Hudson Technologies (HDSN)

We’re wary of Hudson Technologies. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Hudson Technologies Is Not Exciting

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

- Anticipated sales growth of 6.3% for the next year implies demand will be shaky

- A positive is that its healthy operating margin shows it’s a well-run company with efficient processes

Hudson Technologies doesn’t meet our quality criteria. Our attention is focused on better businesses.

Why There Are Better Opportunities Than Hudson Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Hudson Technologies

Hudson Technologies is trading at $7.40 per share, or 8.5x forward EV-to-EBITDA. While valuation is appropriate for the quality you get, we’re still on the sidelines for now.

We’d rather pay a premium for quality. Cheap stocks can look like a great deal at first glance, but they can be value traps. Less earnings power means more reliance on a re-rating to generate good returns; this can be an unlikely scenario for low-quality companies.

3. Hudson Technologies (HDSN) Research Report: Q3 CY2025 Update

Refrigerant services company Hudson Technologies (NASDAQ:HDSN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.5% year on year to $74.01 million. Its GAAP profit of $0.27 per share was 40.3% above analysts’ consensus estimates.

Hudson Technologies (HDSN) Q3 CY2025 Highlights:

- Revenue: $74.01 million vs analyst estimates of $72.15 million (19.5% year-on-year growth, 2.6% beat)

- EPS (GAAP): $0.27 vs analyst estimates of $0.19 (40.3% beat)

- Operating Margin: 18.9%, up from 11.3% in the same quarter last year

- Free Cash Flow Margin: 9.1%, down from 46.2% in the same quarter last year

- Market Capitalization: $370.7 million

Company Overview

Founded in 1991, Hudson Technologies (NASDAQ:HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

The company addresses the need for responsible refrigerant management, including reclamation and recycling, to comply with regulatory standards and environmental safety. The company’s offerings have certainly been more top-of-mind for companies in the last decade as ESG efforts have ramped up.

Hudson Technologies' services include refrigerant sales, recovery, recycling, and reclamation. Its reclamation services purify refrigerants to industry specifications for air conditioning, refrigeration, and heating systems. A company might hire Hudson Technology to service HVAC systems in commercial buildings to ensure optimal and eco-friendly operation or provide refrigerant recovery services during system repairs or decommissioning.

Hudson Technologies generates revenue from selling reclaimed and virgin refrigerants and providing associated services to clients. Sales are conducted through direct distribution channels and partner networks. The business model encompasses fixed costs related to facilities and equipment maintenance, and variable costs driven by the volume of refrigerants processed. While some aspects of revenue are project-based, recurring revenue streams are established through ongoing service contracts and the sale of refrigerants to regular customers.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the refrigerant services and solutions industry include Arkema (OTC:ARKAY), The Chemours Company (NYSE:CC), and Honeywell International (NASDAQ:HON).

