Columbia Financial (CLBK)

We wouldn’t buy Columbia Financial. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Columbia Financial Will Underperform

Founded during the Roaring Twenties in 1926 and headquartered in Fair Lawn, New Jersey, Columbia Financial (NASDAQ:CLBK) operates federally chartered savings banks in New Jersey that offer traditional banking services including loans, deposits, and insurance products.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 1.7% annually over the last five years

- Earnings per share have dipped by 1% annually over the past five years, which is concerning because stock prices follow EPS over the long term

- Flat net interest income over the last five years suggest it must find different ways to grow during this cycle

Columbia Financial doesn’t check our boxes. There are more appealing investments to be made.

Why There Are Better Opportunities Than Columbia Financial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Columbia Financial

Columbia Financial’s stock price of $16.80 implies a valuation ratio of 1.5x forward P/B. Not only is Columbia Financial’s multiple richer than most banking peers, but it’s also expensive for its revenue characteristics.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Columbia Financial (CLBK) Research Report: Q3 CY2025 Update

Community banking company Columbia Financial (NASDAQ:CLBK) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 29.4% year on year to $64.91 million. Its non-GAAP profit of $0.15 per share was 15.8% above analysts’ consensus estimates.

Columbia Financial (CLBK) Q3 CY2025 Highlights:

- Net Interest Income: $57.39 million vs analyst estimates of $56.2 million (26.7% year-on-year growth, 2.1% beat)

- Revenue: $64.91 million vs analyst estimates of $56.2 million (29.4% year-on-year growth, 15.5% beat)

- Adjusted EPS: $0.15 vs analyst estimates of $0.13 (15.8% beat)

- Tangible Book Value per Share: $9.76 vs analyst estimates of $9.76 (3.6% year-on-year growth, in line)

- Market Capitalization: $1.59 billion

Company Overview

Founded during the Roaring Twenties in 1926 and headquartered in Fair Lawn, New Jersey, Columbia Financial (NASDAQ:CLBK) operates federally chartered savings banks in New Jersey that offer traditional banking services including loans, deposits, and insurance products.

Columbia Financial serves as the holding company for Columbia Bank and Freehold Bank, both federally chartered savings institutions. The company focuses on providing a comprehensive range of financial products to individuals, businesses, and municipalities throughout New Jersey and surrounding areas.

The bank's lending portfolio is diversified across several categories. On the commercial side, Columbia originates multifamily and commercial real estate loans for apartment buildings, office spaces, retail centers, and industrial properties, typically with terms up to ten years. Its commercial business lending includes equipment financing, working capital loans, and lines of credit to various professionals and businesses. For individual consumers, the bank offers residential mortgages with fixed and adjustable rates, home equity products, and personal loans.

A business owner in New Jersey might use Columbia's services to secure financing for expanding their retail operation, while maintaining business checking accounts and utilizing cash management services like remote deposit and lockbox services. Meanwhile, a family might obtain a mortgage for their home purchase, open checking and savings accounts, and later take out a home equity line for renovations.

Columbia generates revenue primarily through the interest spread between loans and deposits, as well as through fee income from services like title insurance (through First Jersey Title Services) and insurance products (via RSI Insurance Agency). The bank also offers wealth management services through third-party relationships. With its community banking model, Columbia emphasizes local decision-making and relationship building while operating dozens of branches across its market area.

4. Thrifts & Mortgage Finance

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

Columbia Financial competes with other regional and community banks in New Jersey and the surrounding area, including Valley National Bank (NASDAQ:VLY), Provident Financial Services (NYSE:PFS), and Investors Bancorp, as well as larger national institutions like Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), and JPMorgan Chase (NYSE:JPM).

