Allegro MicroSystems (ALGM)

We’re cautious of Allegro MicroSystems. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Allegro MicroSystems Will Underperform

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

- Earnings per share fell by 15.6% annually over the last five years while its revenue grew, showing its incremental sales were much less profitable

- Low free cash flow margin declined over the last five years as its investments ramped, giving it little breathing room

- The good news is that its demand will likely accelerate over the next 12 months as its forecasted revenue growth of 19.7% is above its two-year trend

Allegro MicroSystems’s quality isn’t up to par. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Allegro MicroSystems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Allegro MicroSystems

Allegro MicroSystems’s stock price of $34.52 implies a valuation ratio of 44.3x forward P/E. This valuation is extremely expensive, especially for the quality you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Allegro MicroSystems (ALGM) Research Report: Q4 CY2025 Update

Chip designer Allegro MicroSystems (NASDAQ:ALGM) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 28.9% year on year to $229.2 million. Guidance for next quarter’s revenue was optimistic at $235 million at the midpoint, 2.7% above analysts’ estimates. Its GAAP profit of $0.04 per share was $0.01 below analysts’ consensus estimates.

Allegro MicroSystems (ALGM) Q4 CY2025 Highlights:

- Revenue: $229.2 million vs analyst estimates of $221.3 million (28.9% year-on-year growth, 3.6% beat)

- EPS (GAAP): $0.04 vs analyst estimates of $0.05 ($0.01 miss)

- Adjusted EBITDA: $46.18 million vs analyst estimates of $38.86 million (20.1% margin, 18.8% beat)

- Revenue Guidance for Q1 CY2026 is $235 million at the midpoint, above analyst estimates of $228.7 million

- EPS (GAAP) guidance for Q1 CY2026 is $0.16 at the midpoint, beating analyst estimates by 156%

- Operating Margin: 4.2%, up from 0% in the same quarter last year

- Free Cash Flow was $41.26 million, up from -$21.8 million in the same quarter last year

- Inventory Days Outstanding: 133, down from 135 in the previous quarter

- Market Capitalization: $6.40 billion

Company Overview

The result of a spinoff from Sanken in Japan, Allegro MicroSystems (NASDAQ:ALGM) is a designer of power management chips and distance sensors used in electric vehicles and data centers.

