Cadence Design Systems (CDNS)

We’re not sold on Cadence Design Systems. Its growth has been lacking and its cash conversion is projected to decline, a situation we’d avoid.― StockStory Analyst Team

1. News

2. Summary

Why Cadence Design Systems Is Not Exciting

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ:CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

- Static operating margin over the last year shows it couldn’t become more efficient

- Sales trends were unexciting over the last five years as its 14.6% annual growth was below the typical software company

- The good news is that its software is difficult to replicate at scale and results in a best-in-class gross margin of 87.4%

Cadence Design Systems’s quality is not up to our standards. Better stocks can be found in the market.

Why There Are Better Opportunities Than Cadence Design Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Cadence Design Systems

Cadence Design Systems’s stock price of $300.15 implies a valuation ratio of 13.5x forward price-to-sales. Not only does Cadence Design Systems trade at a premium to companies in the software space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Cadence Design Systems (CDNS) Research Report: Q4 CY2025 Update

Electronic design automation company Cadence Design Systems (NASDAQ:CDNS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 6.2% year on year to $1.44 billion. The company expects the full year’s revenue to be around $5.95 billion, close to analysts’ estimates. Its non-GAAP profit of $1.99 per share was 4.1% above analysts’ consensus estimates.

Cadence Design Systems (CDNS) Q4 CY2025 Highlights:

- Revenue: $1.44 billion vs analyst estimates of $1.43 billion (6.2% year-on-year growth, 1% beat)

- Adjusted EPS: $1.99 vs analyst estimates of $1.91 (4.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.10 at the midpoint, beating analyst estimates by 0.6%

- Operating Margin: 32.2%, down from 33.7% in the same quarter last year

- Free Cash Flow Margin: 35.6%, up from 20.7% in the previous quarter

- Market Capitalization: $81.51 billion

Company Overview

Powering the chips behind everything from smartphones to AI accelerators for over 35 years, Cadence Design Systems (NASDAQ:CDNS) provides essential computational software, hardware, and intellectual property used by engineers to design and verify advanced electronic systems and semiconductors.

Cadence's solutions form the backbone of modern electronics design, enabling customers to create the complex chips and systems that power our digital world. Its software suite spans the entire design process—from creating initial circuit schematics to verifying functionality, optimizing performance, and preparing designs for manufacturing. These tools help engineers tackle crucial challenges like minimizing power consumption, maximizing performance, and ensuring reliability.

The company organizes its offerings into five main categories: Custom IC Design for creating specialized analog and mixed-signal circuits; Digital IC Design for developing complex digital chips; Functional Verification for ensuring designs work as intended before manufacturing; System Design for creating printed circuit boards and packages; and Intellectual Property, which provides pre-verified design blocks that accelerate development.

A semiconductor company developing a new AI processor might use Cadence's tools to design the chip architecture, simulate its performance, verify its functionality through emulation, and incorporate pre-designed IP blocks for standard interfaces. Increasingly, Cadence is incorporating generative AI and digital twin capabilities across its portfolio to automate complex design tasks and improve productivity.

Cadence operates on a primarily subscription-based business model, with customers typically licensing software access for two to three years. The company also sells and leases specialized hardware for design verification, offers engineering services, and collects royalties when customers ship products containing Cadence IP.

4. Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Cadence's primary competitors include Synopsys (NASDAQ:SNPS), Siemens EDA (formerly Mentor Graphics, now part of OTCMKTS:SIEGY), and ANSYS (NASDAQ:ANSS). The company also competes with specialized tool providers, electronics manufacturers with in-house design capabilities, and emerging Chinese competitors like Huada Empyrean and Xpeedic.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Cadence Design Systems grew its sales at a 14.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Cadence Design Systems.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Cadence Design Systems’s annualized revenue growth of 13.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Cadence Design Systems reported year-on-year revenue growth of 6.2%, and its $1.44 billion of revenue exceeded Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 12.1% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

