GE HealthCare (GEHC)

We’re wary of GE HealthCare. Its revenue and earnings have underwhelmed, suggesting weak business fundamentals.― StockStory Analyst Team

1. News

2. Summary

Why GE HealthCare Is Not Exciting

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ:GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

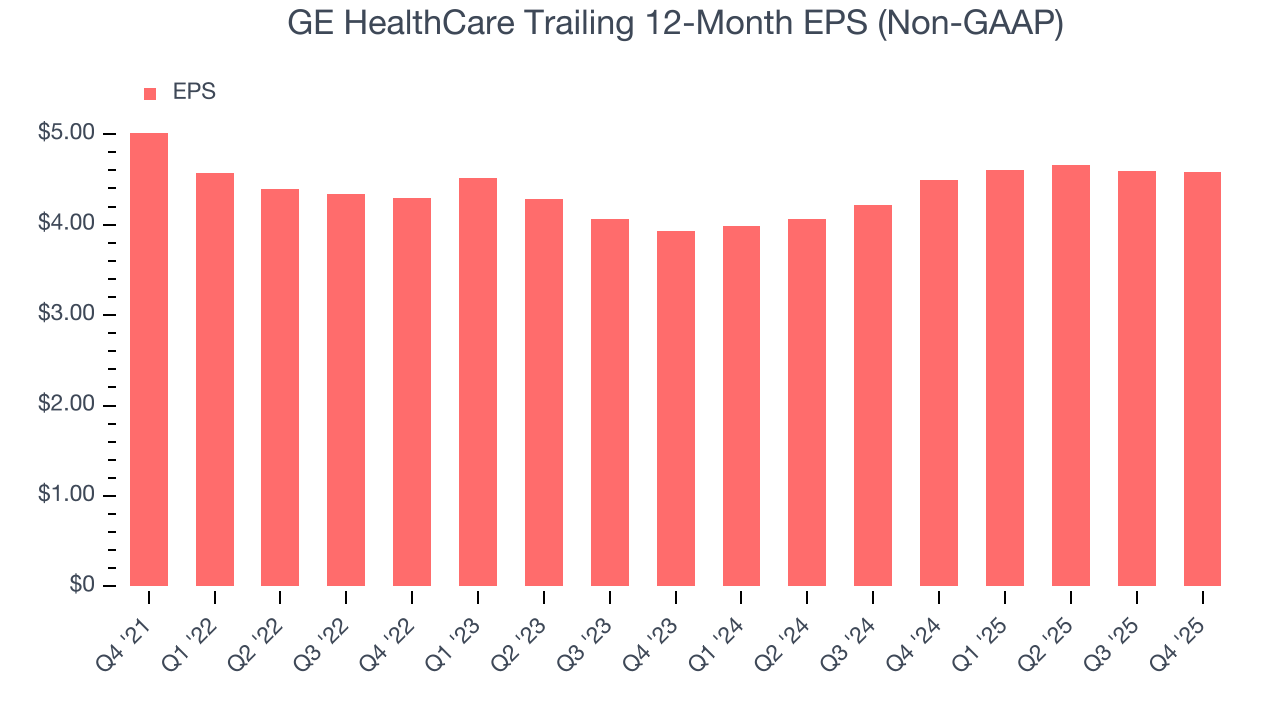

- Earnings per share fell by 2.3% annually over the last four years while its revenue grew, showing its incremental sales were much less profitable

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 4.1% for the last four years

- A silver lining is that its economies of scale give it some operating leverage when demand rises

GE HealthCare’s quality doesn’t meet our hurdle. There are better opportunities in the market.

Why There Are Better Opportunities Than GE HealthCare

High Quality

Investable

Underperform

Why There Are Better Opportunities Than GE HealthCare

At $82.63 per share, GE HealthCare trades at 15.5x forward P/E. Yes, this valuation multiple is lower than that of other healthcare peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. GE HealthCare (GEHC) Research Report: Q4 CY2025 Update

Healthcare technology company GE HealthCare Technologies (NASDAQ:GEHC) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 7.1% year on year to $5.70 billion. Its non-GAAP profit of $1.44 per share was 3% above analysts’ consensus estimates.