4. Revenue Growth

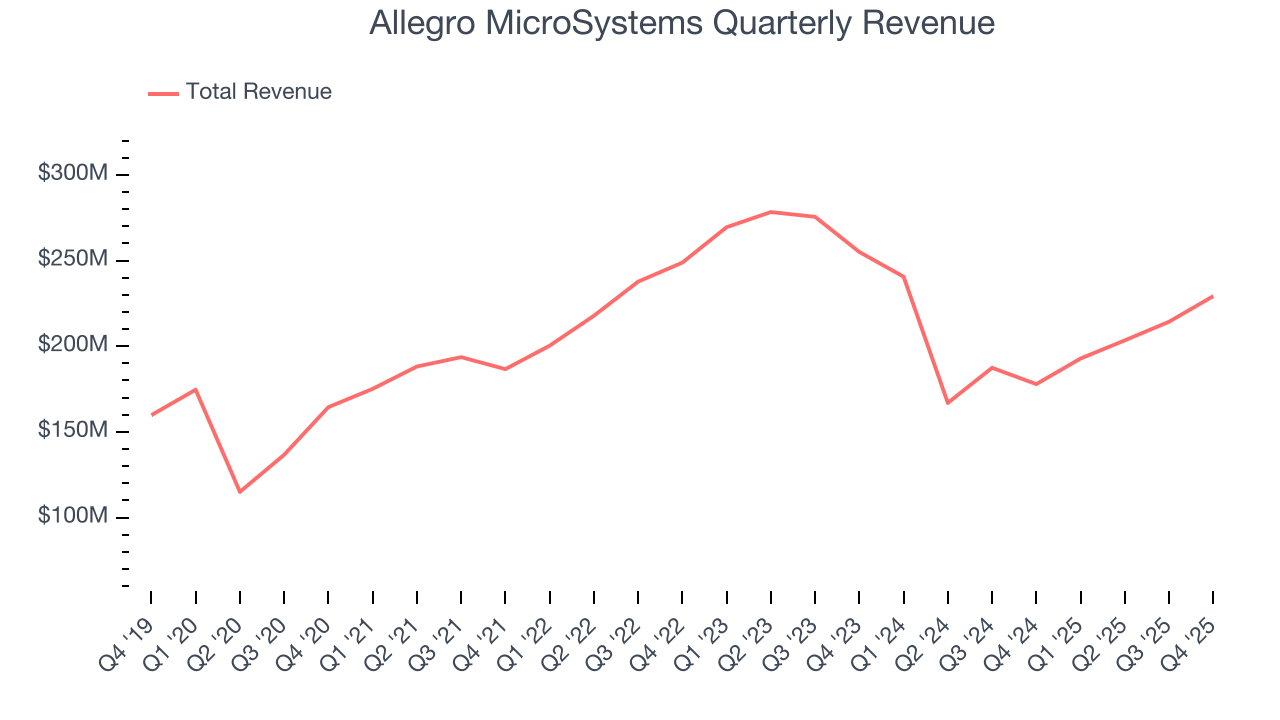

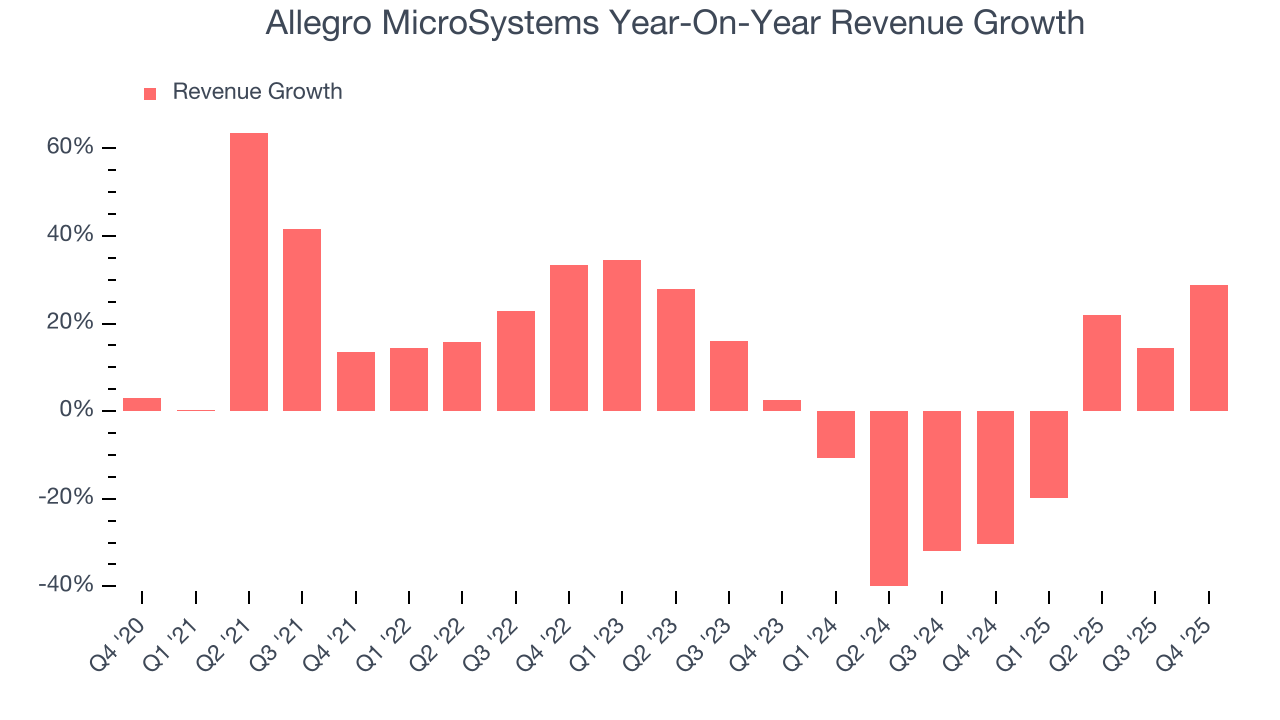

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Allegro MicroSystems grew its sales at a decent 7.3% compounded annual growth rate. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Allegro MicroSystems’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 11.8% over the last two years.

This quarter, Allegro MicroSystems reported robust year-on-year revenue growth of 28.9%, and its $229.2 million of revenue topped Wall Street estimates by 3.6%. Beyond the beat, we believe the company is still in the early days of an upcycle as this was the third consecutive quarter of growth - a typical upcycle tends to last 8-10 quarters. Company management is currently guiding for a 21.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 16.6% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will fuel better top-line performance.

