Steven Madden (SHOO)

Steven Madden faces an uphill battle. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Steven Madden Will Underperform

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ:SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

- Muted 16.1% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 6.1% for the last two years

Steven Madden is in the penalty box. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than Steven Madden

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Steven Madden

Steven Madden is trading at $36.64 per share, or 17.1x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Steven Madden (SHOO) Research Report: Q4 CY2025 Update

Shoe and apparel company Steven Madden (NASDAQ:SHOO) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 29.4% year on year to $753.7 million. Its non-GAAP profit of $0.48 per share was in line with analysts’ consensus estimates.

Steven Madden (SHOO) Q4 CY2025 Highlights:

- Revenue: $753.7 million vs analyst estimates of $757.4 million (29.4% year-on-year growth, in line)

- Adjusted EPS: $0.48 vs analyst estimates of $0.47 (in line)

- Adjusted EBITDA: $74.14 million vs analyst estimates of $52.74 million (9.8% margin, 40.6% beat)

- Operating Margin: 4.8%, down from 8% in the same quarter last year

- Free Cash Flow Margin: 10.7%, down from 16.2% in the same quarter last year

- Market Capitalization: $2.71 billion

Company Overview

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ:SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

Steven Madden was founded by designer and entrepreneur Steve Madden in 1990. From the outset, Madden aimed to provide young, fashion-forward women with an avenue to express their individuality through unique and daring styles.

The brand quickly became renowned for its innovative designs, blending edgy aesthetics with a keen understanding of what people wanted to wear at an affordable price. Since then, the company has expanded beyond its original focus on women's shoes to include a wide range of accessories, handbags, and apparel.

Steve Madden's core products include sandals, boots, sneakers, and heels. Its collection constantly evolves to keep pace with the ever-changing world of fashion, where styles can quickly go in and out of fashion.

Steve Madden's handbag, accessories, and apparel lines share similar business characteristics and have helped the brand build a comprehensive lifestyle image, appealing to a broader demographic.

4. Consumer Discretionary - Footwear

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Footwear companies design, manufacture, and market shoes across athletic, casual, and luxury segments. Tailwinds include the global athleisure trend, growing health and fitness awareness driving sneaker demand, and expanding direct-to-consumer digital channels that improve brand control and margins. However, headwinds are notable: the industry faces intense competition and brand-switching behavior, heavy marketing spend requirements to maintain relevance, and exposure to volatile raw material and freight costs. Tariff risk from concentrated overseas manufacturing, primarily in Asia, remains a persistent concern. Additionally, inventory management is challenging given seasonal and trend-driven demand, with markdowns eroding profitability when styles miss consumer expectations.

Steve Madden's primary competitors include Sam Edelman (owned by Caleres NYSE:CAL), Michael Kors (owned by Capri Holdings NYSE:CPRI), Zara (owned by Inditex BME:ITX), and private companies Aldo and Nine West.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Steven Madden grew its sales at a 16.1% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Steven Madden’s recent performance shows its demand has slowed as its annualized revenue growth of 13.1% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Wholesale and Retail, which are 57.5% and 42% of revenue. Over the last two years, Steven Madden’s Wholesale revenue (sales to retailers) averaged 3.1% year-on-year growth while its Retail revenue (direct sales to consumers) averaged 36% growth.

This quarter, Steven Madden’s year-on-year revenue growth of 29.4% was excellent, and its $753.7 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Operating Margin

