Iridium (IRDM)

We aren’t fans of Iridium. Its weak returns on capital indicate management was inefficient with its resources and missed opportunities.― StockStory Analyst Team

1. News

2. Summary

Why Iridium Is Not Exciting

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ:IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

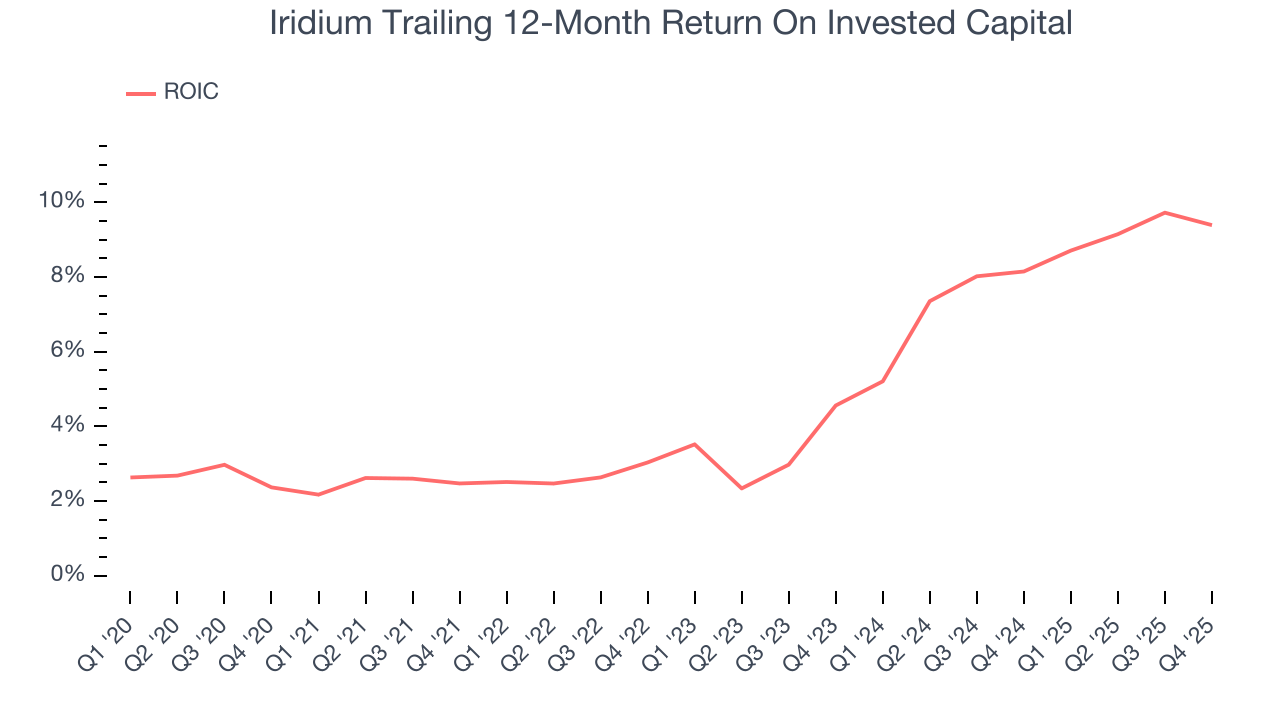

- ROIC of 5.2% reflects management’s challenges in identifying attractive investment opportunities

- Estimated sales growth of 2.6% for the next 12 months implies demand will slow from its two-year trend

- On the plus side, its robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

Iridium doesn’t live up to our standards. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Iridium

Why There Are Better Opportunities Than Iridium

At $18.50 per share, Iridium trades at 17.7x forward P/E. While valuation is appropriate for the quality you get, we’re still not buyers.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Iridium (IRDM) Research Report: Q4 CY2025 Update

