Hain Celestial (HAIN)

Hain Celestial is up against the odds. Its low returns on capital and plummeting sales suggest it struggles to generate demand and profits, a red flag.― StockStory Analyst Team

1. News

2. Summary

Why We Think Hain Celestial Will Underperform

Sold in over 75 countries around the world, Hain Celestial (NASDAQ:HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

- Products aren't resonating with the market as its revenue declined by 6.7% annually over the last three years

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

- High net-debt-to-EBITDA ratio of 7× could force the company to raise capital at unfavorable terms if market conditions deteriorate

Hain Celestial lacks the business quality we seek. There are more promising prospects in the market.

Why There Are Better Opportunities Than Hain Celestial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hain Celestial

Hain Celestial’s stock price of $0.74 implies a valuation ratio of 22.2x forward P/E. Not only is Hain Celestial’s multiple richer than most consumer staples peers, but it’s also expensive for its revenue characteristics.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Hain Celestial (HAIN) Research Report: Q3 CY2025 Update

Natural food company Hain Celestial (NASDAQ:HAIN) reported revenue ahead of Wall Streets expectations in Q3 CY2025, but sales fell by 6.8% year on year to $367.9 million. Its non-GAAP loss of $0.08 per share was 48.1% below analysts’ consensus estimates.

Hain Celestial (HAIN) Q3 CY2025 Highlights:

- Revenue: $367.9 million vs analyst estimates of $360.5 million (6.8% year-on-year decline, 2.1% beat)

- Adjusted EPS: -$0.08 vs analyst expectations of -$0.05 (3c miss)

- Adjusted EBITDA: $19.73 million vs analyst estimates of $19.81 million (5.4% margin, in line)

- Operating Margin: -1.9%, down from 2.1% in the same quarter last year

- Free Cash Flow was -$13.71 million compared to -$16.54 million in the same quarter last year

- Organic Revenue fell 6% year on year vs analyst estimates of 5.4% declines (61.1 basis point miss)

- Market Capitalization: $96.61 million

Company Overview

Sold in over 75 countries around the world, Hain Celestial (NASDAQ:HAIN) is a natural and organic food company whose products range from snacks to teas to baby food.

The company was established in 1993 by Irwin D. Simon. His aim was to offer consumers wholesome and better-for-you food choices. Throughout time, the company has grown through both organic growth and acquisitions, with its 1999 acquisition of the Celestial Seasonings brand as a key milestone.

Today, in addition to the Celestial Seasonings teas, Hain Celestial’s product portfolio includes Terra Chips vegetable chips, Earth's Best baby food and formula, Garden of Eatin’ corn tortilla chips, and Alba Botanica personal and skincare offerings to name a few. The core customer is therefore broad but is generally the head of an everyday American household. This individual does the grocery shopping for the family and values healthier food options at reasonable prices from trusted and established brands.

The company’s brands can be found in many locations selling food and snacks, including supermarkets, club stores, large-format general merchandise retailers, and convenience stores. Additionally, Hain Celestial also sells to food service companies, meaning you can find the company’s products in corporate and school cafeterias, for example.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors offering healthier packaged foods include General Mills (NYSE:GIS), Kellogg's (NYSE:K), and Conagra Brands (NYSE:CAG), all of which did not start in organic and natural foods but have since pivoted towards this segment.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.53 billion in revenue over the past 12 months, Hain Celestial is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