GE HealthCare (GEHC) Q4 CY2025 Highlights:

- Revenue: $5.70 billion vs analyst estimates of $5.60 billion (7.1% year-on-year growth, 1.7% beat)

- Adjusted EPS: $1.44 vs analyst estimates of $1.40 (3% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $5.05 at the midpoint, beating analyst estimates by 2.5%

- Operating Margin: 14.5%, in line with the same quarter last year

- Free Cash Flow Margin: 16.1%, similar to the same quarter last year

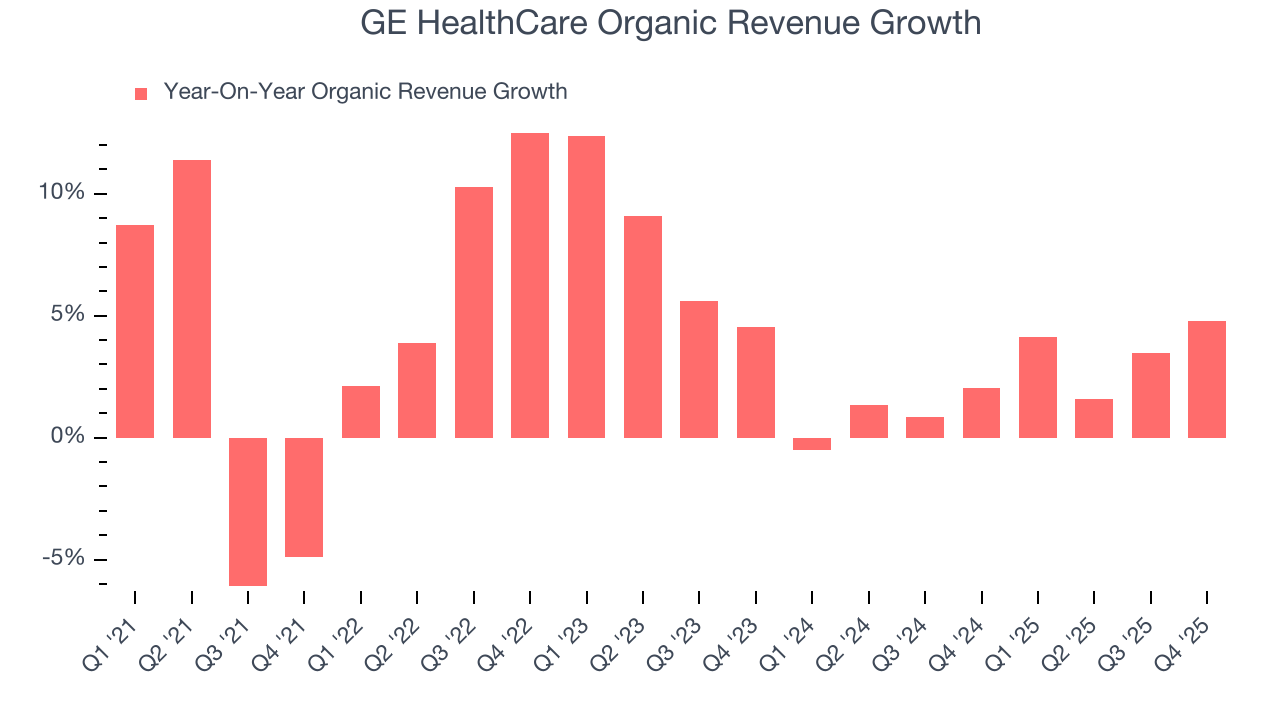

- Organic Revenue rose 4.8% year on year (beat)

- Market Capitalization: $35.89 billion

Company Overview

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ:GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

GE HealthCare operates through four main segments that cover the spectrum of medical diagnostics and patient care. The Imaging segment offers a comprehensive suite of scanning technologies including CT, MRI, X-ray, and molecular imaging systems that help clinicians visualize internal structures for disease detection and treatment planning. The Advanced Visualization Solutions segment provides ultrasound systems and image-guided therapy tools that support everything from routine screenings to complex surgical procedures.

The Patient Care Solutions segment delivers monitoring equipment that tracks vital signs and other patient parameters in hospital settings, along with life support systems like anesthesia delivery devices and neonatal care equipment. The Pharmaceutical Diagnostics segment produces contrast media and radiopharmaceuticals that enhance the visibility of tissues during imaging procedures, making abnormalities easier to detect.

A hospital purchasing a GE HealthCare MRI machine might also contract for the company's service plan, software updates, and contrast agents – creating multiple revenue streams from a single customer relationship. The company's business model combines equipment sales with recurring revenue from consumables, software subscriptions, and maintenance services.

GE HealthCare has invested heavily in artificial intelligence and digital solutions that help clinicians interpret complex medical data more efficiently. These tools can automatically highlight potential abnormalities in scans, streamline workflows, and integrate patient information across different care settings – addressing healthcare's persistent challenges of staff shortages and increasing patient loads.

