Kura Sushi (KRUS)

We’re cautious of Kura Sushi. Its negative returns on capital show it destroyed value by losing money on unprofitable business ventures.― StockStory Analyst Team

1. News

2. Summary

Why We Think Kura Sushi Will Underperform

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

- Historical operating margin losses point to an inefficient cost structure

- Cash-burning tendencies make us wonder if it can sustainably generate shareholder value

- Unfavorable liquidity position could lead to additional equity financing that dilutes shareholders

Kura Sushi’s quality is inadequate. There are more promising prospects in the market.

Why There Are Better Opportunities Than Kura Sushi

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Kura Sushi

Kura Sushi is trading at $69.81 per share, or 42.4x forward EV-to-EBITDA. We consider this valuation aggressive considering the business fundamentals.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Kura Sushi (KRUS) Research Report: Q4 CY2025 Update

Sushi restaurant chain Kura Sushi (NASDAQ:KRUS) met Wall Streets revenue expectations in Q4 CY2025, with sales up 14% year on year to $73.46 million. The company’s full-year revenue guidance of $332 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP loss of $0.23 per share was 45.6% below analysts’ consensus estimates.

Kura Sushi (KRUS) Q4 CY2025 Highlights:

- Revenue: $73.46 million vs analyst estimates of $73.65 million (14% year-on-year growth, in line)

- Adjusted EPS: -$0.23 vs analyst expectations of -$0.16 (45.6% miss)

- Adjusted EBITDA: $2.44 million vs analyst estimates of $3.41 million (3.3% margin, relatively in line)

- The company reconfirmed its revenue guidance for the full year of $332 million at the midpoint

- Operating Margin: -5%, down from -2.3% in the same quarter last year

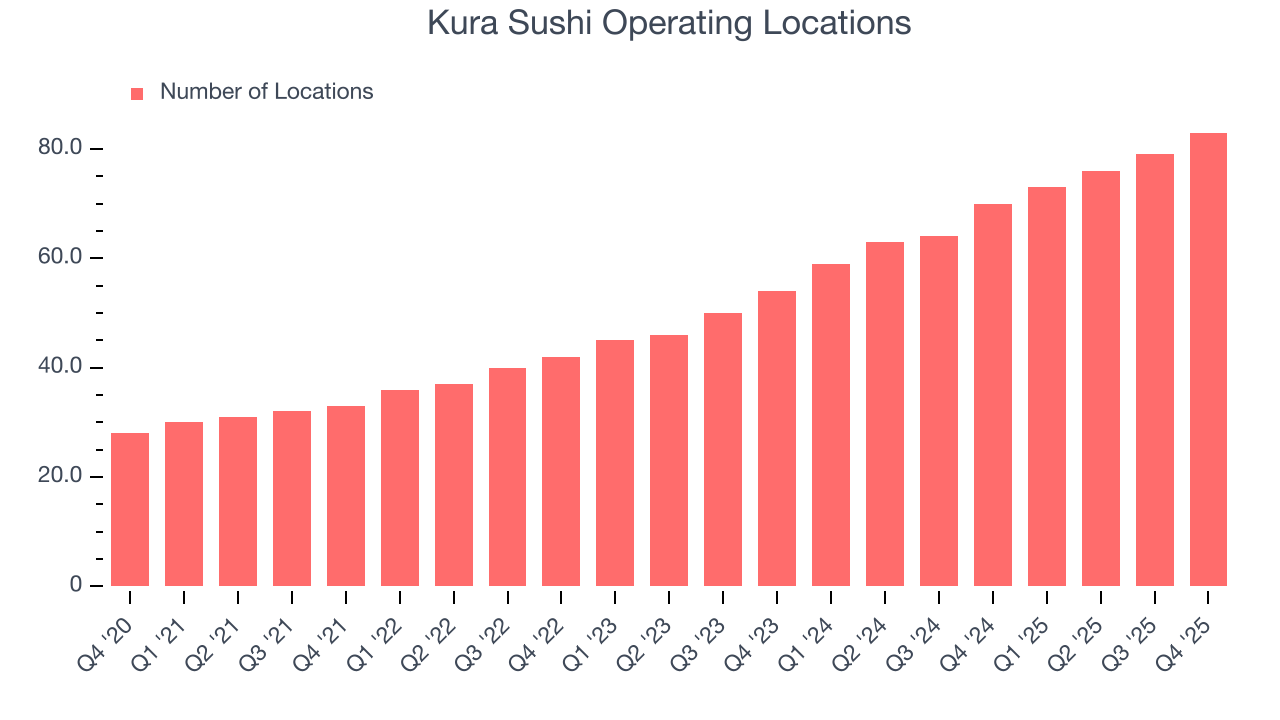

- Locations: 83 at quarter end, up from 70 in the same quarter last year

- Same-Store Sales fell 2.5% year on year (1.8% in the same quarter last year)

