iHeartMedia (IHRT)

We wouldn’t buy iHeartMedia. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think iHeartMedia Will Underperform

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ:IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

- Lackluster 4.9% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Poor expense management has led to operating margin losses

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

iHeartMedia’s quality doesn’t meet our expectations. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than iHeartMedia

High Quality

Investable

Underperform

Why There Are Better Opportunities Than iHeartMedia

iHeartMedia is trading at $3.78 per share, or 7.9x forward EV-to-EBITDA. The current valuation may be appropriate, but we’re still not buyers of the stock.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. iHeartMedia (IHRT) Research Report: Q3 CY2025 Update

Global media and entertainment company iHeartMedia (NASDAQ:IHRT) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 1.1% year on year to $997 million. Its GAAP loss of $0.43 per share was significantly below analysts’ consensus estimates.

iHeartMedia (IHRT) Q3 CY2025 Highlights:

- Revenue: $997 million vs analyst estimates of $978.7 million (1.1% year-on-year decline, 1.9% beat)

- EPS (GAAP): -$0.43 vs analyst estimates of -$0.01 (significant miss)

- Adjusted EBITDA: $204.8 million vs analyst estimates of $203.3 million (20.5% margin, 0.7% beat)

- Operating Margin: -11.7%, down from 7.6% in the same quarter last year

- Free Cash Flow was -$32.82 million, down from $73.35 million in the same quarter last year

- Market Capitalization: $652.2 million

Company Overview

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ:IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

iHeartMedia got its start as a single radio station and has since evolved into one of the largest radio and media companies. This growth stemmed from recognizing radio's potential as a personal, engaging medium to deliver varied audio content, from music and news to talk shows.

iHeartMedia offers a diverse range of content, including broadcast and online radio, podcasts, live music events, and syndicated programming. By providing on-demand, versatile audio content, the company caters to a broad spectrum of listener interests and offers advertisers targeted marketing opportunities.

The company generates revenue through advertising, live events, and digital subscriptions. Its extensive network ensures constant content flow, appealing to various tastes.

4. Broadcasting

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

Competitors in the audio and radio broadcasting industry include Sirius XM (NASDAQ:SIRI), Cumulus Media (NASDAQ:CMLS), and Townsquare Media (NYSE:TSQ).

