Central Garden & Pet (CENT)

Central Garden & Pet keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Central Garden & Pet Will Underperform

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

- Sales tumbled by 2.1% annually over the last three years, showing consumer trends are working against its favor

- Core business is underperforming as its organic revenue has disappointed over the past two years, suggesting it might need acquisitions to stimulate growth

- Sales are projected to be flat over the next 12 months and imply weak demand

Central Garden & Pet’s quality is insufficient. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Central Garden & Pet

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Central Garden & Pet

Central Garden & Pet is trading at $34.28 per share, or 12.4x forward P/E. This multiple is lower than most consumer staples companies, but for good reason.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Central Garden & Pet (CENT) Research Report: Q4 CY2025 Update

Pet company Central Garden & Pet (NASDAQ:CENT) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 6% year on year to $617.4 million. Its non-GAAP profit of $0.21 per share was 51.8% above analysts’ consensus estimates.

Central Garden & Pet (CENT) Q4 CY2025 Highlights:

- Revenue: $617.4 million vs analyst estimates of $625 million (6% year-on-year decline, 1.2% miss)

- Adjusted EPS: $0.21 vs analyst estimates of $0.14 (51.8% beat)

- Adjusted EBITDA: $49.76 million vs analyst estimates of $44.85 million (8.1% margin, 11% beat)

- Management reiterated its full-year Adjusted EPS guidance of $2.70 at the midpoint

- Operating Margin: 2.7%, down from 4.3% in the same quarter last year

- Free Cash Flow was -$81.03 million compared to -$74.93 million in the same quarter last year

- Market Capitalization: $1.98 billion

Company Overview

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

The company was founded in 1980 and has a plethora of brands under its belt. In its pet care division, it serves pets of all kinds through its comprehensive range of products, including pet food, treats, toys, accessories, and healthcare solutions.

Central Garden & Pet is also equally recognized for its pest control and lawn and garden care expertise, providing a wide array of products such as fertilizers, pesticides, grass seed, and gardening tools. These products empower homeowners and gardeners to maintain lush lawns, vibrant gardens, and pest-free outdoor spaces.

Each brand, whether it be Kaytee for pet care products or Amdro for pest control solutions, caters to a specific niche within the pet care and lawn and garden markets. Many brands often hold market-leading positions and are recognized for their quality.

While headquartered in the United States, Central Garden & Pet’s products are distributed internationally, serving customers around the world. To reach its customer base, the company utilizes an extensive distribution network. Products are available through a wide range of channels, including major retail chains, independent pet stores, garden centers, and online platforms.

4. Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Competitors in the pet care space include Hill's Science Diet (owned by Colgate-Palmolive, NYSE:CL) and private companies Mars Petcare, Nestlé Purina while pest control and lawn and garden competitors include Scotts Miracle-Gro (NYSE:SMG) and Spectrum Brands (NYSE:SPB) along with private company Terminix.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $3.09 billion in revenue over the past 12 months, Central Garden & Pet carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