With operations in over 160 countries, the company maintains a global sales force of approximately 9,800 professionals and 8,300 field service engineers who support healthcare providers ranging from large hospital systems to small clinics and imaging centers.

4. Medical Devices & Supplies - Imaging, Diagnostics

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

GE HealthCare's primary competitors include Siemens Healthineers (ETR:SHL), Philips Healthcare (NYSE:PHG), Canon Medical Systems (TYO:7751), and Mindray (SHE:300760). In the pharmaceutical diagnostics segment, the company competes with Bayer (ETR:BAYN), Bracco, Guerbet (EPA:GBT), and Curium.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $20.63 billion in revenue over the past 12 months, GE HealthCare has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

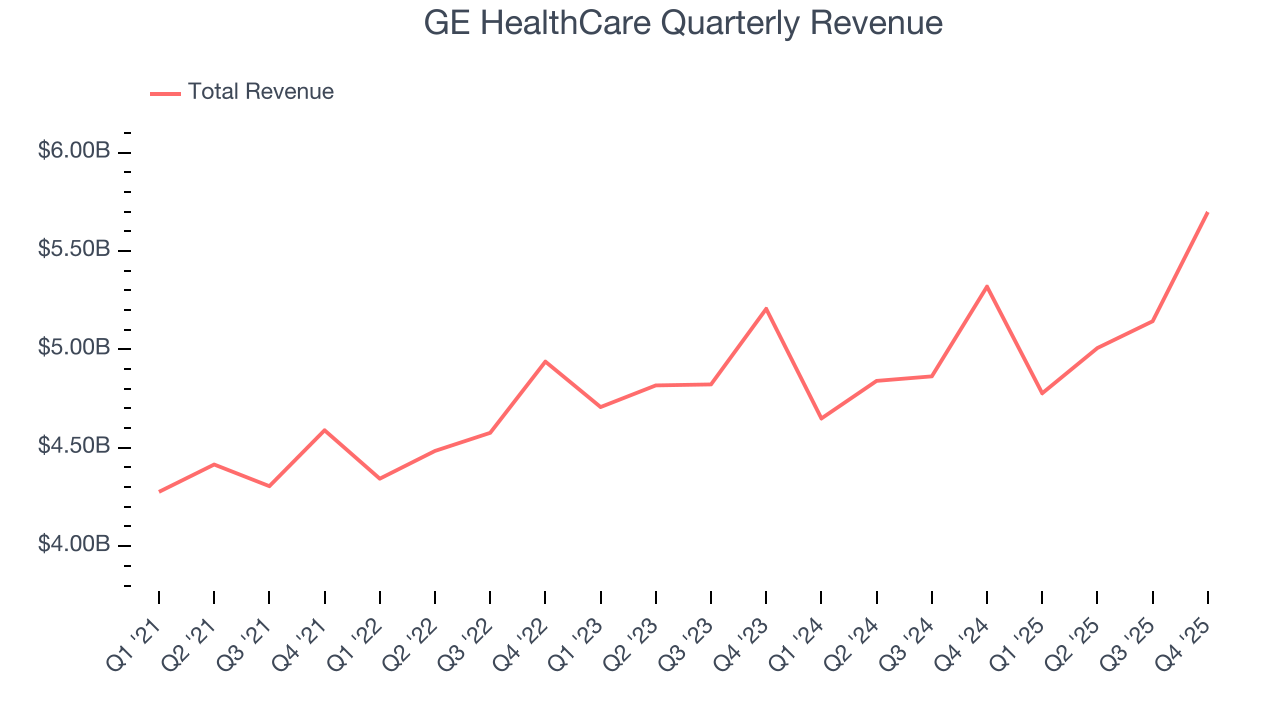

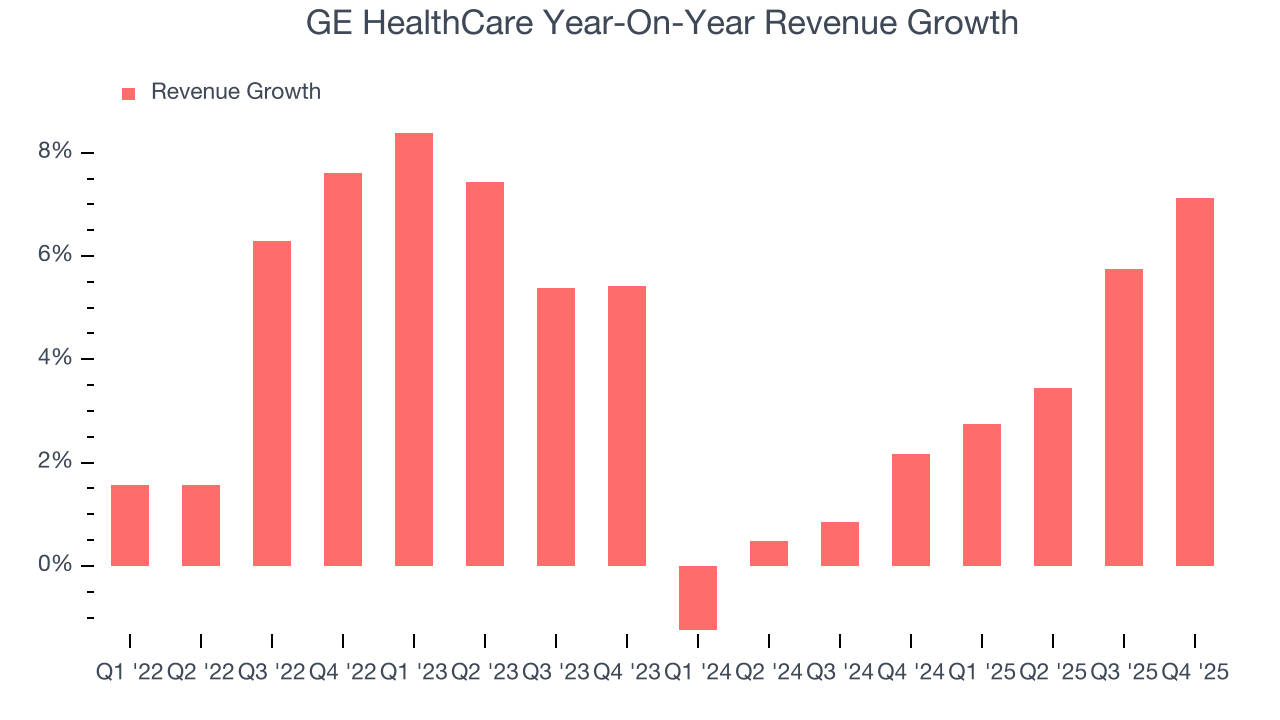

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last four years, GE HealthCare grew its sales at a mediocre 4.1% compounded annual growth rate. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. GE HealthCare’s recent performance shows its demand has slowed as its annualized revenue growth of 2.7% over the last two years was below its four-year trend.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, GE HealthCare’s organic revenue averaged 2.2% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, GE HealthCare reported year-on-year revenue growth of 7.1%, and its $5.70 billion of revenue exceeded Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

