Upland Software (UPLD)

Upland Software doesn’t excite us. Its shrinking sales suggest demand is waning and its lousy free cash flow generation doesn’t do it any favors.― StockStory Analyst Team

1. News

2. Summary

Why We Think Upland Software Will Underperform

Operating under the mantra "land and expand," Upland Software (NASDAQ:UPLD) provides cloud-based applications that help organizations manage projects, workflows, and digital transformation across various business functions.

- Sales tumbled by 3.4% annually over the last five years, showing industry trends like AI are working against its favor

- Projected sales decline of 14% over the next 12 months indicates demand will continue deteriorating

- A consolation is that its efficiency rose over the last year as its Operating margin increased by 37.3 percentage points

Upland Software’s quality doesn’t meet our expectations. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Upland Software

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Upland Software

Upland Software is trading at $0.94 per share, or 0.1x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Upland Software (UPLD) Research Report: Q3 CY2025 Update

Cloud software provider Upland Software (NASDAQ:UPLD) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 24.2% year on year to $50.53 million. On the other hand, next quarter’s revenue guidance of $49.4 million was less impressive, coming in 2.7% below analysts’ estimates. Its non-GAAP profit of $0.30 per share was 73.1% above analysts’ consensus estimates.

Upland Software (UPLD) Q3 CY2025 Highlights:

- Revenue: $50.53 million vs analyst estimates of $49.91 million (24.2% year-on-year decline, 1.2% beat)

- Adjusted EPS: $0.30 vs analyst estimates of $0.17 (73.1% beat)

- Adjusted EBITDA: $16.03 million vs analyst estimates of $15.96 million (31.7% margin, in line)

- Revenue Guidance for Q4 CY2025 is $49.4 million at the midpoint, below analyst estimates of $50.79 million

- EBITDA guidance for the full year is $58 million at the midpoint, below analyst estimates of $58.82 million

- Operating Margin: 10.6%, up from -5% in the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 5% in the previous quarter

- Market Capitalization: $55.24 million

Company Overview

Operating under the mantra "land and expand," Upland Software (NASDAQ:UPLD) provides cloud-based applications that help organizations manage projects, workflows, and digital transformation across various business functions.

Upland's software suite spans eight key functional areas: marketing, sales, contact center, knowledge management, project management, IT, business operations, and human resources/legal. This diverse portfolio allows the company to address numerous business needs, from strategic planning to everyday task execution. Each solution aims to improve productivity, streamline processes, and enhance collaboration within organizations.

The company generates revenue primarily through subscription-based pricing models, with contracts typically ranging from one to three years. Subscriptions are sold either on a per-seat basis or with minimum contracted volumes plus overage fees. Upland has built its product portfolio through numerous acquisitions—31 in total over a 12-year period ending in 2023—which it integrates through its "UplandOne" operating platform.

For example, a marketing department might use Upland's applications to run email campaigns and analyze customer feedback, while a project management office could employ different Upland tools to optimize resource allocation and track deliverables. The company serves over 10,000 customers across industries including financial services, technology, healthcare, government, and retail, with a particular focus on mid-sized to large enterprises designated as "major accounts."

4. Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Upland Software competes with larger enterprise software providers like Microsoft (NASDAQ:MSFT), Salesforce (NYSE:CRM), and Adobe (NASDAQ:ADBE), as well as specialized cloud software vendors such as Monday.com (NASDAQ:MNDY), Atlassian (NASDAQ:TEAM), and HubSpot (NYSE:HUBS).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Upland Software’s demand was weak over the last five years as its sales fell at a 3.4% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Upland Software’s recent performance shows its demand remained suppressed as its revenue has declined by 12% annually over the last two years.

This quarter, Upland Software’s revenue fell by 24.2% year on year to $50.53 million but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 27.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 13% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not catalyze better top-line performance yet.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Upland Software is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

For software companies like Upland Software, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Upland Software’s gross margin is better than the broader software industry and signals it has solid unit economics and competitive products. As you can see below, it averaged a decent 73.2% gross margin over the last year. Said differently, Upland Software paid its providers $26.75 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Upland Software has seen gross margins improve by 5.9 percentage points over the last 2 year, which is elite in the software space.

Upland Software produced a 76.9% gross profit margin in Q3, up 6.4 percentage points year on year. Upland Software’s full-year margin has also been trending up over the past 12 months, increasing by 3.7 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs.

