Vita Coco (COCO)

Vita Coco catches our eye. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Vita Coco Is Interesting

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are growing as it capitalizes on even better market opportunities

- Earnings per share have massively outperformed its peers over the last three years, increasing by 89.3% annually

- A drawback is its smaller revenue base of $609.3 million means it hasn’t achieved the economies of scale that some industry juggernauts enjoy (but also enables it to grow faster if it executes properly)

Vita Coco is solid, but not perfect. We’d wait until its quality rises or its price falls.

Why Should You Watch Vita Coco

High Quality

Investable

Underperform

Why Should You Watch Vita Coco

Vita Coco is trading at $57.63 per share, or 37.5x forward P/E. This valuation represents a premium to consumer staples peers.

Vita Coco can improve its fundamentals over time by putting up good numbers quarter after quarter, year after year. Once that happens, we’ll be happy to recommend the stock.

3. Vita Coco (COCO) Research Report: Q4 CY2025 Update

Coconut water company The Vita Coco Company (NASDAQ:COCO) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales were flat year on year at $127.8 million. The company’s full-year revenue guidance of $690 million at the midpoint came in 0.9% above analysts’ estimates. Its GAAP profit of $0.09 per share was 29.6% below analysts’ consensus estimates.

Vita Coco (COCO) Q4 CY2025 Highlights:

- Revenue: $127.8 million vs analyst estimates of $120.4 million (flat year on year, 6.2% beat)

- EPS (GAAP): $0.09 vs analyst expectations of $0.13 (4c miss)

- Adjusted EBITDA: $14.1 million vs analyst estimates of $10.73 million (11% margin, 31.5% beat)

- EBITDA guidance for the upcoming financial year 2026 is $125 million at the midpoint, above analyst estimates of $122.7 million

- Operating Margin: 8%, up from 3.4% in the same quarter last year

- Free Cash Flow was -$7.12 million, down from $6.80 million in the same quarter last year

- Sales Volumes fell 3.7% year on year (19.3% in the same quarter last year)

- Market Capitalization: $3.22 billion

Company Overview

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

The company’s flagship product is made from young green coconuts, and Vita Coco emphasizes their hydrating properties, natural electrolytes, and delicious taste. For those leading an active lifestyle, the company markets its products as an alternative to sports drinks plain water. Vita Coco also has a commitment to sourcing coconuts from sustainable and ethical suppliers, allowing its customers to not only enjoy something that tastes good but also feel good about how they’re spending their money.

While Vita Coco aims for broad appeal, its core customer is more health-conscious like a fitness buff or nutrition enthusiast. By promoting its products as a healthier alternative to artificially flavored sports drinks or sugary sodas, the company caters to the growing demand for functional beverages featuring natural and clean ingredients.

Vita Coco's products can be found in a wide range of locations, and the list is growing. Grocery stores, convenience stores, health food stores, and fitness centers are the most common sellers today. As the company adds flavored variations such as pineapple, mango, and peach as well as caffeinated versions, its presence on shelves could continue to grow.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors that offer coconut or other hydrating drinks include ZICO from Coca-Cola (NYSE:KO), ONE Coconut Water from PepsiCo (NASDAQ:PEP), and private companies Harmless Harvest and Naked Juice.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $609.8 million in revenue over the past 12 months, Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