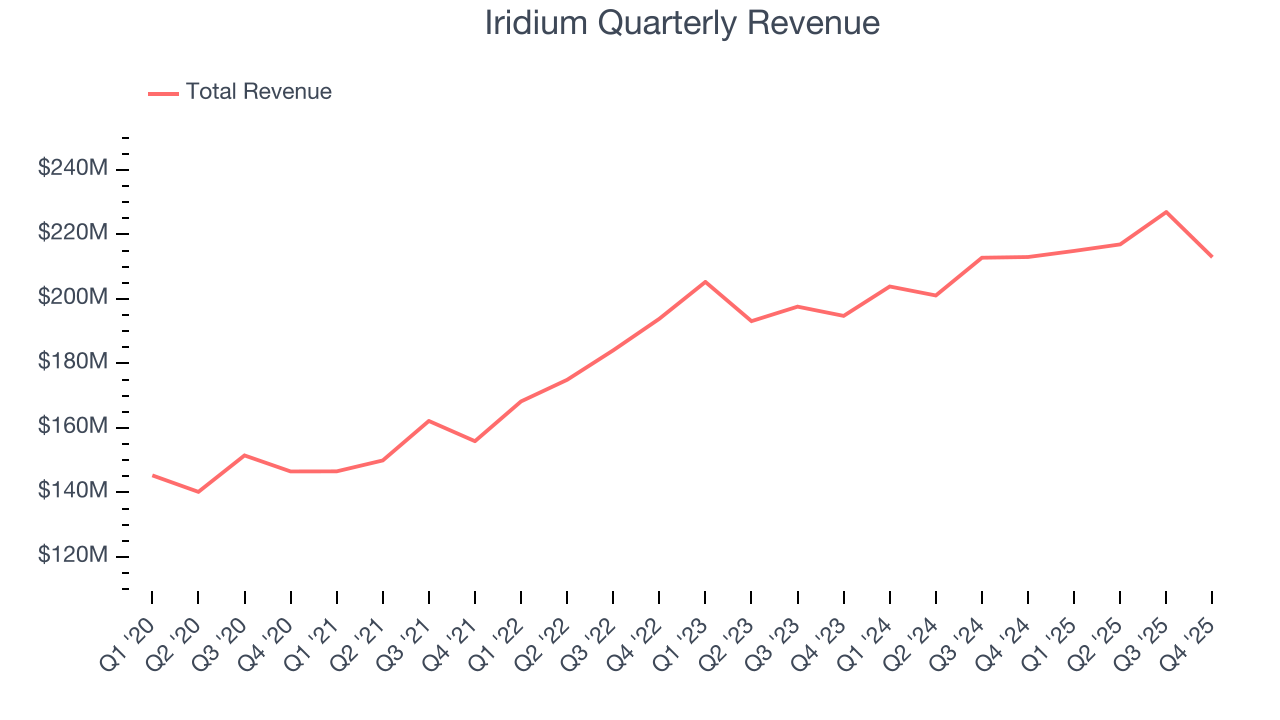

Satellite communications provider missed Wall Street’s revenue expectations in Q4 CY2025, with sales flat year on year at $212.9 million. Its GAAP profit of $0.23 per share was in line with analysts’ consensus estimates.

Iridium (IRDM) Q4 CY2025 Highlights:

- Revenue: $212.9 million vs analyst estimates of $219.9 million (flat year on year, 3.2% miss)

- EPS (GAAP): $0.23 vs analyst estimates of $0.24 (in line)

- Adjusted EBITDA: $115.3 million vs analyst estimates of $119.6 million (54.2% margin, 3.6% miss)