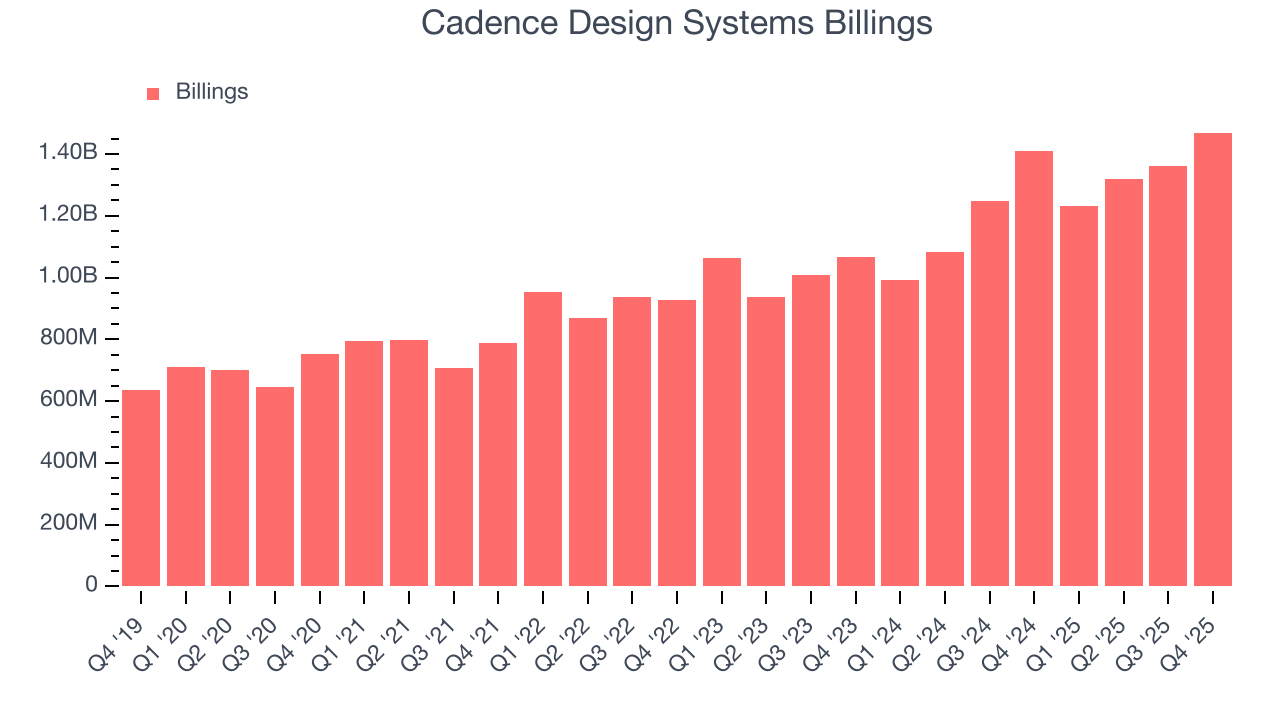

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Cadence Design Systems’s billings came in at $1.47 billion in Q4, and over the last four quarters, its growth slightly lagged the sector as it averaged 14.8% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Cadence Design Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Cadence Design Systems’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 87.4% gross margin over the last year. That means Cadence Design Systems only paid its providers $12.56 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Cadence Design Systems has seen gross margins decline by 1.9 percentage points over the last 2 year, which is poor compared to software peers.

In Q4, Cadence Design Systems produced a 86.9% gross profit margin, up 3.1 percentage points year on year. Cadence Design Systems’s full-year margin has also been trending up over the past 12 months, increasing by 1.4 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