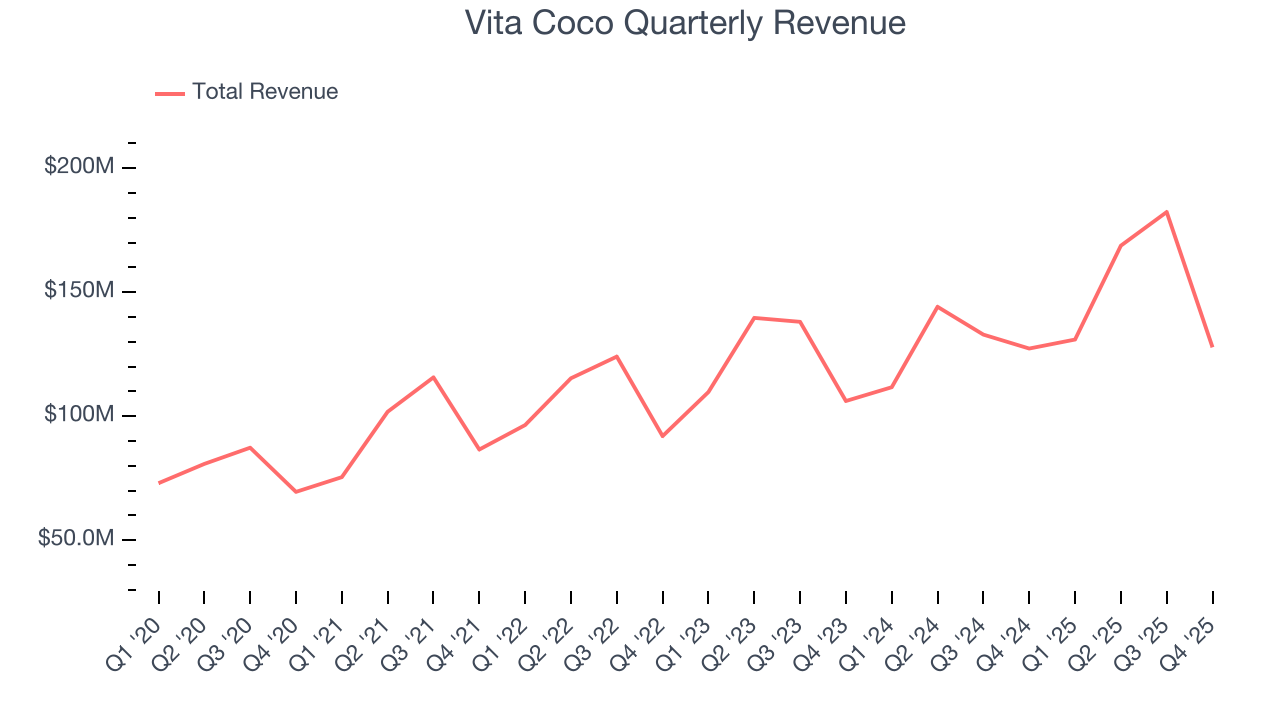

As you can see below, Vita Coco’s sales grew at a solid 12.5% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Vita Coco’s $127.8 million of revenue was flat year on year but beat Wall Street’s estimates by 6.2%.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, similar to its three-year rate. This projection is admirable and indicates the market is baking in success for its products.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

