AMC Networks (AMCX)

We wouldn’t buy AMC Networks. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think AMC Networks Will Underperform

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

- Products and services have few die-hard fans as sales have declined by 3.9% annually over the last five years

- Performance over the past five years shows each sale was less profitable as its earnings per share dropped by 21.6% annually, worse than its revenue

- Sales are projected to tank by 1.9% over the next 12 months as its demand continues evaporating

AMC Networks’s quality is not up to our standards. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than AMC Networks

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AMC Networks

AMC Networks is trading at $7.68 per share, or 3.4x forward P/E. AMC Networks’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. AMC Networks (AMCX) Research Report: Q4 CY2025 Update

Television broadcasting and production company AMC Networks (NASDAQ:AMCX) announced better-than-expected revenue in Q4 CY2025, but sales were flat year on year at $594.8 million. Its non-GAAP profit of $0.64 per share was 3.7% below analysts’ consensus estimates.

AMC Networks (AMCX) Q4 CY2025 Highlights:

- Revenue: $594.8 million vs analyst estimates of $585.2 million (flat year on year, 1.6% beat)

- Adjusted EPS: $0.64 vs analyst expectations of $0.66 (3.7% miss)

- Adjusted EBITDA: -$19.68 million vs analyst estimates of $93.49 million (-3.3% margin, significant miss)

- Operating Margin: -8.6%, up from -42.4% in the same quarter last year

- Free Cash Flow Margin: 6.8%, similar to the same quarter last year

- Market Capitalization: $334.3 million

Company Overview

Originally the joint-venture of four cable television companies, AMC Networks (NASDAQ:AMCX) is a broadcaster producing a diverse range of television shows and movies.

AMC Networks was founded to create orginal, high-quality television and film content. The company's first channel was AMC, known for its classic movies, and it has since expanded to include BBC America, IFC, SundanceTV, and WE TV. These channels offer a variety of genres to audiences.

The company's portfolio features critically acclaimed original series, independent films, and documentaries, and it generates revenue through cable licensing fees, advertising sales, and digital streaming.

In response to the evolving media landscape, the company has effectively balanced traditional cable broadcasting with online streaming. This dual-channel strategy expands its reach as it appeals to both traditional cable subscribers and an increasingly online audience.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the television and media production industry include Lions Gate Entertainment (NYSE:LGF.A), Paramount Global (NASDAQ:PARA), and Warner Bros. Discovery (NASDAQ:WBD).

