eXp World (EXPI)

eXp World keeps us up at night. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think eXp World Will Underperform

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

- Annual revenue growth of 5.7% over the last two years was below our standards for the consumer discretionary sector

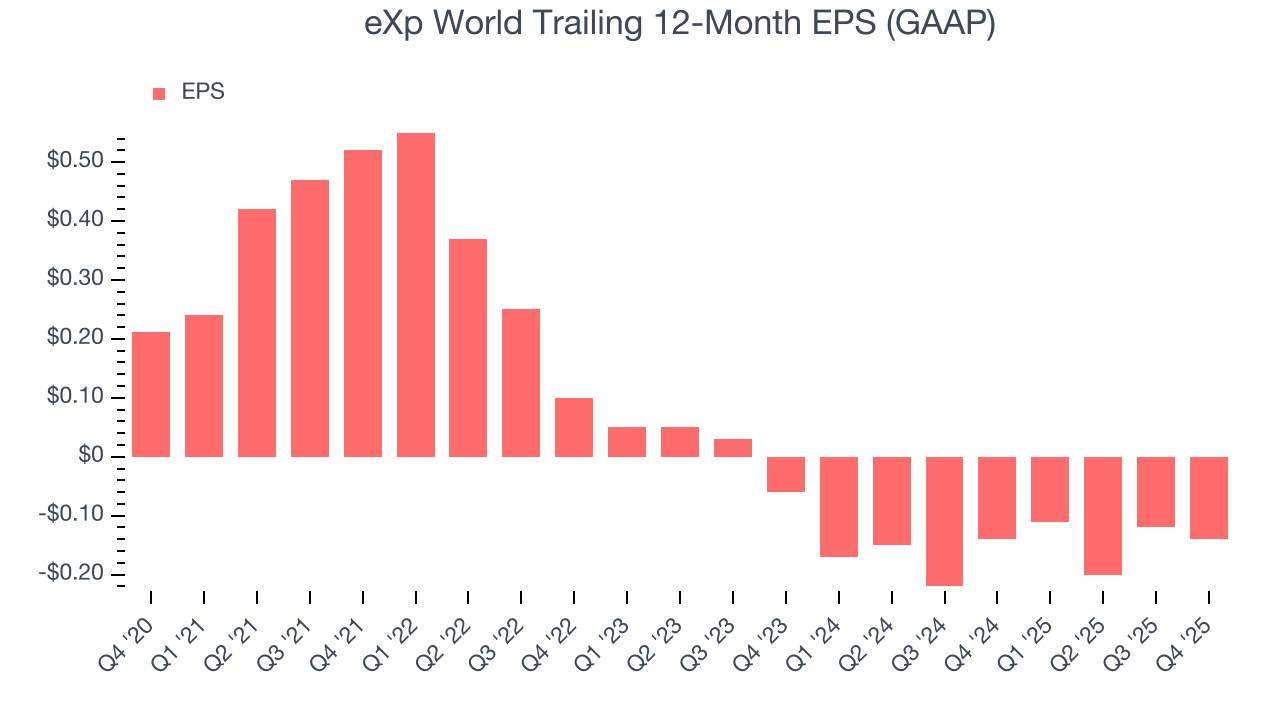

- Performance over the past five years shows its incremental sales were much less profitable, as its earnings per share fell by 16.4% annually

- Operating margin falls short of the industry average, and the smaller profit dollars make it harder to react to unexpected market developments

eXp World doesn’t pass our quality test. There are more appealing investments to be made.

Why There Are Better Opportunities Than eXp World

High Quality

Investable

Underperform

Why There Are Better Opportunities Than eXp World

At $6.50 per share, eXp World trades at 26.1x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. eXp World (EXPI) Research Report: Q4 CY2025 Update

Real estate technology company eXp World (NASDAQ:EXPI) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.5% year on year to $1.19 billion. Its GAAP loss of $0.08 per share was significantly below analysts’ consensus estimates.

eXp World (EXPI) Q4 CY2025 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.16 billion (8.5% year-on-year growth, 2.6% beat)

- EPS (GAAP): -$0.08 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $2.1 million vs analyst estimates of $10.2 million (0.2% margin, 79.4% miss)

- Operating Margin: -1.1%, in line with the same quarter last year

- Free Cash Flow Margin: 1.2%, similar to the same quarter last year

- Market Capitalization: $1.16 billion

Company Overview

Founded in 2009, eXp World (NASDAQ:EXPI) is a real estate company known for its virtual, cloud-based approach to real estate brokerage.

At the core of eXp World's business model is eXp Realty, a full-service real estate brokerage. eXp Realty offers agents and brokers an array of tools and services that include lead generation, training, and an online collaborative platform. This model supports a remote and flexible working environment, attracting a growing network of real estate professionals worldwide.

Another significant aspect of eXp World is its agent ownership model. The company offers a unique financial model for its agents and brokers, including revenue sharing and an opportunity to earn equity awards for contributing to the growth of the company.

In addition to real estate brokerage services, eXp World also operates Virbela, a technology company that develops virtual world solutions for remote work, education, and events.