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Although Upland Software was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Upland Software reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

On the plus side, Upland Software’s operating margin rose by 37.3 percentage points over the last two years. Still, it will take much more for the company to show consistent profitability.

This quarter, Upland Software generated an operating margin profit margin of 10.6%, up 15.5 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Upland Software has shown mediocre cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.1%, subpar for a software business.

Upland Software’s free cash flow clocked in at $6.68 million in Q3, equivalent to a 13.2% margin. This result was good as its margin was 6.9 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Upland Software’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 11.1% for the last 12 months will increase to 12.1%, giving it more flexibility for investments, share buybacks, and dividends.

10. Balance Sheet Assessment

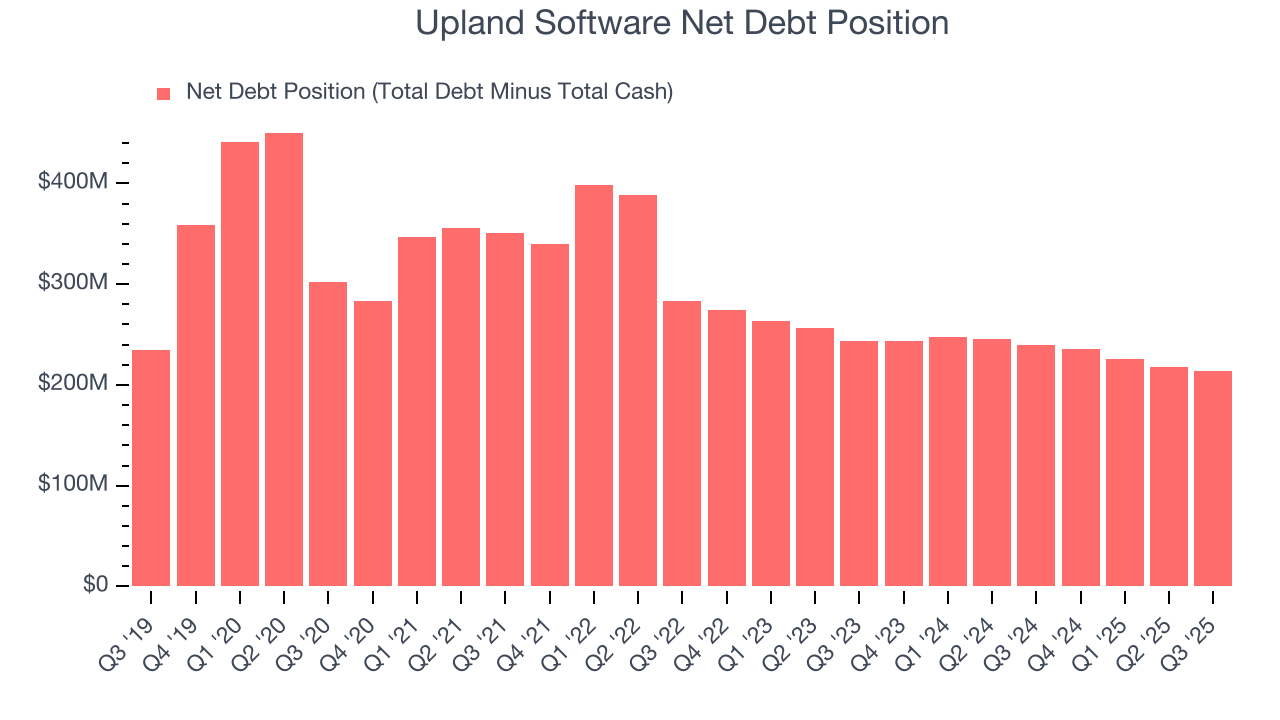

Upland Software reported $23.38 million of cash and $236.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $57.6 million of EBITDA over the last 12 months, we view Upland Software’s 3.7× net-debt-to-EBITDA ratio as safe. We also see its $0 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Upland Software’s Q3 Results

It was good to see Upland Software narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded up 2.5% to $1.95 immediately after reporting.

12. Is Now The Time To Buy Upland Software?

Updated: February 25, 2026 at 9:31 PM EST

Before investing in or passing on Upland Software, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Upland Software’s business quality ultimately falls short of our standards. To kick things off, its revenue has declined over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its efficient sales strategy allows it to target and onboard new users at scale, the downside is its low free cash flow margins give it little breathing room. On top of that, its operating margins are low compared to other software companies.

Upland Software’s price-to-sales ratio based on the next 12 months is 0.1x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $4.33 on the company (compared to the current share price of $0.94).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.