1. News

2. Summary

Why BGC Is Interesting

Tracing its roots back to 1945 and named after founder Bernard Gerald Cantor, BGC Group (NASDAQ:BGC) operates a global brokerage and financial technology platform that facilitates trading across fixed income, foreign exchange, equities, energy, and commodities markets.

- Incremental sales over the last five years boosted profitability as its annual earnings per share growth of 15.7% outstripped its revenue performance

- ROE of 11.7% shows management can invest its resources competently

- A drawback is its sales trends were unexciting over the last five years as its 7.3% annual growth was below the typical financials company

BGC shows some potential. If you believe in the company, the valuation seems reasonable.

Why Is Now The Time To Buy BGC?

High Quality

Investable

Underperform

Why Is Now The Time To Buy BGC?

BGC is trading at $9.22 per share, or 6.8x forward P/E. Price is what you pay, and value is what you get. Considering this, we think the current valuation is quite a good deal.

It could be a good time to invest if you see something the market doesn’t.

3. BGC (BGC) Research Report: Q4 CY2025 Update

Financial brokerage and technology company BGC Group (NASDAQ:BGC) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 32% year on year to $723.3 million. On the other hand, next quarter’s outlook exceeded expectations with revenue guided to $890 million at the midpoint, or 7% above analysts’ estimates. Its non-GAAP profit of $0.31 per share was 6.9% above analysts’ consensus estimates.

BGC (BGC) Q4 CY2025 Highlights:

- Revenue: $723.3 million vs analyst estimates of $750.9 million (32% year-on-year growth, 3.7% miss)

- Pre-tax Profit: $25 million (3.5% margin)

- Adjusted EPS: $0.31 vs analyst estimates of $0.29 (6.9% beat)

- Revenue Guidance for Q1 CY2026 is $890 million at the midpoint, above analyst estimates of $831.8 million

- Market Capitalization: $4.45 billion

Company Overview

Tracing its roots back to 1945 and named after founder Bernard Gerald Cantor, BGC Group (NASDAQ:BGC) operates a global brokerage and financial technology platform that facilitates trading across fixed income, foreign exchange, equities, energy, and commodities markets.

BGC serves as an intermediary between major financial institutions, connecting buyers and sellers in various markets through both traditional voice brokerage and electronic trading platforms. The company's Fenics division represents its growing electronic business, which includes fully electronic trading venues, market data services, and post-trade solutions. This technology-driven segment has expanded to account for approximately 25% of BGC's total revenue.

The company's brokerage services span multiple asset classes. In fixed income, BGC brokers government bonds, corporate debt, and interest rate derivatives. Its foreign exchange business covers spot trading, options, and precious metals. The energy and commodities division handles everything from environmental products and weather derivatives to shipping brokerage and agricultural commodities.

For example, a hedge fund might use BGC's services to execute a large corporate bond trade with minimal market impact, or an airline could hedge fuel price exposure through BGC's energy desk. A global bank might utilize BGC's electronic Fenics UST platform to trade U.S. Treasury securities efficiently.

BGC generates revenue primarily through commissions on trades it brokers, as well as through subscription fees for its data and technology services. The company is expanding its FMX business, which will combine U.S. Treasury trading with interest rate futures on a single platform, with plans to launch the FMX Futures Exchange in 2024.

BGC maintains offices across major financial centers worldwide, employing thousands of brokers, salespeople, and technology professionals who serve institutional clients including banks, investment firms, hedge funds, and corporations.

4. Investment Banking & Brokerage

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

BGC Group's main competitors include other global inter-dealer brokers such as TP ICAP and Tradition, as well as Dealerweb (Tradeweb's inter-dealer business). In electronic trading and market data, BGC competes with firms like Bloomberg, ION Group, and Pico, while its post-trade services face competition from LSEG's Quantile and OSSTRA.