5. Revenue Growth

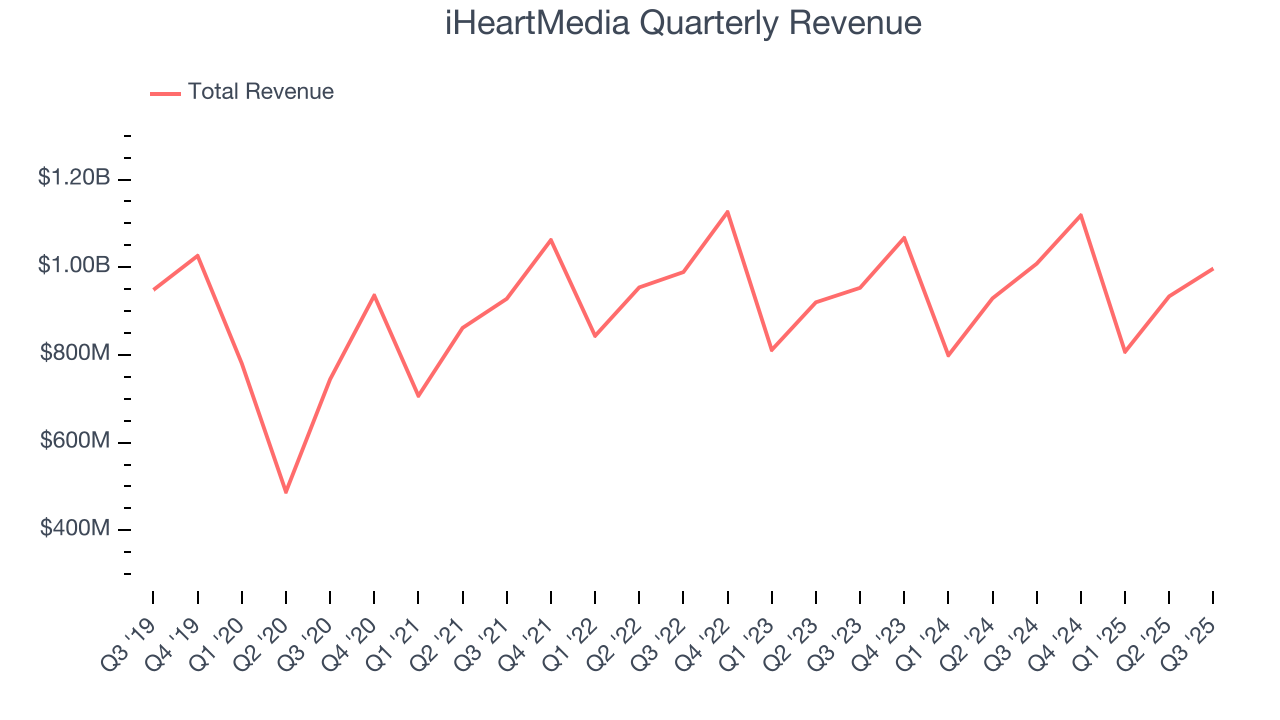

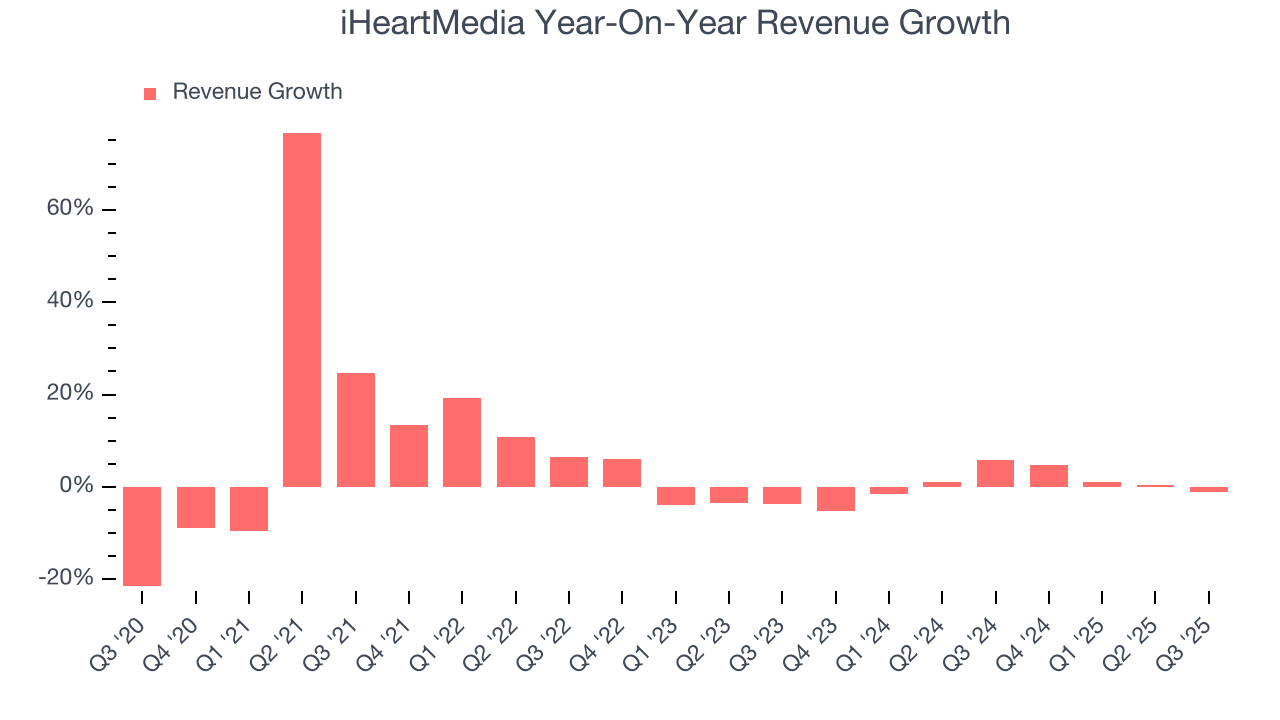

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, iHeartMedia’s sales grew at a sluggish 4.9% compounded annual growth rate over the last five years. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. iHeartMedia’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

