Align Technology (ALGN)

We’re wary of Align Technology. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Align Technology Is Not Exciting

Pioneering an alternative to traditional metal braces with nearly invisible plastic aligners, Align Technology (NASDAQ:ALGN) designs and manufactures Invisalign clear aligners, iTero intraoral scanners, and dental CAD/CAM software for orthodontic and restorative treatments.

- Estimated sales growth of 3.4% for the next 12 months is soft and implies weaker demand

- On the bright side, its earnings per share grew by 15% annually over the last five years and beat its peers

Align Technology doesn’t fulfill our quality requirements. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Align Technology

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Align Technology

Align Technology is trading at $172.64 per share, or 14.1x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Align Technology (ALGN) Research Report: Q4 CY2025 Update

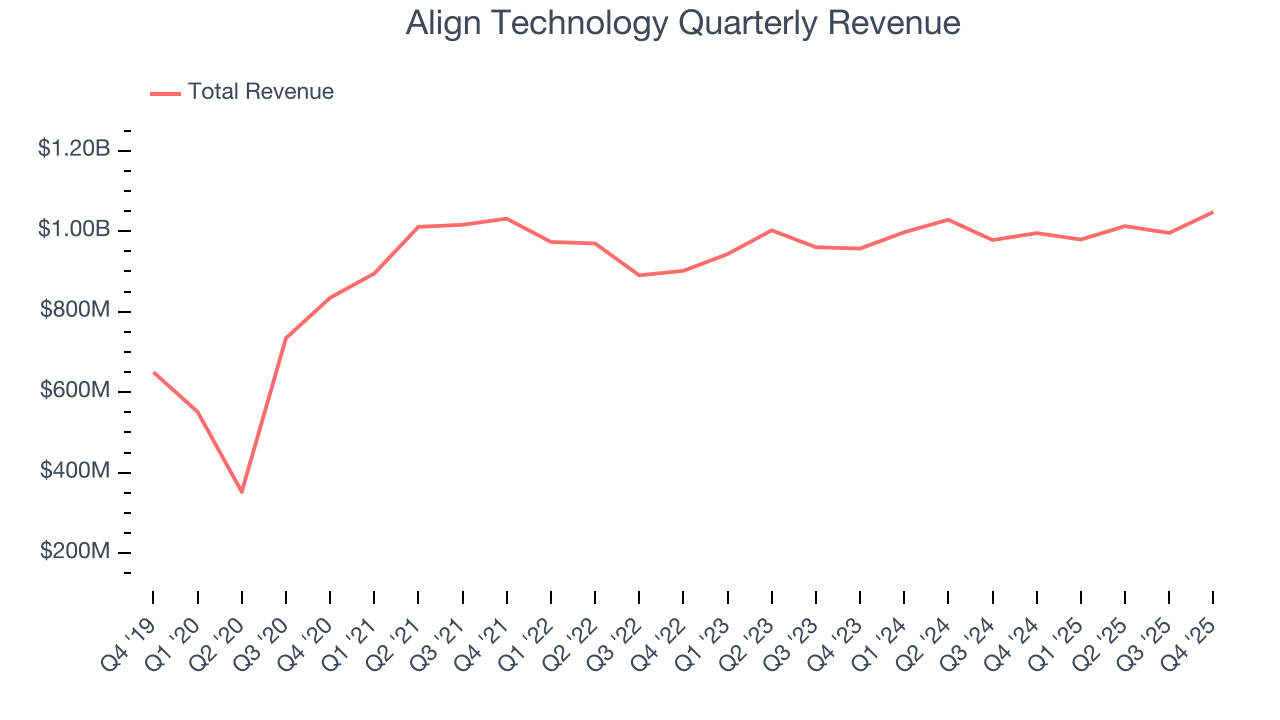

Dental technology company Align Technology (NASDAQ:ALGN) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 5.3% year on year to $1.05 billion. The company expects next quarter’s revenue to be around $1.02 billion, close to analysts’ estimates. Its non-GAAP profit of $3.29 per share was 10.8% above analysts’ consensus estimates.