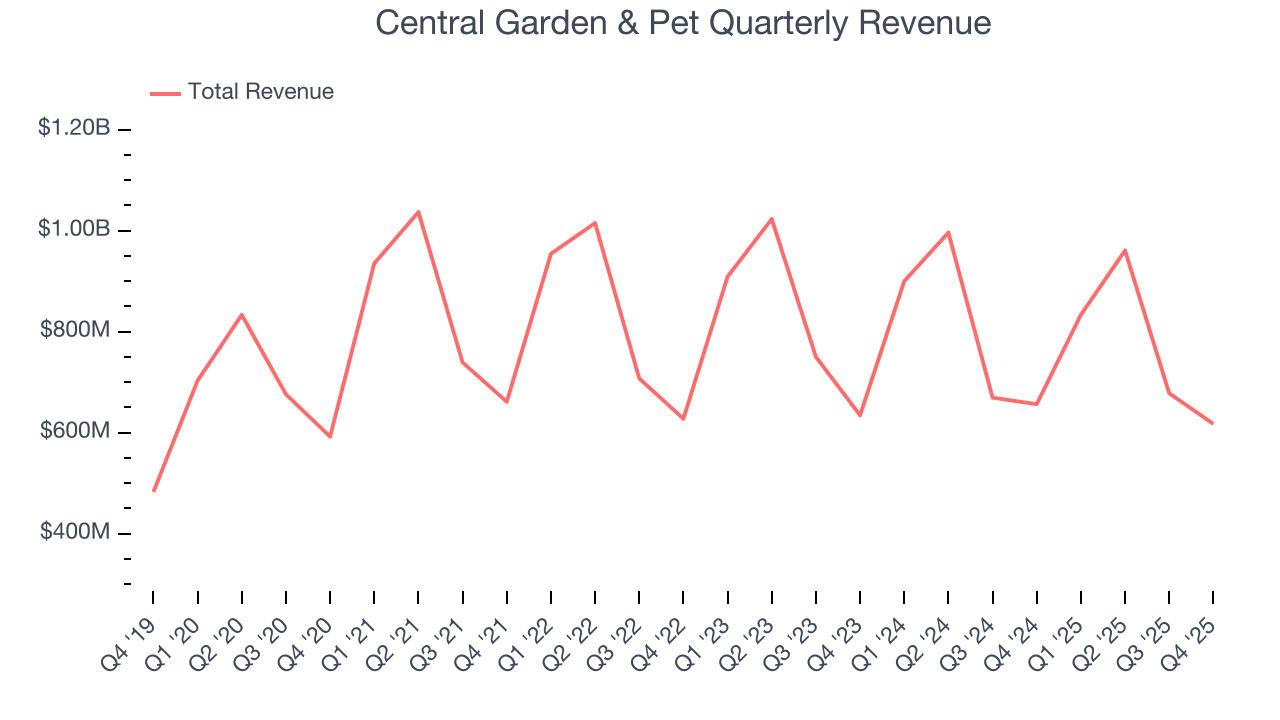

As you can see below, Central Garden & Pet struggled to generate demand over the last three years. Its sales dropped by 2.2% annually, a poor baseline for our analysis.

This quarter, Central Garden & Pet missed Wall Street’s estimates and reported a rather uninspiring 6% year-on-year revenue decline, generating $617.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. Although this projection implies its newer products will fuel better top-line performance, it is still below the sector average.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