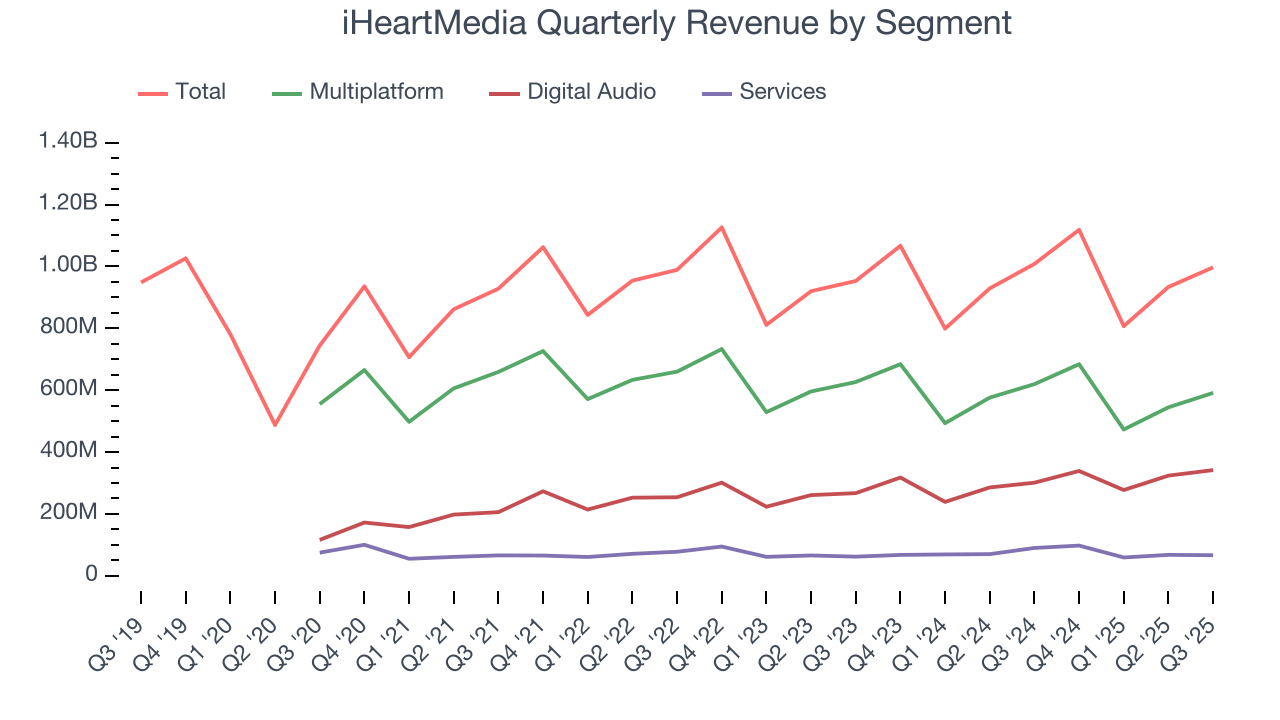

iHeartMedia also breaks out the revenue for its three most important segments: Multiplatform, Digital Audio, and Services, which are 59.3%, 34.3%, and 6.7% of revenue. Over the last two years, iHeartMedia’s Multiplatform revenue (broadcasting, networks, events) averaged 4% year-on-year declines, but its Digital Audio (podcasting) and Services (media representation) revenues averaged 10.5% and 4.6% growth.

