Tennant (TNC)

We wouldn’t buy Tennant. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Tennant Will Underperform

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE:TNC) designs, manufactures, and sells cleaning products to various sectors.

- Sales tumbled by 1.1% annually over the last two years, showing market trends are working against its favor during this cycle

- Performance over the past two years shows each sale was less profitable as its earnings per share dropped by 16.8% annually, worse than its revenue

- Weak free cash flow margin of 4.6% has deteriorated further over the last five years as its investments increased

Tennant doesn’t satisfy our quality benchmarks. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Tennant

Why There Are Better Opportunities Than Tennant

Tennant trades at a stock price of $74.98. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. Tennant (TNC) Research Report: Q3 CY2025 Update

Industrial cleaning equipment manufacturer Tennant Company missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 4% year on year to $303.3 million. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $1.23 billion at the midpoint. Its non-GAAP profit of $1.46 per share was 2.9% below analysts’ consensus estimates.

Tennant (TNC) Q3 CY2025 Highlights:

- Revenue: $303.3 million vs analyst estimates of $306 million (4% year-on-year decline, 0.9% miss)

- Adjusted EPS: $1.46 vs analyst expectations of $1.50 (2.9% miss)

- Adjusted EBITDA: $49.8 million vs analyst estimates of $50.35 million (16.4% margin, 1.1% miss)

- The company reconfirmed its revenue guidance for the full year of $1.23 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $5.95 at the midpoint

- EBITDA guidance for the full year is $202.5 million at the midpoint, above analyst estimates of $199.5 million

- Operating Margin: 7.4%, down from 9.7% in the same quarter last year

- Free Cash Flow Margin: 7.4%, similar to the same quarter last year

- Market Capitalization: $1.48 billion

Company Overview

As the world’s largest manufacturer of autonomous mobile robots, Tennant (NYSE:TNC) designs, manufactures, and sells cleaning products to various sectors.

Tennant, headquartered in Eden Prairie, Minnesota, is a global leader in designing, manufacturing, and marketing solutions for creating cleaner, safer, and healthier environments.

Founded in 1870 by George H. Tennant, the company has evolved from a one-man woodworking business into a prominent manufacturer of floor cleaning equipment and sustainable cleaning technologies. Tennant operates with a presence in the Americas, Europe, Middle East and Africa (EMEA), and Asia Pacific (APAC) regions. The company's primary focus is on developing and providing cleaning solutions for non-residential surfaces. Tennant's product portfolio includes manual and mechanized cleaning equipment, detergent-free cleaning technologies, aftermarket parts, and consumables as well as equipment maintenance and repair services.

The company serves a customer base of factories, warehouses, distribution centers, office buildings, public venues, schools, universities, hospitals, and clinics. Tennant markets its products under several brands, including Tennant, Nobles, Alfa Uma Empresa Tennant, IPC, Gaomei, and Rongen, as well as private-label brands.

Tennant generates income through direct sales to end-users, as well as through its extensive network of authorized distributors worldwide. Additionally, Tennant offers various business solutions, including financing, rental, and leasing programs, which provide alternative revenue streams and help customers manage their equipment needs more flexibly. The company also derives revenue from its aftermarket parts and consumables business, which supplies customers with the necessary components to maintain and operate their Tennant equipment.

4. Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Standex (NYSE:SXI), Middleby (NASDAQ:MIDD), and Enerpac (NYSE:EPAC).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Tennant’s 3.9% annualized revenue growth over the last five years was sluggish. This fell short of our benchmark for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Tennant’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Tennant missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $303.3 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Tennant’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 41.3% gross margin over the last five years. That means Tennant only paid its suppliers $58.72 for every $100 in revenue.

Tennant’s gross profit margin came in at 42.7% this quarter, in line with the same quarter last year. On a wider time horizon, Tennant’s full-year margin has been trending down over the past 12 months, decreasing by 1.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

