Broadcom (AVGO)

We’re bullish on Broadcom. Its ability to balance growth and profitability while maintaining a bright outlook makes it a gem.― StockStory Analyst Team

1. News

2. Summary

Why We Like Broadcom

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate spanning wireless communications, networking, and data storage as well as infrastructure software focused on mainframes and cybersecurity.

- Annual revenue growth of 33.6% over the last two years was superb and indicates its market share increased during this cycle

- Projected revenue growth of 53.6% for the next 12 months is above its two-year trend, pointing to accelerating demand

- Offerings are difficult to replicate at scale and lead to a best-in-class gross margin of 76.4%

Broadcom is a no-brainer. The valuation looks fair relative to its quality, and we think now is the time to invest.

Why Is Now The Time To Buy Broadcom?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Broadcom?

Broadcom’s stock price of $325.36 implies a valuation ratio of 31.9x forward P/E. The valuation multiple is below many companies in the semiconductor sector. We therefore think the stock is a good deal for the fundamentals.

Where you buy a stock impacts returns. Our analysis shows that business quality is a much bigger determinant of market outperformance over the long term compared to entry price, but getting a good deal on a stock certainly isn’t a bad thing.

3. Broadcom (AVGO) Research Report: Q3 CY2025 Update

Fabless chip and software maker Broadcom (NASDAQ:AVGO) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 28.2% year on year to $18.02 billion. On top of that, next quarter’s revenue guidance ($19.1 billion at the midpoint) was surprisingly good and 4.4% above what analysts were expecting. Its non-GAAP profit of $1.95 per share was 4.3% above analysts’ consensus estimates.

Broadcom (AVGO) Q3 CY2025 Highlights:

- Revenue: $18.02 billion vs analyst estimates of $17.49 billion (28.2% year-on-year growth, 3% beat)

- Adjusted EPS: $1.95 vs analyst estimates of $1.87 (4.3% beat)

- Adjusted EBITDA: $12.22 billion vs analyst estimates of $11.64 billion (67.8% margin, 5% beat)

- Revenue Guidance for Q4 CY2025 is $19.1 billion at the midpoint, above analyst estimates of $18.29 billion