This quarter, iHeartMedia’s revenue fell by 1.1% year on year to $997 million but beat Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, similar to its two-year rate. Although this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

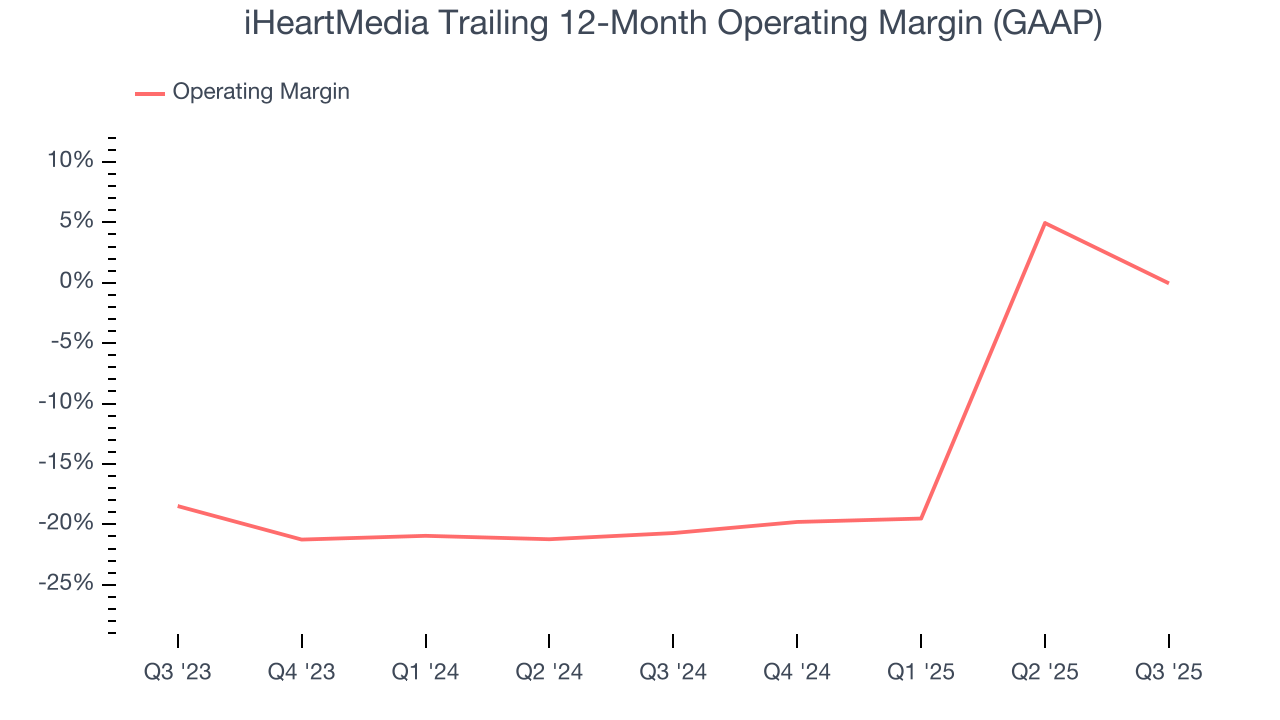

iHeartMedia’s operating margin has been trending up over the last 12 months, but it still averaged negative 10.3% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q3, iHeartMedia generated a negative 11.7% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