5. Sales Growth

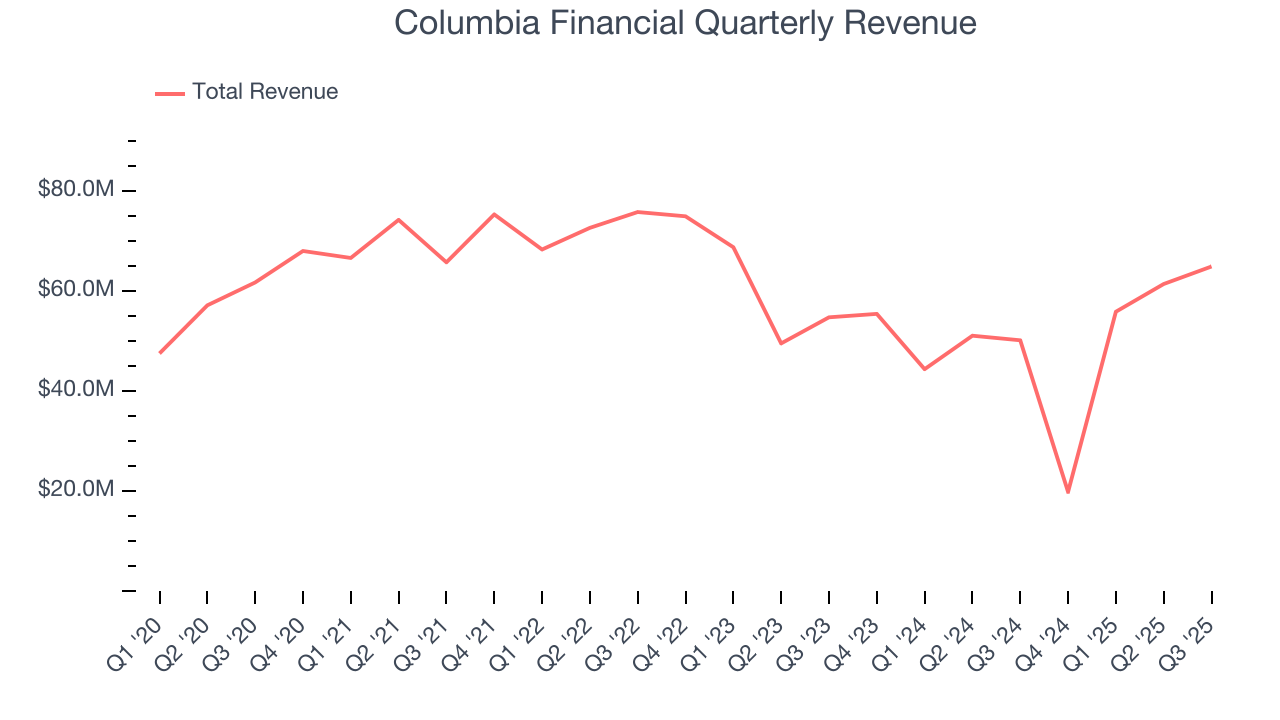

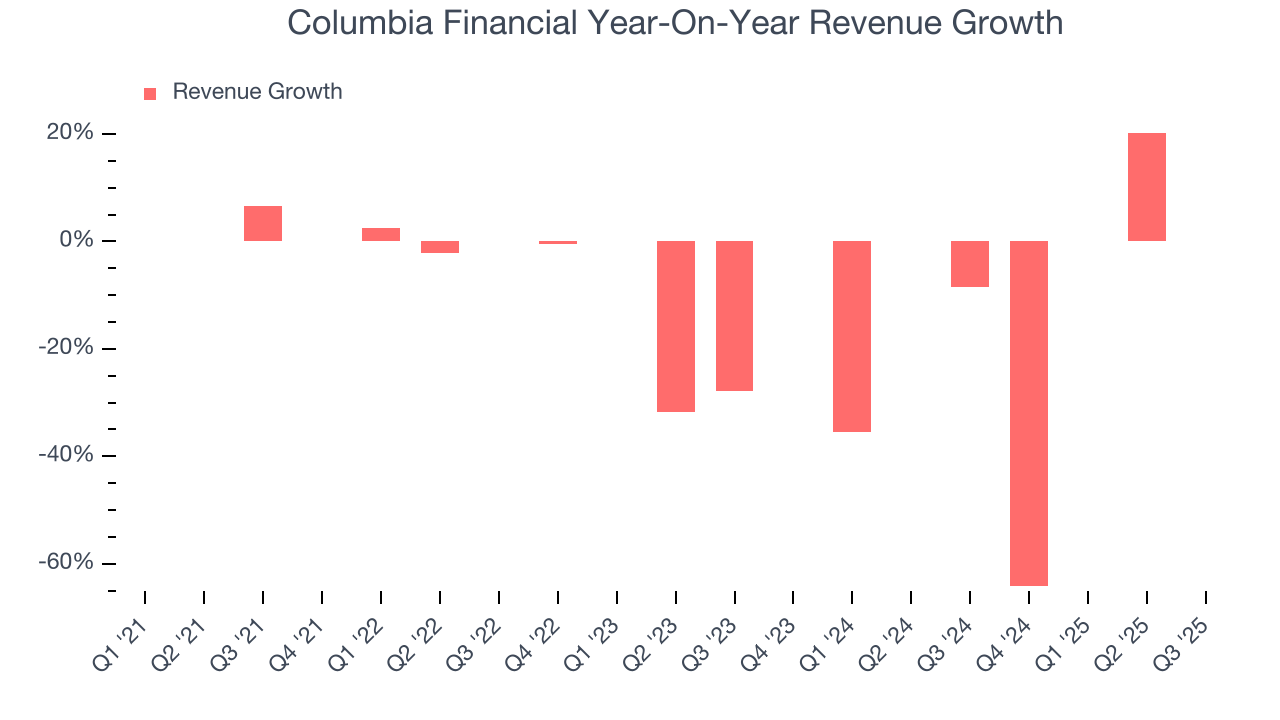

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Regrettably, Columbia Financial’s revenue grew at a tepid 1.8% compounded annual growth rate over the last five years. This was below our standards and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Columbia Financial’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.7% annually.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Columbia Financial reported robust year-on-year revenue growth of 29.4%, and its $64.91 million of revenue topped Wall Street estimates by 15.5%.

