ZoomInfo (GTM)

ZoomInfo keeps us up at night. Its revenue hasn’t budged recently and its expected drop in cash profitability gives us little confidence.― StockStory Analyst Team

1. News

2. Summary

Why We Think ZoomInfo Will Underperform

Operating a platform it calls "RevOS" - short for Revenue Operating System - ZoomInfo (NASDAQ:GTM) provides sales, marketing, and recruiting teams with business intelligence and analytics to identify prospects and deliver targeted outreach.

- Sales were flat over the last two years, indicating it’s failed to expand its business

- Customers were hesitant to make long-term commitments to its software as its 1.9% average ARR growth over the last year was sluggish

- Demand will likely be weak over the next 12 months as Wall Street expects flat revenue

ZoomInfo doesn’t measure up to our expectations. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than ZoomInfo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ZoomInfo

ZoomInfo is trading at $7.03 per share, or 1.9x forward price-to-sales. ZoomInfo’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. ZoomInfo (GTM) Research Report: Q4 CY2025 Update

Go-to-market intelligence provider ZoomInfo (NASDAQ:GTM) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 3.2% year on year to $319.1 million. The company expects next quarter’s revenue to be around $307.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.32 per share was 13.5% above analysts’ consensus estimates.

ZoomInfo (GTM) Q4 CY2025 Highlights:

- Revenue: $319.1 million vs analyst estimates of $309.3 million (3.2% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.28 (13.5% beat)

- Revenue Guidance for Q1 CY2026 is $307.5 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the upcoming financial year 2026 is $1.11 at the midpoint, in line with analyst estimates

- Operating Margin: 17%, up from 10% in the same quarter last year

- Free Cash Flow Margin: 42.4%, up from 30% in the previous quarter

- Market Capitalization: $2.28 billion

Company Overview

Operating a platform it calls "RevOS" - short for Revenue Operating System - ZoomInfo (NASDAQ:GTM) provides sales, marketing, and recruiting teams with business intelligence and analytics to identify prospects and deliver targeted outreach.

ZoomInfo's platform integrates comprehensive data about companies and contacts with workflow tools to help revenue professionals streamline their processes. The platform is structured across three interconnected layers: an Intelligence Layer with data on businesses and contacts; an Orchestration Layer that integrates and routes this data; and an Engagement Layer that enables users to act on insights through various communication channels.

At the core of ZoomInfo's offering is its data engine, which combines artificial intelligence and machine learning with human verification to maintain accuracy. This engine processes billions of data points weekly from millions of sources, providing users with detailed insights such as personnel changes, technology usage, buying signals, and organizational structures.

The company offers specialized products tailored to different functions: SalesOS for sales teams, MarketingOS for marketing campaigns, TalentOS for recruiters, and OperationsOS for sales operations. A typical customer might use ZoomInfo to identify potential buyers at companies that match their ideal customer profile, find decision-makers' contact information, receive alerts about relevant events like leadership changes, and track engagement across multiple channels.

ZoomInfo monetizes its platform through subscription-based access, with pricing tiers based on features, data access, and user seats. The company serves organizations of all sizes across industries including software, business services, manufacturing, financial services, and telecommunications.

4. Sales Software

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

ZoomInfo's primary competitor is Microsoft-owned LinkedIn (NASDAQ:MSFT), particularly its Sales Navigator product. Other competitors include data providers like Dun & Bradstreet (NYSE:DNB), Apollo.io, and Clearbit, as well as sales engagement platforms such as Outreach and SalesLoft.