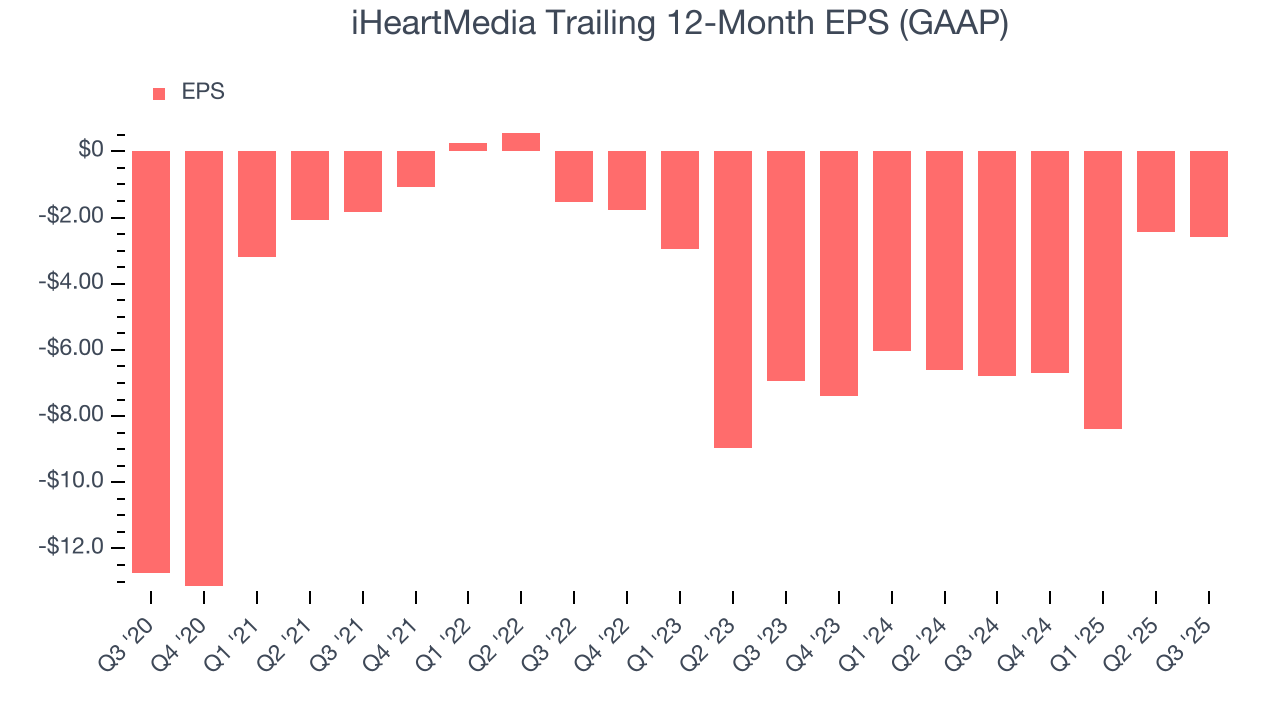

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although iHeartMedia’s full-year earnings are still negative, it reduced its losses and improved its EPS by 27.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q3, iHeartMedia reported EPS of negative $0.43, down from negative $0.27 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast iHeartMedia’s full-year EPS of negative $2.60 will flip to positive $0.22.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

