Fiserv (FISV)

We’re wary of Fiserv. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fiserv Will Underperform

Powering over 1 billion accounts and processing more than 12,000 financial transactions per second globally, Fiserv (NASDAQ:FISV) provides payment processing and financial technology solutions that enable merchants, banks, and credit unions to accept payments and manage financial transactions.

- ROE of 9.2% reflects management’s challenges in identifying attractive investment opportunities

- Annual sales growth of 7.3% over the last five years lagged behind its financials peers as its large revenue base made it difficult to generate incremental demand

- A silver lining is that its performance over the past five years shows its incremental sales were more profitable, as its annual earnings per share growth of 14.3% outpaced its revenue gains

Fiserv falls short of our quality standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Fiserv

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fiserv

Fiserv’s stock price of $62.92 implies a valuation ratio of 7.4x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Fiserv (FISV) Research Report: Q4 CY2025 Update

Financial technology provider Fiserv (NASDAQ:FISV) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.8% year on year to $5.28 billion. Its non-GAAP profit of $1.99 per share was 4.6% above analysts’ consensus estimates.

Fiserv (FISV) Q4 CY2025 Highlights:

- Revenue: $5.28 billion vs analyst estimates of $4.91 billion (7.8% year-on-year growth, 7.7% beat)

- Pre-tax Profit: $962 million (18.2% margin)

- Adjusted EPS: $1.99 vs analyst estimates of $1.90 (4.6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $8.15 at the midpoint, missing analyst estimates by 0.6%

- Market Capitalization: $32.35 billion

Company Overview

Powering over 1 billion accounts and processing more than 12,000 financial transactions per second globally, Fiserv (NASDAQ:FISV) provides payment processing and financial technology solutions that enable merchants, banks, and credit unions to accept payments and manage financial transactions.

Fiserv operates through three main segments: Merchant Acceptance, Financial Technology, and Payments and Network. The Merchant Acceptance segment offers solutions that allow businesses of all sizes to securely accept payments through physical point-of-sale systems or online channels. This includes Clover, a cloud-based operating system for small and mid-sized businesses, and Carat, an integrated platform for large enterprises.

The Financial Technology segment provides core account processing systems that financial institutions use to maintain customer deposit and loan accounts, manage ledgers, and handle essential banking operations. These solutions are complemented by digital banking platforms, financial management tools, and risk management services that help banks and credit unions serve their customers efficiently.

In the Payments segment, Fiserv delivers the infrastructure needed to process various payment types, including debit, credit, and prepaid card transactions. The company owns and operates payment networks like Accel, STAR, and MoneyPass, which connect financial institutions, merchants, and consumers. This segment also includes bill payment services, person-to-person payment capabilities, and prepaid solutions.

A typical client might be a regional bank that uses Fiserv's core processing platform to manage customer accounts, its digital banking solution to offer mobile banking services, and its payment processing infrastructure to handle debit card transactions. The bank pays Fiserv recurring fees for these services, creating a steady revenue stream. Similarly, a retail merchant might use Fiserv's Clover system to accept payments and manage inventory, paying transaction fees on each sale processed through the system.

4. Payment Processing

Payment processors facilitate transactions between merchants, consumers, and financial institutions. Growth comes from e-commerce expansion, declining cash usage globally, and value-added services beyond basic processing. Headwinds include margin pressure from merchant negotiating power, rapid technological change requiring investment, and emerging competition from technology companies entering the payments ecosystem.

Fiserv competes with other financial technology and payment processing companies including FIS (NYSE:FIS), Global Payments (NYSE:GPN), Jack Henry & Associates (NASDAQ:JKHY), and PayPal (NASDAQ:PYPL). In the merchant services space, it also faces competition from Block (NYSE:SQ) and Stripe (private).

