FOX (FOXA)

We wouldn’t recommend FOX. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think FOX Will Underperform

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

- Large revenue base makes it harder to increase sales quickly, and its annual revenue growth of 5.9% over the last five years was below our standards for the consumer discretionary sector

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 11.3% annually

- Demand will likely fall over the next 12 months as Wall Street expects flat revenue

FOX’s quality doesn’t meet our expectations. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than FOX

High Quality

Investable

Underperform

Why There Are Better Opportunities Than FOX

FOX is trading at $70.06 per share, or 15.8x forward P/E. This multiple is lower than most consumer discretionary companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. FOX (FOXA) Research Report: Q4 CY2025 Update

Cable news and media network Fox (NASDAQ:FOXA) announced better-than-expected revenue in Q4 CY2025, with sales up 2% year on year to $5.18 billion. Its non-GAAP profit of $0.82 per share was 58.6% above analysts’ consensus estimates.

FOX (FOXA) Q4 CY2025 Highlights:

- Revenue: $5.18 billion vs analyst estimates of $5.09 billion (2% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.82 vs analyst estimates of $0.52 (58.6% beat)

- Adjusted EBITDA: $692 million vs analyst estimates of $461.8 million (13.4% margin, 49.9% beat)

- Operating Margin: 36.3%, up from 13.4% in the same quarter last year

- Free Cash Flow was -$791 million compared to -$436 million in the same quarter last year

- Market Capitalization: $29.53 billion

Company Overview

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX was initially established to meet early 20th-century demands for entertainment and news. Over the decades, the company has significantly evolved, branching into various media segments and adopting digital platforms.

FOX provides a broad spectrum of media services including news coverage, sports broadcasting, and other entertainment. FOX caters to a large audience, seeking engagement with diverse viewers, from news aficionados to entertainment consumers.

The company's revenue is primarily derived from advertising, subscription fees, and content licensing. Furthermore, it must produce quality content to maintain its channel space.

A notable aspect of FOX's value proposition is its focus on delivering content that resonates with specific viewer segments, particularly those seeking a certain perspective on news and entertainment. This targeted content strategy has enabled FOX to carve out a niche in the competitive media landscape.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the media and entertainment industry include Comcast Corporation (NASDAQ:CMCSA), Walt Disney (NYSE:DIS), and Paramount Global (NASDAQ:PARA).

