Integral Ad Science (IAS)

Integral Ad Science doesn’t impress us. Its decelerating revenue growth and expected decline in cash profitability will make it tough to beat the market.― StockStory Analyst Team

1. News

2. Summary

Why Integral Ad Science Is Not Exciting

Processing over 280 billion digital ad interactions daily through its AI-powered technology, Integral Ad Science (NASDAQ:IAS) provides a cloud-based platform that measures and verifies digital advertising across devices, channels, and formats to ensure ads are viewable, fraud-free, and brand-safe.

- Operating profits increased over the last year as the company gained some leverage on its fixed costs and became more efficient

- Estimated sales growth of 12.8% for the next 12 months is soft and implies weaker demand

- A silver lining is that its well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

Integral Ad Science’s quality isn’t great. There are more promising alternatives.

Why There Are Better Opportunities Than Integral Ad Science

Why There Are Better Opportunities Than Integral Ad Science

Integral Ad Science’s stock price of $10.28 implies a valuation ratio of 2.6x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Integral Ad Science (IAS) Research Report: Q3 CY2025 Update

Digital ad verification company Integral Ad Science (NASDAQ:IAS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 15.6% year on year to $154.4 million. Its GAAP profit of $0.04 per share was 42.2% below analysts’ consensus estimates.

Integral Ad Science (IAS) Q3 CY2025 Highlights:

- Revenue: $154.4 million vs analyst estimates of $149.3 million (15.6% year-on-year growth, 3.4% beat)

- EPS (GAAP): $0.04 vs analyst expectations of $0.07 (42.2% miss)

- Adjusted Operating Income: $30.2 million vs analyst estimates of $16.73 million (19.6% margin, 80.5% beat)

- Operating Margin: 4.9%, down from 15.1% in the same quarter last year

- Free Cash Flow Margin: 32.9%, down from 36.9% in the previous quarter

- Market Capitalization: $1.71 billion

Company Overview

Processing over 280 billion digital ad interactions daily through its AI-powered technology, Integral Ad Science (NASDAQ:IAS) provides a cloud-based platform that measures and verifies digital advertising across devices, channels, and formats to ensure ads are viewable, fraud-free, and brand-safe.

The company serves as a crucial intermediary in the digital advertising ecosystem, helping both advertisers and publishers optimize their ad spend and inventory. For advertisers, IAS offers pre-bid optimization and post-bid measurement solutions that evaluate ad campaigns across multiple quality dimensions including viewability (whether ads can be seen by humans), fraud prevention (detecting and filtering out bot traffic), brand safety (ensuring ads don't appear alongside inappropriate content), and geographical targeting.

IAS's proprietary "Quality Impressions" metric has become an industry standard that verifies an ad was viewed by a real person in a brand-suitable environment within the intended geography. The company's Context Control solution offers over 600 contextual targeting segments, allowing advertisers to place their ads in the most relevant environments without relying on cookies or personal data.

For publishers, IAS helps classify and package inventory to showcase quality placements and increase revenue. Its Publica product line specifically serves streaming publishers with tools for CTV (Connected TV) advertising, including a unified auction system and server-side ad insertion technology.

IAS has built deep integrations with major advertising platforms including Facebook, Google, Amazon, Microsoft, TikTok, and The Trade Desk. The company's self-serve reporting platform, IAS Signal, provides customers with actionable insights through an intuitive interface. With offices across 12 countries, IAS serves a global customer base that includes many of the world's largest advertisers across industries like consumer packaged goods, finance, automotive, and retail.

4. Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Integral Ad Science competes primarily with DoubleVerify and Oracle's MOAT in the ad verification and measurement space, as well as point solution providers like Human, Inc. and ZEFR, Inc. for specific capabilities. The company also faces competition from Nielsen in the broader media measurement market.