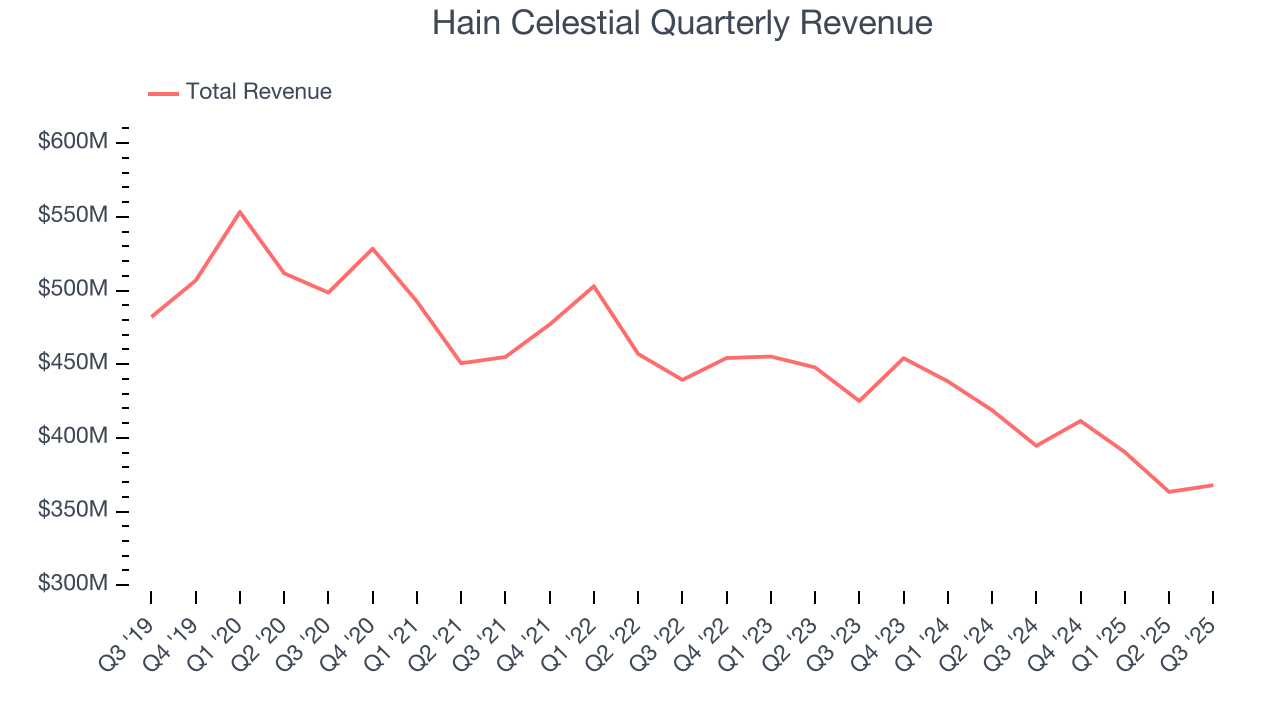

As you can see below, Hain Celestial struggled to generate demand over the last three years. Its sales dropped by 6.5% annually, a poor baseline for our analysis.

This quarter, Hain Celestial’s revenue fell by 6.8% year on year to $367.9 million but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to decline by 2.1% over the next 12 months. it’s hard to get excited about a company that is struggling with demand.

6. Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

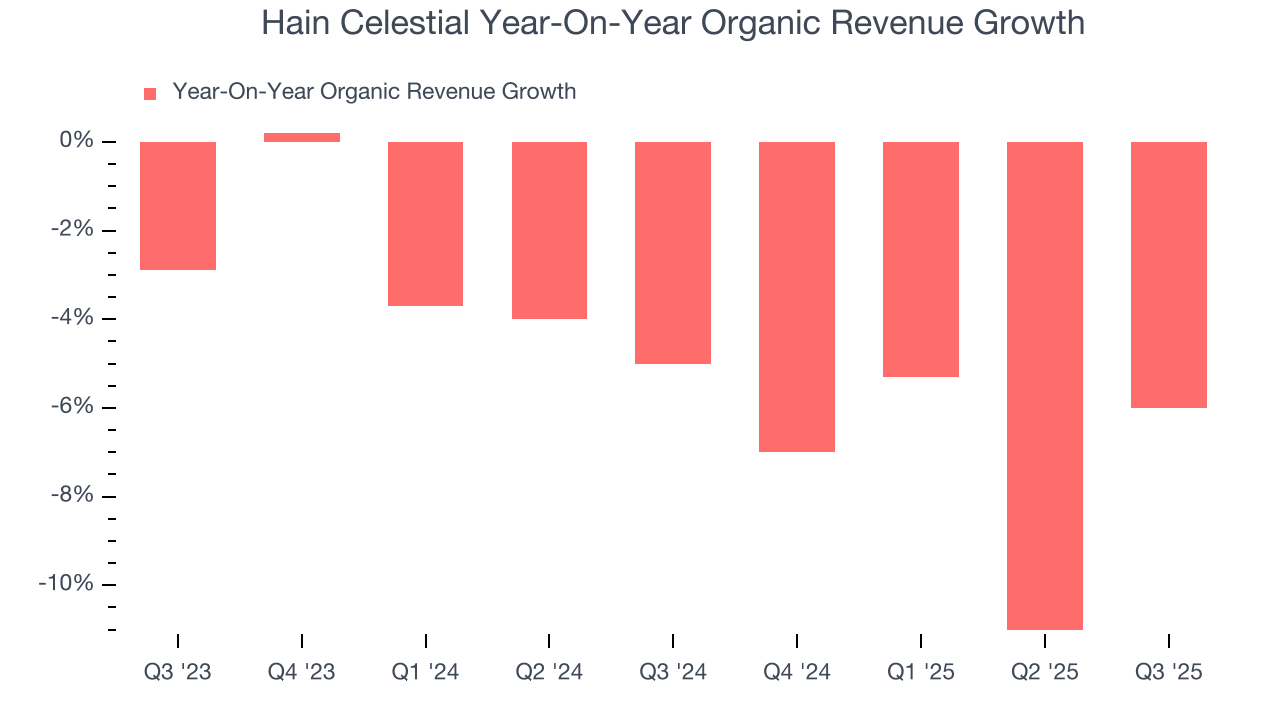

Hain Celestial’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 5.2% year on year.

In the latest quarter, Hain Celestial’s organic sales fell by 6% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

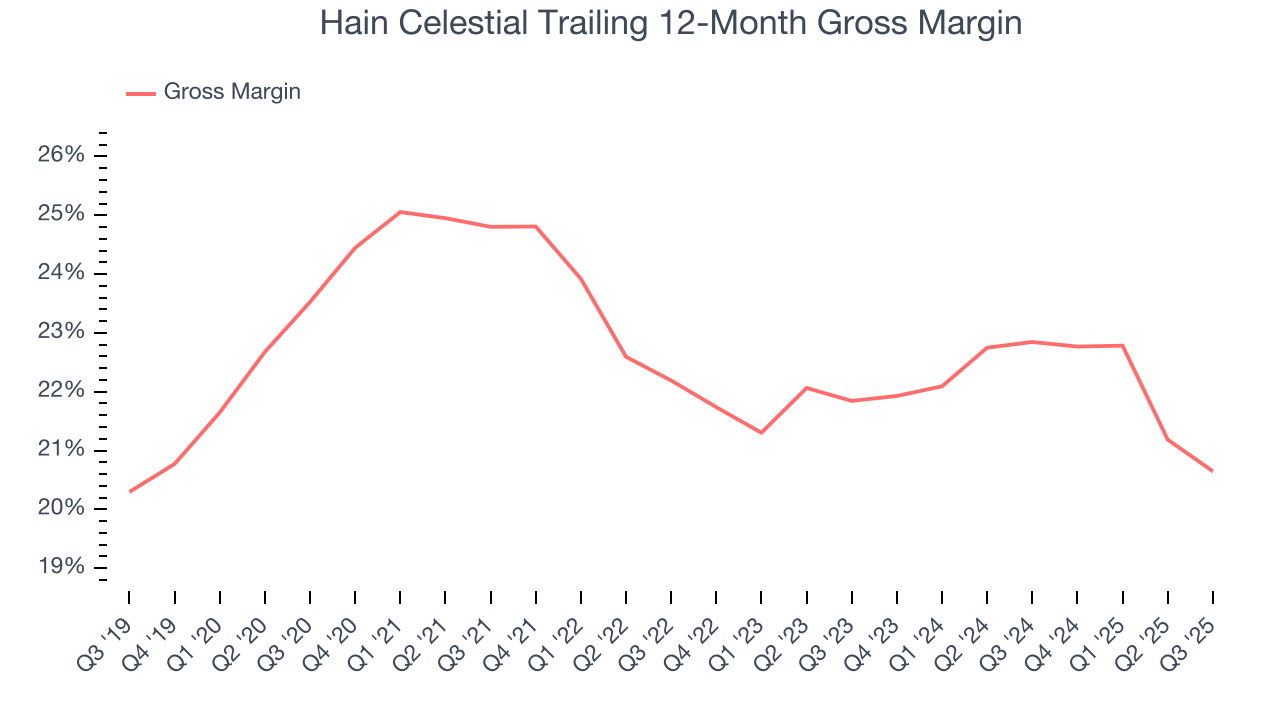

Hain Celestial has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 21.8% gross margin over the last two years. That means Hain Celestial paid its suppliers a lot of money ($78.19 for every $100 in revenue) to run its business.