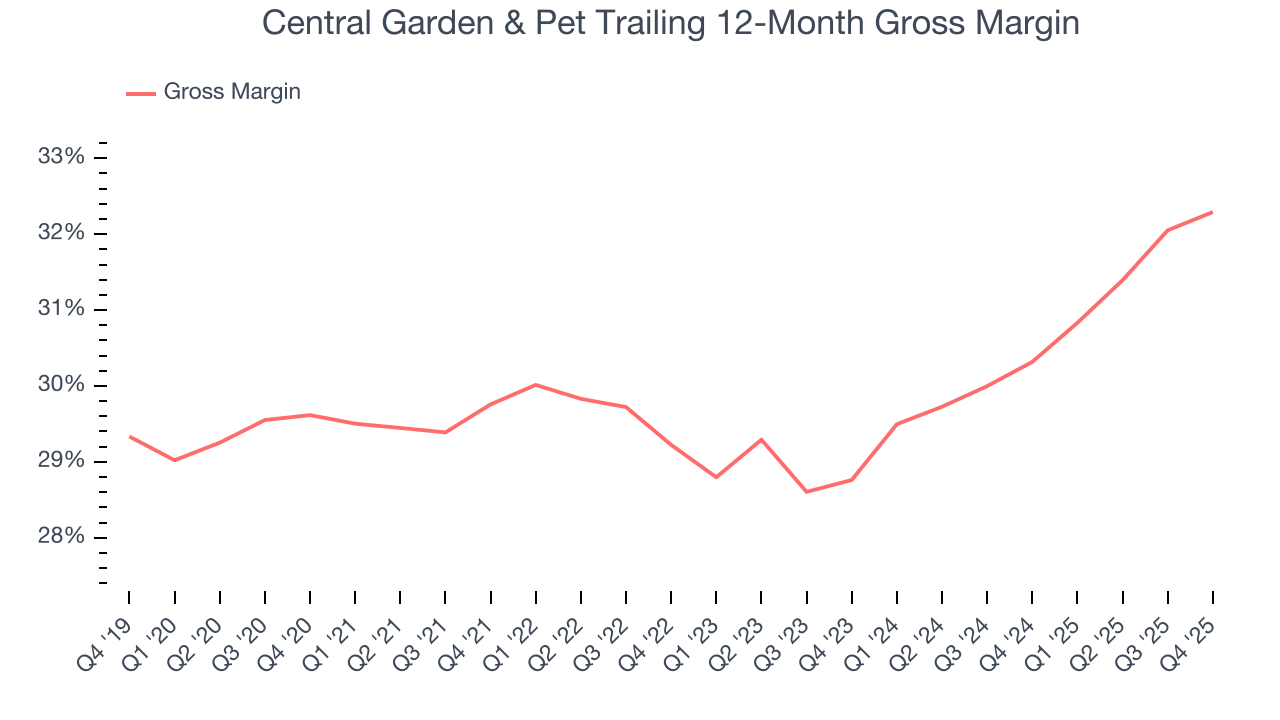

Central Garden & Pet’s unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 31.3% gross margin over the last two years. That means for every $100 in revenue, $68.72 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, Central Garden & Pet’s gross profit margin was 30.9%, marking a 1.1 percentage point increase from 29.8% in the same quarter last year. Central Garden & Pet’s full-year margin has also been trending up over the past 12 months, increasing by 2 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

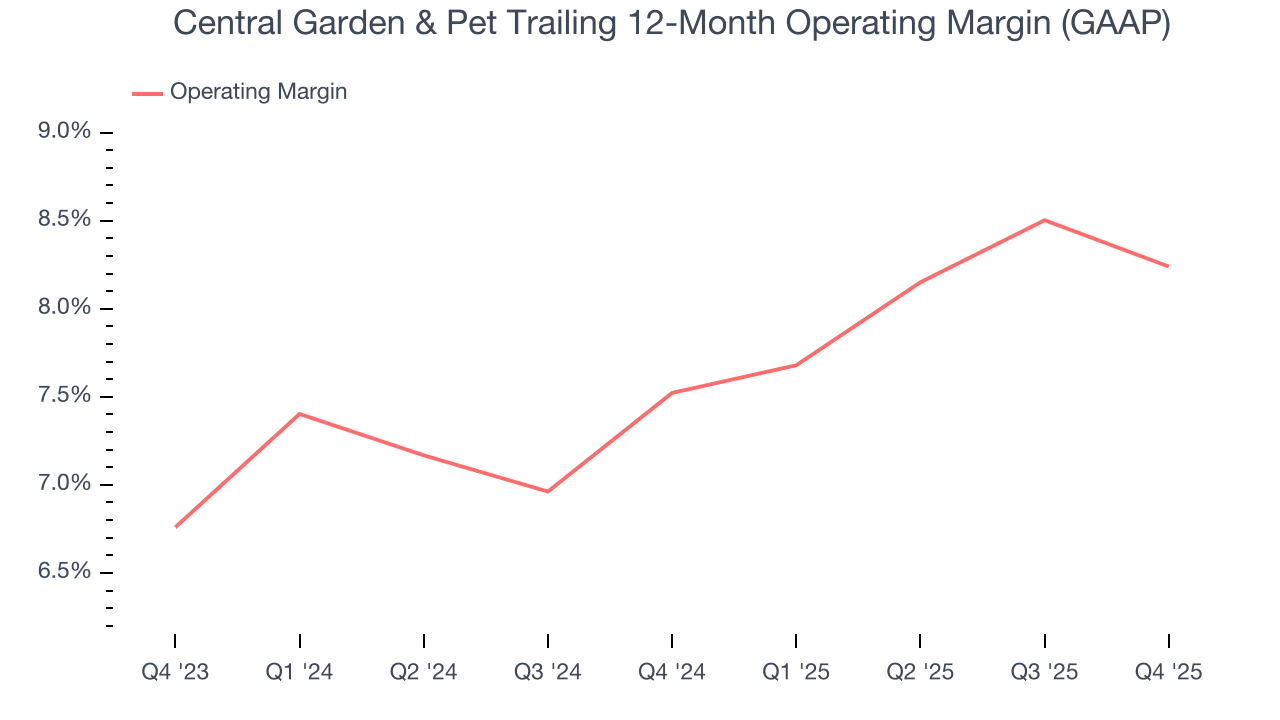

Central Garden & Pet’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 7.9% over the last two years. This profitability was higher than the broader consumer staples sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Central Garden & Pet’s operating margin might fluctuated slightly but has generally stayed the same over the last year. Shareholders will want to see Central Garden & Pet grow its margin in the future.

