Applied Digital (APLD)

We’re wary of Applied Digital. Its decelerating revenue growth and historical cash burn don’t give us much confidence in a potential turnaround.― StockStory Analyst Team

1. News

2. Summary

Why Applied Digital Is Not Exciting

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ:APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

- Poor expense management has led to adjusted operating margin losses

- Cash burn makes us question whether it can achieve sustainable long-term growth

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Applied Digital’s quality doesn’t meet our expectations. There are better opportunities in the market.

Why There Are Better Opportunities Than Applied Digital

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Applied Digital

At $28.16 per share, Applied Digital trades at 67.6x forward EV-to-EBITDA. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Applied Digital (APLD) Research Report: Q4 CY2025 Update

Digital infrastructure provider Applied Digital (NASDAQ:APLD) announced better-than-expected revenue in Q4 CY2025, with sales up 98.2% year on year to $126.6 million. Its non-GAAP loss of $0 per share was significantly above analysts’ consensus estimates.

Applied Digital (APLD) Q4 CY2025 Highlights:

- Revenue: $126.6 million vs analyst estimates of $110.3 million (98.2% year-on-year growth, 14.8% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.21 (significant beat)

- Adjusted EBITDA: $20.2 million vs analyst estimates of $4.16 million (16% margin, significant beat)

- Operating Margin: -24.5%, up from -28.6% in the same quarter last year

- Free Cash Flow was -$567.9 million compared to -$223.3 million in the same quarter last year

- Market Capitalization: $8.64 billion

Company Overview

Pivoting from its origins in cryptocurrency mining to become a key player in the AI infrastructure boom, Applied Digital (NASDAQ:APLD) designs and operates specialized data centers that provide high-performance computing infrastructure for artificial intelligence and blockchain applications.

Applied Digital operates across three business segments: blockchain data center hosting, cloud services, and high-performance computing (HPC) data center hosting. The company's blockchain hosting business provides power-intensive infrastructure services to cryptocurrency mining customers through multi-year contracts at facilities in North Dakota with approximately 286 megawatts of capacity.

In 2023, Applied Digital launched its cloud services business through its wholly owned subsidiary, Applied Digital Cloud. This segment focuses on providing GPU computing solutions for AI and machine learning workloads. The company deploys GPU clusters containing NVIDIA graphics processing units, which are leased to customers for AI development and other computational tasks. Applied Digital partners with hardware providers like Super Micro Computer, Hewlett Packard Enterprise, and Dell to supply the necessary computing equipment.

The company's newest segment, HPC hosting, involves building purpose-designed data centers specifically optimized for high-performance computing applications like artificial intelligence. Applied Digital is constructing facilities in North Dakota, including a 100-megawatt HPC data center in Ellendale, and has announced a letter of intent with a major U.S. hyperscaler for a 400-megawatt capacity lease.

Applied Digital's business model revolves around providing the specialized power and cooling infrastructure needed for computationally intensive applications. For blockchain customers, this means reliable, cost-effective power for mining operations. For AI and HPC customers, it means access to scarce GPU computing resources without the capital expenditure of building their own infrastructure.

The company generates revenue primarily through hosting fees and service contracts. These arrangements provide Applied Digital with more stable revenue streams compared to direct cryptocurrency mining, which the company discontinued in 2022 to focus on its infrastructure and hosting businesses.

4. Enterprise Networking

The Enterprise Networking subsector is poised for growth as businesses accelerate cloud adoption, AI-driven network automation, and edge computing deployments. While these seem like big, nebulous trends, they require very real products and services like switches, firewalls, and datacenter hosting services. On the other hand, challenges on the horizon include intensifying competition from cloud-native networking providers, regulatory scrutiny over data privacy and cybersecurity, and potential supply chain constraints for networking hardware. While AI and automation will enhance network efficiency and security, they also introduce risks related to algorithmic bias, compliance complexity, and increased energy consumption.

Applied Digital's competitors in the cloud services and HPC hosting markets include specialized AI infrastructure providers like CoreWeave, Crusoe Energy, and Lambda Labs, as well as traditional data center operators such as Digital Realty and Equinix. In the blockchain hosting segment, the company competes with Core Scientific, Bitdeer Technologies Group, and Riot Platforms.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $281.7 million in revenue over the past 12 months, Applied Digital is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, Applied Digital’s sales grew at an incredible 211% compounded annual growth rate over the last four years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Applied Digital’s annualized revenue growth of 56.8% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, Applied Digital reported magnificent year-on-year revenue growth of 98.2%, and its $126.6 million of revenue beat Wall Street’s estimates by 14.8%.

Looking ahead, sell-side analysts expect revenue to grow 41.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and suggests the market is baking in success for its products and services.

