SunOpta (STKL)

SunOpta is up against the odds. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think SunOpta Will Underperform

Committed to clean-label foods, SunOpta (NASDAQ:STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of organic products.

- Sales tumbled by 1.6% annually over the last three years, showing consumer trends are working against its favor

- Commoditized products, bad unit economics, and high competition are reflected in its low gross margin of 15.4%

- Modest revenue base of $792.4 million gives it less fixed cost leverage and fewer distribution channels than larger companies

SunOpta’s quality doesn’t meet our bar. We see more lucrative opportunities elsewhere.

Why There Are Better Opportunities Than SunOpta

High Quality

Investable

Underperform

Why There Are Better Opportunities Than SunOpta

At $6.42 per share, SunOpta trades at 36.1x forward P/E. Not only is SunOpta’s multiple richer than most consumer staples peers, but it’s also expensive for its revenue characteristics.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. SunOpta (STKL) Research Report: Q3 CY2025 Update

Plant-based food and beverage company SunOpta (NASDAQ:STKL) announced better-than-expected revenue in Q3 CY2025, with sales up 16.6% year on year to $205.4 million. The company’s full-year revenue guidance of $872.5 million at the midpoint came in 7.9% above analysts’ estimates. Its non-GAAP profit of $0.05 per share was $0.02 above analysts’ consensus estimates.

SunOpta (STKL) Q3 CY2025 Highlights:

- Revenue: $205.4 million vs analyst estimates of $195.3 million (16.6% year-on-year growth, 5.2% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.03 ($0.02 beat)

- Adjusted EBITDA: $23.58 million vs analyst estimates of $23.62 million (11.5% margin, in line)

- The company lifted its revenue guidance for the full year to $872.5 million at the midpoint from $810 million, a 7.7% increase

- EBITDA guidance for the full year is $105 million at the midpoint, above analyst estimates of $101.2 million

- Operating Margin: 3.3%, up from 0.9% in the same quarter last year

- Free Cash Flow Margin: 5.9%, similar to the same quarter last year

- Market Capitalization: $625.2 million

Company Overview

Committed to clean-label foods, SunOpta (NASDAQ:STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of organic products.

The company was established in the early 1970s as a small operation focused on processing and supplying organic and non-GMO soybeans. At the time, the health benefits of soy were gaining recognition, and SunOpta aimed to capitalize on its growing demand.

Over the years, SunOpta has expanded its offerings to include a diverse range of products, such as plant-based milk beverages, fruit-based snacks, organic ingredients, and specialty grains. SunOpta runs a vertically integrated model to ensure its rigorous quality standards are met, and its products are carefully sourced, processed, and distributed to meet the growing demand for natural and nutritious food options.

The company's commitment to wholesome foods resonates with health-conscious consumers, and it serves customers in North America, Europe, Asia, and beyond. Its plant-based beverage brands consist of SOWN, DREAM, and West Life and can be found at select retailers. SunOpta also partners with food manufacturers through its Sunrise Growers division to provide private-label and co-branded products.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors include private companies Organic Valley and Nature’s Path along with public companies Oatly (NASDAQ:OTLY), Conagra (NYSE:CAG), and General Mills (NYSE:GIS).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $792.4 million in revenue over the past 12 months, SunOpta is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, SunOpta’s revenue declined by 1.6% per year over the last three years despite consumers buying more of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, SunOpta reported year-on-year revenue growth of 16.6%, and its $205.4 million of revenue exceeded Wall Street’s estimates by 5.2%.

Looking ahead, sell-side analysts expect revenue to grow 8.1% over the next 12 months, an acceleration versus the last three years. This projection is commendable and suggests its newer products will spur better top-line performance.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

SunOpta has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 15.1% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $84.89 went towards paying for raw materials, production of goods, transportation, and distribution.

This quarter, SunOpta’s gross profit margin was 12.4%, marking a 4.6 percentage point decrease from 17% in the same quarter last year. SunOpta’s full-year margin has also been trending down over the past 12 months, decreasing by 1.9 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