7. Operating Margin

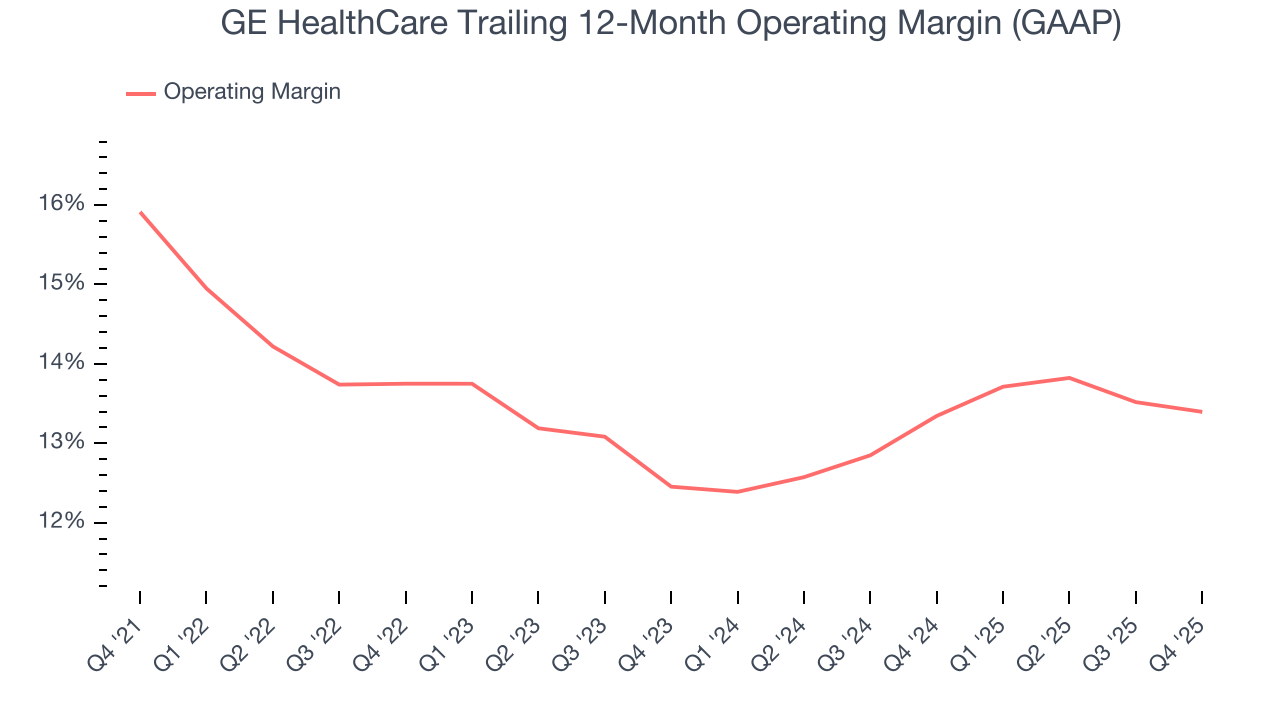

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

GE HealthCare has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.7%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, GE HealthCare’s operating margin decreased by 2.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, GE HealthCare generated an operating margin profit margin of 14.5%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for GE HealthCare, its EPS declined by 2.3% annually over the last four years while its revenue grew by 4.1%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

In Q4, GE HealthCare reported adjusted EPS of $1.44, down from $1.45 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3%. Over the next 12 months, Wall Street expects GE HealthCare’s full-year EPS of $4.58 to grow 7.2%.

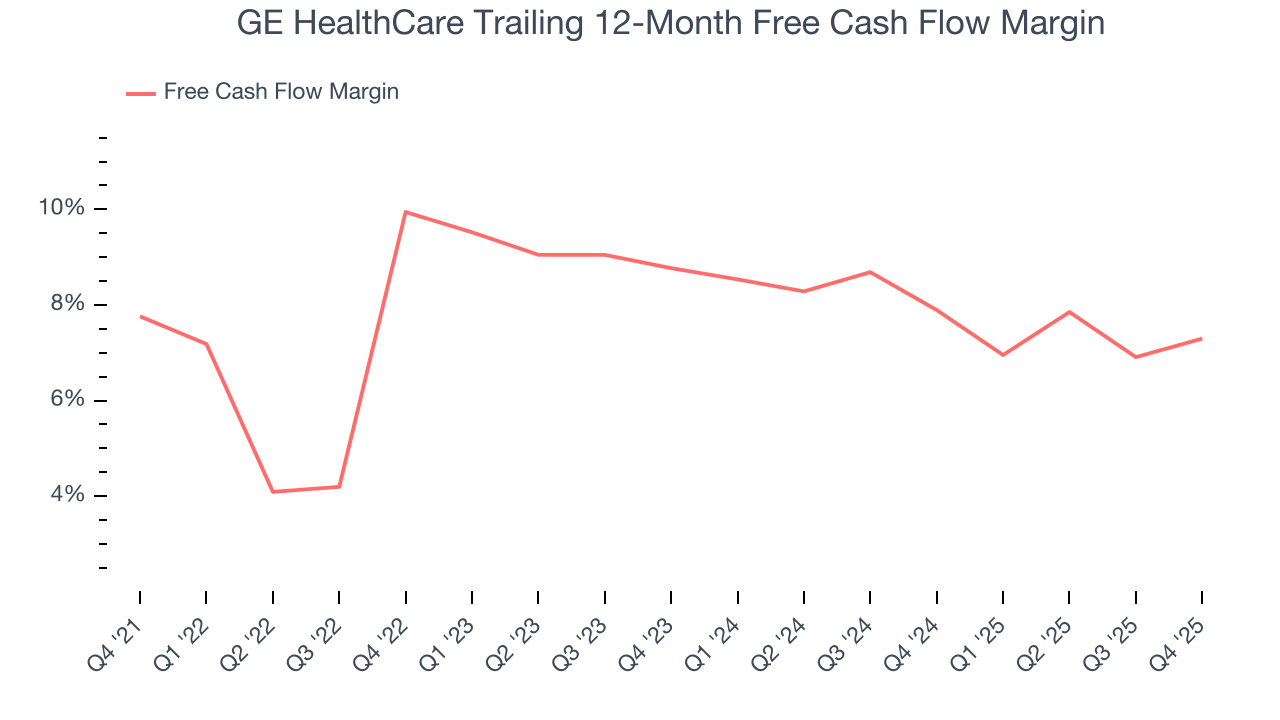

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

GE HealthCare has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.3% over the last five years, slightly better than the broader healthcare sector.