- Operating Margin: 25.9%, up from 24.5% in the same quarter last year

- Free Cash Flow Margin: 35.3%, down from 37.8% in the same quarter last year

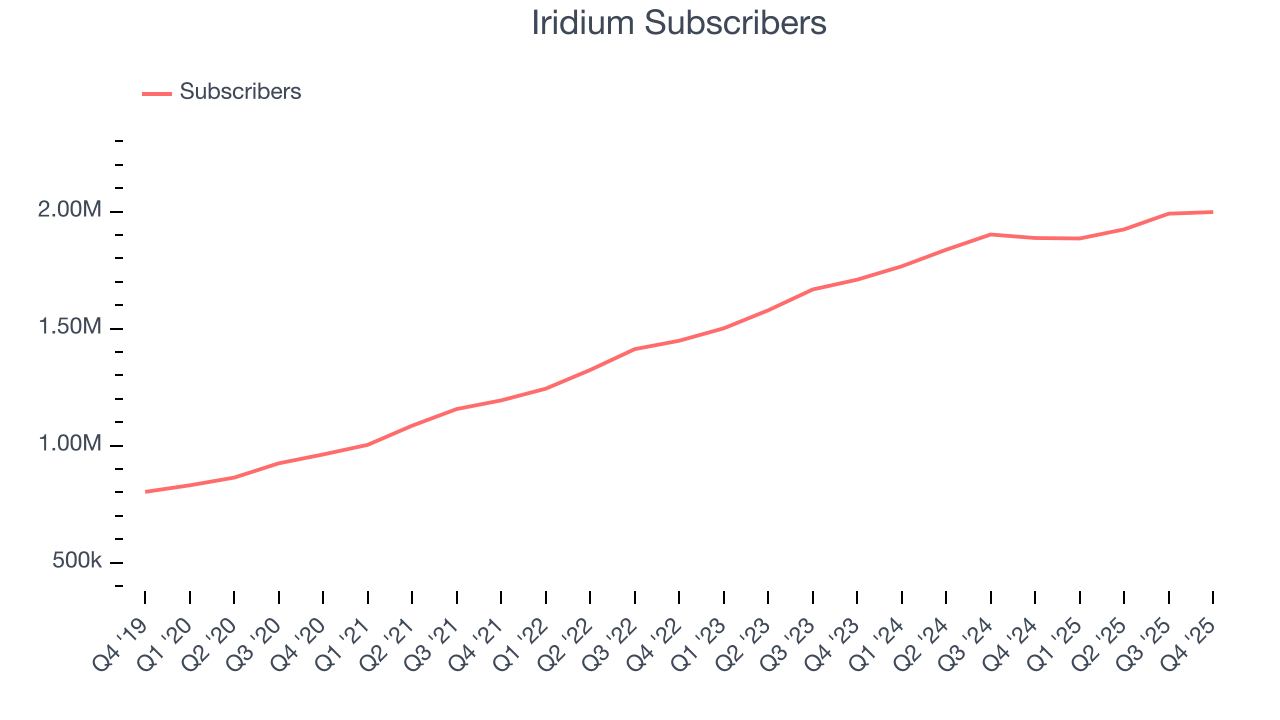

- Subscribers: 2 million, up 111,000 year on year

- Market Capitalization: $2.35 billion

Company Overview

With a constellation of 66 low-earth orbit satellites providing coverage to every inch of the planet, Iridium Communications (NASDAQ:IRDM) operates a global satellite network that provides voice and data services to customers in remote areas where traditional telecommunications are unavailable.

Iridium's network is unique in the satellite industry because of its architecture of interconnected satellites that communicate directly with each other via "crosslinks," eliminating the need for extensive ground infrastructure. This design allows Iridium to provide truly global coverage, including remote land areas, open oceans, airways, and even the polar regions.

The company serves diverse markets through various service offerings. Its commercial voice and data services enable everything from basic phone calls to internet access for ships at sea, aircraft in flight, and teams working in remote locations. Its Internet of Things (IoT) services allow businesses to track assets, monitor equipment, and collect data from sensors deployed worldwide. For example, mining companies use Iridium's services to monitor heavy equipment in remote locations, while shipping companies track vessels and transmit critical operational data.

In 2019, Iridium completed the replacement of its entire satellite constellation, enhancing network capabilities and enabling its Iridium Certus broadband service, which provides data speeds up to 704 Kbps. This upgrade also allowed the company to host the Aireon system, which provides global aircraft tracking services to air navigation service providers.

The U.S. government, particularly the Department of Defense, represents a significant customer segment for Iridium. Under a fixed-price contract called Enhanced Mobile Satellite Services (EMSS), Iridium provides satellite services to unlimited government users. The military values Iridium's network for its security, global coverage, and resilience, using it for tactical communications, logistics, and emergency operations.

In 2024, Iridium acquired Satelles, expanding into position, navigation, and timing (PNT) services that complement GPS systems. This acquisition addresses growing concerns about GPS vulnerabilities by providing an alternative timing and location solution for critical infrastructure.

Iridium sells its services primarily through a distribution network of service providers, value-added resellers (VARs), and value-added manufacturers (VAMs) who integrate Iridium technology into specialized solutions for their customers. The company's business model is largely based on recurring service revenue from its global subscriber base.