5. Revenue Growth

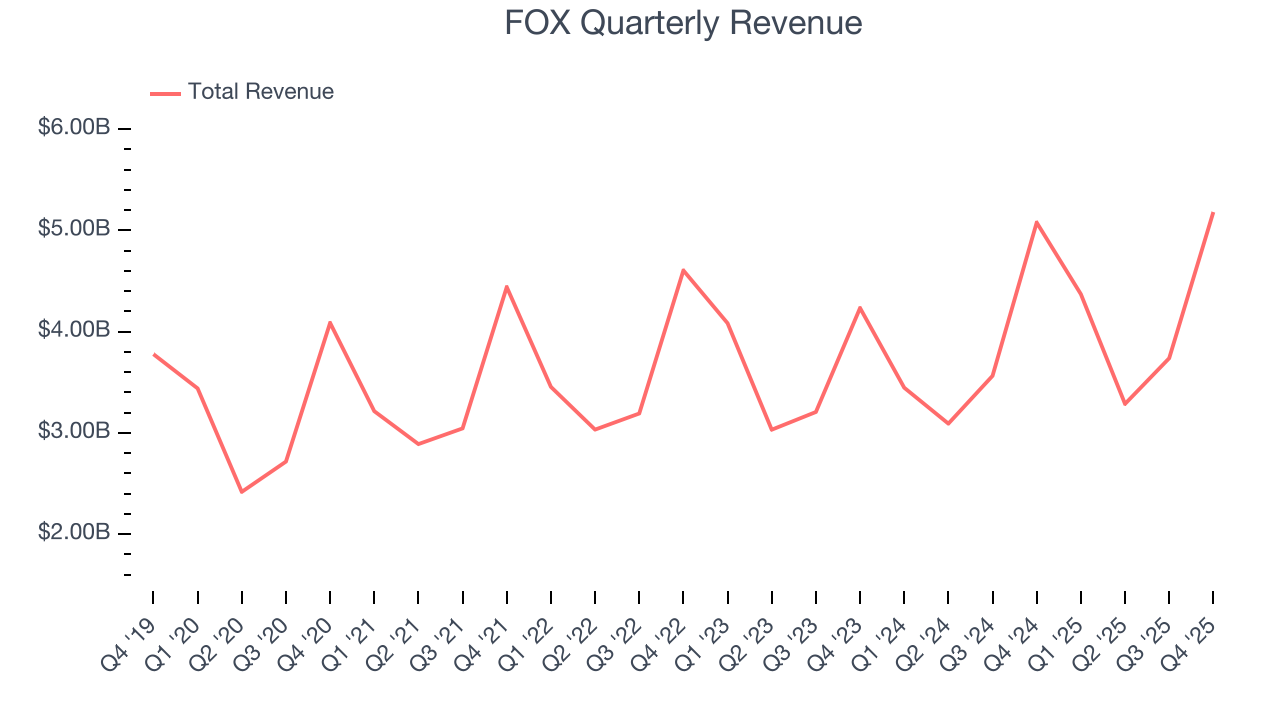

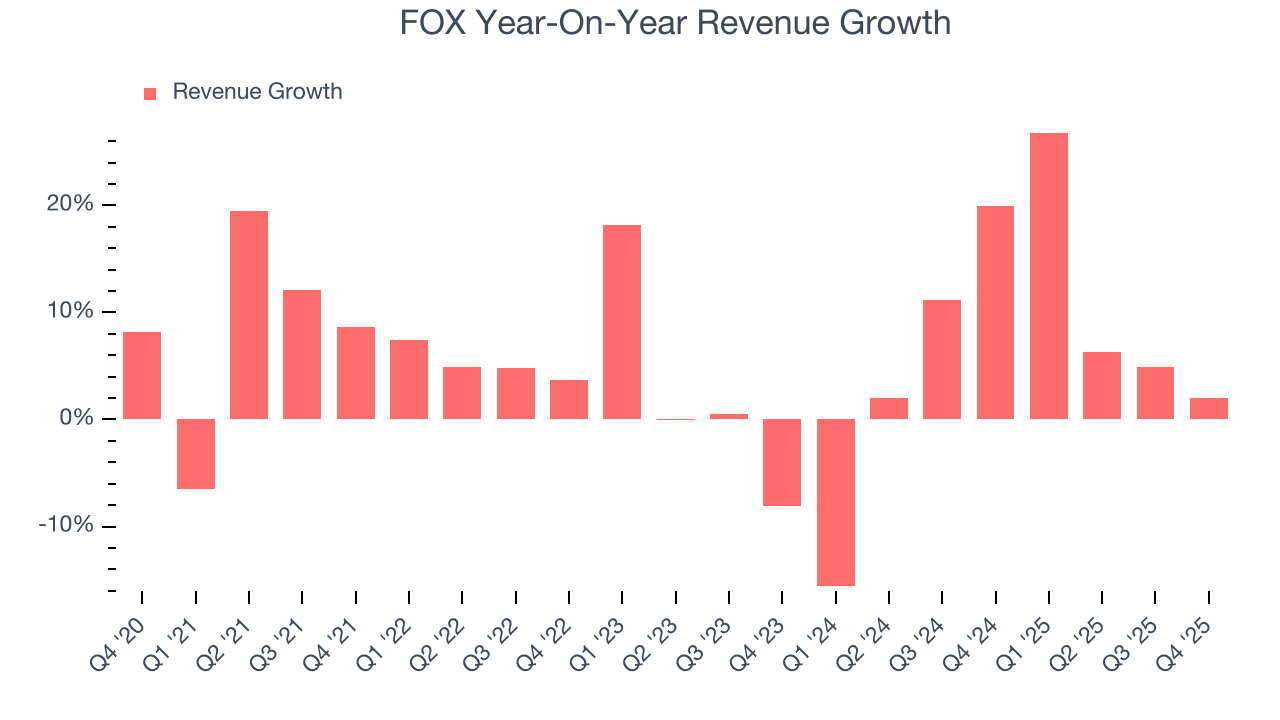

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, FOX’s 5.5% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. FOX’s annualized revenue growth of 6.7% over the last two years is above its five-year trend, but we were still disappointed by the results.