5. Revenue Growth

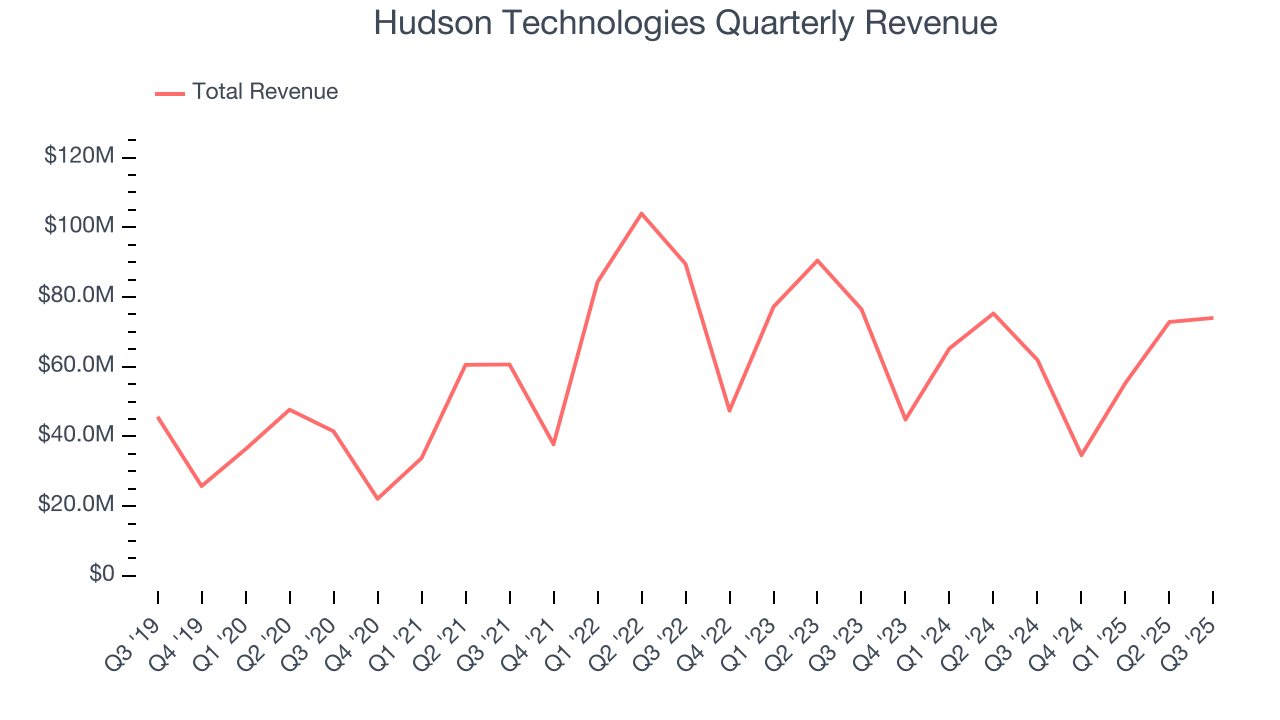

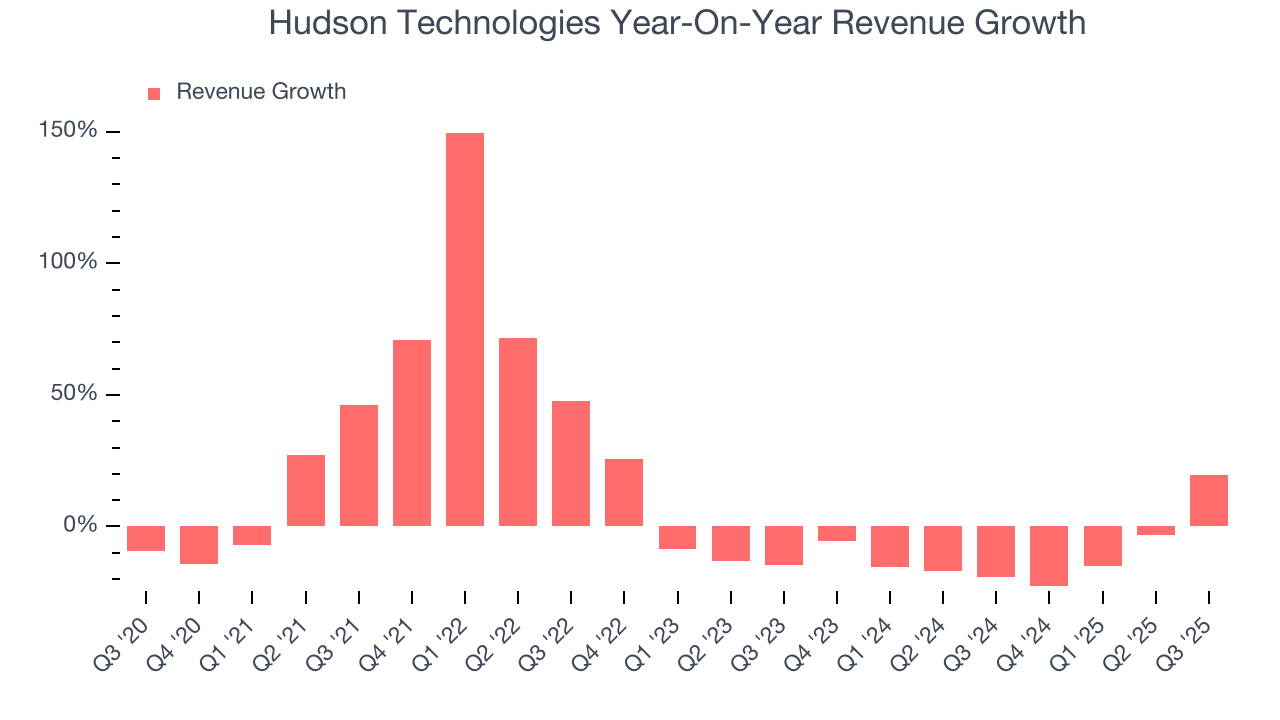

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Hudson Technologies’s 9.4% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Hudson Technologies’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.9% over the last two years.