Align Technology (ALGN) Q4 CY2025 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.03 billion (5.3% year-on-year growth, 1.2% beat)

- Adjusted EPS: $3.29 vs analyst estimates of $2.97 (10.8% beat)

- Adjusted Operating Income: $273.8 million vs analyst estimates of $265.2 million (26.1% margin, 3.2% beat)

- Revenue Guidance for Q1 CY2026 is $1.02 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 14.8%, in line with the same quarter last year

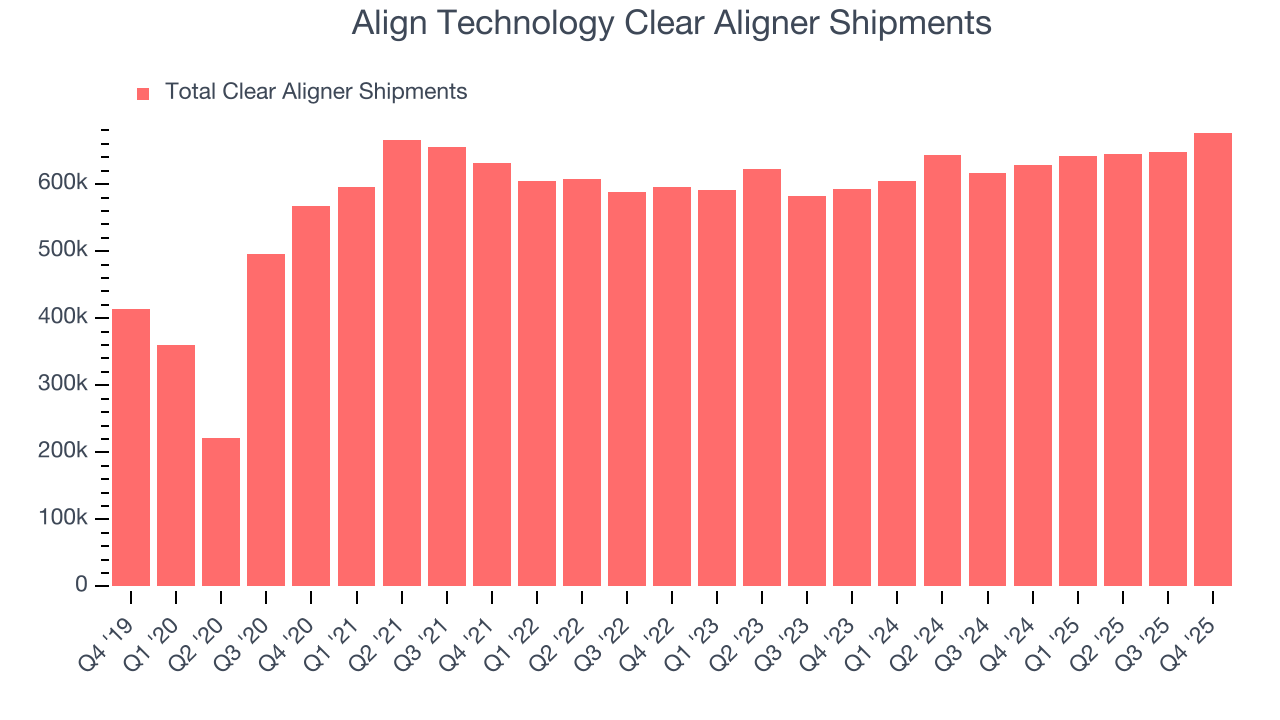

- Sales Volumes rose 7.7% year on year (6.1% in the same quarter last year)

- Market Capitalization: $11.27 billion

Company Overview

Pioneering an alternative to traditional metal braces with nearly invisible plastic aligners, Align Technology (NASDAQ:ALGN) designs and manufactures Invisalign clear aligners, iTero intraoral scanners, and dental CAD/CAM software for orthodontic and restorative treatments.

Align Technology's flagship product is the Invisalign system, a series of custom-manufactured clear polymer removable aligners that straighten teeth without metal brackets or wires. When orthodontists or general dentists want to treat a patient with Invisalign, they capture a digital scan of the patient's teeth (often using Align's own iTero scanner), then work with Align's proprietary ClinCheck software to create a customized treatment plan. Align then manufactures and ships the prescribed series of aligners, which patients wear sequentially to gradually move their teeth to the desired position.

The company serves two main customer groups: orthodontists who specialize in teeth straightening, and general dental practitioners who offer Invisalign as part of their broader services. Align has treated approximately 17 million patients worldwide with its Invisalign system, which ranges from comprehensive packages for complex cases to limited treatment options for simpler alignment needs.