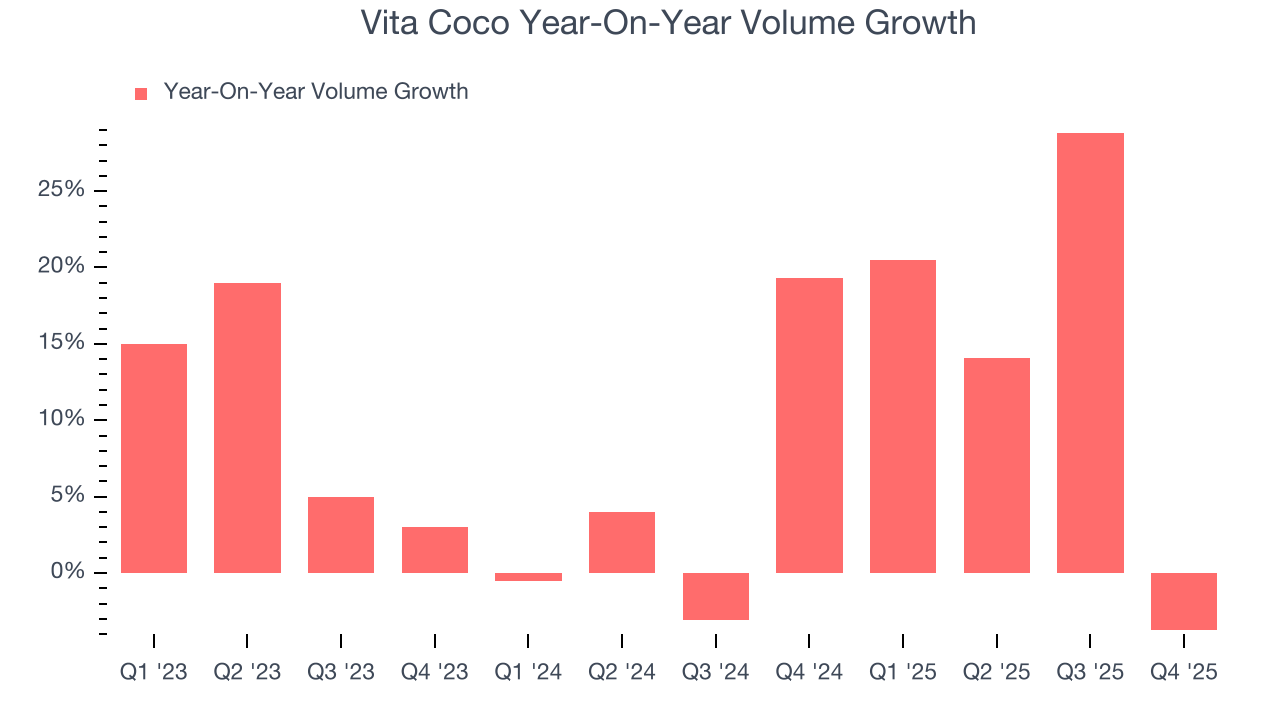

Vita Coco’s average quarterly volume growth was a robust 9.9% over the last two years. This is good because meaningful volume growth is hard to come by in the stable consumer staples sector.

In Vita Coco’s Q4 2025, sales volumes dropped 3.7% year on year. This result was a reversal from its historical levels. A one quarter hiccup shouldn’t deter you from investing in a business, and we’ll be monitoring the company to see how things progress.