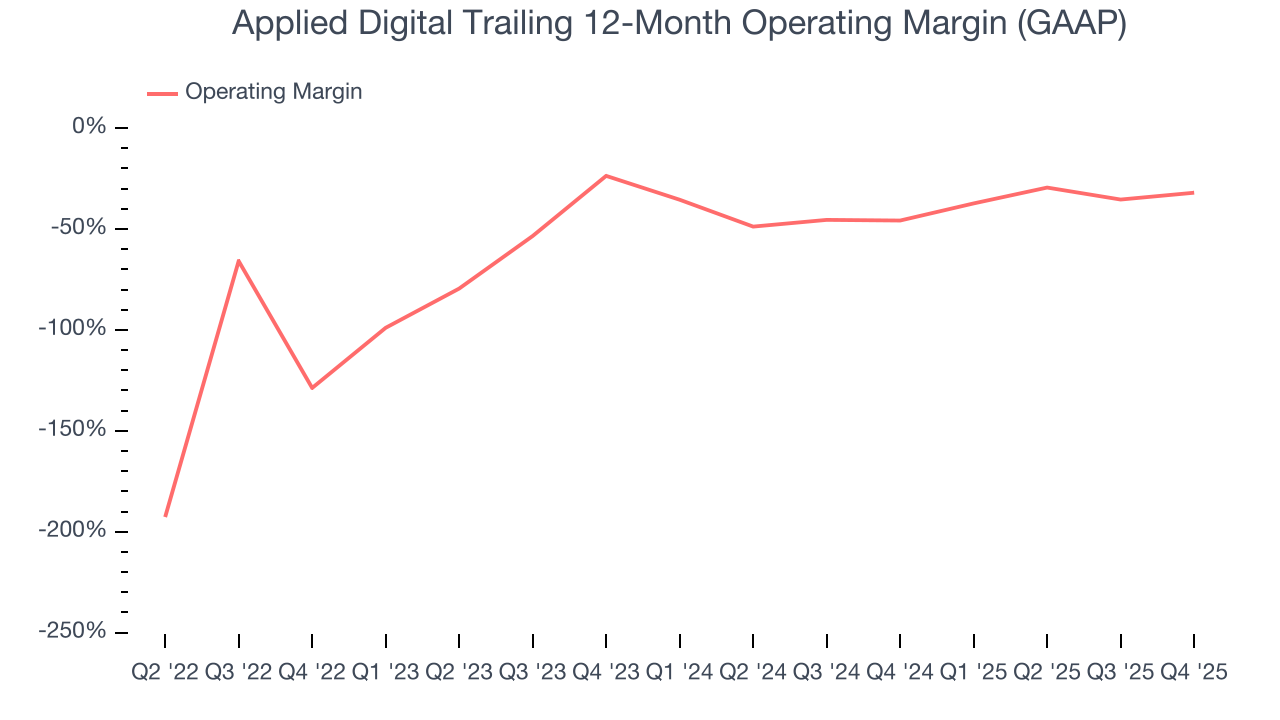

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Applied Digital’s high expenses have contributed to an average operating margin of negative 41.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Applied Digital’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Applied Digital generated a negative 24.5% operating margin.