- Market Capitalization: $712.5 million

Company Overview

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ:KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

It was originally established in 1977 as a modest 40-seat sushi restaurant in Osaka, Japan. Founder Kunihiko Tanaka aimed to provide quality sushi at an affordable price while ensuring a unique dining experience for customers. The uniqueness came by way of the conveyor belt, which not only entertained customers but also allowed them to efficiently pick dishes.

Today, Kura Sushi continues to focus on providing high-quality sushi at affordable prices. There are recognizable items such as the salmon skin roll and the spicy tuna roll as well as soups and noodles. Innovation also remains a focus, and Kura Sushi boasts touch screen ordering and digital payment capabilities.

The core Kura Sushi customer is a mix of sushi aficionados looking for an affordable yet authentic experience, tech-savvy diners who appreciate the digital integration, and families who find the conveyor belt model fun and engaging. Kura Sushi locations tend to be a mix of futuristic and cozy. Seating is primarily arranged around the famous conveyor belt, allowing every customer direct access to the moving dishes. In addition, there are booths and tables where families or larger groups can sit together more comfortably. The aesthetic is modern and bright, with hints of traditional Japanese design elements.

4. Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

There are no other publicly-traded sushi restaurant chains, but competitors offering entertaining or lively dining experiences include El Pollo Loco (NASDAQ:LOCO), Brinker International (NYSE:EAT), Dine Brands (NYSE:DIN), and The Cheesecake Factory (NASDAQ:CAKE). Sushi Land is a private sushi chain that competes with Kura Sushi.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $291.8 million in revenue over the past 12 months, Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