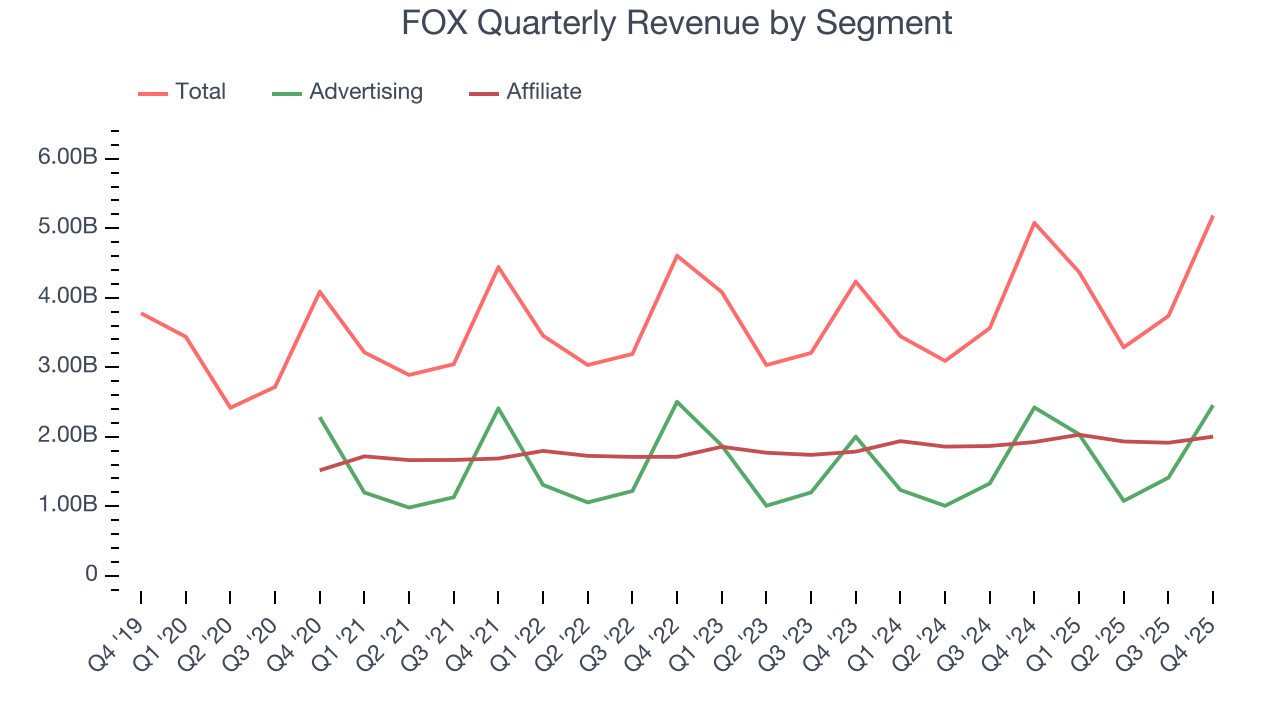

FOX also breaks out the revenue for its most important segments, Advertising and Affiliate, which are 47.4% and 38.6% of revenue. Over the last two years, FOX’s Advertising revenue (marketing services) averaged 9.6% year-on-year growth while its Affiliate revenue (licensing and retransmission fees) averaged 5% growth.

