Braze (BRZE)

Braze catches our eye. Its elite ARR growth suggests it not only generates recurring revenue but also is winning market share.― StockStory Analyst Team

1. News

2. Summary

Why Braze Is Interesting

With its technology powering interactions with 6.2 billion monthly active users across the digital landscape, Braze (NASDAQ:BRZE) provides a platform that helps brands build and maintain direct relationships with their customers through personalized, cross-channel messaging and engagement.

- Annual revenue growth of 38.4% over the last five years was superb and indicates its market share is rising

- Billings growth has averaged 22.5% over the last year, indicating a healthy pipeline of new contracts that should drive future revenue increases

- One risk is its track record of operating margin losses stem from its decision to pursue growth instead of profits

Braze shows some signs of a high-quality business. If you like the story, the valuation looks reasonable.

Why Is Now The Time To Buy Braze?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Braze?

Braze is trading at $34.42 per share, or 4x forward price-to-sales. Braze’s valuation seems like a good deal for the revenue momentum you get.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Braze (BRZE) Research Report: Q3 CY2025 Update

Customer engagement platform Braze (NASDAQ:BRZE) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 25.5% year on year to $190.8 million. Guidance for next quarter’s revenue was optimistic at $198 million at the midpoint, 2.7% above analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Braze (BRZE) Q3 CY2025 Highlights:

- Revenue: $190.8 million vs analyst estimates of $184.2 million (25.5% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.07 (in line)

- Adjusted Operating Income: $5.08 million vs analyst estimates of $4.17 million (2.7% margin, 21.9% beat)

- Revenue Guidance for Q4 CY2025 is $198 million at the midpoint, above analyst estimates of $192.8 million

- Management raised its full-year Adjusted EPS guidance to $0.43 at the midpoint, a 2.4% increase