4. Satellite Telecommunication Services

Satellite telecommunication is generally buoyed by rising global demand for connectivity in costly-to-connect and remote areas. IoT (Internet of Things) expansion and government-backed space and defense initiatives also help. As advancements in low Earth orbit (LEO) technology happen, companies in the space will have more favorable competitive positions, which could lead to further partnerships with mobile network operators to extend coverage. On the other hand, headwinds include high capital expenditures for satellite deployment as well as regulatory hurdles related to spectrum allocation. Competition from larger players like SpaceX’s Starlink and Amazon’s Kuiper could also intensify over time, especially if tech advancements lead to better unit economics and financial prospects.

Iridium's main competitors in the mobile satellite services market include Viasat, Globalstar, ORBCOMM, and Thuraya. In the broader satellite communications industry, it also competes with geostationary satellite operators and emerging low-earth orbit constellations focused on broadband services.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $871.7 million in revenue over the past 12 months, Iridium is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

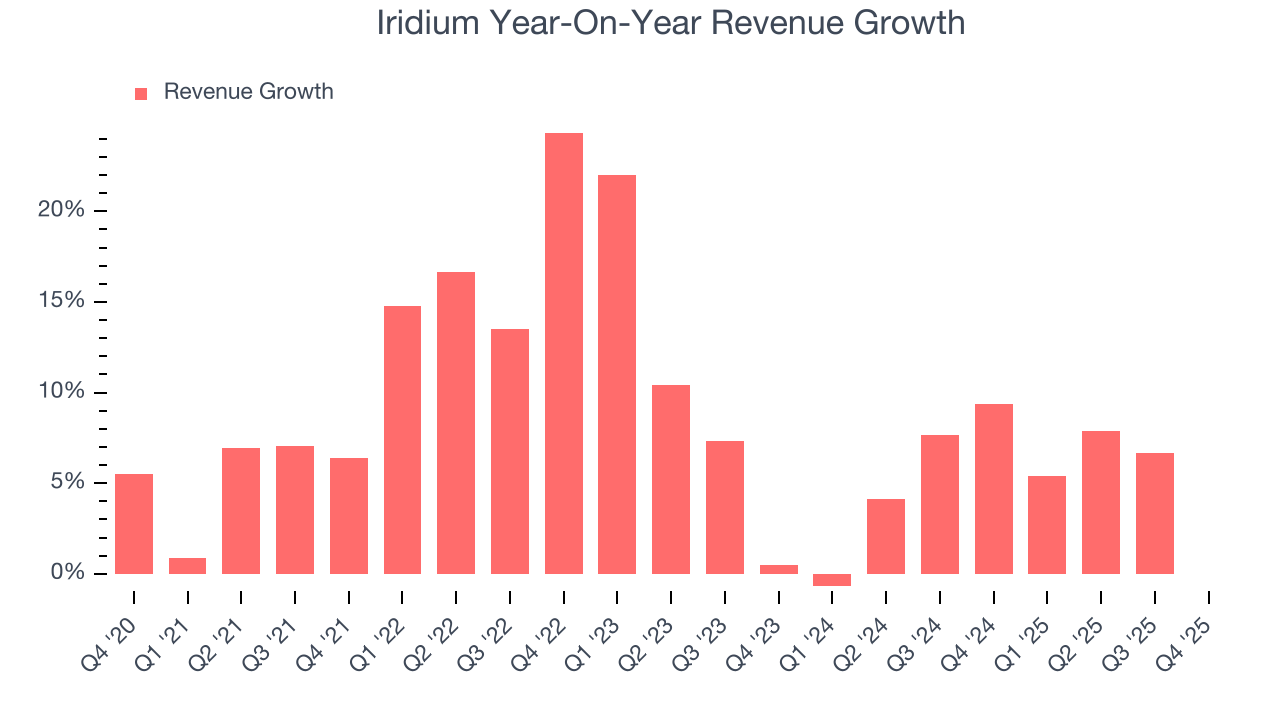

As you can see below, Iridium’s sales grew at a solid 8.4% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Iridium’s recent performance shows its demand has slowed as its annualized revenue growth of 5% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its number of subscribers, which reached 2 million in the latest quarter. Over the last two years, Iridium’s subscribers averaged 10.1% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Iridium missed Wall Street’s estimates and reported a rather uninspiring 0% year-on-year revenue decline, generating $212.9 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Adjusted Operating Margin