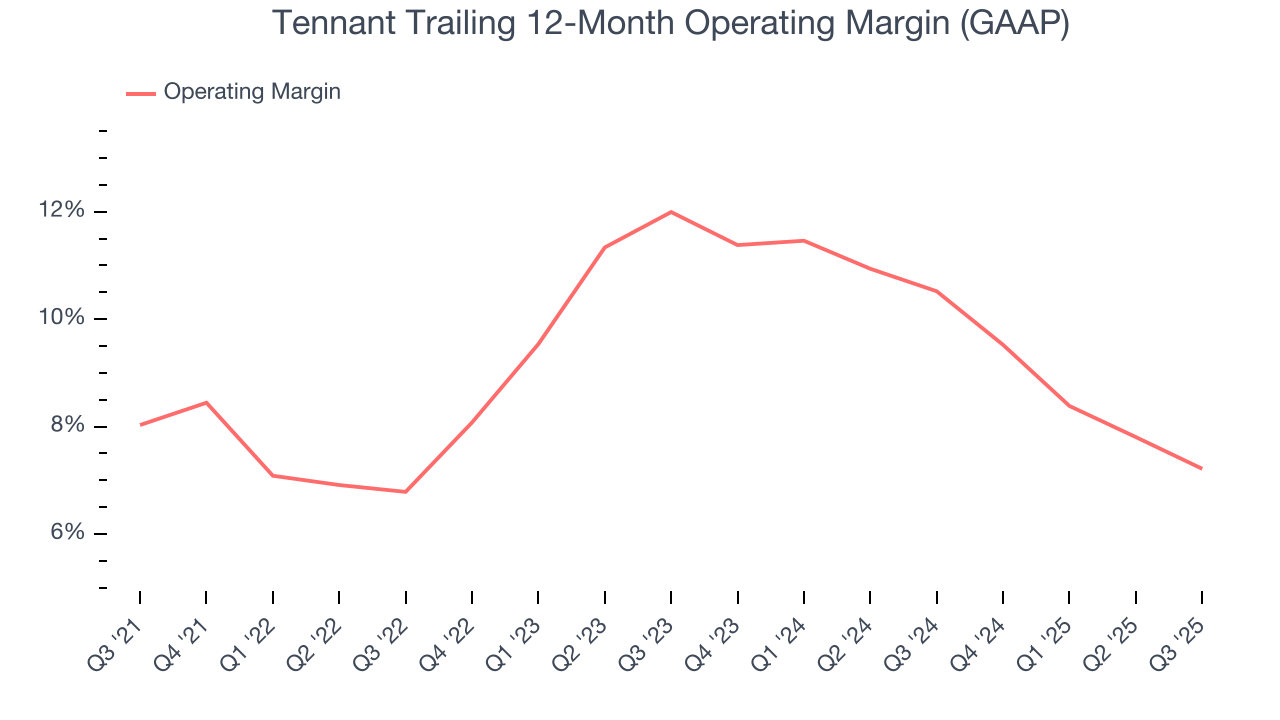

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Tennant’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 9% over the last five years. This profitability was higher than the broader industrials sector, showing it did a decent job managing its expenses.

Looking at the trend in its profitability, Tennant’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Tennant generated an operating margin profit margin of 7.4%, down 2.3 percentage points year on year. Since Tennant’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

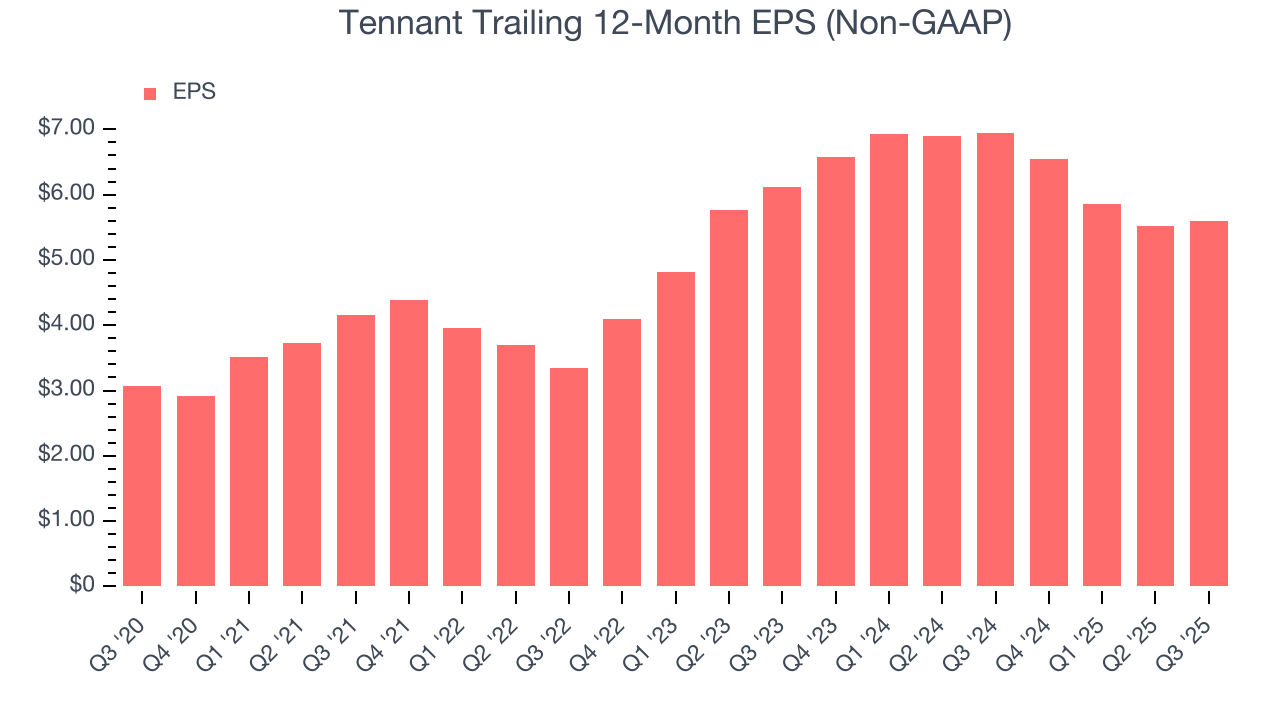

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Tennant’s EPS grew at a remarkable 12.7% compounded annual growth rate over the last five years, higher than its 3.9% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Tennant’s two-year annual EPS declines of 4.3% were bad and lower than its flat revenue.