In Q4, Central Garden & Pet generated an operating margin profit margin of 2.7%, down 1.6 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, and administrative overhead.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

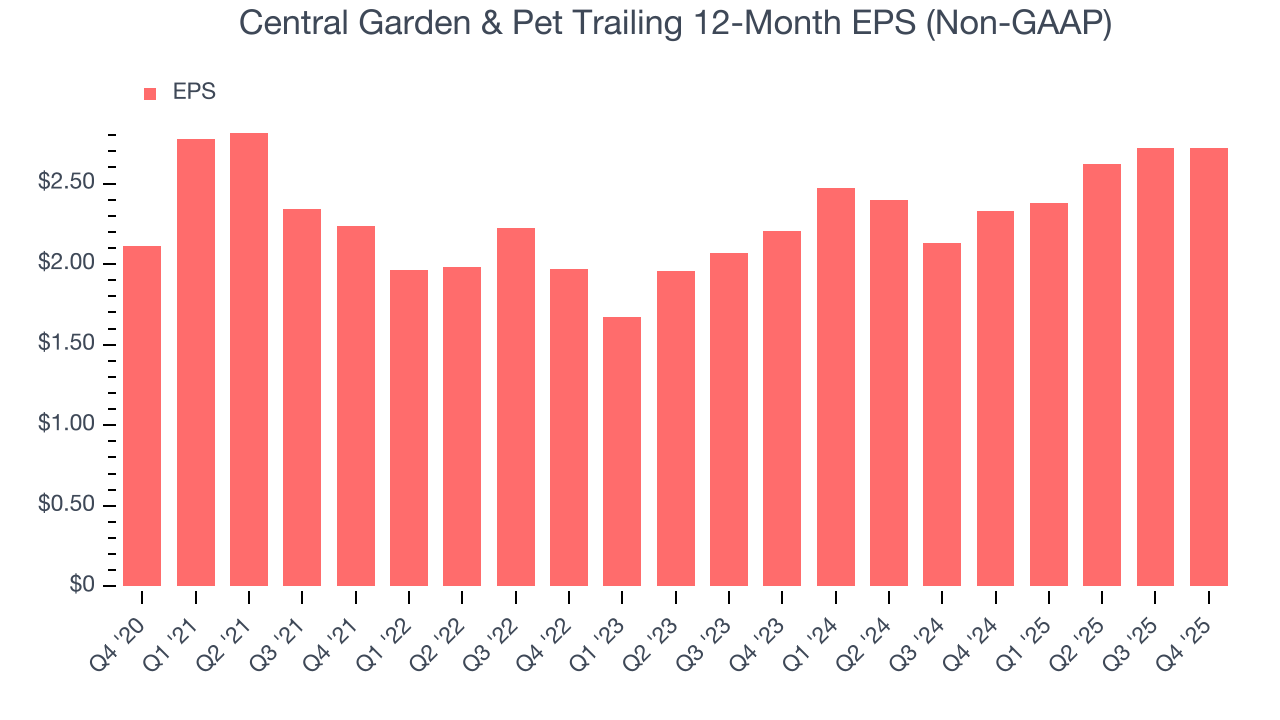

Central Garden & Pet’s EPS grew at a solid 11.4% compounded annual growth rate over the last three years, higher than its 2.2% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

In Q4, Central Garden & Pet reported adjusted EPS of $0.21, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Central Garden & Pet’s full-year EPS of $2.72 to grow 4.3%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