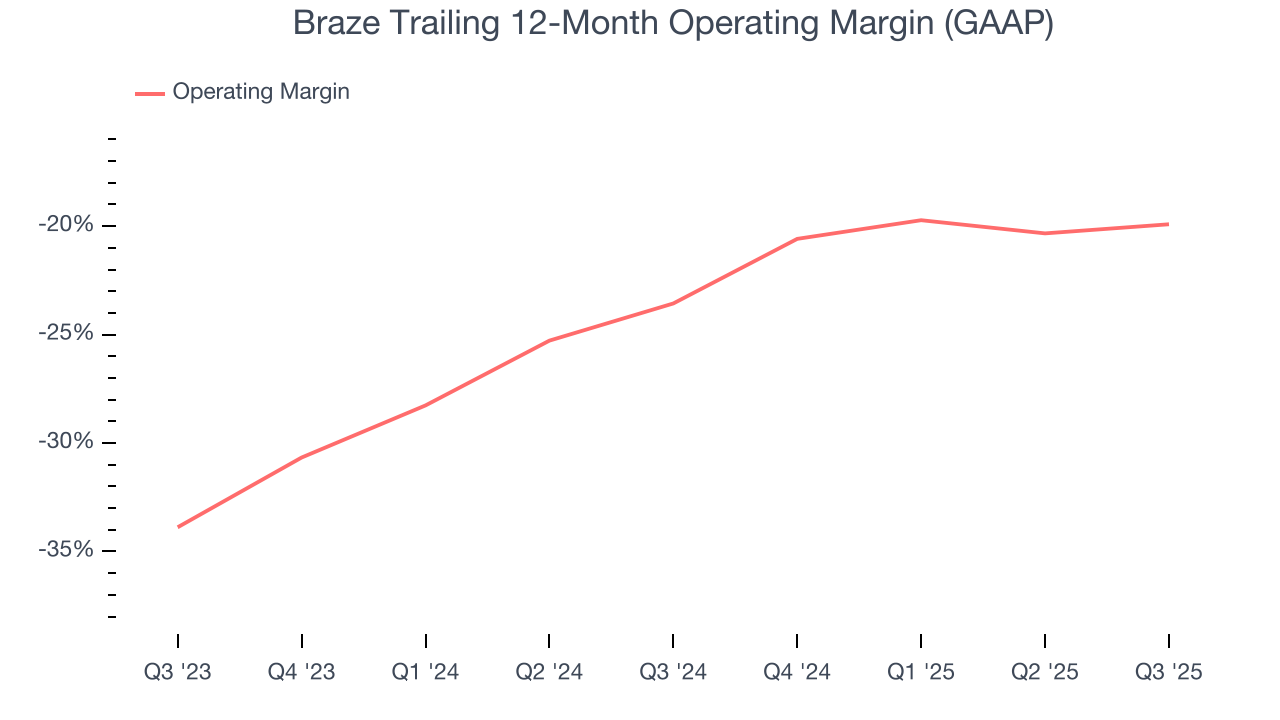

- Operating Margin: -19.7%, up from -21.4% in the same quarter last year

- Free Cash Flow Margin: 9.3%, up from 2% in the previous quarter

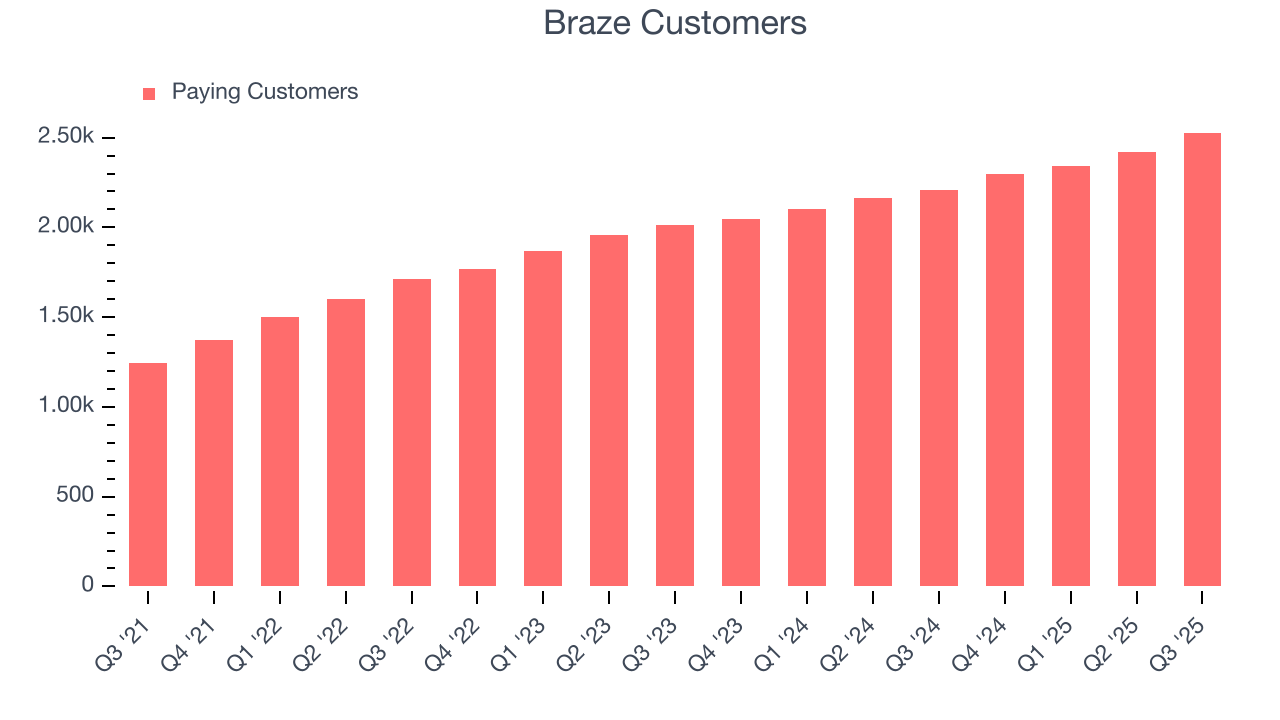

- Customers: 2,528, up from 2,422 in the previous quarter

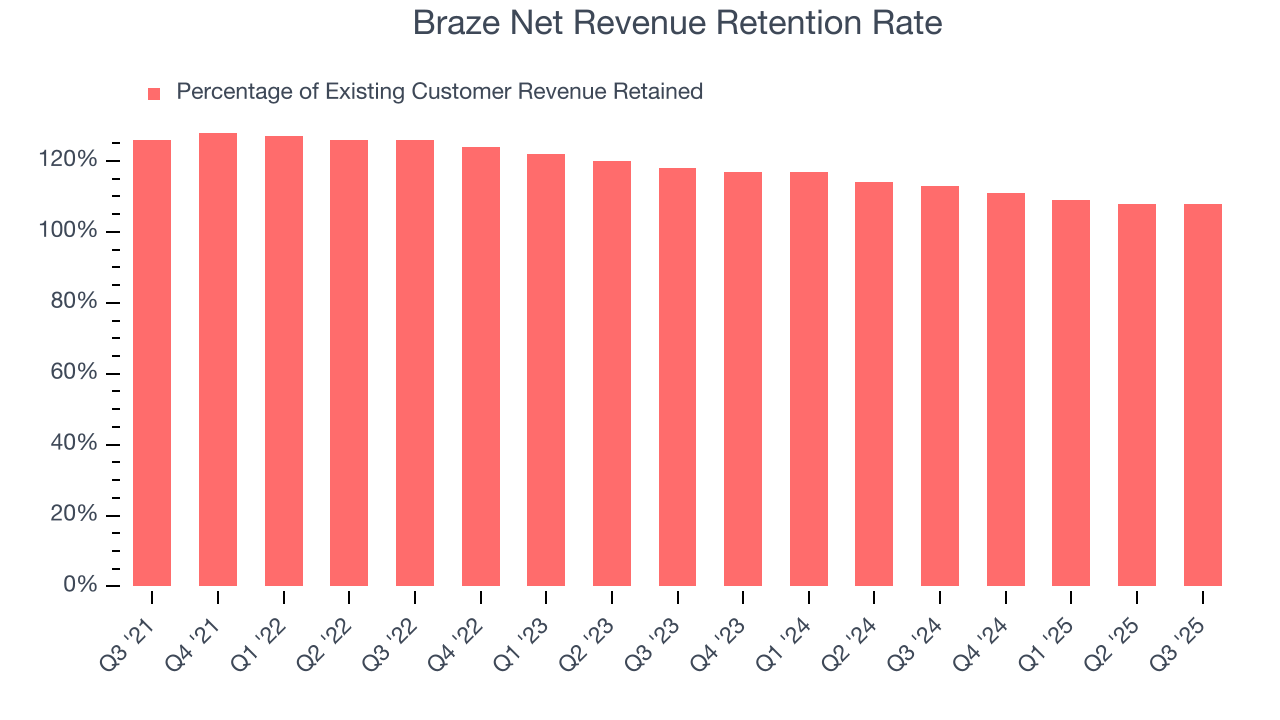

- Net Revenue Retention Rate: 108%, in line with the previous quarter

- Billings: $200.3 million at quarter end, up 22.4% year on year

- Market Capitalization: $3.34 billion

Company Overview

With its technology powering interactions with 6.2 billion monthly active users across the digital landscape, Braze (NASDAQ:BRZE) provides a platform that helps brands build and maintain direct relationships with their customers through personalized, cross-channel messaging and engagement.

At its core, Braze enables companies to listen to customer behavior, understand their preferences, and act on that understanding in ways that feel human and personal. The platform integrates data ingestion, classification, orchestration, personalization, and action capabilities into a single system, allowing brands to create cohesive customer journeys rather than disjointed messages across different channels.

Braze supports numerous messaging channels including in-app messages, push notifications, email, SMS, WhatsApp, and Content Cards (embedded message feeds within apps). The platform also features Canvas, a proprietary journey orchestration tool that allows marketers to design and visualize multi-step customer experiences across these channels without coding knowledge.

What differentiates Braze is its real-time data processing architecture, which allows brands to immediately respond to customer actions. For example, an e-commerce company might use Braze to automatically send a personalized message when a customer abandons their shopping cart, or a streaming service could recommend new content based on viewing behavior the moment a user finishes watching a show.

The company operates on a subscription-based business model, with pricing typically based on the number of monthly active users a brand engages with and message volume. Braze's customer base spans industries from retail and financial services to media and entertainment, including both established enterprises and growing digital-first companies. Revenue grows as customers expand usage across more channels, implement additional features, or roll out the platform to new business units.

4. Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Braze competes with legacy marketing cloud platforms like Adobe Experience Cloud and Salesforce Marketing Cloud, as well as customer engagement specialists such as Airship, Iterable, Klaviyo, CleverTap, and MoEngage. As customer engagement evolves, Braze also increasingly competes with customer data platforms and specialized messaging providers.

5. Revenue Growth

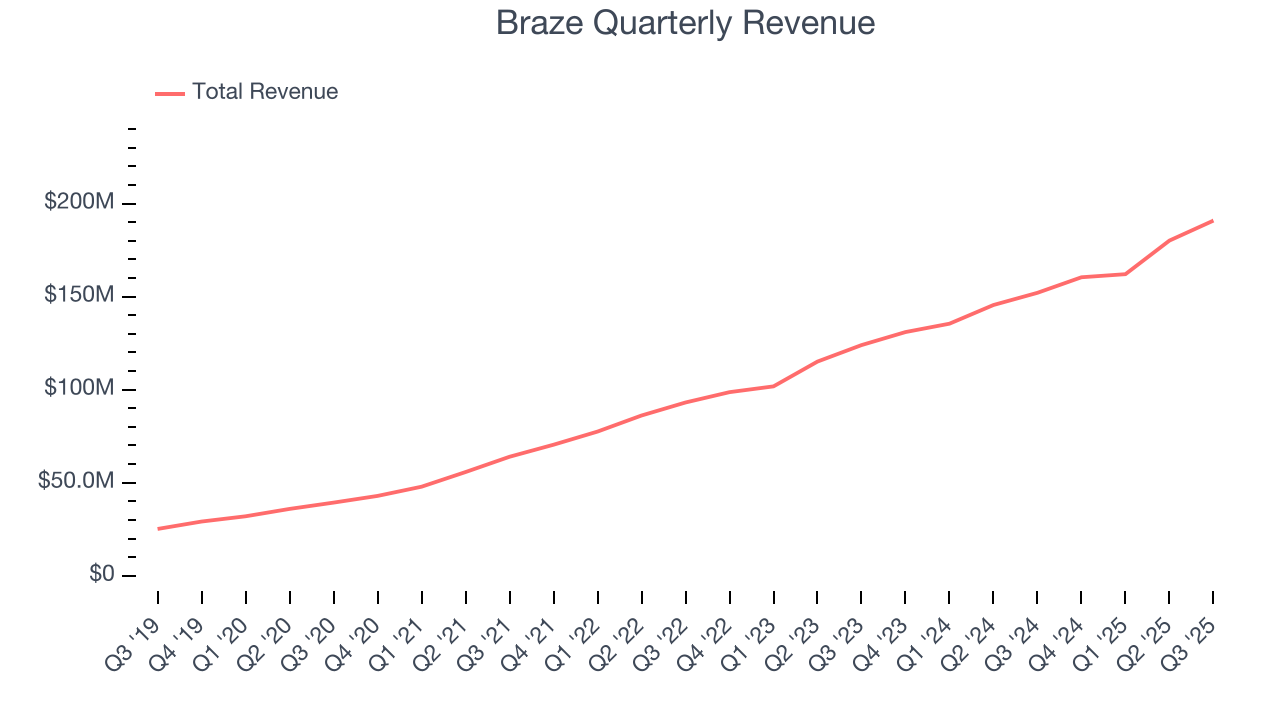

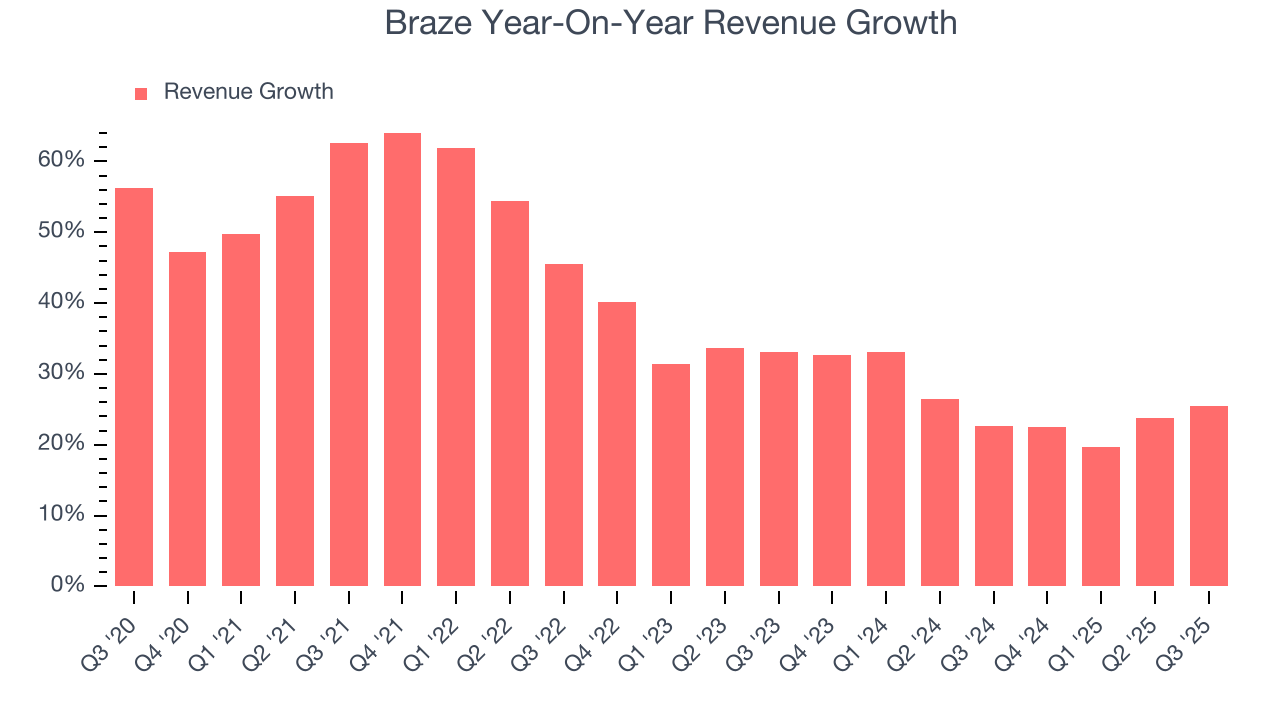

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Braze grew its sales at an exceptional 38.4% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Braze’s annualized revenue growth of 25.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Braze reported robust year-on-year revenue growth of 25.5%, and its $190.8 million of revenue topped Wall Street estimates by 3.6%. Company management is currently guiding for a 23.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17% over the next 12 months, a deceleration versus the last two years. Still, this projection is above the sector average and implies the market sees some success for its newer products and services.