5. Revenue Growth

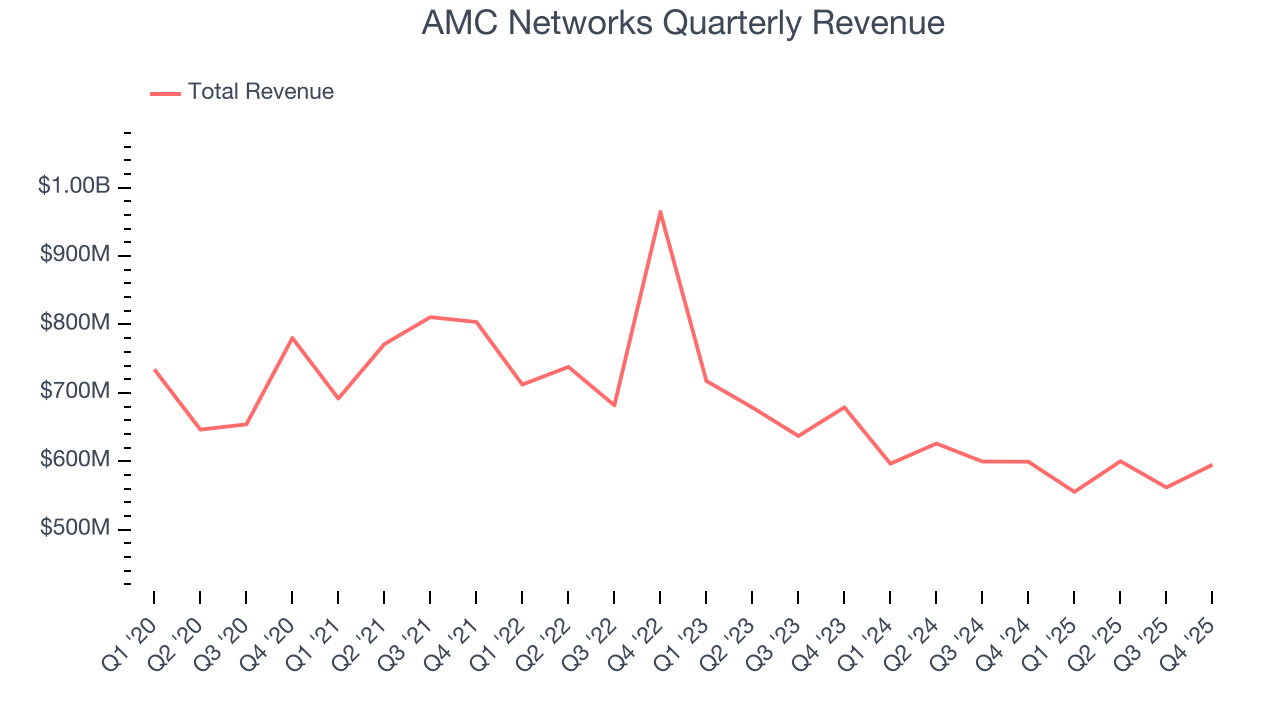

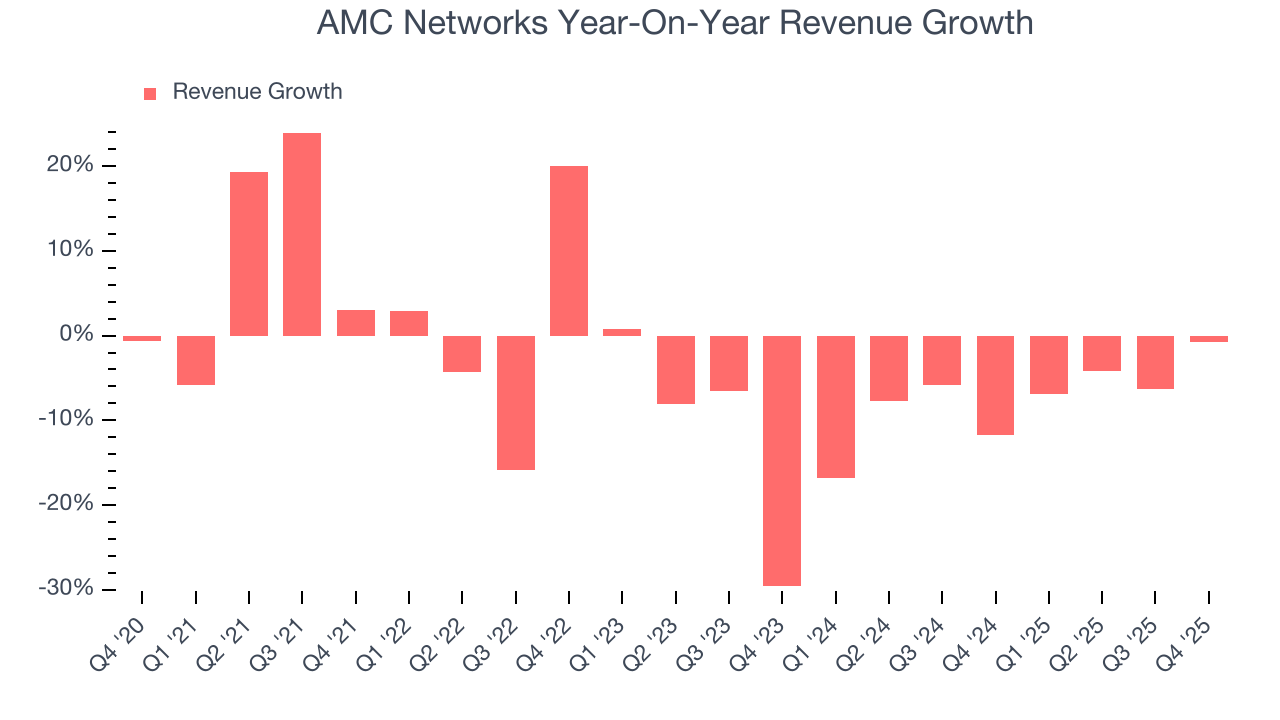

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. AMC Networks struggled to consistently generate demand over the last five years as its sales dropped at a 3.9% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. AMC Networks’s recent performance shows its demand remained suppressed as its revenue has declined by 7.7% annually over the last two years.

