Energy Recovery (ERII)

Energy Recovery catches our eye. It consistently invests in attractive growth opportunities, generating substantial cash flows and returns.― StockStory Analyst Team

1. News

2. Summary

Why Energy Recovery Is Interesting

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

- Exciting sales outlook for the upcoming 12 months calls for 20.6% growth, an acceleration from its two-year trend

- Offerings are difficult to replicate at scale and lead to a best-in-class gross margin of 67.6%

- A drawback is its muted 3.8% annual revenue growth over the last five years shows its demand lagged behind its industrials peers

Energy Recovery has some noteworthy aspects. If you’ve been itching to buy the stock, the valuation seems fair.

Why Is Now The Time To Buy Energy Recovery?

Why Is Now The Time To Buy Energy Recovery?

Energy Recovery is trading at $16.24 per share, or 18.7x forward P/E. This multiple is lower than most industrials companies, and we think the valuation is reasonable for the quality you get.

This could be a good time to invest if you think there are underappreciated aspects of the business.

3. Energy Recovery (ERII) Research Report: Q3 CY2025 Update

Energy recovery device manufacturer Energy Recovery (NASDAQ:ERII) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales fell by 17.1% year on year to $32 million. Its non-GAAP profit of $0.12 per share was 24.1% above analysts’ consensus estimates.

Energy Recovery (ERII) Q3 CY2025 Highlights:

- Revenue: $32 million vs analyst estimates of $29.94 million (17.1% year-on-year decline, 6.9% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.10 (24.1% beat)

- Adjusted EBITDA: $6.8 million vs analyst estimates of $7.21 million (21.3% margin, 5.7% miss)

- Operating Margin: 11.4%, down from 18.3% in the same quarter last year

- Free Cash Flow was -$3.5 million compared to -$3.17 million in the same quarter last year

- Market Capitalization: $873 million

Company Overview

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Energy Recovery was founded in 1992 and initially specialized in developing pressure exchangers for seawater desalination plants. Following its IPO in 2008, the company broadened its product line to include a range of pressure exchangers for desalination, wastewater treatment, and CO2 refrigeration. Today, its products are used in the water treatment, oil and gas, and chemical processing sectors.

The company's flagship product, the PX Pressure Exchanger, is widely used in seawater desalination plants to reduce energy consumption during the desalination process. Additionally, Energy Recovery offers turbochargers and pumps for oil and gas production. Turbochargers help improve the performance of gas turbines used in processing facilities while pumps are utilized for fluid transfer, injection, and circulation within production systems.

Energy Recovery primarily sells its products to original equipment manufacturers (OEMs) and engineering, procurement, and construction (EPC) firms. Specifically, the company engages in long-term supply agreements with these partners and also offers aftermarket services for its products. These aftermarket services include spare parts, repair services, field services, and various commissioning activities, helping plant owners optimize and upgrade their existing installations while creating a recurring revenue source for the company. Offered alongside these long-term supply agreements are volume discounts to incentivize larger orders and foster stronger partnerships.

4. Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Dupont (NYSE:DD), Pentair (NYSE:PNR), and Xylem (NYSE:XYL).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Energy Recovery’s 3.8% annualized revenue growth over the last five years was sluggish. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Energy Recovery.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Energy Recovery’s annualized revenue growth of 9.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Energy Recovery’s revenue fell by 17.1% year on year to $32 million but beat Wall Street’s estimates by 6.9%.

Looking ahead, sell-side analysts expect revenue to grow 31.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

Cost of sales for an industrials business is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics.

Energy Recovery has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 67.6% gross margin over the last five years. That means Energy Recovery only paid its suppliers $32.40 for every $100 in revenue.

In Q3, Energy Recovery produced a 64.2% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