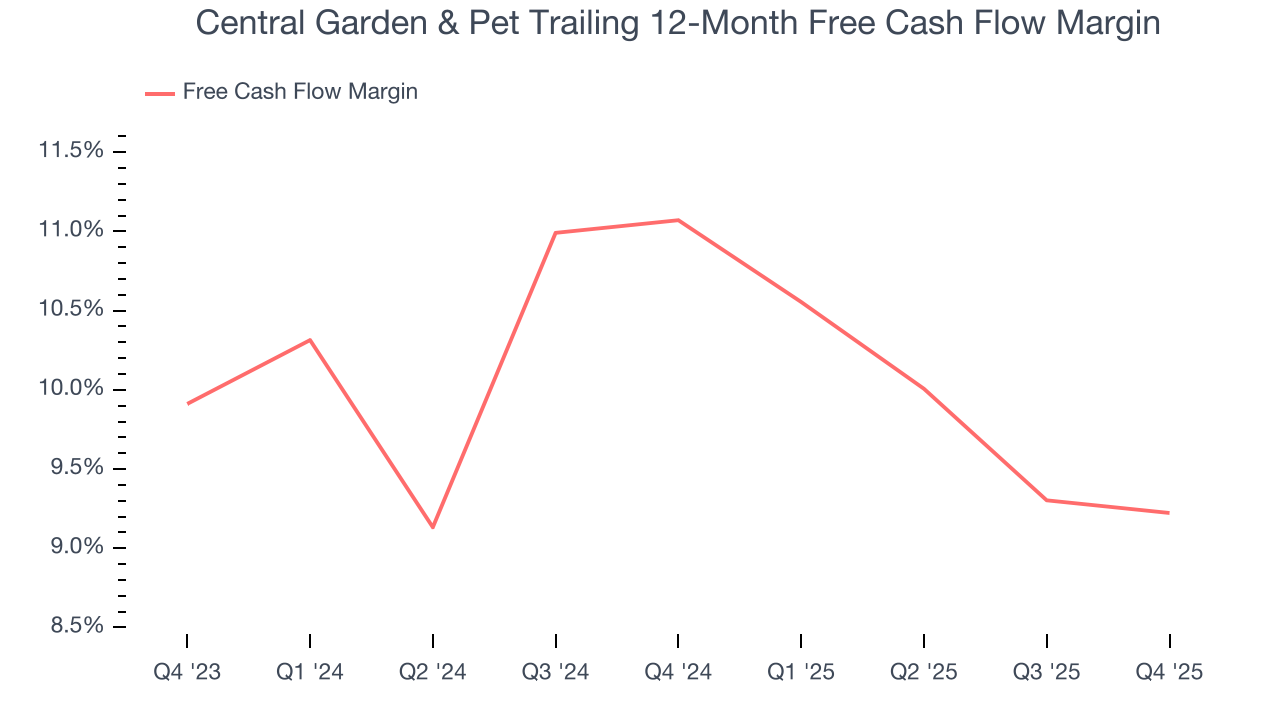

Central Garden & Pet has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.2% over the last two years, quite impressive for a consumer staples business.

Taking a step back, we can see that Central Garden & Pet’s margin dropped by 1.8 percentage points over the last year. This decrease warrants extra caution because Central Garden & Pet failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Central Garden & Pet burned through $81.03 million of cash in Q4, equivalent to a negative 13.1% margin. The company’s cash burn was similar to its $74.93 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

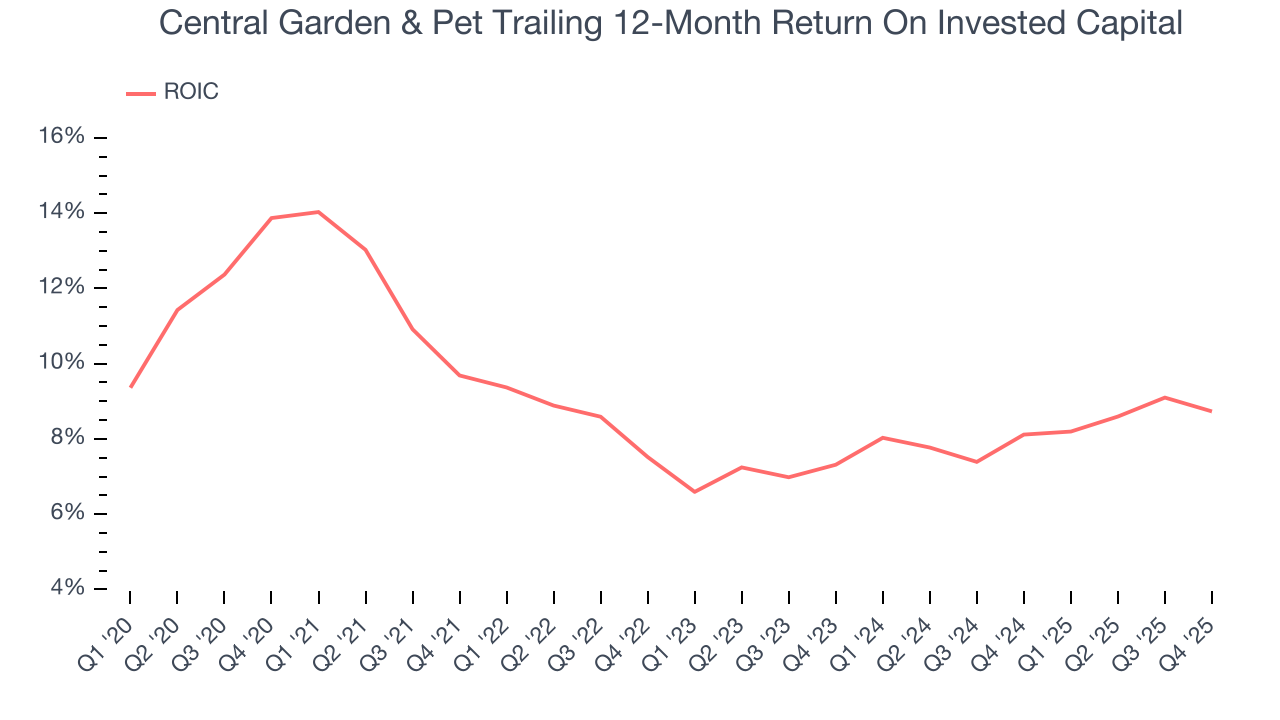

Central Garden & Pet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.3%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

