BrightSpring Health Services (BTSG)

BrightSpring Health Services piques our interest. It’s one of the fastest-growing companies we cover, and there’s a solid chance its momentum will continue.― StockStory Analyst Team

1. News

2. Summary

Why BrightSpring Health Services Is Interesting

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

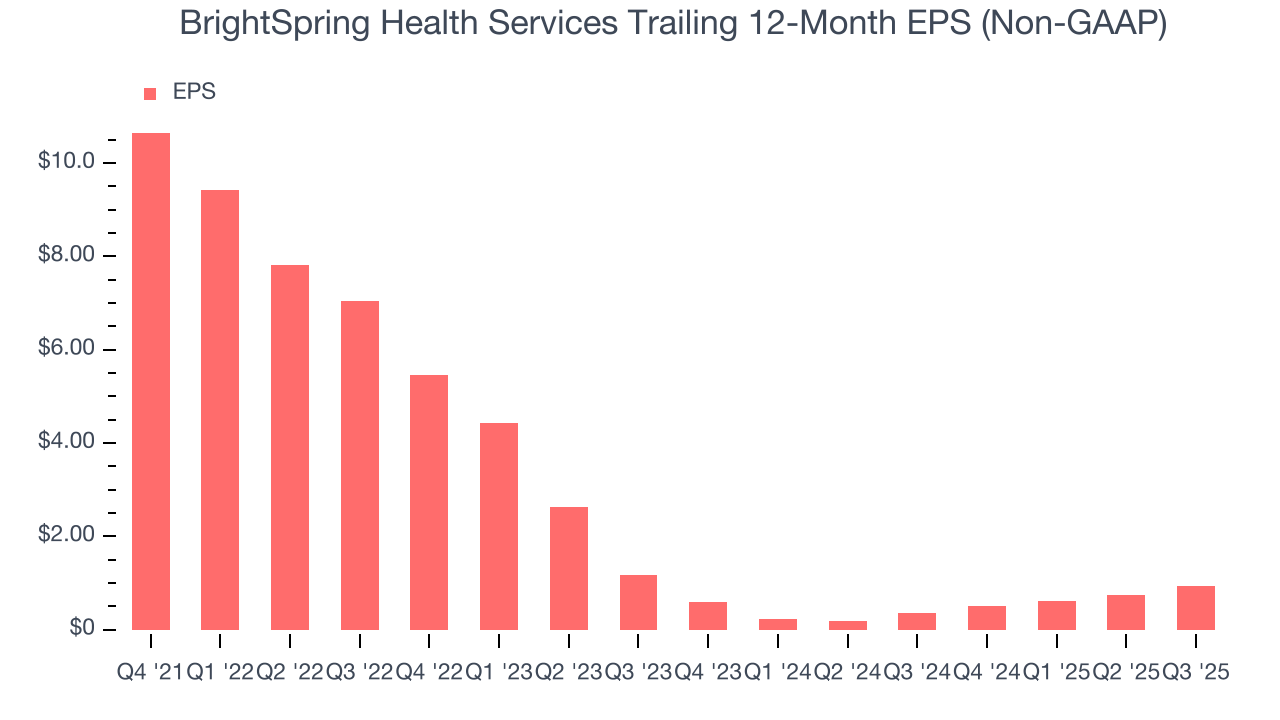

- Earnings per share grew by 15.7% annually over the last four years, massively outpacing its peers

- Estimated revenue growth of 13.9% for the next 12 months implies its momentum over the last two years will continue

- One pitfall is its adjusted operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

BrightSpring Health Services has the potential to be a high-quality business. This company is a good candidate for your watchlist.

Why Should You Watch BrightSpring Health Services

High Quality

Investable

Underperform

Why Should You Watch BrightSpring Health Services

BrightSpring Health Services’s stock price of $39.92 implies a valuation ratio of 33.6x forward P/E. This valuation represents a premium to healthcare peers.

If BrightSpring Health Services strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. BrightSpring Health Services (BTSG) Research Report: Q3 CY2025 Update

Healthcare services provider BrightSpring Health Services (NASDAQ:BTSG) announced better-than-expected revenue in Q3 CY2025, with sales up 14.7% year on year to $3.33 billion. The company’s full-year revenue guidance of $12.65 billion at the midpoint came in 0.9% above analysts’ estimates. Its non-GAAP profit of $0.29 per share was 11.2% above analysts’ consensus estimates.