This quarter, Hudson Technologies reported year-on-year revenue growth of 19.5%, and its $74.01 million of revenue exceeded Wall Street’s estimates by 2.6%.

Looking ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, an improvement versus the last two years. This projection is healthy and suggests its newer products and services will spur better top-line performance.

6. Gross Margin & Pricing Power

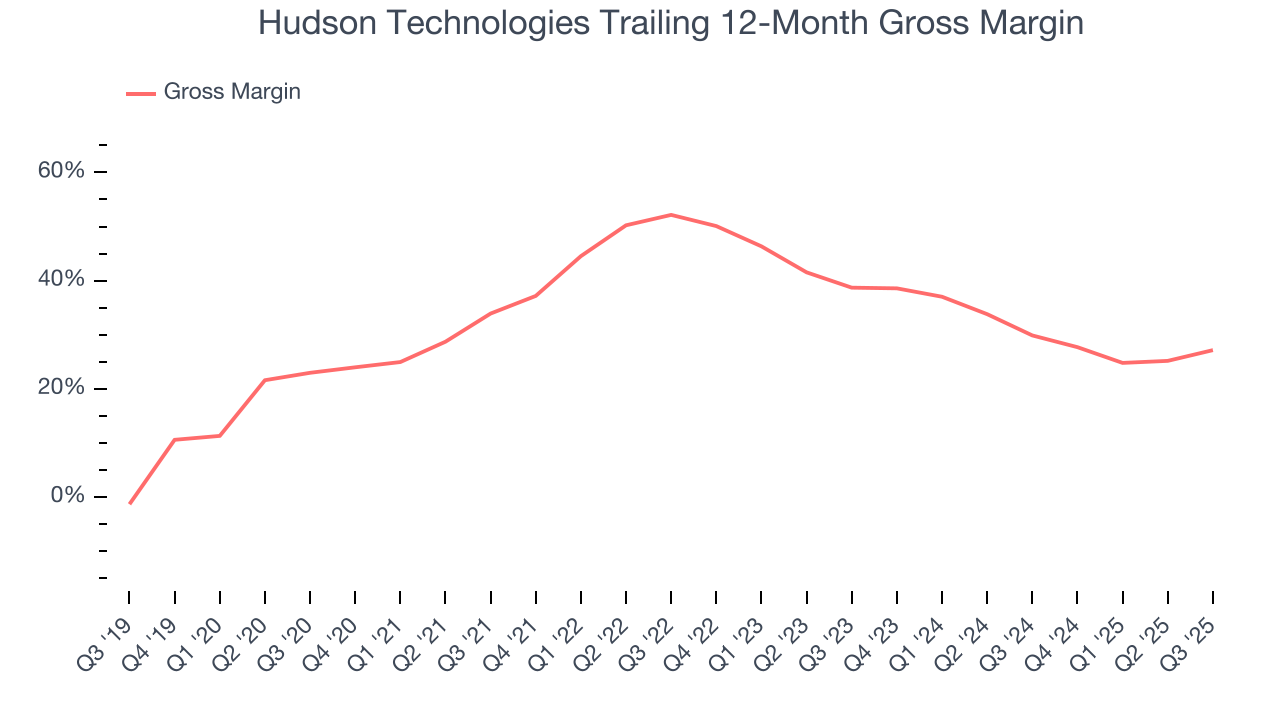

All else equal, we prefer higher gross margins because they make it easier to generate more operating profits and indicate that a company commands pricing power by offering more differentiated products.