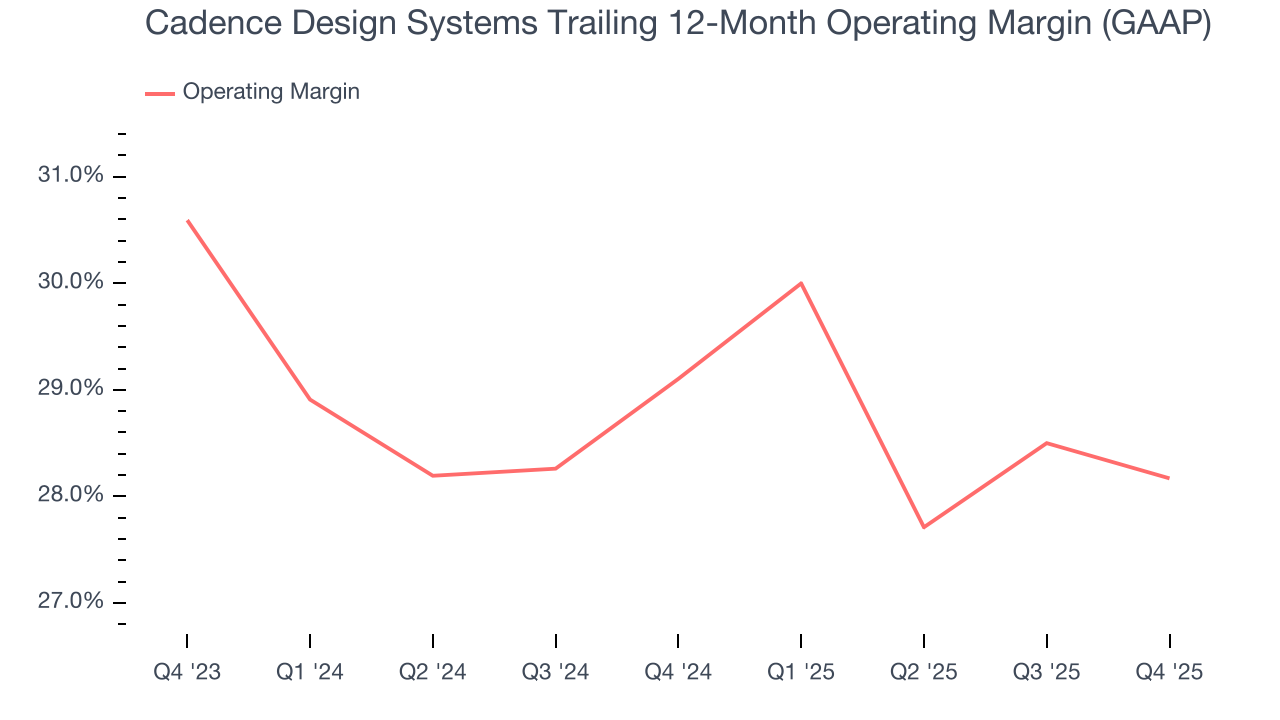

9. Operating Margin

Cadence Design Systems has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 28.2%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Cadence Design Systems’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Cadence Design Systems generated an operating margin profit margin of 32.2%, down 1.5 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

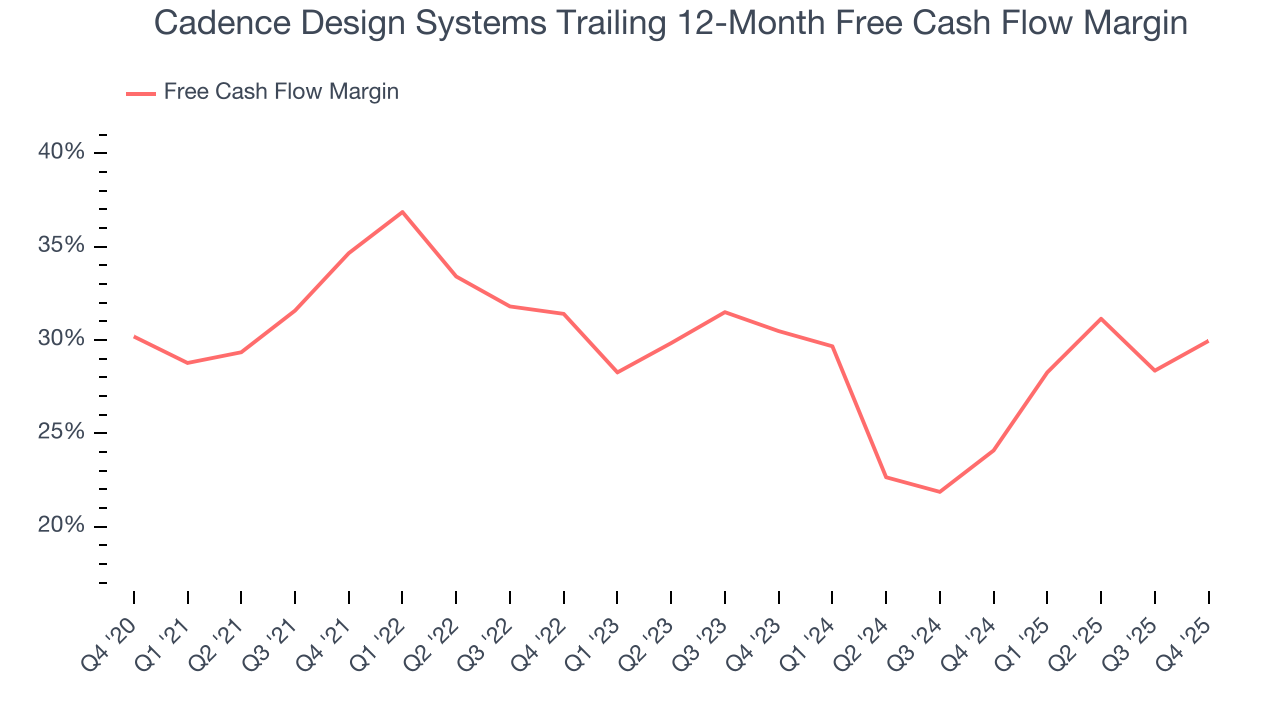

Cadence Design Systems has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 30% over the last year, quite impressive for a software business.

