Payoneer (PAYO)

We’d invest in Payoneer. Its impressive revenue growth indicates the value of its offerings.― StockStory Analyst Team

1. News

2. Summary

Why We Like Payoneer

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer (NASDAQ:PAYO) provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

- Impressive 28.2% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 56.2% outpaced its revenue gains

- The stock is slightly expensive, but we’d argue it’s often wise to hold onto high-quality businesses for the long term

Payoneer is a standout company. No surprise this ranks among our best financials stocks.

Is Now The Time To Buy Payoneer?

High Quality

Investable

Underperform

Is Now The Time To Buy Payoneer?

At $5.02 per share, Payoneer trades at 18.9x forward P/E. There’s no arguing the market has lofty expectations given its premium multiple.

Are you a fan of the business model? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Payoneer (PAYO) Research Report: Q3 CY2025 Update

Cross-border payment platform Payoneer (NASDAQ:PAYO) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.1% year on year to $270.9 million. The company’s full-year revenue guidance of $1.06 billion at the midpoint came in 0.9% above analysts’ estimates. Its GAAP profit of $0.04 per share was $0.02 below analysts’ consensus estimates.

Payoneer (PAYO) Q3 CY2025 Highlights:

Company Overview

Founded during the early days of global e-commerce in 2005 to solve international payment challenges, Payoneer (NASDAQ:PAYO) provides financial technology services that enable small and medium-sized businesses to send and receive payments globally across borders.

At the heart of Payoneer's offering is its multi-currency account, which functions as a comprehensive financial stack for cross-border commerce. This account allows businesses to receive payments from international marketplaces, direct business clients, and consumers, while also managing outgoing payments to suppliers and vendors worldwide. Users can hold balances in multiple currencies, convert funds at competitive rates, and access their money through local bank withdrawals or Payoneer-issued physical and virtual cards.

The company serves diverse customer segments, including e-commerce sellers on global marketplaces, business-to-business service providers, freelancers, and direct-to-consumer merchants. For example, a handcraft producer in India might use Payoneer to receive payments from customers in Europe and the United States, then use those funds to pay for raw materials from suppliers in China—all without the complexity and high fees typically associated with traditional international banking.

Payoneer generates revenue through transaction fees, currency conversion spreads, and interest on customer balances. It also offers additional services like working capital loans to qualified merchants, invoice management tools, and mass payout solutions for enterprises that need to pay multiple recipients globally. The company's platform connects to approximately 100 banking and payment service providers worldwide, enabling transactions across over 7,000 trade corridors with same-day settlement capabilities in more than 150 countries.

Operating in a highly regulated industry, Payoneer maintains licenses in multiple jurisdictions, including money transmitter licenses in U.S. states and payment service authorizations in regions like the European Economic Area, the United Kingdom, Australia, and Japan.

4. Diversified Financial Services

Diversified financial services encompass specialized offerings outside traditional categories. These firms benefit from identifying niche market opportunities, developing tailored financial products, and often facing less direct competition. Challenges include scale limitations, regulatory classification uncertainties, and the need to continuously innovate to maintain market differentiation against larger competitors expanding their offerings.

Payoneer competes with other cross-border payment providers like Wise (LSE:WISE), PayPal (NASDAQ:PYPL), and Stripe (private), as well as traditional banks offering international wire transfers and specialized B2B payment platforms such as Flywire (NASDAQ:FLYW) and Adyen (AMS:ADYEN).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Payoneer grew its revenue at an incredible 25.3% compounded annual growth rate. Its growth surpassed the average financials company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Payoneer’s annualized revenue growth of 14.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Payoneer reported year-on-year revenue growth of 9.1%, and its $270.9 million of revenue exceeded Wall Street’s estimates by 2.9%.

6. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Diversified Financial Services companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

This is because for financials businesses, interest income and expense should be factored into the definition of profit but taxes - which are largely out of a company's control - should not.

Over the last four years, Payoneer’s pre-tax profit margin has fallen by 15.5 percentage points, going from negative 4.5% to 11%. However, fixed cost leverage was muted more recently as the company’s pre-tax profit margin was flat on a two-year basis.

Payoneer’s pre-tax profit margin came in at 11.3% this quarter. This result was 2.4 percentage points better than the same quarter last year.

