Commercial Vehicle Group (CVGI)

Commercial Vehicle Group keeps us up at night. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Commercial Vehicle Group Will Underperform

Formed from a partnership between two distinct companies, CVG (NASDAQ:CVGI) offers various components used in vehicles and systems used in warehouses.

- Flat sales over the last five years suggest it must find different ways to grow during this cycle

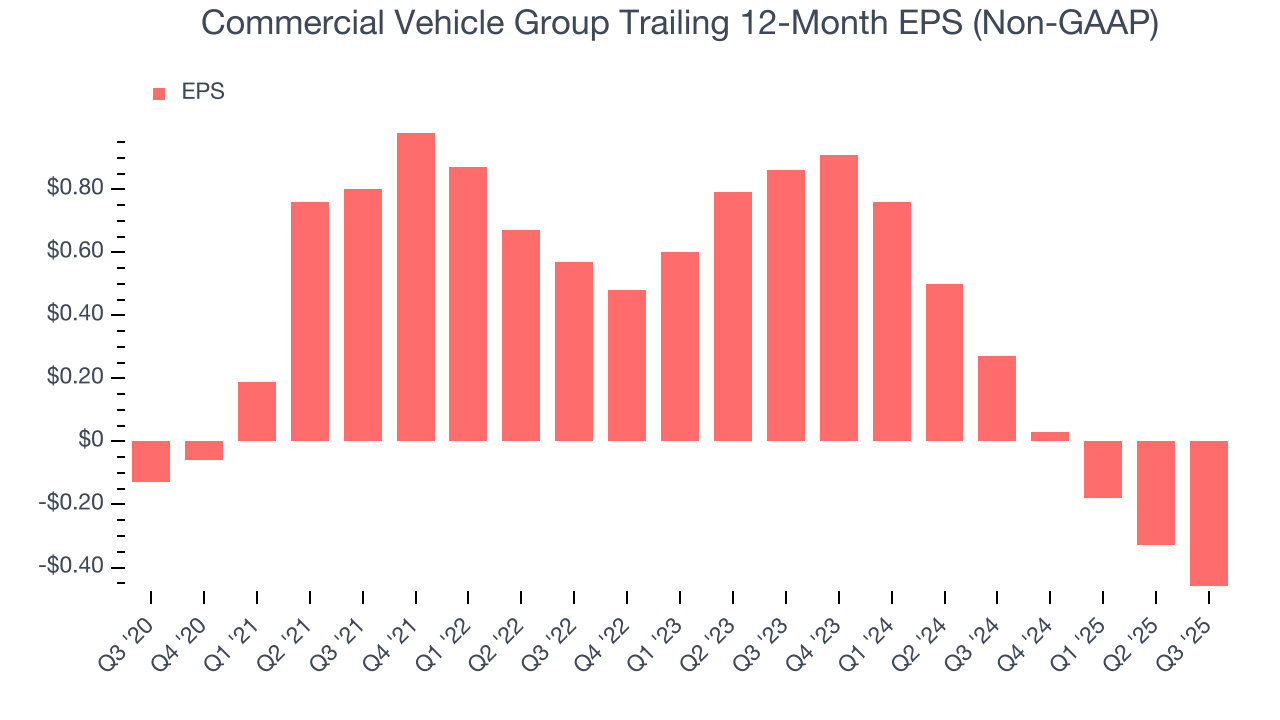

- Historically negative EPS casts doubt for cautious investors and clouds its long-term earnings prospects

- 5× net-debt-to-EBITDA ratio makes lenders less willing to extend additional capital, potentially necessitating dilutive equity offerings

Commercial Vehicle Group is in the penalty box. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Commercial Vehicle Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Commercial Vehicle Group

Commercial Vehicle Group is trading at $1.70 per share, or 9.5x forward EV-to-EBITDA. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Commercial Vehicle Group (CVGI) Research Report: Q3 CY2025 Update

Vehicle systems manufacturer Commercial Vehicle Group (NASDAQ:CVGI) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 11.2% year on year to $152.5 million. The company’s full-year revenue guidance of $645 million at the midpoint came in 1.6% below analysts’ estimates. Its non-GAAP loss of $0.14 per share was 16.7% below analysts’ consensus estimates.

Commercial Vehicle Group (CVGI) Q3 CY2025 Highlights:

- Revenue: $152.5 million vs analyst estimates of $157.4 million (11.2% year-on-year decline, 3.1% miss)

- Adjusted EPS: -$0.14 vs analyst expectations of -$0.12 (16.7% miss)

- Adjusted EBITDA: $4.6 million vs analyst estimates of $4.78 million (3% margin, relatively in line)

- The company dropped its revenue guidance for the full year to $645 million at the midpoint from $660 million, a 2.3% decrease

- EBITDA guidance for the full year is $18 million at the midpoint, below analyst estimates of $21.01 million

- Operating Margin: -0.7%, down from 1.7% in the same quarter last year

- Free Cash Flow was -$3.50 million compared to -$20.35 million in the same quarter last year

- Market Capitalization: $46.53 million

Company Overview

Formed from a partnership between two distinct companies, CVG (NASDAQ:CVGI) offers various components used in vehicles and systems used in warehouses.

