Beyond Meat (BYND)

Beyond Meat keeps us up at night. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Beyond Meat Will Underperform

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

- Annual revenue declines of 12.9% over the last three years indicate problems with its market positioning

- Sales are projected to tank by 6.1% over the next 12 months as its demand continues evaporating

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Beyond Meat’s quality isn’t up to par. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than Beyond Meat

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Beyond Meat

At $0.91 per share, Beyond Meat trades at 0.2x forward price-to-sales. The market typically values companies like Beyond Meat based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Beyond Meat (BYND) Research Report: Q3 CY2025 Update

Plant-based protein company Beyond Meat (NASDAQ:BYND) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 13.3% year on year to $70.22 million. On the other hand, next quarter’s revenue guidance of $62.5 million was less impressive, coming in 11.9% below analysts’ estimates. Its non-GAAP loss of $0.47 per share was 8.9% below analysts’ consensus estimates.

Beyond Meat (BYND) Q3 CY2025 Highlights:

- Beyond Meat delayed filing its 10-Q for its fiscal quarter ended September 27, 2025. As previously disclosed on Form 8-K filed on October 24, 2025, the Company expects to record a non-cash impairment charge related to certain of its long-lived assets in the three months ended September 27, 2025.

- Revenue: $70.22 million vs analyst estimates of $68.77 million (13.3% year-on-year decline, 2.1% beat)

- Adjusted EPS: -$0.47 vs analyst expectations of -$0.43 (8.9% miss)

- Adjusted EBITDA: -$21.63 million vs analyst estimates of -$18.94 million (-30.8% margin, 14.2% miss)

- Revenue Guidance for Q4 CY2025 is $62.5 million at the midpoint, below analyst estimates of $70.97 million

- Operating Margin: -160%, down from -38.2% in the same quarter last year

- Free Cash Flow was -$41.69 million compared to -$24.07 million in the same quarter last year

- Sales Volumes fell 10.3% year on year (-12.6% in the same quarter last year)

- Market Capitalization: $546.1 million

Company Overview

A pioneer at the forefront of the plant-based protein revolution, Beyond Meat (NASDAQ:BYND) is a food company specializing in alternatives to traditional meat products.

The company was founded in 2009 by Ethan Brown, who had a background in clean energy and realized that animal agriculture was a leading contributor to greenhouse gas emissions. He believed that by creating plant-based alternatives indistinguishable from animal meat in terms of taste and texture, he could improve both the environment and animal welfare.

Brown assembled a team of scientists, researchers, and chefs to execute his vision and began experimenting with various plant ingredients. They focused on understanding the molecular composition of meat, including its proteins, fats, and trace elements, and recreated these components using plant sources.

Years of research and development led to the creation of Beyond Meat's first flagship product, the Beyond Burger, which launched in 2016. The Beyond Burger made waves in the food industry for its uncanny resemblance to traditional beef burgers and can now be found in grocery stores, restaurants, and fast-food chains around the world.

Beyond Meat has also expanded in other categories like plant-based sausage, meatballs, and chicken, which are all made with peas, mung beans, and brown rice. The company invests heavily into research and development to enhance its products and create new offerings.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors include private company Impossible Foods and public companies Conagra (NYSE:CAG), which owns Gardein, and Kellanova (NYSE:K), which owns MorningStar Farms, and Maple Leaf Foods (TSX:MFI).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $290.6 million in revenue over the past 12 months, Beyond Meat is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Beyond Meat’s demand was weak over the last three years. Its sales fell by 12.9% annually as consumers bought less of its products.