GE HealthCare’s free cash flow clocked in at $916 million in Q4, equivalent to a 16.1% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

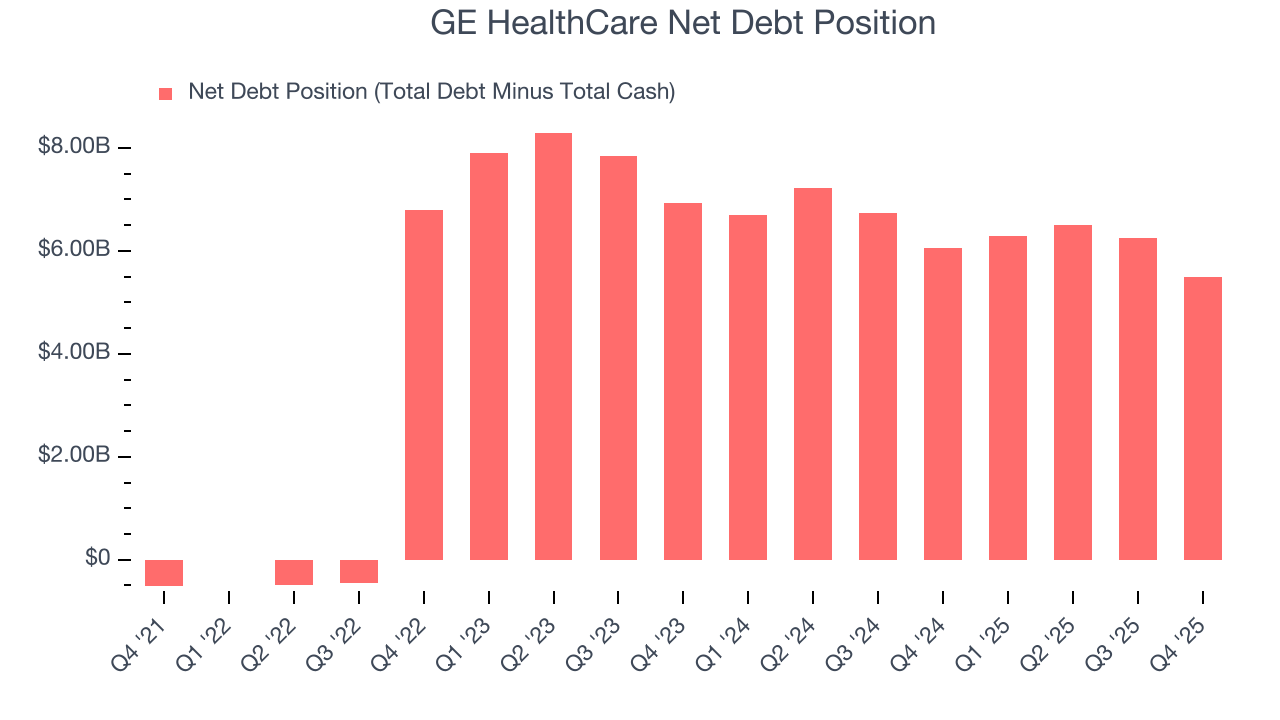

10. Balance Sheet Assessment

GE HealthCare reported $4.51 billion of cash and $10 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $3.60 billion of EBITDA over the last 12 months, we view GE HealthCare’s 1.5× net-debt-to-EBITDA ratio as safe. We also see its $2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from GE HealthCare’s Q4 Results

We enjoyed seeing GE HealthCare beat analysts’ full-year EPS guidance expectations this quarter. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.4% to $79.91 immediately following the results.

12. Is Now The Time To Buy GE HealthCare?

Updated: February 4, 2026 at 10:45 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

GE HealthCare isn’t a terrible business, but it isn’t one of our picks. For starters, its revenue growth was mediocre over the last four years, and analysts don’t see anything changing over the next 12 months. And while its expanding adjusted operating margin shows the business has become more efficient, the downside is its declining EPS over the last four years makes it a less attractive asset to the public markets. On top of that, its organic revenue growth has disappointed.

GE HealthCare’s P/E ratio based on the next 12 months is 15.5x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $93 on the company (compared to the current share price of $82.63).