Cadence Design Systems’s free cash flow clocked in at $512.5 million in Q4, equivalent to a 35.6% margin. This result was good as its margin was 5.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Cadence Design Systems’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 30% for the last 12 months will decrease to 28.9%.

11. Balance Sheet Assessment

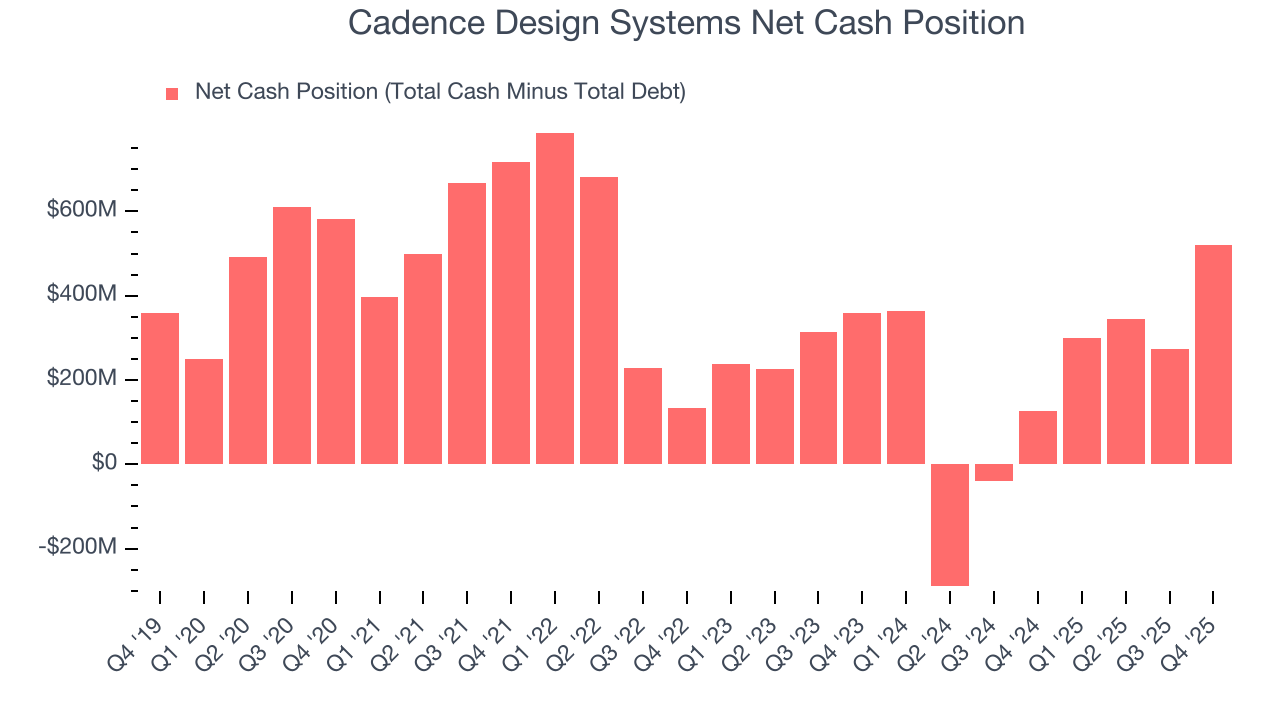

Companies with more cash than debt have lower bankruptcy risk.

Cadence Design Systems is a profitable, well-capitalized company with $3.00 billion of cash and $2.48 billion of debt on its balance sheet. This $521.2 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Cadence Design Systems’s Q4 Results

We were impressed by Cadence Design Systems’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance slightly exceeded Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.2% to $294.71 immediately after reporting.

13. Is Now The Time To Buy Cadence Design Systems?

Updated: February 28, 2026 at 9:51 PM EST

Before deciding whether to buy Cadence Design Systems or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Cadence Design Systems has a few positive attributes, but it doesn’t top our wishlist. Although its revenue growth was a little slower over the last five years, its admirable gross margin indicates excellent unit economics. We advise investors to be cautious with this one, however, as its operating margin hasn't moved over the last year.

Cadence Design Systems’s price-to-sales ratio based on the next 12 months is 13.5x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $371.82 on the company (compared to the current share price of $300.15).