J&J Snack Foods (JJSF)

We’re cautious of J&J Snack Foods. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think J&J Snack Foods Will Underperform

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

- Revenue base of $1.58 billion puts it at a disadvantage compared to larger competitors exhibiting economies of scale

- Estimated sales growth of 1.9% for the next 12 months implies demand will slow from its three-year trend

- A positive is that its earnings growth has topped the peer group average over the last three years as its EPS has compounded at 15.9% annually

J&J Snack Foods doesn’t meet our quality criteria. There are more promising prospects in the market.

Why There Are Better Opportunities Than J&J Snack Foods

High Quality

Investable

Underperform

Why There Are Better Opportunities Than J&J Snack Foods

J&J Snack Foods is trading at $95.22 per share, or 21.1x forward P/E. This multiple is higher than most consumer staples companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. J&J Snack Foods (JJSF) Research Report: Q4 CY2025 Update

Snack food company J&J Snack Foods (NASDAQ:JJSF) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 5.2% year on year to $343.8 million. Its non-GAAP profit of $0.33 per share was 8.3% below analysts’ consensus estimates.

J&J Snack Foods (JJSF) Q4 CY2025 Highlights:

- Revenue: $343.8 million vs analyst estimates of $360.7 million (5.2% year-on-year decline, 4.7% miss)

- Adjusted EPS: $0.33 vs analyst expectations of $0.36 (8.3% miss)

- Adjusted EBITDA: $27.03 million vs analyst estimates of $28.17 million (7.9% margin, 4% miss)

- Operating Margin: 0.2%, down from 1.7% in the same quarter last year

- Free Cash Flow Margin: 4.9%, similar to the same quarter last year

- Market Capitalization: $1.81 billion

Company Overview

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ:JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

The company was founded in 1971 by Gerald B. Shreiber after he bought J&J Soft Pretzel company at an auction. From this humble beginning of selling pretzels to schools and local businesses, J&J Snack Foods expanded its product portfolio organically. It also acquired other businesses, with its 1987 purchase of ICEE as a major milestone.

Today, J&J Snack Foods boasts an eclectic mix of products including pretzels, ice cream products, and churros. As such, the company’s core customer is someone in search of a treat at home or in venues such as movie theaters or baseball stadiums.

For the retail customer, the company’s products can be found in supermarkets, convenience stores, and entertainment venues. Beyond this, J&J Snack Foods sells its offerings to food service businesses. This is how their soft pretzels, Dippin’ Dots, and churros find their way into concession stands of ballparks and theme parks.

4. Shelf-Stable Food

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

Competitors in the snack food space include PepsiCo (NASDAQ:PEP), Nestle (SWX:NESN), and Utz Brands (NYSE:UTZ).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.56 billion in revenue over the past 12 months, J&J Snack Foods is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