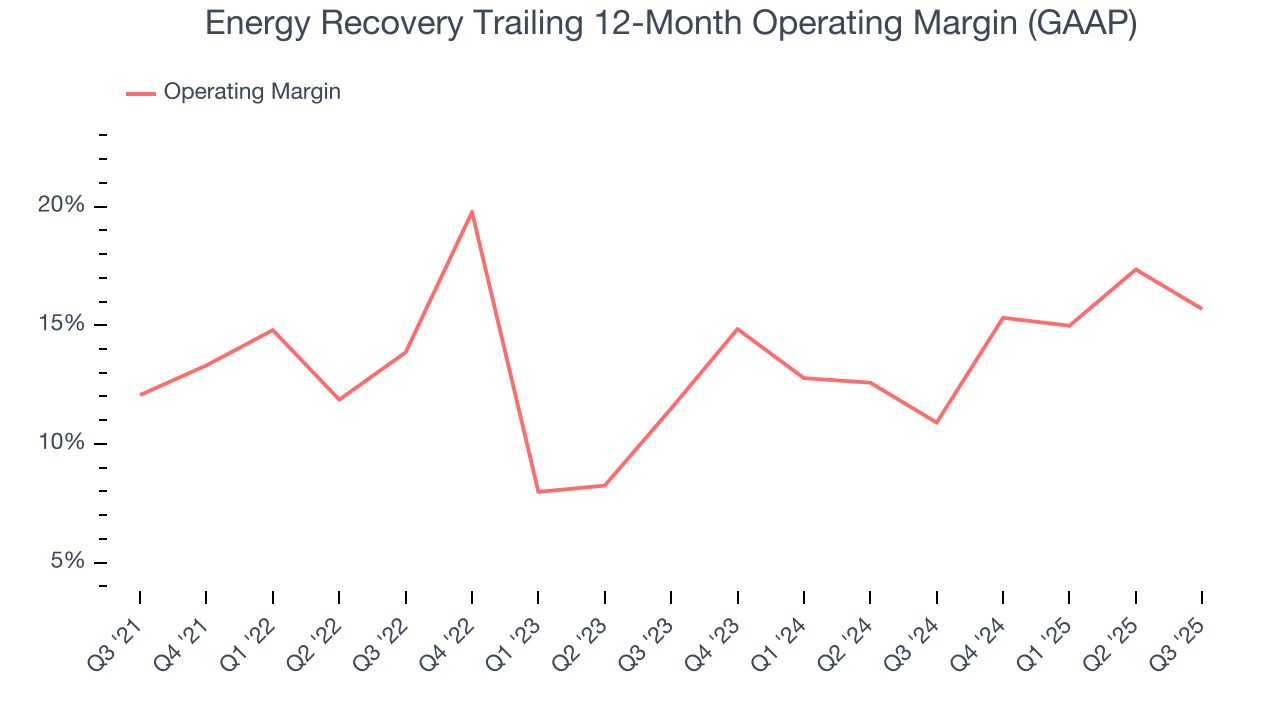

7. Operating Margin

Energy Recovery has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 12.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Energy Recovery’s operating margin rose by 3.6 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Energy Recovery generated an operating margin profit margin of 11.4%, down 6.8 percentage points year on year. Since Energy Recovery’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

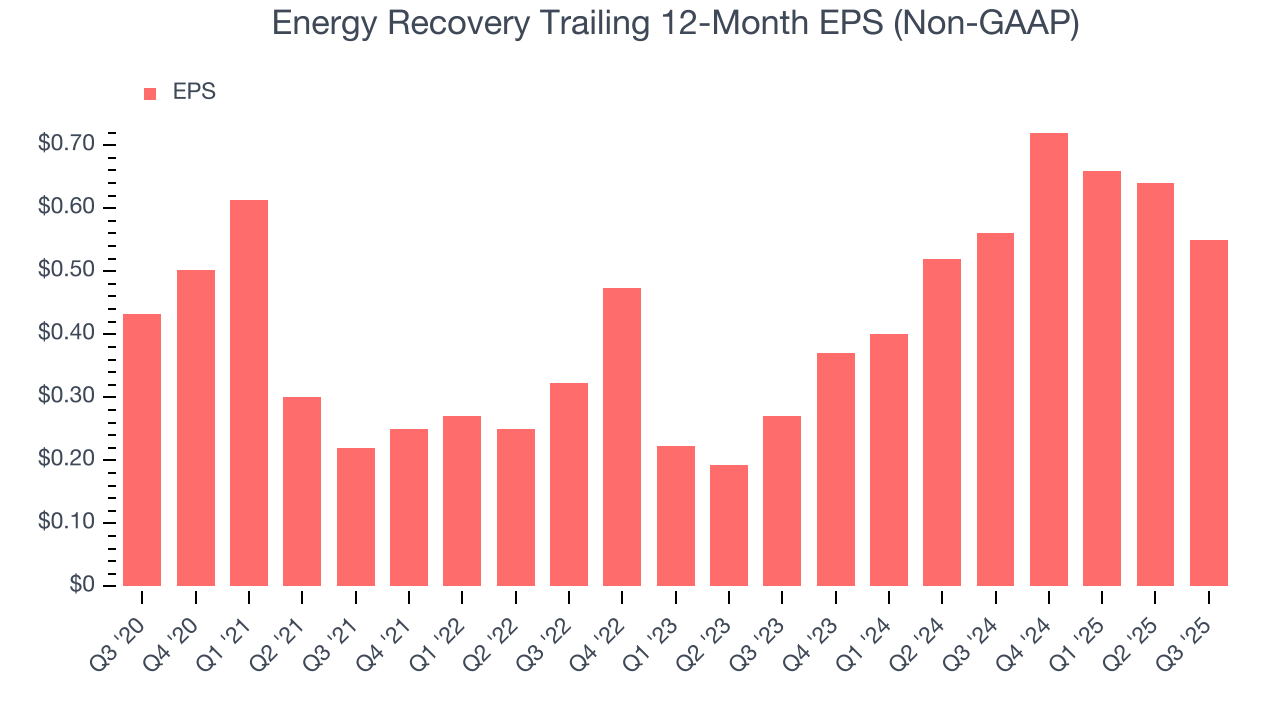

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Energy Recovery’s unimpressive 4.9% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Energy Recovery’s two-year annual EPS growth of 42.6% was fantastic and topped its 9.2% two-year revenue growth.

