Herc (HRI)

We’re skeptical of Herc. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Herc Is Not Exciting

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

- Low free cash flow margin declined over the last five years as its investments ramped, giving it little breathing room

- 5× net-debt-to-EBITDA ratio shows it’s overleveraged and increases the probability of shareholder dilution if things turn unexpectedly

Herc falls short of our quality standards. There are more promising prospects in the market.

Why There Are Better Opportunities Than Herc

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Herc

Herc’s stock price of $120.11 implies a valuation ratio of 18.4x forward P/E. This multiple is cheaper than most industrials peers, but we think this is justified.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Herc (HRI) Research Report: Q4 CY2025 Update

Equipment rental company Herc Holdings (NYSE:HRI) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 27.1% year on year to $1.21 billion. The company’s full-year revenue guidance of $4.34 billion at the midpoint came in 14.2% below analysts’ estimates. Its non-GAAP profit of $2.07 per share was 11% above analysts’ consensus estimates.

Herc (HRI) Q4 CY2025 Highlights:

- Revenue: $1.21 billion vs analyst estimates of $1.26 billion (27.1% year-on-year growth, 3.8% miss)

- Adjusted EPS: $2.07 vs analyst estimates of $1.87 (11% beat)

- Adjusted EBITDA: $519 million vs analyst estimates of $543 million (42.9% margin, 4.4% miss)

- EBITDA guidance for the upcoming financial year 2026 is $2.05 billion at the midpoint, below analyst estimates of $2.20 billion

- Operating Margin: 20.7%, down from 22.8% in the same quarter last year

- Free Cash Flow was -$145 million, down from $96 million in the same quarter last year

- Market Capitalization: $5.76 billion

Company Overview

Formerly a subsidiary of Hertz Corporation and with a logo that still bears some similarities to its former parent, Herc Holdings (NYSE:HRI) provides equipment rental and related services to a wide range of industries.

The company was created to address the increasing demand for equipment rentals. Renting enables businesses to manage their projects efficiently without the significant capital investment required for equipment ownership. In essence, renting heavy equipment instead of buying it means customers can incur predictable, smooth operating expenses rather than lumpy, capital expenditures.

Herc Holdings offers earthmoving machinery, material handling equipment, aerial work platforms, and power generation equipment. Predictably, the company caters to industries such as construction, industrial manufacturing, and government operations. For example, construction companies rely on Herc Holdings for short-term rentals of heavy machinery like excavators and loaders in the initial stage of a project. Once that portion of the project is done, the customer can rent other equipment like lifts.

The primary revenue sources for Herc Holdings come from rental fees and service agreements. The company's business model focuses on providing equipment through a vast network of rental locations and an online platform. Herc Holdings generates recurring revenue through long-term rental agreements and ongoing customer relationships.

4. Specialty Equipment Distributors

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

Competitors in the equipment rental industry include United Rentals (NYSE: URI), Sunbelt Rentals (LSE:AHT), and H&E Equipment Services NASDAQ:HEES).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Herc’s 19.7% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Herc’s annualized revenue growth of 15.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Equipment rentals. Over the last two years, Herc’s Equipment rentals revenue (aerial, earthmoving, material handling) averaged 16.4% year-on-year growth.

This quarter, Herc generated an excellent 27.1% year-on-year revenue growth rate, but its $1.21 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 14.6% over the next 12 months, similar to its two-year rate. This projection is healthy and suggests the market sees success for its products and services.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Herc’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.3% gross margin over the last five years. Said differently, roughly $36.28 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

This quarter, Herc’s gross profit margin was 33.3% , marking a 6 percentage point decrease from 39.3% in the same quarter last year. Herc’s full-year margin has also been trending down over the past 12 months, decreasing by 4.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

Herc has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Herc’s operating margin decreased by 5.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Herc generated an operating margin profit margin of 20.7%, down 2.1 percentage points year on year. Since Herc’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