BrightSpring Health Services (BTSG) Q3 CY2025 Highlights:

- Revenue: $3.33 billion vs analyst estimates of $3.17 billion (14.7% year-on-year growth, 5.3% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.26 (11.2% beat)

- Adjusted EBITDA: $160.4 million vs analyst estimates of $156.3 million (4.8% margin, 2.6% beat)

- The company lifted its revenue guidance for the full year to $12.65 billion at the midpoint from $12.4 billion, a 2% increase

- EBITDA guidance for the full year is $610 million at the midpoint, in line with analyst expectations

- Operating Margin: 2.6%, in line with the same quarter last year

- Free Cash Flow Margin: 1.4%, up from 0.2% in the same quarter last year

- Market Capitalization: $7.03 billion

Company Overview

Founded in 1974, BrightSpring Health Services (NASDAQ:BTSG) offers home health care, hospice, neuro-rehabilitation, and pharmacy services.

The company focuses on serving individuals in need of high-quality, personalized care in home and community settings as opposed to formal facilities such as hospitals.

4. Senior Health, Home Health & Hospice

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

Competitors include Amedisys (NASDAQ:AMED), Encompass Health (NYSE:EHC), UnitedHealth Group (NYSE:UNH), and Addus HomeCare (NASDAQ:ADUS).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $12.41 billion in revenue over the past 12 months, BrightSpring Health Services has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, BrightSpring Health Services’s sales grew at an impressive 17.9% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. BrightSpring Health Services’s annualized revenue growth of 21.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Pharmacy. Over the last two years, BrightSpring Health Services’s Pharmacy revenue averaged 32.2% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, BrightSpring Health Services reported year-on-year revenue growth of 14.7%, and its $3.33 billion of revenue exceeded Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products and services.

7. Adjusted Operating Margin

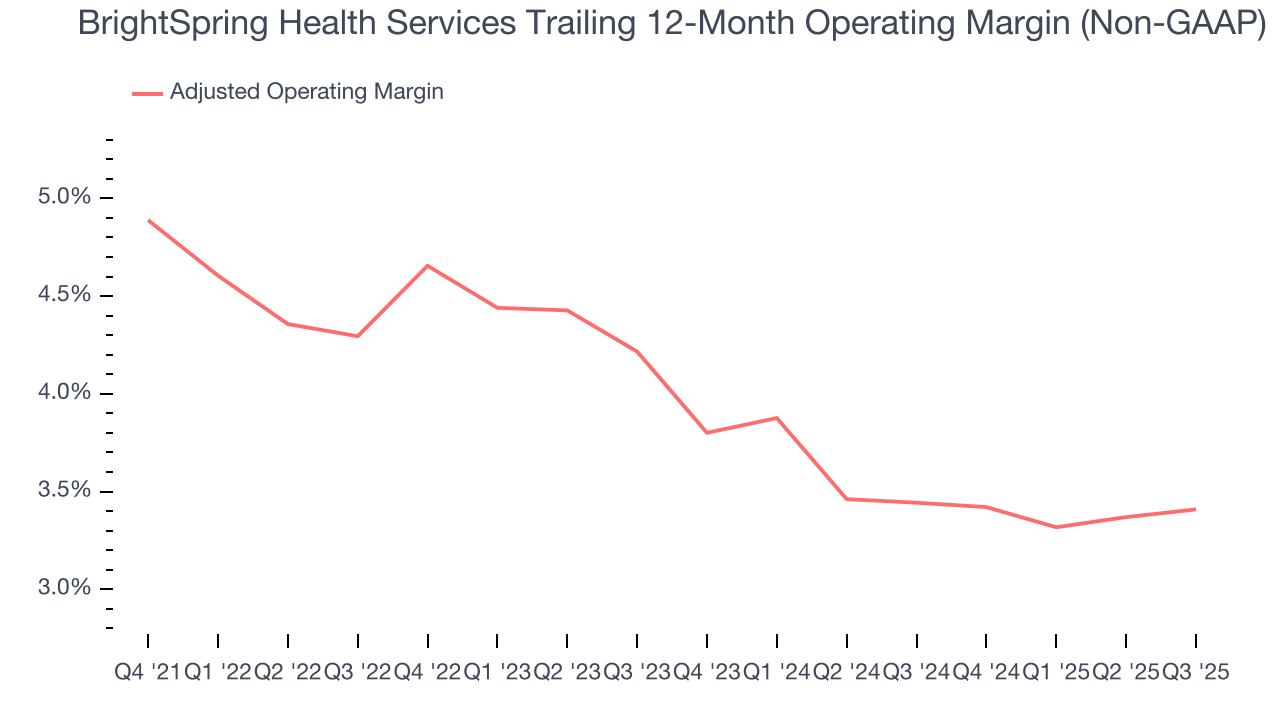

BrightSpring Health Services was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 3.9% was weak for a healthcare business.

