ICF International (ICFI)

We wouldn’t buy ICF International. Its weak returns on capital indicate management was inefficient with its resources and missed opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think ICF International Will Underperform

Operating at the intersection of policy, technology, and implementation for over five decades, ICF International (NASDAQ:ICFI) provides professional consulting services and technology solutions to government agencies and commercial clients across energy, health, environment, and security sectors.

- Sales stagnated over the last two years and signal the need for new growth strategies

- Sales are projected to tank by 3% over the next 12 months as demand evaporates further

- Sales pipeline suggests its future revenue growth won’t meet our standards as its backlog averaged 2.9% declines over the past two years

ICF International’s quality doesn’t meet our expectations. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than ICF International

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ICF International

ICF International’s stock price of $97.03 implies a valuation ratio of 14.1x forward P/E. Yes, this valuation multiple is lower than that of other business services peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. ICF International (ICFI) Research Report: Q3 CY2025 Update

Professional consulting firm ICF International (NASDAQ:ICFI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 10% year on year to $465.4 million. Its non-GAAP profit of $1.67 per share was 3.7% below analysts’ consensus estimates.

ICF International (ICFI) Q3 CY2025 Highlights:

- Revenue: $465.4 million vs analyst estimates of $484.2 million (10% year-on-year decline, 3.9% miss)

- Adjusted EPS: $1.67 vs analyst expectations of $1.73 (3.7% miss)

- Adjusted EBITDA: $53.16 million vs analyst estimates of $55.3 million (11.4% margin, 3.9% miss)

- Operating Margin: 8.3%, in line with the same quarter last year

- Free Cash Flow Margin: 9%, up from 3.9% in the same quarter last year

- Backlog: $3.5 billion at quarter end

- Market Capitalization: $1.58 billion

Company Overview

Operating at the intersection of policy, technology, and implementation for over five decades, ICF International (NASDAQ:ICFI) provides professional consulting services and technology solutions to government agencies and commercial clients across energy, health, environment, and security sectors.

ICF's services span five core areas: advisory services, program implementation, analytics, digital solutions, and engagement services. The company helps clients navigate complex challenges by combining subject matter expertise with technical capabilities to deliver practical solutions.

In the energy sector, ICF assists utilities and government agencies with power market analysis, grid modernization, renewable energy implementation, and energy efficiency programs. For example, a utility might engage ICF to design and implement residential demand-side management programs that reduce peak electricity usage while helping consumers lower their bills.

Environmental work includes impact assessments, compliance programs, and disaster recovery services. Following major hurricanes like Maria or Ian, ICF helps affected communities rebuild by managing recovery funds, designing resilient infrastructure, and implementing housing assistance programs.

In health and social programs, ICF supports agencies like the Centers for Disease Control and Prevention (CDC) and the National Institutes of Health (NIH) with program evaluation, data collection, and technical assistance. The company might help design public health campaigns, manage healthcare quality initiatives, or evaluate the effectiveness of social welfare programs.

ICF generates revenue through consulting contracts, typically ranging from one month to five years. Government clients represent approximately three-quarters of ICF's business, including U.S. federal agencies, state and local governments, and international bodies like the European Commission. Commercial clients, including corporations and non-profit organizations, make up the remaining quarter.

The company maintains a global footprint with headquarters in the Washington, D.C. area, 55 regional offices throughout the United States, and 15 international locations in countries including the United Kingdom, Belgium, India, and Canada. This geographic diversity allows ICF to serve clients worldwide while maintaining local expertise in key markets.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

ICF International competes with large consulting firms like Accenture, Deloitte, and Booz Allen Hamilton, as well as specialized government contractors such as CACI International, Leidos Holdings, and Science Applications International Corporation (SAIC). In the energy and environmental space, competitors include Tetra Tech and AECOM.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.93 billion in revenue over the past 12 months, ICF International is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

