El Pollo Loco (LOCO)

El Pollo Loco is in for a bumpy ride. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think El Pollo Loco Will Underperform

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

- 1.4% annual revenue growth over the last six years was slower than its restaurant peers

- Modest revenue base of $480.8 million gives it less fixed cost leverage and fewer distribution channels than larger companies

- Estimated sales growth of 3.7% for the next 12 months is soft and implies weaker demand

El Pollo Loco doesn’t meet our quality standards. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than El Pollo Loco

High Quality

Investable

Underperform

Why There Are Better Opportunities Than El Pollo Loco

El Pollo Loco’s stock price of $10.94 implies a valuation ratio of 11.9x forward P/E. This multiple is lower than most restaurant companies, but for good reason.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. El Pollo Loco (LOCO) Research Report: Q3 CY2025 Update

Fast food chain El Pollo Loco (NASDAQ:LOCO) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $121.5 million. Its non-GAAP profit of $0.27 per share was 26.2% above analysts’ consensus estimates.

El Pollo Loco (LOCO) Q3 CY2025 Highlights:

- Revenue: $121.5 million vs analyst estimates of $124 million (flat year on year, 2% miss)

- Adjusted EPS: $0.27 vs analyst estimates of $0.21 (26.2% beat)

- Adjusted EBITDA: $17.42 million vs analyst estimates of $15.56 million (14.3% margin, 12% beat)

- Operating Margin: 9.4%, up from 8.4% in the same quarter last year

- Locations: 498 at quarter end, up from 496 in the same quarter last year

- Same-Store Sales were flat year on year (2.7% in the same quarter last year)

- Market Capitalization: $285.3 million

Company Overview

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

The company was founded in 1980 in Los Angeles, California. While it started with that signature chicken dish, the chain has expanded its offering to include a variety of Mexican-inspired dishes like tacos, burritos, and quesadillas. In response to changing consumer tastes, El Pollo Loco now offers a ‘fit’ menu featuring items such as Keto burritos and salads.

The core El Pollo Loco customer is diverse but principally a middle-income individual or family seeking a tasty and unique menu that is also affordable. More specifically, the core customer is likely someone who appreciates the depths of Mexican food beyond just the simple taco.

El Pollo Loco locations are moderate in size, catering to the fast food and casual segments. There's often seating available, but it's typically limited compared to large sit-down restaurants. There are booths, tables, and sometimes outdoor patios. The vibe inside mirrors its Californian roots with a modern, relaxed atmosphere featuring hues of orange and earth tones. Artwork or motifs hinting at its Mexican culinary heritage complete the look. In all, it is a laid back, casual atmosphere where no one minds if things get lively or even celebratory.

4. Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Competitors offering Mexican-inspired fare or specialty chicken dishes include Chipotle (NYSE:CMG), Fiesta Restaurant Group (NASDAQ:FRGI), Chuy’s (NASDAQ:CHUY), and private company Qdoba.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $480.8 million in revenue over the past 12 months, El Pollo Loco is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

As you can see below, El Pollo Loco’s 1.4% annualized revenue growth over the last six years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its restaurant footprint remained unchanged and it barely increased sales at existing, established dining locations.

This quarter, El Pollo Loco’s $121.5 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.2% over the next 12 months. While this projection implies its newer menu offerings will catalyze better top-line performance, it is still below average for the sector.