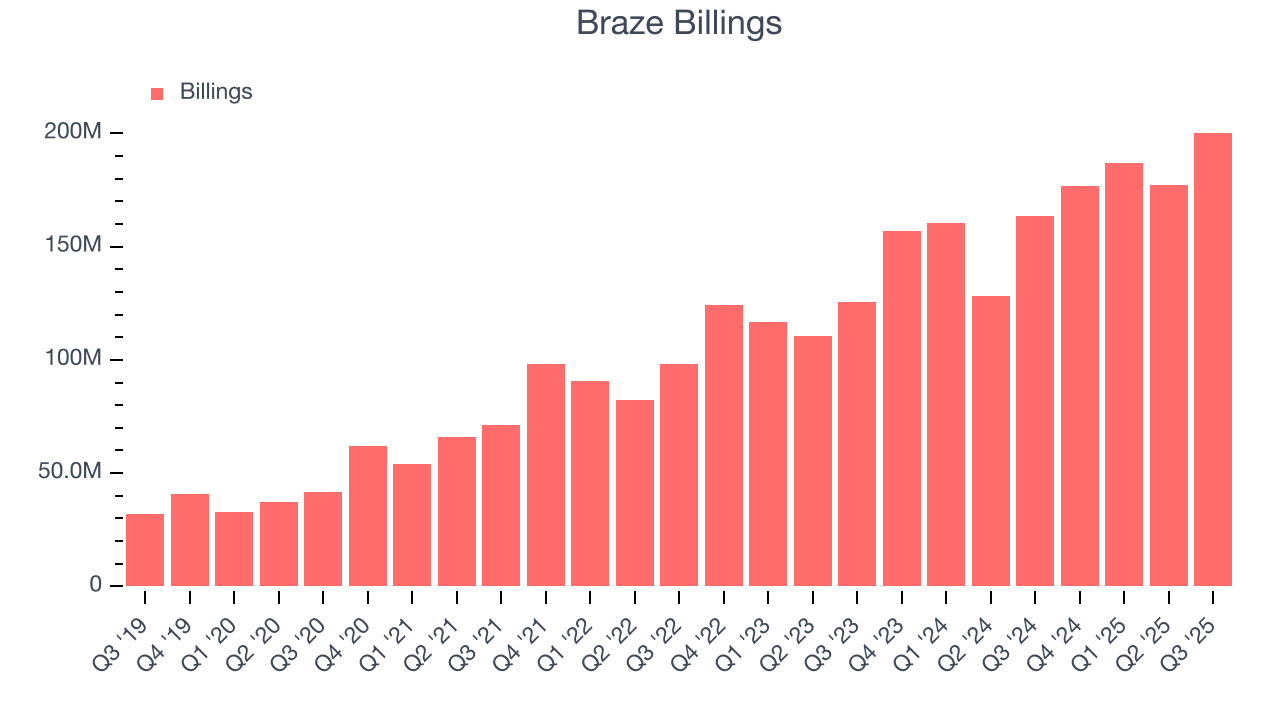

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Braze’s billings punched in at $200.3 million in Q3, and over the last four quarters, its growth was impressive as it averaged 22.5% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Customer Base

Braze reported 2,528 customers at the end of the quarter, a sequential increase of 106. That’s a little better than last quarter and quite a bit above the typical growth we’ve seen over the previous year. Shareholders should take this as an indication that Braze’s go-to-market strategy is working well.

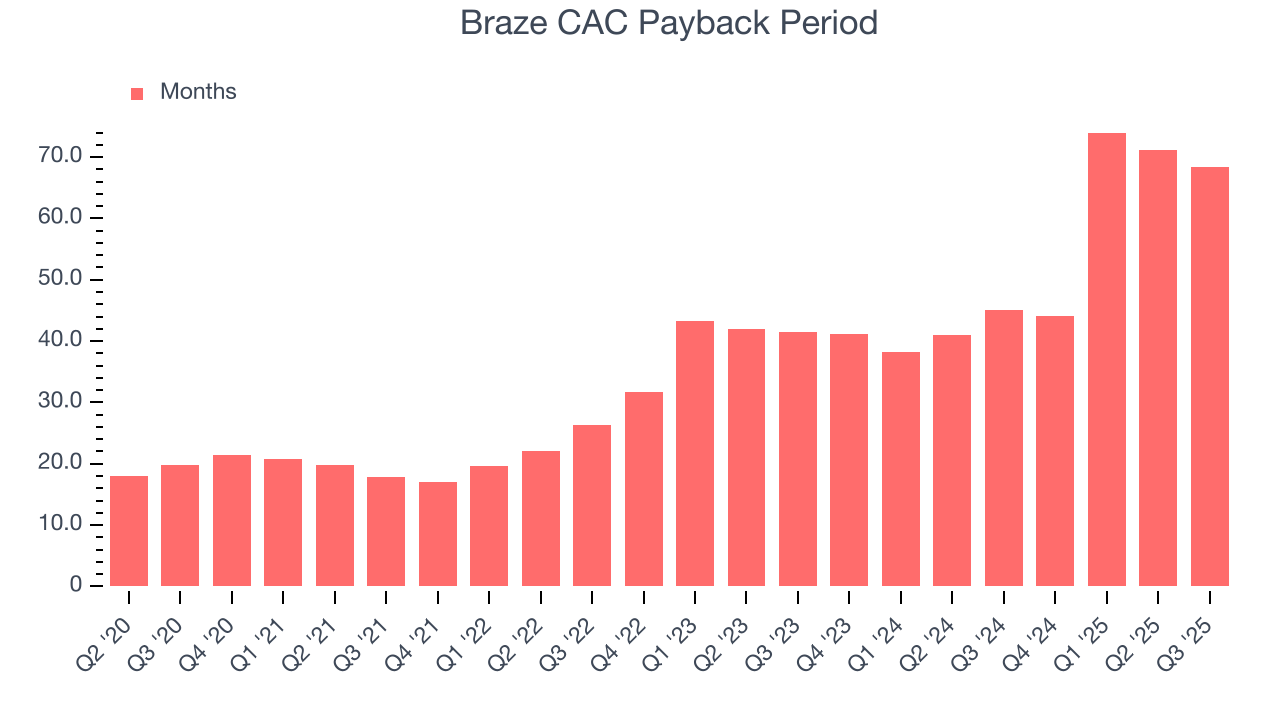

8. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Braze to acquire new customers as its CAC payback period checked in at 68.5 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a competitive market. A silver lining is that once it acquires its customers, they typically don’t leave and increase their spending - a sign of high switching costs.

9. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Braze’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 109% in Q3. This means Braze would’ve grown its revenue by 9% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Braze still has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

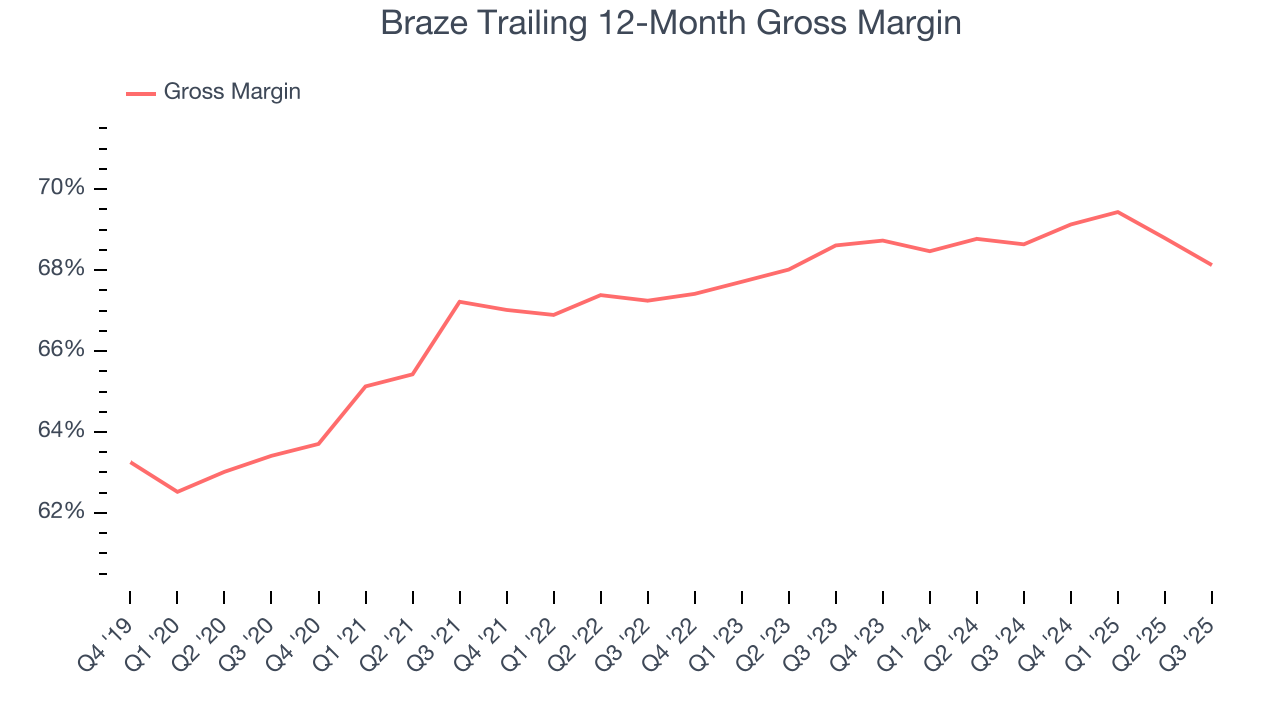

10. Gross Margin & Pricing Power

For software companies like Braze, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Braze’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 68.1% gross margin over the last year. That means Braze paid its providers a lot of money ($31.87 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Braze has seen gross margins decline by 0.5 percentage points over the last 2 year, which is slightly worse than average for software.

Braze produced a 67.2% gross profit margin in Q3, down 2.6 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

11. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Braze’s expensive cost structure has contributed to an average operating margin of negative 19.9% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Over the last two years, Braze’s expanding sales gave it operating leverage as its margin rose by 3.7 percentage points. Still, it will take much more for the company to reach long-term profitability.