5. Product Demand & Outstanding Inventory

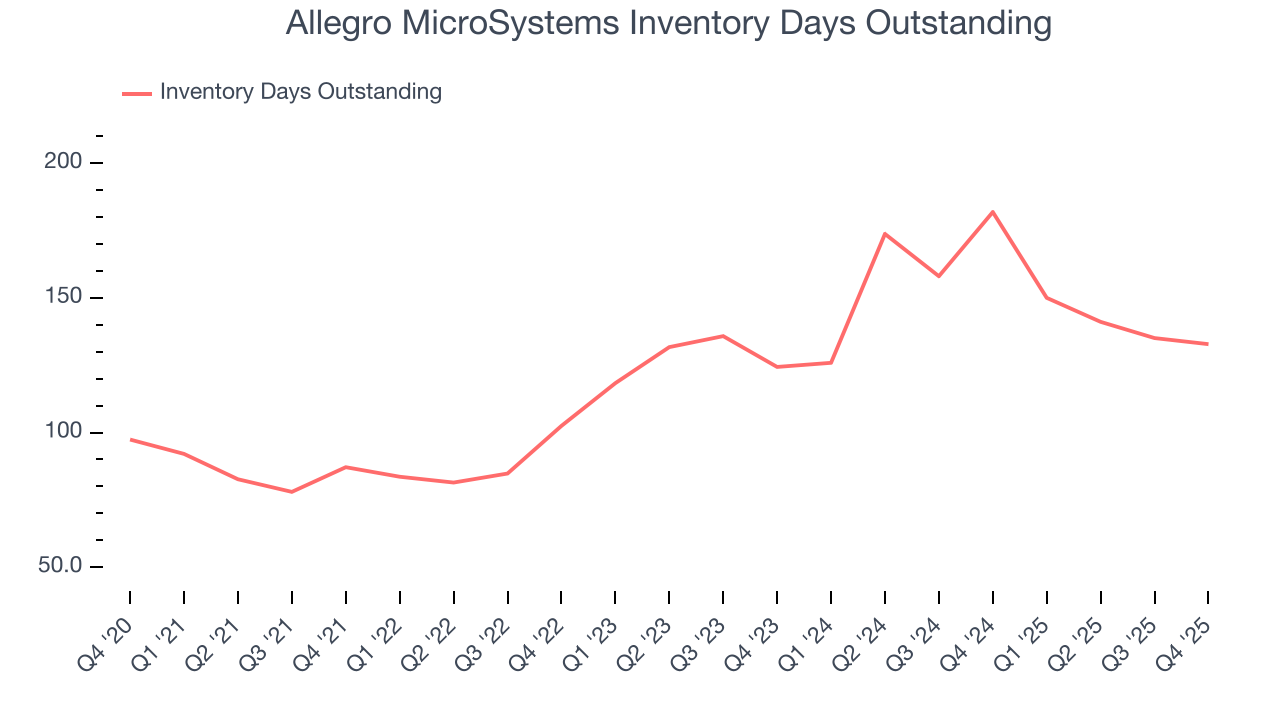

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Allegro MicroSystems’s DIO came in at 133, which is 13 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