5. Revenue Growth

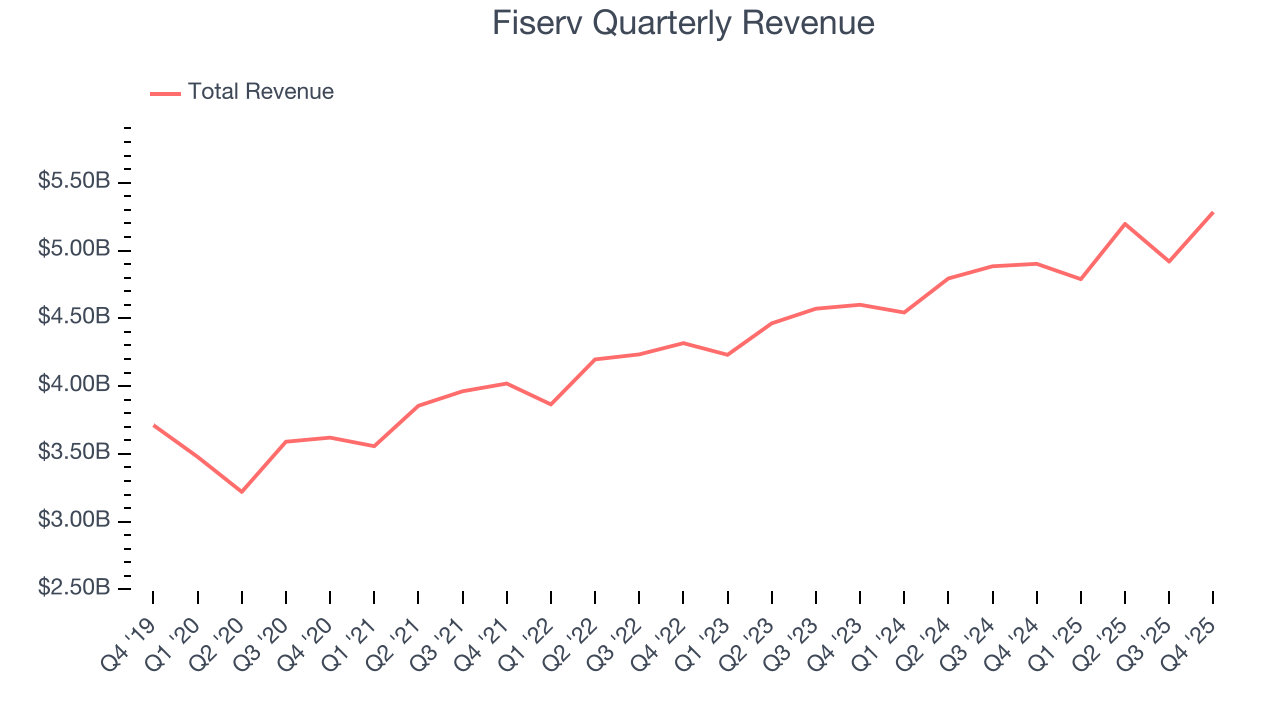

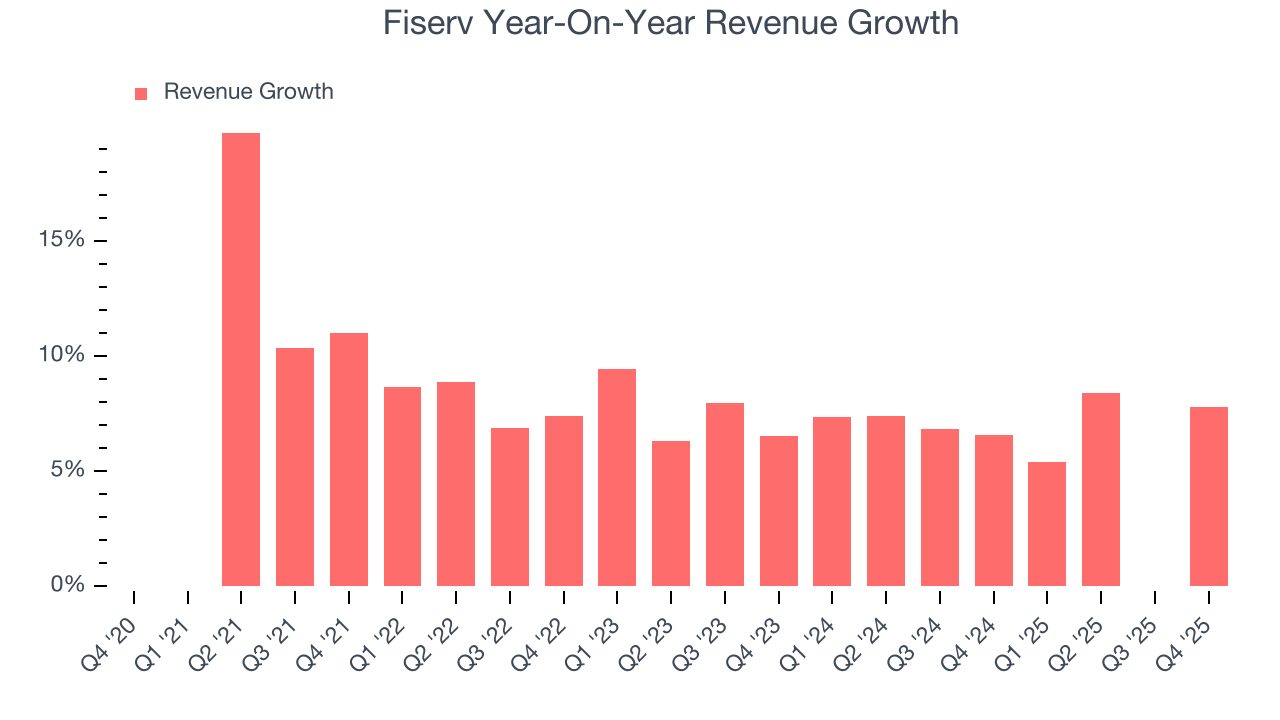

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Fiserv grew its revenue at a decent 7.7% compounded annual growth rate. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Fiserv’s recent performance shows its demand has slowed as its annualized revenue growth of 6.3% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Fiserv reported year-on-year revenue growth of 7.8%, and its $5.28 billion of revenue exceeded Wall Street’s estimates by 7.7%.