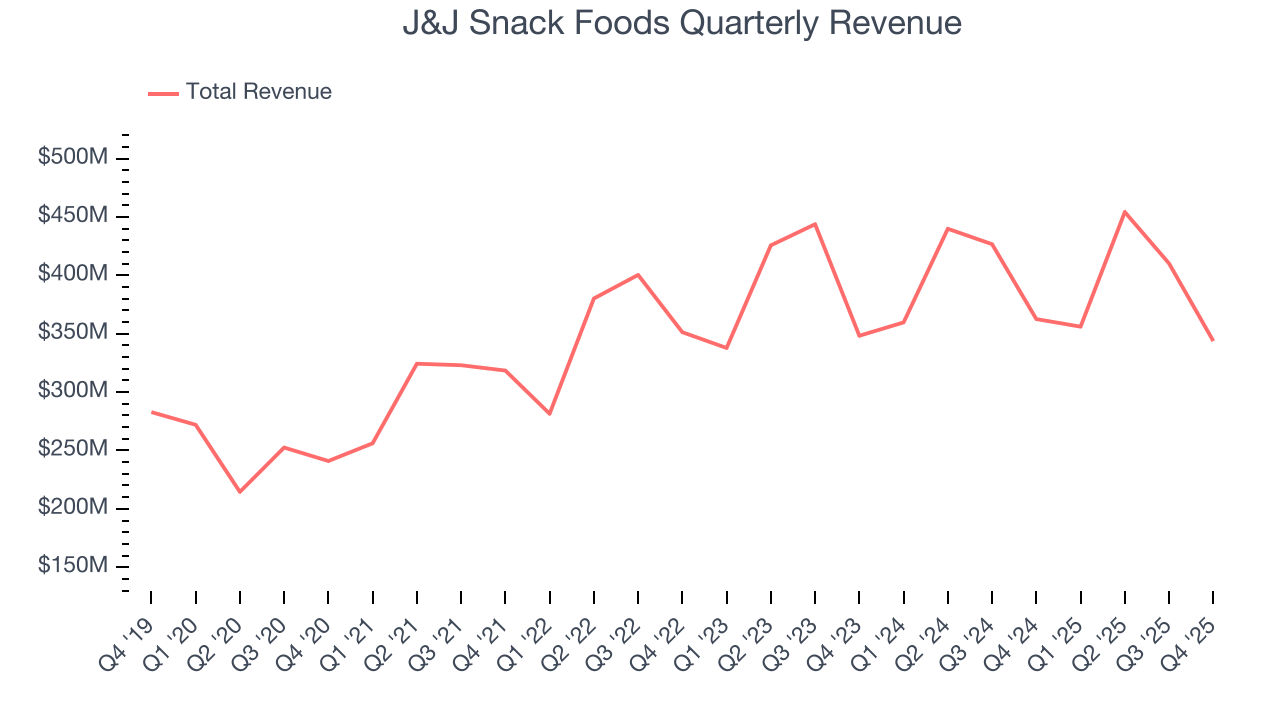

As you can see below, J&J Snack Foods’s sales grew at a sluggish 3.4% compounded annual growth rate over the last three years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, J&J Snack Foods missed Wall Street’s estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $343.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products will not catalyze better top-line performance yet.

6. Gross Margin & Pricing Power

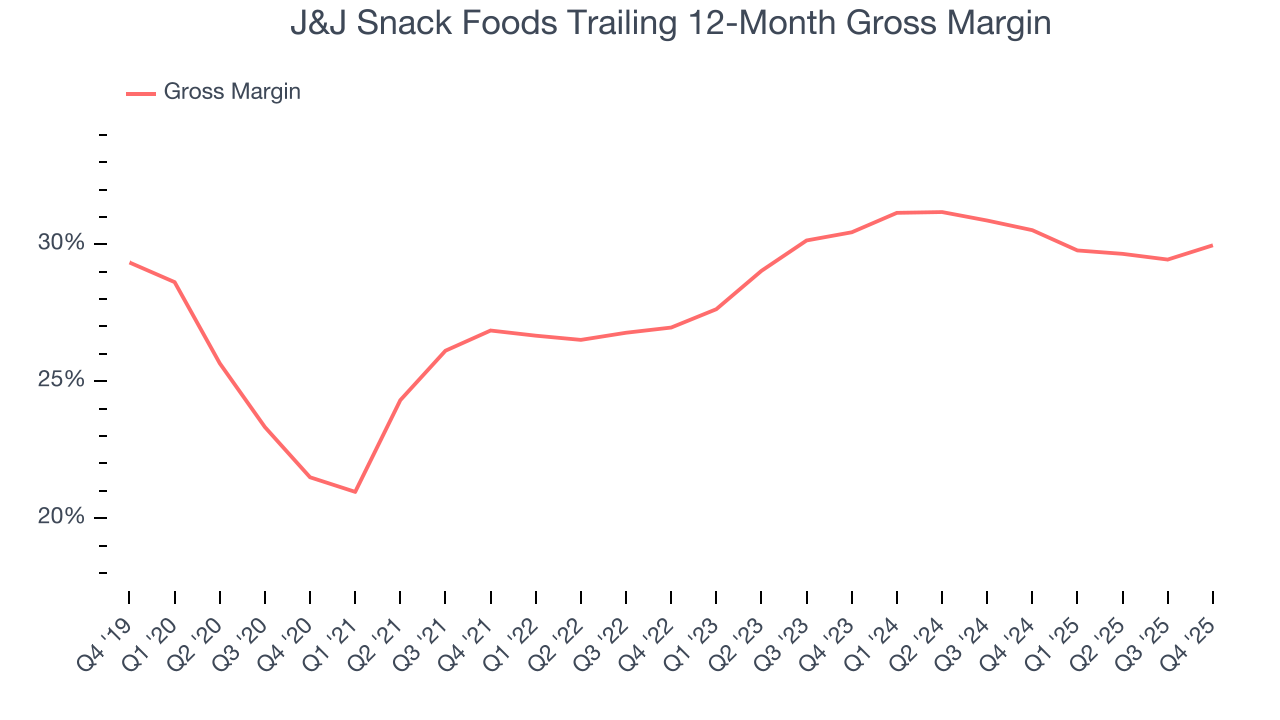

J&J Snack Foods’s unit economics are higher than the typical consumer staples company, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 30.2% gross margin over the last two years. Said differently, J&J Snack Foods paid its suppliers $69.76 for every $100 in revenue.