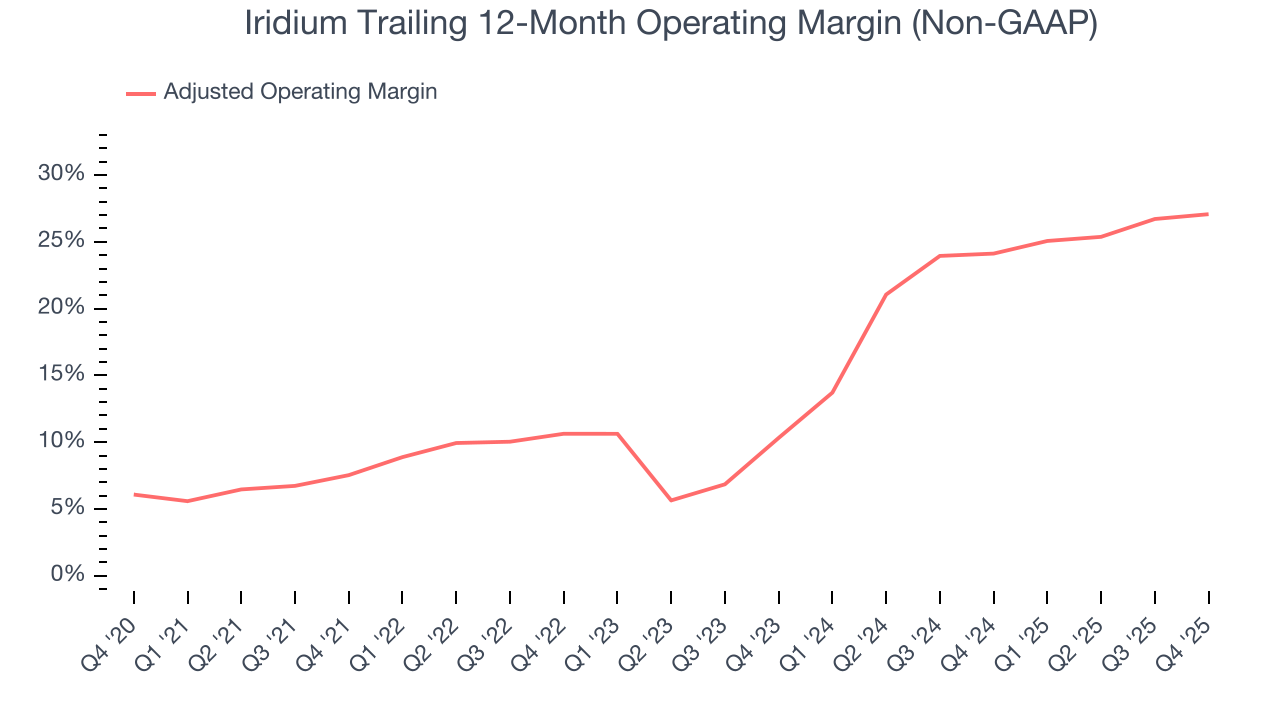

Iridium has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average adjusted operating margin of 16.7%.

Analyzing the trend in its profitability, Iridium’s adjusted operating margin rose by 19.5 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q4, Iridium generated an adjusted operating margin profit margin of 25.9%, up 1.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