6. Pre-Tax Profit Margin

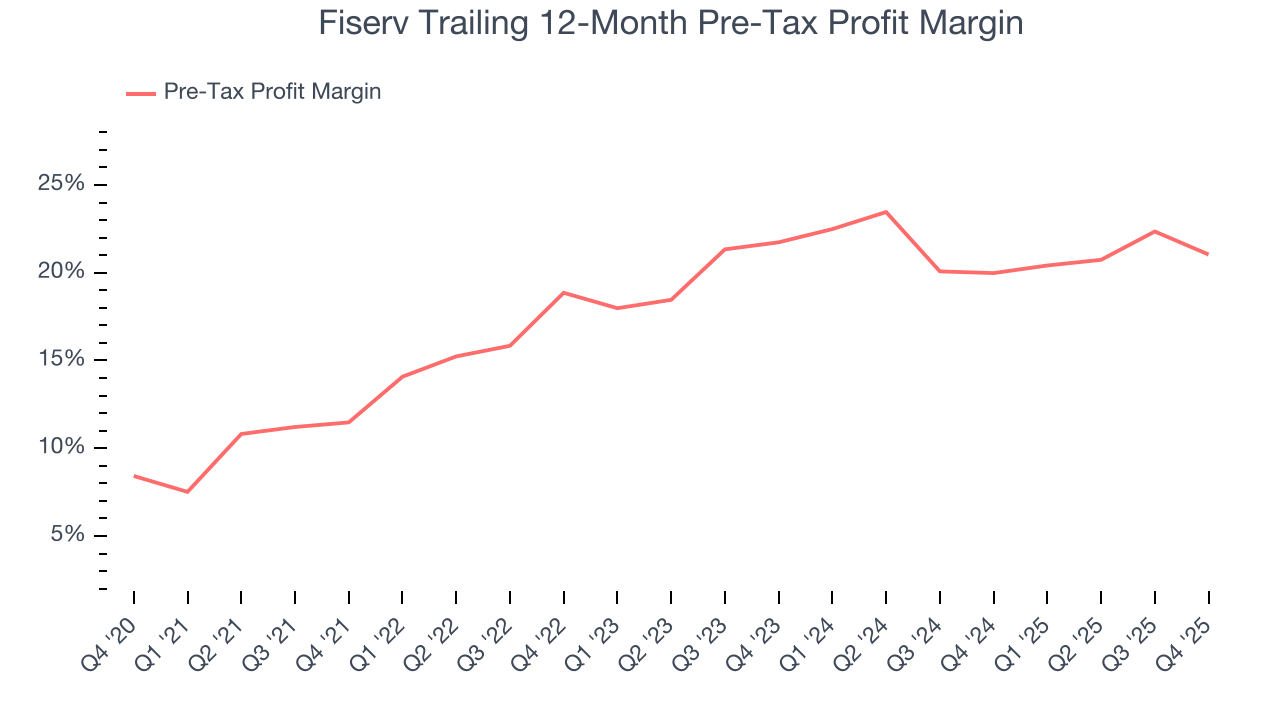

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Payment Processing companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

Financials companies manage interest-bearing assets and liabilities, making the interest income and expenses included in pre-tax profit essential to their profit calculation. Taxes, being external factors beyond management control, are appropriately excluded from this alternative margin measure.

Over the last five years, Fiserv’s pre-tax profit margin has fallen by 12.6 percentage points, going from 11.5% to 21%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