This quarter, FOX reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

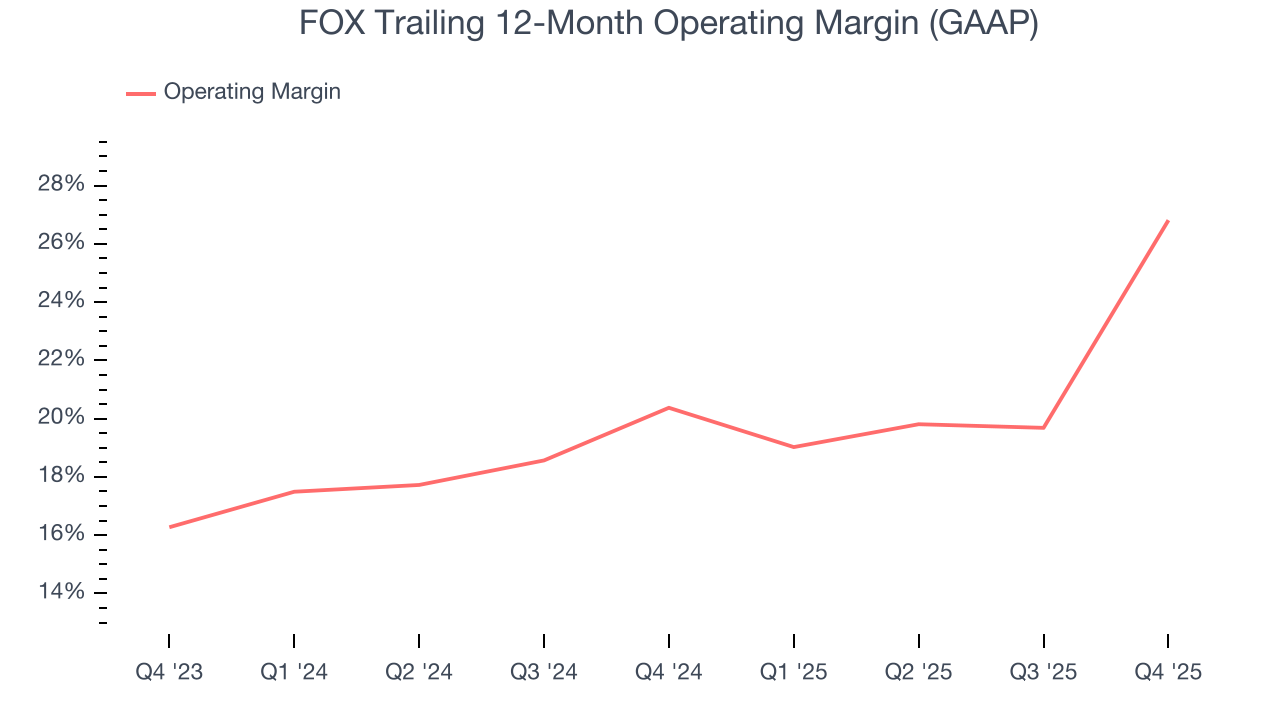

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

FOX’s operating margin has risen over the last 12 months and averaged 23.7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q4, FOX generated an operating margin profit margin of 36.3%, up 22.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