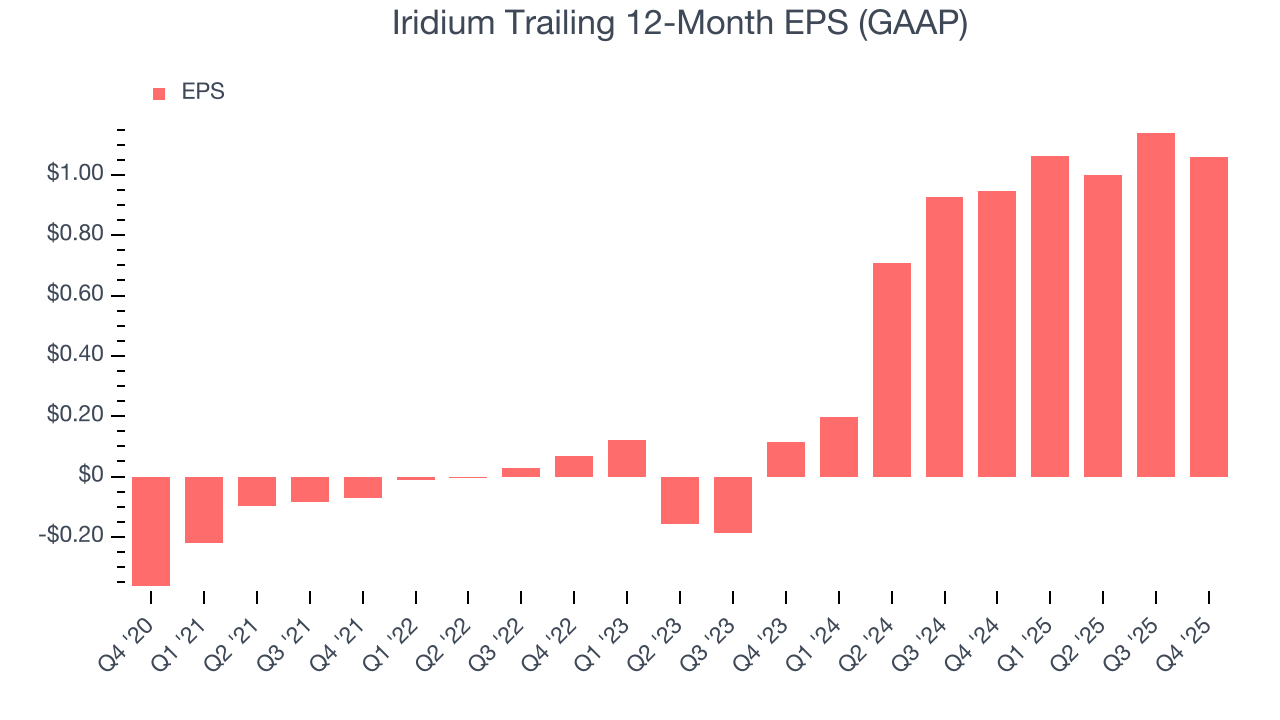

Iridium’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Iridium’s EPS grew at an astounding 204% compounded annual growth rate over the last two years, higher than its 5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