5. Revenue Growth

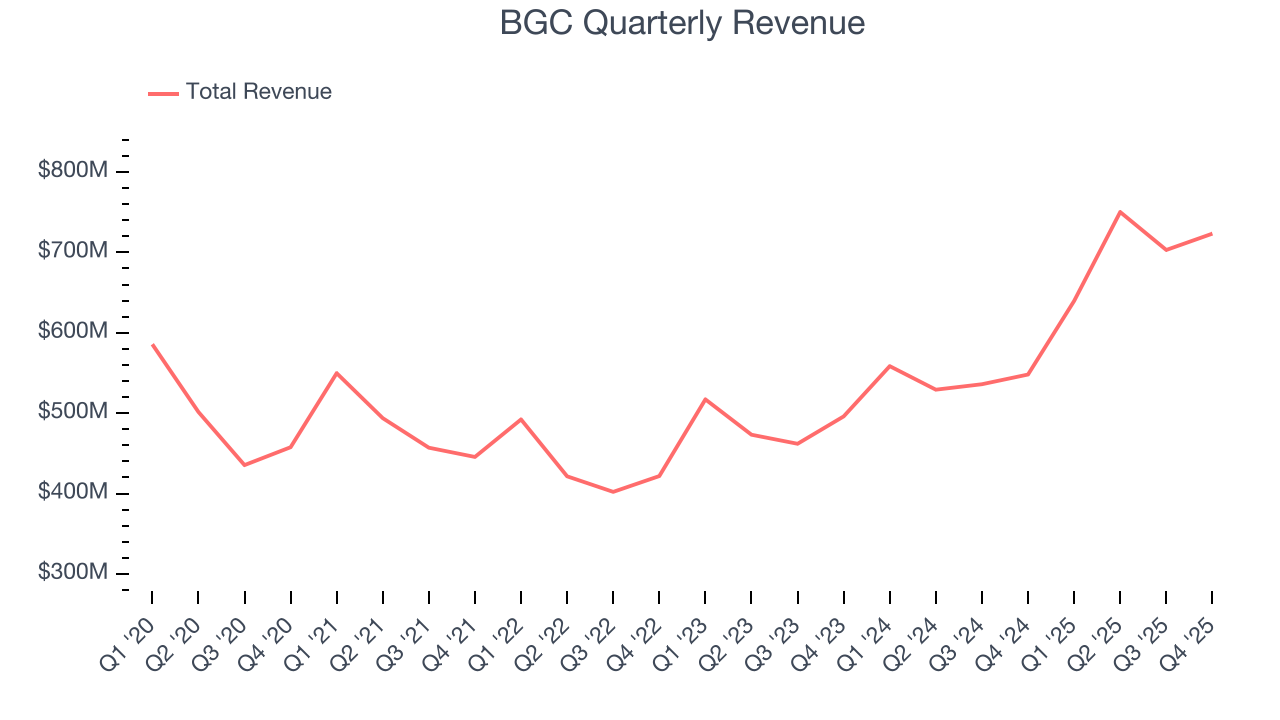

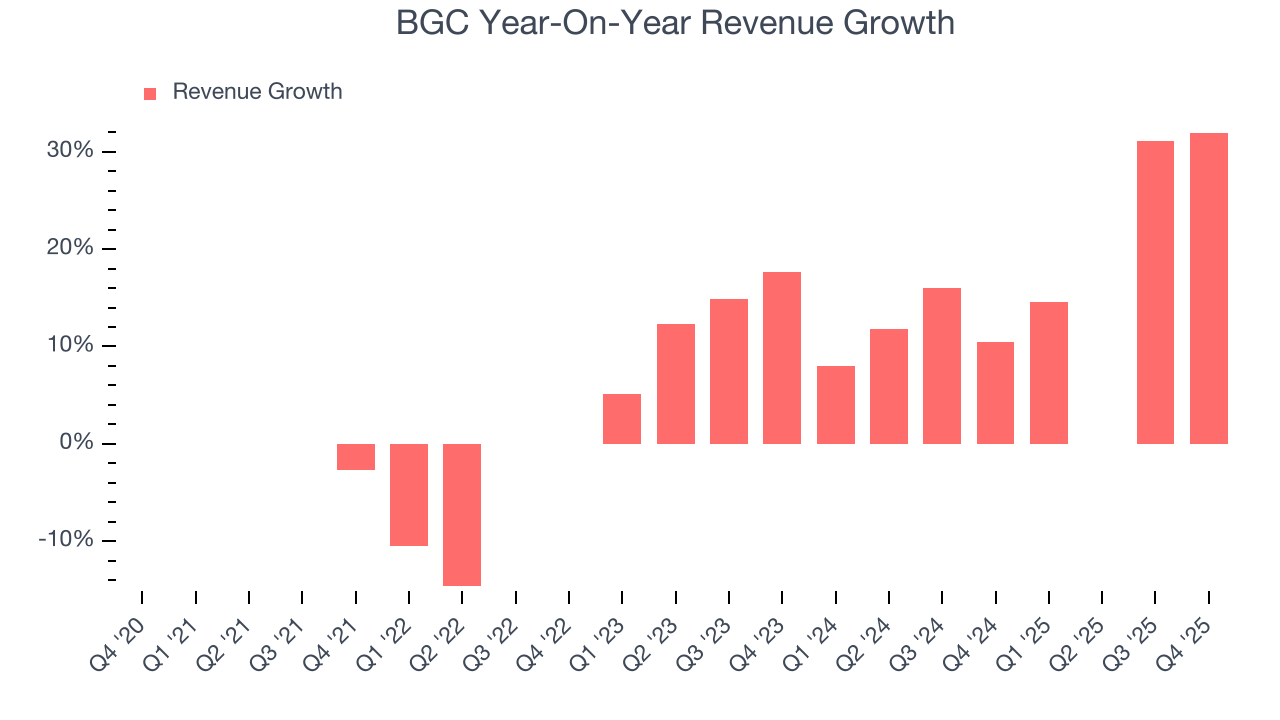

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, BGC grew its revenue at a mediocre 7.3% compounded annual growth rate. This wasn’t a great result compared to the rest of the financials sector, but there are still things to like about BGC.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. BGC’s annualized revenue growth of 20.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, BGC pulled off a wonderful 32% year-on-year revenue growth rate, but its $723.3 million of revenue fell short of Wall Street’s rosy estimates. Company management is currently guiding for a 39.2% year-on-year increase in sales next quarter.