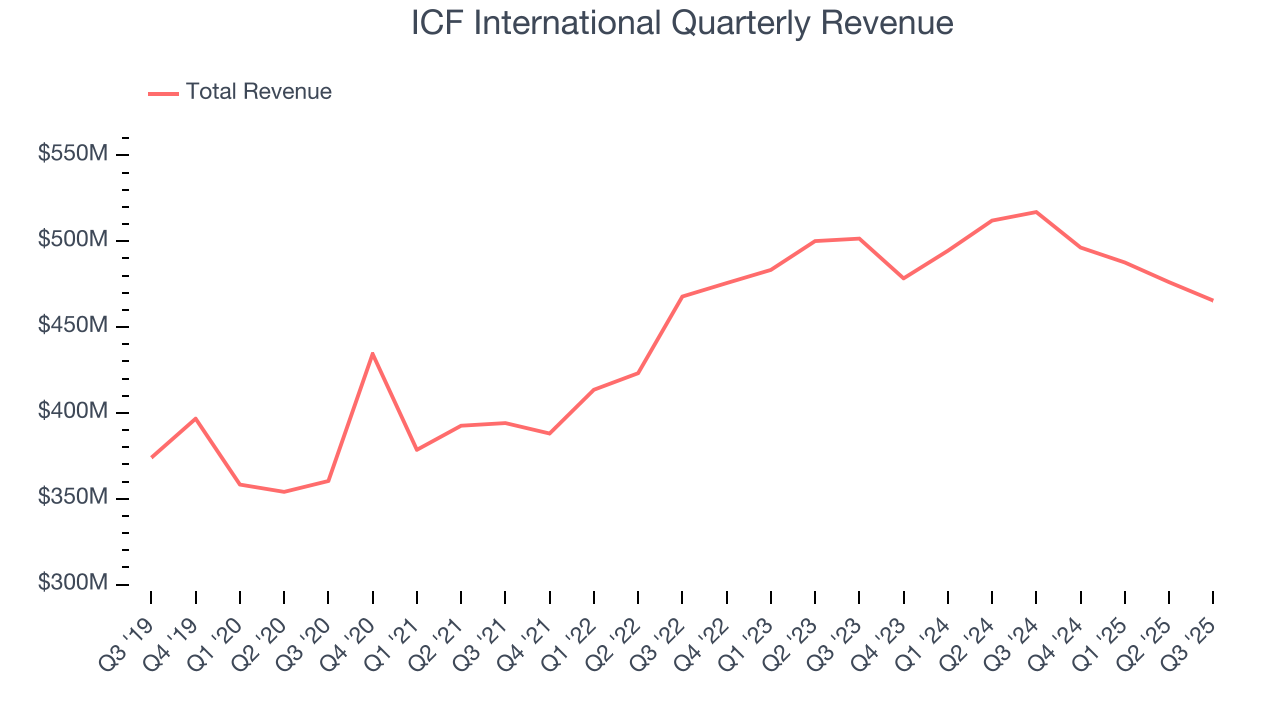

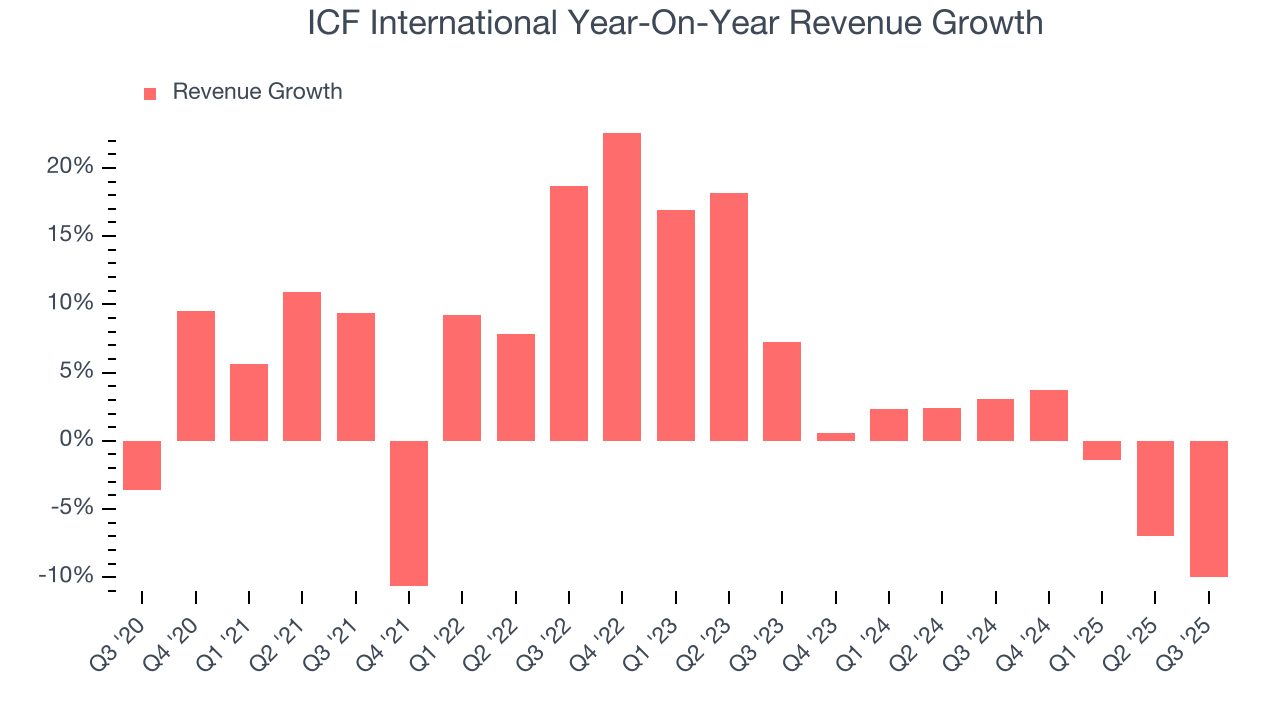

As you can see below, ICF International’s 5.6% annualized revenue growth over the last five years was decent. This shows its offerings generated slightly more demand than the average business services company, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ICF International’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

ICF International also reports its backlog, or the value of its outstanding orders that have not yet been executed or delivered. ICF International’s backlog reached $3.5 billion in the latest quarter.

This quarter, ICF International missed Wall Street’s estimates and reported a rather uninspiring 10% year-on-year revenue decline, generating $465.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.3% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Operating Margin