In Q3, Hain Celestial produced a 18.5% gross profit margin, down 2.3 percentage points year on year. Hain Celestial’s full-year margin has also been trending down over the past 12 months, decreasing by 2.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

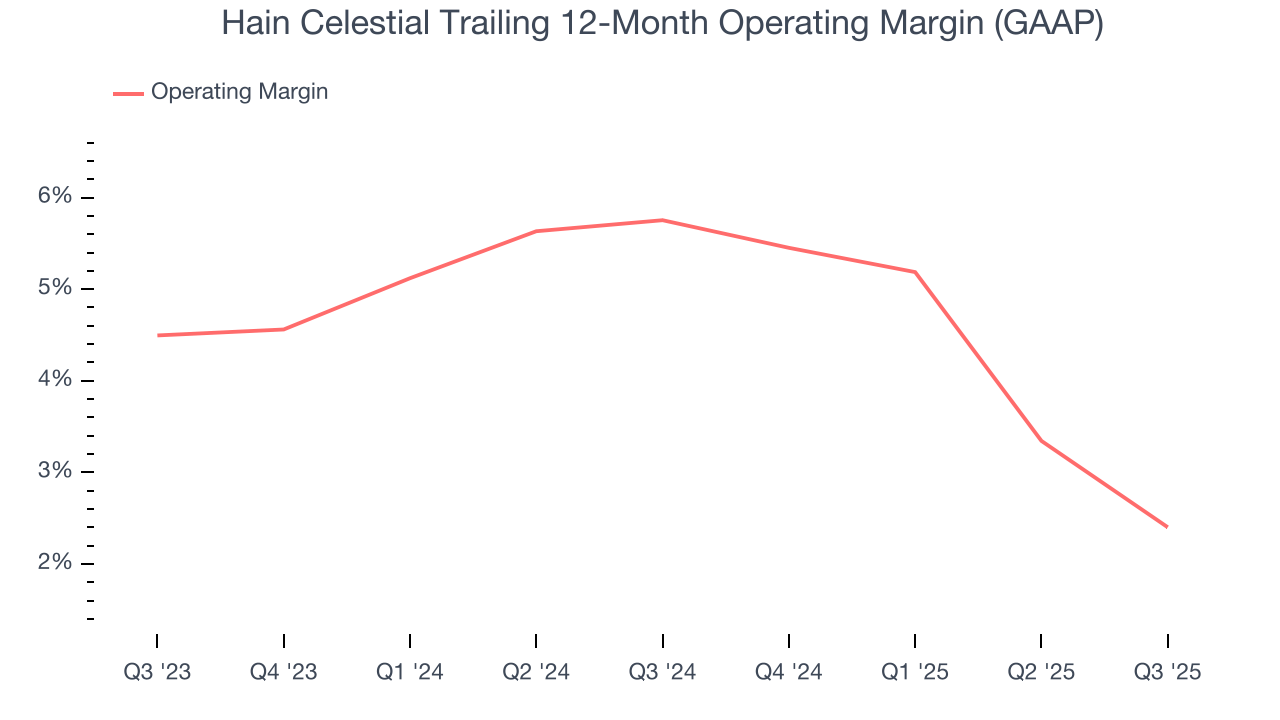

Hain Celestial was profitable over the last two years but held back by its large cost base. Its average operating margin of 4.2% was weak for a consumer staples business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Hain Celestial’s operating margin decreased by 3.4 percentage points over the last year. Hain Celestial’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Hain Celestial generated an operating margin profit margin of negative 1.9%, down 4 percentage points year on year. Since Hain Celestial’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