5. Revenue Growth

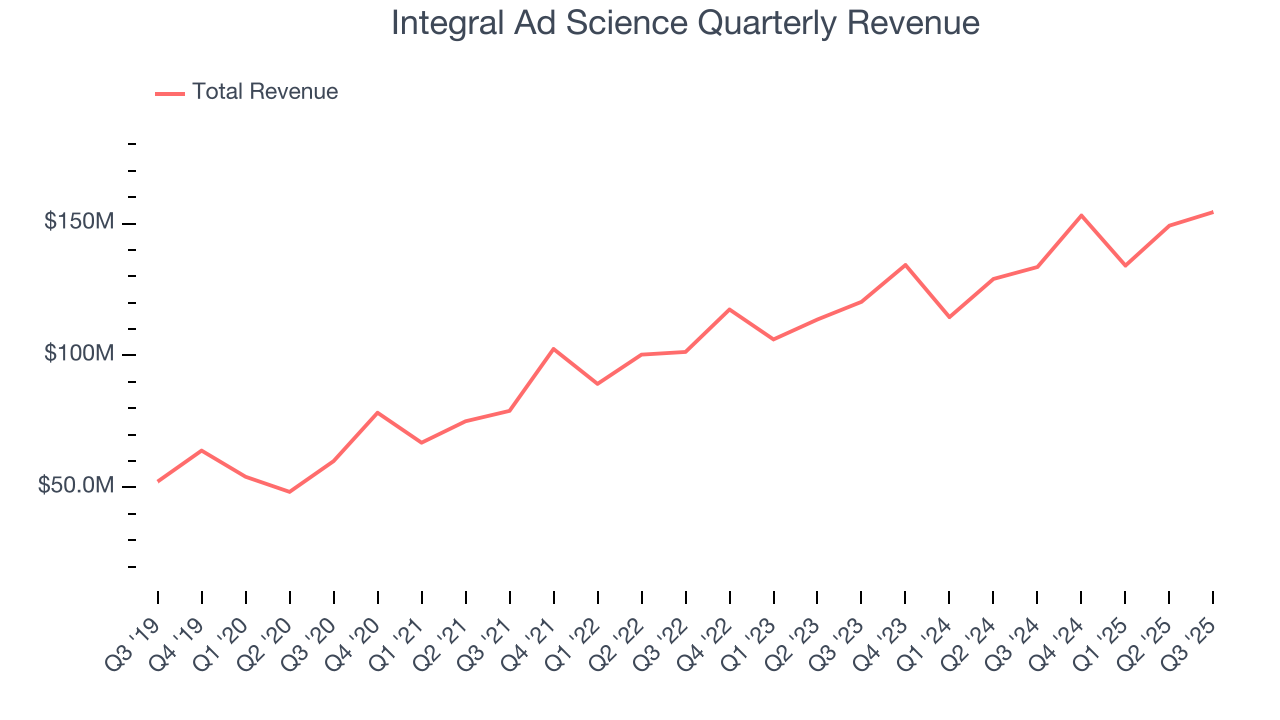

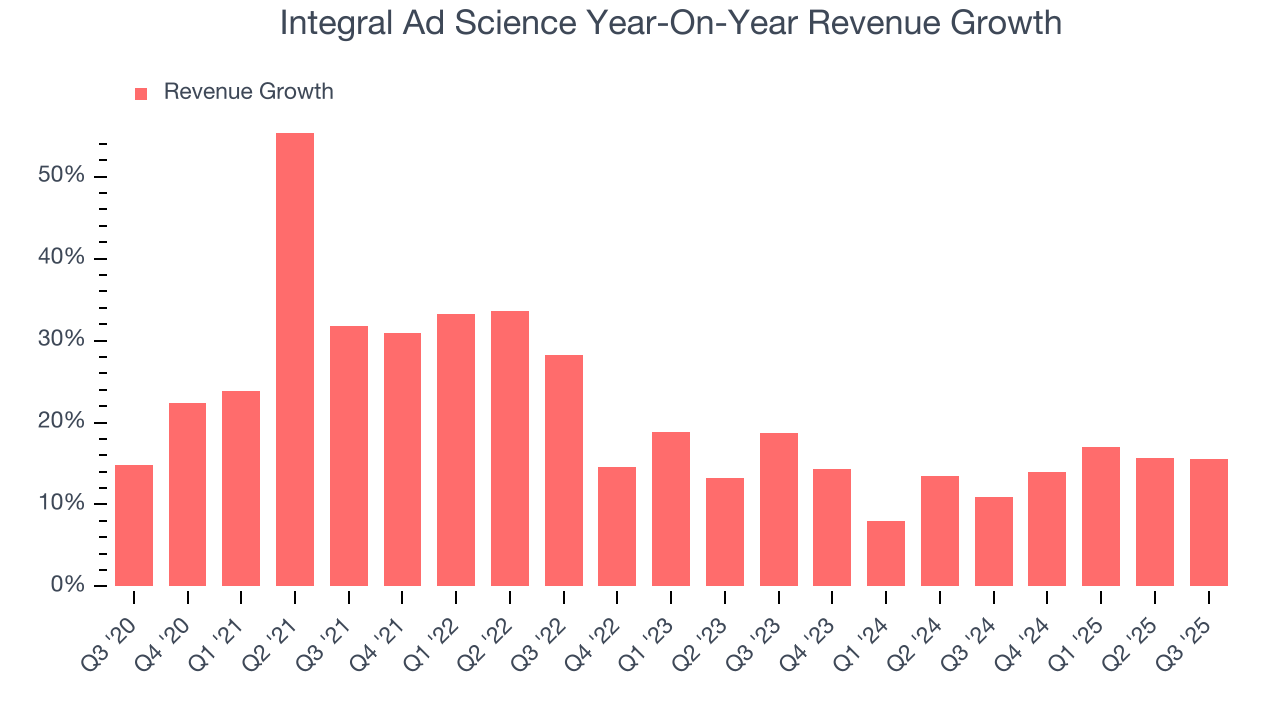

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Integral Ad Science’s 21.2% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Integral Ad Science’s recent performance shows its demand has slowed as its annualized revenue growth of 13.6% over the last two years was below its five-year trend.

This quarter, Integral Ad Science reported year-on-year revenue growth of 15.6%, and its $154.4 million of revenue exceeded Wall Street’s estimates by 3.4%.

Looking ahead, sell-side analysts expect revenue to grow 10% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Integral Ad Science is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

For software companies like Integral Ad Science, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