7. Gross Margin & Pricing Power

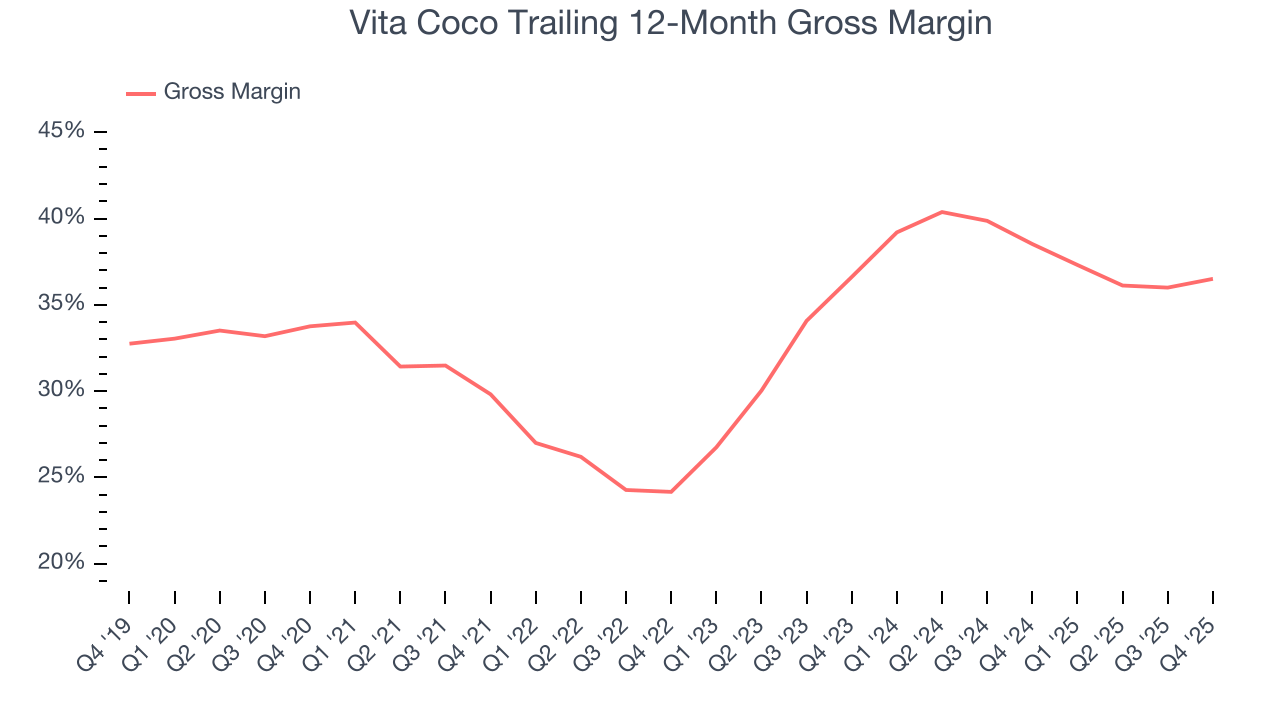

Vita Coco has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 37.4% gross margin over the last two years. Said differently, Vita Coco paid its suppliers $62.57 for every $100 in revenue.

Vita Coco’s gross profit margin came in at 34.9% this quarter , marking a 2.4 percentage point increase from 32.5% in the same quarter last year. Zooming out, however, Vita Coco’s full-year margin has been trending down over the past 12 months, decreasing by 2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