This quarter, Beyond Meat’s revenue fell by 13.3% year on year to $70.22 million but beat Wall Street’s estimates by 2.1%. Company management is currently guiding for a 18.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.9% over the next 12 months. it’s tough to feel optimistic about a company facing demand difficulties.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Beyond Meat’s average quarterly sales volumes have shrunk by 10.8% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Beyond Meat’s Q3 2025, sales volumes dropped 10.3% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Beyond Meat has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 7.7% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $92.33 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, Beyond Meat produced a 10.3% gross profit margin, marking a 7.4 percentage point decrease from 17.7% in the same quarter last year. Zooming out, however, Beyond Meat’s full-year margin has been trending up over the past 12 months, increasing by 3.7 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

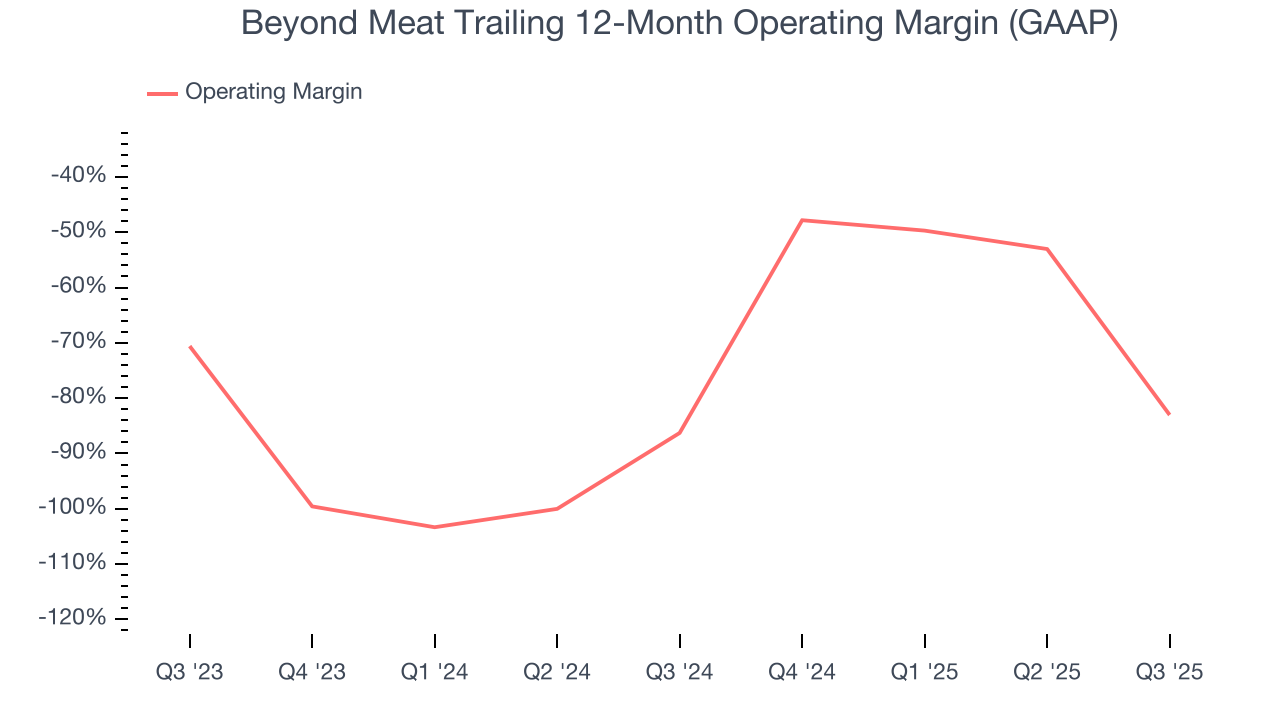

8. Operating Margin

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, Beyond Meat was one of them over the last two years as its high expenses contributed to an average operating margin of negative 84.7%.

On the plus side, Beyond Meat’s operating margin rose by 3.3 percentage points over the last year. Still, it will take much more for the company to reach long-term profitability.

Beyond Meat’s operating margin was negative 160% this quarter. The company's consistent lack of profits raise a flag.

