Crocs (CROX)

Crocs is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Crocs Will Underperform

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

- Sales were flat over the last two years, indicating it’s failed to expand its business

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

- Underwhelming constant currency revenue performance over the past two years suggests its product offering at current prices doesn’t resonate with customers

Crocs doesn’t meet our quality criteria. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Crocs

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Crocs

At $92.01 per share, Crocs trades at 7x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Crocs (CROX) Research Report: Q4 CY2025 Update

Footwear company Crocs (NASDAQ:CROX) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, but sales fell by 3.2% year on year to $957.6 million. On the other hand, next quarter’s revenue guidance of $895.2 million was less impressive, coming in 1% below analysts’ estimates. Its non-GAAP profit of $2.29 per share was 19.7% above analysts’ consensus estimates.

Crocs (CROX) Q4 CY2025 Highlights:

- Revenue: $957.6 million vs analyst estimates of $918.2 million (3.2% year-on-year decline, 4.3% beat)

- Adjusted EPS: $2.29 vs analyst estimates of $1.91 (19.7% beat)

- Adjusted EBITDA: $204 million vs analyst estimates of $162.2 million (21.3% margin, 25.8% beat)

- Revenue Guidance for Q1 CY2026 is $895.2 million at the midpoint, below analyst estimates of $904.6 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $13.12 at the midpoint, beating analyst estimates by 10%

- Operating Margin: 15.3%, down from 20.2% in the same quarter last year

- Free Cash Flow Margin: 25.7%, down from 30.7% in the same quarter last year

- Constant Currency Revenue was flat year on year (3.8% in the same quarter last year)

- Market Capitalization: $4.29 billion

Company Overview

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

The original Crocs shoe, made from the company's proprietary closed-cell resin called Croslite, was initially intended for boating and outdoor wear due to its slip-resistant, non-marking sole. However, the comfort and functionality of the shoes quickly made them a cross-cultural phenomenon, expanding their use to casual wear, professional use, and even as a fashion statement.

Crocs has capitalized on the popularity of its signature clog by offering a broad assortment of footwear styles, including sandals, wedges, slides, and boots. The brand is also known for its wide range of colors and the ability to personalize shoes with "Jibbitz" charms, small decorative pieces that fit into the holes of the Crocs clogs.

The company sells its products in more than 90 countries through wholesalers, retail stores, and directly to consumers through its website and company-owned stores. Despite its simple product line, Crocs has maintained its relevance through strategic collaborations with designers, celebrities, and brands, elevating the relevance of its products.

4. Footwear

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Crocs primary competitors include Skechers (NYSE:SKX), Deckers (NYSE:DECK), Birkenstock (private), and private companies Sanuk and Teva.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Crocs grew its sales at a 23.9% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Crocs’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 2.8% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Crocs.

This quarter, Crocs’s revenue fell by 3.2% year on year to $957.6 million but beat Wall Street’s estimates by 4.3%. Company management is currently guiding for a 4.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 1.6% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Crocs’s operating margin has been trending down over the last 12 months and averaged 14.4% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Crocs generated an operating margin profit margin of 15.3%, down 4.9 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