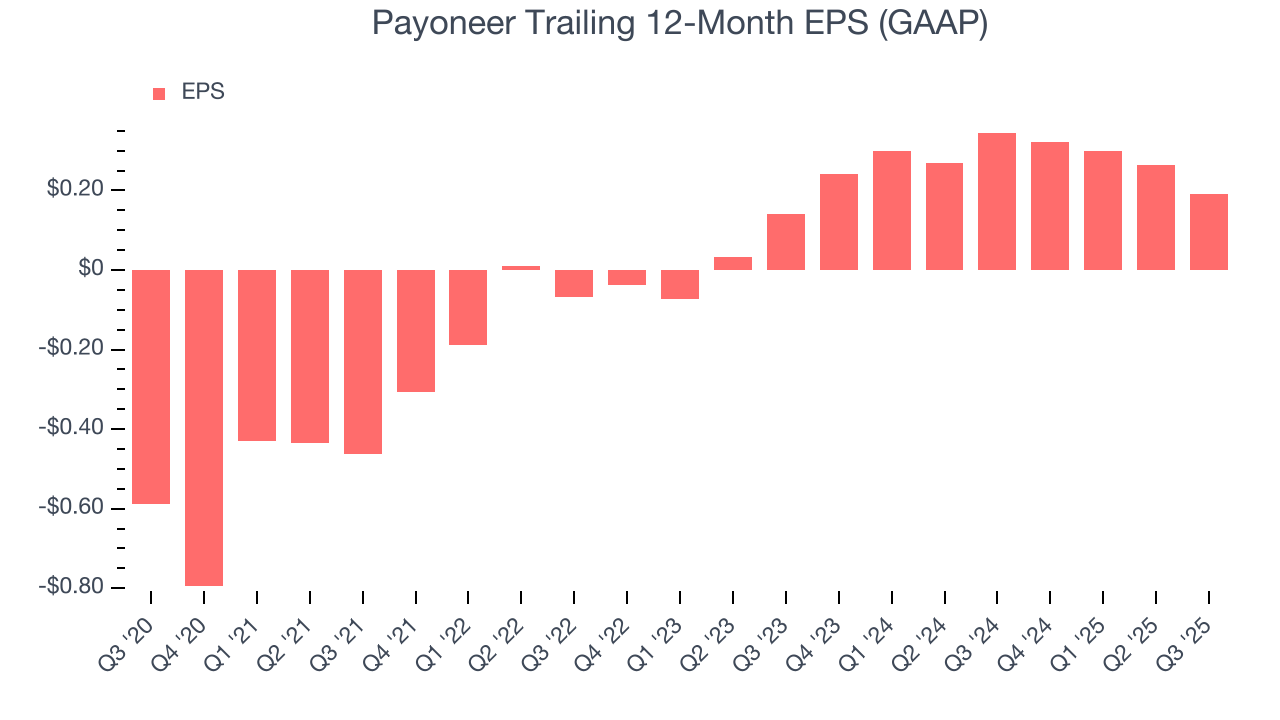

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Payoneer’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Payoneer’s remarkable 16.5% annual EPS growth over the last two years aligns with its revenue trend. This tells us it maintained its per-share profitability as it expanded.

In Q3, Payoneer reported EPS of $0.04, down from $0.11 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Payoneer’s full-year EPS of $0.19 to grow 48.3%.

8. Return on Equity

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Payoneer has averaged an ROE of 6%, uninspiring for a company operating in a sector where the average shakes out around 10%. We’re optimistic Payoneer can turn the ship around given its success in other measures of financial health.

9. Balance Sheet Assessment

The debt-to-equity ratio is a widely used measure to assess a company's balance sheet health. A higher ratio means that a business aggressively financed its growth with debt. This can result in higher earnings (if the borrowed funds are invested profitably) but also increases risk.

If debt levels are too high, there could be difficulties in meeting obligations, especially during economic downturns or periods of rising interest rates if the debt has variable-rate payments.

Payoneer currently has $267.3 million of debt and $750.5 million of shareholder's equity on its balance sheet, and over the past four quarters, has averaged a debt-to-equity ratio of 0.1×. We think this is safe and raises no red flags. In general, we’re comfortable with any ratio below 3.5× for a financials business.

10. Key Takeaways from Payoneer’s Q3 Results

It was encouraging to see Payoneer beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EPS was in line. Overall, this quarter could have been better. The stock traded up 4.8% to $6.07 immediately after reporting.

11. Is Now The Time To Buy Payoneer?

Updated: February 23, 2026 at 11:54 PM EST

When considering an investment in Payoneer, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There is a lot to like about Payoneer. First of all, the company’s revenue growth was exceptional over the last five years. And while its mediocre ROE lags the market and is a headwind for its stock price, its expanding pre-tax profit margin shows the business has become more efficient. Additionally, Payoneer’s spectacular EPS growth over the last four years shows its profits are trickling down to shareholders.

Payoneer’s P/E ratio based on the next 12 months is 18.9x. This multiple isn’t necessarily cheap, but we’ll happily own Payoneer as its fundamentals shine bright. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $8.38 on the company (compared to the current share price of $5.02).