6. Gross Margin & Pricing Power

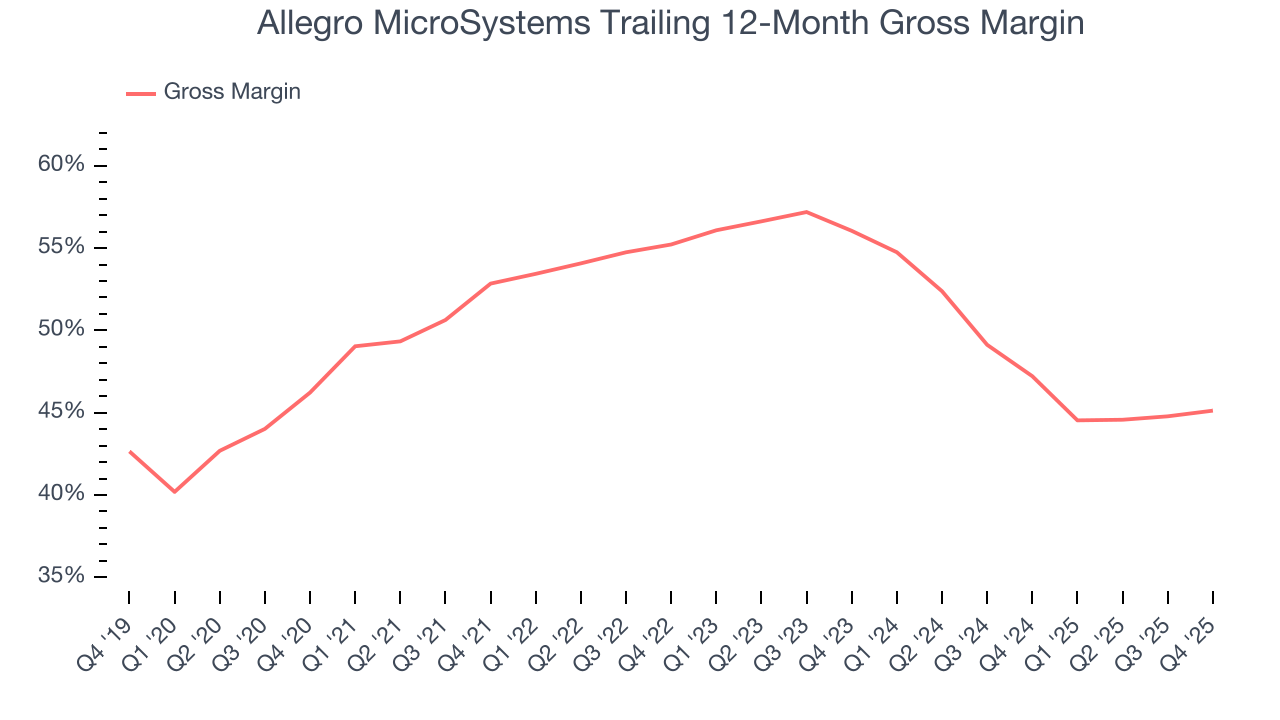

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Allegro MicroSystems’s gross margin is slightly below the average semiconductor company, indicating its products aren’t as mission-critical as its competitors. As you can see below, it averaged a 46.1% gross margin over the last two years. Said differently, Allegro MicroSystems had to pay a chunky $53.87 to its suppliers for every $100 in revenue.

In Q4, Allegro MicroSystems produced a 46.7% gross profit margin, up 1.1 percentage points year on year. Zooming out, however, Allegro MicroSystems’s full-year margin has been trending down over the past 12 months, decreasing by 2.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