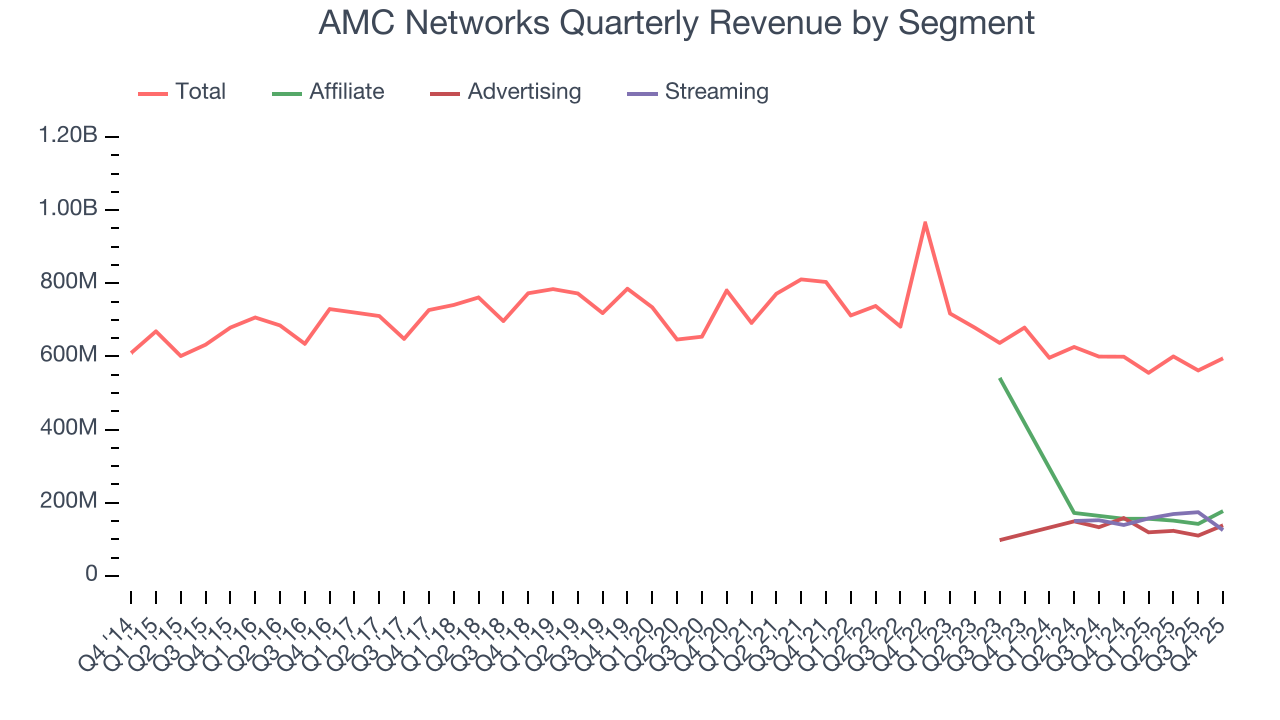

AMC Networks also breaks out the revenue for its three most important segments: Affiliate, Advertising, and Streaming, which are 29.8%, 23.2%, and 21% of revenue. Over the last two years, AMC Networks’s Affiliate (retransmission and licensing fees) and Advertising (marketing services) revenues averaged year-on-year declines of 20.5% and 2.8% while its Streaming revenue (subscription video on demand) averaged 5.7% growth.