6. Restaurant Performance

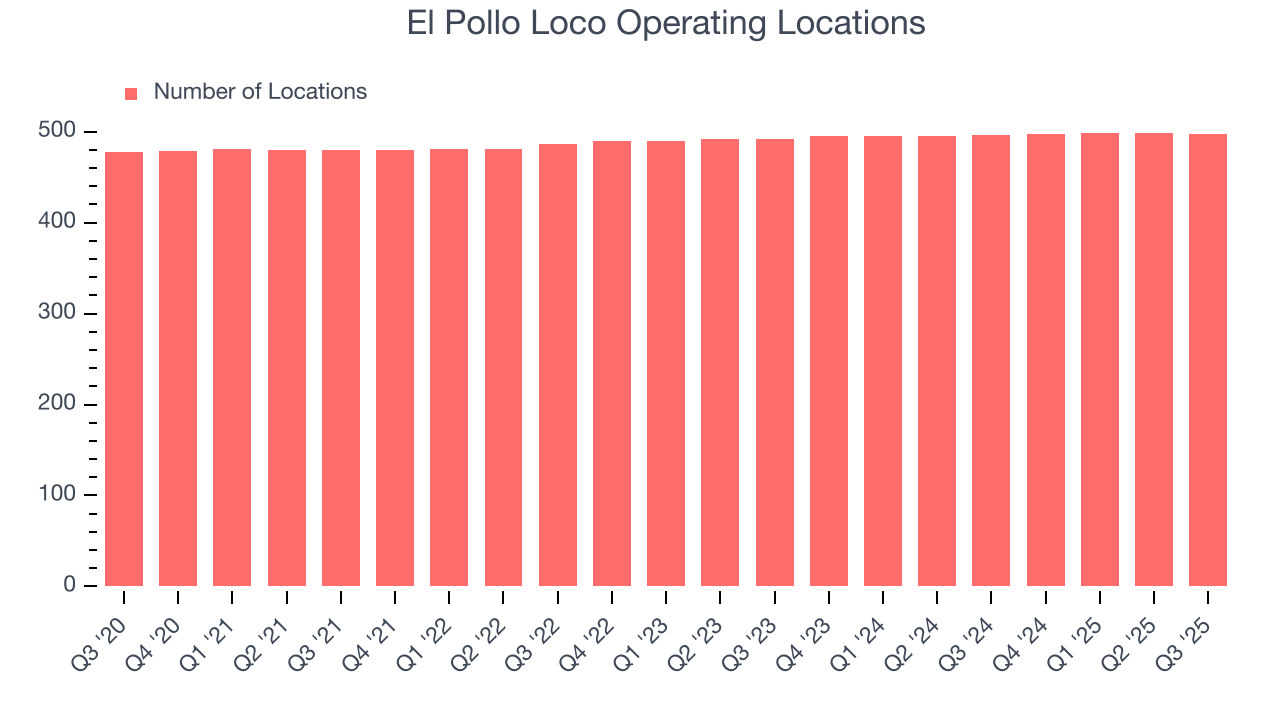

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

El Pollo Loco operated 498 locations in the latest quarter, and over the last two years, has kept its restaurant count flat while other restaurant businesses have opted for growth.

When a chain doesn’t open many new restaurants, it usually means there’s stable demand for its meals and it’s focused on improving operational efficiency to increase profitability.

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at restaurants open for at least a year.

El Pollo Loco’s demand within its existing dining locations has been relatively stable over the last two years but was below most restaurant chains. On average, the company’s same-store sales have grown by 1.5% per year. Given its flat restaurant base over the same period, this performance stems from a mixture of higher prices and increased foot traffic at existing locations.

In the latest quarter, El Pollo Loco’s year on year same-store sales were flat. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if El Pollo Loco can reaccelerate growth.

7. Gross Margin & Pricing Power

El Pollo Loco has bad unit economics for a restaurant company, giving it less room to reinvest and grow its presence. As you can see below, it averaged a 21.7% gross margin over the last two years. Said differently, El Pollo Loco had to pay a chunky $78.25 to its suppliers for every $100 in revenue.

El Pollo Loco produced a 22.9% gross profit margin in Q3, up 1.6 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as ingredients and transportation expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Operating margin is an important measure of profitability for restaurants as it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

El Pollo Loco’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.4% over the last two years. This profitability was higher than the broader restaurant sector, showing it did a decent job managing its expenses.

Analyzing the trend in its profitability, El Pollo Loco’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, El Pollo Loco generated an operating margin profit margin of 9.4%, up 1 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