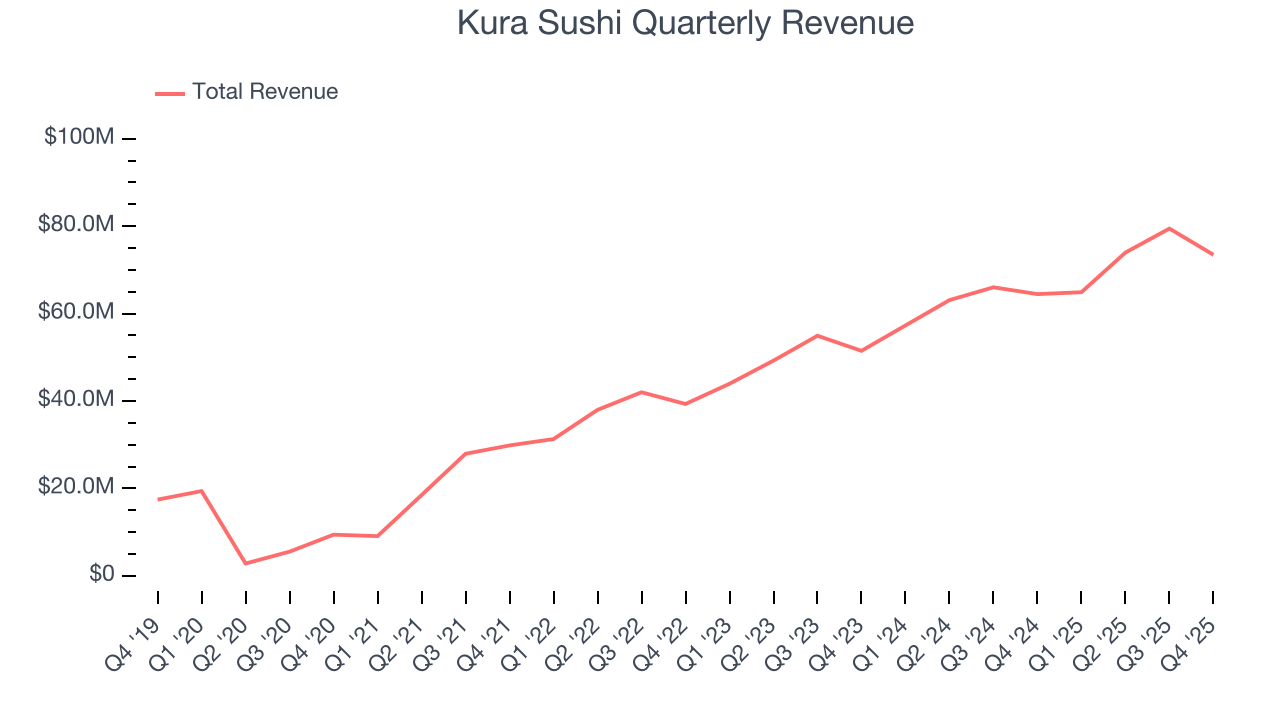

As you can see below, Kura Sushi’s 27.4% annualized revenue growth over the last six years was incredible as it opened new restaurants and expanded its reach.

This quarter, Kura Sushi’s year-on-year revenue growth was 14%, and its $73.46 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18% over the next 12 months, a deceleration versus the last six years. Still, this projection is noteworthy and suggests the market is forecasting success for its menu offerings.

6. Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Kura Sushi operated 83 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 26.5% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

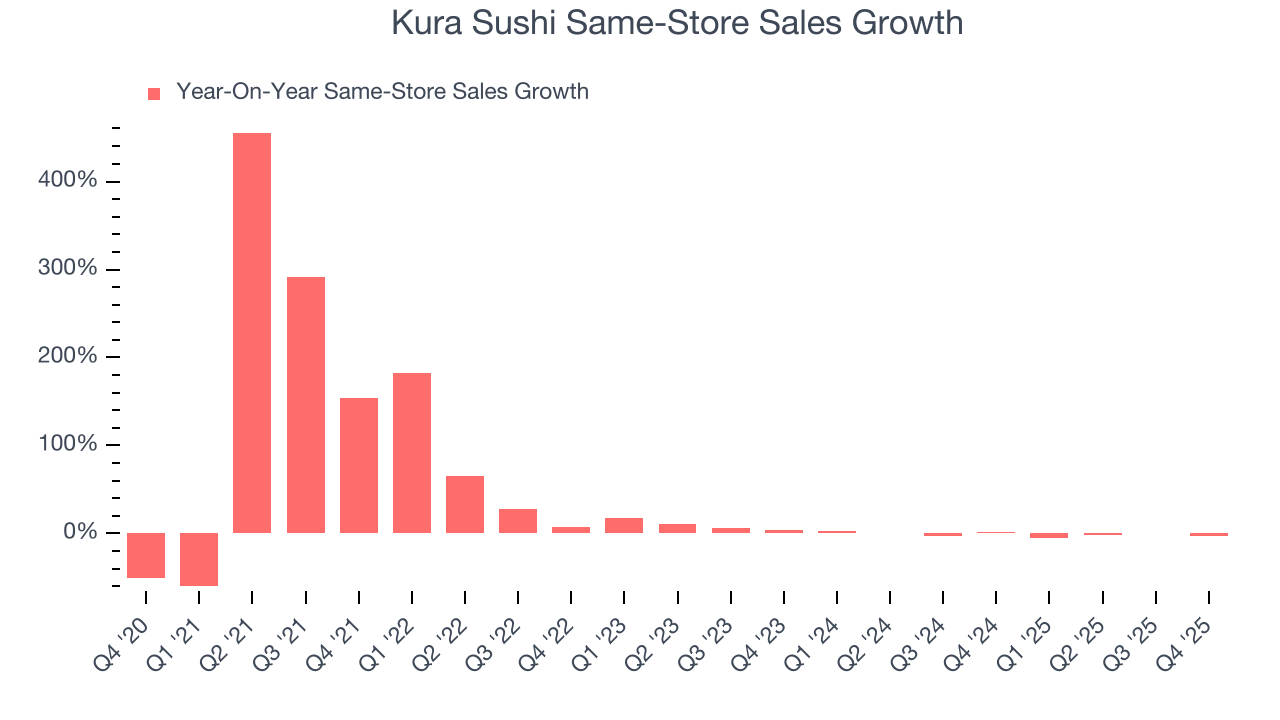

Kura Sushi’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Kura Sushi should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Kura Sushi’s same-store sales fell by 2.5% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate pricing power and differentiation, whether it be the dining experience or quality and taste of food.