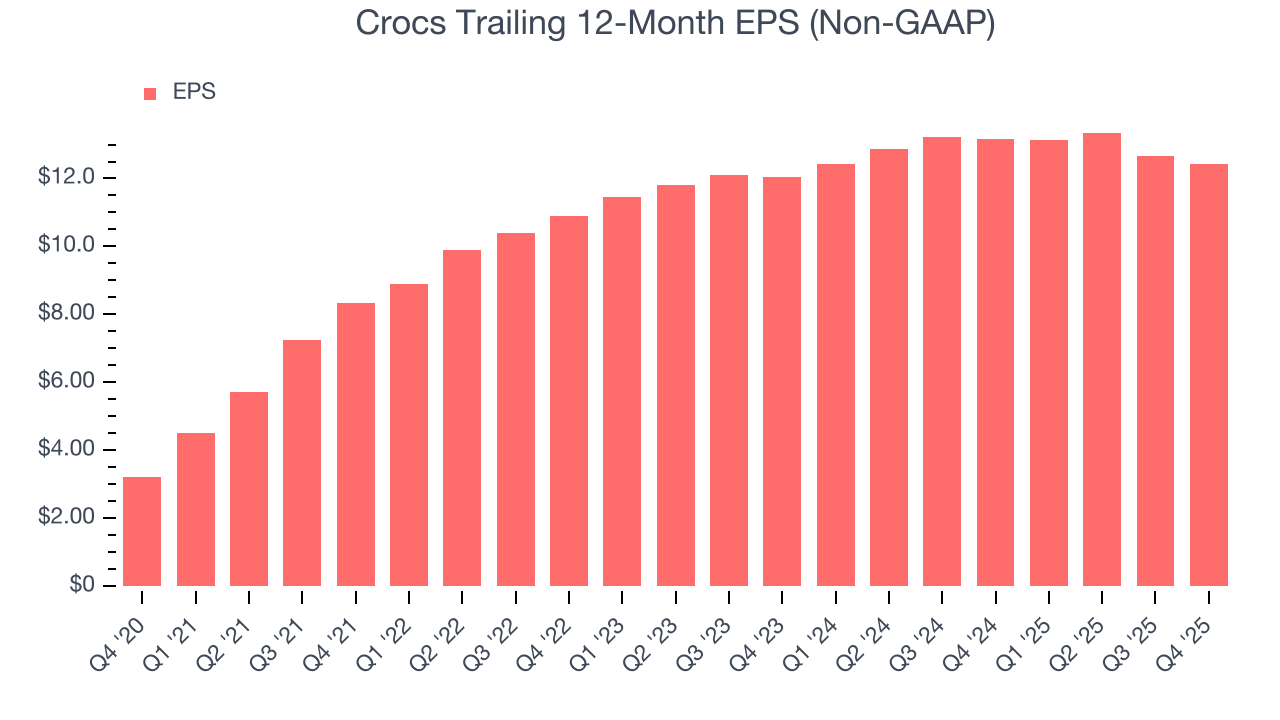

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Crocs’s EPS grew at a decent 31% compounded annual growth rate over the last five years, higher than its 23.9% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Crocs reported adjusted EPS of $2.29, down from $2.52 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Crocs’s full-year EPS of $12.44 to shrink by 5%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Crocs has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 19.4%, lousy for a consumer discretionary business.

Crocs’s free cash flow clocked in at $246.4 million in Q4, equivalent to a 25.7% margin. The company’s cash profitability regressed as it was 4.9 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Crocs historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 29%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Crocs’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

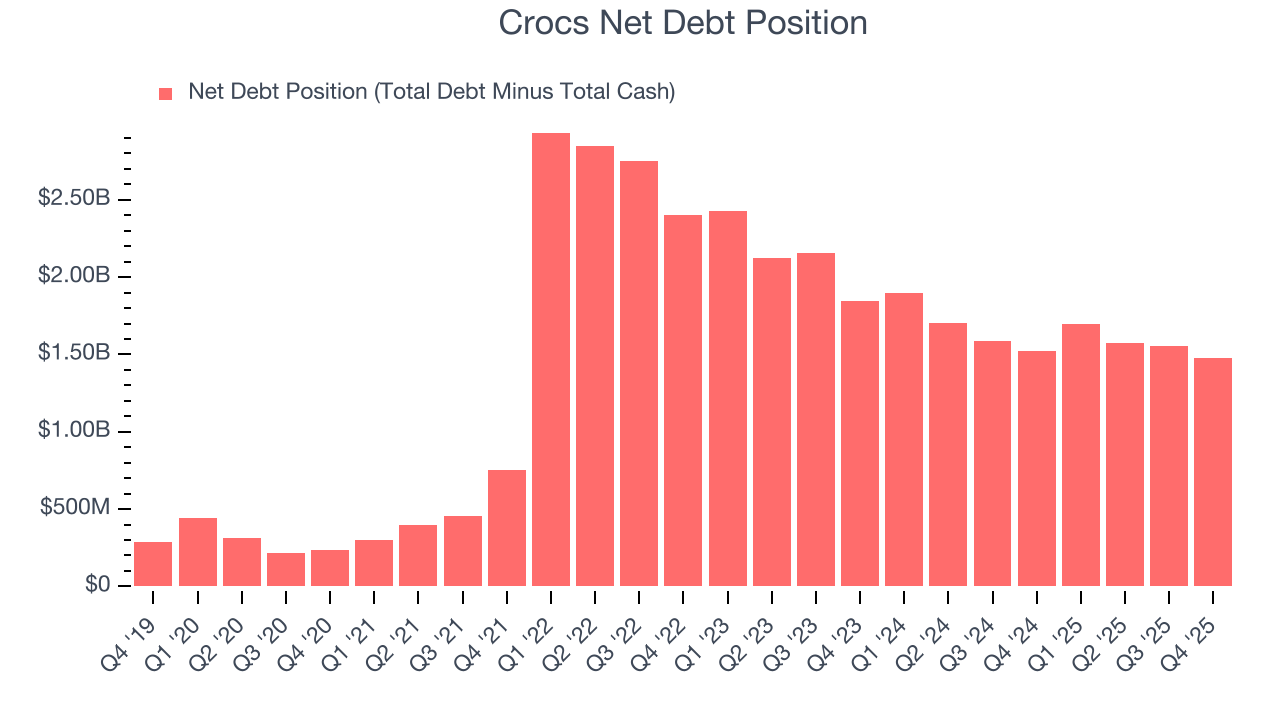

10. Balance Sheet Assessment

Crocs reported $133.9 million of cash and $1.61 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.00 billion of EBITDA over the last 12 months, we view Crocs’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $45.09 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Crocs’s Q4 Results

We were impressed by Crocs’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue guidance for next quarter slightly missed. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 11.3% to $92.09 immediately after reporting.

12. Is Now The Time To Buy Crocs?

Updated: February 26, 2026 at 10:17 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Crocs.

We cheer for all companies serving everyday consumers, but in the case of Crocs, we’ll be cheering from the sidelines. On top of that, Crocs’s Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, and its constant currency sales performance has disappointed.

Crocs’s P/E ratio based on the next 12 months is 7x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $102.91 on the company (compared to the current share price of $92.01).