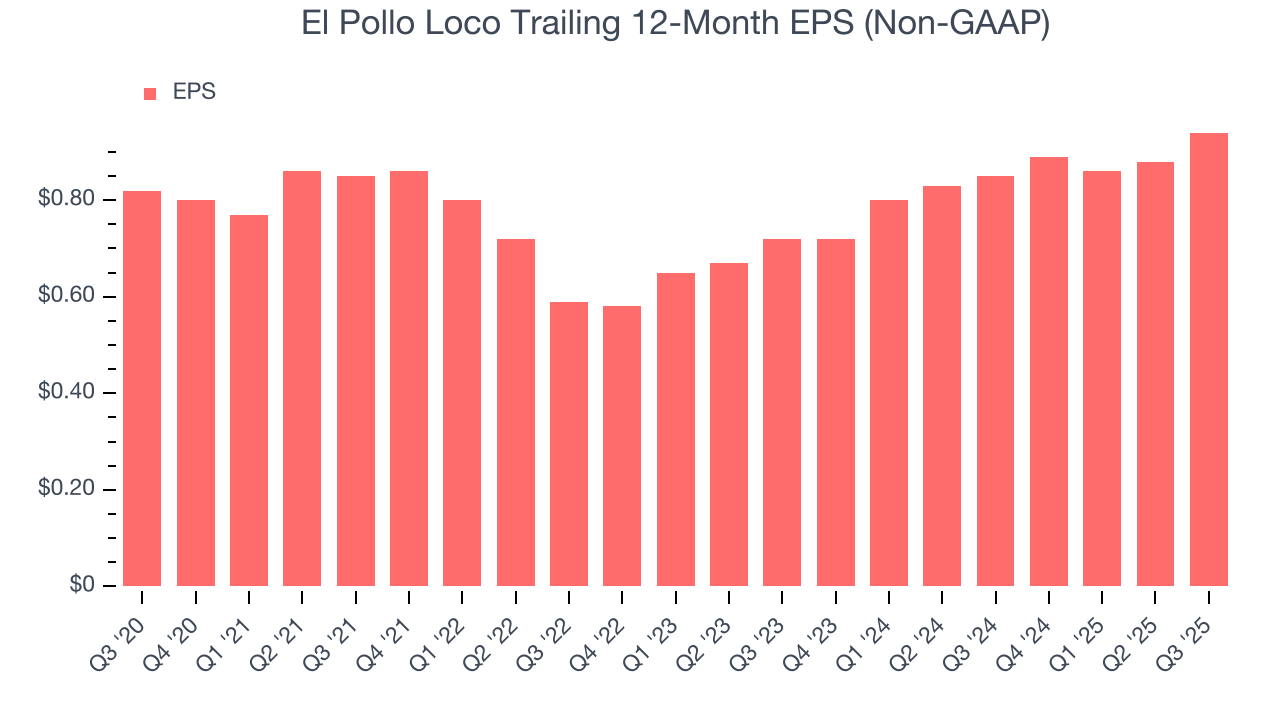

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

El Pollo Loco’s EPS grew at an unimpressive 4.1% compounded annual growth rate over the last six years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q3, El Pollo Loco reported adjusted EPS of $0.27, up from $0.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects El Pollo Loco’s full-year EPS of $0.94 to shrink by 7.4%.

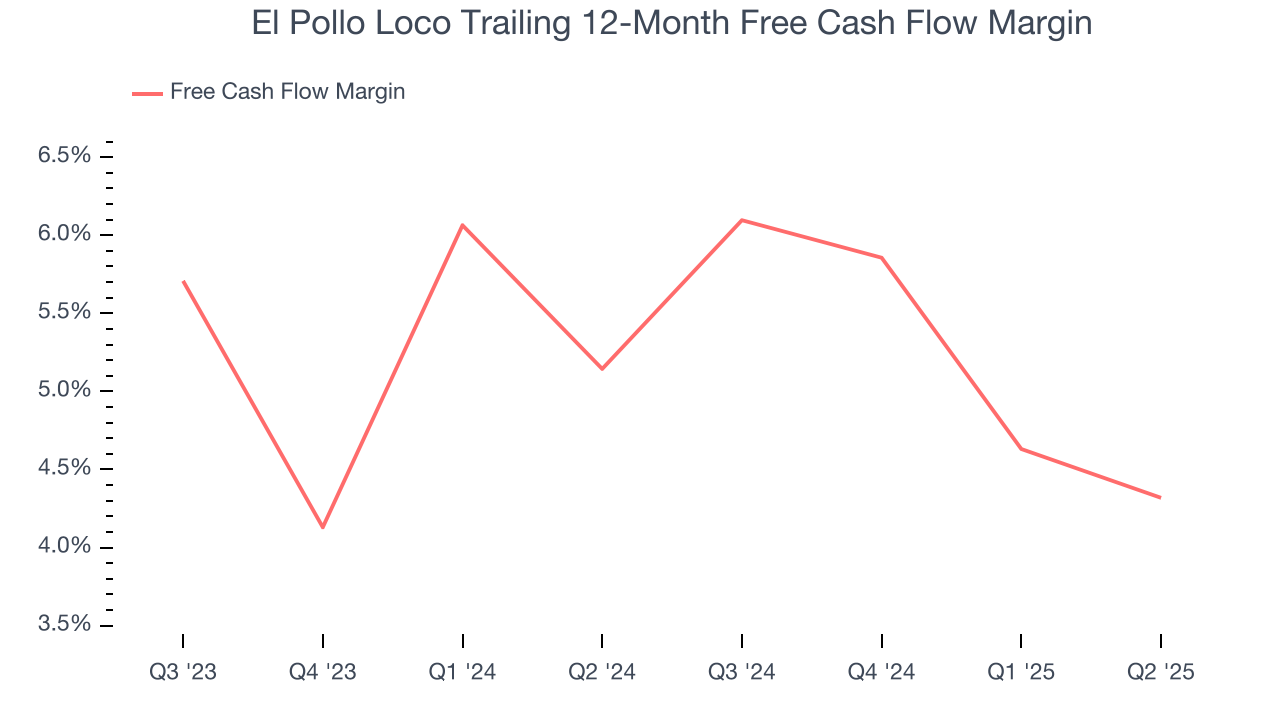

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

El Pollo Loco has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 4.9% over the last two years, slightly better than the broader restaurant sector.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

El Pollo Loco’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.8%, slightly better than typical restaurant business.