We can take a deeper look into Energy Recovery’s earnings to better understand the drivers of its performance. A two-year view shows that Energy Recovery has repurchased its stock, shrinking its share count by 7.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Energy Recovery reported adjusted EPS of $0.12, down from $0.21 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Energy Recovery’s full-year EPS of $0.55 to grow 55.3%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Energy Recovery has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.5% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Energy Recovery’s margin expanded by 6.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Energy Recovery burned through $3.5 million of cash in Q3, equivalent to a negative 10.9% margin. The company’s cash burn was similar to its $3.17 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Energy Recovery’s five-year average ROIC was 15.2%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Energy Recovery’s ROIC decreased by 5 percentage points annually over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

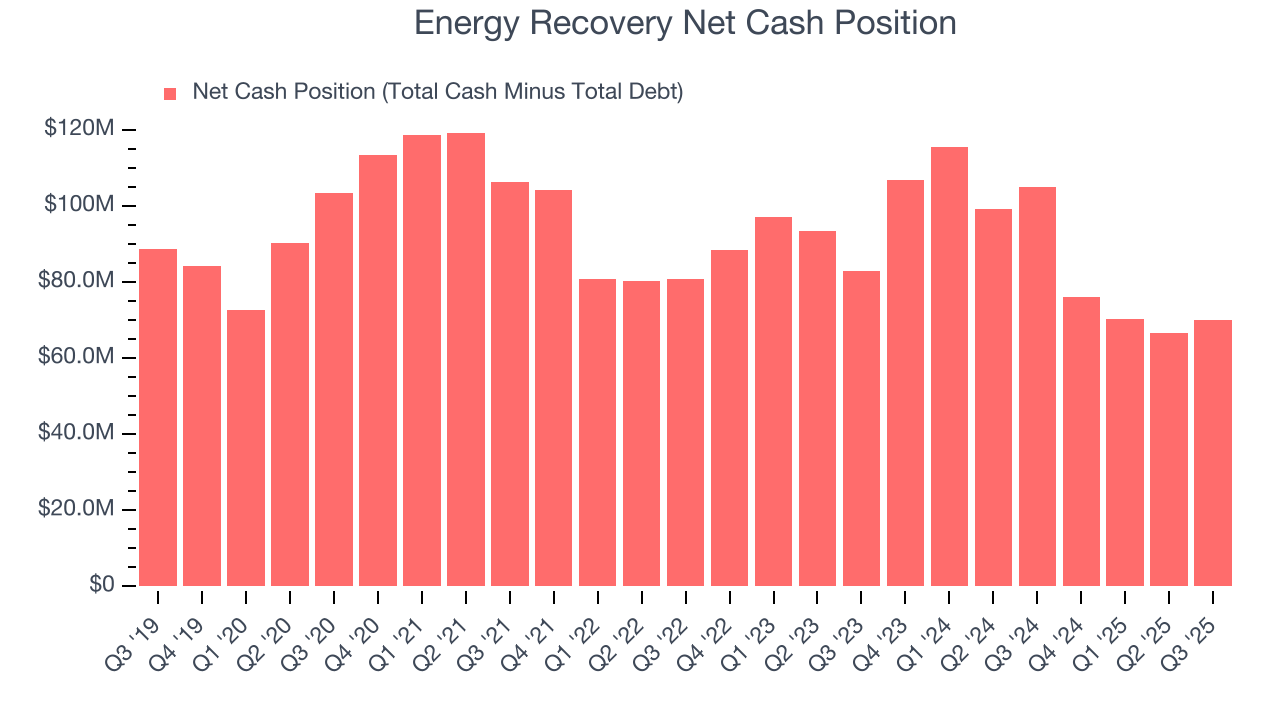

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Energy Recovery is a profitable, well-capitalized company with $79.94 million of cash and $10.00 million of debt on its balance sheet. This $69.94 million net cash position is 8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Energy Recovery’s Q3 Results

We were impressed by how significantly Energy Recovery blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 6% to $16.20 immediately following the results.

13. Is Now The Time To Buy Energy Recovery?

Updated: February 22, 2026 at 10:14 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Energy Recovery.

In our opinion, Energy Recovery is a solid company. Although its revenue growth was uninspiring over the last five years, its growth over the next 12 months is expected to be higher. And while Energy Recovery’s diminishing returns show management's recent bets still have yet to bear fruit, its admirable gross margins indicate the mission-critical nature of its offerings. On top of that, its rising cash profitability gives it more optionality.

Energy Recovery’s P/E ratio based on the next 12 months is 18.7x. When scanning the industrials space, Energy Recovery trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $19.05 on the company (compared to the current share price of $16.24), implying they see 17.3% upside in buying Energy Recovery in the short term.