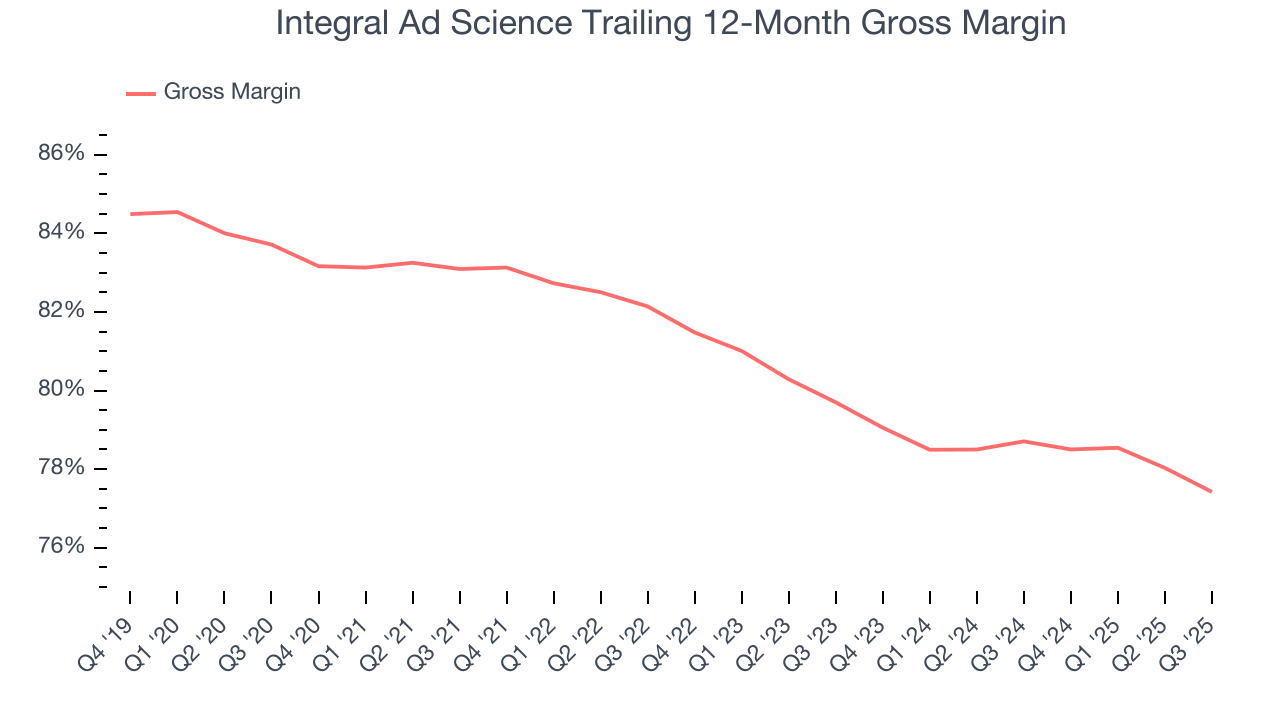

Integral Ad Science’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 77.4% gross margin over the last year. That means for every $100 in revenue, roughly $77.42 was left to spend on selling, marketing, and R&D.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Integral Ad Science has seen gross margins decline by 2.3 percentage points over the last 2 year, which is among the worst in the software space.

This quarter, Integral Ad Science’s gross profit margin was 77%, down 2.5 percentage points year on year. Integral Ad Science’s full-year margin has also been trending down over the past 12 months, decreasing by 1.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