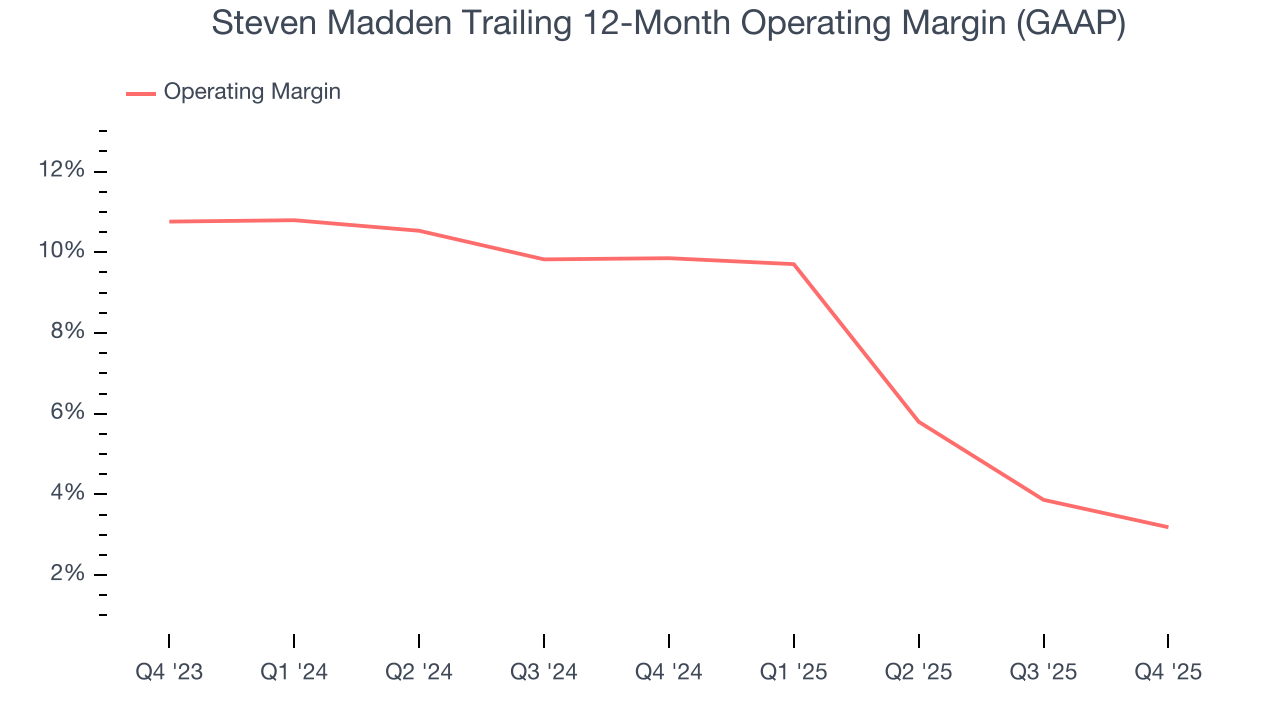

Steven Madden’s operating margin has been trending down over the last 12 months and averaged 6.3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, Steven Madden generated an operating margin profit margin of 4.8%, down 3.2 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

7. Earnings Per Share

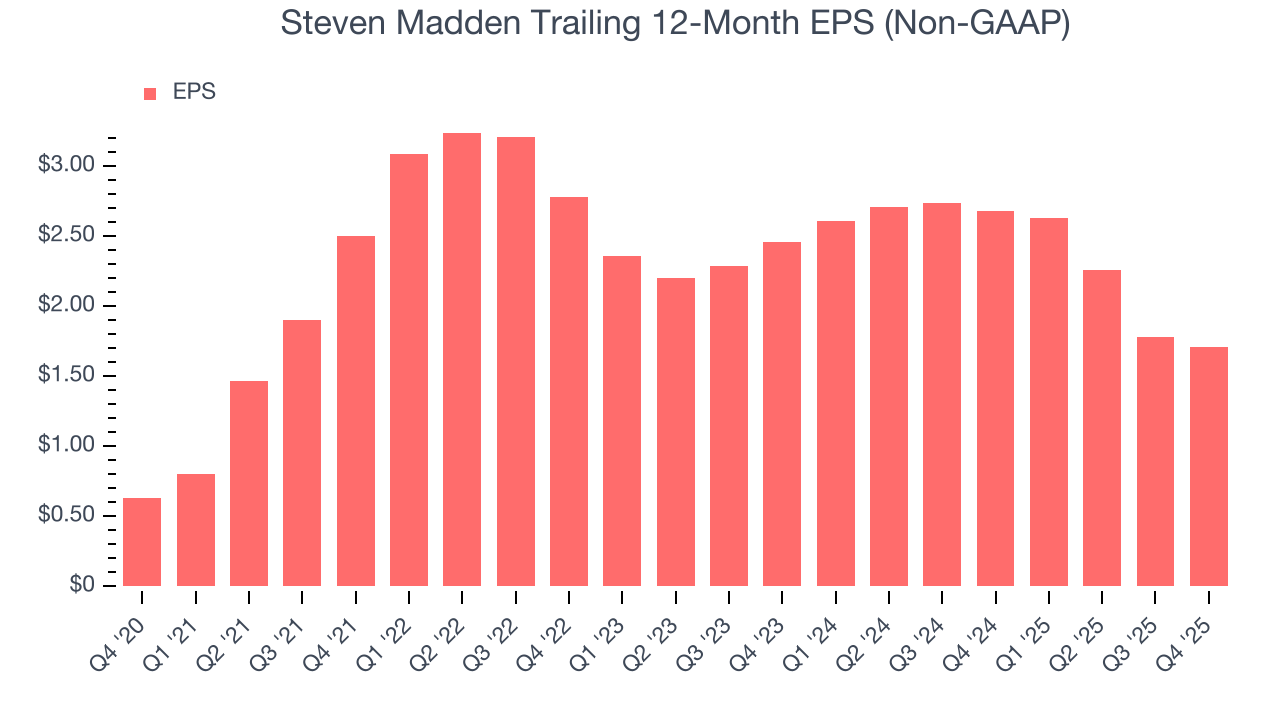

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Steven Madden’s EPS grew at a weak 22.1% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Steven Madden reported adjusted EPS of $0.48, down from $0.55 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 1.4%. Over the next 12 months, Wall Street expects Steven Madden’s full-year EPS of $1.71 to grow 27.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Steven Madden has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.1%, lousy for a consumer discretionary business.