5. Revenue Growth

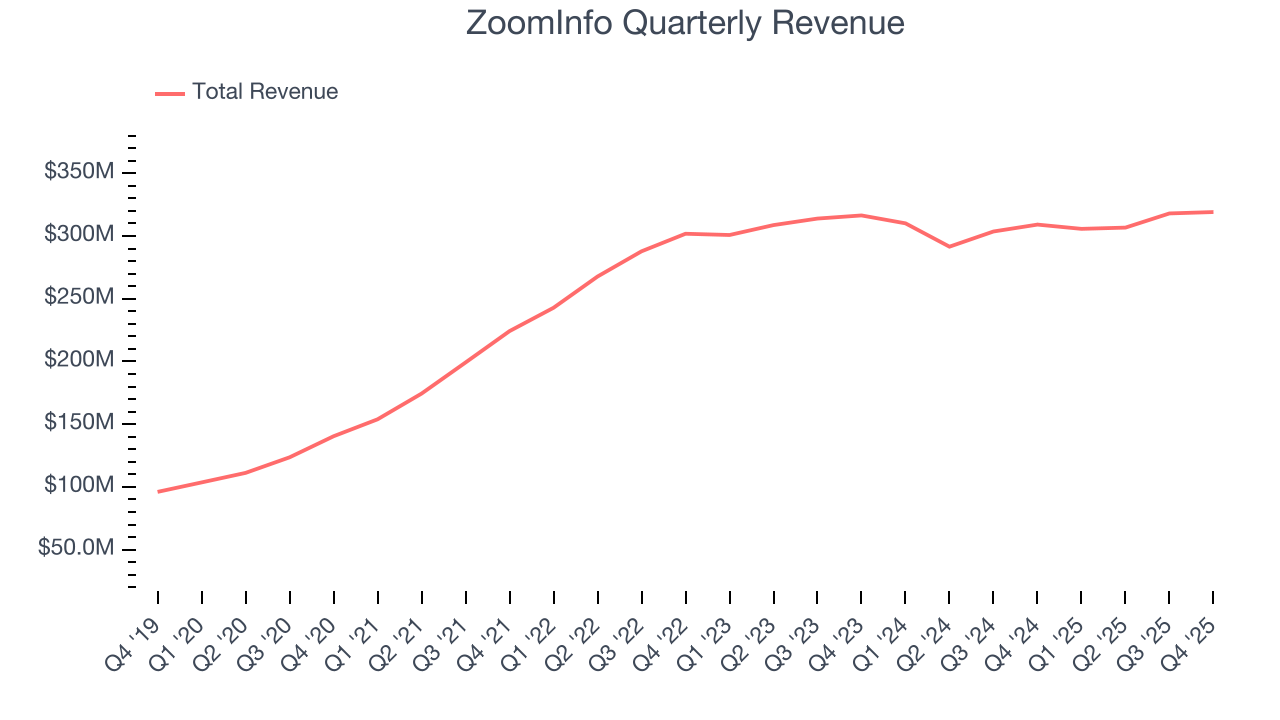

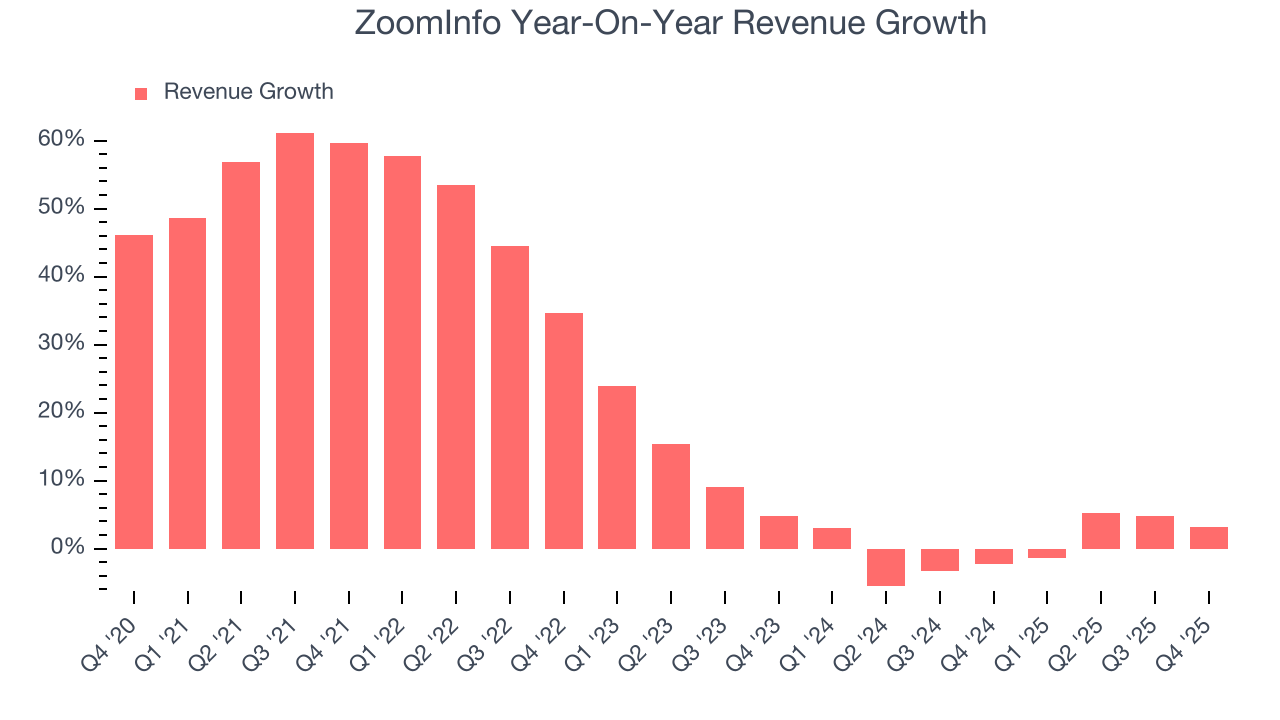

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, ZoomInfo grew its sales at a decent 21.1% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. ZoomInfo’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, ZoomInfo reported modest year-on-year revenue growth of 3.2% but beat Wall Street’s estimates by 3.2%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for ZoomInfo to acquire new customers as its CAC payback period checked in at 154.1 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

