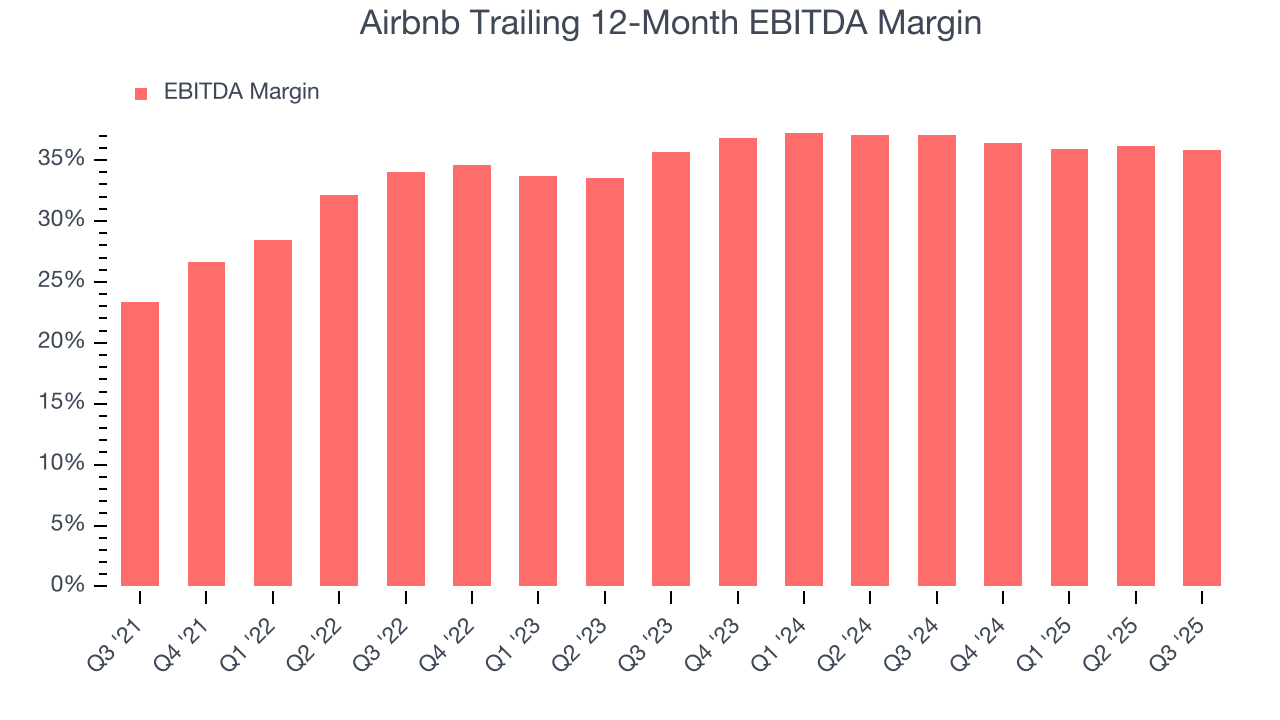

Airbnb has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 36.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Airbnb’s EBITDA margin rose by 1.8 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, Airbnb generated an EBITDA margin profit margin of 50.1%, down 2.4 percentage points year on year. Since Airbnb’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