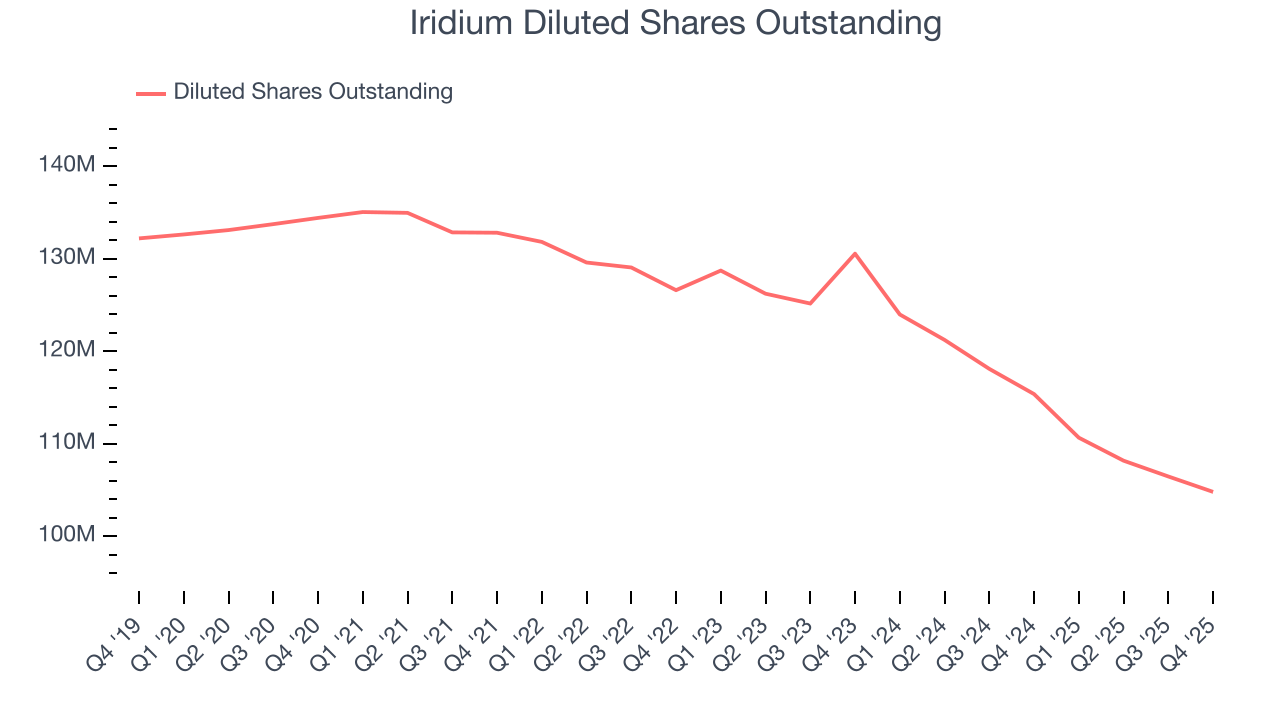

We can take a deeper look into Iridium’s earnings to better understand the drivers of its performance. Iridium’s adjusted operating margin has expanded over the last two yearswhile its share count has shrunk 19.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Iridium reported EPS of $0.23, down from $0.31 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Iridium’s full-year EPS of $1.06 to grow 15%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

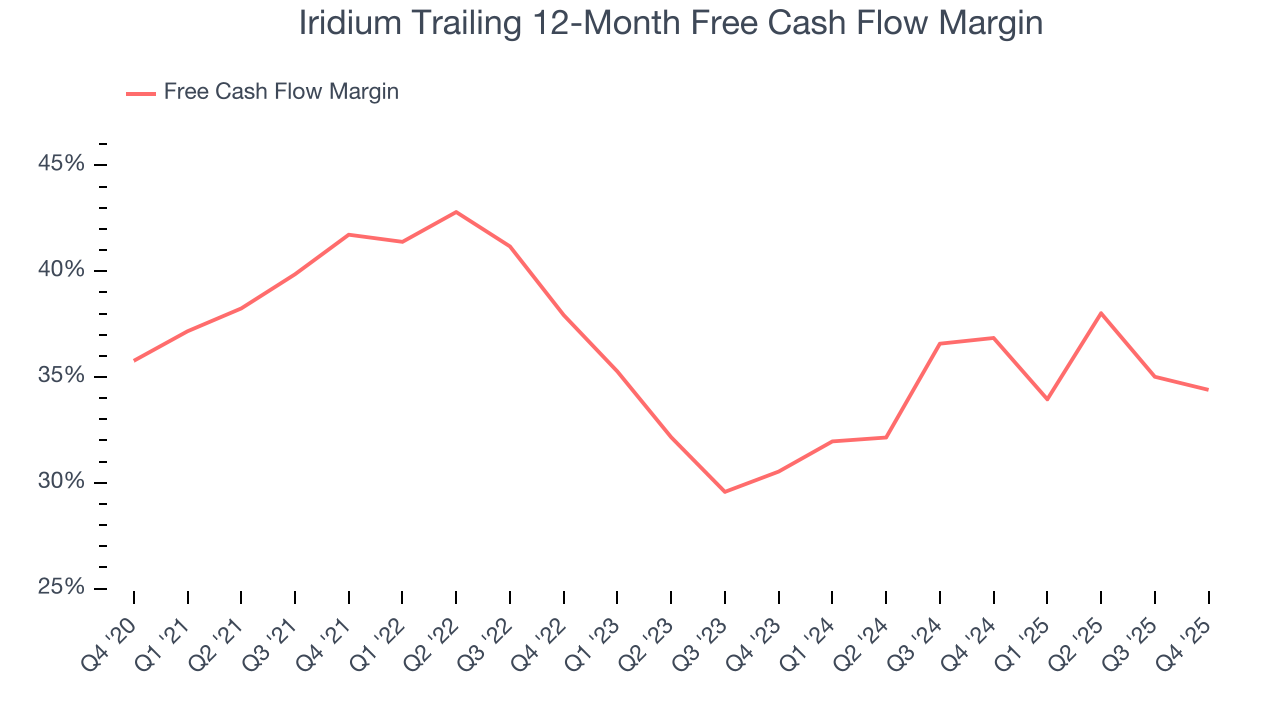

Iridium has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging an eye-popping 36% over the last five years.