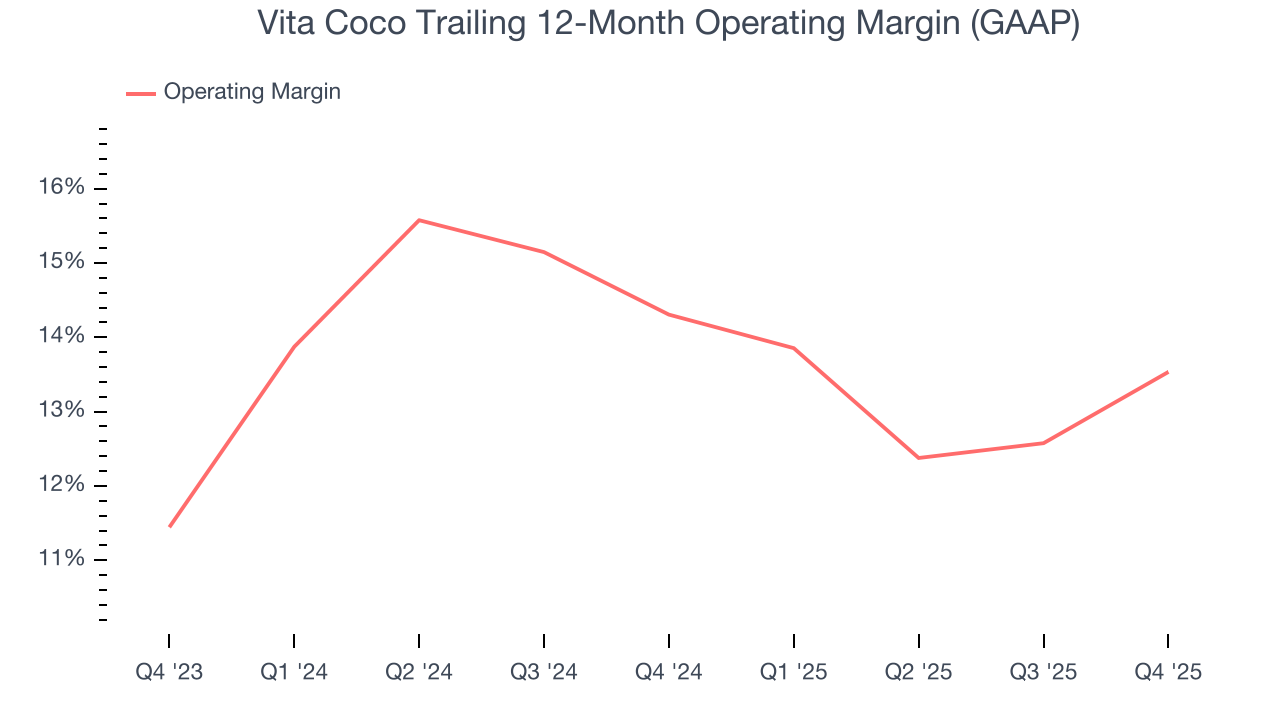

Vita Coco’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 13.9% over the last two years. This profitability was solid for a consumer staples business and shows it’s an efficient company that manages its expenses well. This is seen in its fast historical revenue growth and healthy gross margin, which is why we look at all three data points together.

Looking at the trend in its profitability, Vita Coco’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Vita Coco generated an operating margin profit margin of 8%, up 4.6 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, and administrative overhead.

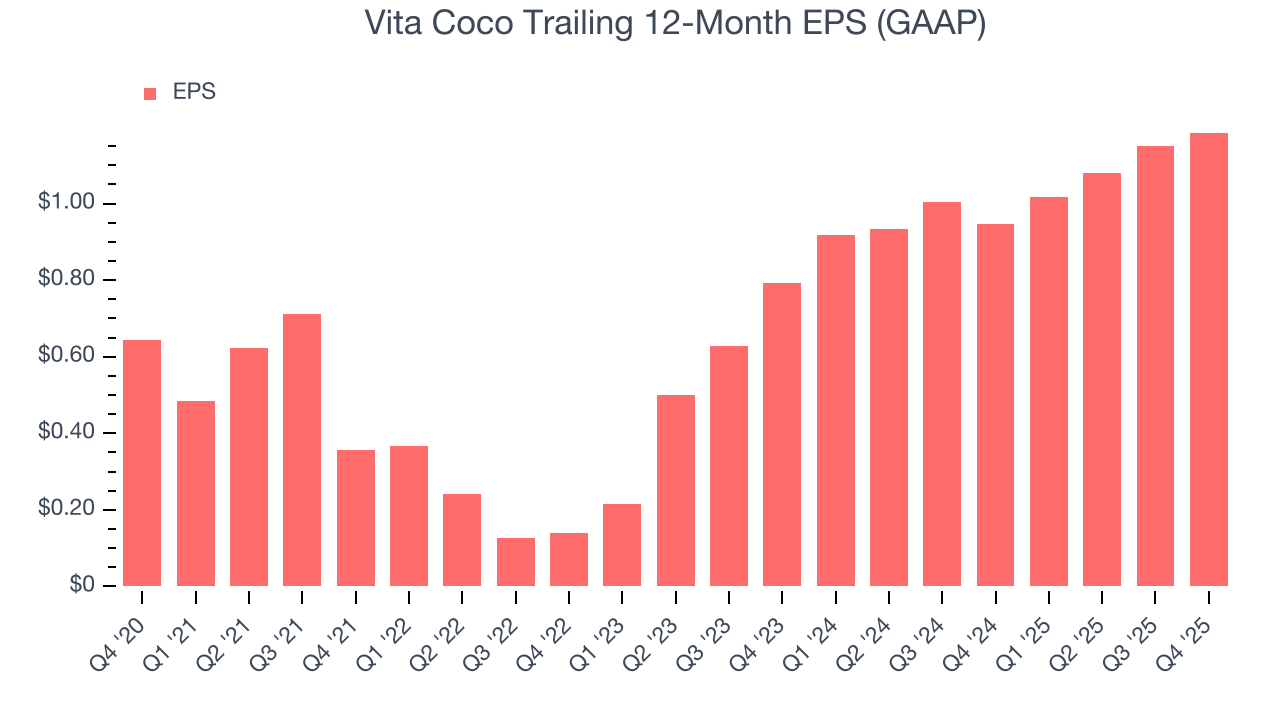

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Vita Coco’s EPS grew at an astounding 104% compounded annual growth rate over the last three years, higher than its 12.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Vita Coco reported EPS of $0.09, up from $0.06 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Vita Coco’s full-year EPS of $1.19 to grow 26.3%.