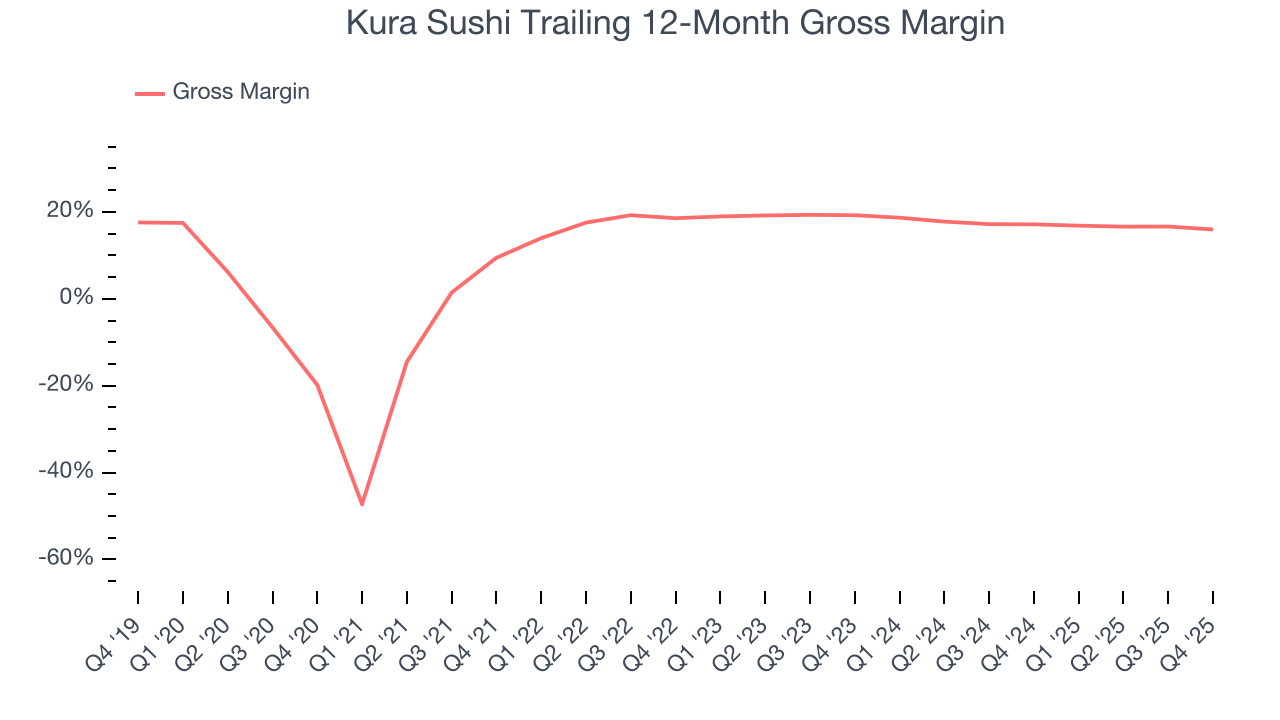

Kura Sushi has bad unit economics for a restaurant company, signaling it operates in a competitive market and has little room for error if demand unexpectedly falls. As you can see below, it averaged a 16.5% gross margin over the last two years. Said differently, Kura Sushi had to pay a chunky $83.50 to its suppliers for every $100 in revenue.

This quarter, Kura Sushi’s gross profit margin was 13.6%, down 2.6 percentage points year on year. Kura Sushi’s full-year margin has also been trending down over the past 12 months, decreasing by 1.2 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as ingredients and transportation expenses).