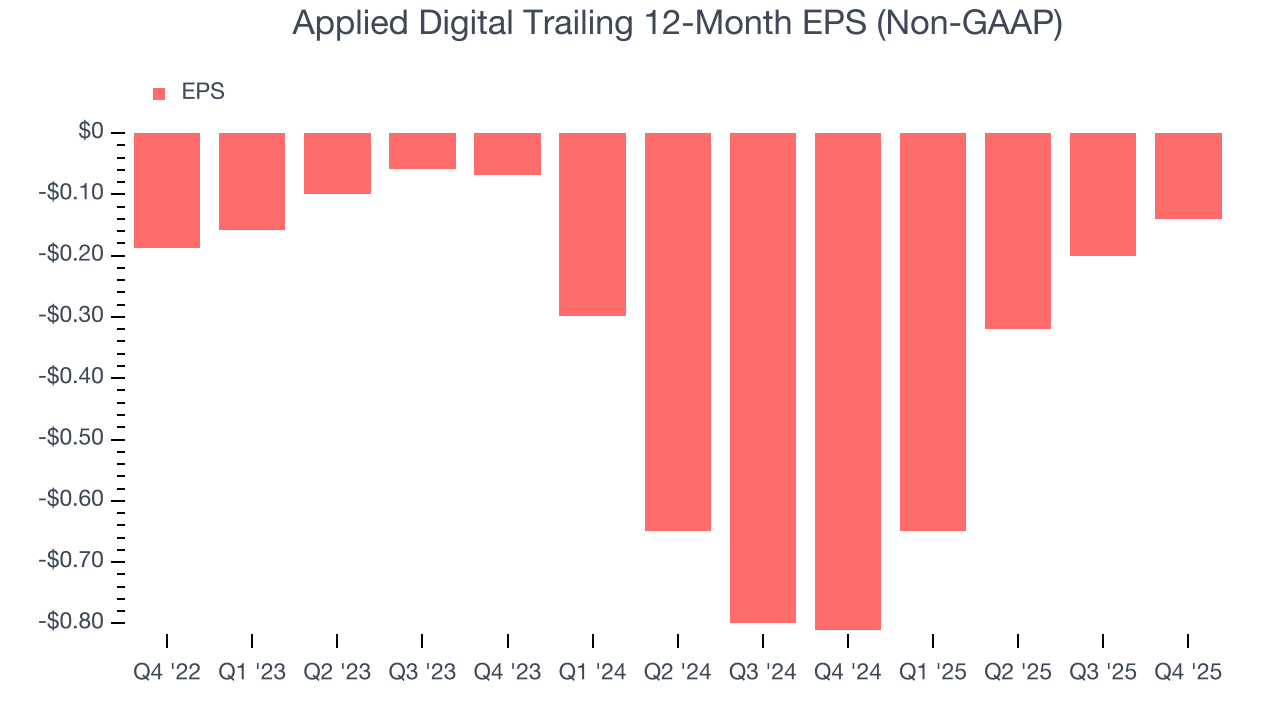

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Applied Digital’s full-year EPS was flat over the last three years. This performance was underwhelming across the board.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Applied Digital, its two-year annual EPS declines of 42.3% show its recent history was to blame for its underperformance over the last three years. These results were bad no matter how you slice the data.

In Q4, Applied Digital reported adjusted EPS of $0, up from negative $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Applied Digital to perform poorly. Analysts forecast its full-year EPS of negative $0.14 will tumble to negative $0.97.

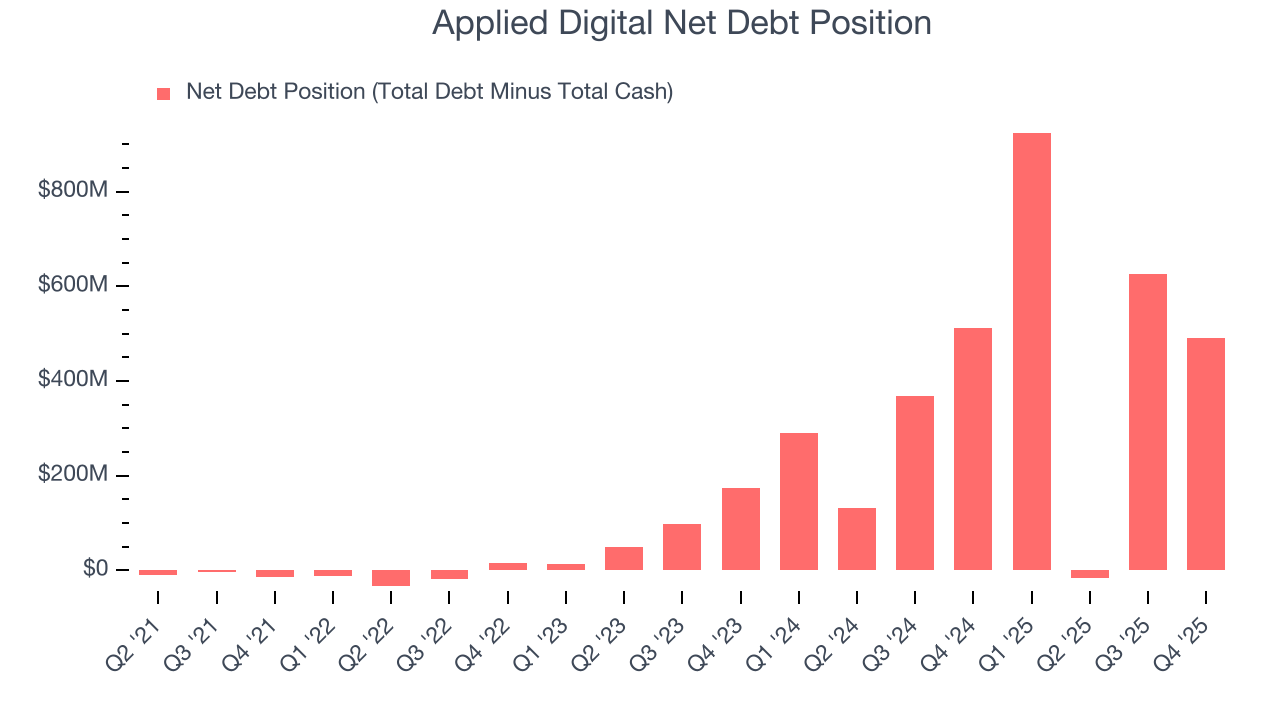

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Applied Digital’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 319%, meaning it lit $319.07 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Applied Digital’s margin dropped by 79.8 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Applied Digital burned through $567.9 million of cash in Q4, equivalent to a negative 449% margin. The company’s cash burn increased from $223.3 million of lost cash in the same quarter last year.

9. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Applied Digital burned through $1.34 billion of cash over the last year, and its $2.61 billion of debt exceeds the $2.12 billion of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Applied Digital’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Applied Digital until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

10. Key Takeaways from Applied Digital’s Q4 Results

It was good to see Applied Digital beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 5.3% to $31.14 immediately after reporting.

11. Is Now The Time To Buy Applied Digital?

Updated: February 26, 2026 at 11:48 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Applied Digital isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was exceptional over the last four years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s expanding adjusted operating margin shows the business has become more efficient, the downside is its weak EPS growth over the last three years shows it’s failed to produce meaningful profits for shareholders.

Applied Digital’s EV-to-EBITDA ratio based on the next 12 months is 67.6x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $45.27 on the company (compared to the current share price of $28.16).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.