PayPal (PYPL)

PayPal piques our interest. Its superb 19.9% ROE illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why PayPal Is Interesting

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ:PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

- Industry-leading 19.9% return on equity demonstrates management’s skill in finding high-return investments

- Annual revenue growth of 9.1% over the last five years was above the sector average and underscores its products and services value to customers

- One pitfall is its annual earnings per share growth of 6.4% underperformed its revenue over the last five years, showing its incremental sales were less profitable

PayPal has the potential to be a high-quality business. If you like the story, the price seems fair.

Why Is Now The Time To Buy PayPal?

High Quality

Investable

Underperform

Why Is Now The Time To Buy PayPal?

At $44.24 per share, PayPal trades at 7.8x forward P/E. Price is what you pay, and value is what you get. We think the current valuation is quite a good deal considering PayPal’s business fundamentals.

It could be a good time to invest if you see something the market doesn’t.

3. PayPal (PYPL) Research Report: Q4 CY2025 Update

Digital payments platform PayPal (NASDAQ:PYPL) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3.7% year on year to $8.68 billion. Its non-GAAP profit of $1.23 per share was 4.5% below analysts’ consensus estimates.

PayPal (PYPL) Q4 CY2025 Highlights:

- Revenue: $8.68 billion vs analyst estimates of $8.78 billion (3.7% year-on-year growth, 1.2% miss)

- Pre-tax Profit: $1.63 billion (18.8% margin)

- Adjusted EPS: $1.23 vs analyst expectations of $1.29 (4.5% miss)

- Market Capitalization: $48.96 billion

Company Overview

Originally spun off from eBay in 2015 after being acquired by the auction giant in 2002, PayPal (NASDAQ:PYPL) operates a global digital payments platform that enables consumers and merchants to send, receive, and process payments online and in person.

PayPal's two-sided network connects hundreds of millions of consumers with millions of merchants across approximately 200 markets worldwide. The platform offers various payment solutions, including its flagship PayPal digital wallet, the peer-to-peer payment app Venmo (popular in the US), and Xoom for international money transfers.

For merchants, PayPal provides tools beyond simple payment processing. These include fraud prevention systems, risk management solutions, and data analytics to help businesses understand customer behavior. Merchants can integrate PayPal's checkout solutions on websites and mobile apps, or use its point-of-sale systems for in-person transactions. A small business owner might use PayPal to accept credit card payments on their website, protect against fraudulent transactions, and access working capital through PayPal's business financing options.

For consumers, PayPal offers secure ways to shop online without sharing financial information directly with merchants. Users can fund transactions through multiple sources, including bank accounts, credit cards, debit cards, account balances, and even certain cryptocurrencies. The company has expanded its consumer offerings to include buy-now-pay-later installment options, credit products, and cryptocurrency trading services in select markets.

PayPal generates revenue primarily through transaction fees charged to merchants based on payment volume. Additional revenue streams include currency conversion fees, instant transfer fees, interest on consumer credit products, and fees from facilitating cryptocurrency transactions. The company's protection programs for both buyers and sellers, backed by its proprietary risk management systems, are central to maintaining trust in its platform.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

PayPal's competitors include traditional payment processors like Visa (NYSE:V) and Mastercard (NYSE:MA), digital payment platforms such as Block's Cash App (NYSE:SQ), Stripe (private), Adyen (AMS:ADYEN), and emerging fintech companies like Affirm (NASDAQ:AFRM) and Klarna (private).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, PayPal’s 9.1% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. PayPal’s recent performance shows its demand has slowed as its annualized revenue growth of 5.6% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, PayPal’s revenue grew by 3.7% year on year to $8.68 billion, falling short of Wall Street’s estimates.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last five years, PayPal’s pre-tax profit margin has risen by 4.6 percentage points, going from 16.2% to 19%. Expenses have stabilized more recently as the company’s pre-tax profit margin was flat on a two-year basis.

PayPal’s pre-tax profit margin came in at 18.8% this quarter. This result was 1.9 percentage points better than the same quarter last year.