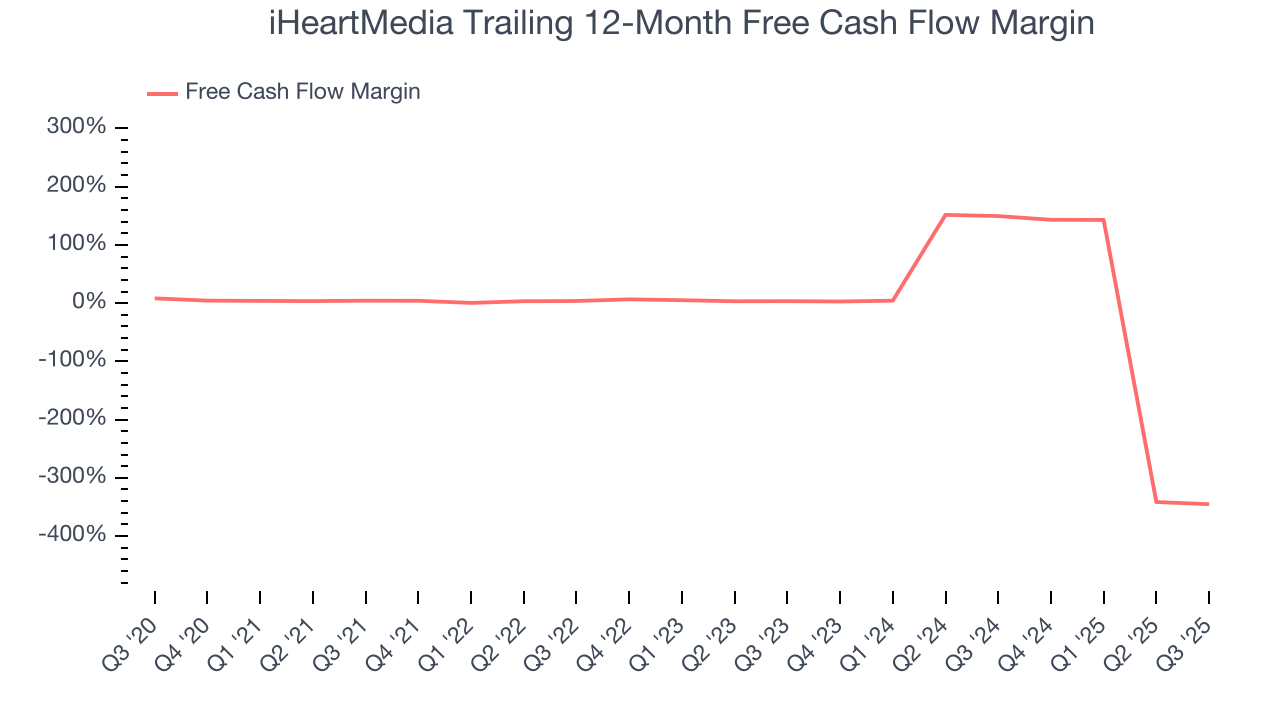

Over the last two years, iHeartMedia’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 99.5%, meaning it lit $99.52 of cash on fire for every $100 in revenue.

iHeartMedia burned through $32.82 million of cash in Q3, equivalent to a negative 3.3% margin. The company’s cash flow turned negative after being positive in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

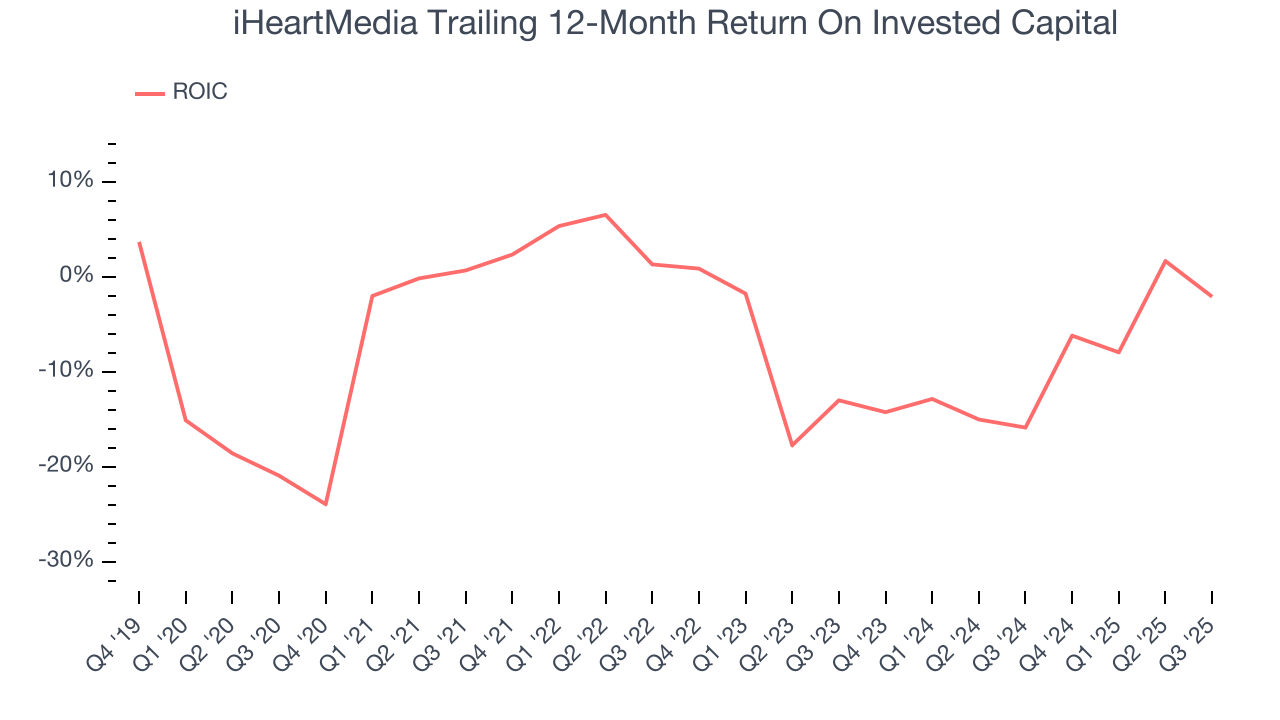

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

iHeartMedia’s five-year average ROIC was negative 5.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, iHeartMedia’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