Taking a step back, we can see that Iridium’s margin dropped by 7.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

Iridium’s free cash flow clocked in at $75.11 million in Q4, equivalent to a 35.3% margin. The company’s cash profitability regressed as it was 2.5 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Iridium historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Iridium’s ROIC has increased. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

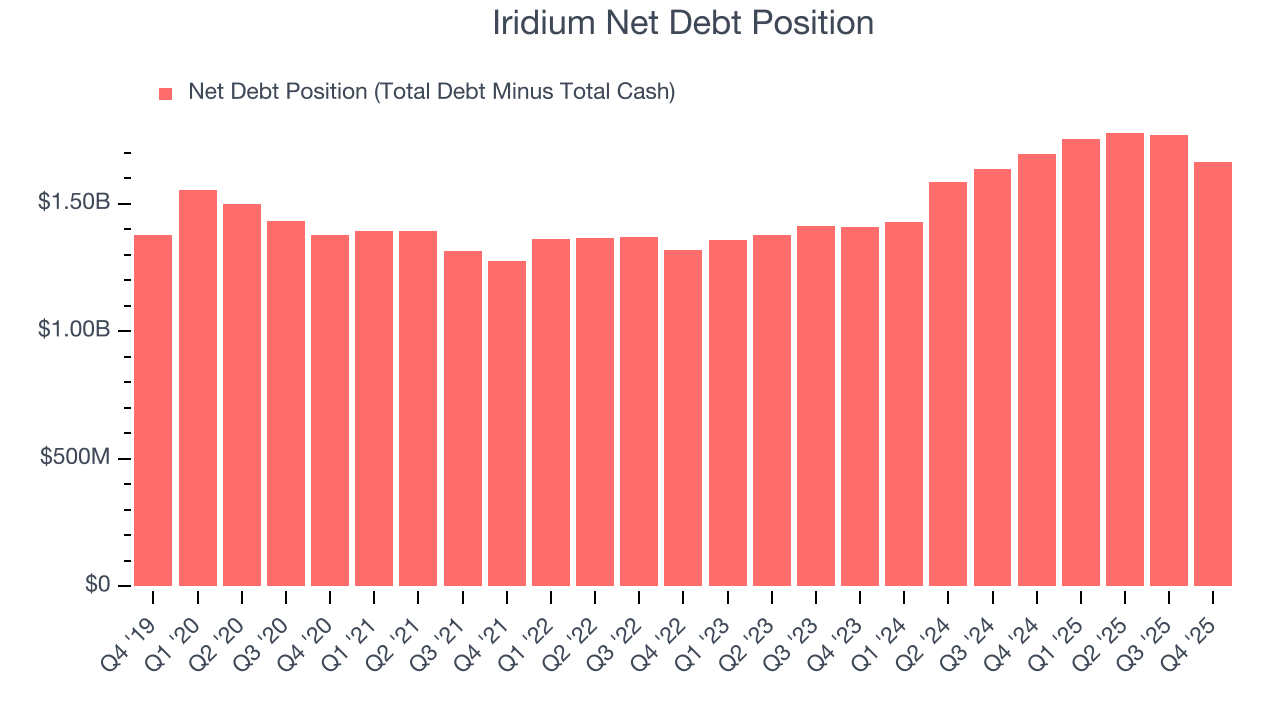

10. Balance Sheet Assessment

Iridium reported $96.5 million of cash and $1.76 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $495.3 million of EBITDA over the last 12 months, we view Iridium’s 3.4× net-debt-to-EBITDA ratio as safe. We also see its $88.25 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Iridium’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EPS was in line with Wall Street’s estimates. Overall, this was a weaker quarter. The stock remained flat at $22.19 immediately following the results.

12. Is Now The Time To Buy Iridium?

Updated: February 12, 2026 at 11:34 PM EST

Before deciding whether to buy Iridium or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Iridium doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was solid over the last five years. And while its cash profitability fell over the last five years, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. On top of that, its expanding adjusted operating margin shows the business has become more efficient.

Iridium’s P/E ratio based on the next 12 months is 15.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $28.13 on the company (compared to the current share price of $22.19).