Hudson Technologies’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.5% gross margin over the last five years. Said differently, roughly $37.51 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Hudson Technologies produced a 32% gross profit margin in Q3, up 6.3 percentage points year on year. Zooming out, however, Hudson Technologies’s full-year margin has been trending down over the past 12 months, decreasing by 2.7 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

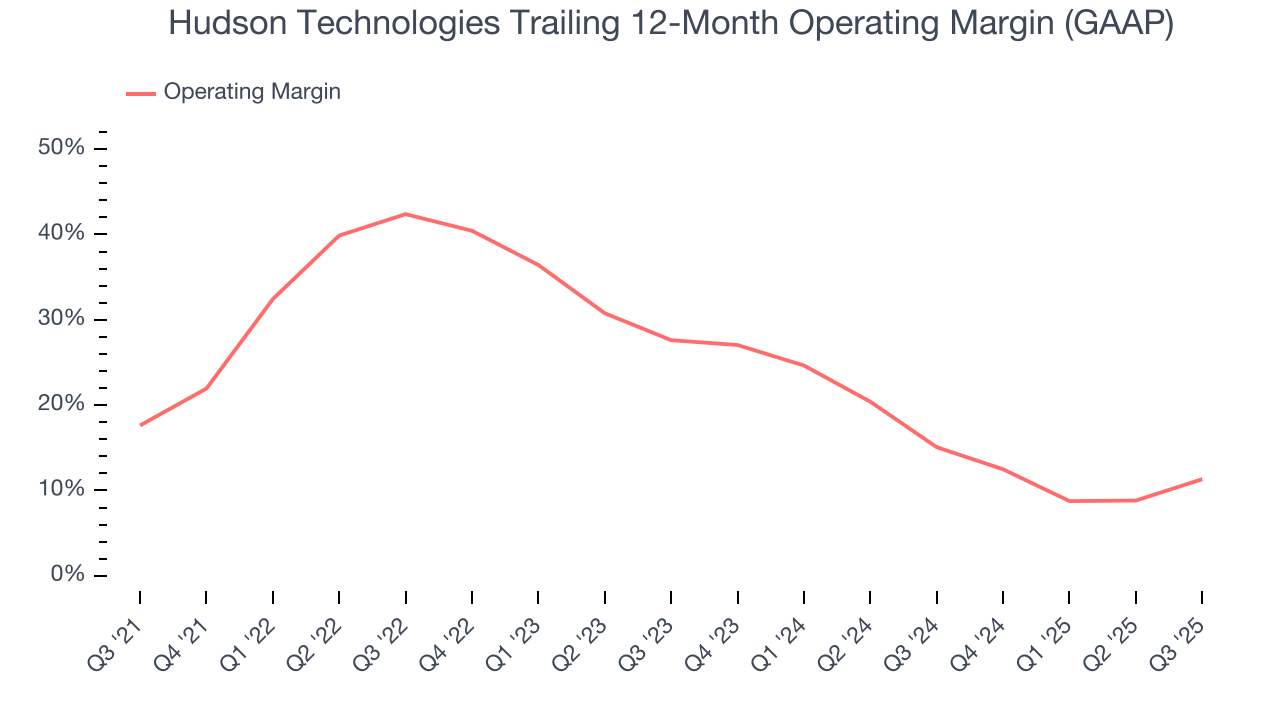

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hudson Technologies has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Hudson Technologies’s operating margin decreased by 6.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Hudson Technologies generated an operating margin profit margin of 18.9%, up 7.6 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