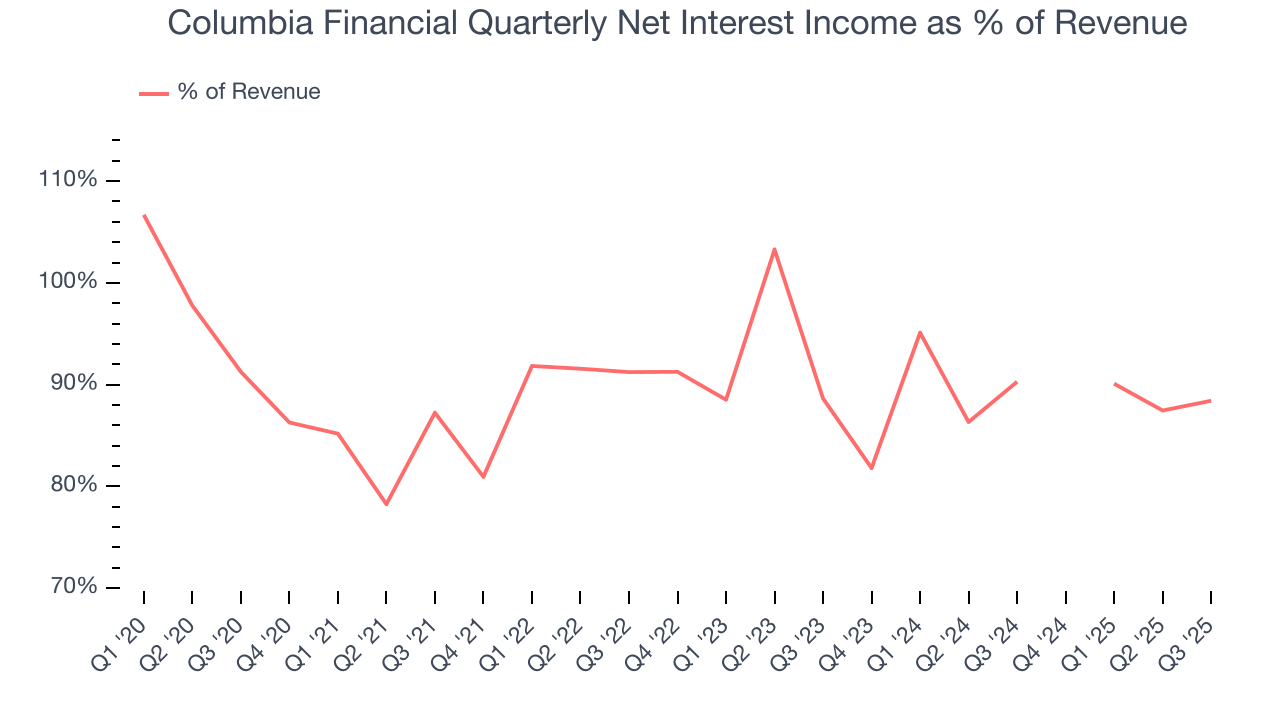

Net interest income made up 95.9% of the company’s total revenue during the last five years, meaning Columbia Financial lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.While banks generate revenue from multiple sources, investors view net interest income as the cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of non-interest income.