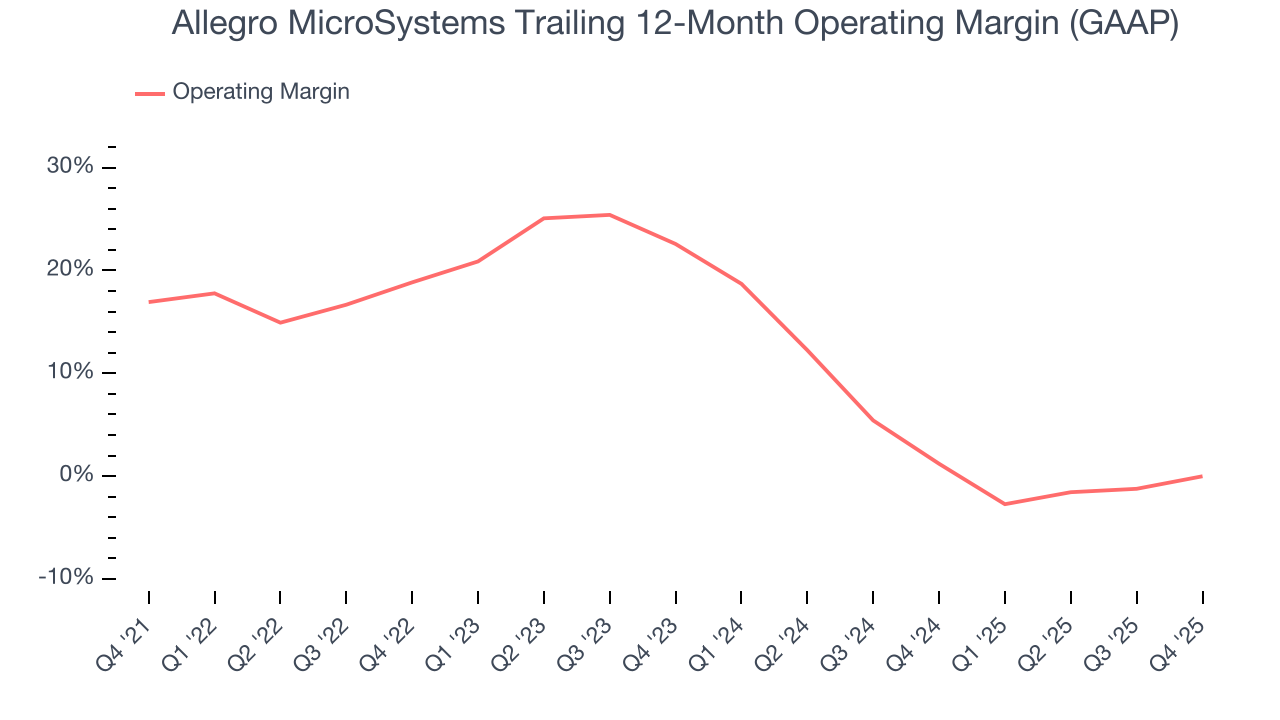

Allegro MicroSystems was roughly breakeven when averaging the last two years of quarterly operating profits, lousy for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Allegro MicroSystems’s operating margin decreased by 16.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Allegro MicroSystems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Allegro MicroSystems generated an operating margin profit margin of 4.2%, up 4.2 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

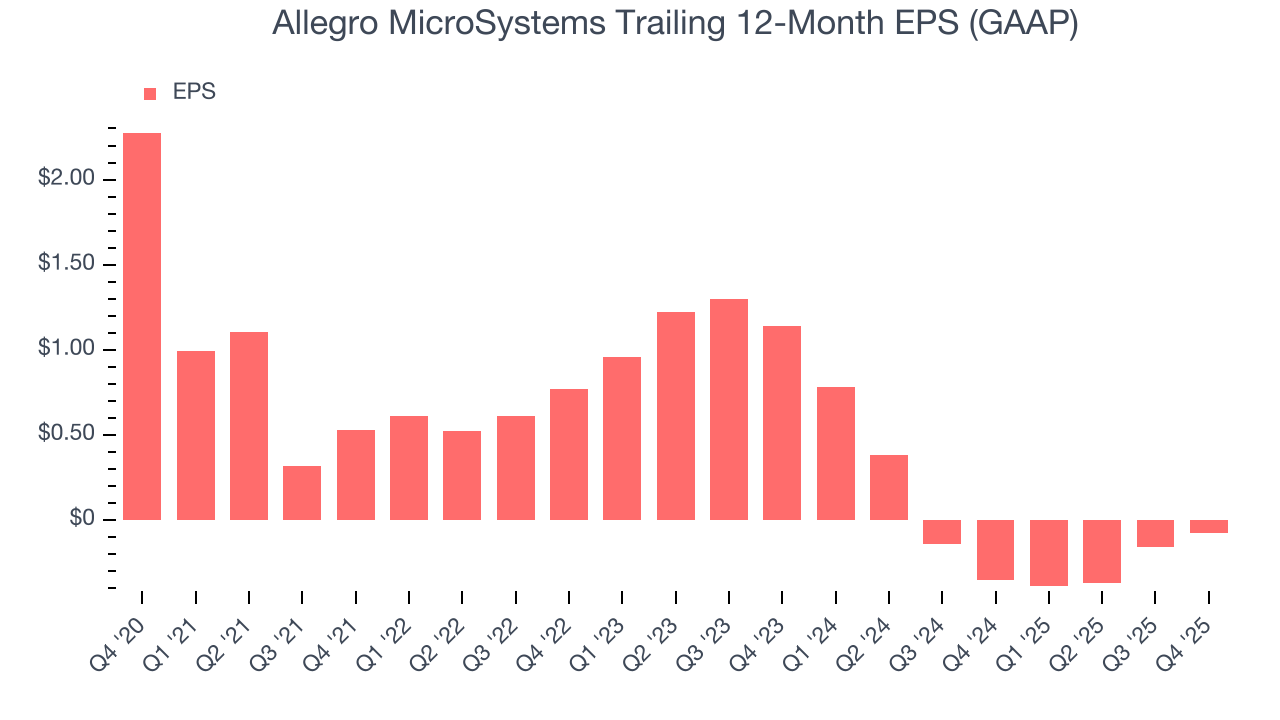

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Allegro MicroSystems, its EPS declined by 15.3% annually over the last five years while its revenue grew by 7.3%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