4. Consumer Discretionary - Real Estate Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Real estate services companies provide brokerage, property management, appraisal, and advisory services, earning transaction-based commissions and recurring management fees. Tailwinds include long-term housing demand driven by demographic growth, technology platforms that expand market access, and commercial real estate complexity that sustains advisory needs. Headwinds are pronounced: rising interest rates directly suppress transaction volumes by reducing housing affordability and commercial deal activity. Commission-rate compression, driven by discount brokerages and regulatory changes, erodes per-transaction revenue. The industry is highly cyclical, with revenue swings amplified by leverage. PropTech (property technology) disruptors threaten traditional intermediary models.

eXp World's primary competitors include Realogy Holdings (NYSE:RLGY), Zillow (NASDAQ:ZG), Redfin (NASDAQ:RDFN), and Compass (NYSE:COMP).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, eXp World grew its sales at a 21.6% annual rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. eXp World’s recent performance shows its demand has slowed as its annualized revenue growth of 5.7% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, eXp World reported year-on-year revenue growth of 8.5%, and its $1.19 billion of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Operating Margin

eXp World’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same. The company broke even over the last two years, inadequate for a consumer discretionary business. Its large expense base and inefficient cost structure were the main culprits behind this performance.

eXp World’s operating margin was negative 1.1% this quarter. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for eXp World, its EPS declined by 21.6% annually over the last five years while its revenue grew by 21.6%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, eXp World reported EPS of negative $0.08, down from negative $0.06 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast eXp World’s full-year EPS of negative $0.14 will flip to positive $0.12.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

eXp World has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, lousy for a consumer discretionary business.

eXp World’s free cash flow clocked in at $13.79 million in Q4, equivalent to a 1.2% margin. This cash profitability was in line with the comparable period last year but below its two-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

eXp World’s four-year average ROIC was negative 16.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, eXp World’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

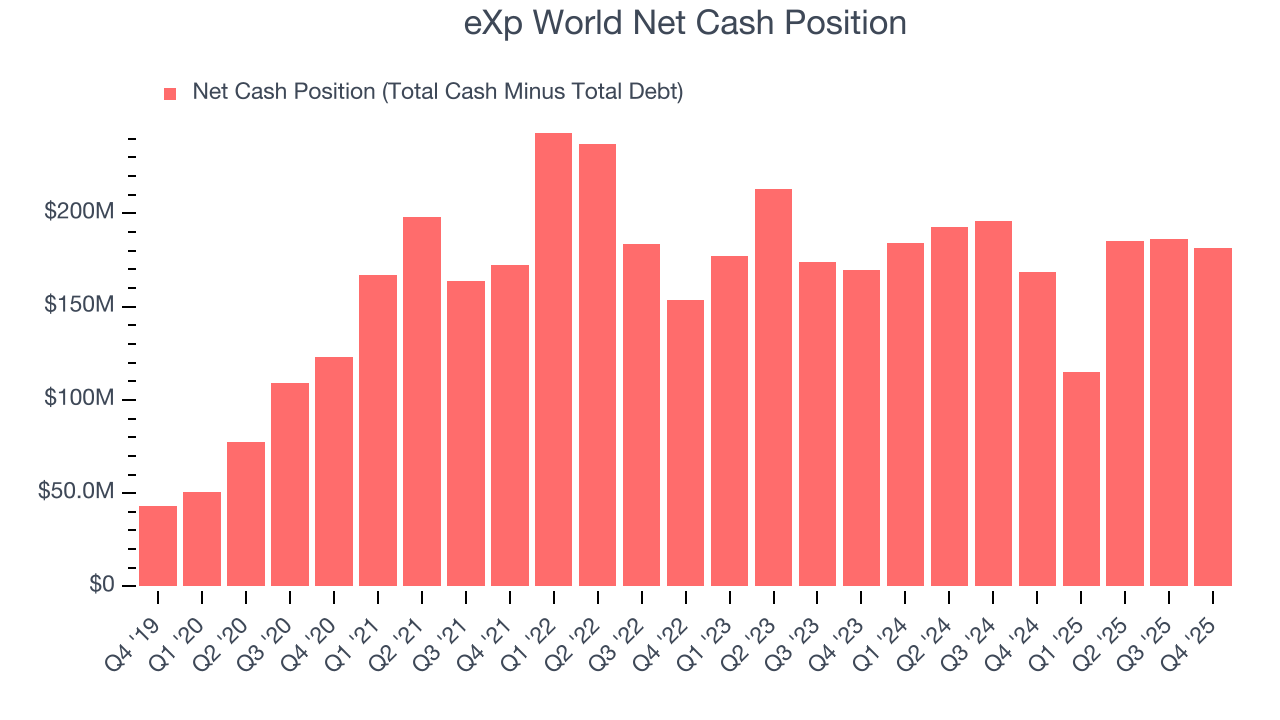

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

eXp World is a well-capitalized company with $181.5 million of cash and no debt. This position is 15.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from eXp World’s Q4 Results

It was encouraging to see eXp World beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.9% to $7.24 immediately after reporting.

12. Is Now The Time To Buy eXp World?

Updated: March 6, 2026 at 9:03 PM EST

Before deciding whether to buy eXp World or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

eXp World falls short of our quality standards. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

eXp World’s P/E ratio based on the next 12 months is 26.1x. This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $11 on the company (compared to the current share price of $6.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.