Calavo (CVGW)

Calavo is up against the odds. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Calavo Will Underperform

A trailblazer in the avocado industry, Calavo Growers (NASDAQ:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

- Sales tumbled by 18.3% annually over the last three years, showing consumer trends are working against its favor

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- Gross margin of 10% is an output of its commoditized products

Calavo’s quality isn’t up to par. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Calavo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Calavo

At $25.90 per share, Calavo trades at 17.2x forward P/E. This multiple expensive for its subpar fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects. That helps the prudent investor sleep well at night.

3. Calavo (CVGW) Research Report: Q3 CY2025 Update

Fresh produce company Calavo Growers (NASDAQ:CVGW) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 26.6% year on year to $124.7 million. Its non-GAAP profit of $0.25 per share was 32.4% below analysts’ consensus estimates.

Calavo (CVGW) Q3 CY2025 Highlights:

- Revenue: $124.7 million vs analyst estimates of $148 million (26.6% year-on-year decline, 15.7% miss)

- Adjusted EPS: $0.25 vs analyst expectations of $0.37 (32.4% miss)

- Adjusted EBITDA: $5.03 million vs analyst estimates of $10.45 million (4% margin, 51.9% miss)

- Operating Margin: -1.4%, down from 1.8% in the same quarter last year

- Market Capitalization: $396.3 million

Company Overview

A trailblazer in the avocado industry, Calavo Growers (NASDAQ:CVGW) is a pioneering California-based provider of high-quality avocados and other fresh food products.

The company's story began in 1924 when a group of farmers in the fertile region of Santa Paula, California formed a cooperative to market and distribute avocados. Their goal was to raise awareness and create a thriving market for this then-unfamiliar fruit among Americans.

Through innovative marketing campaigns and efforts to educate the public on the culinary uses and health benefits of avocados, Calavo Growers played a pivotal role in its integration into American cuisine. Today, avocados have become a staple ingredient in countless dishes and are celebrated for their nutritional benefits.

While avocados lie at the heart of Calavo Growers's business, its product portfolio extends far beyond. The company offers a diverse array of fresh foods, including tomatoes, papayas, pineapples, and pre-packaged guacamole. This diversification allows it to serve the evolving needs and tastes of consumers, making it a versatile player in the fresh produce industry.

Calavo Growers operates across North America, Mexico, and other international markets, and its extensive distribution network ensures products are readily available in grocery stores, restaurants, and food service establishments.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Competitors in the fresh produce category include Dole (NYSE:DOLE), Fresh Del Monte (NYSE:FDP), and Mission Produce (NASDAQ:AVO) along with private companies Chiquita Brands International and Sunkist Growers.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $648.4 million in revenue over the past 12 months, Calavo is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Calavo’s revenue declined by 18.3% per year over the last three years, a rough starting point for our analysis.

This quarter, Calavo missed Wall Street’s estimates and reported a rather uninspiring 26.6% year-on-year revenue decline, generating $124.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 14.7% over the next 12 months, an acceleration versus the last three years. This projection is healthy and suggests its newer products will spur better top-line performance.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Calavo has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 10% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $89.97 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, Calavo’s gross profit margin was 9.3%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Calavo’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 2.8% over the last two years. This profitability was paltry for a consumer staples business and caused by its suboptimal cost structureand low gross margin.

Analyzing the trend in its profitability, Calavo’s operating margin might fluctuated slightly but has generally stayed the same over the last year, meaning it will take a fundamental shift in the business model to change.

This quarter, Calavo generated an operating margin profit margin of negative 1.4%, down 3.2 percentage points year on year. Since Calavo’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