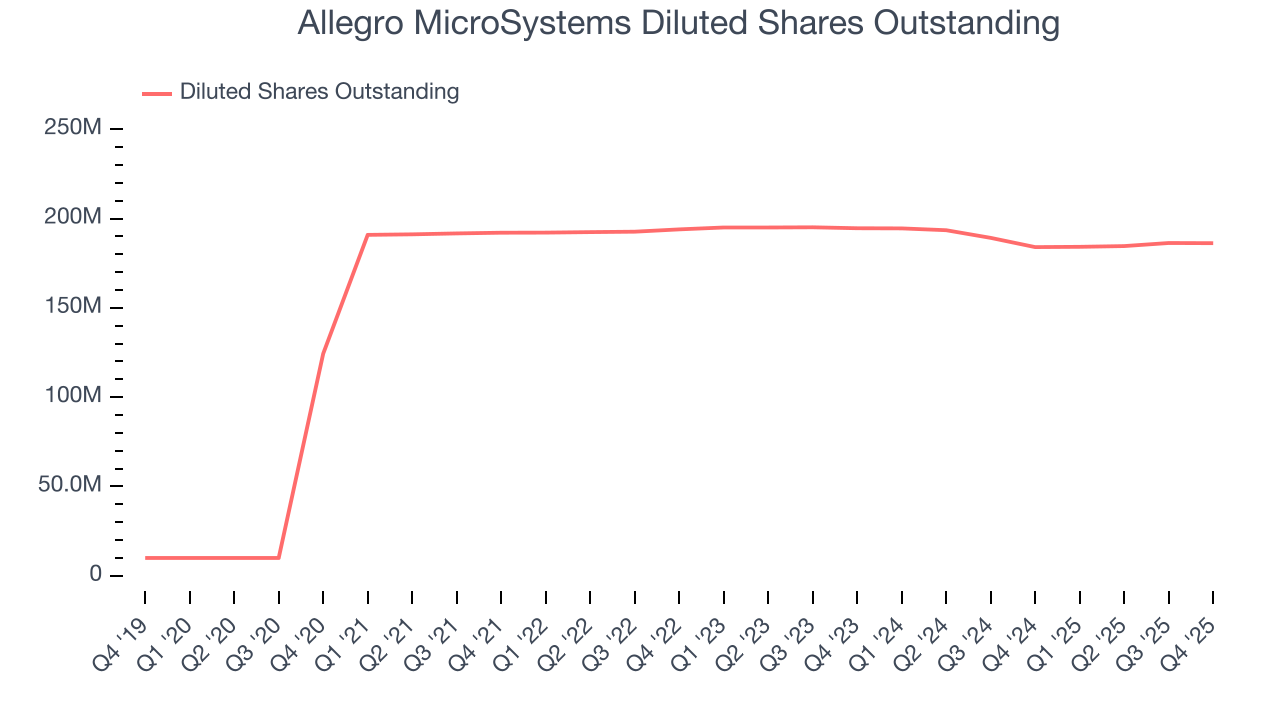

Diving into the nuances of Allegro MicroSystems’s earnings can give us a better understanding of its performance. As we mentioned earlier, Allegro MicroSystems’s operating margin expanded this quarter but declined by 16.9 percentage points over the last five years. Its share count also grew by 49.7%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, Allegro MicroSystems reported EPS of $0.04, up from negative $0.04 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Allegro MicroSystems’s full-year EPS of negative $0.08 will flip to positive $0.45.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