6. Pre-Tax Profit Margin

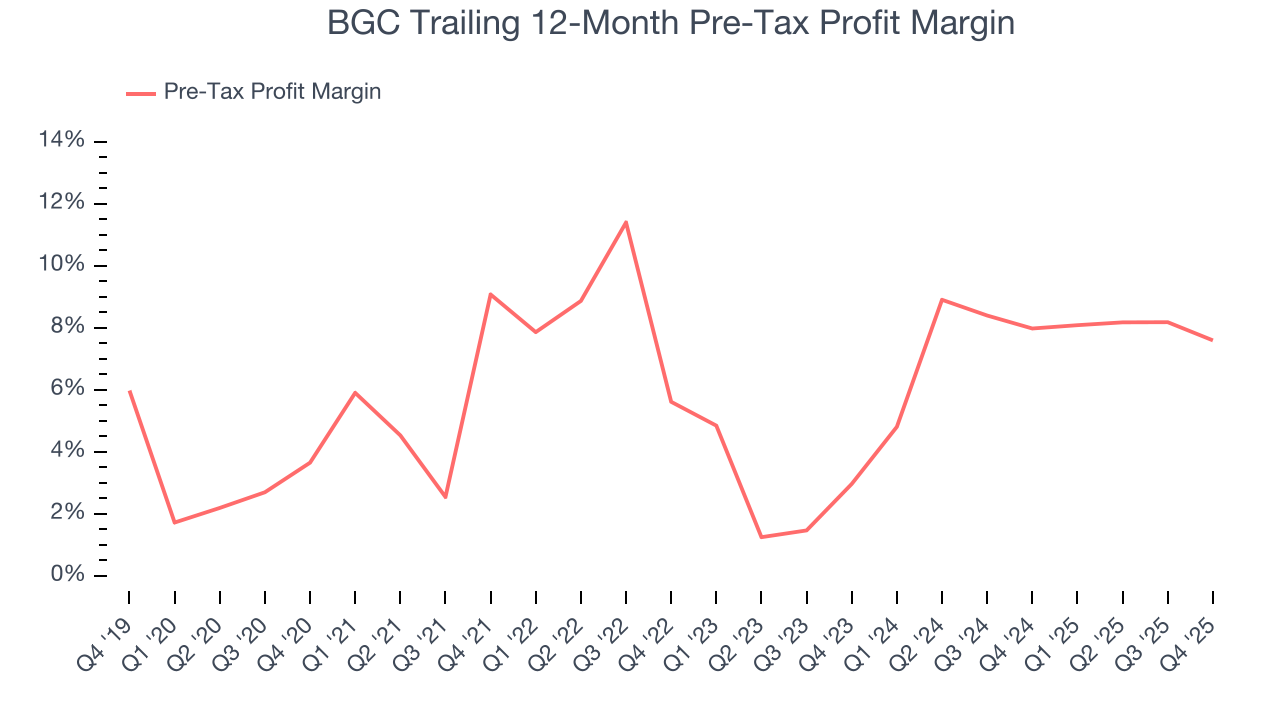

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Investment Banking & Brokerage companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Interest income and expenses play a big role in financial institutions' profitability, so they should be factored into the definition of profit. Taxes, however, should not as they are largely out of a company's control. This is pre-tax profit by definition.

Over the last five years, BGC’s pre-tax profit margin has fallen by 3.9 percentage points, going from 9.1% to 7.6%. It has also expanded by 4.6 percentage points on a two-year basis, showing its expenses have consistently grown at a slower rate than revenue. This typically signals prudent management.

In Q4, BGC’s pre-tax profit margin was 3.5%. This result was 1.5 percentage points worse than the same quarter last year.