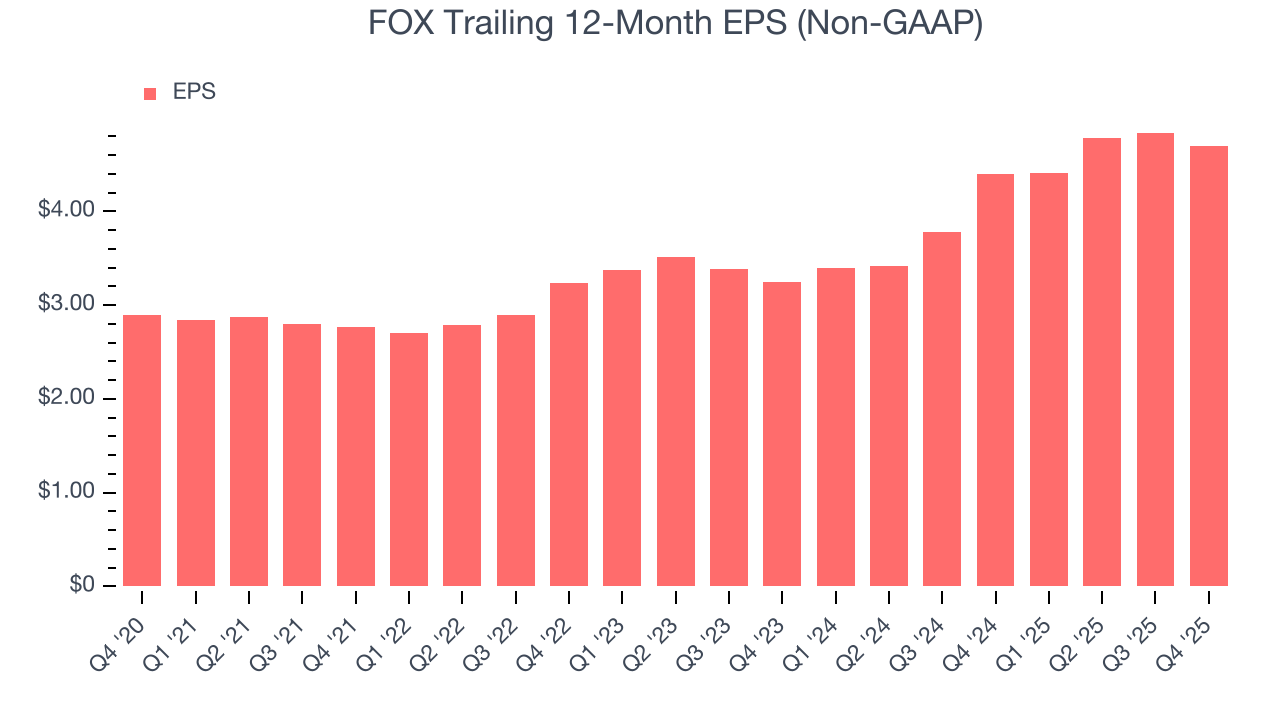

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

FOX’s EPS grew at a weak 10.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 5.5% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, FOX reported adjusted EPS of $0.82, down from $0.96 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects FOX’s full-year EPS of $4.70 to grow 5.6%.