11. Balance Sheet Assessment

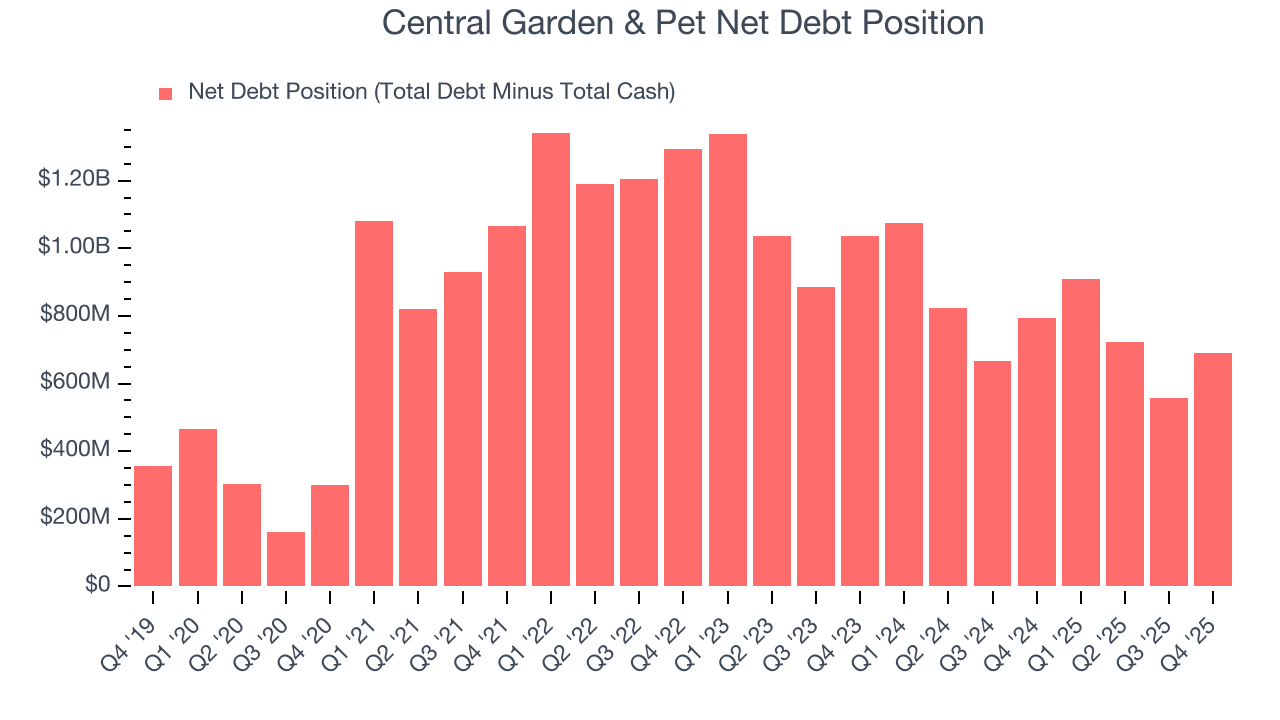

Central Garden & Pet reported $737.2 million of cash and $1.43 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $349.8 million of EBITDA over the last 12 months, we view Central Garden & Pet’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $32.85 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Central Garden & Pet’s Q4 Results

It was good to see Central Garden & Pet beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue slightly missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. Investors were likely hoping for more, and shares traded down 2.4% to $34.26 immediately following the results.

13. Is Now The Time To Buy Central Garden & Pet?

Updated: February 4, 2026 at 9:43 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Central Garden & Pet isn’t a terrible business, but it isn’t one of our picks. To kick things off, its revenue has declined over the last three years. And while its strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its projected EPS for the next year is lacking. On top of that, its mediocre ROIC lags the market and is a headwind for its stock price.

Central Garden & Pet’s P/E ratio based on the next 12 months is 12.2x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $46 on the company (compared to the current share price of $34.26).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.