6. Earnings Per Share

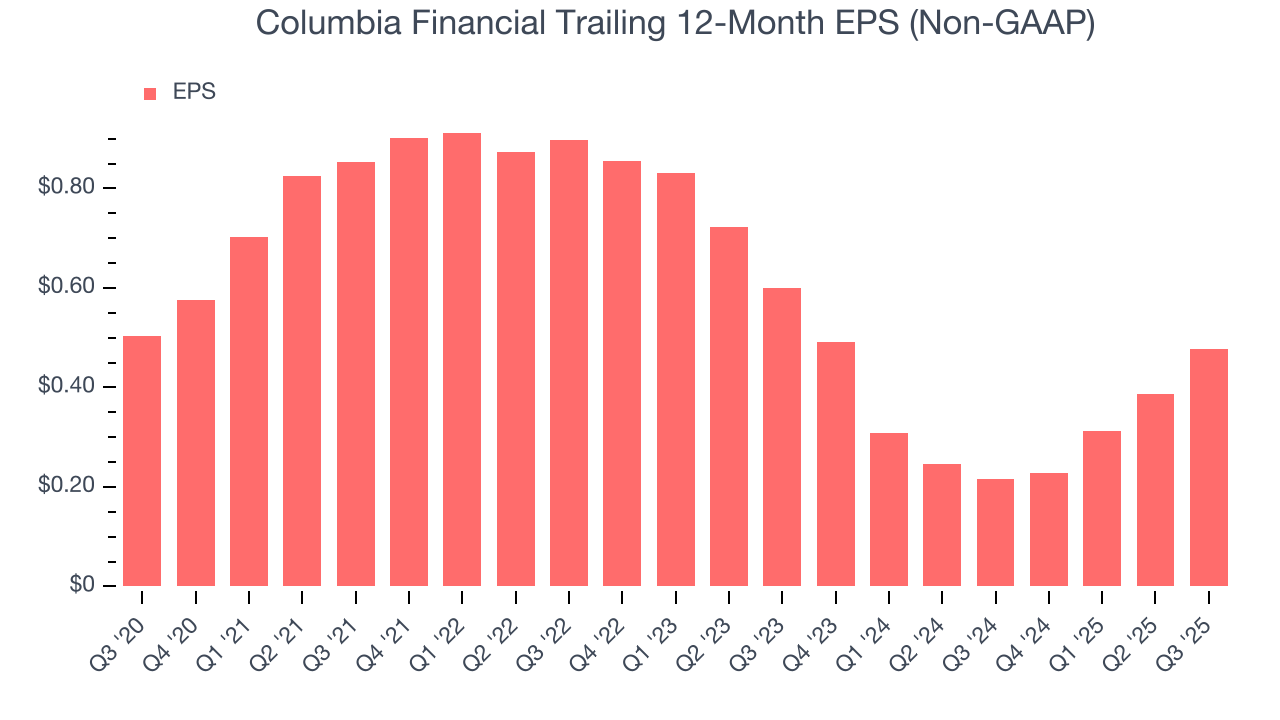

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Columbia Financial, its EPS declined by 1% annually over the last five years while its revenue grew by 1.8%. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Columbia Financial, its two-year annual EPS declines of 10.8% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Columbia Financial reported adjusted EPS of $0.15, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Columbia