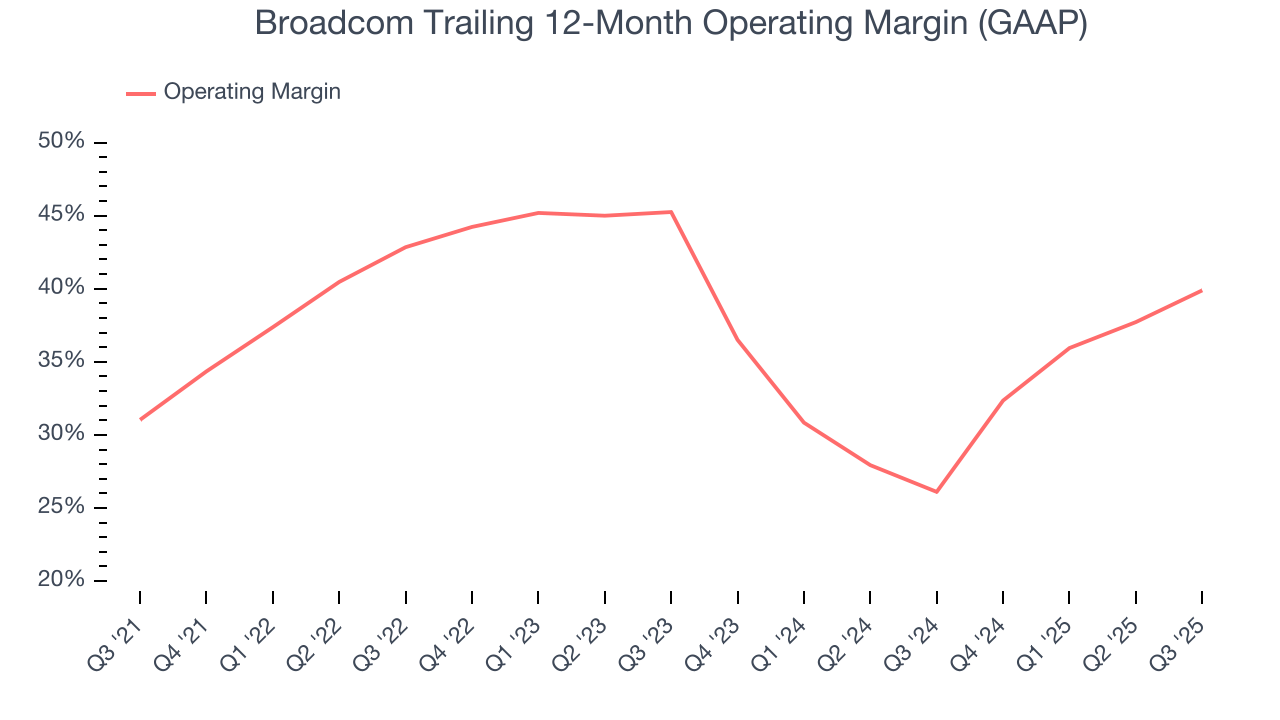

- Operating Margin: 41.7%, up from 32.9% in the same quarter last year

- Free Cash Flow Margin: 41.4%, up from 39% in the same quarter last year

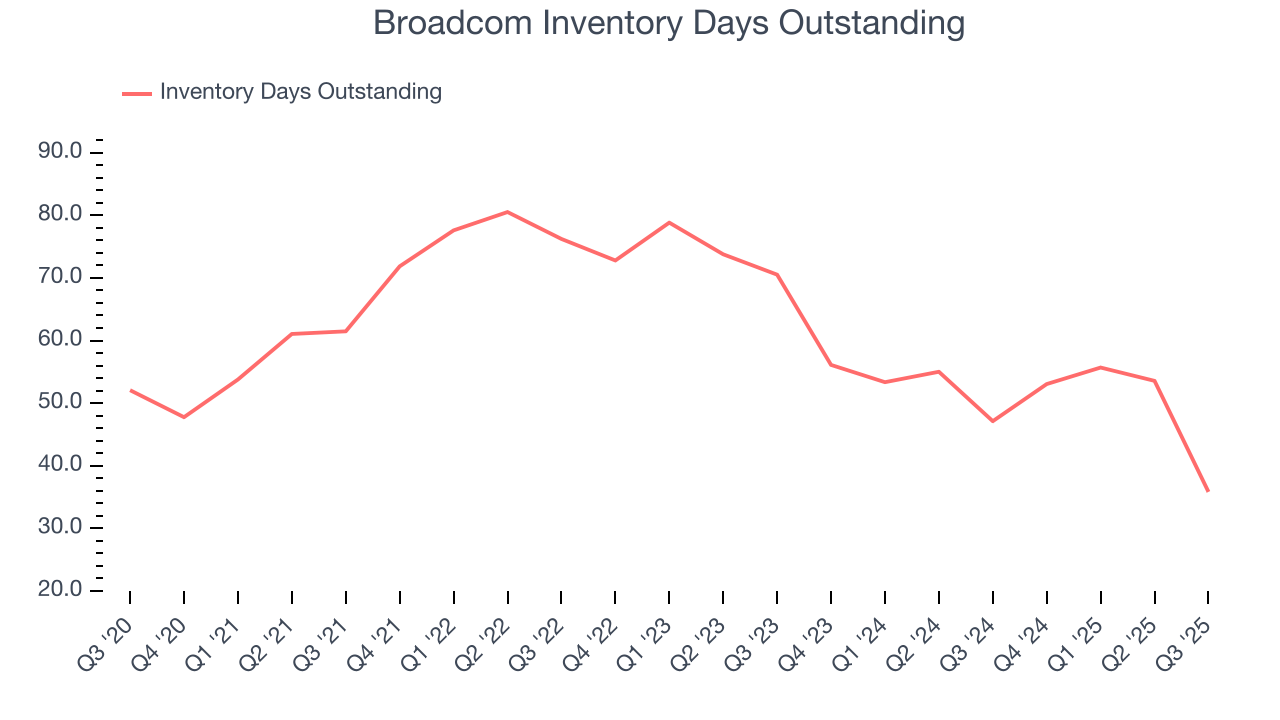

- Inventory Days Outstanding: 36, down from 54 in the previous quarter

- Market Capitalization: $1.95 trillion

Company Overview

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ:AVGO) is a semiconductor conglomerate spanning wireless communications, networking, and data storage as well as infrastructure software focused on mainframes and cybersecurity.

Today’s Broadcom traces its roots to the chip division of Agilent Technologies, which was acquired by private equity giants KKR and Silver Lake in 2005, renamed Avago and put under the guidance of CEO Hock Tan. Since 2005, its strategy has been to acquire leading infrastructure technology providers, and improve their margins and FCF by integrating their back office and sales functions into its platform and running the businesses with an emphasis on profitability over growth at any cost.

Over time, the acquired companies diversified Broadcom’s business model and the improved free cash flow provides the capital for further acquisitions. In the past decade Hock Tan’s Avago has spent over $70 billion acquiring CYOptics, LSI, Emulex, Broadcom (whose name it adopted), Brocade, CA, and Symantec’s enterprise security business.

Broadcom’s semiconductor business provides chips used in smartphones, data centers, set top boxes, servers, telecom, and networking systems. Its software business focuses on infrastructure and security, with key businesses in database, application development, endpoint security, and identity management.

Broadcom’s peers and competitors in semiconductors include Analog Devices (NASDAQ: ADI), Cisco Systems (NASDAQ: CSCO), Intel (NASDAQ:INTC), MediaTek (TWSE:2454), Marvell Technology (NASDAQ:MRVL), NXP Semiconductors NV (NASDAQ:NXPI), Qualcomm (NASDAQ:QCOM), Qorvo (NASDAQ: QRVO), and Skyworks (NASDAQ:SWKS). Its software rivals are Atlassian (NASDAQ:TEAM), CrowdStrike (NASDAQ:CRWD), IBM (NYSE:IBM), Oracle (NYSE:ORCL), ServiceNow (NASDAQ:NOW), Splunk (NASDAQ:SPLK), and VMware (NYSE: VMW).

4. Processors and Graphics Chips

Chips need to keep getting smaller in order to advance on Moore’s law, and that is proving increasingly more complicated and expensive to achieve with time. That has caused most digital chip makers to become “fabless” designers, rather than manufacturers, instead relying on contracted foundries like TSMC to manufacture their designs. This has benefitted the digital chip makers’ free cash flow margins, as exiting the manufacturing business has removed large cash expenses from their business models.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Broadcom’s 21.7% annualized revenue growth over the last five years was exceptional. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers, a great starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Broadcom’s annualized revenue growth of 33.6% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Broadcom reported robust year-on-year revenue growth of 28.2%, and its $18.02 billion of revenue topped Wall Street estimates by 3%. Company management is currently guiding for a 28.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 37.4% over the next 12 months, an improvement versus the last two years. This projection is eye-popping for a company of its scale and indicates its newer products and services will fuel better top-line performance.

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Broadcom’s DIO came in at 36, which is 26 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

7. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Broadcom’s gross margin is one of the best in the semiconductor sector, and its differentiated products give it strong pricing power. As you can see below, it averaged an elite 75% gross margin over the last two years. That means Broadcom only paid its suppliers $24.97 for every $100 in revenue.