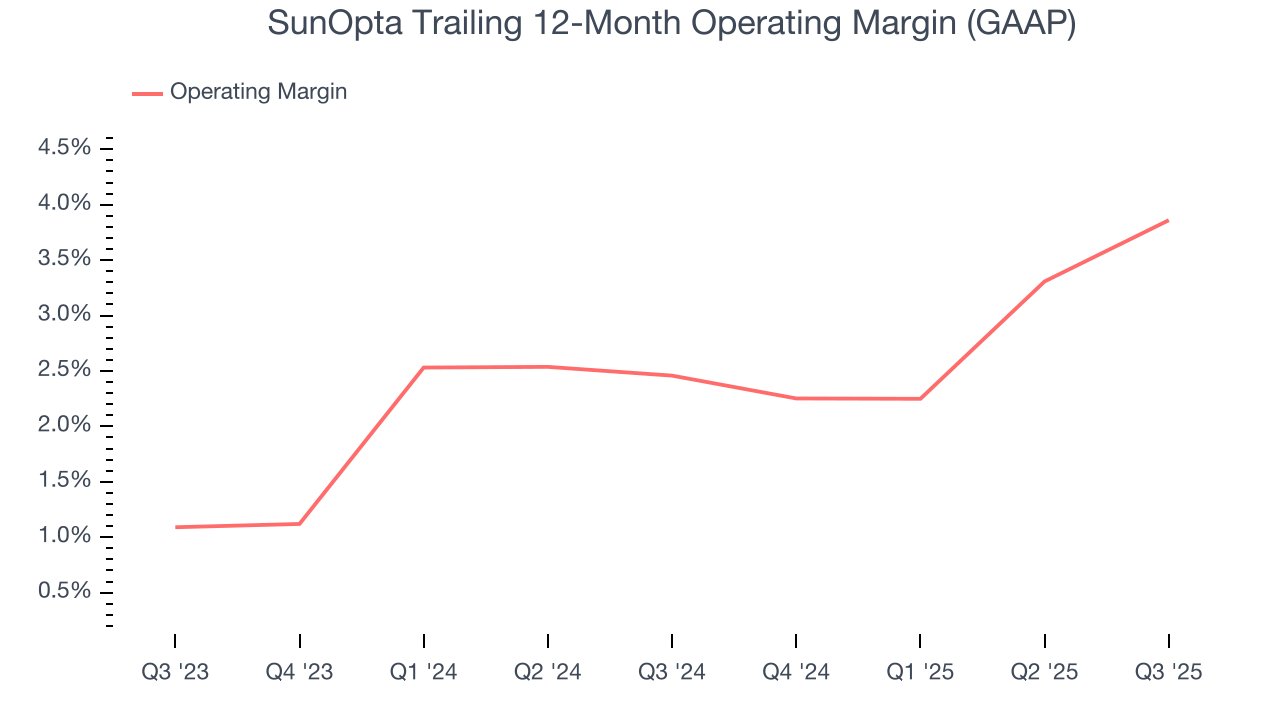

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

SunOpta was profitable over the last two years but held back by its large cost base. Its average operating margin of 3.2% was weak for a consumer staples business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, SunOpta’s operating margin rose by 1.4 percentage points over the last year.

This quarter, SunOpta generated an operating margin profit margin of 3.3%, up 2.5 percentage points year on year. The increase was encouraging, and because its gross margin actually decreased, we can assume it was more efficient because its operating expenses like marketing, and administrative overhead grew slower than its revenue.

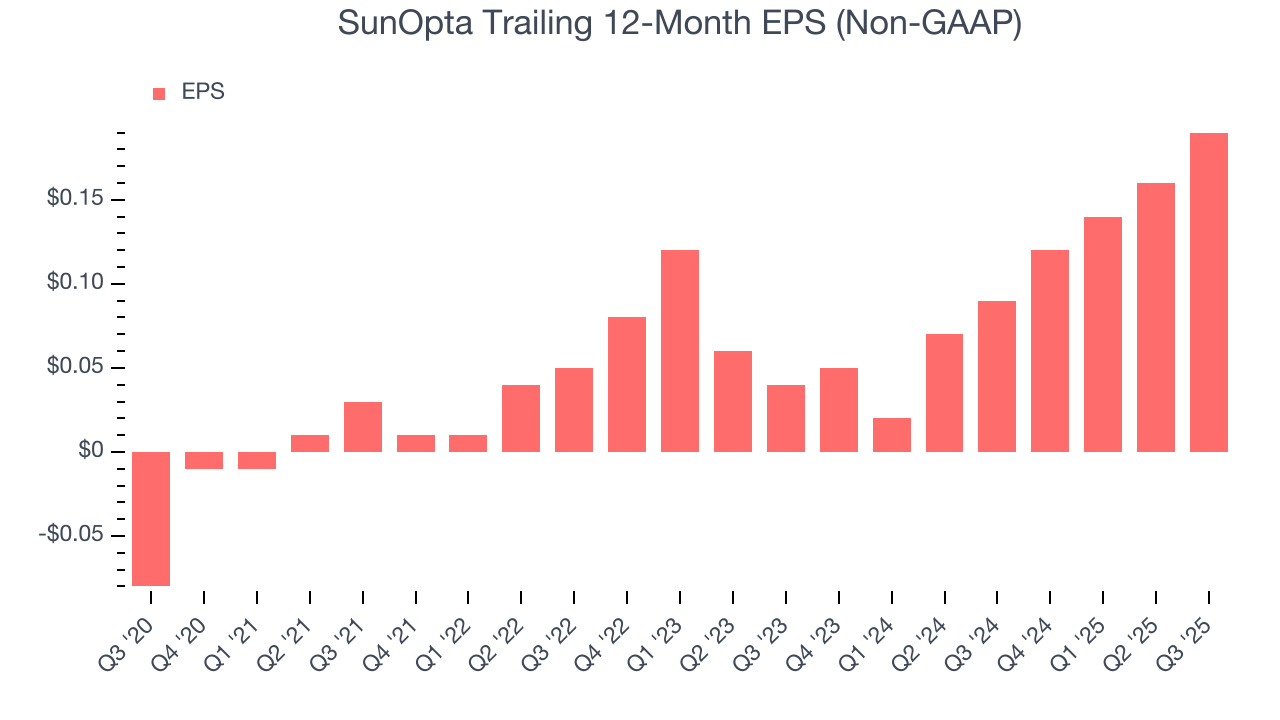

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, SunOpta reported adjusted EPS of $0.05, up from $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects SunOpta’s full-year EPS of $0.19 to grow 43%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

SunOpta has shown weak cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, subpar for a consumer staples business.