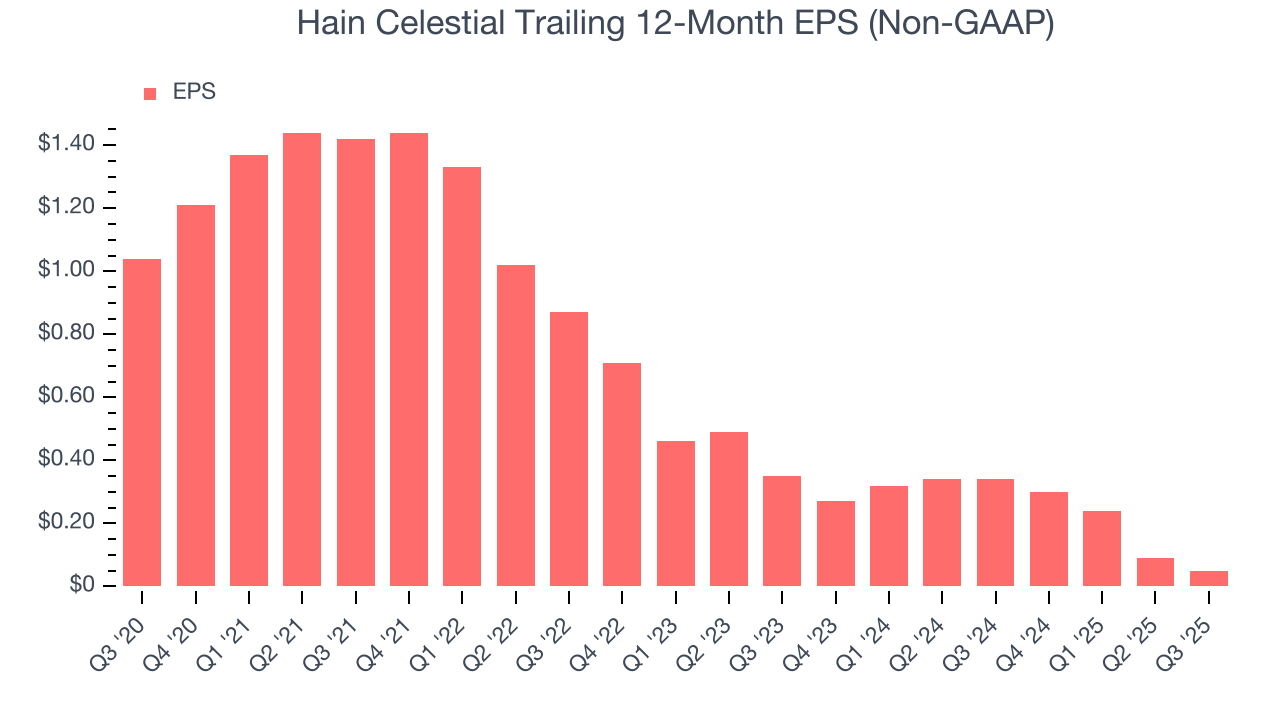

9. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Hain Celestial reported adjusted EPS of negative $0.08, down from negative $0.04 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Hain Celestial’s full-year EPS of $0.05 to grow 193%.