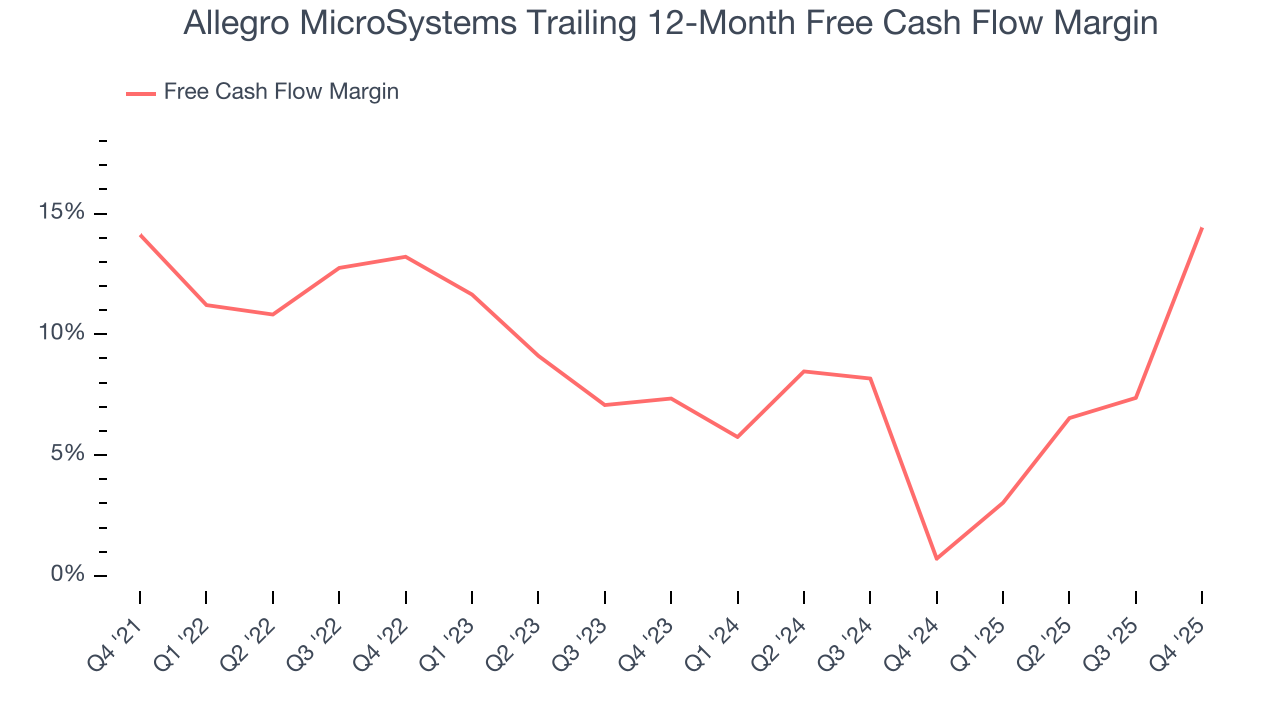

Allegro MicroSystems has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 7.9%, lousy for a semiconductor business.

Taking a step back, we can see that Allegro MicroSystems failed to improve its margin over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level.

Allegro MicroSystems’s free cash flow clocked in at $41.26 million in Q4, equivalent to a 18% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

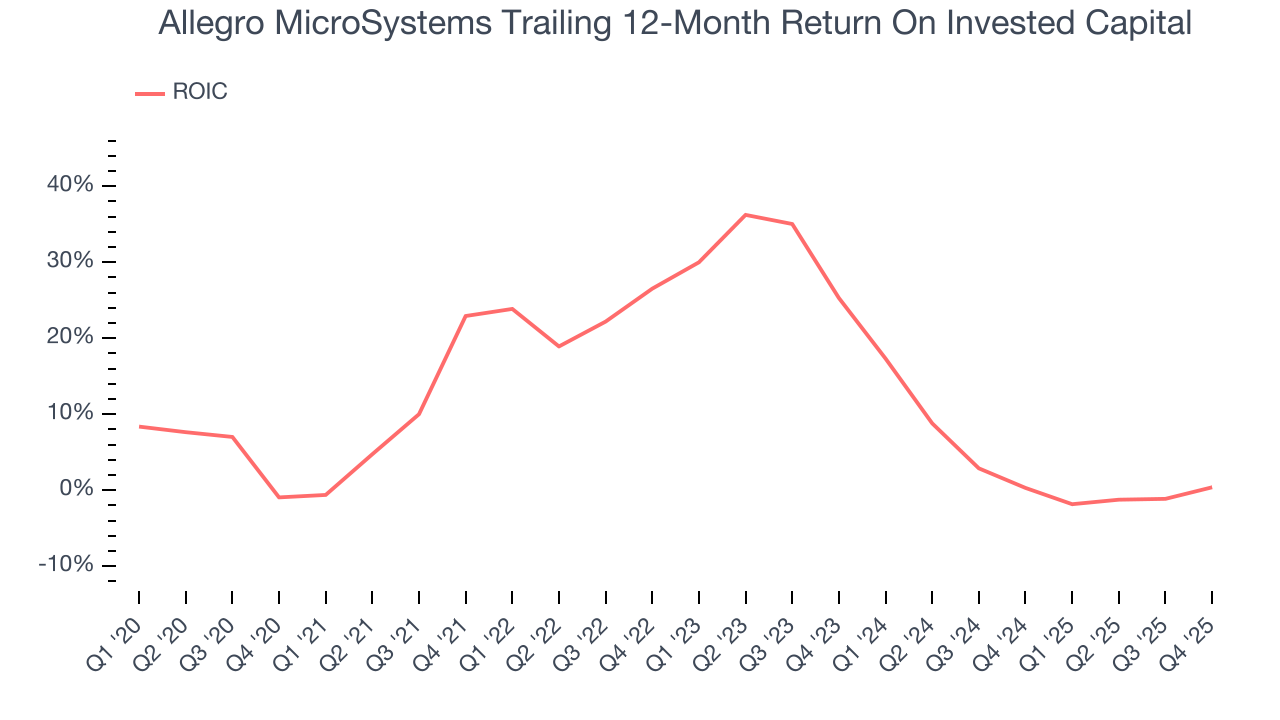

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Allegro MicroSystems historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.1%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