Financial’s full-year EPS of $0.48 to grow 29.8%.

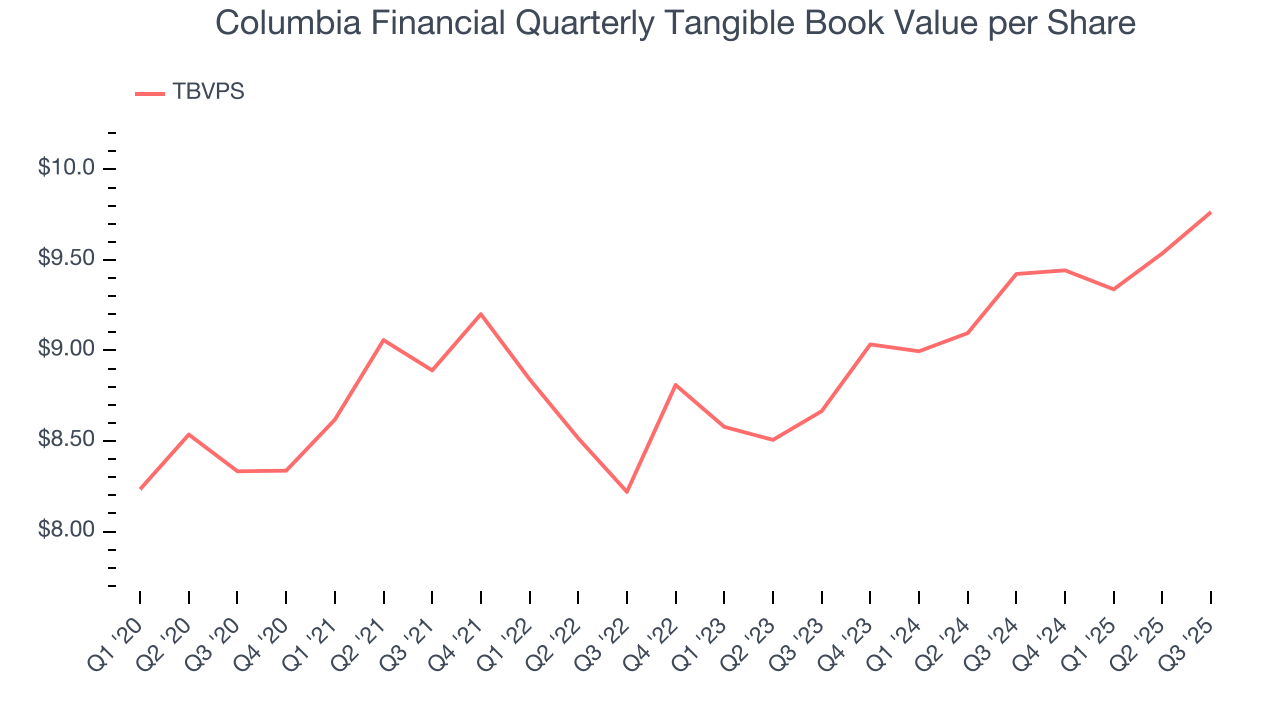

7. Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Columbia Financial’s TBVPS grew at a tepid 3.2% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 6.2% annually over the last two years from $8.66 to $9.76 per share.

Over the next 12 months, Consensus estimates call for Columbia Financial’s TBVPS to grow by 5.9% to $10.35, mediocre growth rate.