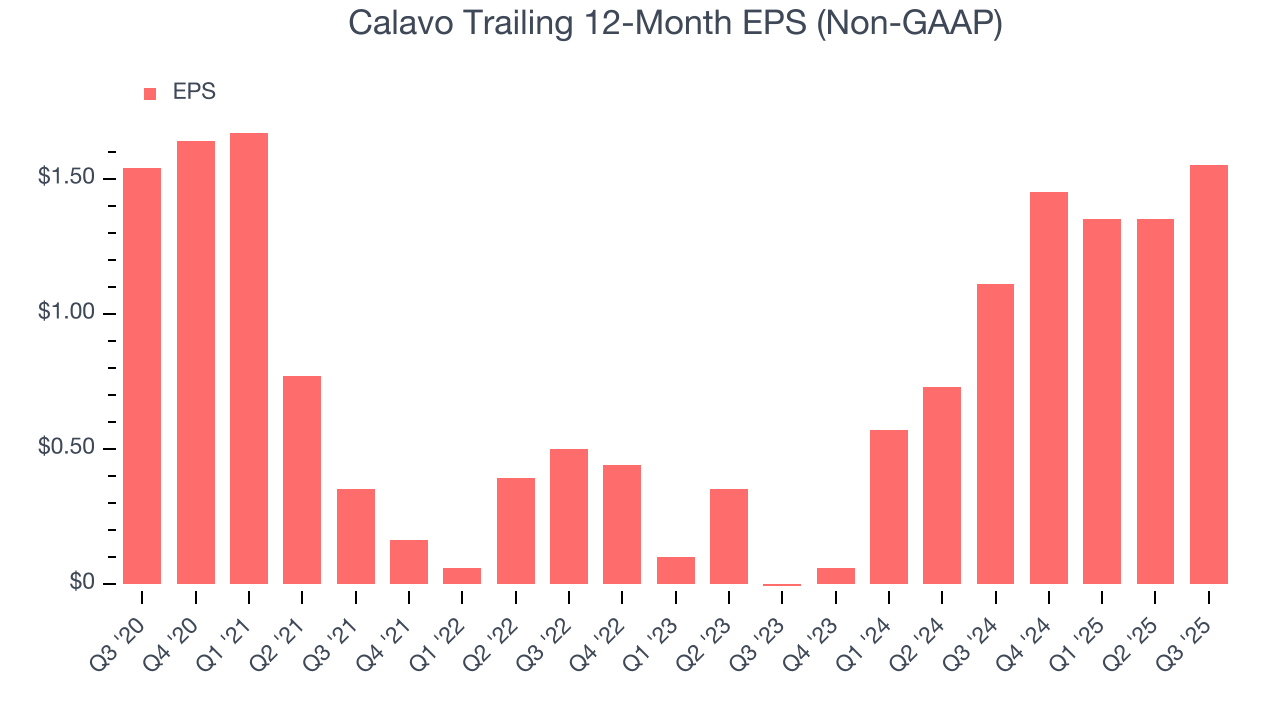

Calavo’s EPS grew at an astounding 45.8% compounded annual growth rate over the last three years, higher than its 18.3% annualized revenue declines. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q3, Calavo reported adjusted EPS of $0.25, up from $0.05 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Calavo’s full-year EPS of $1.55 to grow 17.4%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Calavo has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.3%, subpar for a consumer staples business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Calavo historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.9%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

11. Balance Sheet Assessment

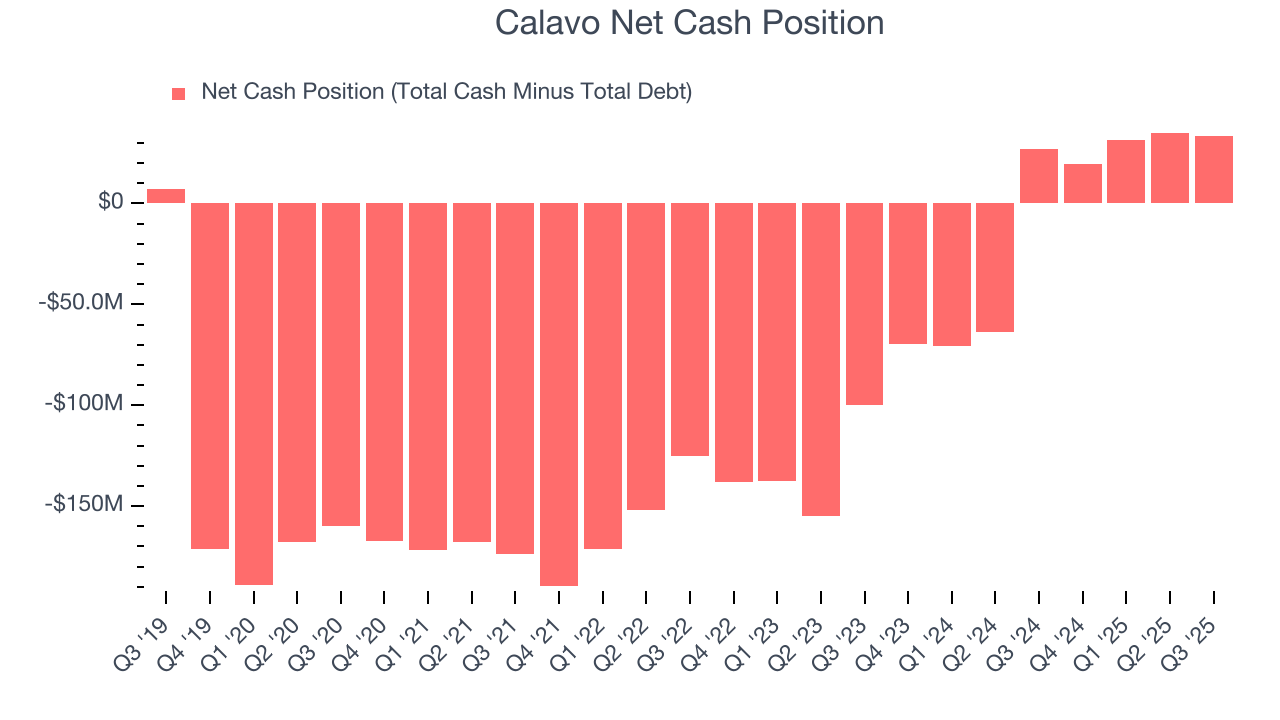

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Calavo is a profitable, well-capitalized company with $61.16 million of cash and $27.92 million of debt on its balance sheet. This $33.24 million net cash position is 7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Calavo’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded up 13.4% to $25.58 immediately following the results.

13. Is Now The Time To Buy Calavo?

Updated: March 6, 2026 at 9:58 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Calavo, you should also grasp the company’s longer-term business quality and valuation.

Calavo doesn’t pass our quality test. To begin with, its revenue has declined over the last three years. While its EPS growth over the last three years has been fantastic, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses. On top of that, its brand caters to a niche market.

Calavo’s P/E ratio based on the next 12 months is 17.2x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $27 on the company (compared to the current share price of $25.90).