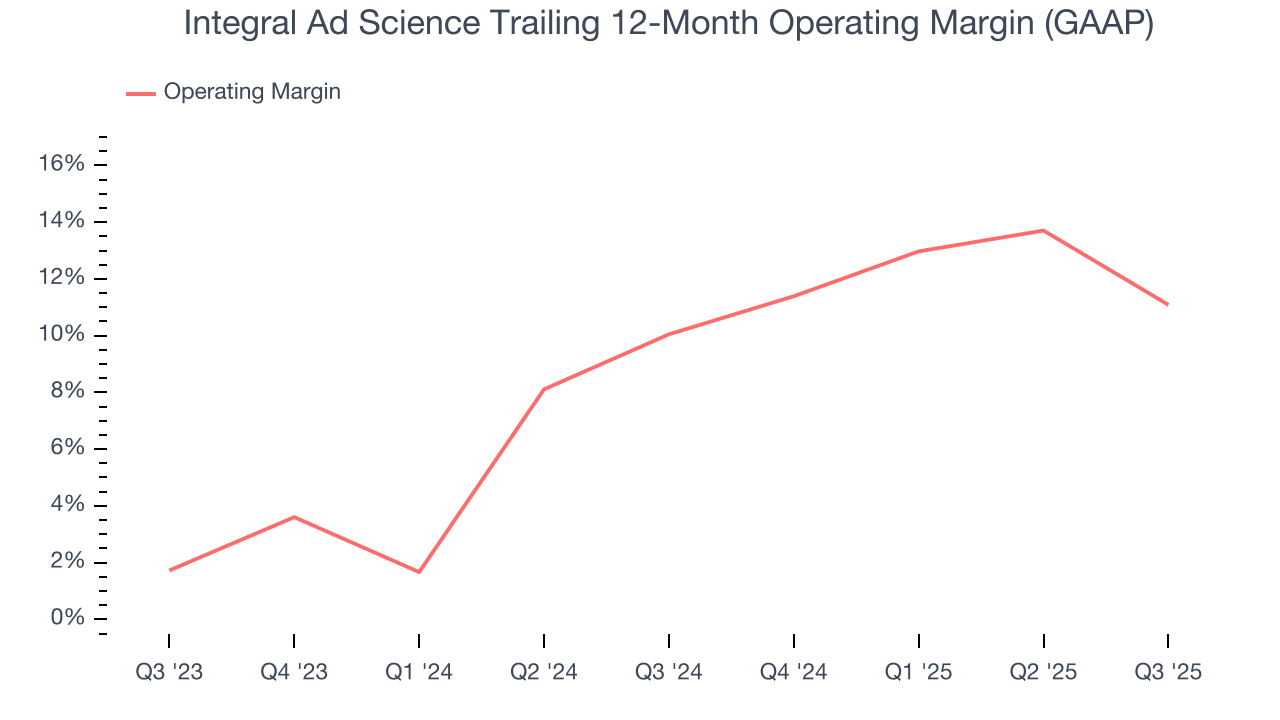

Integral Ad Science has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 11.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Integral Ad Science’s operating margin rose by 1 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q3, Integral Ad Science generated an operating margin profit margin of 4.9%, down 10.2 percentage points year on year. Since Integral Ad Science’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