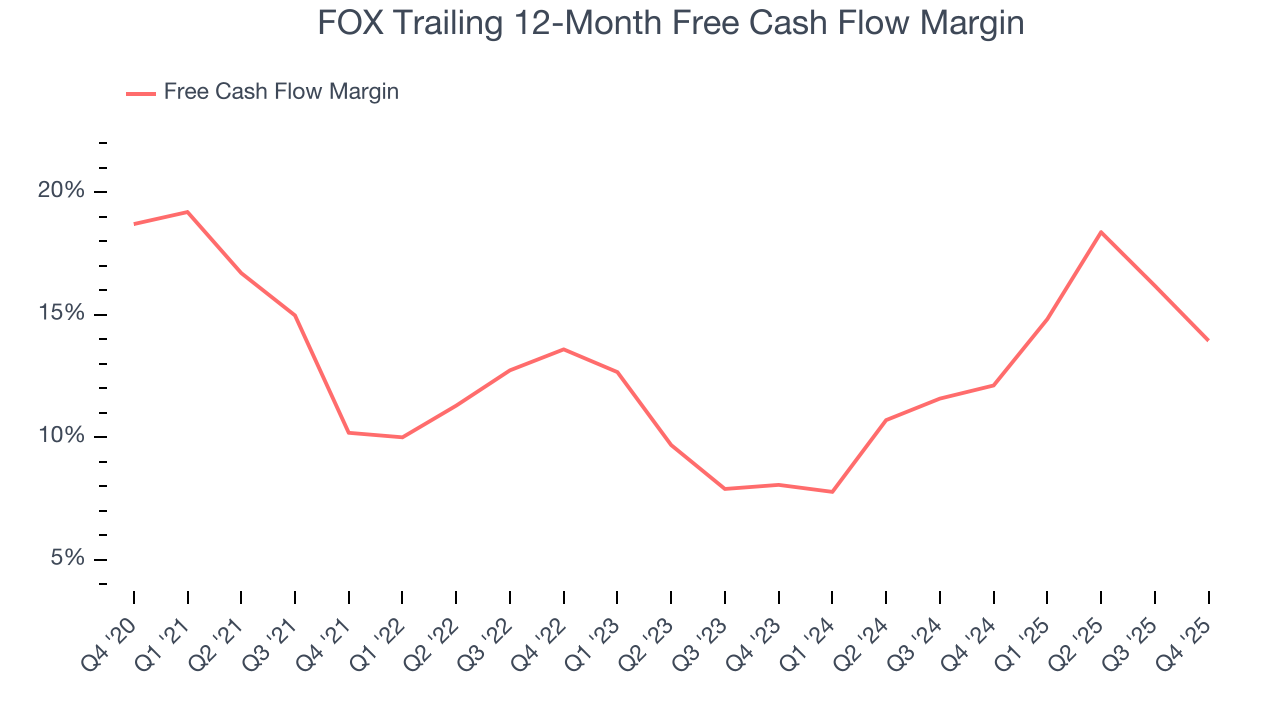

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

FOX has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 13.1%, lousy for a consumer discretionary business.

FOX burned through $791 million of cash in Q4, equivalent to a negative 15.3% margin. The company’s cash burn increased from $436 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

Over the next year, analysts predict FOX’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 13.9% for the last 12 months will decrease to 4%.

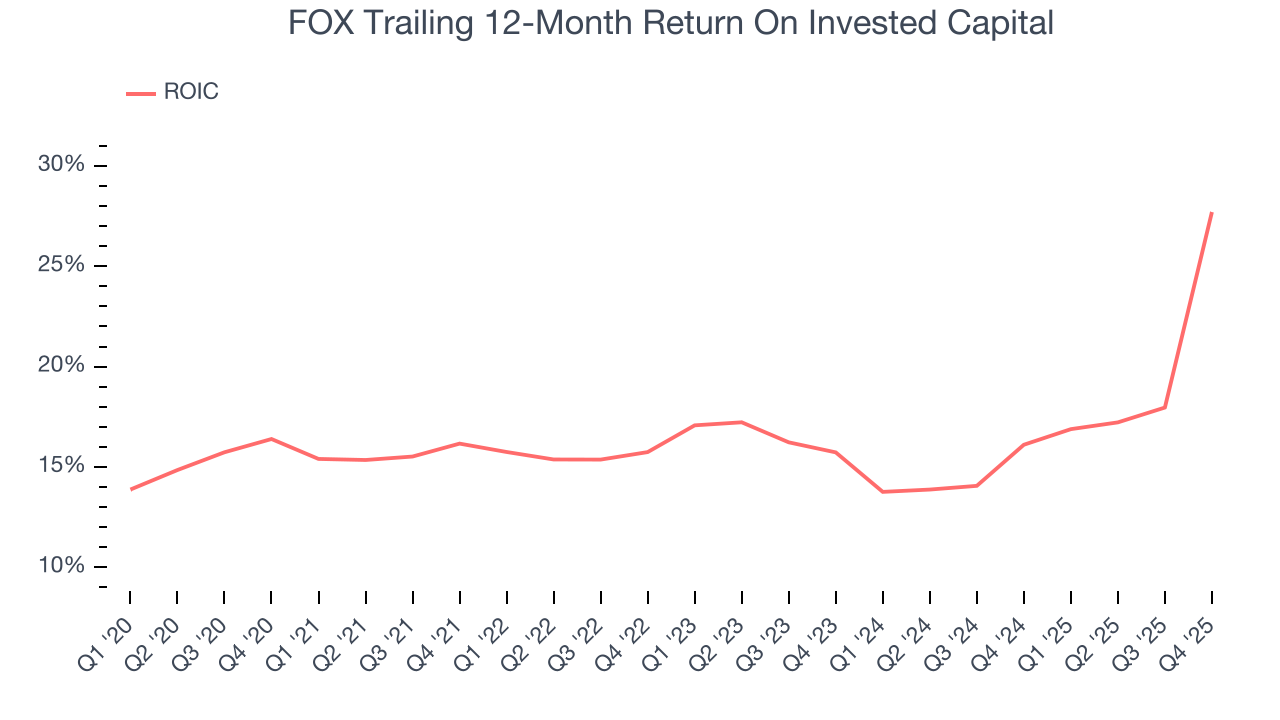

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

FOX historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 18.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, FOX’s ROIC has increased. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