This quarter, AMC Networks’s $594.8 million of revenue was flat year on year but beat Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to decline by 2.3% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

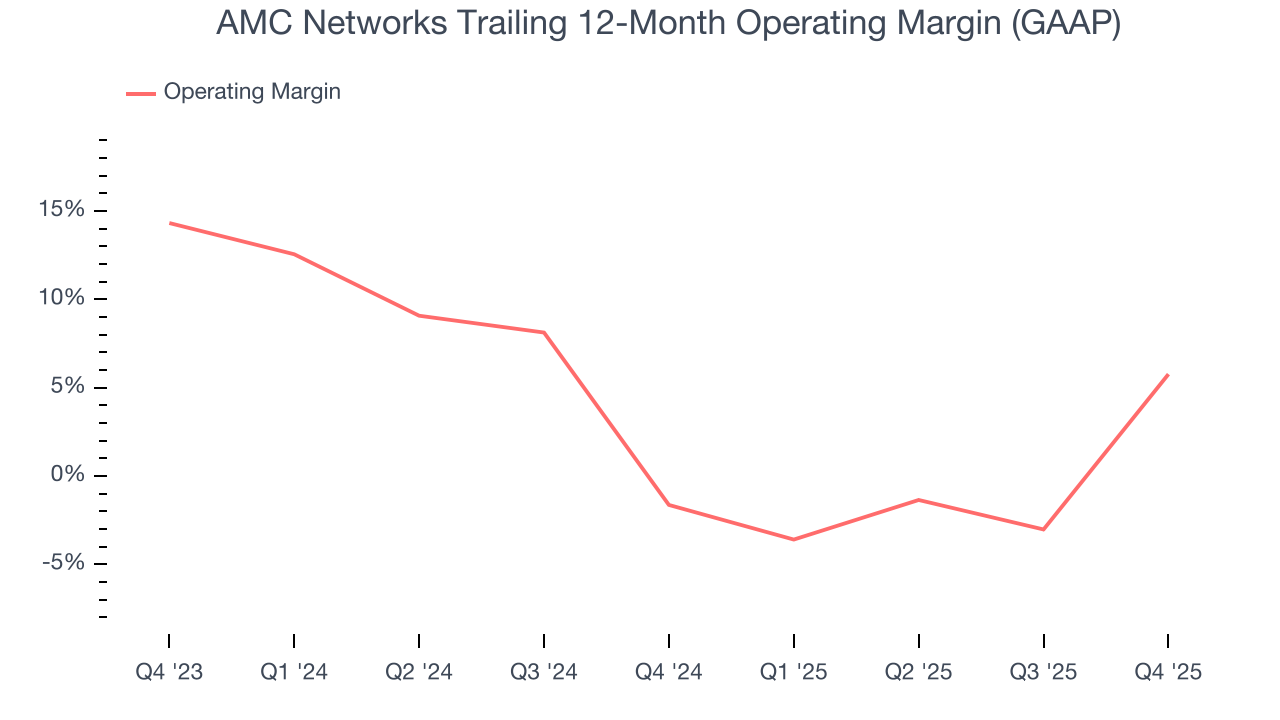

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

AMC Networks’s operating margin has risen over the last 12 months and averaged 2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, AMC Networks generated an operating margin profit margin of negative 8.6%, up 33.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