J&J Snack Foods’s gross profit margin came in at 27.9% this quarter, up 2.2 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

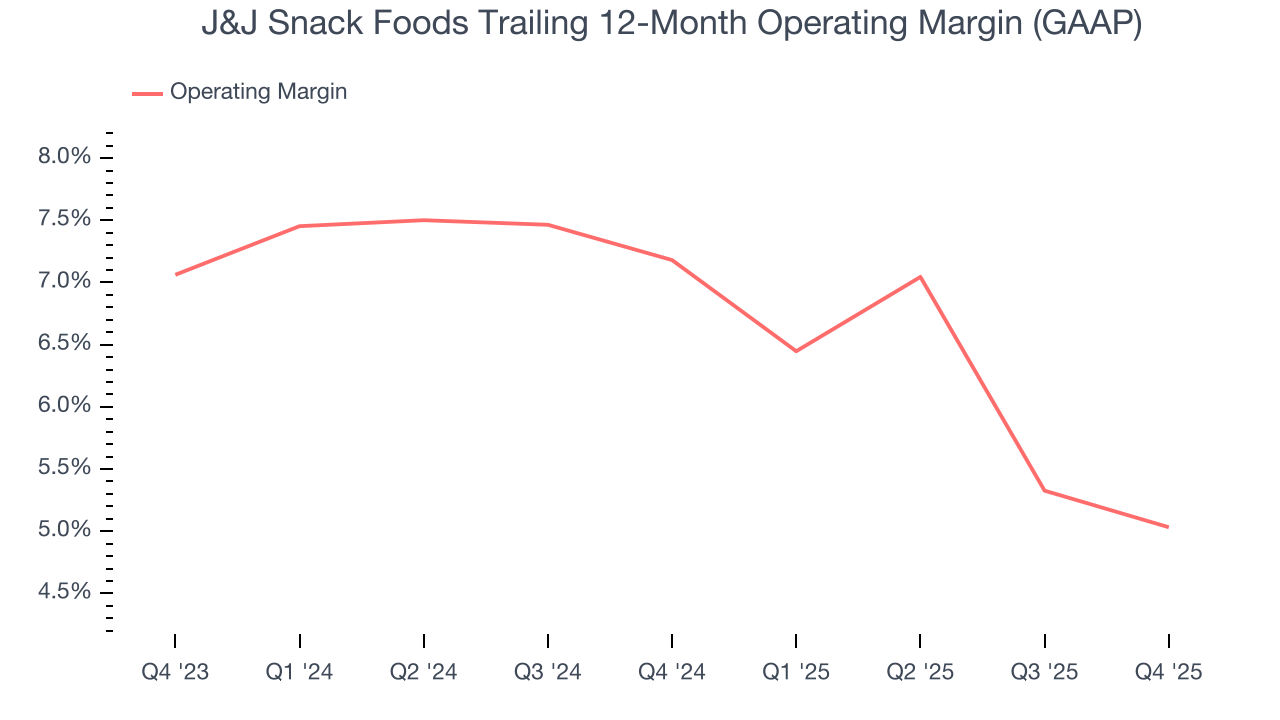

J&J Snack Foods was profitable over the last two years but held back by its large cost base. Its average operating margin of 6.1% was weak for a consumer staples business.

Analyzing the trend in its profitability, J&J Snack Foods’s operating margin decreased by 2.1 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. J&J Snack Foods’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, J&J Snack Foods’s breakeven margin was down 1.5 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, and administrative overhead.