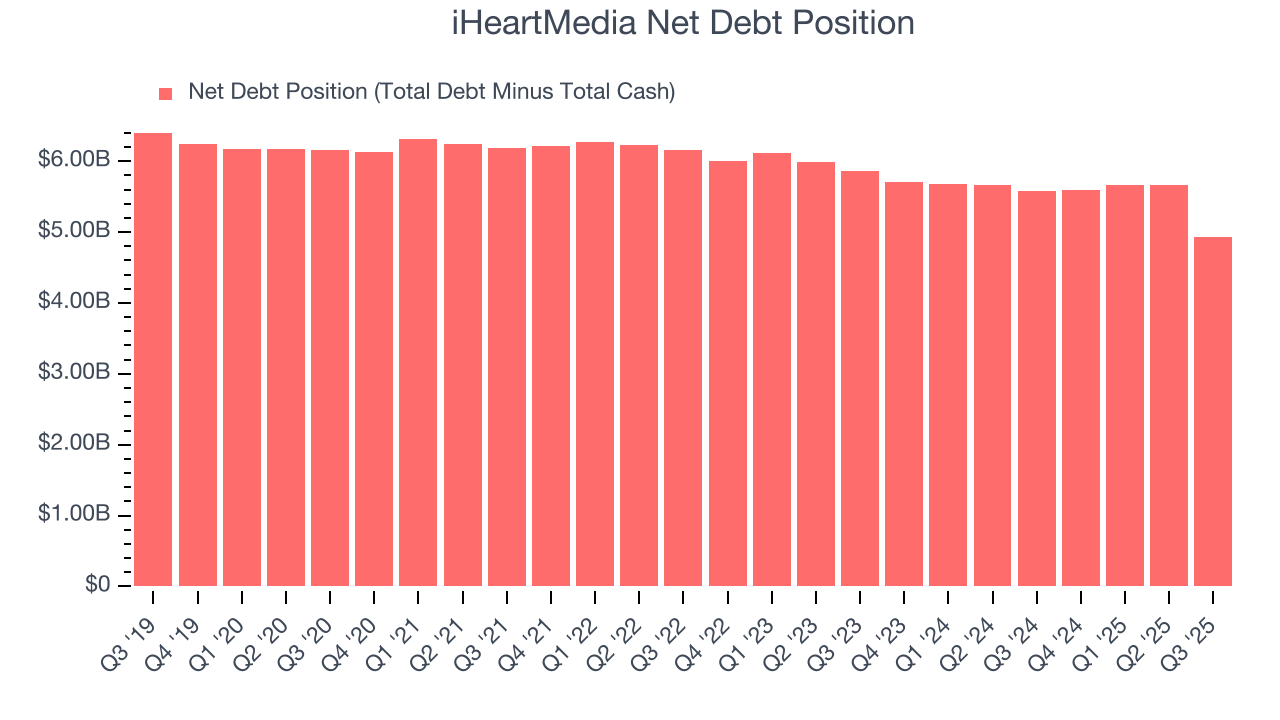

iHeartMedia burned through $13.31 billion of cash over the last year, and its $5.12 billion of debt exceeds the $192.2 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the iHeartMedia’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of iHeartMedia until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from iHeartMedia’s Q3 Results

It was encouraging to see iHeartMedia beat analysts’ revenue expectations this quarter. We were also happy its Digital Audio revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded down 6.6% to $4.24 immediately after reporting.

12. Is Now The Time To Buy iHeartMedia?

Updated: January 21, 2026 at 10:02 PM EST

When considering an investment in iHeartMedia, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of iHeartMedia, we’ll be cheering from the sidelines. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

iHeartMedia’s EV-to-EBITDA ratio based on the next 12 months is 7.9x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $4.25 on the company (compared to the current share price of $3.78).