Fiserv’s pre-tax profit margin came in at 18.2% this quarter. This result was 5.1 percentage points worse than the same quarter last year.

7. Earnings Per Share

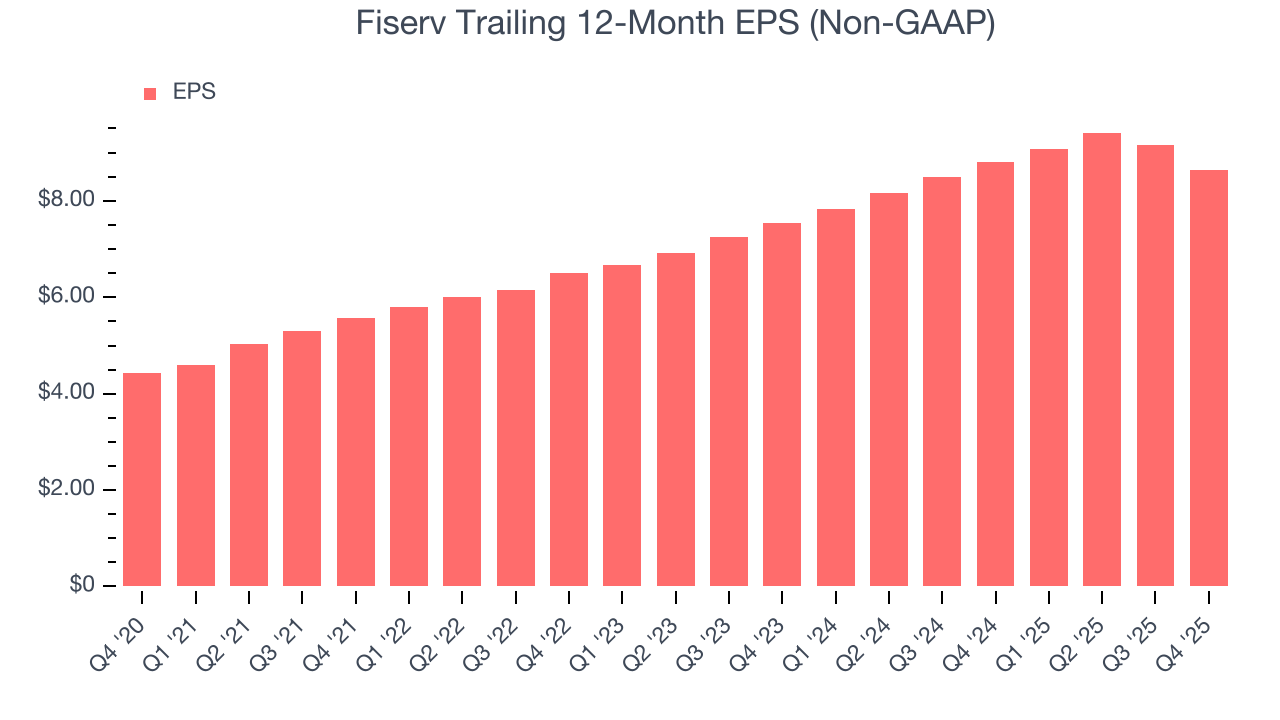

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Fiserv’s EPS grew at a solid 14.3% compounded annual growth rate over the last five years, higher than its 7.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Fiserv, its two-year annual EPS growth of 7% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q4, Fiserv reported adjusted EPS of $1.99, down from $2.51 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 4.6%. Over the next 12 months, Wall Street expects Fiserv’s full-year EPS of $8.64 to shrink by 5.3%.