8. Earnings Per Share

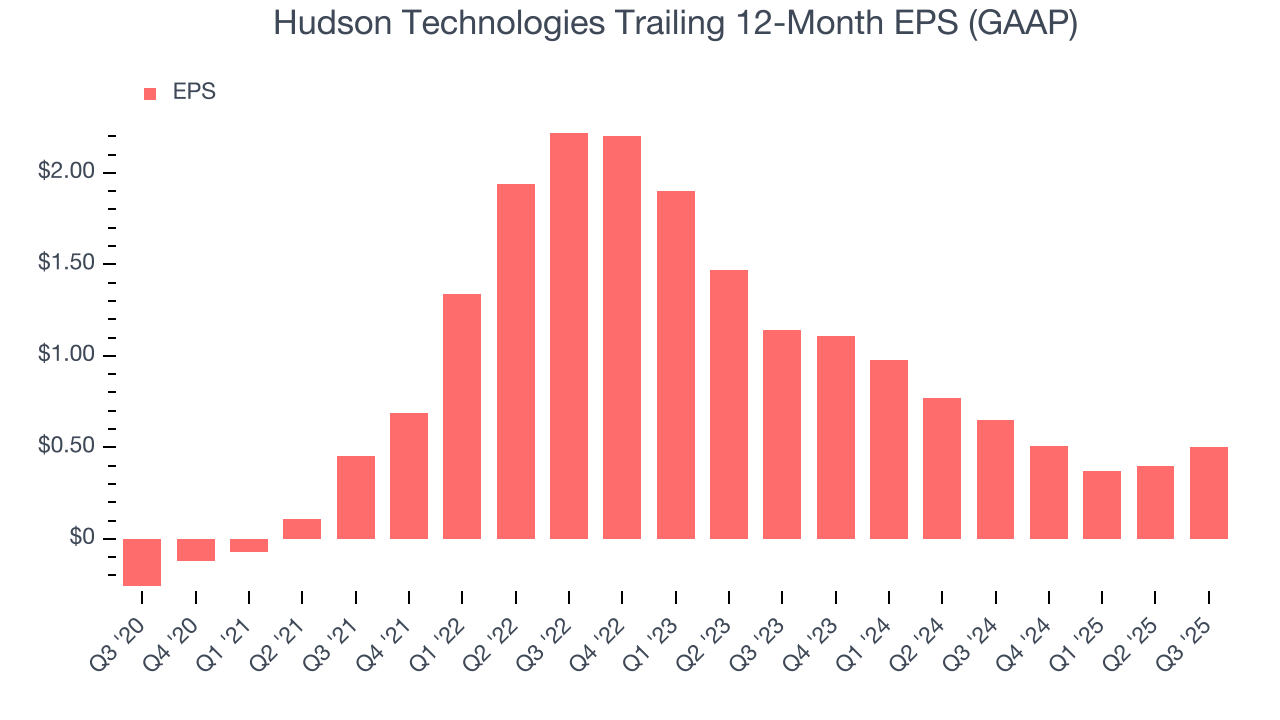

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Hudson Technologies’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Hudson Technologies, its EPS declined by more than its revenue over the last two years, dropping 33.8%. This tells us the company struggled to adjust to shrinking demand.

Diving into the nuances of Hudson Technologies’s earnings can give us a better understanding of its performance. While we mentioned earlier that Hudson Technologies’s operating margin expanded this quarter, a two-year view shows its margin has declined. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Hudson Technologies reported EPS of $0.27, up from $0.17 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Hudson Technologies’s full-year EPS of $0.50 to grow 21%.