ICF International’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 7.2% over the last five years. This profitability was paltry for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, ICF International’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, ICF International generated an operating margin profit margin of 8.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

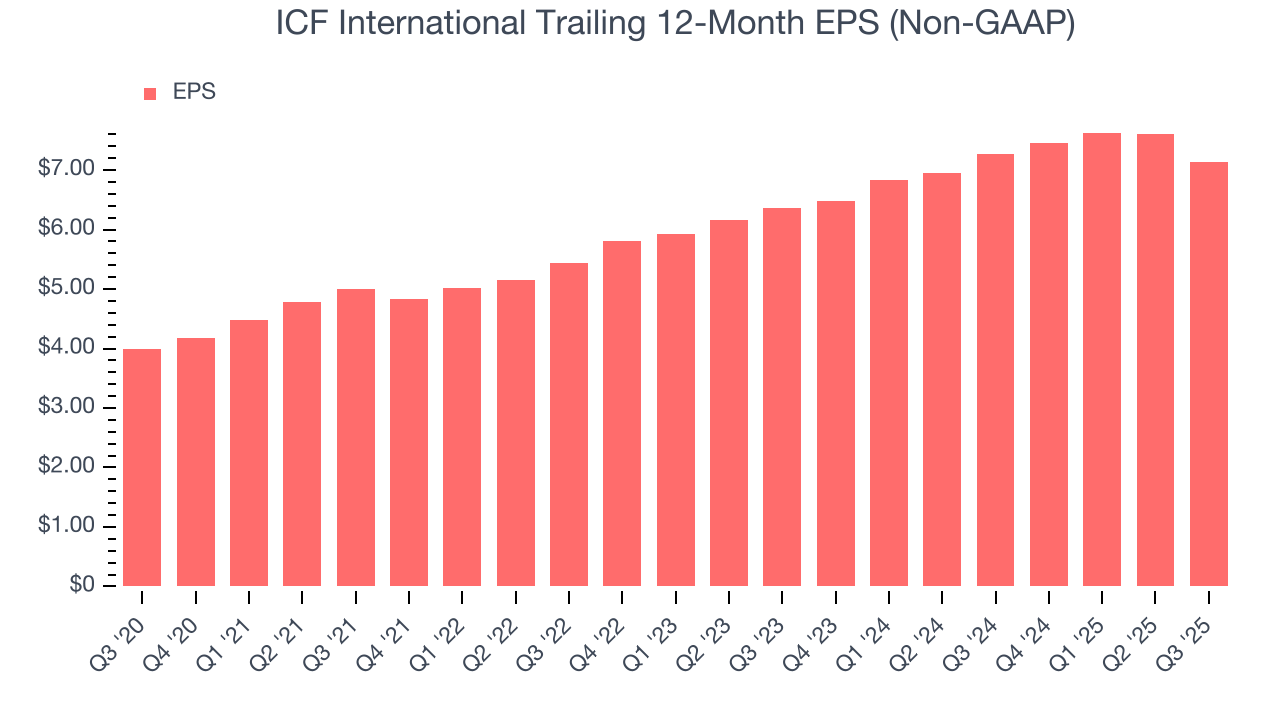

ICF International’s EPS grew at a remarkable 12.3% compounded annual growth rate over the last five years, higher than its 5.6% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For ICF International, its two-year annual EPS growth of 6% was lower than its five-year trend. We hope its growth can accelerate in the future.