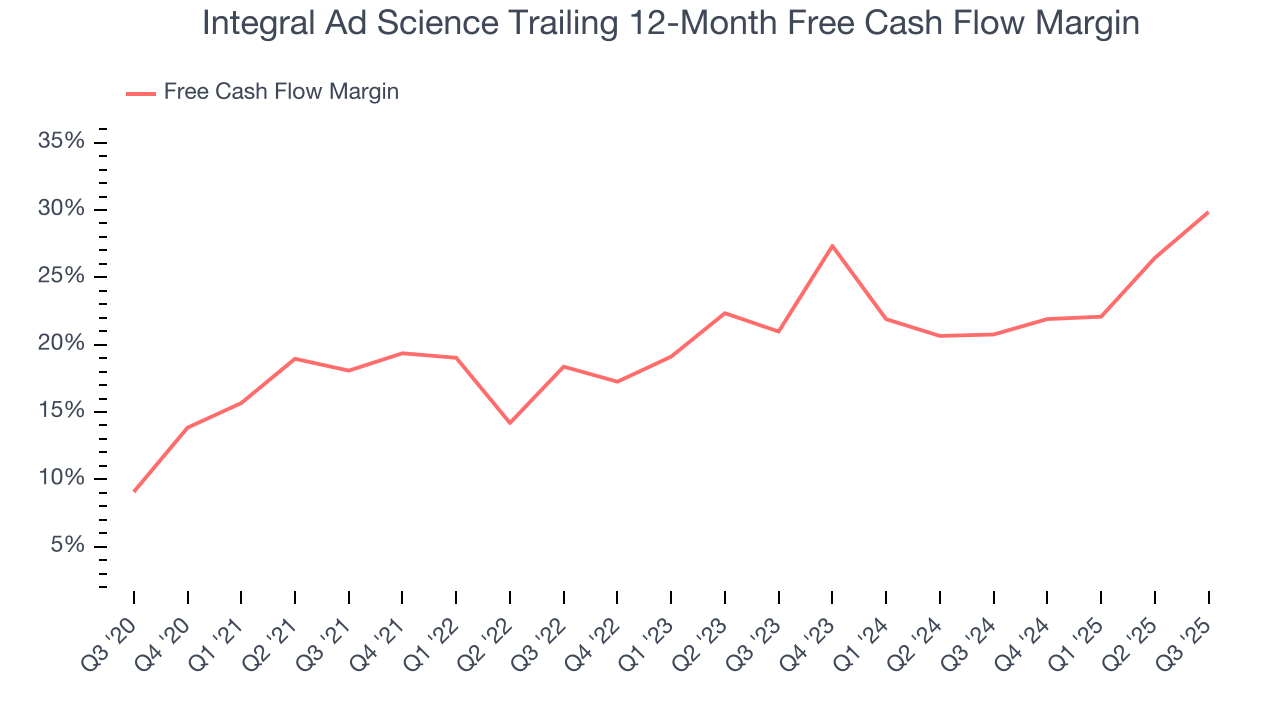

Integral Ad Science has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 29.9% over the last year, quite impressive for a software business.

Integral Ad Science’s free cash flow clocked in at $50.8 million in Q3, equivalent to a 32.9% margin. This result was good as its margin was 14.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Integral Ad Science’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 29.9% for the last 12 months will decrease to 25.1%.