7. Gross Margin & Pricing Power

For software companies like ZoomInfo, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

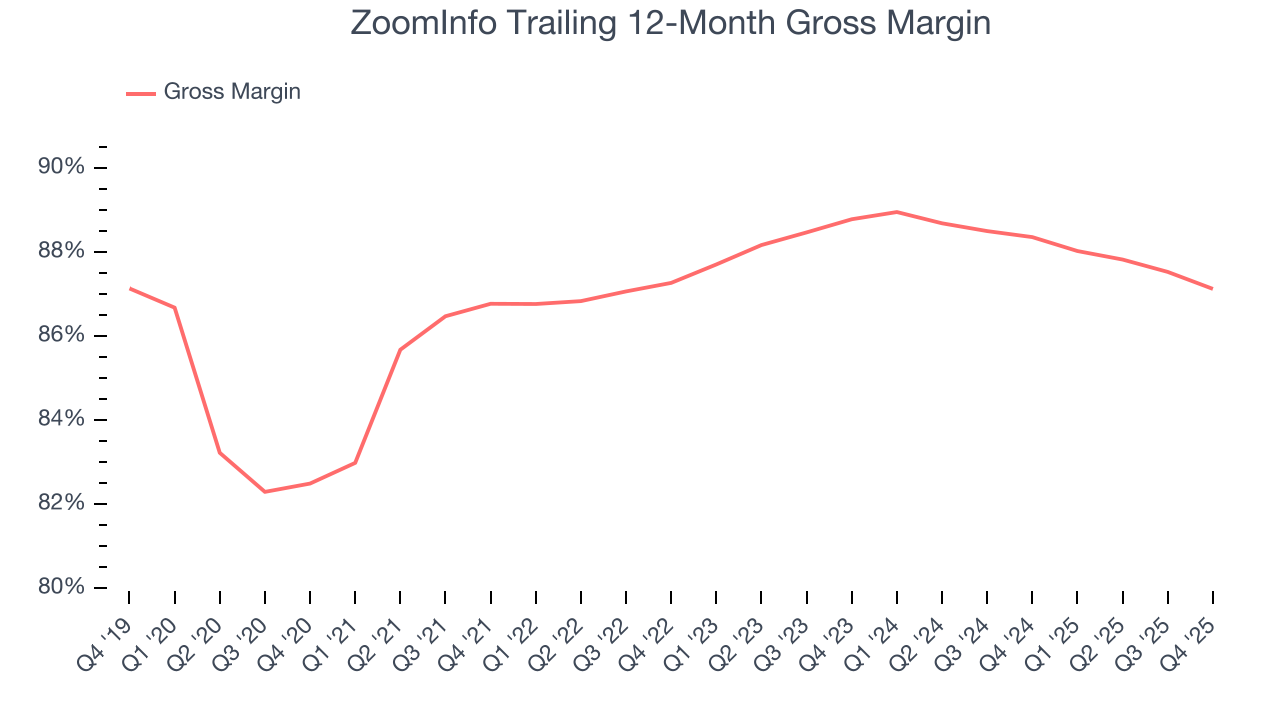

ZoomInfo’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 87.1% gross margin over the last year. Said differently, roughly $87.13 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. ZoomInfo has seen gross margins decline by 1.7 percentage points over the last 2 year, which is poor compared to software peers.