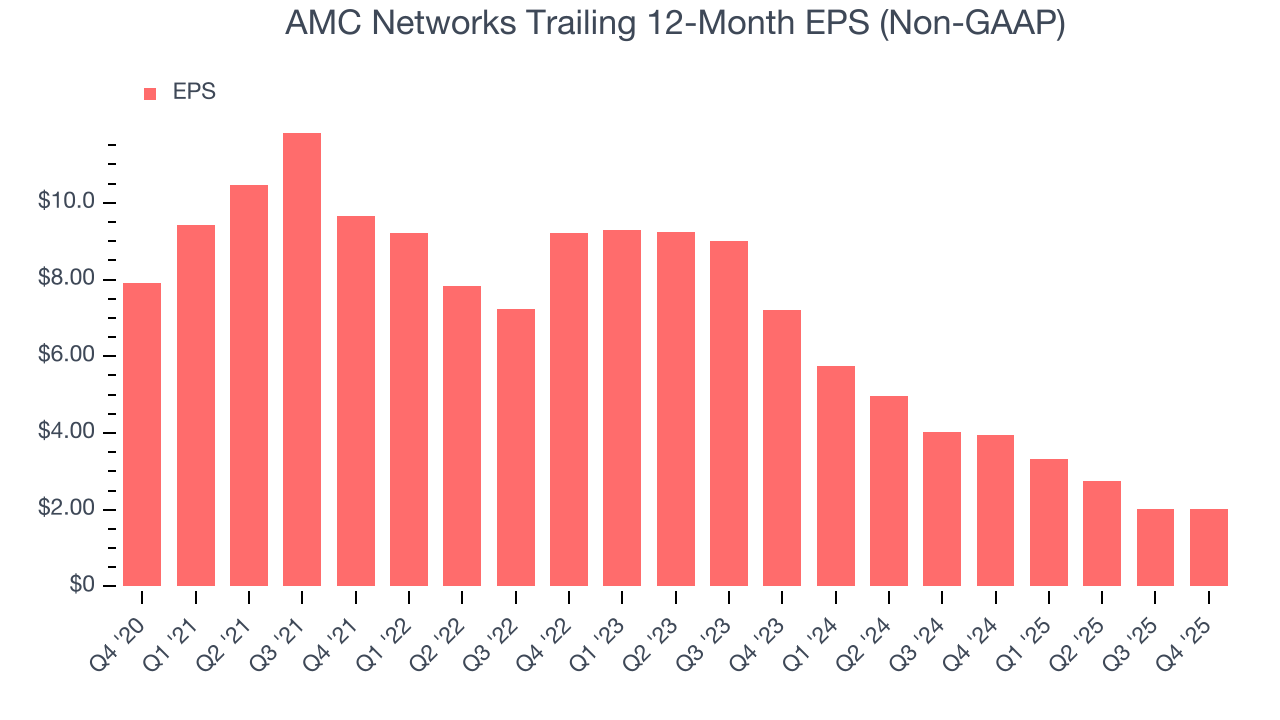

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for AMC Networks, its EPS declined by 23.8% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q4, AMC Networks reported adjusted EPS of $0.64, in line with the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects AMC Networks’s full-year EPS of $2.03 to grow 3%.