10. Balance Sheet Assessment

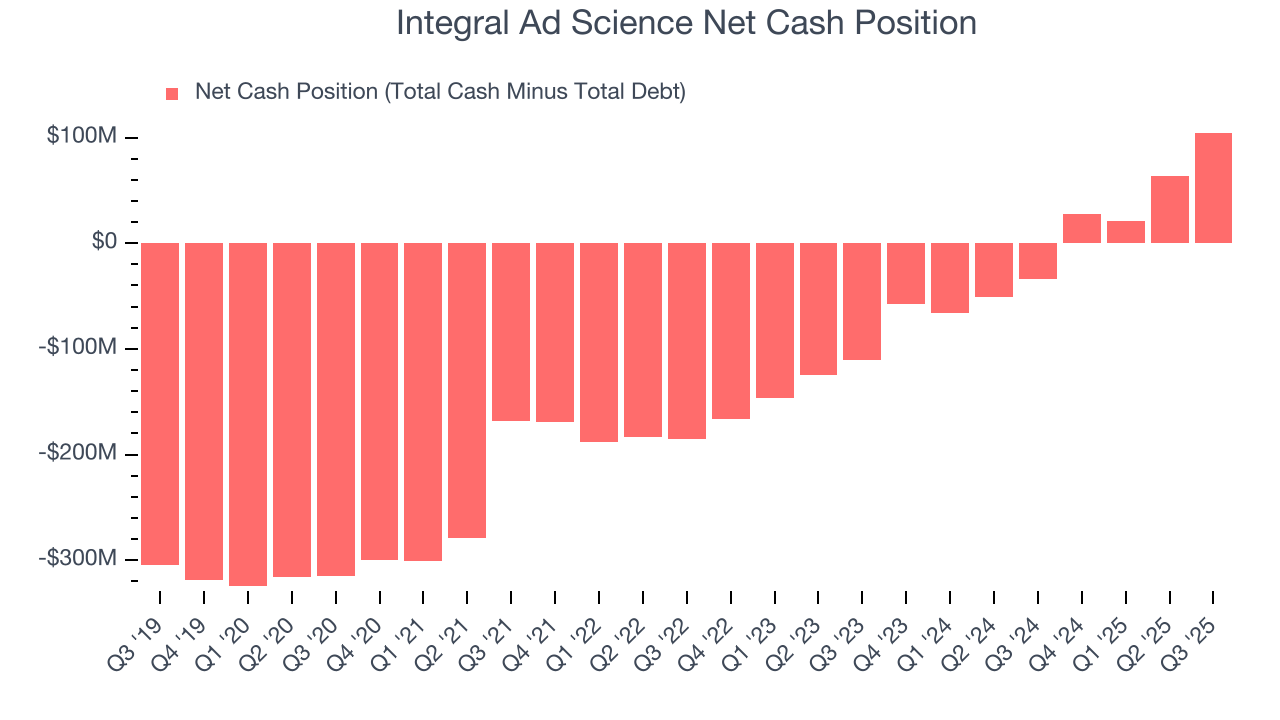

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Integral Ad Science is a profitable, well-capitalized company with $129.5 million of cash and $24.78 million of debt on its balance sheet. This $104.7 million net cash position is 6.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Integral Ad Science’s Q3 Results

We enjoyed seeing Integral Ad Science beat analysts’ adjusted operating income expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $10.24 immediately following the results.

12. Is Now The Time To Buy Integral Ad Science?

Updated: December 3, 2025 at 11:13 PM EST

Before making an investment decision, investors should account for Integral Ad Science’s business fundamentals and valuation in addition to what happened in the latest quarter.

Integral Ad Science doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was solid over the last five years. And while Integral Ad Science’s expanding operating margin shows it’s becoming more efficient at building and selling its software, its efficient sales strategy allows it to target and onboard new users at scale.

Integral Ad Science’s price-to-sales ratio based on the next 12 months is 2.6x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $10.59 on the company (compared to the current share price of $10.28).