8. Earnings Per Share

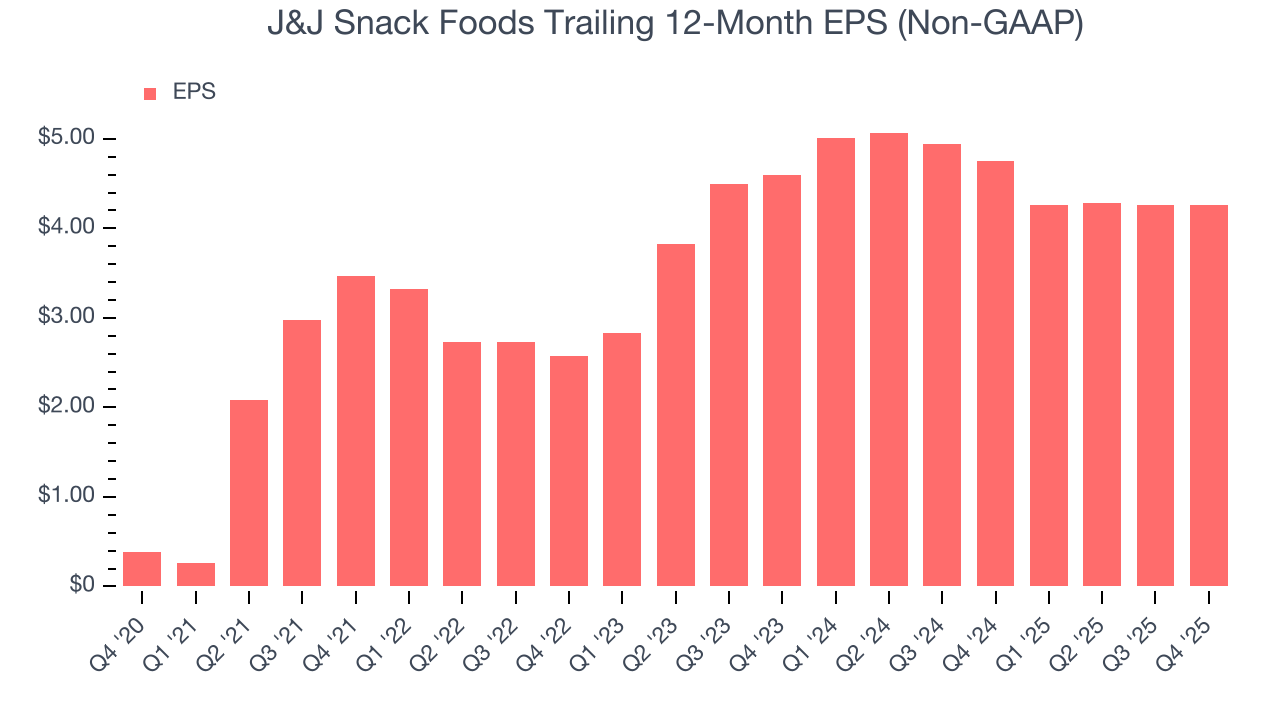

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

J&J Snack Foods’s EPS grew at a remarkable 18.3% compounded annual growth rate over the last three years, higher than its 3.4% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, J&J Snack Foods reported adjusted EPS of $0.33, in line with the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