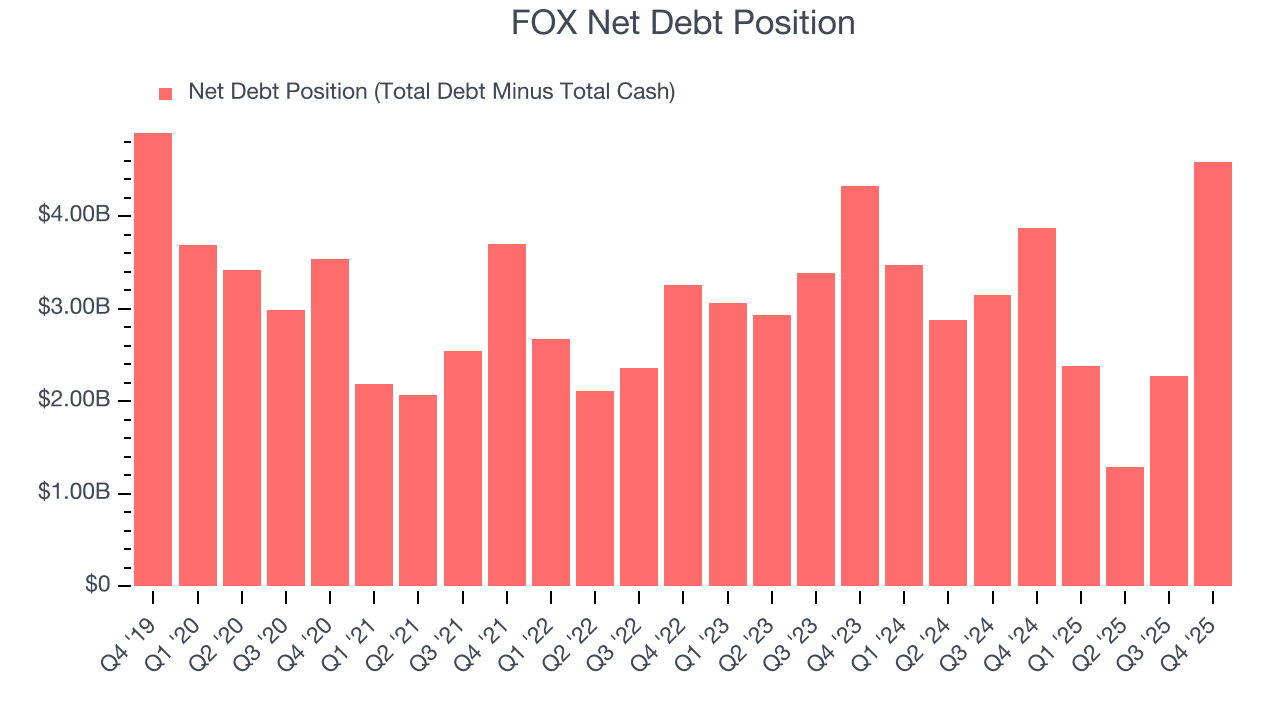

FOX reported $2.02 billion of cash and $6.60 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.55 billion of EBITDA over the last 12 months, we view FOX’s 1.3× net-debt-to-EBITDA ratio as safe. We also see its $245 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from FOX’s Q4 Results

It was good to see FOX beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock remained flat at $70.18 immediately after reporting.

12. Is Now The Time To Buy FOX?

Updated: February 4, 2026 at 8:19 AM EST

Before deciding whether to buy FOX or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

FOX doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, FOX’s Forecasted free cash flow margin suggests the company will ramp up its investments next year, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

FOX’s P/E ratio based on the next 12 months is 14.2x. This valuation multiple is fair, but we don’t have much confidence in the company. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $73.22 on the company (compared to the current share price of $70.18).