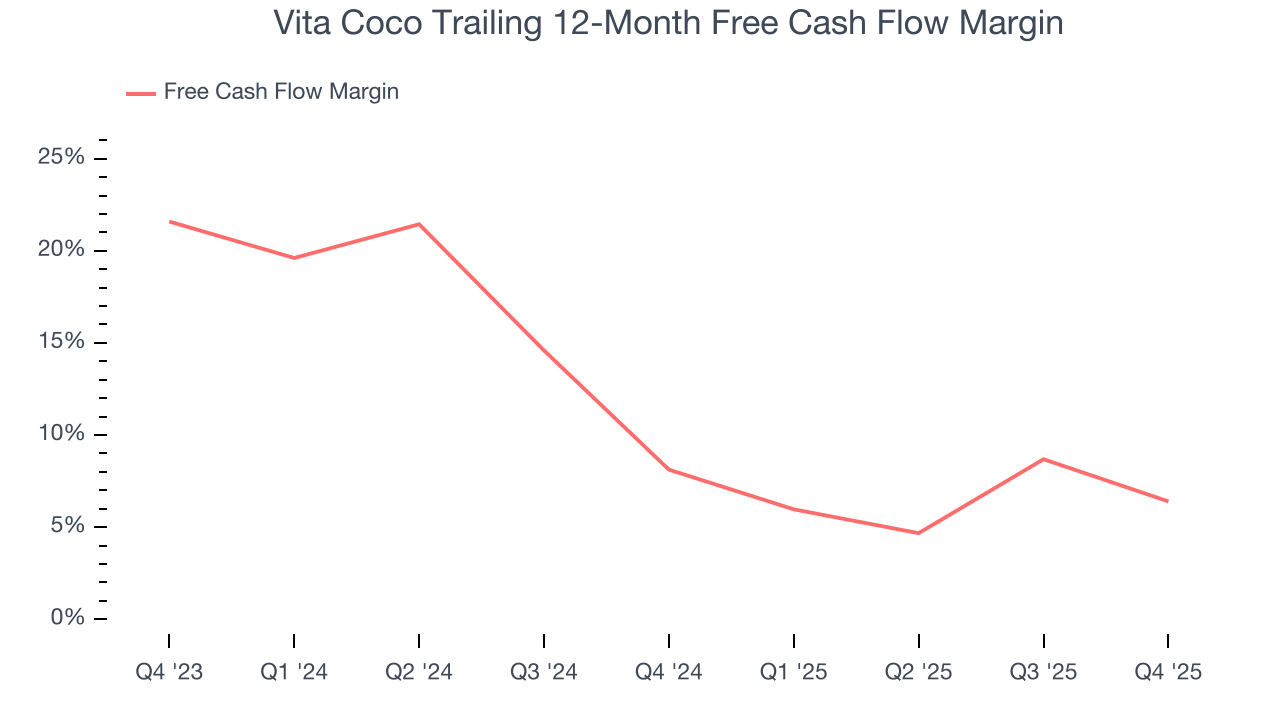

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Vita Coco has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.2% over the last two years, better than the broader consumer staples sector.

Taking a step back, we can see that Vita Coco’s margin dropped by 1.7 percentage points over the last year. We’re willing to live with its performance for now but hope its cash conversion can rise soon. Continued declines could signal it is in the middle of an investment cycle.