Beyond clear aligners, Align's digital ecosystem includes the iTero intraoral scanners, which create 3D digital models of patients' teeth. These scanners offer additional diagnostic capabilities such as near-infrared imaging to detect cavities between teeth without radiation. The company's 2020 acquisition of exocad expanded its offerings to include CAD/CAM software that dental laboratories use to design and manufacture restorations like crowns and bridges.

Align generates revenue primarily through the sale of Invisalign treatment packages, which vary in price depending on case complexity. Additional revenue streams include the sale of iTero scanners and related services, exocad software licenses, and complementary products like Vivera retainers that help maintain teeth position after treatment.

The company operates globally with a direct sales force in major markets and distribution partners in others. Align invests significantly in consumer marketing to build awareness and drive patients to Invisalign-trained doctors, with approximately 125,800 active trained doctors worldwide as of the end of 2023.

4. Dental Equipment & Technology

The dental equipment and technology industry encompasses companies that manufacture orthodontic products, dental implants, imaging systems, and digital tools for dental professionals. These companies benefit from recurring revenue streams tied to consumables, ongoing maintenance, and growing demand for aesthetic and restorative dentistry. However, high R&D costs, significant capital investment requirements, and reliance on discretionary spending make them vulnerable to economic cycles. Over the next few years, tailwinds for the sector include innovation in digital workflows, such as 3D printing and AI-driven diagnostics, which enhance the efficiency and precision of dental care. However, headwinds include economic uncertainty, which could reduce patient spending on elective procedures, regulatory challenges, and potential pricing pressures from consolidated dental service organizations (DSOs).

Align Technology's competitors include 3M's Clarity aligners, Dentsply Sirona's SureSmile, Straumann's ClearCorrect, and SmileDirectClub in the clear aligner market. In the intraoral scanner space, they compete with Dentsply Sirona's CEREC, 3Shape TRIOS, and Carestream Dental scanners.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $4.03 billion in revenue over the past 12 months, Align Technology has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