8. Balance Sheet Assessment

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Columbia Financial has averaged a Tier 1 capital ratio of 13.4%, which is considered safe and well capitalized in the event that macro or market conditions suddenly deteriorate.

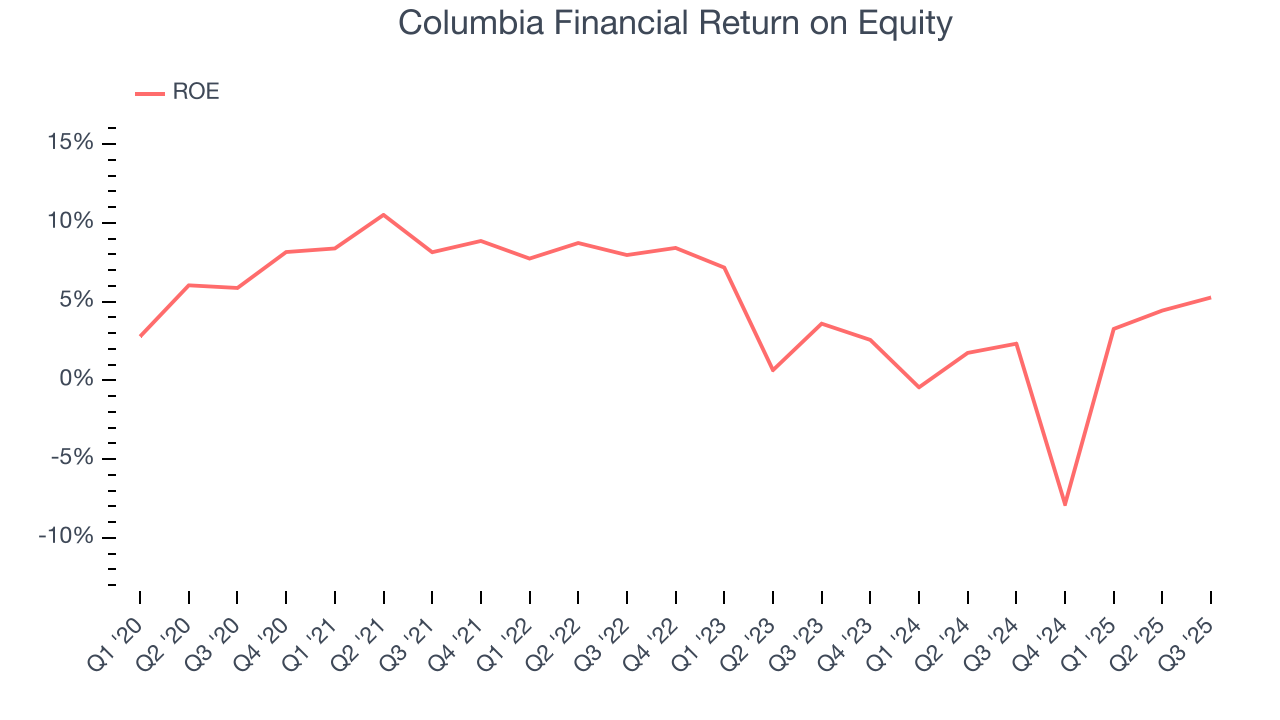

9. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Columbia Financial has averaged an ROE of 5%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

10. Key Takeaways from Columbia Financial’s Q3 Results

We were impressed by how significantly Columbia Financial blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $15.19 immediately after reporting.

11. Is Now The Time To Buy Columbia Financial?

Updated: December 4, 2025 at 11:38 PM EST

Are you wondering whether to buy Columbia Financial or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies supporting the economy, but in the case of Columbia Financial, we’ll be cheering from the sidelines. First off, its revenue has declined over the last five years. And while its estimated net interest income growth for the next 12 months is great, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its net interest margin limits its operating profit potential compared to other banks that can earn more, all else equal..

Columbia Financial’s P/B ratio based on the next 12 months is 1.5x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $17 on the company (compared to the current share price of $16.80).