Taking a step back, an encouraging sign is that SunOpta’s margin expanded by 6.3 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

SunOpta’s free cash flow clocked in at $12.06 million in Q3, equivalent to a 5.9% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

SunOpta historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.1%, lower than the typical cost of capital (how much it costs to raise money) for consumer staples companies.

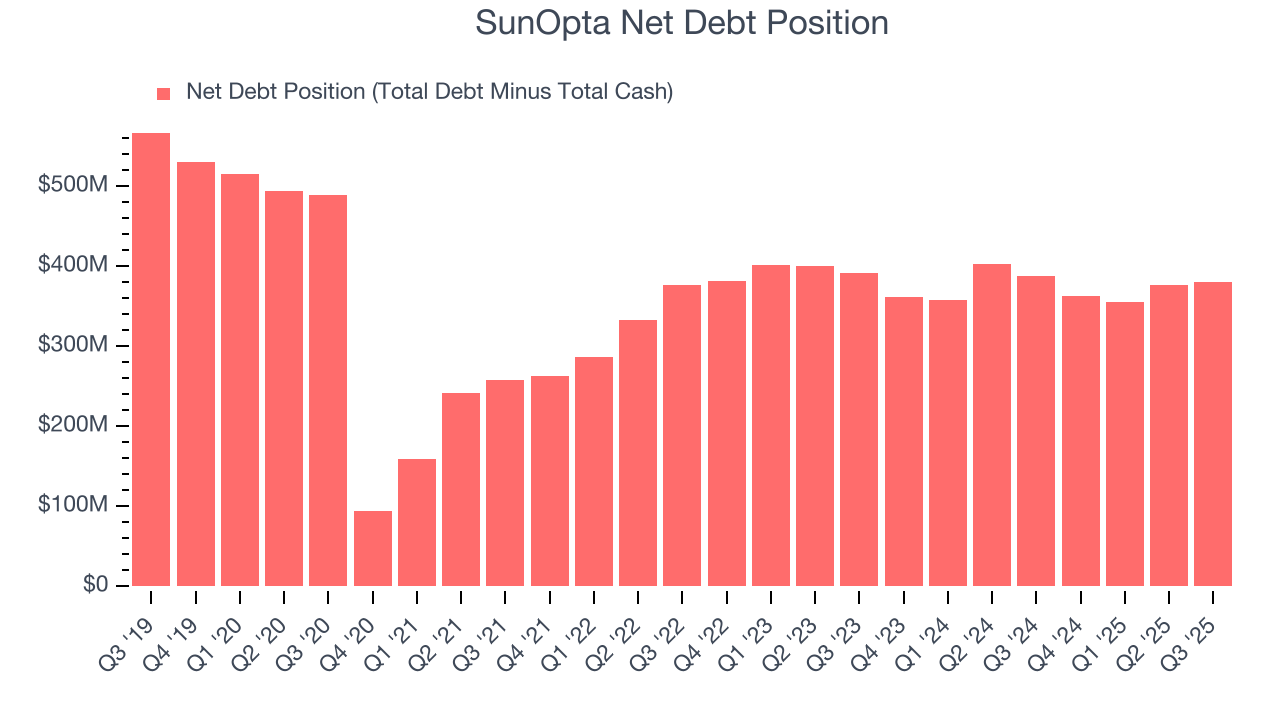

11. Balance Sheet Assessment

SunOpta reported $10.45 million of cash and $391.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $94.8 million of EBITDA over the last 12 months, we view SunOpta’s 4.0× net-debt-to-EBITDA ratio as safe. We also see its $10.67 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from SunOpta’s Q3 Results

It was good to see SunOpta beat analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance trumped Wall Street’s estimates. On the other hand, its gross margin missed. Zooming out, we think this quarter featured some important positives. The stock remained flat at $5.22 immediately following the results.

13. Is Now The Time To Buy SunOpta?

Updated: February 28, 2026 at 10:06 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own SunOpta, you should also grasp the company’s longer-term business quality and valuation.

We cheer for all companies serving everyday consumers, but in the case of SunOpta, we’ll be cheering from the sidelines. To kick things off, its revenue has declined over the last three years. While its volume growth has been in a league of its own, the downside is its gross margins make it more challenging to reach positive operating profits compared to other consumer staples businesses. On top of that, its brand caters to a niche market.

SunOpta’s P/E ratio based on the next 12 months is 36.1x. This valuation tells us a lot of optimism is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $7.40 on the company (compared to the current share price of $6.42).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.