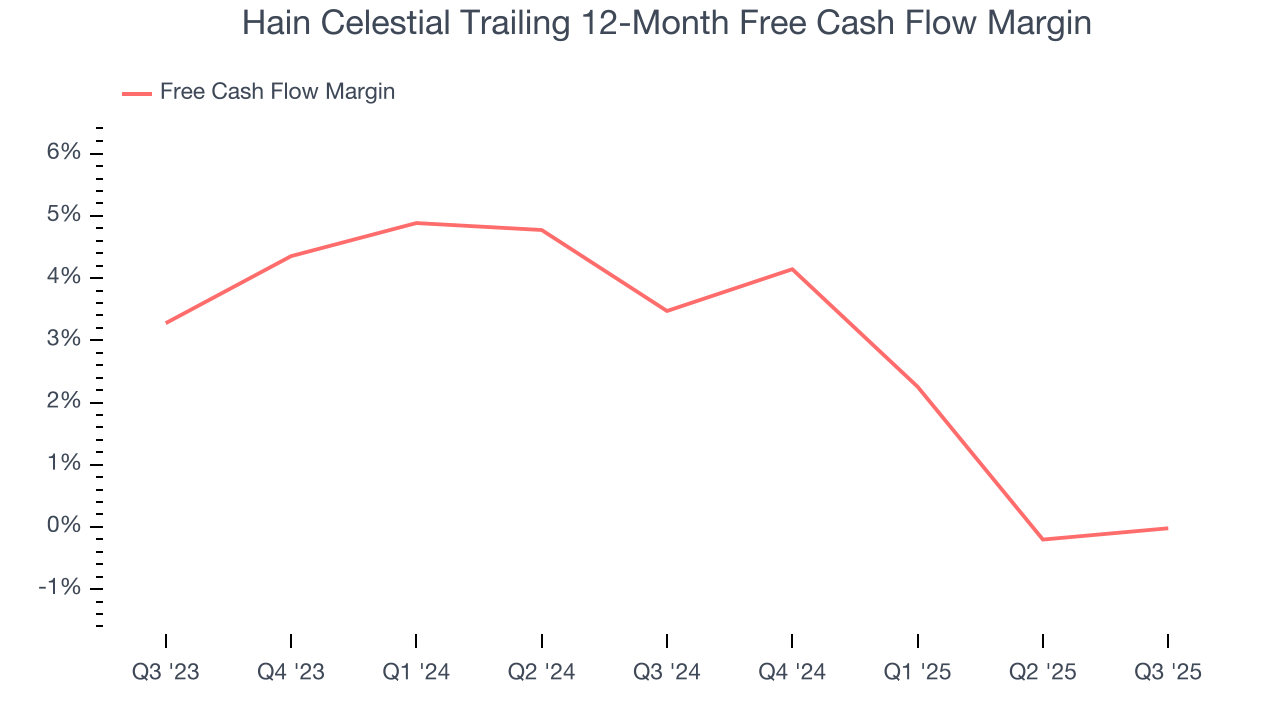

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hain Celestial has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.8%, subpar for a consumer staples business.

Taking a step back, we can see that Hain Celestial’s margin dropped by 3.5 percentage points over the last year. This decrease warrants extra caution because Hain Celestial failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Hain Celestial burned through $13.71 million of cash in Q3, equivalent to a negative 3.7% margin. The company’s cash burn was similar to its $16.54 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

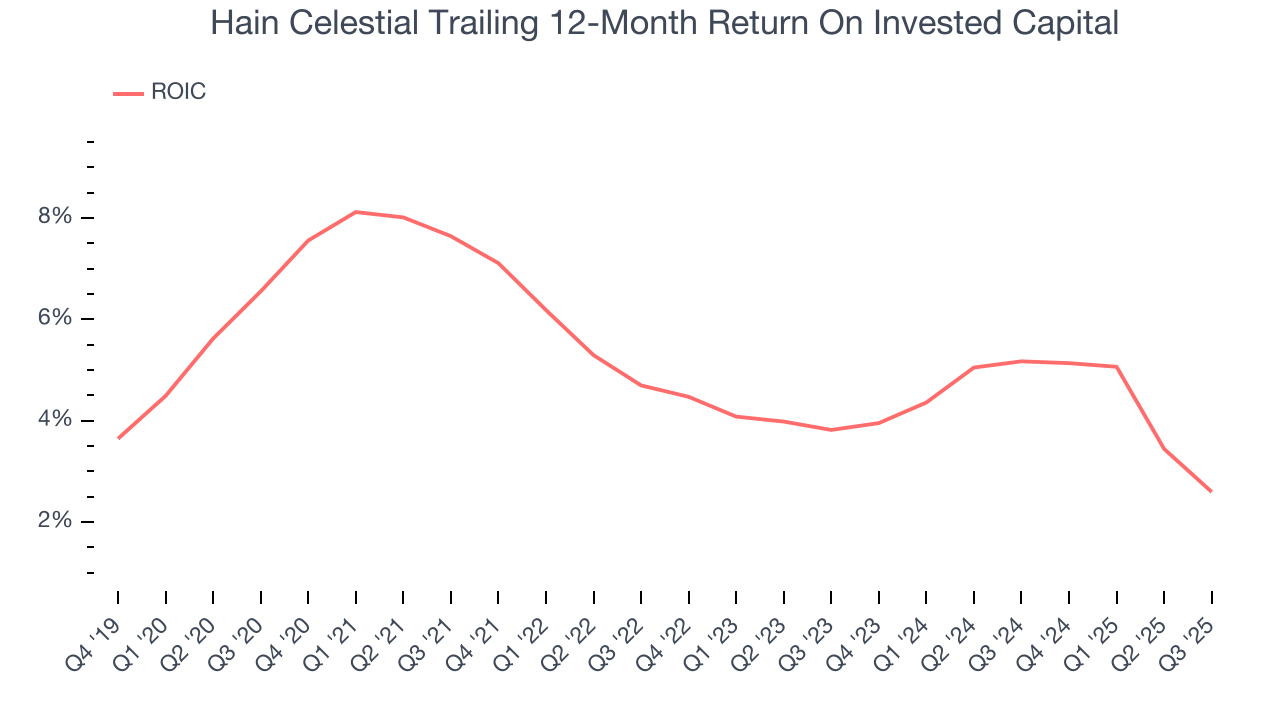

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Hain Celestial historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.8%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