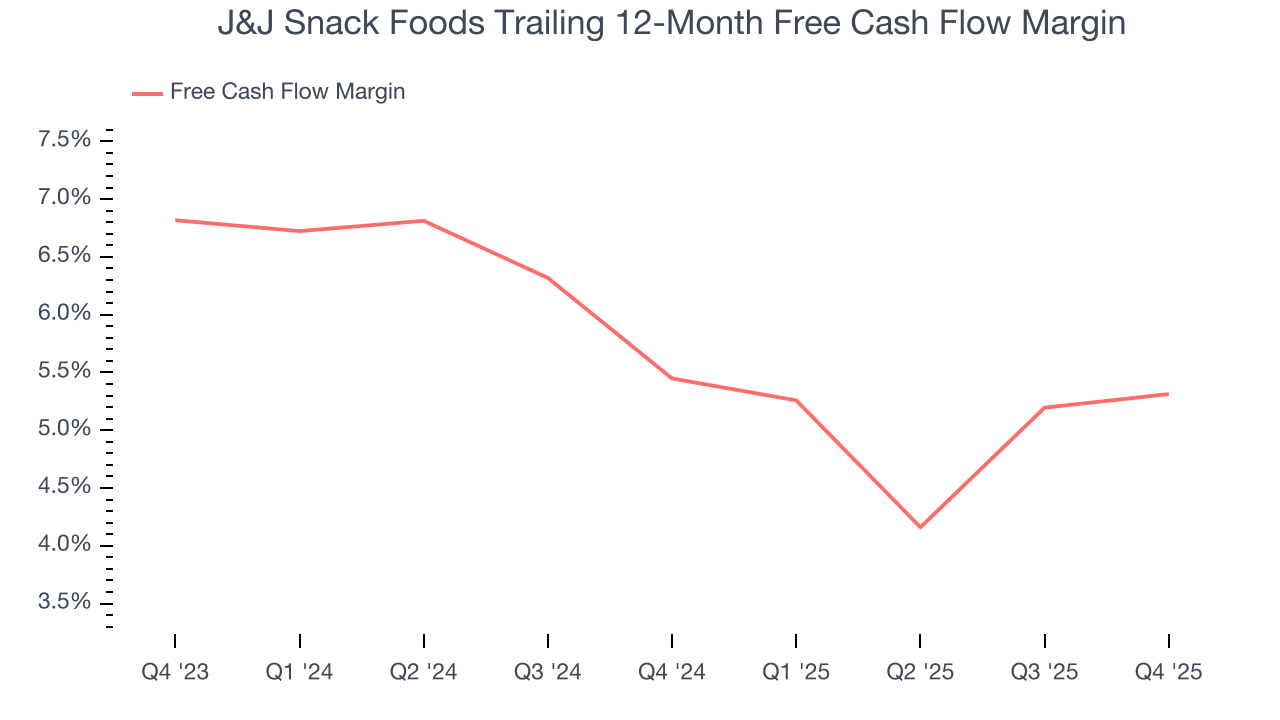

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

J&J Snack Foods has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.4% over the last two years, slightly better than the broader consumer staples sector.

J&J Snack Foods’s free cash flow clocked in at $16.96 million in Q4, equivalent to a 4.9% margin. This cash profitability was in line with the comparable period last year and its two-year average.

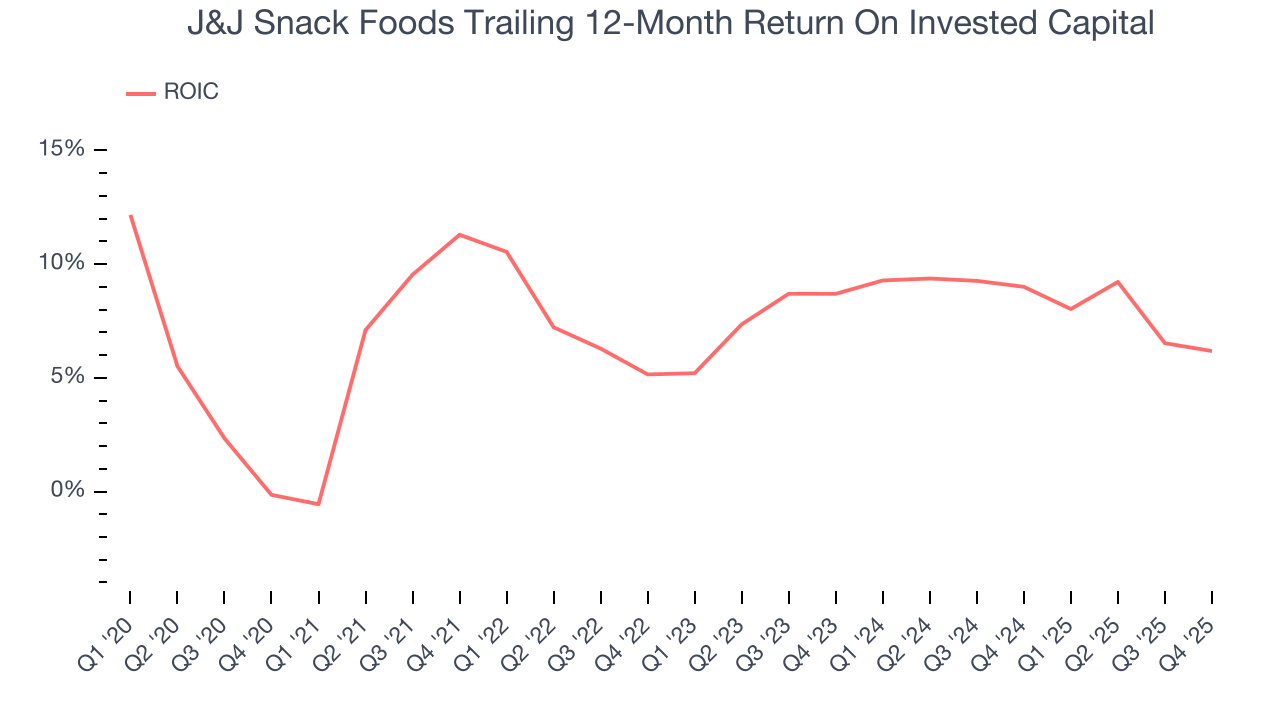

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

J&J Snack Foods historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.1%, somewhat low compared to the best consumer staples companies that consistently pump out 20%+.