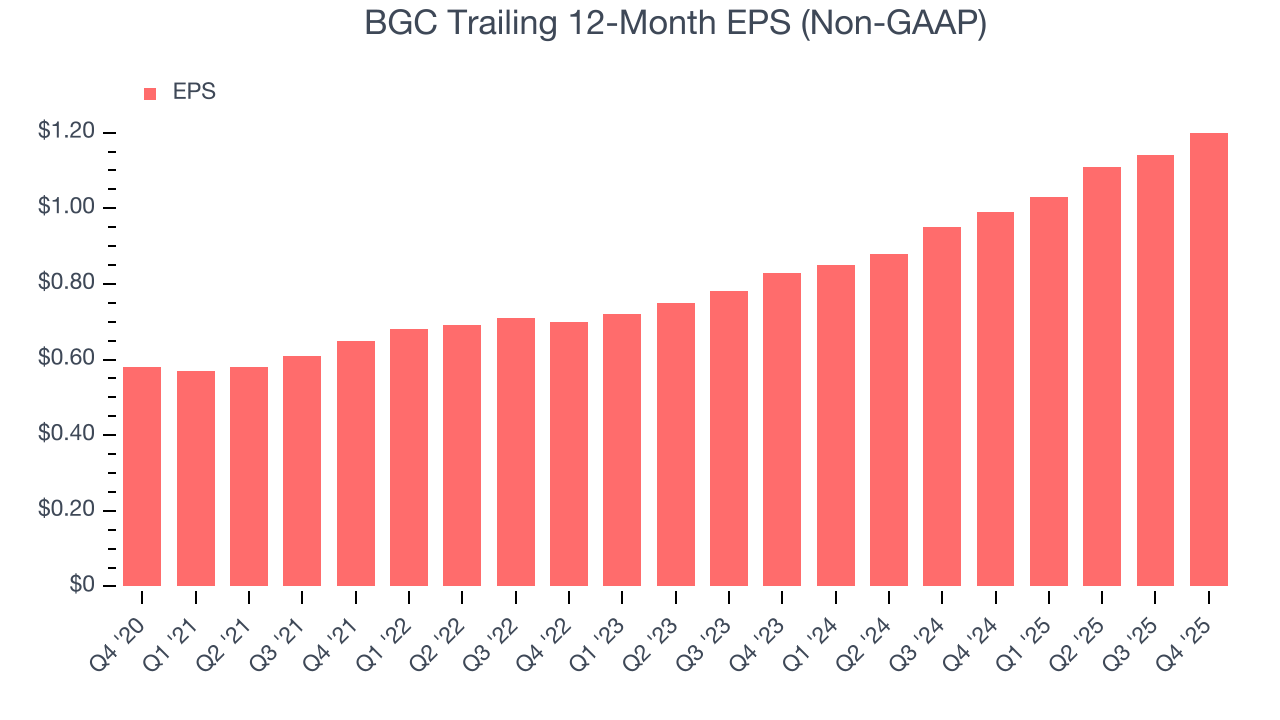

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

BGC’s EPS grew at a solid 15.7% compounded annual growth rate over the last five years, higher than its 7.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For BGC, its two-year annual EPS growth of 20.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, BGC reported adjusted EPS of $0.31, up from $0.25 