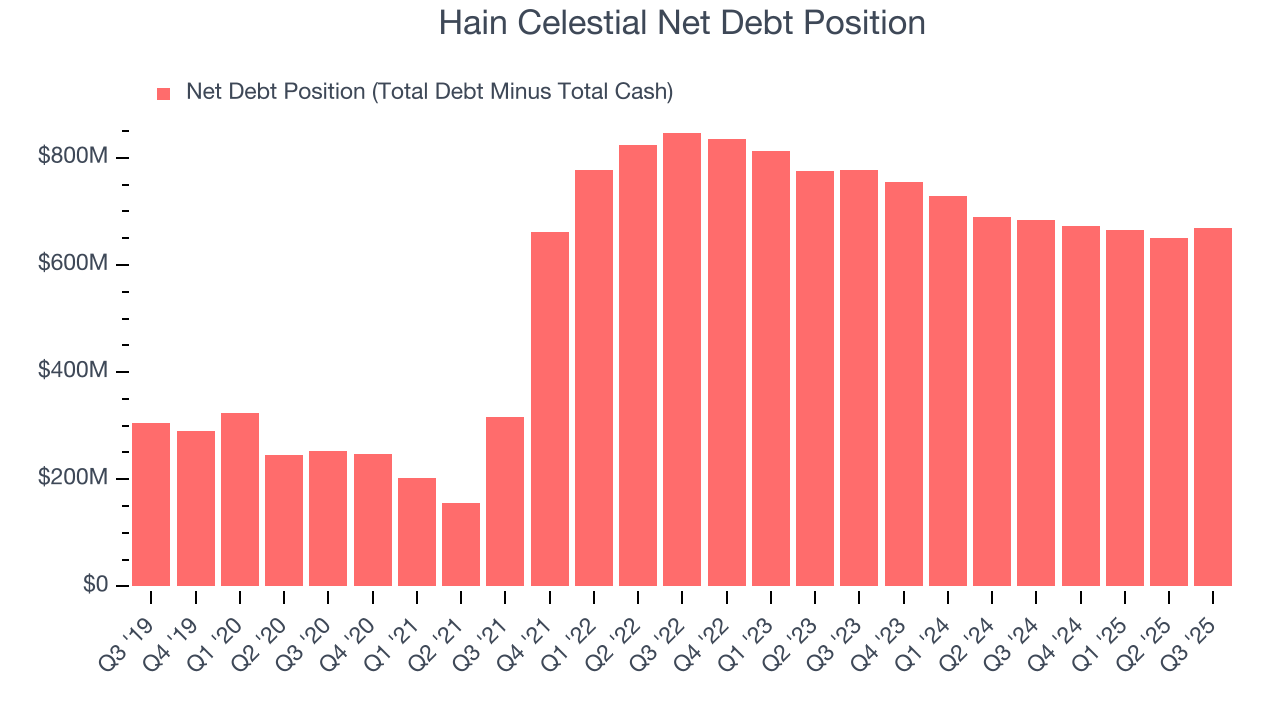

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Hain Celestial’s $716.2 million of debt exceeds the $47.89 million of cash on its balance sheet. Furthermore, its 6× net-debt-to-EBITDA ratio (based on its EBITDA of $111.1 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Hain Celestial could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Hain Celestial can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

13. Key Takeaways from Hain Celestial’s Q3 Results

It was encouraging to see Hain Celestial beat analysts’ revenue expectations this quarter. On the other hand, its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 4.2% to $1.11 immediately following the results.

14. Is Now The Time To Buy Hain Celestial?

Updated: February 8, 2026 at 9:57 PM EST

When considering an investment in Hain Celestial, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Hain Celestial falls short of our quality standards. For starters, its revenue has declined over the last three years. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last three years makes it a less attractive asset to the public markets. On top of that, its brand caters to a niche market.

Hain Celestial’s P/E ratio based on the next 12 months is 8.4x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $2.04 on the company (compared to the current share price of $1.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.