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Fiserv has averaged an ROE of 9.2%, uninspiring for a company operating in a sector where the average shakes out around 10%.

9. Balance Sheet Assessment

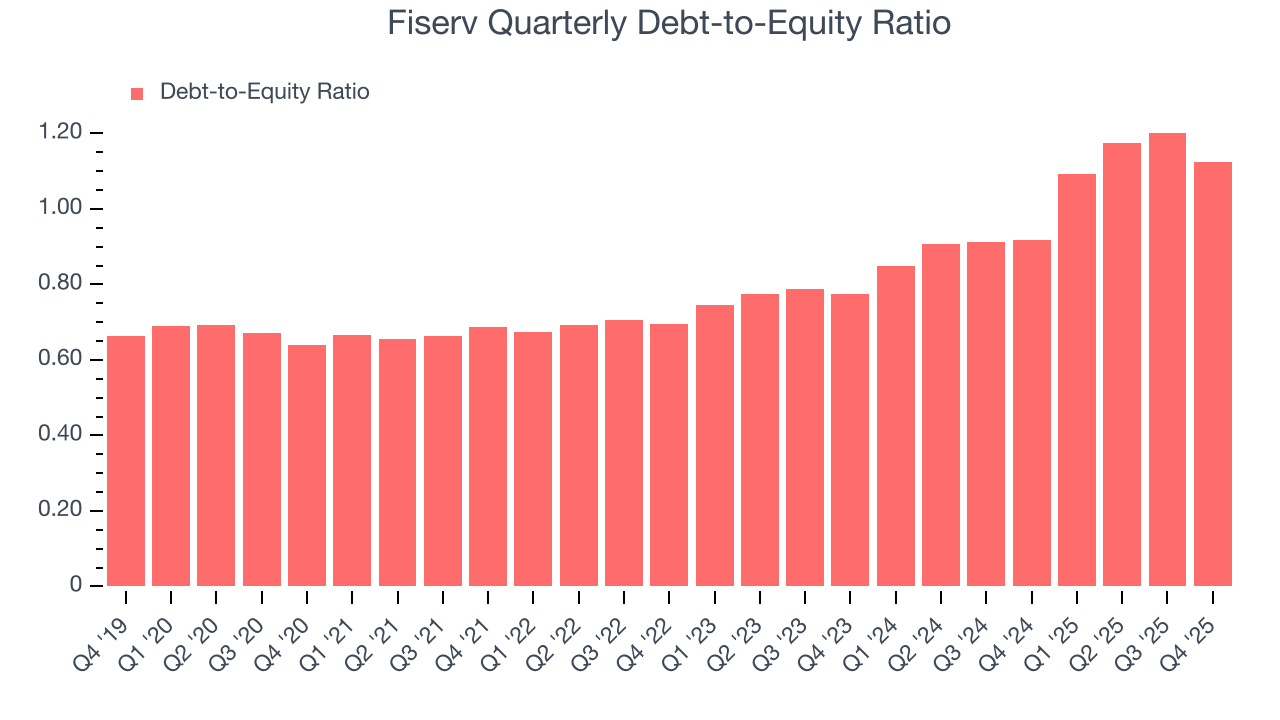

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Fiserv currently has $29 billion of debt and $25.81 billion of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 1.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Fiserv’s Q4 Results

We were impressed by how significantly Fiserv blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance slightly missed. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 3.8% to $57.65 immediately after reporting.

11. Is Now The Time To Buy Fiserv?

Updated: February 10, 2026 at 11:42 PM EST

Before making an investment decision, investors should account for Fiserv’s business fundamentals and valuation in addition to what happened in the latest quarter.

Fiserv isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months.

Fiserv’s P/E ratio based on the next 12 months is 7.4x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $79.59 on the company (compared to the current share price of $62.92).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.