Commercial Vehicle Group was founded in 1989 with a vision to provide vehicle seats and seating systems for vehicles. Over the years, the company has significantly grown through its acquisitions of various companies, offering entries into new markets and product lines. For example, its acquisition of First Source Electronics in 2019 helped the company enter the warehouse automation market and strengthened its electrical systems.

Today, its offerings include vehicle seats and seating systems along with electrical wire harness assemblies. The latter are essential bundles of wires that distribute power and signals to different parts of the vehicle to make sure that everything works correctly. The company also offers cap structures (frames that support the vehicle’s cabin) and trim components (make the cabin look good and stay durable). It primarily sells these products to original equipment manufacturers (OEMs) who integrate the components into their vehicles.

In addition the products above, Commercial Vehicle Group offers systems that help warehouses operate. These systems automate tasks like keeping track of inventory, filling orders, and moving materials around. This automation helps warehouses work faster, reduce mistakes, and lower costs.

The company primarily engages in long-term contracts with OEMs and commercial vehicle operators that span three to five years. These contracts include the supply of products as well as service agreements (for products that require servicing). As part of these supply agreements, volume discounts are extended to incentivize customers to purchase in larger quantities.

4. Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Competitors offering similar products include Dana (NYSE:DAN), Lear (NYSE:LEA), and Gentherm (NASDAQ:THRM).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Commercial Vehicle Group struggled to consistently increase demand as its $657.5 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Commercial Vehicle Group’s recent performance shows its demand remained suppressed as its revenue has declined by 17.4% annually over the last two years. Commercial Vehicle Group isn’t alone in its struggles as the Heavy Transportation Equipment industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Commercial Vehicle Group missed Wall Street’s estimates and reported a rather uninspiring 11.2% year-on-year revenue decline, generating $152.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Commercial Vehicle Group has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 11.5% gross margin over the last five years. That means Commercial Vehicle Group paid its suppliers a lot of money ($88.45 for every $100 in revenue) to run its business.

Commercial Vehicle Group’s gross profit margin came in at 10.5% this quarter, marking a 1.1 percentage point decrease from 11.6% in the same quarter last year. Commercial Vehicle Group’s full-year margin has also been trending down over the past 12 months, decreasing by 1.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Commercial Vehicle Group was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Commercial Vehicle Group’s operating margin decreased by 5.3 percentage points over the last five years. Commercial Vehicle Group’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Commercial Vehicle Group’s breakeven margin was down 2.4 percentage points year on year. Since Commercial Vehicle Group’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Commercial Vehicle Group’s earnings losses deepened over the last five years as its EPS dropped 29.3% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Commercial Vehicle Group’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for Commercial Vehicle Group, its EPS declined by more than its revenue over the last two years, dropping 59.2%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of Commercial Vehicle Group’s earnings can give us a better understanding of its performance. Commercial Vehicle Group’s operating margin has declined over the last two yearswhile its share count has grown 1.6%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Commercial Vehicle Group reported adjusted EPS of negative $0.14, down from negative $0.01 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Commercial Vehicle Group to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.46 will advance to negative $0.10.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Commercial Vehicle Group broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Commercial Vehicle Group’s margin expanded by 2.3 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Commercial Vehicle Group burned through $3.50 million of cash in Q3, equivalent to a negative 2.3% margin. The company’s cash burn was similar to its $20.35 million of lost cash in the same quarter last year.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Commercial Vehicle Group historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.1%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Commercial Vehicle Group’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Commercial Vehicle Group reported $31.33 million of cash and $112.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $16.5 million of EBITDA over the last 12 months, we view Commercial Vehicle Group’s 4.9× net-debt-to-EBITDA ratio as safe. We also see its $2.93 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Commercial Vehicle Group’s Q3 Results

We struggled to find many positives in these results. Its full-year EBITDA guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 7.2% to $1.41 immediately following the results.

13. Is Now The Time To Buy Commercial Vehicle Group?

Updated: February 25, 2026 at 11:26 PM EST

Before investing in or passing on Commercial Vehicle Group, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Commercial Vehicle Group doesn’t pass our quality test. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Commercial Vehicle Group’s EV-to-EBITDA ratio based on the next 12 months is 9.5x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $4 on the company (compared to the current share price of $1.70).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.