Steven Madden’s free cash flow clocked in at $80.99 million in Q4, equivalent to a 10.7% margin. The company’s cash profitability regressed as it was 5.5 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Steven Madden historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 21.7%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Steven Madden’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

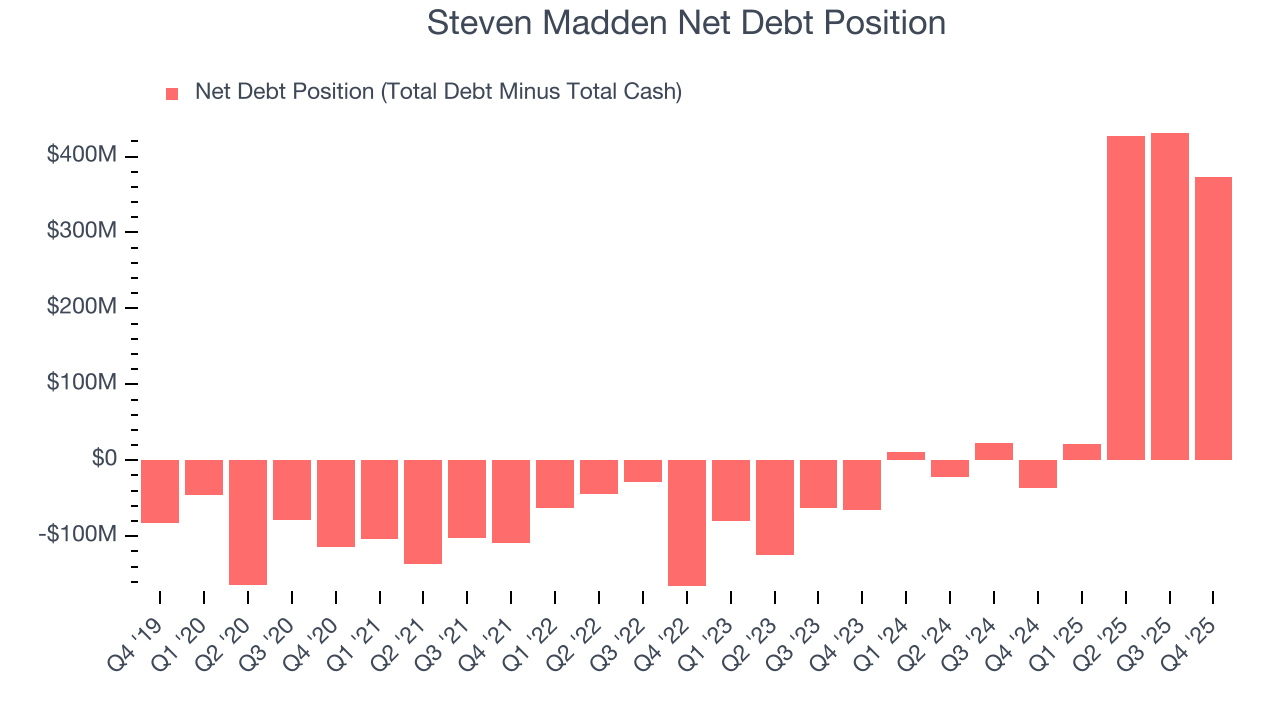

Steven Madden reported $112.4 million of cash and $486.1 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $223.5 million of EBITDA over the last 12 months, we view Steven Madden’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $12.34 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Steven Madden’s Q4 Results

We were impressed by how significantly Steven Madden blew past analysts’ EBITDA expectations this quarter. On the other hand, its revenue was in line. Overall, we think this was still a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 2.2% to $36.53 immediately following the results.

12. Is Now The Time To Buy Steven Madden?

Updated: February 26, 2026 at 10:18 PM EST

Are you wondering whether to buy Steven Madden or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

We cheer for all companies serving everyday consumers, but in the case of Steven Madden, we’ll be cheering from the sidelines. On top of that, Steven Madden’s low free cash flow margins give it little breathing room, and its operating margins reveal poor profitability compared to other consumer discretionary companies.

Steven Madden’s P/E ratio based on the next 12 months is 17.1x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $44.22 on the company (compared to the current share price of $36.64).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.