ZoomInfo’s gross profit margin came in at 86.9% this quarter, down 1.6 percentage points year on year. ZoomInfo’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

ZoomInfo has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 18.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, ZoomInfo’s operating margin rose by 10 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, ZoomInfo generated an operating margin profit margin of 17%, up 7 percentage points year on year. The increase was solid, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, R&D, and administrative overhead grew slower than its revenue.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

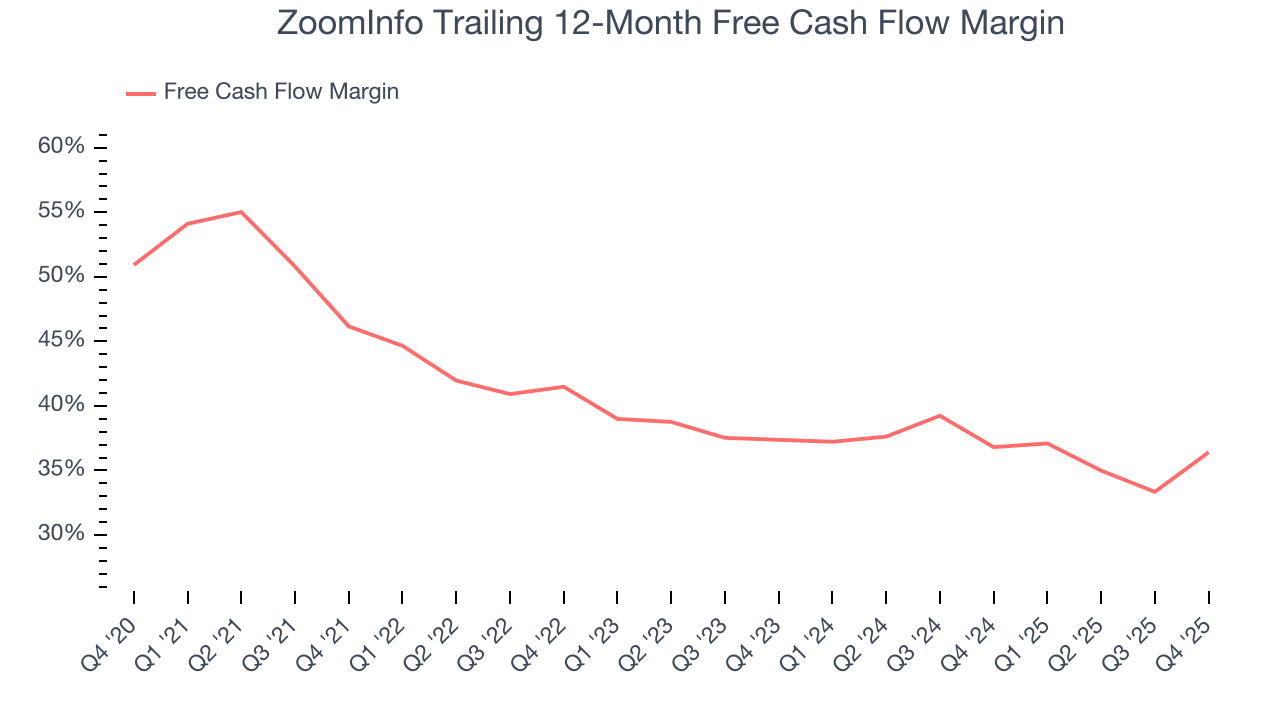

ZoomInfo has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 36.4% over the last year.

ZoomInfo’s free cash flow clocked in at $135.2 million in Q4, equivalent to a 42.4% margin. This result was good as its margin was 12.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict ZoomInfo’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 36.4% for the last 12 months will decrease to 33.3%.

10. Key Takeaways from ZoomInfo’s Q4 Results

It was encouraging to see ZoomInfo beat analysts’ revenue expectations this quarter. We were also glad its EPS guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 4% to $7.03 immediately after reporting.

11. Is Now The Time To Buy ZoomInfo?

Updated: February 9, 2026 at 9:17 PM EST

When considering an investment in ZoomInfo, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies addressing major business pain points, but in the case of ZoomInfo, we’re out. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its ARR has disappointed and shows the company is having difficulty retaining customers and their spending.

ZoomInfo’s price-to-sales ratio based on the next 12 months is 1.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $12 on the company (compared to the current share price of $7.03).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.