Broadcom produced a 68% gross profit margin in Q3, marking a 7.8 percentage point decrease from 75.8% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Broadcom has been a well-oiled machine over the last two years. It demonstrated elite profitability for a semiconductor business, boasting an average operating margin of 33.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Broadcom’s operating margin rose by 8.9 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Broadcom generated an operating margin profit margin of 41.7%, up 8.8 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

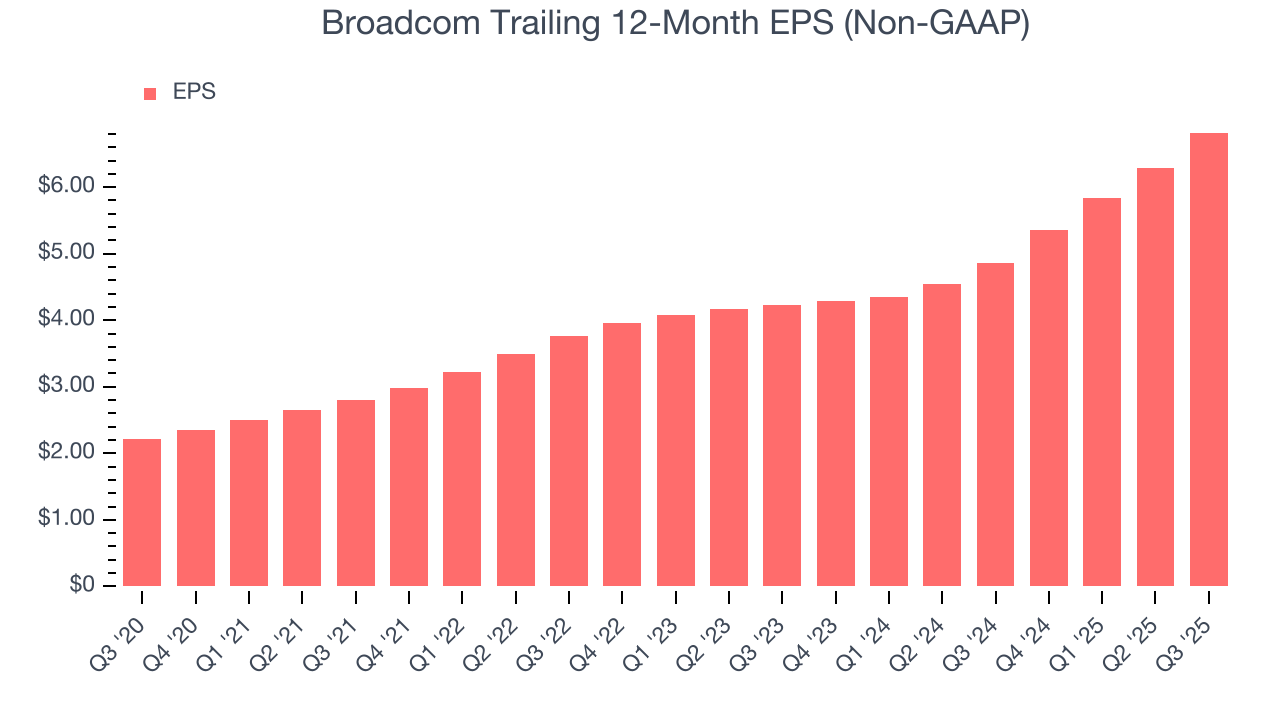

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Broadcom’s EPS grew at a spectacular 25.2% compounded annual growth rate over the last five years, higher than its 21.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Broadcom’s earnings can give us a better understanding of its performance. As we mentioned earlier, Broadcom’s operating margin expanded by 8.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Broadcom reported adjusted EPS of $1.95, up from $1.42 in the same quarter last year. This print beat analysts’ estimates by 4.3%. Over the next 12 months, Wall Street expects Broadcom’s full-year EPS of $6.82 to grow 38.2%.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Broadcom has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 40.1% over the last two years.

Taking a step back, we can see that Broadcom’s margin dropped by 6.4 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity.

Broadcom’s free cash flow clocked in at $7.47 billion in Q3, equivalent to a 41.4% margin. This result was good as its margin was 2.4 percentage points higher than in the same quarter last year. Its cash profitability was also above its two-year level, and we hope the company can build on this trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Broadcom’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 17.9%, slightly better than typical semiconductor business.