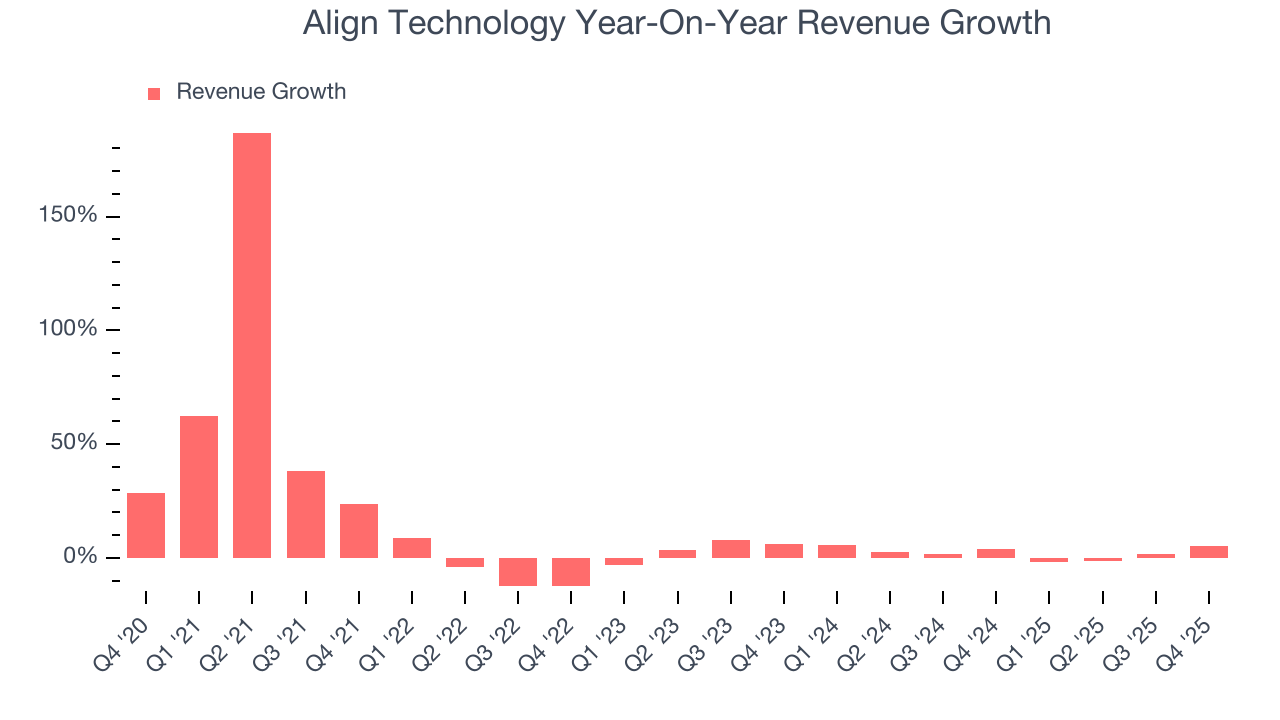

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Align Technology’s 10.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Align Technology’s recent performance shows its demand has slowed as its annualized revenue growth of 2.2% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of clear aligner shipments, which reached 676,855 in the latest quarter. Over the last two years, Align Technology’s clear aligner shipments averaged 4.6% year-on-year growth. Because this number is better than its revenue growth, we can see the company’s average selling price decreased.

This quarter, Align Technology reported year-on-year revenue growth of 5.3%, and its $1.05 billion of revenue exceeded Wall Street’s estimates by 1.2%. Company management is currently guiding for a 4.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, similar to its two-year rate. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

7. Adjusted Operating Margin

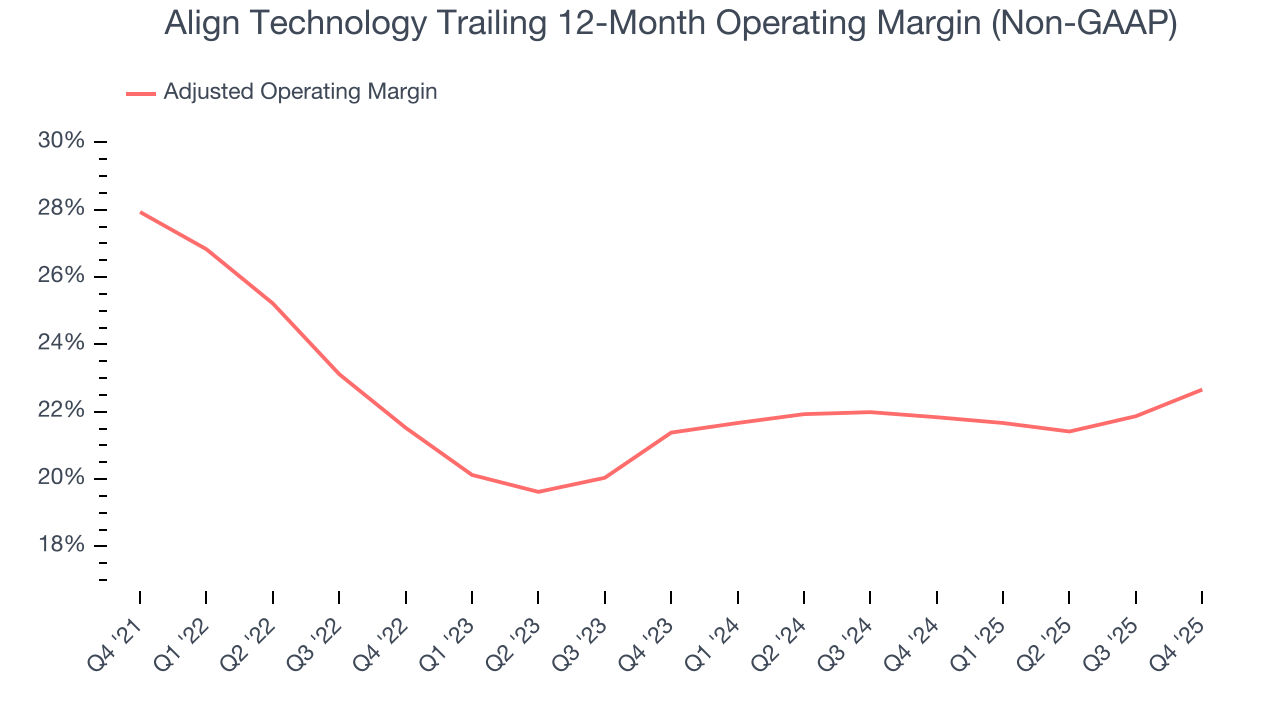

Align Technology has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 23.1%.

Looking at the trend in its profitability, Align Technology’s adjusted operating margin decreased by 5.3 percentage points over the last five years, but it rose by 1.3 percentage points on a two-year basis. Still, shareholders will want to see Align Technology become more profitable in the future.