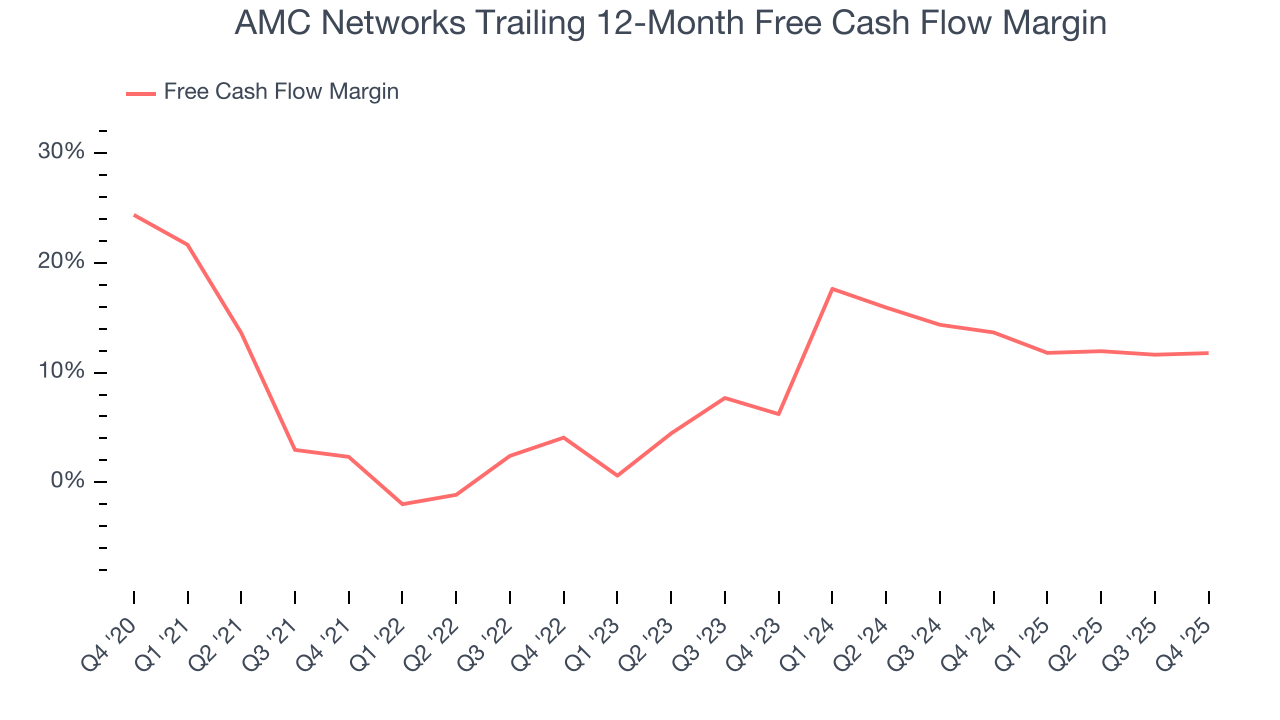

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

AMC Networks has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12.7%, lousy for a consumer discretionary business.

AMC Networks’s free cash flow clocked in at $40.45 million in Q4, equivalent to a 6.8% margin. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict AMC Networks’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 11.8% for the last 12 months will decrease to 8.9%.

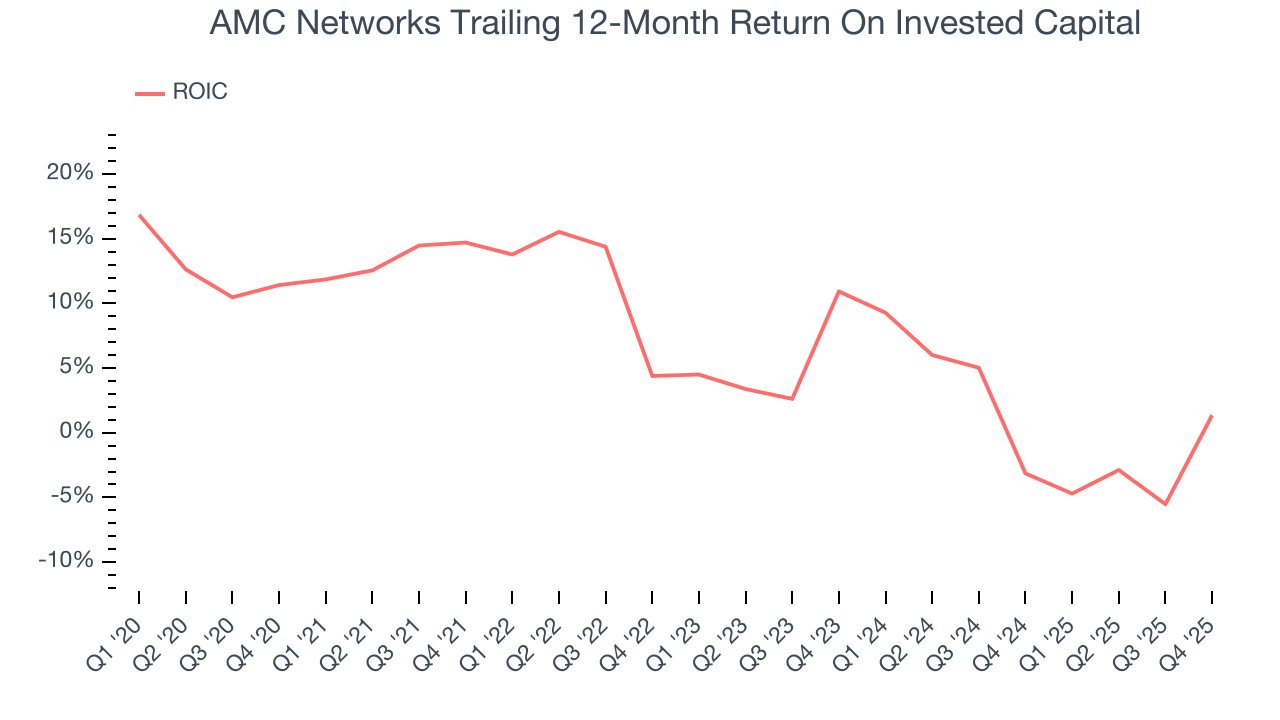

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

AMC Networks historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.6%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AMC Networks’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