Diving into the nuances of Tennant’s earnings can give us a better understanding of its performance. Tennant’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Tennant reported adjusted EPS of $1.46, up from $1.39 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Tennant’s full-year EPS of $5.59 to grow 15.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Tennant has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.9%, subpar for an industrials business.

Taking a step back, we can see that Tennant’s margin dropped by 2.7 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Tennant’s free cash flow clocked in at $22.3 million in Q3, equivalent to a 7.4% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Tennant hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 13.3%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Tennant’s ROIC has stayed the same over the last few years. Given the company’s underwhelming financial performance in other areas, we’d like to see its returns improve before recommending the stock.

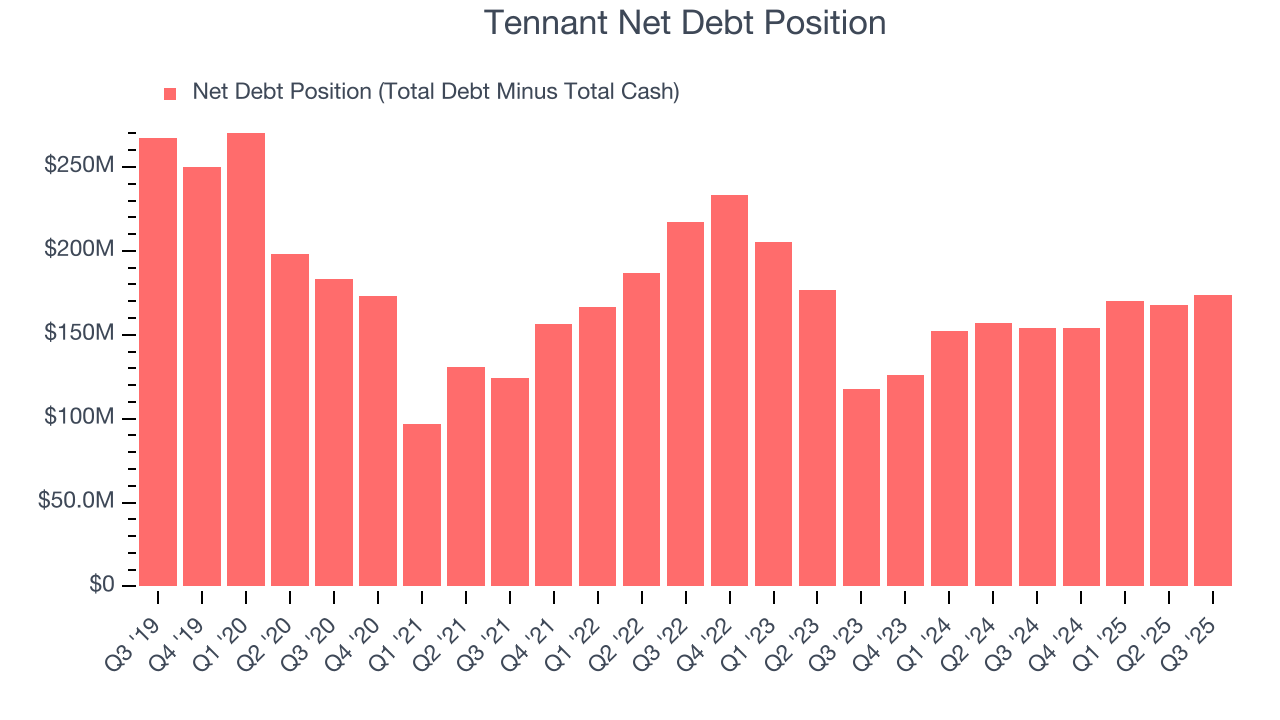

11. Balance Sheet Assessment

Tennant reported $99.4 million of cash and $273 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $189.2 million of EBITDA over the last 12 months, we view Tennant’s 0.9× net-debt-to-EBITDA ratio as safe. We also see its $8.5 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Tennant’s Q3 Results

It was great to see Tennant’s full-year EBITDA guidance top analysts’ expectations. On the other hand, its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.4% to $77.83 immediately after reporting.

13. Is Now The Time To Buy Tennant?

Updated: February 22, 2026 at 10:41 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Tennant.

Tennant falls short of our quality standards. First off, its revenue growth was uninspiring over the last five years, and analysts don’t see anything changing over the next 12 months. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its cash profitability fell over the last five years. On top of that, its low free cash flow margins give it little breathing room.

Tennant’s P/E ratio based on the next 12 months is 12.9x. This valuation multiple is fair, but we don’t have much confidence in the company. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $110 on the company (compared to the current share price of $83.45).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.