In Q4, Align Technology generated an adjusted operating margin profit margin of 26.1%, up 3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

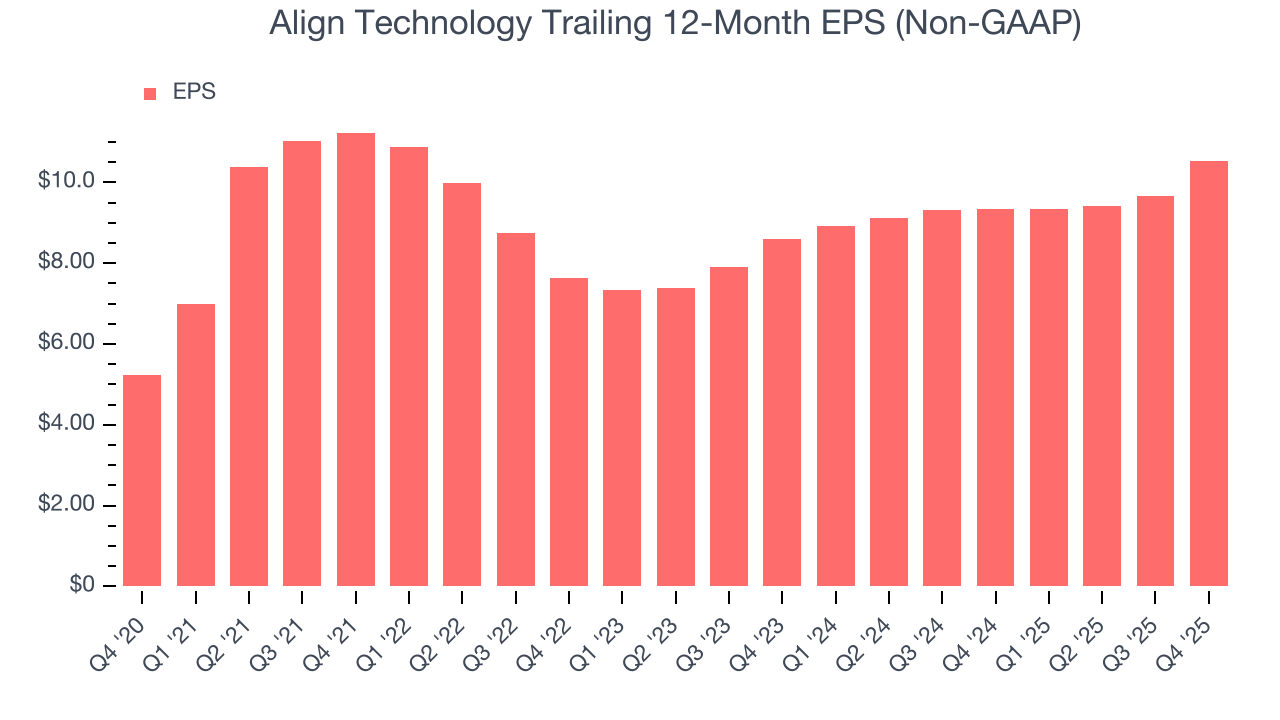

Align Technology’s EPS grew at a spectacular 15% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its adjusted operating margin didn’t improve.