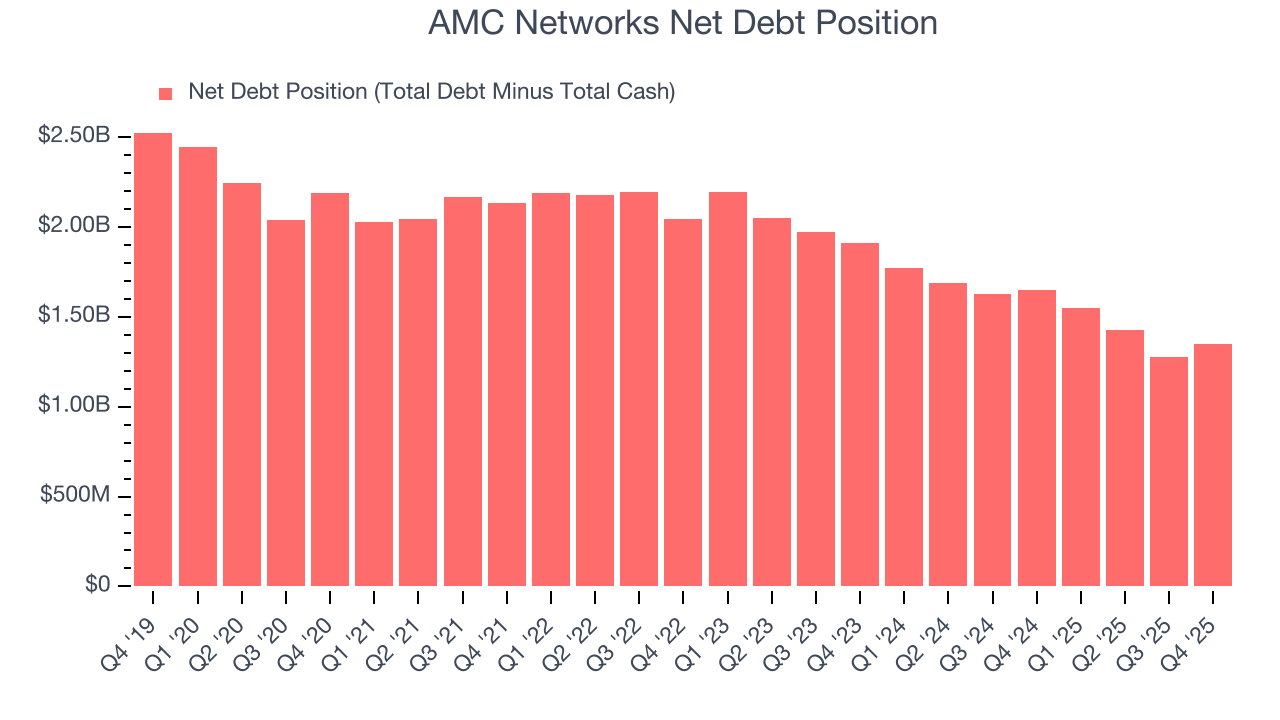

AMC Networks reported $502.4 million of cash and $1.85 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $292.1 million of EBITDA over the last 12 months, we view AMC Networks’s 4.6× net-debt-to-EBITDA ratio as safe. We also see its $70.78 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AMC Networks’s Q4 Results

It was encouraging to see AMC Networks beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $7.46 immediately following the results.

12. Is Now The Time To Buy AMC Networks?

Updated: February 11, 2026 at 9:51 PM EST

Before deciding whether to buy AMC Networks or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

AMC Networks falls short of our quality standards. On top of that, AMC Networks’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its declining EPS over the last five years makes it a less attractive asset to the public markets.

AMC Networks’s P/E ratio based on the next 12 months is 3.7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $7 on the company (compared to the current share price of $7.48).