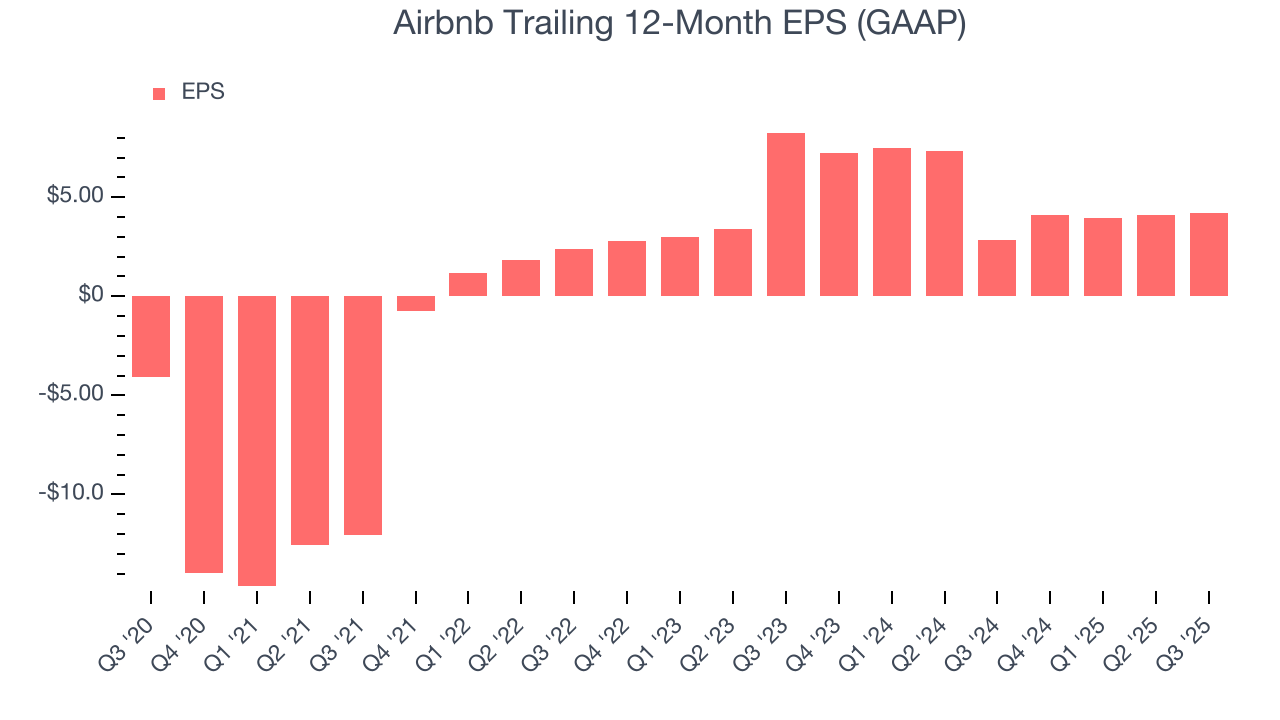

Diving into the nuances of Airbnb’s earnings can give us a better understanding of its performance. As we mentioned earlier, Airbnb’s EBITDA margin declined this quarter but expanded by 1.8 percentage points over the last three years. Its share count also shrank by 8.7%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q3, Airbnb reported EPS of $2.21, up from $2.13 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Airbnb’s full-year EPS of $4.20 to grow 11.7%.

11. Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

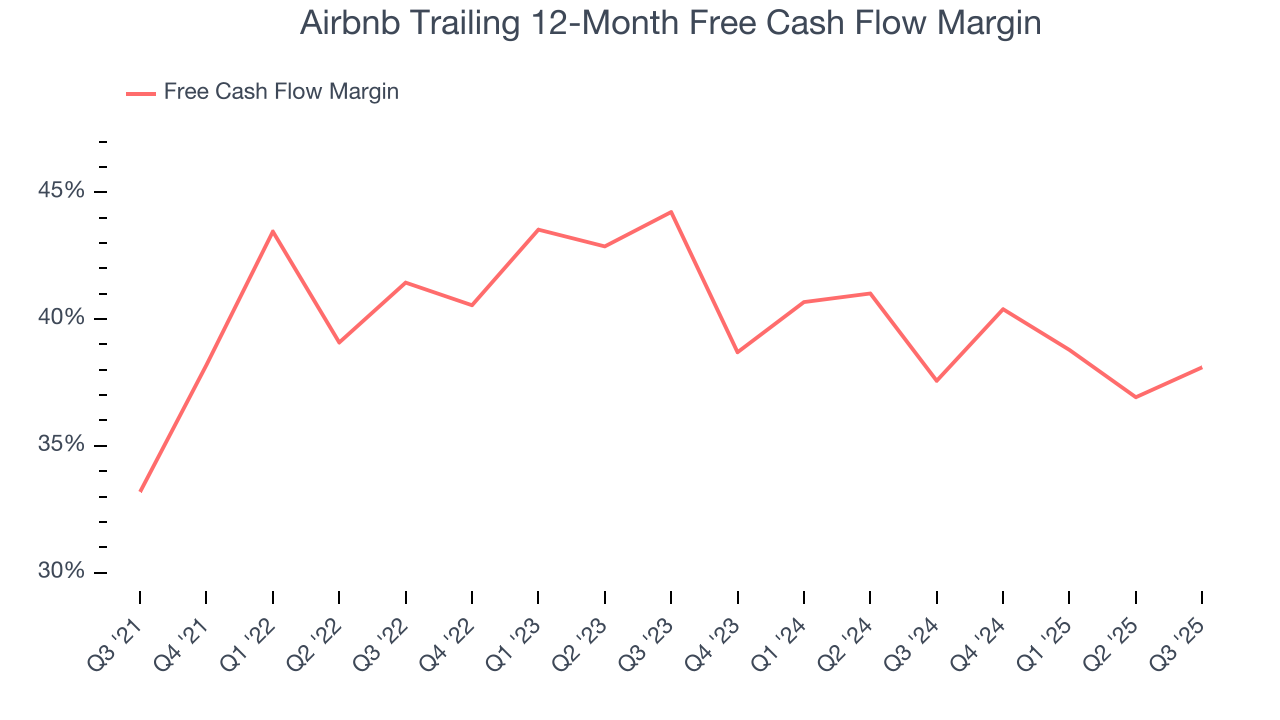

Airbnb has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 37.8% over the last two years.