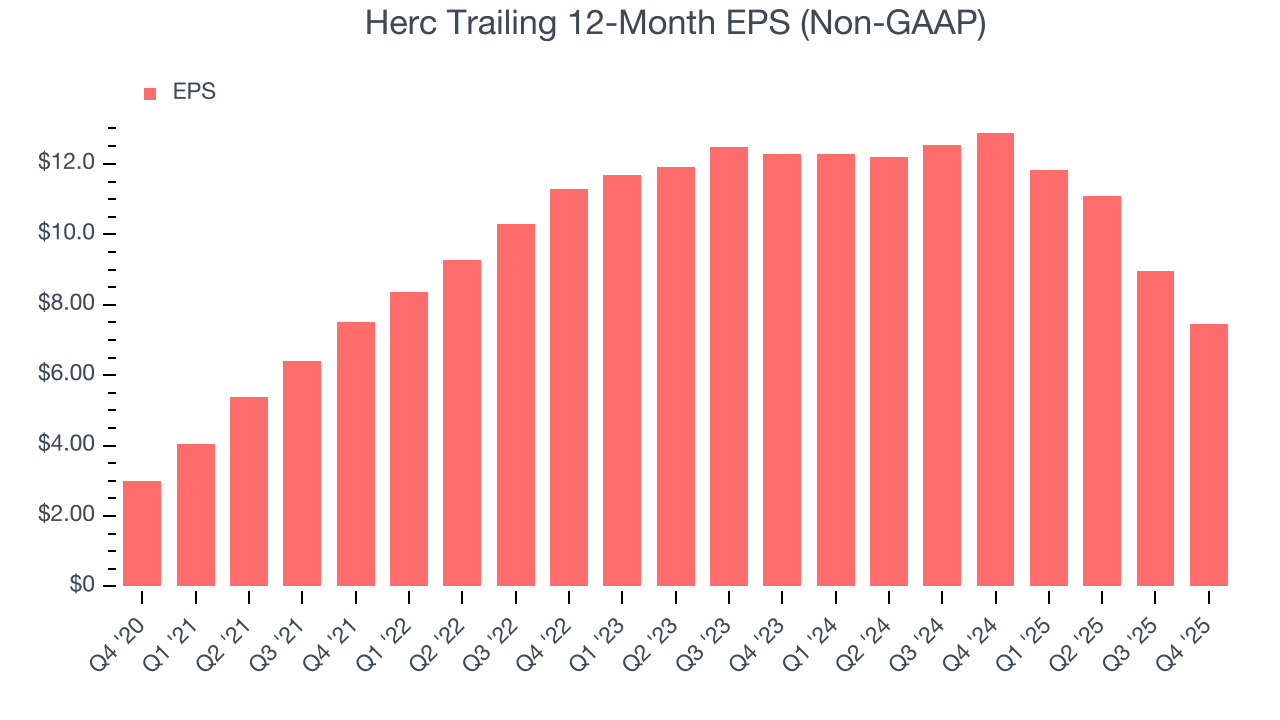

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Herc’s astounding 20.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us its incremental sales were profitable.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Herc’s two-year annual EPS declines of 22.1% were bad and lower than its 15.5% two-year revenue growth.

Diving into the nuances of Herc’s earnings can give us a better understanding of its performance. A two-year view shows Herc has diluted its shareholders, growing its share count by 17.6%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Herc reported adjusted EPS of $2.07, down from $3.58 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Herc’s full-year EPS of $7.46 to grow 13.8%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Herc has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.3%, lousy for an industrials business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Herc to make large cash investments in working capital and capital expenditures.

Taking a step back, we can see that Herc’s margin dropped by 10.6 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Herc burned through $145 million of cash in Q4, equivalent to a negative 12% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Herc’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.8%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Herc’s ROIC decreased by 4.3 percentage points annually each year over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Herc’s $9.68 billion of debt exceeds the $52 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $1.82 billion over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Herc could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Herc can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Herc’s Q4 Results

It was good to see Herc beat analysts’ EPS expectations this quarter. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4% to $166 immediately following the results.

13. Is Now The Time To Buy Herc?

Updated: March 8, 2026 at 11:19 PM EDT

Before investing in or passing on Herc, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Herc isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s impressive operating margins show it has a highly efficient business model, the downside is its declining operating margin shows the business has become less efficient.

Herc’s P/E ratio based on the next 12 months is 18.4x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $176.64 on the company (compared to the current share price of $120.11).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.