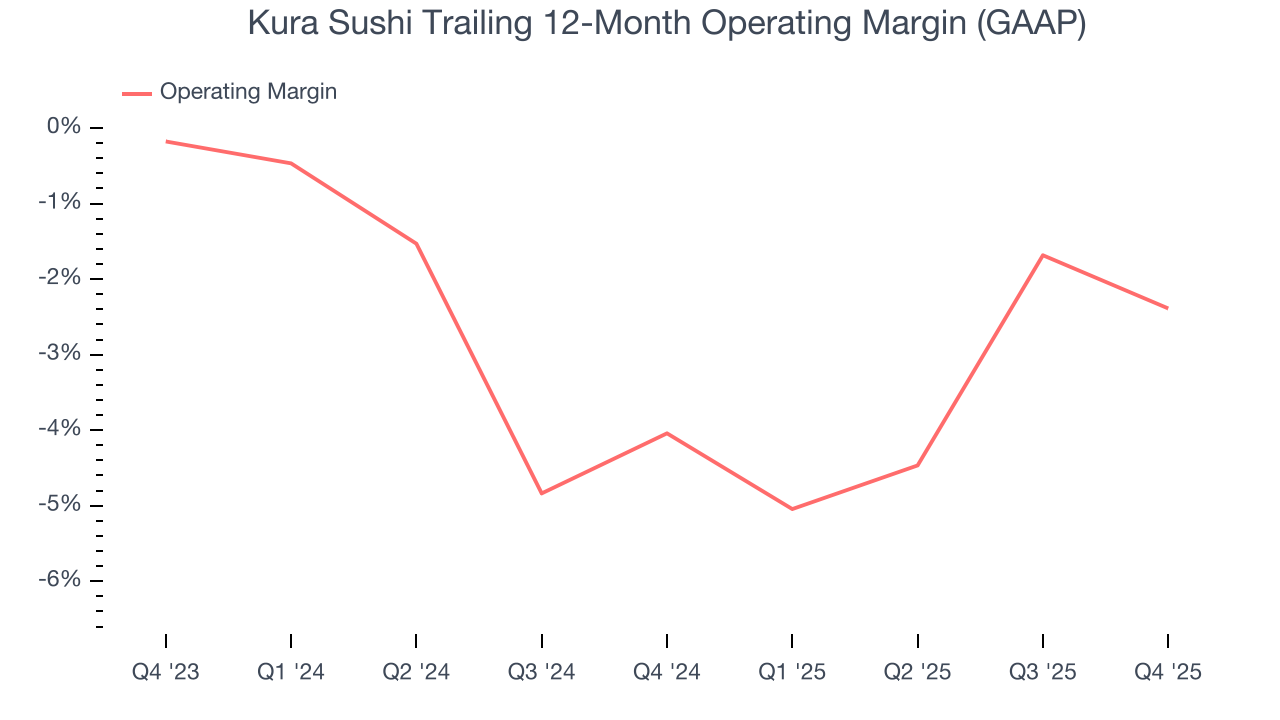

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

The restaurant business is tough to succeed in because of its unpredictability, whether it be employees not showing up for work, sudden changes in consumer preferences, or the cost of ingredients skyrocketing thanks to supply shortages.Kura Sushi has been a victim of these challenges over the last two years, and its high expenses have contributed to an average operating margin of negative 3.2%.

On the plus side, Kura Sushi’s operating margin rose by 1.7 percentage points over the last year, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q4, Kura Sushi generated a negative 5% operating margin.