Taking a step back, we can see that Airbnb’s margin dropped by 3.3 percentage points over the last few years. Rising cash conversion would be ideal, but we’re willing to live with Airbnb’s performance for now because it’s still one of the more cash generative and investable businesses in its space. If its declines continue, it could signal increasing investment needs and capital intensity.

Airbnb’s free cash flow clocked in at $1.35 billion in Q3, equivalent to a 32.9% margin. This result was good as its margin was 4.2 percentage points higher than in the same quarter last year, but we note it was lower than its two-year cash profitability. Nevertheless, we wouldn’t read too much into a single quarter because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

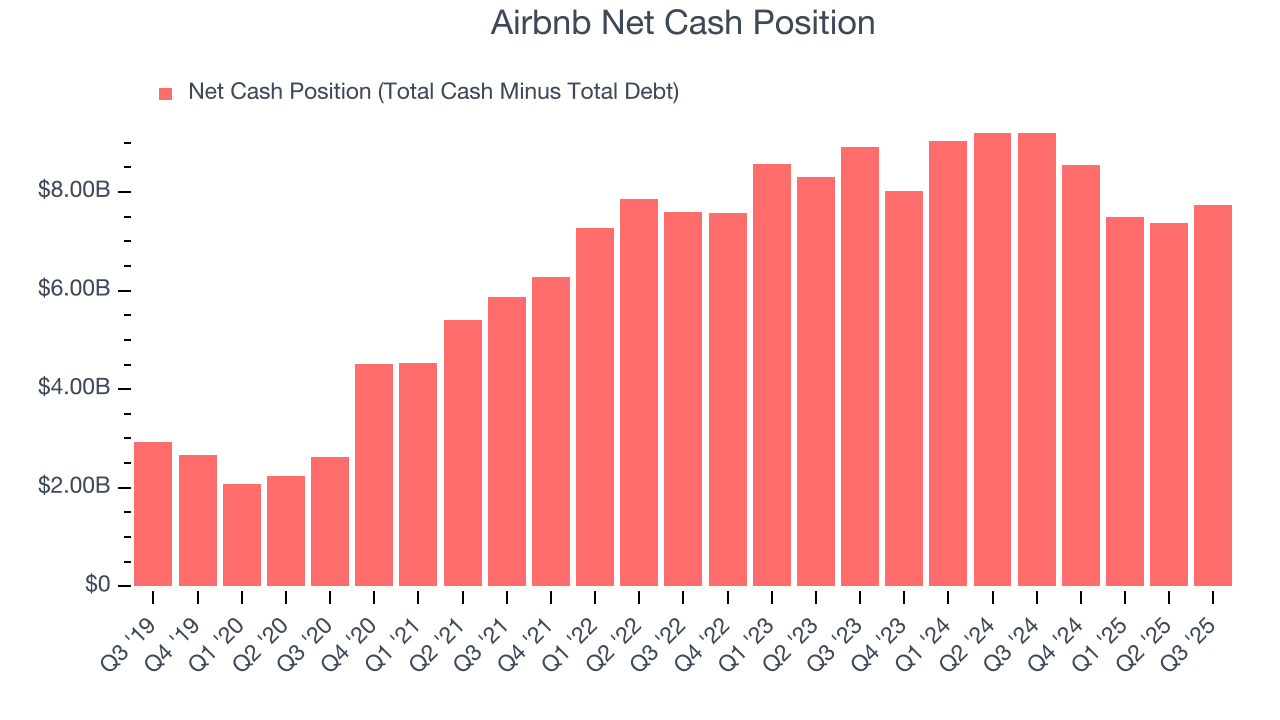

Airbnb is a profitable, well-capitalized company with $11.72 billion of cash and $3.99 billion of debt on its balance sheet. This $7.73 billion net cash position is 10.3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Airbnb’s Q3 Results

It was encouraging to see Airbnb beat analysts’ number of nights and experiences booked expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.5% to $126 immediately after reporting.

14. Is Now The Time To Buy Airbnb?

Updated: January 23, 2026 at 9:33 PM EST

Are you wondering whether to buy Airbnb or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Airbnb is an amazing business ranking highly on our list. For starters, its revenue growth was solid over the last three years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive EBITDA margins show it has a highly efficient business model.

Airbnb’s EV/EBITDA ratio based on the next 12 months is 16.2x. Looking at the consumer internet landscape today, Airbnb’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $143.23 on the company (compared to the current share price of $132.50), implying they see 8.1% upside in buying Airbnb in the short term.