9. Cash Is King

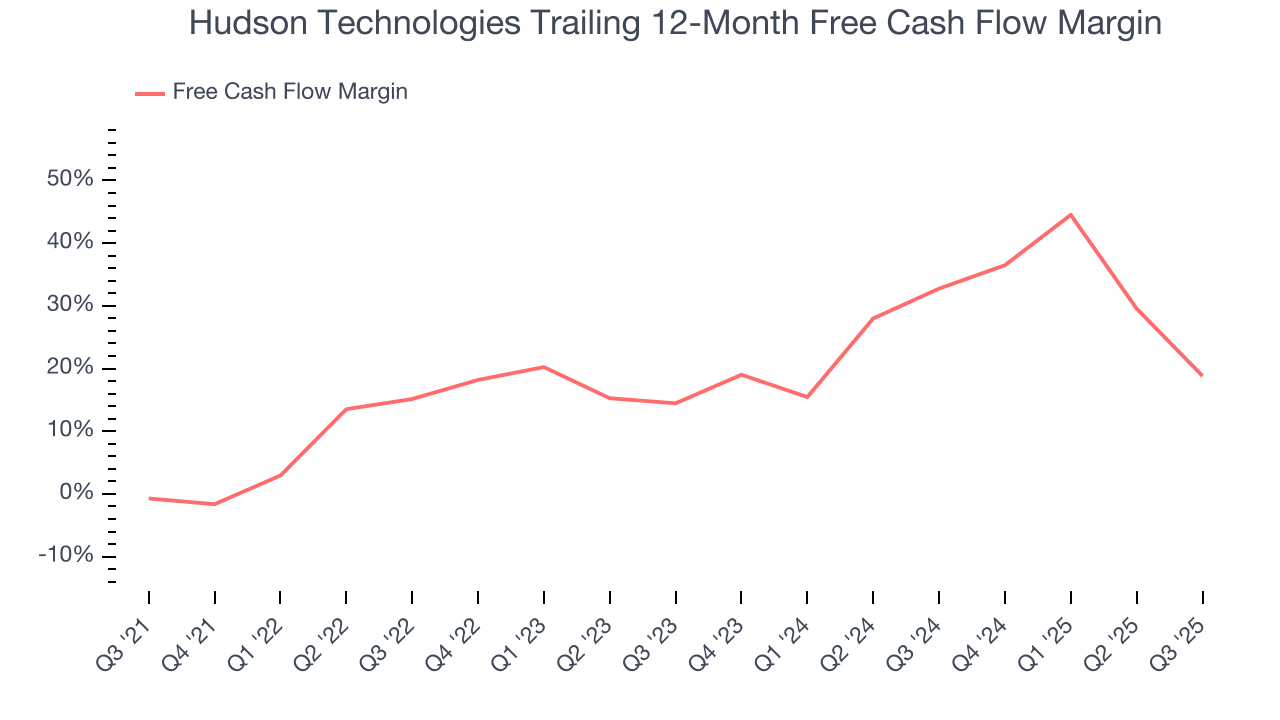

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Hudson Technologies has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.9% over the last five years.

Taking a step back, we can see that Hudson Technologies’s margin expanded by 19.6 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Hudson Technologies’s free cash flow clocked in at $6.75 million in Q3, equivalent to a 9.1% margin. The company’s cash profitability regressed as it was 37.1 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

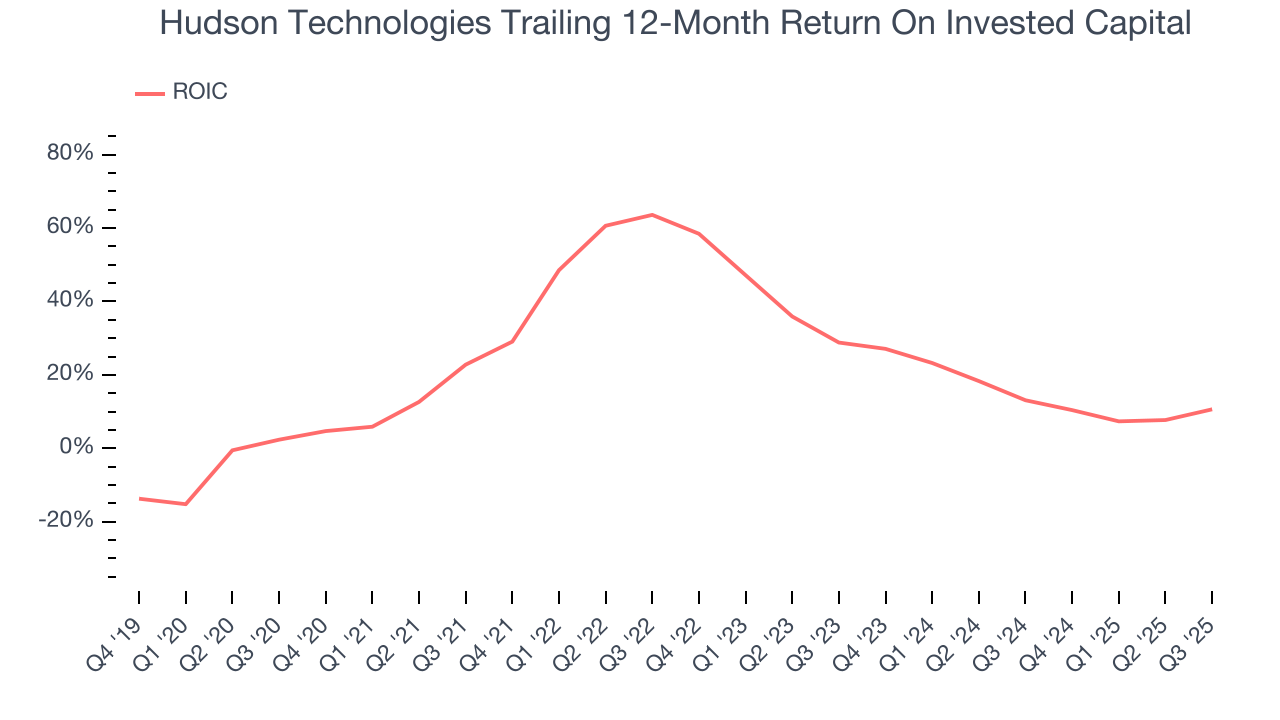

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Hudson Technologies hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 27.8%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hudson Technologies’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