Vita Coco burned through $7.12 million of cash in Q4, equivalent to a negative 5.6% margin. The company’s cash flow turned negative after being positive in the same quarter last year, which isn’t ideal considering its longer-term trend.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Vita Coco’s five-year average ROIC was 36.9%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

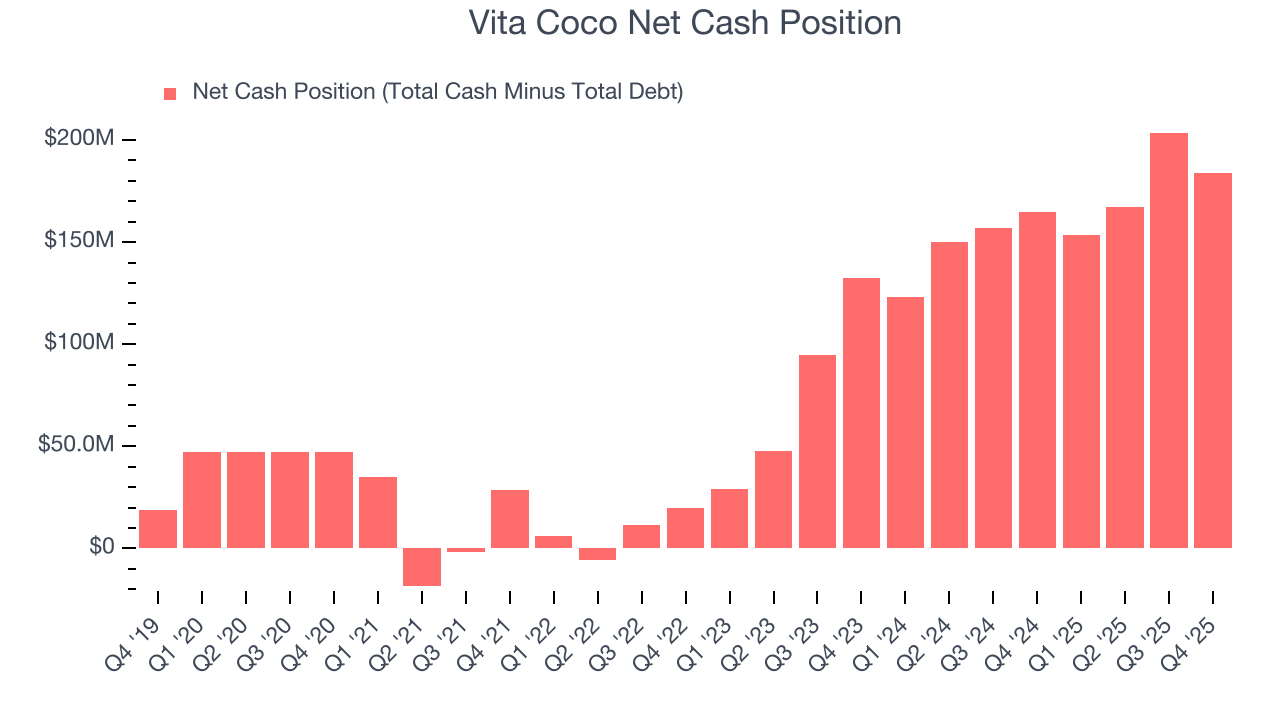

12. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Vita Coco is a profitable, well-capitalized company with $196.9 million of cash and $13.09 million of debt on its balance sheet. This $183.8 million net cash position is 5.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Vita Coco’s Q4 Results

We liked that Vita Coco beat analysts’ revenue and EBITDA expectations this quarter. We were also excited its EBITDA guidance outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 4.4% to $59.00 immediately after reporting.

14. Is Now The Time To Buy Vita Coco?

Updated: February 18, 2026 at 7:19 AM EST

Before investing in or passing on Vita Coco, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

First, the company’s revenue growth was solid over the last three years, and analysts believe it can continue growing at these levels. And while its brand caters to a niche market, its stellar ROIC suggests it has been a well-run company historically. On top of that, Vita Coco’s EPS growth over the last three years has been fantastic.

Vita Coco’s P/E ratio based on the next 12 months is 34.4x. This valuation tells us that a lot of optimism is priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $58.78 on the company (compared to the current share price of $59.00).