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Beyond Meat reported adjusted EPS of negative $0.47, down from negative $0.41 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Beyond Meat to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.19 will advance to negative $0.75.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Beyond Meat’s demanding reinvestments have drained its resources over the last two years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 40.4%, meaning it lit $40.36 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Beyond Meat’s margin dropped by 16.7 percentage points over the last year. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Beyond Meat burned through $41.69 million of cash in Q3, equivalent to a negative 59.4% margin. The company’s cash burn was similar to its $24.07 million of lost cash in the same quarter last year.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Beyond Meat’s five-year average ROIC was negative 54.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

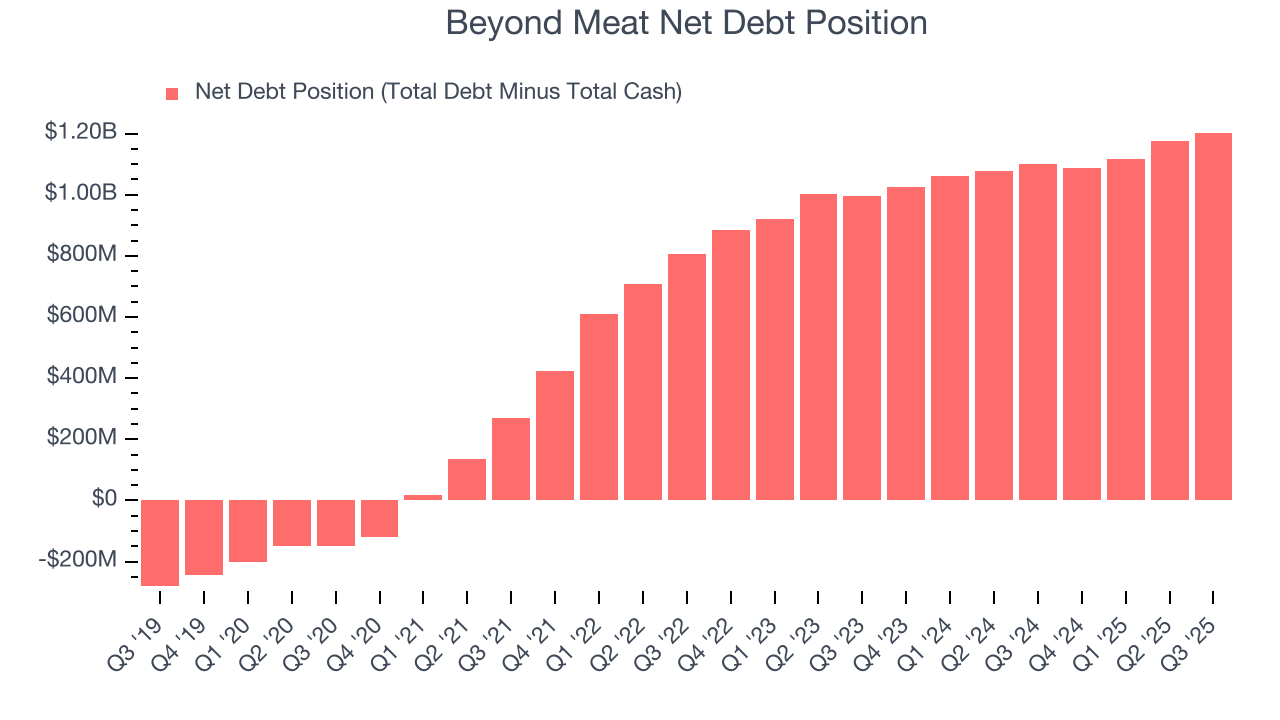

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Beyond Meat burned through $142.9 million of cash over the last year, and its $1.32 billion of debt exceeds the $118.5 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Beyond Meat’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Beyond Meat until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

13. Key Takeaways from Beyond Meat’s Q3 Results

It was encouraging to see Beyond Meat beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3.3% to $1.30 immediately following the results.

14. Is Now The Time To Buy Beyond Meat?

Updated: March 1, 2026 at 9:57 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Beyond Meat.

We cheer for all companies serving everyday consumers, but in the case of Beyond Meat, we’ll be cheering from the sidelines. To kick things off, its revenue has declined over the last three years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash profitability fell over the last year. On top of that, its brand caters to a niche market.

Beyond Meat’s forward price-to-sales ratio is 0.2x. The market typically values companies like Beyond Meat based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy.

Wall Street analysts have a consensus one-year price target of $1.61 on the company (compared to the current share price of $0.91).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.