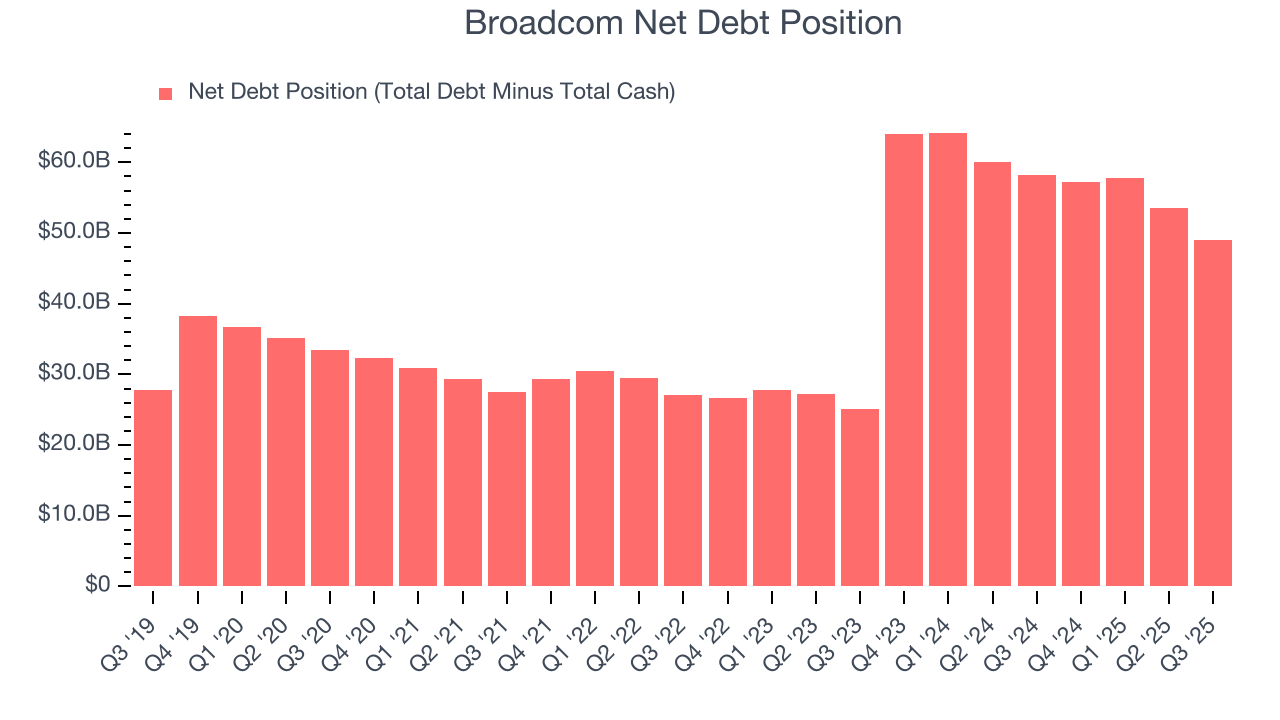

12. Balance Sheet Assessment

Broadcom reported $16.18 billion of cash and $65.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $43 billion of EBITDA over the last 12 months, we view Broadcom’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $1.69 billion of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Broadcom’s Q3 Results

We were impressed by Broadcom’s revenue beat and strong improvement in inventory levels. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 3.1% to $418.84 immediately after reporting.

14. Is Now The Time To Buy Broadcom?

Updated: February 24, 2026 at 9:22 PM EST

Before making an investment decision, investors should account for Broadcom’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are multiple reasons why we think Broadcom is an elite semiconductor company. To begin with, its revenue growth was exceptional over the last five years, and its growth over the next 12 months is expected to accelerate. And while its cash profitability fell over the last five years, its admirable gross margins indicate robust pricing power. Additionally, Broadcom’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Broadcom’s P/E ratio based on the next 12 months is 31.9x. Looking at the semiconductor space today, Broadcom’s qualities as one of the best businesses really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $455.10 on the company (compared to the current share price of $325.36), implying they see 39.9% upside in buying Broadcom in the short term.