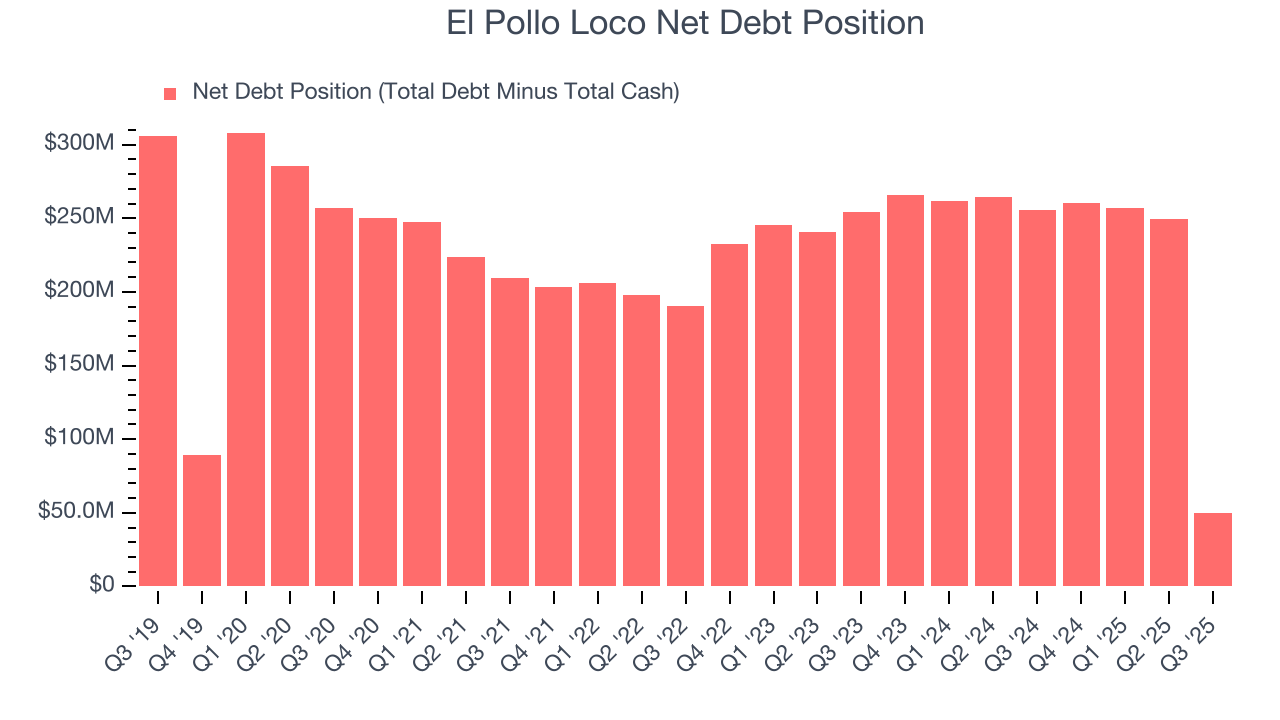

12. Balance Sheet Assessment

El Pollo Loco reported $10.87 million of cash and $61 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $64.16 million of EBITDA over the last 12 months, we view El Pollo Loco’s 0.8× net-debt-to-EBITDA ratio as safe. We also see its $2.53 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from El Pollo Loco’s Q3 Results

We were impressed by how significantly El Pollo Loco blew past analysts’ EPS and EBITDA expectations this quarter. On the other hand, its revenue and same-store sales fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock traded up 6.6% to $9.65 immediately after reporting.

14. Is Now The Time To Buy El Pollo Loco?

Updated: March 6, 2026 at 9:57 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in El Pollo Loco.

We see the value of companies helping consumers, but in the case of El Pollo Loco, we’re out. To begin with, its revenue growth was weak over the last six years. While its stable growth in new restaurants shows it has steady demand, the downside is its brand caters to a niche market. On top of that, its projected EPS for the next year is lacking.

El Pollo Loco’s P/E ratio based on the next 12 months is 11.9x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $13.63 on the company (compared to the current share price of $10.94).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.