in the same quarter last year. This print beat analysts’ estimates by 6.9%. Over the next 12 months, Wall Street expects BGC’s full-year EPS of $1.20 to grow 13.3%.

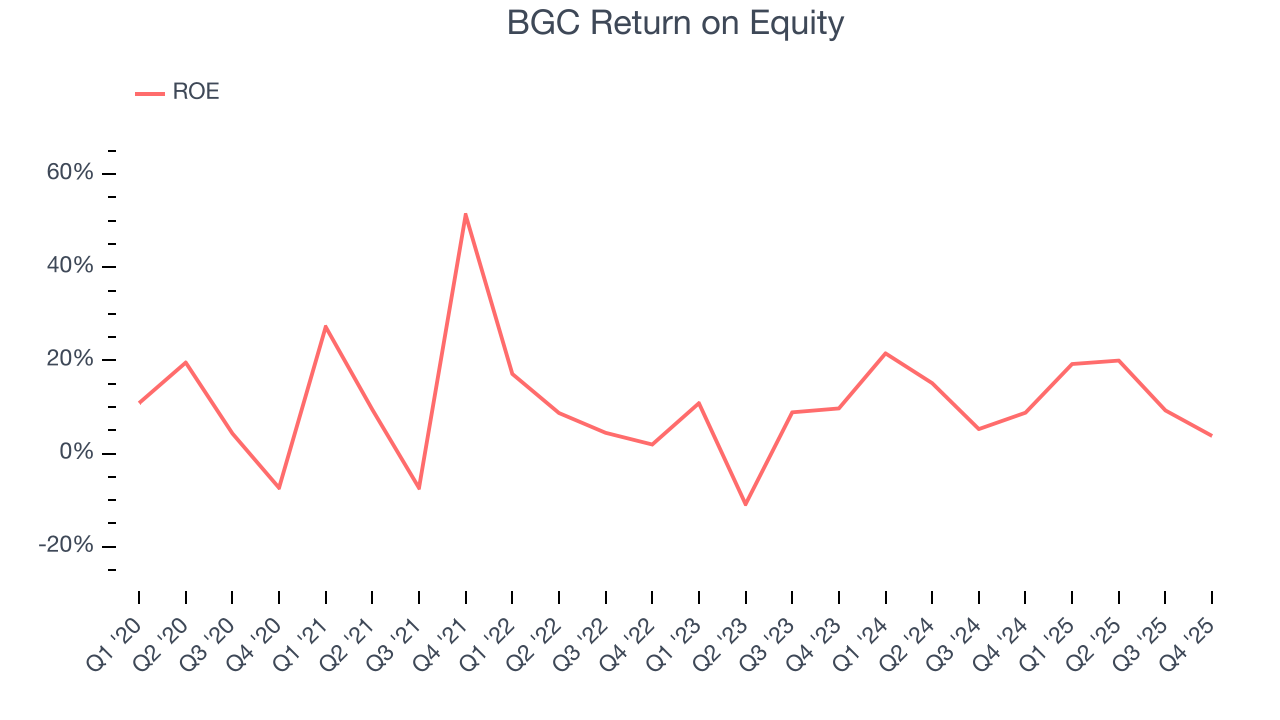

8. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, BGC has averaged an ROE of 11.7%, respectable for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows BGC has a narrow competitive moat.