Braze’s operating margin was negative 19.7% this quarter.

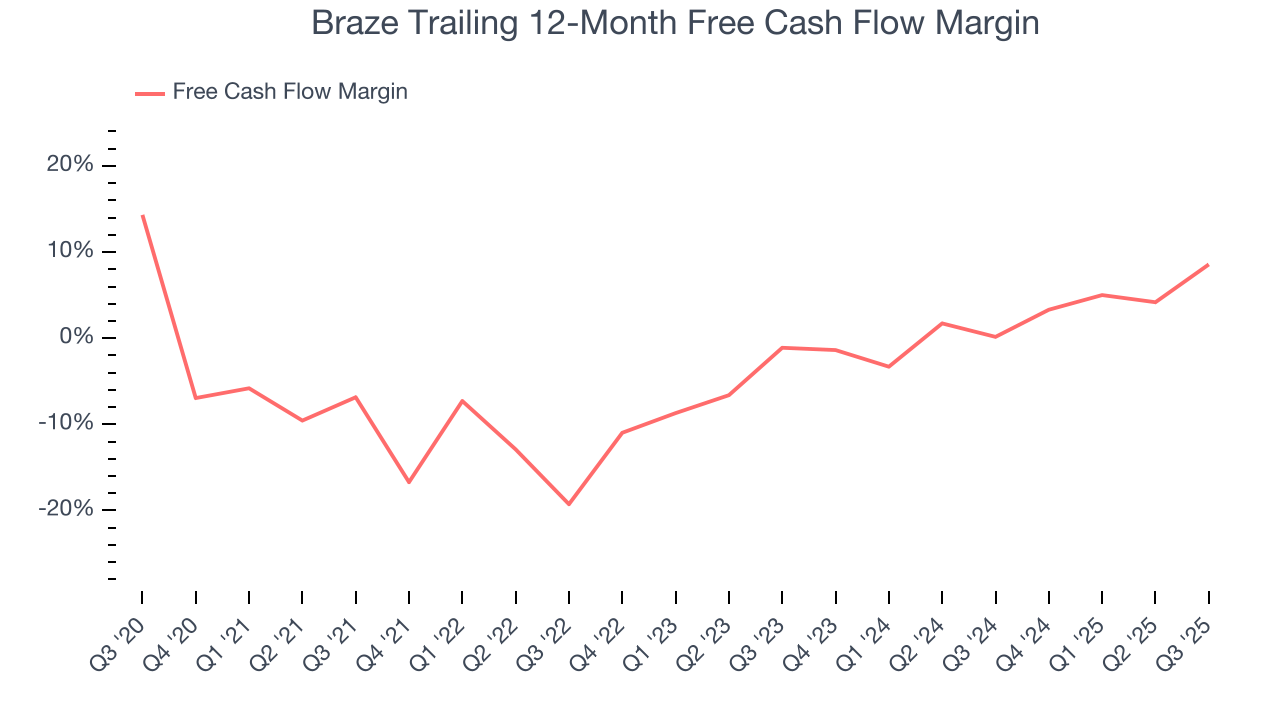

12. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Braze has shown weak cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.6%, subpar for a software business.

Braze’s free cash flow clocked in at $17.78 million in Q3, equivalent to a 9.3% margin. Its cash flow turned positive after being negative in the same quarter last year. We hope the company can build on this trend.

Over the next year, analysts’ consensus estimates show they’re expecting Braze’s free cash flow margin of 8.6% for the last 12 months to remain the same.

13. Key Takeaways from Braze’s Q3 Results

We enjoyed seeing Braze beat analysts’ billings expectations this quarter. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 7.4% to $32.96 immediately following the results.

14. Is Now The Time To Buy Braze?

Updated: December 9, 2025 at 9:28 PM EST

Before investing in or passing on Braze, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We think Braze is a solid business. To kick things off, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other software companies, its splendid ARR growth shows it’s securing more long-term contracts and becoming a more predictable business.

Braze’s price-to-sales ratio based on the next 12 months is 4x. Looking at the software space right now, Braze trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $45.11 on the company (compared to the current share price of $34.42), implying they see 31% upside in buying Braze in the short term.