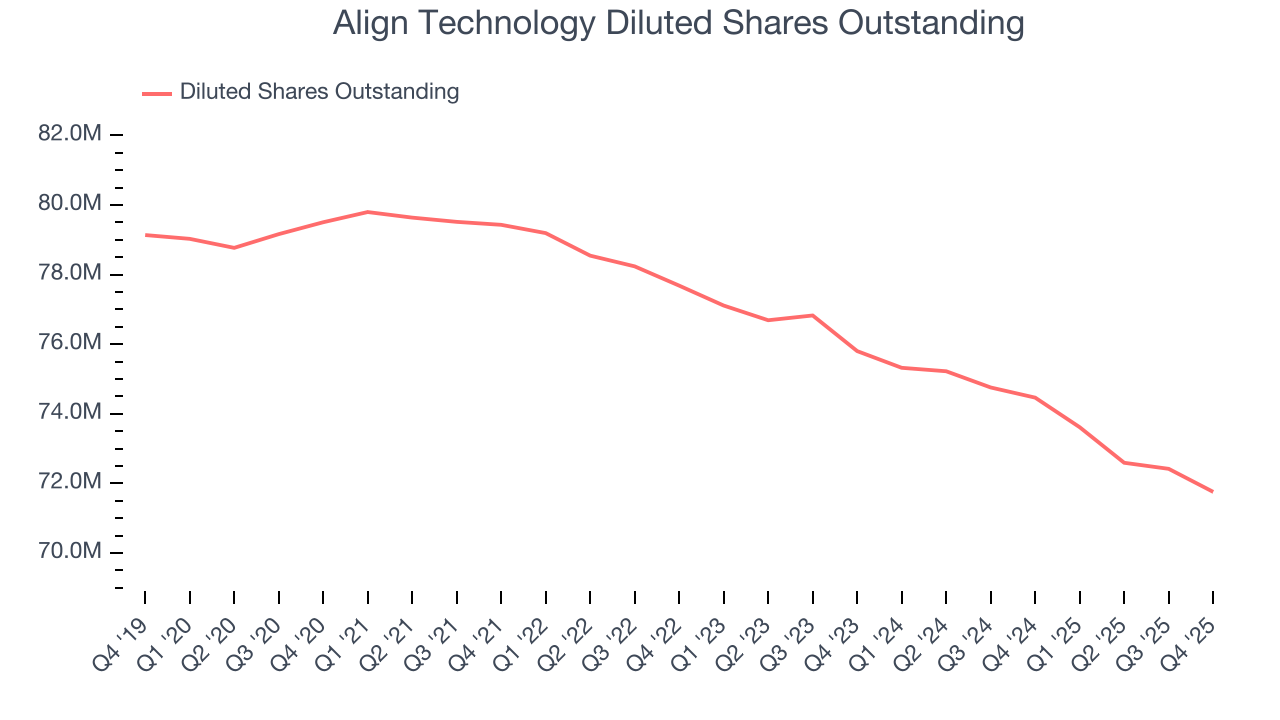

We can take a deeper look into Align Technology’s earnings to better understand the drivers of its performance. A five-year view shows that Align Technology has repurchased its stock, shrinking its share count by 9.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Align Technology reported adjusted EPS of $3.29, up from $2.44 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Align Technology’s full-year EPS of $10.52 to grow 5.4%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