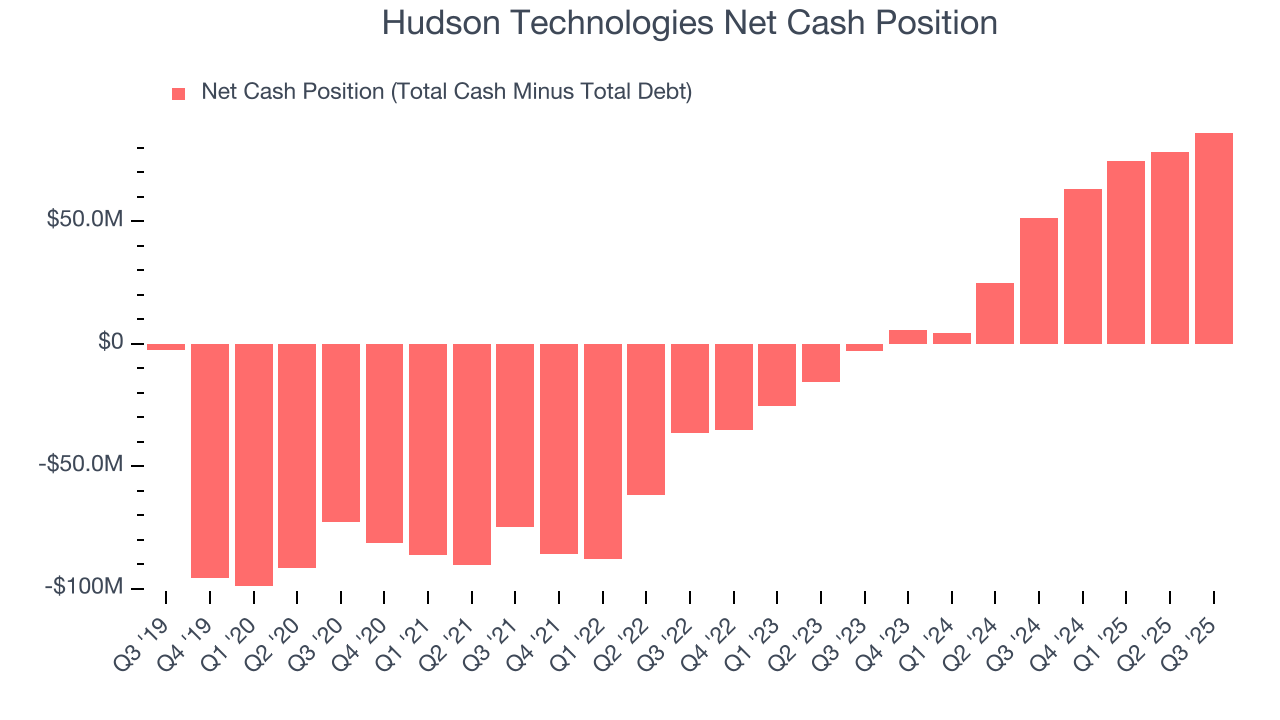

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Hudson Technologies is a profitable, well-capitalized company with $89.68 million of cash and $3.49 million of debt on its balance sheet. This $86.19 million net cash position is 29.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Hudson Technologies’s Q3 Results

It was good to see Hudson Technologies beat analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock remained flat at $8.63 immediately following the results.

13. Is Now The Time To Buy Hudson Technologies?

Updated: February 16, 2026 at 9:05 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Hudson Technologies, you should also grasp the company’s longer-term business quality and valuation.

Hudson Technologies isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining operating margin shows the business has become less efficient.

Hudson Technologies’s EV-to-EBITDA ratio based on the next 12 months is 8.5x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $9.63 on the company (compared to the current share price of $7.40).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.