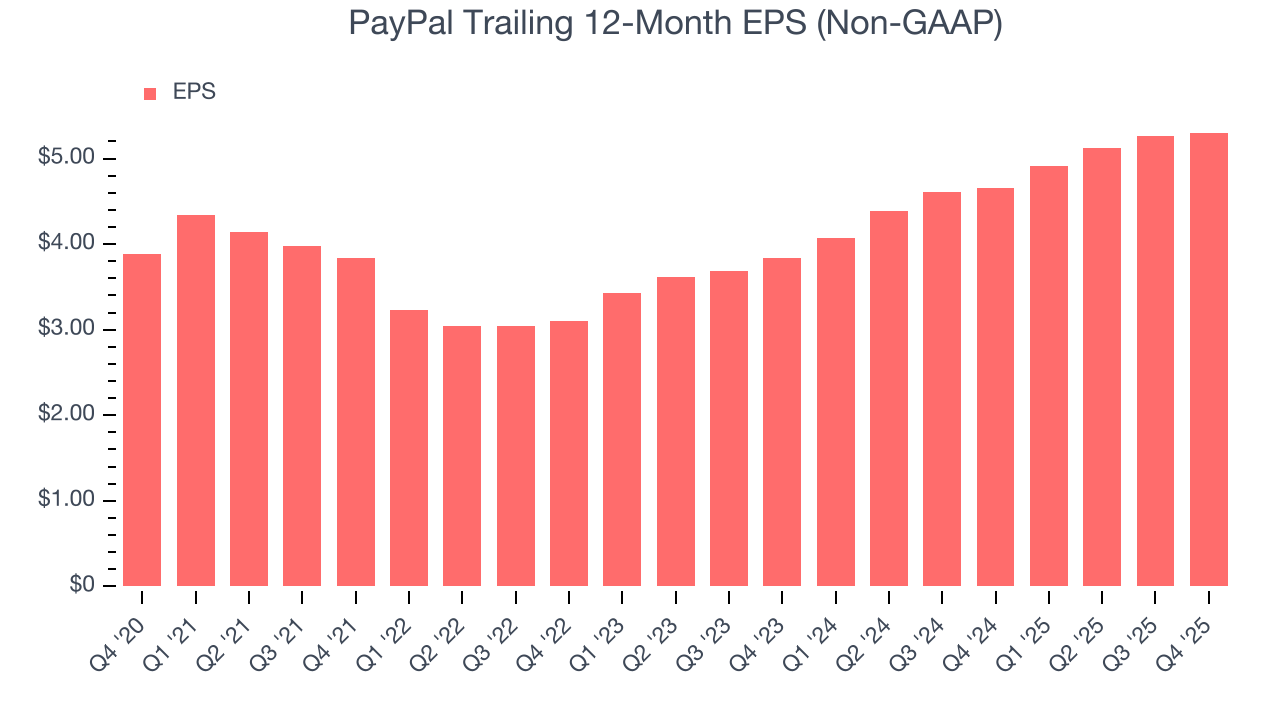

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

PayPal’s EPS grew at an unimpressive 6.4% compounded annual growth rate over the last five years, lower than its 9.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For PayPal, its two-year annual EPS growth of 17.6% was higher than its five-year trend. This acceleration made it one of the faster-growing financials companies in recent history.

In Q4, PayPal reported adjusted EPS of $1.23, up from $1.19 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects PayPal’s full-year EPS of $5.30 to grow 8.6%.

8. Return on Equity

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, PayPal has averaged an ROE of 19.4%, excellent for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows PayPal has a strong competitive moat.

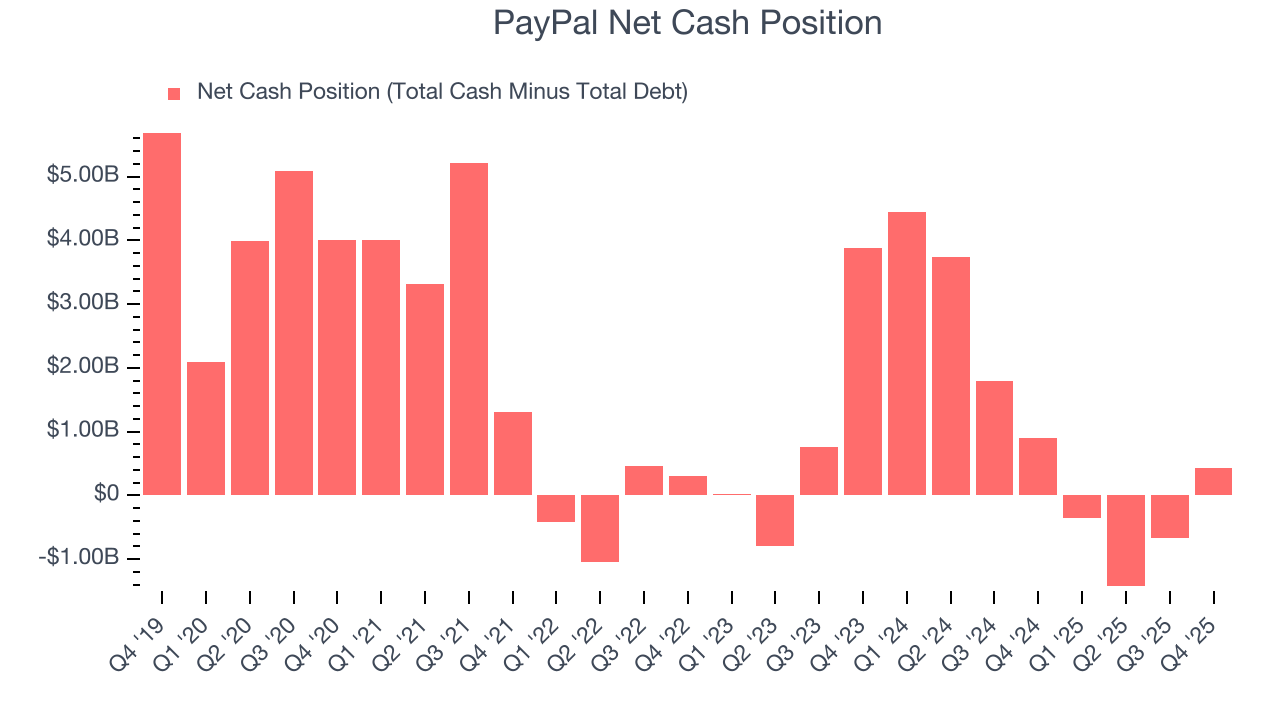

9. Balance Sheet Assessment

PayPal reported $10.42 billion of cash and $9.99 billion of debt on its balance sheet in the most recent quarter.

Given the company has more cash than debt, leverage is not an issue here.

10. Key Takeaways from PayPal’s Q4 Results

We struggled to find many positives in these results. Its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 14.6% to $44.86 immediately after reporting.

11. Is Now The Time To Buy PayPal?

Updated: February 23, 2026 at 11:16 PM EST

Before investing in or passing on PayPal, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

PayPal isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its declining pre-tax profit margin shows the business has become less efficient. And while the company’s market-beating ROE suggests it has been a well-managed company historically, the downside is its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

PayPal’s P/E ratio based on the next 12 months is 7.8x. Looking at the financials space right now, PayPal trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $51.88 on the company (compared to the current share price of $44.24), implying they see 17.3% upside in buying PayPal in the short term.

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.