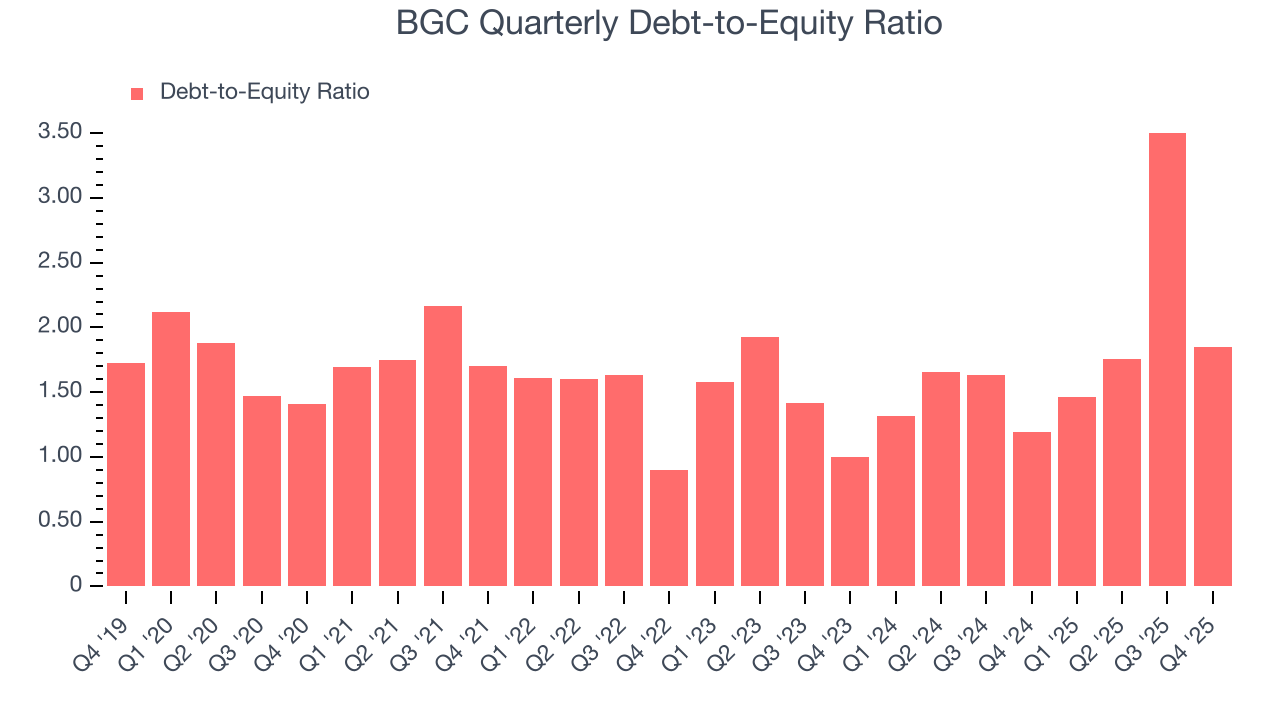

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

BGC currently has $1.80 billion of debt and $972.5 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 2.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from BGC’s Q4 Results

It was good to see BGC beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock remained flat at $9.53 immediately after reporting.

11. Is Now The Time To Buy BGC?

Updated: February 13, 2026 at 10:59 PM EST

Are you wondering whether to buy BGC or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

BGC is a fine business. Although its revenue growth was mediocre over the last five years, its growth over the next 12 months is expected to be higher. On top of that, BGC’s expanding pre-tax profit margin shows the business has become more efficient, and the company’s solid EPS growth over the last five years shows its profits are trickling down to shareholders.

BGC’s P/E ratio based on the next 12 months is 6.8x. Looking at the financials space right now, BGC trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $14.50 on the company (compared to the current share price of $9.22), implying they see 57.4% upside in buying BGC in the short term.