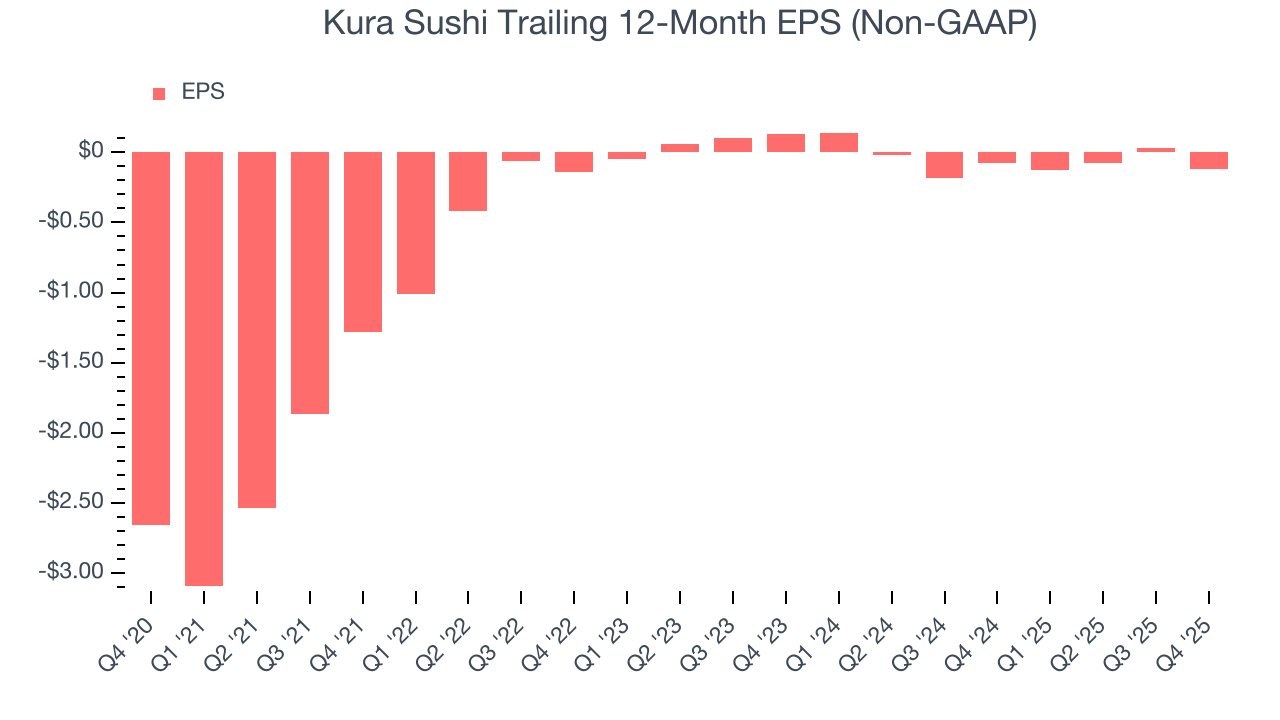

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Kura Sushi’s full-year earnings are still negative, it reduced its losses and improved its EPS by 46.2% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Kura Sushi reported adjusted EPS of negative $0.23, down from negative $0.08 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

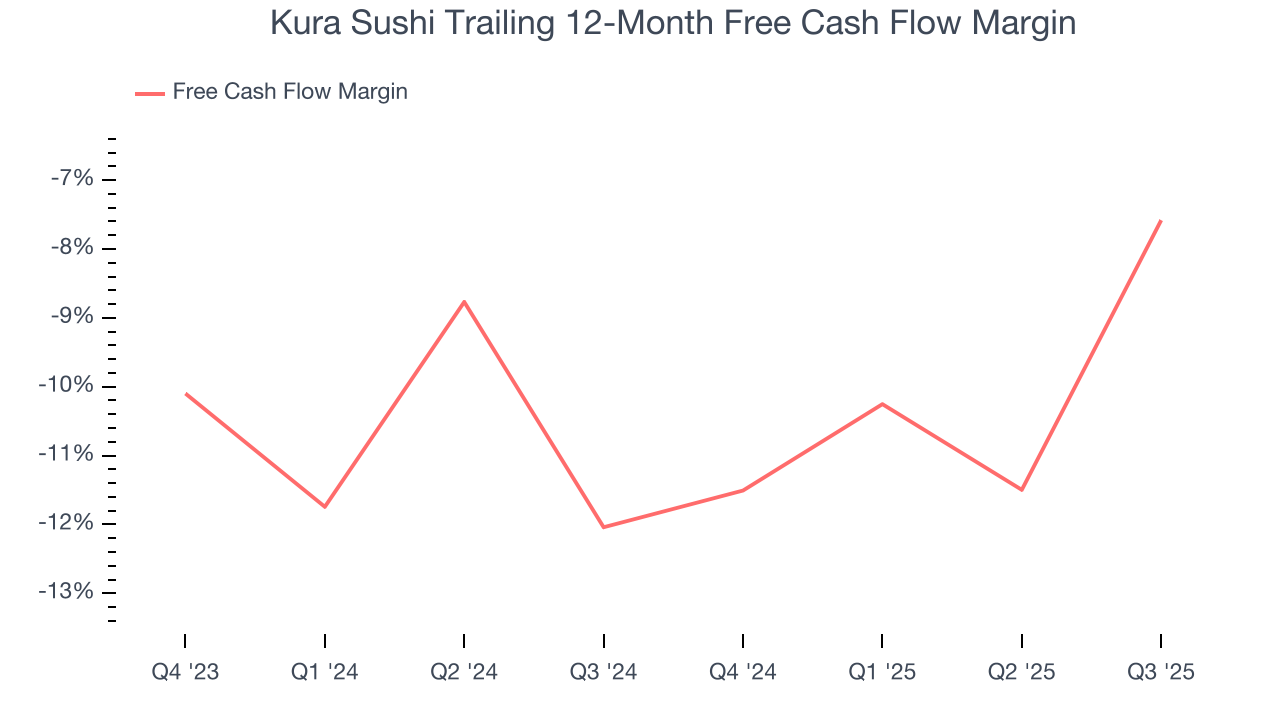

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Kura Sushi’s capital-intensive business model and large investments in new physical locations have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.2%, meaning it lit $9.19 of cash on fire for every $100 in revenue.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Kura Sushi’s five-year average ROIC was negative 5.9%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