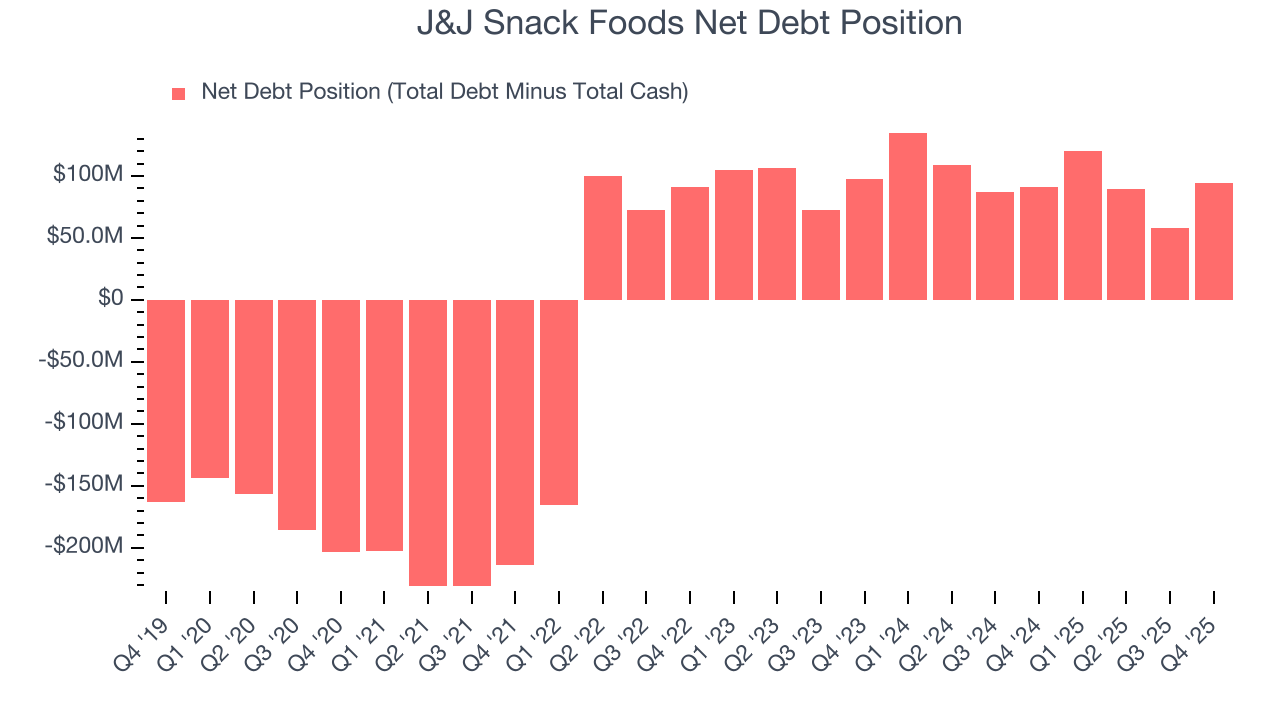

11. Balance Sheet Assessment

J&J Snack Foods reported $66.76 million of cash and $161.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $182.6 million of EBITDA over the last 12 months, we view J&J Snack Foods’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $705,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from J&J Snack Foods’s Q4 Results

We enjoyed seeing J&J Snack Foods beat analysts’ gross margin expectations this quarter. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $95.22 immediately following the results.

13. Is Now The Time To Buy J&J Snack Foods?

Updated: February 3, 2026 at 7:09 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in J&J Snack Foods.

J&J Snack Foods isn’t a terrible business, but it doesn’t pass our bar. To begin with, its revenue growth was uninspiring over the last three years, and analysts don’t see anything changing over the next 12 months. And while its EPS growth over the last three years has significantly beat its peer group average, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

J&J Snack Foods’s forward price-to-sales ratio is 1.1x. The market typically values companies like J&J Snack Foods based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $112.50 on the company (compared to the current share price of $95.22).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.