Analyzing the trend in its profitability, BrightSpring Health Services’s adjusted operating margin decreased by 1.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. BrightSpring Health Services’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, BrightSpring Health Services generated an adjusted operating margin profit margin of 3.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

BrightSpring Health Services’s full-year EPS dropped significantly over the last four years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q3, BrightSpring Health Services reported adjusted EPS of $0.29, up from $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects BrightSpring Health Services’s full-year EPS of $0.92 to grow 23.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

BrightSpring Health Services has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.1%, subpar for a healthcare business.

Taking a step back, we can see that BrightSpring Health Services’s margin dropped by 3.9 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

BrightSpring Health Services’s free cash flow clocked in at $46.09 million in Q3, equivalent to a 1.4% margin. This result was good as its margin was 1.1 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

10. Balance Sheet Assessment

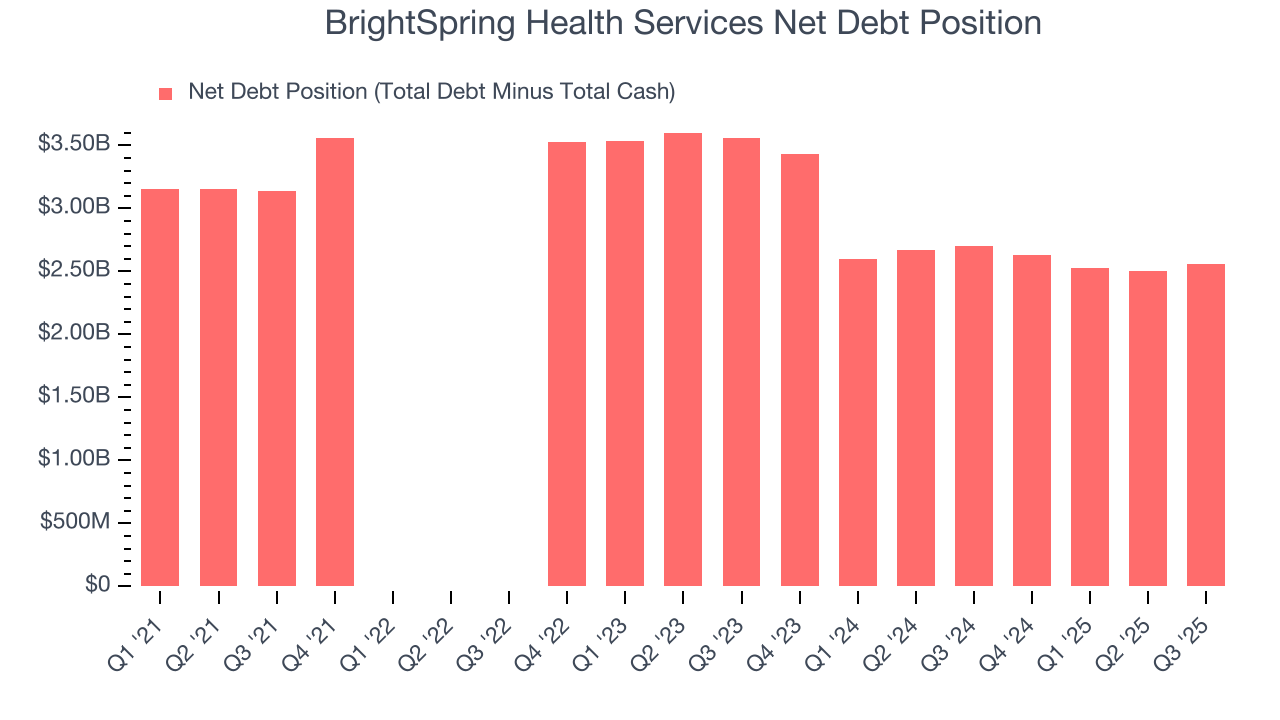

BrightSpring Health Services reported $140.3 million of cash and $2.7 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $601.4 million of EBITDA over the last 12 months, we view BrightSpring Health Services’s 4.3× net-debt-to-EBITDA ratio as safe. We also see its $173.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from BrightSpring Health Services’s Q3 Results

We were impressed by how significantly BrightSpring Health Services blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad it raised its full-year revenue guidance. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more given its premium valuation going into the print, and the stock traded down 2.3% to $33.20 immediately after reporting.

12. Is Now The Time To Buy BrightSpring Health Services?

Updated: February 23, 2026 at 11:23 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in BrightSpring Health Services.

We think BrightSpring Health Services is a good business. To kick things off, its revenue growth was impressive over the last five years. And while its operating margins are low compared to other healthcare companies, its astounding EPS growth over the last four years shows its profits are trickling down to shareholders. On top of that, its scale and strong customer awareness give it negotiating power.

BrightSpring Health Services’s P/E ratio based on the next 12 months is 33.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. BrightSpring Health Services is a good one to add to your watchlist - there are companies featuring superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $44.47 on the company (compared to the current share price of $39.92).