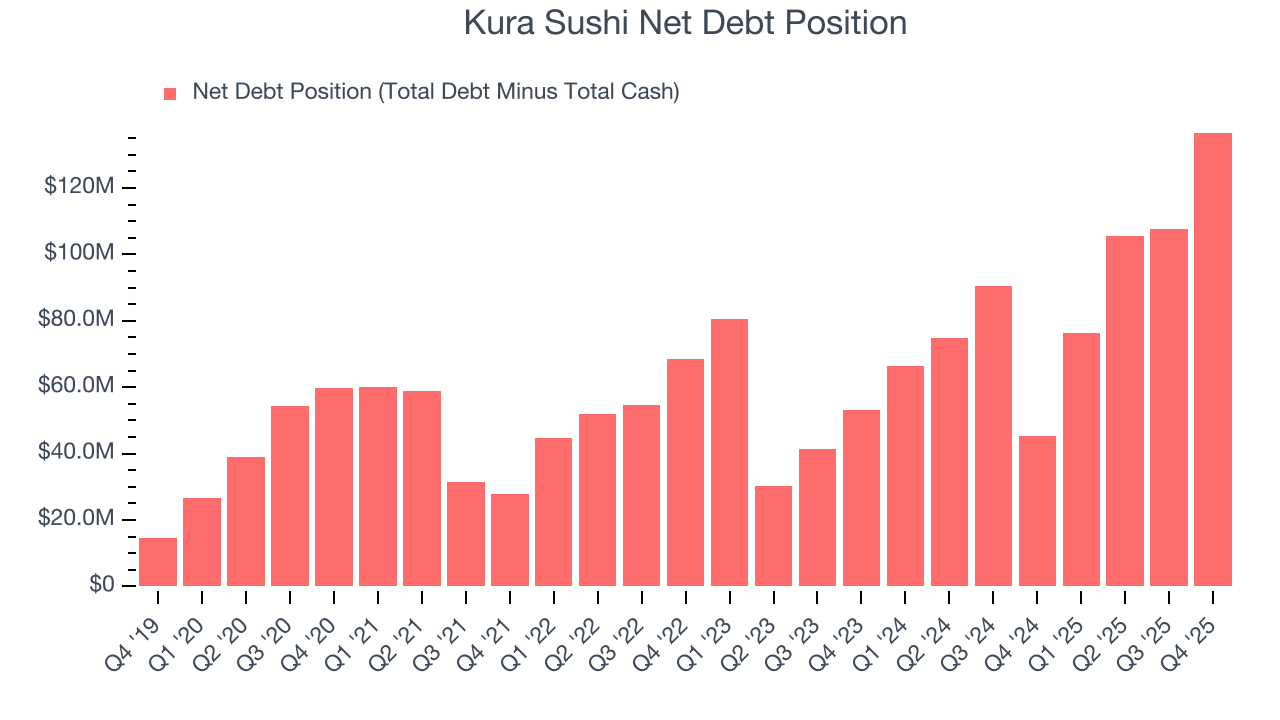

12. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Kura Sushi burned through $27.54 million of cash over the last year, and its $187.4 million of debt exceeds the $50.7 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Kura Sushi’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Kura Sushi until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

13. Key Takeaways from Kura Sushi’s Q4 Results

We were impressed by how significantly Kura Sushi blew past analysts’ same-store sales expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2% to $54.59 immediately following the results.

14. Is Now The Time To Buy Kura Sushi?

Updated: January 23, 2026 at 9:38 PM EST

Before deciding whether to buy Kura Sushi or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Kura Sushi’s business quality ultimately falls short of our standards. Although its revenue growth was exceptional over the last six years, it’s expected to deteriorate over the next 12 months and its brand caters to a niche market. And while the company’s new restaurant openings have increased its brand equity, the downside is its projected EPS for the next year is lacking.

Kura Sushi’s EV-to-EBITDA ratio based on the next 12 months is 42.4x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $73.44 on the company (compared to the current share price of $69.81).