In Q3, ICF International reported adjusted EPS of $1.67, down from $2.13 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects ICF International’s full-year EPS of $7.14 to stay about the same.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

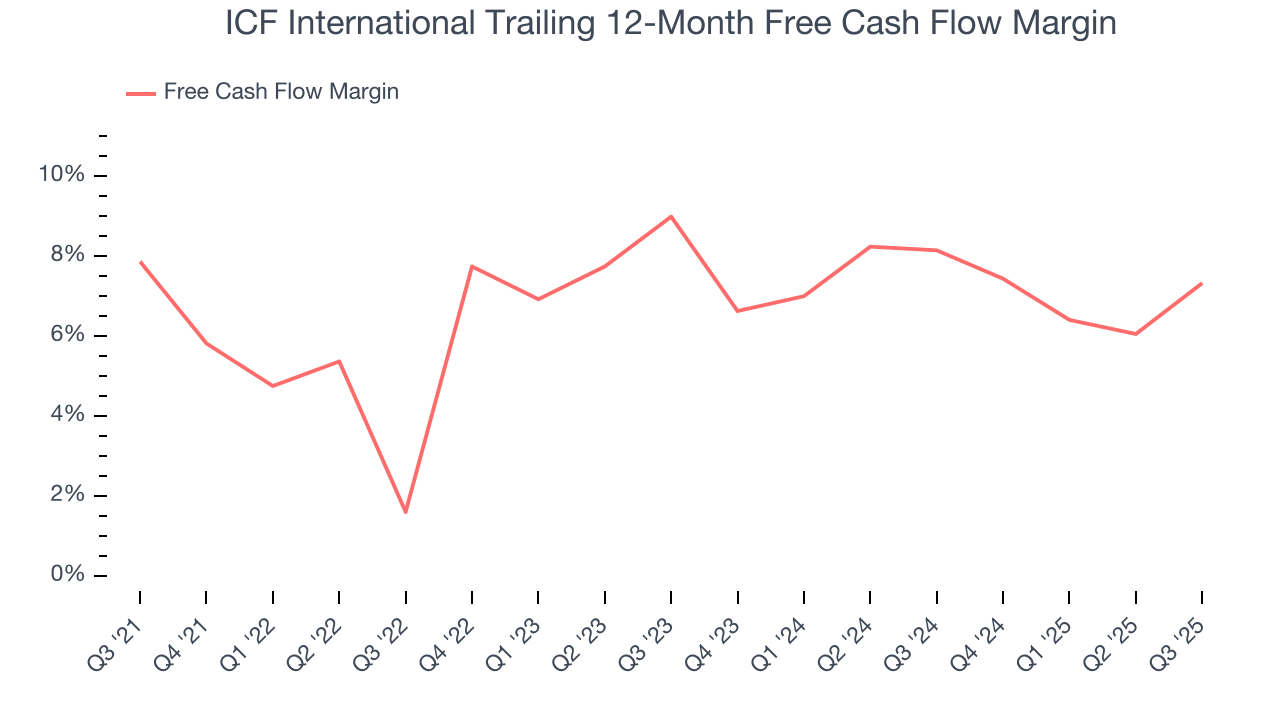

ICF International has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.9% over the last five years, slightly better than the broader business services sector.

ICF International’s free cash flow clocked in at $41.78 million in Q3, equivalent to a 9% margin. This result was good as its margin was 5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

ICF International historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.1%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, ICF International’s ROIC increased by 2.4 percentage points annually over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

ICF International reported $3.99 million of cash and $623.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $217.5 million of EBITDA over the last 12 months, we view ICF International’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $30.07 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ICF International’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $85.46 immediately following the results.

12. Is Now The Time To Buy ICF International?

Updated: January 24, 2026 at 10:30 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in ICF International.

ICF International doesn’t pass our quality test. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its backlog declined.

ICF International’s P/E ratio based on the next 12 months is 14.1x. At this valuation, there’s a lot of good news priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $108.75 on the company (compared to the current share price of $97.03).