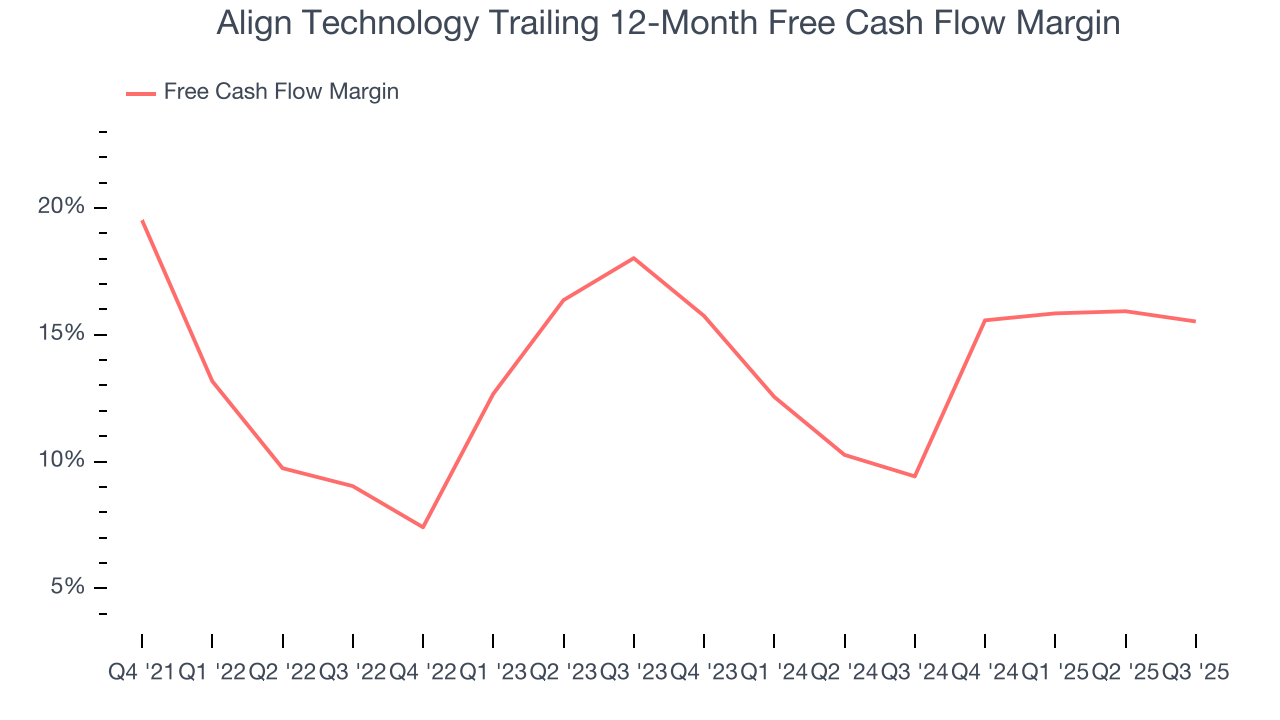

Align Technology has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 14.2% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that Align Technology’s margin dropped by 8.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

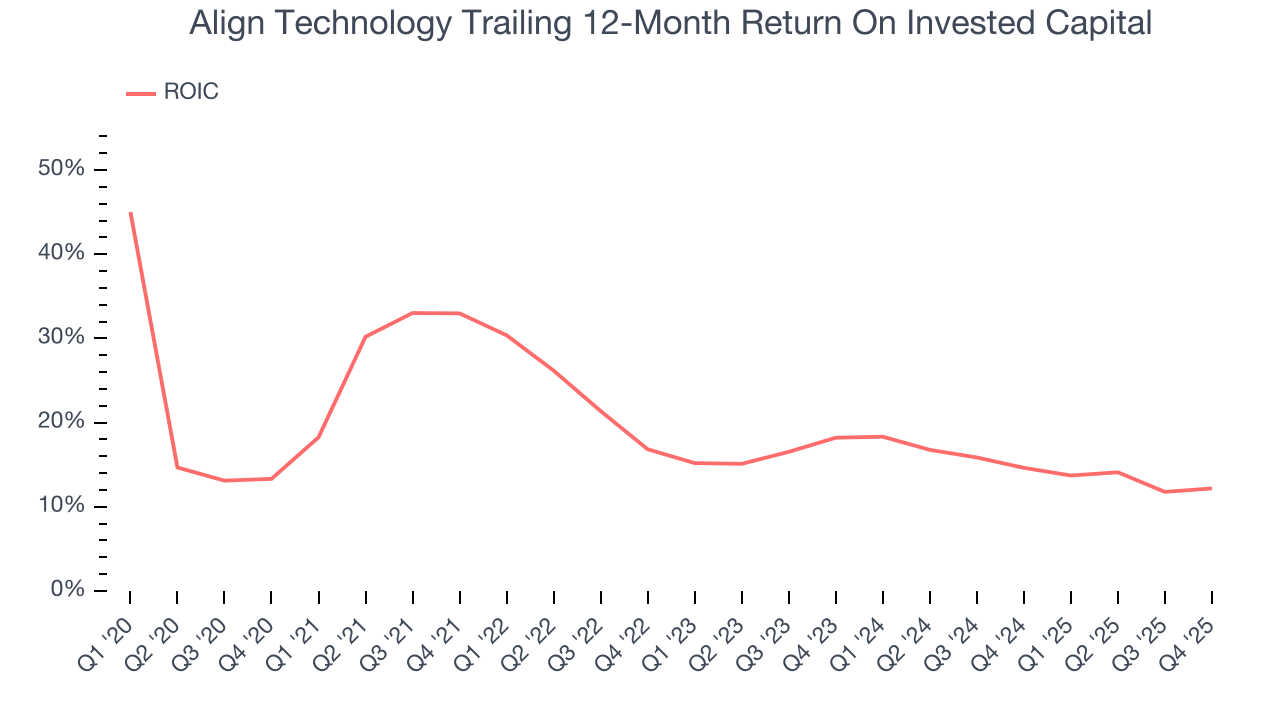

Although Align Technology hasn’t been the highest-quality company lately, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 19%, impressive for a healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Align Technology’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Key Takeaways from Align Technology’s Q4 Results

It was good to see Align Technology beat analysts’ EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 7% to $172.64 immediately following the results.

12. Is Now The Time To Buy Align Technology?

Updated: February 4, 2026 at 11:21 PM EST

Before deciding whether to buy Align Technology or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Align Technology isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was good over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s spectacular EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its cash profitability fell over the last five years.

Align Technology’s P/E ratio based on the next 12 months is 14.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $184.87 on the company (compared to the current share price of $172.64).