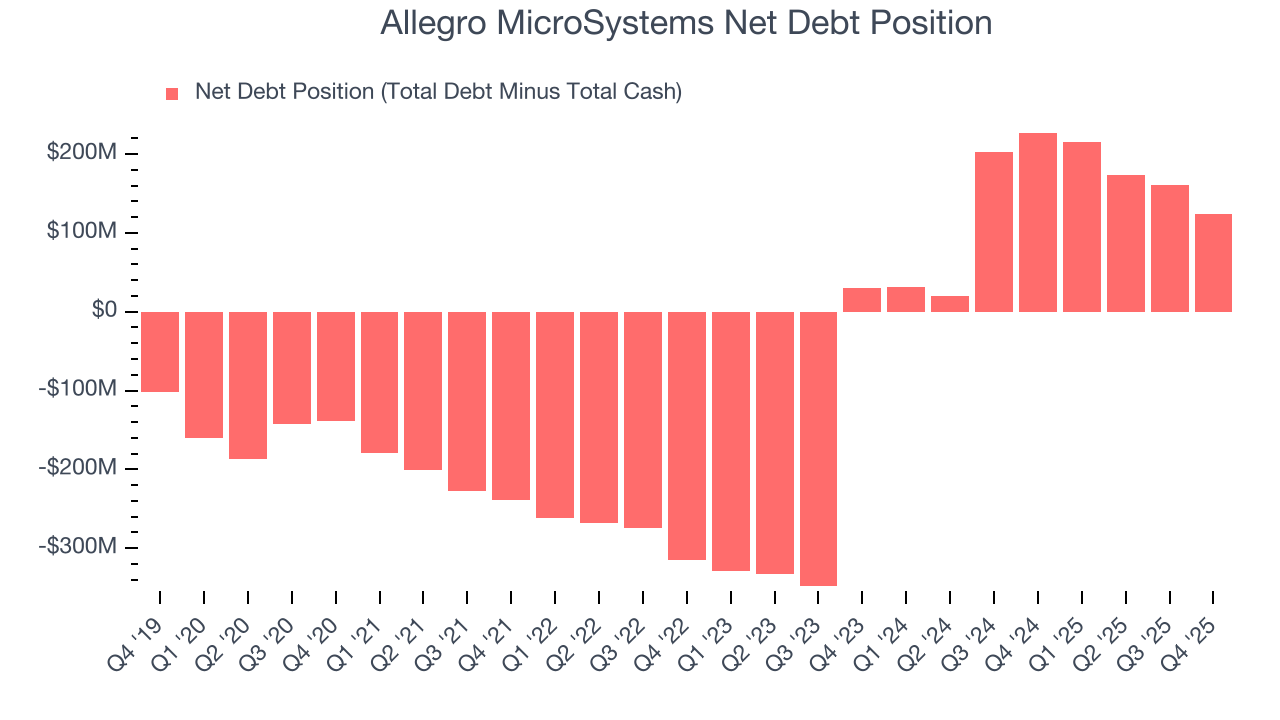

11. Balance Sheet Assessment

Allegro MicroSystems reported $163.4 million of cash and $287.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $148.8 million of EBITDA over the last 12 months, we view Allegro MicroSystems’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $9.27 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Allegro MicroSystems’s Q4 Results

We enjoyed seeing Allegro MicroSystems beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Overall, this print had some key positives. The stock traded up 4.9% to $36.25 immediately following the results.

13. Is Now The Time To Buy Allegro MicroSystems?

Updated: January 29, 2026 at 8:04 AM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Allegro MicroSystems, you should also grasp the company’s longer-term business quality and valuation.

Allegro MicroSystems isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months, its declining EPS over the last five years makes it a less attractive asset to the public markets. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

Allegro MicroSystems’s P/E ratio based on the next 12 months is 41.5x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $38.92 on the company (compared to the current share price of $36.25).